Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

50<br />

Problems <strong>and</strong> <strong>Solutions</strong><br />

where R c (t, θ) is the continuously compounded zero-coupon rate at date t with<br />

maturity θ.<br />

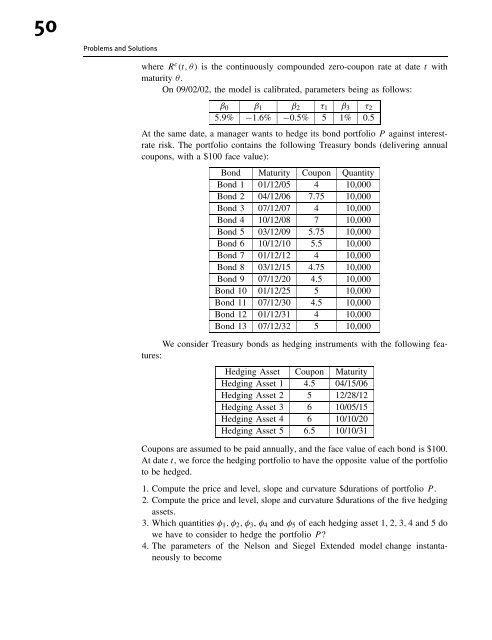

On 09/02/02, the model is calibrated, parameters being as follows:<br />

β0 β1 β2 τ1 β3 τ2<br />

5.9% −1.6% −0.5% 5 1% 0.5<br />

At the same date, a manager wants <strong>to</strong> hedge its bond portfolio P against interestrate<br />

risk. The portfolio contains the following Treasury bonds (delivering annual<br />

coupons, with a $100 face value):<br />

Bond Maturity Coupon Quantity<br />

Bond 1 01/12/05 4 10,000<br />

Bond 2 04/12/06 7.75 10,000<br />

Bond 3 07/12/07 4 10,000<br />

Bond 4 10/12/08 7 10,000<br />

Bond 5 03/12/09 5.75 10,000<br />

Bond 6 10/12/10 5.5 10,000<br />

Bond 7 01/12/12 4 10,000<br />

Bond 8 03/12/15 4.75 10,000<br />

Bond 9 07/12/20 4.5 10,000<br />

Bond 10 01/12/25 5 10,000<br />

Bond 11 07/12/30 4.5 10,000<br />

Bond 12 01/12/31 4 10,000<br />

Bond 13 07/12/32 5 10,000<br />

We consider Treasury bonds as hedging instruments with the following features:<br />

Hedging Asset Coupon Maturity<br />

Hedging Asset 1 4.5 04/15/06<br />

Hedging Asset 2 5 12/28/12<br />

Hedging Asset 3 6 10/05/15<br />

Hedging Asset 4 6 10/10/20<br />

Hedging Asset 5 6.5 10/10/31<br />

Coupons are assumed <strong>to</strong> be paid annually, <strong>and</strong> the face value of each bond is $100.<br />

At date t, we force the hedging portfolio <strong>to</strong> have the opposite value of the portfolio<br />

<strong>to</strong> be hedged.<br />

1. Compute the price <strong>and</strong> level, slope <strong>and</strong> curvature $durations of portfolio P .<br />

2. Compute the price <strong>and</strong> level, slope <strong>and</strong> curvature $durations of the five hedging<br />

assets.<br />

3. Which quantities φ1,φ2,φ3, φ4 <strong>and</strong> φ5 of each hedging asset 1, 2, 3, 4<strong>and</strong>5do<br />

we have <strong>to</strong> consider <strong>to</strong> hedge the portfolio P ?<br />

4. The parameters of the Nelson <strong>and</strong> Siegel Extended model change instantaneously<br />

<strong>to</strong> become