An American Evolution: American University Annual Report 2013-2014

During the 2013–2014 year, the Middle States Commission on Higher Education affirmed American University’s transformation and achievements over the past 10 years, noting AU’s exceptional leadership, strong faculty, and engaged students.

During the 2013–2014 year, the Middle States Commission on Higher Education affirmed American University’s transformation and achievements over the past 10 years, noting AU’s exceptional leadership, strong faculty, and engaged students.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

From the Chair of the Board of Trustees 2<br />

From the President 3<br />

<strong>An</strong> <strong>American</strong> <strong>Evolution</strong> 5<br />

Financial Statements <strong>2013</strong>–<strong>2014</strong> 43<br />

From the CFO, Vice President and Treasurer 45<br />

Independent Auditor’s <strong>Report</strong> 46<br />

Balance Sheets 47<br />

Statements of Activities 48<br />

Statements of Cash Flows 50<br />

Notes to Financial Statements 51<br />

<strong>University</strong> Administration 69<br />

Board of Trustees 69

From the Chair of the Board of Trustees<br />

In completing the sixth year of our strategic plan—<strong>American</strong> <strong>University</strong><br />

in the Next Decade: Leadership for a Changing World—we acknowledge<br />

the significant progress AU has made as a competitive university with an<br />

increasingly prominent profile.<br />

As an affirmation of AU’s strategic direction, the Middle States<br />

Commission on Higher Education accreditation report offers high praise<br />

in its decennial review. It commends AU’s impressive recent achievements<br />

and emphasizes that our future task is to maintain this momentum and<br />

uphold the high standards we have set.<br />

In accepting this challenge and planning AU’s future, we know that our<br />

success grows from a solid foundation of people and planning that includes<br />

the following:<br />

• innovative leadership, creative faculty, and engaged students who<br />

pride themselves in change not only for the good of AU but for the<br />

world at large<br />

• strategic planning that provides milestones for academic success and<br />

institutional aspirations<br />

• prudent financial planning that ensures that AU has the resources to<br />

achieve our objectives<br />

• facilities improvements that enhance what we have, build what we<br />

need, and identify what comes next<br />

• alumni, trustees, and donors who are personally involved and provide<br />

significant support critical for future success<br />

This year was unique in that our past planning endeavors—for strategic<br />

goals, academic aspirations, financial planning, facilities projects,<br />

and institutional energy—came together in remarkable ways, yielded<br />

impressive results, and earned praise from external reviewers.<br />

As a board working with the university leadership, we are focused on<br />

affordability, accessibility, and sustainability. <strong>An</strong>d we now build on our<br />

success to take AU to the next level of institutional effectiveness, active<br />

engagement, and academic prestige.<br />

Sincerely,<br />

Jeffrey A. Sine<br />

2

From the President<br />

The past year at <strong>American</strong> <strong>University</strong> was extraordinary by any number<br />

of measures.<br />

Every 10 years, the university goes through a public and exhaustive<br />

accreditation process by the Middle States Commission on Higher<br />

Education, which examines every facet of AU’s performance as an<br />

institution of higher learning.<br />

The outcome was a resounding endorsement, as the commission described<br />

AU as a “transformed institution” and one that is “agile, planning intensive,<br />

well governed, and well run.”<br />

We are pleased with the commission’s findings and accept their<br />

conclusion—that AU’s biggest challenge is to continue the considerable<br />

progress of recent years.<br />

Our faculty are innovative and their scholarship relevant in ways that are<br />

raising our academic prestige. This past year more than 100 students and<br />

alumni were recipients, finalists, or alternates in nationally competitive<br />

scholarships and fellowships.<br />

Our facilities improvements are changing the face of campus through<br />

new construction and renovations to meet the needs of our students,<br />

faculty, and staff. The School of Communication moved into its renovated<br />

McKinley Building home; we opened our new Connecticut Avenue home<br />

for WAMU 88.5, Development and Alumni Relations, and <strong>University</strong><br />

Communications and Marketing; and work continues both on the<br />

Tenley Campus home of the Washington College of Law and on the East<br />

Campus, which will include residential, academic, and office facilities.<br />

Our alumni are supportive and increasingly engaged, and Eagles athletics<br />

instill pride in AU through competitive success in league and national play<br />

and in classroom achievements.<br />

The stories that follow illustrate how AU is positioned to continue the<br />

progress of recent years and meet the future challenge. Enjoy the report.<br />

Sincerely,<br />

Cornelius M. Kerwin<br />

3

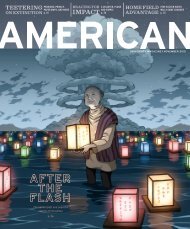

Every decade <strong>American</strong> <strong>University</strong> reflects deeply on the progress and<br />

achievements of the university community as we prepare for the campus visit<br />

of the reaccreditation team representing the Middle States Commission on<br />

Higher Education. We examine our accomplishments and areas for growth<br />

as we engage with these university leaders from across the country. This year<br />

the Middle States team found <strong>American</strong> <strong>University</strong> to be a “transformed<br />

institution,” featuring exceptional leadership at the management and board<br />

levels, a strong faculty of scholars and researchers from a mix of backgrounds,<br />

and an increasingly diverse student body.<br />

Commendations from the reaccreditation team affirm the innovation<br />

and dedication of the AU community and mark this moment in the <strong>American</strong><br />

evolution. We have laid the groundwork for vibrant development and are<br />

committed to cultivating sustainable growth.<br />

AU attracts and engages students of the highest caliber, competing with<br />

internationally renowned schools for ambitious, dedicated students who are<br />

equally committed to learning in the classroom and serving the world outside<br />

it. Accomplished professors conduct pioneering research, both advancing<br />

their fields of knowledge and sharing opportunities for innovative scholarship<br />

with students. Alumni make generous and meaningful gifts in recognition of<br />

how their experiences at AU have changed their lives. New environmentally<br />

sustainable buildings designed with the future of education in mind create<br />

spaces where students can thrive.<br />

<strong>American</strong> <strong>University</strong>’s physical presence in Washington, DC, grows more<br />

prominent, as green construction and renovation are under way at the Tenley<br />

Campus, new East Campus, and other state-of-the-art spaces. As delineated<br />

in the university’s 2011 campus plan and approved by the District of Columbia<br />

government, the university will offer nearly 4.6 million square feet of space for<br />

teaching and learning when construction is completed in 2016.<br />

AU students, faculty, and leaders play a unique role in our city, our<br />

country, and our world, contributing a strong desire to learn and serve in equal<br />

measure, all of them enthusiastic participants in the <strong>American</strong> evolution.

Through the university’s 2008 strategic plan and 2011 campus plan, AU’s leaders imagined the<br />

university’s evolution in intellectual achievement and physical growth. Several years into implementation,<br />

we have renovated residence halls, created academic spaces, opened the new home for the School of<br />

Communication, and made significant progress on the new home for the Washington College of Law.<br />

Generous gifts from alumni support our expansion, including an addition dedicated to DC art at the<br />

<strong>American</strong> <strong>University</strong> Museum. Together these capital improvements foster a climate where the highest<br />

quality teaching and learning can thrive and a campus whose connections with the community and the<br />

world are deep.<br />

The academic commitment and intellectual curiosity of our students were exceptional this year,<br />

as demonstrated by the success of more than 100 students and alumni who were named as recipients,<br />

finalists, or alternates of nationally competitive scholarships and fellowships, including Boren,<br />

Fulbright, Truman, Udall, Pickering, and Hollings scholarships.<br />

Students often credit AU faculty with preparing them to win these and other competitive awards.<br />

Many faculty members volunteer their time and expertise. They go beyond their normal academic<br />

duties and make themselves available for advice and practice interviews, a testament to the value that<br />

AU professors place on student development.

Middle States Commission<br />

on Higher Education<br />

<strong>American</strong> <strong>University</strong><br />

is stronger, more<br />

vibrant, more relevant,<br />

and better positioned<br />

as a result of what<br />

has transpired over<br />

the past six years.

the new campus for the washington college of law opens in 2015.

New and renovated buildings<br />

reflect the intellectual rigor<br />

and forward thinking that<br />

take place in the classroom.<br />

With state-of-the-art technology, environmentally<br />

sophisticated construction, and architecturally inviting<br />

design, <strong>American</strong> <strong>University</strong>’s new and renovated<br />

buildings reflect the intellectual rigor and forward<br />

thinking that take place in the classroom. Significant<br />

progress has been made toward goals outlined in AU’s<br />

2011 campus plan, including renovated buildings for<br />

WAMU and the School of Communication as well as<br />

new construction on Tenley Campus and East Campus.<br />

In <strong>2013</strong> public radio station WAMU 88.5 relocated<br />

to 4401 Connecticut Avenue NW. AU renovated an<br />

existing seven-story, 96,000-square-foot building to<br />

meet the station’s current and future space needs and<br />

to provide an environment for programming growth.<br />

The station, which has nearly 750,000 listeners, is home<br />

to The Diane Rehm Show, The Kojo Nnamdi Show, and<br />

Metro Connection. WAMU occupies more than half of<br />

the building, with AU administrative offices occupying<br />

the remaining floors. The new studio features a large<br />

window facing Connecticut Avenue to connect the<br />

station with the public.<br />

The School of Communication opened the doors<br />

to its new home in the McKinley Building in January<br />

<strong>2014</strong>. The renovation of the historic building on main<br />

campus maintained its iconic rotunda and marble<br />

columns while adding a modern glass entrance, a<br />

rooftop patio, digital classrooms, a media innovation<br />

lab, a teleconference suite, the latest communication<br />

technology, and the 145-seat Malsi Doyle and Michael<br />

Forman Theater with 4K projection for master classes<br />

and screenings. McKinley’s state-of-the-art technologies<br />

were made possible, in large part, through a unique<br />

collaboration with Sony Electronics.<br />

Progress continues on the new home for the<br />

Washington College of Law on Tenley Campus. When<br />

finished, the buildings will support a student population<br />

of 2,000 and a faculty and staff of 500 and provide 50<br />

percent more space than current facilities.<br />

Design of the Tenley Campus will create a new<br />

visual identity for the Washington College of Law while<br />

honoring the site’s important legacy. The renovated site<br />

will incorporate the historic Capital Hall and its chapel,<br />

Dunblane House, and the central quad. Scheduled to<br />

open in 2015, the campus will include flexible teaching<br />

courtrooms, student offices for legal briefs and journals,<br />

a ceremonial courtroom, large tiered classrooms, an<br />

updated Pence Law Library, clinic and trial advocacy<br />

teaching spaces, and a dining facility.<br />

Also under construction is the new East Campus,<br />

located on the corner of Nebraska and New Mexico<br />

Avenues. The former parking lot soon will become<br />

modern academic, administrative, and residence<br />

buildings surrounding a central courtyard of green public<br />

space. The buildings, all designed for LEED certification,<br />

will accommodate learning spaces for the mathematics<br />

and statistics, computer science, and physics departments<br />

in the College of Arts and Sciences as well as its<br />

collaborative game design program with the School<br />

of Communication. The Don Myers Technology and<br />

Innovation Building will house offices for approximately<br />

100 faculty and staff, a tiered classroom, a large flexible<br />

collaboration space, a problem-based instructional<br />

studio, computer classrooms, seminar spaces, and<br />

tutoring and study lounges. Adjacent residence halls will<br />

accommodate nearly 600 students and include a fitness<br />

center, meeting rooms, offices, and retail space. East<br />

Campus is slated to open in 2016.<br />

9

AU student-athletes are<br />

as impressive in the<br />

classroom as on the court,<br />

field, or track.<br />

10<br />

Alexis Dobbs, captain of <strong>American</strong> <strong>University</strong>’s<br />

women’s basketball team and recipient of the <strong>2014</strong><br />

President’s Award, exemplifies AU’s emphasis on<br />

student-athletes.<br />

She is just one of hundreds of AU athletes who,<br />

while earning impressive results on the court, field, or<br />

track this year, committed themselves to scholarship in<br />

the classroom. In fact, 95 percent of AU’s athletes earn<br />

a degree, compared to the 82 percent national average,<br />

according to the NCAA. That number is a bit higher<br />

for AU’s men’s and women’s basketball teams, whose<br />

graduation success rates are 93 percent and 100<br />

percent, respectively.<br />

The President’s Award is AU’s highest honor for<br />

undergraduates, presented to a graduating senior whose<br />

accomplishments are considered exceptional and reflect<br />

the university’s highest ideals. Dobbs was named Patriot<br />

League Scholar-Athlete of the Year three times, and<br />

her GPA exceeded 3.8. While pursuing a public health<br />

major with a minor in biology in the College of Arts and<br />

Sciences, she also volunteered in the community, serving<br />

as a big sister to a 12-year-old girl who had a brain<br />

tumor. Dobbs plans to become a physician’s assistant,<br />

after being inspired by the medical professionals who<br />

helped her through multiple knee injuries, surgeries,<br />

and rehabilitation.<br />

Two of AU’s athletic teams proved that scholarathletes<br />

can be champions. The men’s basketball team<br />

defeated the top-seeded Boston <strong>University</strong> to claim the<br />

<strong>2013</strong>–<strong>2014</strong> Patriot League Championship, the team’s<br />

third in seven years. The Eagles, led by first-year head<br />

coach Mike Brennan, made their third appearance in the<br />

NCAA tournament, where the team lost to Wisconsin<br />

in the first round. Preseason rankings had predicted the<br />

Eagles would finish at the bottom of the league after a<br />

disappointing 10–20 record the year before.<br />

The <strong>American</strong> <strong>University</strong> women’s volleyball team<br />

made its first NCAA Sweet 16 appearance in program<br />

history, losing 3–1 to defending national champion<br />

<strong>University</strong> of Texas in the Lincoln, Nebraska, regionals.<br />

AU concluded its season by matching the program<br />

record for wins with 34, winning its 11th Patriot League<br />

Championship in 13 years, and posting its first two<br />

NCAA tournament victories in program history.<br />

A berth in the NCAA tournament is just one<br />

way the men’s basketball team proves they are winners.<br />

Sophomore Jesse Reed, who won the title of Patriot<br />

League Scholar-Athlete of the Year, was one of five<br />

student-athletes on the <strong>2013</strong>–<strong>2014</strong> Patriot League<br />

Academic Honor Roll. He and junior John Schoof<br />

have twice made the honor roll in their careers. Redshirt<br />

senior Kevin Panzer and freshmen Charlie Jones and<br />

Justice Montgomery made the list for the first time.<br />

The Eagles were one of only four schools to place five or<br />

more student-athletes on the yearly honor roll, finishing<br />

tied for third overall.<br />

Their teammate, Darius Gardner, was the winner<br />

of the <strong>2013</strong>–<strong>2014</strong> Patriot League Sportsmanship Award.<br />

Gardner also was voted the Most Valuable Player of the<br />

Patriot League Tournament and joined fellow Eagles<br />

Reed and Tony Wroblicky on the All-Tournament team.<br />

Like many of her fellow scholar-athletes, Dobbs<br />

relishes the spirit of competition, and her explanation<br />

of her fondness for basketball could just as well apply<br />

to learning.<br />

“[Basketball] is a game that you can never be too<br />

good at playing. There’s always some aspect that you can<br />

improve, all the time. It’s just something that you can’t<br />

master. You can work towards perfection, and that’s the<br />

fun of it,” she said.

alexis dobbs, cas ’14, received AU’s president’s award.

carolyn alper, cas ’68, supports washington artists at the au museum.

A generous gift to the AU<br />

Museum will provide a place<br />

for Washington artists to<br />

meet and talk about art.<br />

Thanks to a major gift from AU alumna and art<br />

advocate Carolyn Alper, CAS/BA ’68, the <strong>American</strong><br />

<strong>University</strong> Museum at the Katzen Arts Center will soon<br />

feature a dedicated space for Washington, DC, artists.<br />

The Alper Initiative for Washington Art will enable<br />

AU students and faculty and members of the public<br />

to learn more about local art through exhibits, events,<br />

gatherings, lectures, and films. The endowment will<br />

also support digitization of AU’s growing collection of<br />

works by Washington artists, allowing it to be more<br />

accessible for study.<br />

“I’m at a point in my life where I want to give<br />

back, and I decided that AU was the place that’s given<br />

me the most in my art life,” said Alper, who earned her<br />

art degree from AU as an adult student when her kids<br />

were teenagers. “It took me about three years to finish<br />

one year, but I really loved it and loved what I learned<br />

and have always been grateful for what I learned. It<br />

whet my appetite for art history.”<br />

Alper’s vision is a home for DC art that draws art<br />

aficionados from around the metropolitan area and<br />

beyond. “Carolyn’s gift provides <strong>American</strong> <strong>University</strong><br />

Museum the funds necessary to elevate Washington<br />

art to the place of prominence it deserves,” said AU<br />

Museum curator and director Jack Rasmussen. “All of<br />

Washington should be grateful, as Carolyn has put her<br />

contributions where her heart is.”<br />

Alper, an artist, designer, and patron of the arts, is<br />

also an alumna of the Corcoran College of Art. She was<br />

a founding member of the Foundry Gallery, a nonprofit<br />

artist-owned cooperative gallery that has showcased DC<br />

artists for more than 40 years.<br />

“The programming will be innovative and<br />

different,” she said. “I want it to be on the edge.”<br />

Alper hopes the space will provide an opportunity for<br />

Washington artists “to meet and greet and talk about<br />

art.” She also envisions public programs where artists<br />

are invited to discuss their work, how they develop<br />

their work, how they feel about the Washington, DC,<br />

art scene, and more. “There are so many artists whom<br />

I know and younger ones coming up,” she said, and a<br />

lack of space where local artists can show their works.<br />

Rasmussen has made Washington art a priority<br />

at the AU Museum with two Washington Art Matters<br />

exhibits and opportunities for regular displays of works<br />

by Washington artists. A reviewer with Washington City<br />

Paper recently wrote, “For almost a decade, the de facto<br />

museum of DC art has been at <strong>American</strong> <strong>University</strong>.<br />

The case has been made: Washington art does matter.<br />

All we need is the wall space to display it.”<br />

Alper’s gift coincides well with the opportunity<br />

for the museum to incorporate into its collections<br />

art from the now-defunct Corcoran Gallery of Art.<br />

As the National Gallery of Art takes custody of the<br />

Corcoran’s collection, some of its Washington art will<br />

be distributed to other organizations.<br />

The design of the new space will be contemporary,<br />

and Alper anticipates that it will stand out from the<br />

current museum and include interactive technology. “I<br />

think it will bring people to the Katzen more often. It’s<br />

a terrific space,” Alper said.<br />

The Alper Initiative for Washington Art is<br />

expected to open in August 2015.<br />

13

14<br />

Innovative research, meaningful scholarship, and personal interactions with students are the<br />

hallmark of AU’s diverse and accomplished faculty. The report from the Middle States reaccreditation<br />

team said that evidence exists within the university of profound contributions at the faculty level.<br />

The team found that AU undergraduate education is highly effective in the application of knowledge<br />

through service learning and study abroad and commended AU’s general education program and the<br />

interdisciplinary nature of university programs.<br />

AU strives toward the “scholar-teacher ideal” outlined in its strategic plan with an enhanced<br />

infrastructure that supports and promotes high-impact faculty scholarship and teaching excellence.<br />

In the fall of <strong>2013</strong>, AU hired more than 100 full-time faculty, including 23 new tenured or tenure-track<br />

faculty. These professors bring expertise and illumination to such topics as genome architecture, inner-city<br />

economic development, and gender representation in public institutions.<br />

The university created 10 new master’s degree programs in <strong>2013</strong>–<strong>2014</strong>—including four online<br />

degrees—that reflect emerging needs and interests in our society. New study areas are bilingual<br />

education, interactive journalism, international economics, teaching English as a foreign language,<br />

nutrition education, game design, public administration and policy, and terrorism and homeland<br />

security policy.

Middle States Commission<br />

on Higher Education<br />

. . . to strive for the<br />

scholar-teacher ideal,<br />

the institution has<br />

raised expectations<br />

for faculty with<br />

respect to high-impact<br />

scholarship, creative<br />

work, external funding,<br />

and teaching excellence.

The “West vs. the rest”<br />

paradigm needs to be<br />

supplanted by “global<br />

international relations.”<br />

16<br />

In his book The End of <strong>American</strong> World Order,<br />

Amitav Acharya argues that the dominant position of<br />

the United States in world politics is coming to an end.<br />

Not to suggest that America is in decline, he explains,<br />

but rather that with increasing global complexity, it will<br />

be impossible for any nation to hold so much power.<br />

Acharya suggests that cooperation and interdependence<br />

among nations will become increasingly important.<br />

Acharya, professor in the School of International<br />

Service and UNESCO Chair in Transnational<br />

Challenges and Governance, was named <strong>2014</strong>–2015<br />

president of the International Studies Association<br />

(ISA). He delivered a presidential address at the<br />

annual ISA convention, in which he drew parallels to<br />

the increasing irrelevance of Western hegemony as a<br />

rational framework both in the current world order and<br />

in the study of international relations. Acharya is the<br />

first non-Western president of the association in its 55-<br />

year history.<br />

“International relations as a discipline has been<br />

very Western-oriented, or at least so in terms of the<br />

theories and literature of it. With the increasing<br />

popularity of this discipline in schools worldwide,<br />

I would hope the literature would become more<br />

global and inclusive, too,” he said. The “West vs. the<br />

rest” divide is an outdated paradigm and one that<br />

needs to be supplanted by what Acharya calls “global<br />

international relations.”<br />

Acharya explained that he does not want to<br />

emerge as a divisive figure in international relations.<br />

Instead, he hopes to suggest a new sense of universalism<br />

based on diversity. “It is about recognizing diversity and<br />

trying to find a common ground,” he said. He predicts<br />

that regional studies will become more prominent as a<br />

field, reflecting the understanding that diversity<br />

is crucial.<br />

Acharya challenged his colleagues to think beyond<br />

the Western perspective when contemplating theories<br />

of international relations and to consider his concept<br />

of non-Western international relations theory, which<br />

he and colleague Barry Buzan of the London School<br />

of Economics published in an edited volume in <strong>2013</strong>.<br />

Acharya’s speech resulted in a standing ovation from<br />

the large convention audience and was followed by a<br />

reception in his honor.<br />

Other participants in the ISA convention,<br />

titled “Spaces and Places: Geopolitics in an Era of<br />

Globalization,” included approximately 30 SIS faculty<br />

members and a dozen doctoral students who presented<br />

their research.<br />

Acharya has been appointed to visiting<br />

professorships and fellowships at universities in<br />

Australia, Malaysia, Singapore, South Africa, Thailand,<br />

and the United Kingdom. He has lectured and<br />

spoken around the world and addressed the United<br />

Nations General Assembly on the subject of human<br />

security. He has published more than 25 books and<br />

200 journal and magazine articles, written numerous<br />

op-eds for international newspapers, and appeared in<br />

media broadcasts worldwide discussing such topics as<br />

international security, the war on terror, and the rise of<br />

China and India.<br />

Acharya was born in India and educated in both<br />

India and Australia. He lived and worked in Singapore<br />

for 12 years and is regarded as one of the world’s top<br />

specialists on Southeast Asia and Asian affairs.

Amitav Acharya, SIS, sees a more cooperative, interdependent world.

ellen feder, cas, advocates for children born with atypical anatomy.

The “problem” of<br />

intersex is one of moral<br />

responsibility to children.<br />

In her book Making Sense of Intersex: Changing<br />

Ethical Perspectives in Biomedicine, published in <strong>2014</strong>,<br />

AU philosophy professor Ellen Feder advocates for<br />

children. Often when babies are born with atypical<br />

sex anatomies, parents and doctors approach this as<br />

a problem to be fixed and never mentioned again,<br />

without understanding the long-term physical and<br />

psychological effects on both children and parents.<br />

Making Sense of Intersex grew out of a paper that<br />

Feder coauthored in 2012 on the ethics of using a<br />

prenatal drug intended to prevent the development of<br />

ambiguous genitalia in girls with congenital adrenal<br />

hyperplasia, a condition that can develop when a<br />

fetus is in utero. The book earned a Publisher’s Weekly<br />

starred review.<br />

Feder was asked to present a paper about intersex<br />

at the first-ever session on the topic at an <strong>American</strong><br />

Philosophical Association conference in 2000. That one<br />

presentation led to many more.<br />

“Looking back, I see what I was doing over these<br />

years as working to clarify ‘the problem’ of intersex,”<br />

she said. “Doctors—and often parents—see the<br />

problem as atypical genitalia, but learning more about<br />

‘the problem,’ both as it is understood today and how it<br />

has been understood historically, led me to see intersex<br />

as a problem of moral responsibility and of a failure—<br />

however well-intentioned—of physicians’ and parents’<br />

responsibility to the children they care for.”<br />

The more she studied the medical treatment<br />

of intersex and spoke with parents and affected<br />

individuals, as well as medical specialists, the more<br />

she felt compelled to convey the knowledge they had<br />

shared with her. “What I learned—especially from the<br />

stories that mothers of children with intersex told me—<br />

was not only the effects of lies and surgeries on their<br />

children, but how the deception and silence affected<br />

parents as well.”<br />

Feder sees the labeling of atypical genitalia as<br />

“abnormal” as part of the problem. Normalizing<br />

medical interventions—altering the genitalia using<br />

surgical, hormonal, and other technologies—does<br />

exactly what the term implies.<br />

“If atypical genitalia are regarded as ‘abnormal,’<br />

then the interventions attempt to make that<br />

abnormality disappear, to make it seem as if there<br />

had never been anything atypical about this child’s<br />

anatomy,” said Feder. “The silence surrounding surgery<br />

is an integral part of the medical management of<br />

atypical sex anatomy.”<br />

Rather than treating children with atypical sex<br />

anatomies as if the children themselves are abnormal,<br />

Feder believes that children should be treated just like<br />

anyone else. “Asking how they should be cared for<br />

suggests that there might be some difference in the<br />

way they should be cared for,” she said. “But that’s<br />

just it: they should be cared for as any child is entitled<br />

to be cared for, namely with love and respect and an<br />

openness to who the child is and will be.”<br />

Feder hopes that readers take a different view of<br />

those born with atypical sex anatomies. “Not fitting<br />

in, being excluded from membership, is painful,” she<br />

said. “Parents and doctors want to ‘fix’ children so that<br />

they will feel this belonging and be spared the pain of<br />

abnormality. But what if we see the problem not in the<br />

bodies of children but in the attitudes that make those<br />

with atypical sex anatomies not feel normal?”<br />

19

Higher prices for fruits and<br />

vegetables have a significant<br />

association with higher<br />

child body mass index.<br />

Higher prices for fresh fruits and vegetables are<br />

associated with higher body mass index (BMI) in<br />

young children in low- and middle-income households,<br />

according to a study published in the journal Pediatrics<br />

by <strong>American</strong> <strong>University</strong> researchers.<br />

“There is a small, but significant, association<br />

between the prices of fruits and vegetables and higher<br />

child BMI,” said Taryn Morrissey, the study’s lead<br />

author and a professor of public administration and<br />

policy at AU’s School of Public Affairs (SPA).<br />

Morrissey said that when the prices of fruits and<br />

vegetables go up, families may buy less produce and<br />

substitute cheaper foods that may be less healthy and<br />

more caloric.<br />

“These associations are driven by changes in the<br />

prices of fresh fruits and vegetables rather than frozen<br />

or canned,” said Alison Jacknowitz, a coauthor of the<br />

study and also a professor of public administration and<br />

policy at SPA.<br />

BMI is a reliable indicator of total body fat,<br />

which is related to the risk of life-threatening diseases.<br />

More than 26 percent of two- to five-year-old children<br />

nationwide were considered overweight, defined as<br />

having a BMI above the 85th percentile, in 2009 and<br />

2010, up from 21 percent a decade earlier.<br />

The researchers linked data from the Early<br />

Childhood Longitudinal Study-Birth Cohort, a<br />

nationally representative study of children from infancy<br />

to age five, to local food price data from the Council<br />

for Community and Economic Research Cost-of-<br />

Living Index. The study focused on households under<br />

300 percent of the federal poverty level, or a family of<br />

four earning $70,650 in <strong>2013</strong>.<br />

While, in general, food prices have trended<br />

downward in recent decades, particularly the prices<br />

of snacks and sugar-sweetened beverages, the real<br />

prices of restaurant meals and fruits and vegetables<br />

have increased. Fruit and vegetable prices increased by<br />

17 percent between 1997 and 2003 alone. Children<br />

living in areas with higher-priced fruits and vegetables<br />

averaged higher measures of BMI scores compared<br />

with their peers in areas with lower-priced fruits<br />

and vegetables.<br />

<strong>An</strong>other surprising finding was an association<br />

between higher fast food prices and an increase in<br />

obesity. Morrissey said local fast food outlets may have<br />

more freedom than grocery stores to increase their<br />

prices in response to higher demand for their products.<br />

The study also identified a small association<br />

between higher-priced soft drinks and a lower<br />

likelihood of obesity among young children. The study<br />

did not find strong associations between food prices<br />

and food insecurity, which means that families are<br />

forced to skip meals, cut portions, or otherwise forgo<br />

food because of a lack of money.<br />

The third coauthor of the article, “Local<br />

Food Prices and Their Associations with Children’s<br />

Weight and Food Security,” is SPA doctoral student<br />

Katie Vinopal.<br />

20

spa’s Taryn Morrissey, Katie vinopal, and Alison Jacknowitz<br />

study the link between food prices and children’s weight.

The <strong>American</strong> Astronautical Society honored School of Public Affairs<br />

professor Howard McCurdy with its John F. Kennedy Astronautics<br />

Award, given for outstanding promotion of the nation’s space<br />

programs. A list of previous award winners reads like a NASA hall<br />

of fame, including former astronauts Buzz Aldrin and Sally Ride and<br />

science writer Carl Sagan. NASA tapped McCurdy to form a space<br />

policy group to examine how public-private partnerships can foster<br />

innovation in space flight.<br />

With his expertise in science policy, McCurdy has authored books<br />

such as Space and the <strong>American</strong> Imagination and Faster, Better,<br />

Cheaper: Low-Cost Innovation in the U.S. Space Program. As part<br />

of a larger project to analyze other endeavors that could provide<br />

lessons for space exploration, McCurdy researched Mt. Everest<br />

climbing expeditions and compared advances in climbing culture<br />

with opportunities for innovation in space technology<br />

through commercialization.<br />

Only a few years after its creation,<br />

the AU Mock Trial team is a nationally<br />

recognized name. Competing against<br />

more than 650 teams from more<br />

than 330 colleges, the AU team<br />

placed fourth in its division and<br />

eighth in the country at the <strong>American</strong><br />

Mock Trial Association’s National<br />

Championship Tournament.<br />

AU staffer Donald Curtis runs<br />

the nonprofit Student-Athletes<br />

Organized to Understand Leadership,<br />

or SOUL, which uses athletics as a<br />

gateway to academic and professional<br />

development for teenage boys in<br />

Washington, DC.<br />

Economist Jeffrey Harris joined the Kogod School of Business as<br />

the first Gary D. Cohn Goldman Sachs Chair in Finance. The chair<br />

was created through the generosity of Cohn, Kogod/BSBA ’82, and<br />

Goldman Sachs, where Cohn is president and COO. Harris served as<br />

chief economist at the U.S. Commodity Futures Trading Commission<br />

from 2007 to 2010 and has taught at the <strong>University</strong> of Delaware and<br />

Syracuse <strong>University</strong>.<br />

Harris began conducting groundbreaking research early in his<br />

academic career. His first published paper examining conflicts of<br />

interest between market traders and regulators led to a major<br />

restructuring of the NASDAQ stock market in the mid-1990s. “That<br />

paper definitely kick-started my career,” Harris said. “I discovered that<br />

I liked grinding away at big data sets and wasn’t too bad at it.” From<br />

there, Harris began looking at economic issues related to day trading<br />

and initial public offerings.<br />

In 2005, Harris presented his research on electronic trading to the U.S.<br />

Commodity Futures Trading Commission just as futures trading pits<br />

were giving way to electronic trading. Harris’s current areas of research<br />

examine trading networks and explore how market rule changes affect<br />

trading behavior.<br />

22

Stephen Macavoy<br />

assistant professor, Cas<br />

Fewer chemicals<br />

entering our<br />

waterways is crucial<br />

to ecosystem health.<br />

People want to live<br />

in nice, clean cities,<br />

and greening our<br />

cities must be a<br />

priority for all of us.<br />

Stephen MacAvoy, an environmental<br />

science professor in CAS, studies<br />

nutrient movement in aquatic<br />

systems, most recently focusing on<br />

the <strong>An</strong>acostia River. His research has<br />

shown that installation of green roofs<br />

throughout Washington, DC, would not<br />

only reduce energy use in buildings<br />

but also help keep pollutants from<br />

entering the city’s waterways.

After decades of military rule, Myanmar slowly began to open up the<br />

government and the country in 2010. As part of the new order, UNICEF<br />

was asked to conduct an in-depth study of the country’s basic education<br />

system and how it could be improved and its complex administrative<br />

structure decentralized. In turn, UNICEF tapped AU professor Nimai<br />

Mehta to lead the investigation. Mehta is academic director of the Global<br />

Economics and Business section of the Washington Semester Program at<br />

AU’s School of Professional and Extended Studies and leads the school’s<br />

programs in China and Europe.<br />

Mehta’s team focused on analyzing the education system in Mon State,<br />

chosen because of the longstanding ceasefire there from ethnic conflicts<br />

that have arisen since the country’s independence. The study included<br />

questions about how schools have managed in the midst of ethnic<br />

conflict, widespread poverty, inequality, and the legacy of a closed and<br />

stagnant economy. The team included ethnographers from China, a<br />

professor from the <strong>University</strong> of London, and Mehta’s AU colleague<br />

Mary Gray from the mathematics and statistics department in the<br />

College of Arts and Sciences.<br />

While the public education system has long been centralized, first by<br />

the British and later under the control of former military governments,<br />

local communities have supported individual schools out of necessity.<br />

The UNICEF report will contribute to the ongoing education reform<br />

efforts in Myanmar.<br />

A team of master’s students from<br />

the School of International Service,<br />

led by instructor Eric Abitbol, spent<br />

12 days in Israel and the Palestinian<br />

West Bank studying the role of water<br />

management in efforts to create<br />

peace instead of conflict.<br />

Enterprising AU students turned their<br />

academic studies in sustainability into<br />

a real-life opportunity to promote<br />

water conservation. Their research<br />

found that replacing existing aerators<br />

on faucets throughout the university<br />

with low-flow models would result in a<br />

significant reduction in water usage—<br />

a projected savings of 570,000<br />

gallons and $10,000 per year for AU.<br />

24<br />

Three Washington College of Law graduates who connected through<br />

the law school’s Human Rights Brief launched a nongovernmental<br />

organization in Nigeria that provides judicial advocacy and trains<br />

citizens of urban slums in law and community organizing to help them<br />

reform their country’s justice system.<br />

Megan Chapman ’11, <strong>An</strong>na Maitland ’12, and <strong>An</strong>drew Maki ’12<br />

joined forces to develop Justice and Empowerment Initiatives ( JEI)–<br />

Nigeria. “We provide them with basic training in the law, community<br />

organizing skills, and supervision as they begin to provide services in<br />

their communities,” said Chapman. “JEI will also serve as a link to a<br />

broader referral network for those more complicated cases that require<br />

the work of a lawyer or higher-level advocacy.”<br />

Chapman, Maitland, and Maki became involved with international<br />

issues in law school. Through their collective experiences with the<br />

United Nations Committee against Torture Project, International<br />

Human Rights Law Clinic, and Human Rights Brief, Maki said they<br />

have been able to “use our acquired knowledge of the international<br />

human rights system to push forward human rights in Nigeria.”

laura juliano<br />

associate professor, cas<br />

The negative effects<br />

of caffeine are often<br />

not recognized as<br />

such because it is<br />

a socially acceptable<br />

and widely consumed<br />

drug that is well<br />

integrated into<br />

our routines.<br />

A study by AU psychology professor<br />

Laura Juliano indicates that many<br />

people struggle with caffeine use<br />

disorder, a condition in which they<br />

are dependent on caffeine to the<br />

point that they suffer withdrawal<br />

symptoms and are unable to reduce<br />

caffeine consumption even if they have<br />

another condition—such as pregnancy<br />

or a heart condition—that makes<br />

caffeine use inadvisable.

The inaugural class of Frederick Douglass Distinguished Scholars<br />

graduated in <strong>2014</strong>, and the scholars are already demonstrating their<br />

promise and passion, earning prizes and recognition as individuals<br />

and as a team. These scholars are high achievers committed to social<br />

justice and the advancement of under-resourced and underserved<br />

communities. The students receive scholarships covering tuition, room,<br />

board, fees, and books for all four years, if they maintain a 3.2 GPA.<br />

Scholars who earn at least a 3.67 GPA can get supplemental funding to<br />

study internationally.<br />

Among the scholars is Nkemdilim Chukwuma, who won first prize,<br />

including scholarship money and an internship, in the <strong>2013</strong> Executive<br />

Leadership Foundation national essay competition during her<br />

sophomore year.<br />

Graduating senior Falon Dominguez interned at Google and received a<br />

permanent job offer there. A double major in international studies and<br />

economics, Dominguez volunteers for Voto Latino.<br />

Rodrigo Futema traveled to Rwanda after his freshman year and<br />

decided to work in the business world of soccer, using it as a tool for<br />

economic development and social good.<br />

As a team, Frederick Douglass scholars founded FotoSynthesis, an<br />

education initiative to connect students through social media and<br />

photography. For an Adobe Youth Voices–UNICEF challenge, the<br />

group recently created an online video refuting racial and cultural<br />

stereotypes and won $30,000.<br />

In association with AU’s School<br />

of International Service, the<br />

French-<strong>American</strong> Global Forum<br />

and French newspaper Le Monde<br />

diplomatique created “Le Monde<br />

Diplomatique Debates—Washington,<br />

DC” to tackle the most consequential<br />

issues in international politics today.<br />

Daniel Maree, SOC-CAS/BA ’08,<br />

launched the Million Hoodies<br />

Movement for Justice in response to<br />

the fatal shooting of Florida teenager<br />

Trayvon Martin. For his efforts to<br />

promote gun law reform and challenge<br />

racial profiling, Maree received the<br />

<strong>2013</strong> Do Something Award, which<br />

included a prize of $100,000.<br />

Repelling from helicopters. Handling millions of dollars of equipment.<br />

Traveling the globe. After 17 years of service in the U.S. Army, Lt. Col.<br />

George Gilbert Jr. has faced challenges few can relate to. The global<br />

health systems analyst for the Defense Intelligence Agency returned<br />

from the field and enrolled in Kogod’s professional MBA program.<br />

Gilbert has found that many of the skills he learned in his military<br />

career have helped him succeed at Kogod. “The PMBA program<br />

requires a lot of self-discipline and time management skills,” he said.<br />

“The military enforces these skills very early in one’s career.”<br />

Gilbert has always valued higher education—something his parents<br />

did not have themselves yet stressed to him during his childhood. He<br />

took the lesson to heart, earning master’s degrees in military arts and<br />

sciences from the U.S. Army Command and General Staff College and<br />

in science and technology intelligence from the National Intelligence<br />

<strong>University</strong>. Now, at Kogod, Gilbert is committed to continually<br />

improving himself.<br />

26

Caty borum chattoo<br />

EXECUTIVE IN RESIDENCE, SOC<br />

My professional<br />

passion is . . .<br />

translating complex<br />

social issues<br />

into entertaining<br />

narratives, connecting<br />

with untold stories<br />

through documentary<br />

production.<br />

By traveling the developing world in<br />

search of comedic talent, Stand Up<br />

Planet demonstrates that it’s<br />

possible to use humor to shed light on<br />

complex social issues, such as global<br />

poverty. One of the collaborators<br />

behind the documentary series is<br />

School of Communication executive in<br />

residence Caty Borum Chattoo, shown<br />

here with comedians Norman Lear<br />

and Carl Reiner.

Wikipedia has often been scorned by academia, but School of<br />

Communication professor <strong>An</strong>drew Lih is bridging the gap between<br />

traditional scholarship and technology-focused democratic data. Lih<br />

studies the intersection of new media, journalism, and technology and<br />

is one of a handful of the country’s experts on Wikipedia—the online<br />

encyclopedia written entirely by volunteers.<br />

Lih’s students are helping some of Washington’s most important<br />

galleries, libraries, archives, and museums (GLAM) to share their<br />

vast stores of knowledge with broad audiences. Partners in this effort<br />

include the Smithsonian <strong>American</strong> Art Museum, the National Museum<br />

of the <strong>American</strong> Indian, the National Archives, and the Library of<br />

Congress. Lih has connected museum curators, who possess significant<br />

knowledge of their collections, with tech-savvy students, who figure out<br />

how to best convey that information to Wikipedia readers.<br />

Wikipedia, said Lih, provides something that’s never been possible<br />

before: “A storehouse of knowledge that works at the speed of human<br />

achievement. A continuous working draft of history.”<br />

Barbara Romzek, dean of the<br />

School of Public Affairs, received<br />

the <strong>2014</strong> John Gaus Award from<br />

the <strong>American</strong> Political Science<br />

Association. Romzek, an expert in<br />

public management and accountability,<br />

is the third AU faculty member to<br />

receive this award.<br />

AU hosted President Barack Obama<br />

as a featured guest on a taping of<br />

MSNBC’s political talk show Hardball<br />

with Chris Matthews. The president<br />

fielded questions about health<br />

care, privacy concerns, economic<br />

justice, government spending,<br />

and other issues.<br />

AU students and faculty have been active in advocating for the rights<br />

of people with disabilities, and several have been recognized for their<br />

efforts. Robert Dinerstein, director of the clinical program, associate<br />

dean for experiential education, and founder and director of the<br />

Disability Rights Law Clinic at the Washington College of Law and<br />

AU’s <strong>2013</strong> Scholar-Teacher of the Year, received the <strong>American</strong> Bar<br />

Association’s Paul G. Hearne Award for Disability Rights for his<br />

decades of dedication.<br />

Eloisa Zepeda, SIS/MA ’12, and John Paul Cruz, SIS/MA ’13,<br />

were honored for their outstanding work in international disability<br />

policy. Originally from the Philippines, both experienced severe<br />

visual impairment in their 20s but have turned their disabilities into<br />

motivation to become advocates. Zepeda was appointed a regional<br />

representative of the Global Coalition of Tuberculosis Activists. Cruz<br />

was a fellow of the Salzburg Seminar in Japan.<br />

Ki’tay Davidson, SPA/BA ’13, was honored by the White House<br />

and spoke on a panel there as a Champion of Change for his work<br />

advancing the <strong>American</strong>s with Disabilities Act.<br />

28

NEIL KERWIN<br />

President<br />

AMERICAN UNIVERSITY<br />

<strong>American</strong> <strong>University</strong><br />

is firmly on its way<br />

to achieving carbon<br />

neutrality by 2020.<br />

We are now a partner<br />

to the second-largest,<br />

non-utility solar<br />

energy purchase in<br />

the United States.<br />

AU has agreed to source half its<br />

electricity from renewable power through<br />

a 20-year solar energy purchase with<br />

partners George Washington <strong>University</strong><br />

and George Washington <strong>University</strong><br />

Hospital. The project will supply the<br />

partners with 123 million kilowatt hours of<br />

emissions-free electricity per year, drawn<br />

from 243,000 solar panels at three sites<br />

in North Carolina.

<strong>American</strong> <strong>University</strong>’s location in the nation’s capital, within a few miles of one of the most<br />

influential governments in the world, enables the university to serve both as a hub that attracts local,<br />

national, and international leaders and as a launching pad for students and faculty to represent AU<br />

across the globe. AU has cultivated vital partnerships with government, the business sector, and<br />

nonprofit organizations to facilitate teaching and learning that transcend the campus.<br />

Speeches from inspirational and influential individuals from Washington and around the world<br />

create unique learning opportunities for AU students and faculty. President Barack Obama joined<br />

MSNBC’s Chris Matthews at a taping of Hardball on campus, and CNN’s <strong>An</strong>derson Cooper accepted<br />

the <strong>2013</strong> Wonk of the Year Award. Other well-known speakers included Dick Cheney, Ron Paul,<br />

Liu Yangdong, David Gregory, Lily Ledbetter, and Jessica Yu.<br />

Not only does the world come to AU, but AU students explore the world. More than half of AU<br />

students study abroad, and AU welcomes students from more than 130 countries. Nearly 90 percent<br />

of AU students participate in internships based in DC, elsewhere in the United States, or abroad.<br />

It’s not uncommon to find AU students working in the halls of Congress, at top media outlets, or at<br />

cutting-edge technology companies.

Middle States Commission<br />

on Higher Education<br />

The university’s<br />

presence in Washington<br />

provides an invaluable<br />

source of term<br />

faculty . . . who add<br />

considerably to the<br />

experiential and<br />

‘real-life’ learning for<br />

the students.

To learn from and work<br />

with veteran reporters<br />

is a dream come true for<br />

journalism students.<br />

32<br />

Access to the newsroom of the Washington Post<br />

might be exciting enough for a journalism student,<br />

but the opportunity to work with and learn from<br />

veteran Post reporters and have bylines in the paper is<br />

a dream come true. This year AU and the venerated<br />

newspaper created a collaboration that enables a select<br />

group of students in the School of Communication<br />

to work under the direction of Pulitzer Prize–<br />

winning investigative journalist and SOC professor<br />

John Sullivan as part of the Investigative <strong>Report</strong>ing<br />

Workshop (IRW).<br />

Sullivan moved to Washington to join the<br />

SOC faculty as a full professor and investigative<br />

journalist in residence. His faculty position is just<br />

one of three hats he now wears. As part of an unusual<br />

joint-hiring arrangement, he’s also a senior editor at<br />

IRW. <strong>An</strong>d he’s a member of the Post’s award-winning<br />

investigations unit.<br />

IRW executive editor Chuck Lewis said that a<br />

university hiring a Pulitzer Prize–winning reporter in<br />

collaboration with one of the nation’s leading daily<br />

newspapers is unprecedented.<br />

The arrangement offers a chance for Sullivan<br />

to continue reporting; exposes students to the pace,<br />

demands, and standards of a working newsroom;<br />

gives those students a chance to work on stories and<br />

investigative projects; and provides Post reporters with<br />

extra help from some well-trained and highly motivated<br />

future journalists.<br />

Students can even pitch investigative story ideas<br />

to Sullivan and, with his approval, develop them. The<br />

Post will run those stories that meet the newspaper’s<br />

standards and are pertinent to the Post’s readership.<br />

Other leading journalism schools have taken note<br />

of the innovative partnership. Several already have<br />

contacted Sullivan for advice on how to replicate this<br />

new model. But for now, it’s an SOC exclusive.<br />

“It’s a tremendous benefit to our students to work<br />

alongside these people,” Sullivan said. It’s also “a way to<br />

give them what they need—clips—but the kind of clip<br />

they can’t get anywhere else: an investigative clip from<br />

the Washington Post.”<br />

At the Post, investigations editor Jeff Leen called<br />

it “a terrific arrangement for all parties.” Acquiring the<br />

necessary investigative reporting chops, Leen pointed<br />

out, has always happened in ways somewhat like this.<br />

“Older veterans have taught newer people this skill<br />

since the beginning of time, so the mentorship aspect<br />

is nothing new to us.”<br />

Previously Sullivan worked for nearly a decade<br />

at the Philadelphia Inquirer, where he covered the<br />

war in Iraq, state government, city hall, science, and<br />

health and was a member of the paper’s investigative<br />

team. Sullivan’s stories have forced officials to answer<br />

for systemic failings and undertake an overhaul of<br />

the city’s child welfare system, restructure criminal<br />

courts after it was shown that people charged with<br />

violent crimes escaped conviction on all charges in<br />

almost two-thirds of cases, and terminate a U.S.<br />

Environmental Protection Agency program that had<br />

allowed corporate polluters to burnish their green<br />

image. Most recently, Sullivan led a team of five<br />

reporters who examined violence in the Philadelphia<br />

schools. The series won the Pulitzer Prize for Public<br />

Service in 2012, a Casey Medal, and an Investigative<br />

<strong>Report</strong>ers and Editors Award.

john sullivan serves as soc professor, senior editor at the<br />

investigative reporting workshop, and journalist at the washington post.

Julia Finkel, MD, at Children’s National medical center and Kogod MBA<br />

students developed a smartphone diagnostic device and app.

A successful collaboration<br />

allows all partners to<br />

gain valuable professional<br />

perspectives.<br />

Kogod School of Business MBA students were<br />

part of an innovative collaboration that designed the<br />

prototype for the pupilometer, a device that doctors can<br />

use to diagnose everything from the level of opiates in<br />

the bloodstream to a mild concussion. The pupilometer<br />

is a small plastic tube that takes a measurement of the<br />

pupil and sends information to a smartphone app.<br />

The Kogod students worked with students from<br />

the International Design Business Management (IDBM)<br />

program at Finland’s Aalto <strong>University</strong> and a team<br />

from the Sheikh Zayed Institute for Pediatric Surgical<br />

Innovation at Children’s National Medical Center.<br />

Beyond developing a useful diagnostic tool for children,<br />

the pupilometer project enabled all involved to gain<br />

valuable new professional perspectives. For the MBA<br />

students, the partnership meant approaching a project<br />

with increased creativity.<br />

The Aalto students “made me realize that a good<br />

product isn’t just about cost and profit but also about<br />

user experience and customer needs,” said Nick Elefante,<br />

Kogod/MBA ’14.<br />

Design students learned process from their Kogod<br />

colleagues. “We came away from this experience with a<br />

better appreciation for time management,” said IDBM<br />

student Alex Rodichev. “Our friends at Kogod were so<br />

efficient in all our dealings with the client and were very<br />

respectful of their time and ours.”<br />

While MBA students aren’t experts in medical<br />

device construction—and designers might not be well<br />

versed in creating a business plan—together, the three<br />

teams created a functional device that will enter the<br />

market quickly and be used by a broader audience.<br />

“It’s been a phenomenally fruitful set of<br />

partnerships,” said Julia Finkel, MD, the project’s<br />

medical director at Children’s National and a specialist<br />

in pediatric pain management. “By tying together<br />

the device design with the business plan development<br />

and market strategy, we’ve been able to cut the project<br />

timeline down significantly.”<br />

Instead of designing and constructing a prototype<br />

in the lab alone, Finkel and Carolyn Cochenour, the<br />

lead technician on the project, worked in tandem with<br />

the students. Cochenour said working with students<br />

who did not have medical training enabled the team to<br />

address important usability questions that the medical<br />

team might not have anticipated. While the primary<br />

market for the pupilometer will be medical professionals<br />

in a hospital setting, the product may also be a useful<br />

field diagnostic tool for first responders and medical<br />

volunteers with less formal training.<br />

“The pupilometer is a screening tool meant to<br />

guide follow-up treatment,” Finkel said. “Its connection<br />

to a smartphone means it could be used anywhere,<br />

from a high school football field to the scene of a<br />

roadside accident.”<br />

Pending regulatory approval, Finkel and Cochenour<br />

expect the device to enter the market within the year.<br />

The pair also hopes the collaboration among the schools<br />

and hospital will continue.<br />

“Projects like this are an incredible opportunity for<br />

our students and our partners,” said Mark Clark, faculty<br />

program director for the full-time MBA. “A successful<br />

collaboration really shows our students what kind of<br />

professional partnership to strive for.”<br />

35

AU attracts students and faculty who want to make the most of living, studying, and working in<br />

Washington, DC. The proximity to government agencies and nonprofit organizations and associations<br />

provides a wealth of opportunities for involvement and education outside the classroom. AU students<br />

are motivated to take what they’re learning into the community and bring new insights back into<br />

the classroom. AU faculty and staff lead community-based organizations and facilitate connections<br />

between students and those in need in the DC area. As a result, 1,000 students participated in service<br />

learning courses, spending nearly 40,000 hours volunteering.<br />

Many students further engage with communities beyond DC by leading or participating in<br />

Alternative Break trips to both domestic and international destinations. These student-led trips partner<br />

with community organizations worldwide to address social justice issues such as education, immigration,<br />

refugee rights, youth empowerment, conflict resolution, food security, and cultural preservation.<br />

Long after graduation, alumni also demonstrate the importance of applying academic investigations<br />

to real-world problems. Whether it’s through establishing organizations to serve the disadvantaged,<br />

advocating for the rights of others, or mentoring the next generation of AU students, the values cultivated<br />

during their time at AU motivate alumni to effect positive change in the world.

Middle States Commission<br />

on Higher Education<br />

[AU] coordinates its<br />

course offerings with<br />

cocurricular activities<br />

. . . that attest to its<br />

commitment to<br />

promoting community<br />

service and to creating<br />

opportunities to<br />

understand diverse<br />

perspectives.

penelope spain, WCL ’05, and whitney louchheim, WCL ’05,<br />

connect juvenile offenders with law student mentors.

WCL mentors challenge<br />

young offenders to imagine<br />

a life outside the criminal<br />

justice system.<br />

Whitney Louchheim, WCL/JD ’05, and Penelope<br />

Spain, WCL/JD ’05, witnessed the child welfare and<br />

rehabilitation systems up close when they were students<br />

at the Washington College of Law. Appalled by the<br />

circumstances that many kids faced and convinced that<br />

they could thrive given the right support, Louchheim<br />

and Spain created Mentoring Today to provide the<br />

opportunities kids lacked.<br />

Like generations of <strong>American</strong> <strong>University</strong> students<br />

before them and waves still to come, Spain and<br />

Louchheim came to Washington in the fall of 2002<br />

to make a difference. “We just needed to define it,”<br />

recalled Spain.<br />

Meeting on the first day of law school orientation,<br />

the women talked for hours about their childhoods,<br />

their spirituality, and their desire to use their law<br />

degrees for good—whatever that might look like.<br />

A budding interest in juvenile justice solidified<br />

their bond.<br />

Spain shadowed a public defender at Oak Hill<br />

Youth Center, a now-defunct juvenile detention<br />

center replaced by a facility named New Beginnings.<br />

Louchheim clerked for a magistrate judge in DC<br />

Superior Court’s child abuse and neglect division. In<br />

2003, the pair founded Students United as a way to<br />

match WCL student mentors with 16- to 21-yearold<br />

inmates at Oak Hill with the goal of enabling<br />

the young men to successfully reintegrate into their<br />

neighborhoods and become responsible citizens.<br />

Mentoring Today now draws its corps of volunteers<br />

exclusively from Students United. Over the past nine<br />

years, Mentoring Today has matched 58 mentors with<br />

64 mentees.<br />

Mentors and mentees get to know each other<br />

over games and food in the New Beginnings cafeteria.<br />

Early on, the mentors’ job is to encourage the young<br />

offenders to take accountability for the choices that<br />

landed them behind bars and challenge them to<br />

imagine a life outside the criminal justice system. As<br />

release dates approach, mentors switch into advocacy<br />

mode, sitting in on meetings with the Department of<br />

Youth Rehabilitation Services and social service officials<br />

to negotiate the terms of release and ensure housing,<br />

education, mental health, and employment needs are<br />

addressed. That’s where the volunteers’ legal training<br />

comes into play.<br />

Louchheim and Spain are both defense attorneys by<br />

day and have grown Mentoring Today from a closet-sized<br />

office near what was then an open-air drug market in<br />

a park in Northeast DC. While preparing to take the<br />

bar exam, they were also applying for nonprofit status,<br />

researching insurance, and learning how to write<br />

grant proposals.<br />

Nine years later, they have seen meaningful<br />

success, including mentees who have gone on to<br />

become mentors themselves. Some Mentoring Today<br />

graduates created the FREE Project to advocate for<br />

education and employment opportunities for kids<br />

caught up in DC’s criminal justice system.<br />

The positive results for mentees are evident in<br />

the statistics. Nationally, 45 percent of mentoring<br />

relationships last 12 months. Twice as many of<br />

Mentoring Today’s matches—90 percent—hit the<br />

year-mark and, in fact, most pairs work together<br />

for about two and a half years. Under the guidance<br />

of the WCL students, 97 percent of youth active<br />

in Mentoring Today enroll in school or a GED or<br />

vocational program upon their release—compared to<br />

only 57 percent of juvenile offenders nationwide.<br />

Many go on to college. Seventy-one percent also<br />

obtain part- or full-time employment.<br />

39

Unsung Heroes of<br />

Compassion honors<br />

those who work to alleviate<br />

the suffering of others.<br />

40<br />

College of Arts and Sciences alumna Susan Dix<br />

Lyons can look back at her time at AU in the 1980s<br />

and see how her literature degree and involvement in<br />

social justice activism led her to receive an award from<br />

the Dalai Lama.<br />

Inspired by her grandparents’ journeys through<br />

Latin America and her own experience as a journalist in<br />

Central America, Dix Lyons traveled to Nicaragua and<br />

decided to create Clinica Verde, a sustainably designed<br />

clinic for families living in poverty in rural Nicaragua.<br />

Nicaragua is the second-poorest country in Latin<br />

America and has the highest rate of adolescent fertility.<br />

One in four pregnancies occurs to a teen mother, while<br />

one in five children is chronically malnourished.<br />

The clinic opened in January 2012 after four years<br />

of fundraising, designing, and building and now serves<br />

more than 14,000 patients annually. The clinic provides<br />

women’s health services, such as prenatal care, health<br />

education, and cervical cancer screenings; children’s<br />

healthcare, including wellness visits, immunizations,<br />

and nebulizations; adolescent healthcare and sexual<br />

reproductive health education; and care for adults,<br />

including disease care, counseling, and nutrition<br />

education. The clinic also has a pharmacy and is raising<br />

money to open an on-site laboratory.<br />

“We’re at a stage now where we’re exploring how<br />

we can expand our impact,” Dix Lyons said, “whether<br />

through helping to design and build other health<br />

hubs such as ours, developing as a site for training and<br />

education, social franchising—or even bringing our<br />

model to underserved areas in the U.S. We’re looking<br />

for experienced partners and people with big visions.”<br />

In February <strong>2014</strong>, the Dalai Lama hosted an<br />

event called Unsung Heroes of Compassion, which<br />

honors individuals who “work to alleviate the suffering<br />

of others without expectation of reward.” The event<br />

has been held four times since 2000, and this year<br />

Susan Dix Lyons was among the 51 honorees from<br />

around the world.<br />

Dix Lyons said <strong>American</strong> <strong>University</strong> shaped the<br />

path she has followed. “I had incredible professors<br />

who encouraged and inspired me, and I developed<br />

friendships with people who influenced my values and<br />

ambitions in a very positive way,” she said. “There was<br />

an activist culture while I was there that allowed us to<br />

really engage with the things we cared about. We were<br />

passionate and excited to contribute and find a sense<br />

of purpose, and we had a lot of fun. I left AU ready to<br />

take on big challenges.”<br />

Dix Lyons credits her literature degree with<br />

introducing her to new perspectives, ideas, and<br />

passions that affected how she approaches every<br />

challenge she faces. It also provided the basis for her<br />

communications skills, which she still practices by way<br />

of short perspective pieces that she records for KQED<br />

in San Francisco. She also teaches Media and Social<br />

Innovation as an adjunct professor at Pacific Union<br />

College in <strong>An</strong>gwin, California.<br />

Her advice to students is, “Say yes to every<br />

opportunity to grow. . . . Throw yourself out there, and<br />

don’t give up on your vision for a better world in which<br />

you play a critical part.”

susan dix lyons, cas ’89, was honored by the dalai Lama for<br />

establishing a sustainable clinic to serve the poor of nicaragua.

From the CFO, Vice President and Treasurer<br />

We were deeply saddened this past year by the passing of our friend,<br />

colleague, and longtime chief financial officer, vice president and treasurer<br />

Don Myers. His extraordinary career at <strong>American</strong> <strong>University</strong> spanned<br />

four decades, including 32 years as CFO. His legacy includes securing the<br />

university’s long-term financial health and developing the resources, facilities,<br />

and grounds to support AU’s academic programs and aspirations. During<br />

his tenure as CFO, the university’s endowment increased from $7 million to<br />

$550 million; the operating budget grew tenfold to $600 million; and total<br />

assets increased fourteen-fold to $1.4 billion. Happily, Don lived long enough<br />

to see his lifelong dedication to AU bear tremendous fruit and make a visible<br />

difference in the physical campus for generations to come and in ways that<br />

enrich the lives of current and future students, faculty, and staff.<br />

We continued to make significant progress in many areas this past year.<br />

Moody’s Investors Service upgraded AU’s credit rating to A1 from A2 and noted that “the upgrade reflects the ongoing<br />

positive momentum in the university’s market strength, flexible reserve growth, and financial stewardship.” Since<br />

then, our financial position has grown only stronger, as shown on the following pages. Total assets now stand at $1.55<br />

billion, and net assets reached the $1 billion mark for the first time in AU’s history.<br />

The past year also saw further progress on a number of our capital projects. The newly renovated McKinley Building<br />