Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

52<br />

Group Management Report<br />

Group Management Report<br />

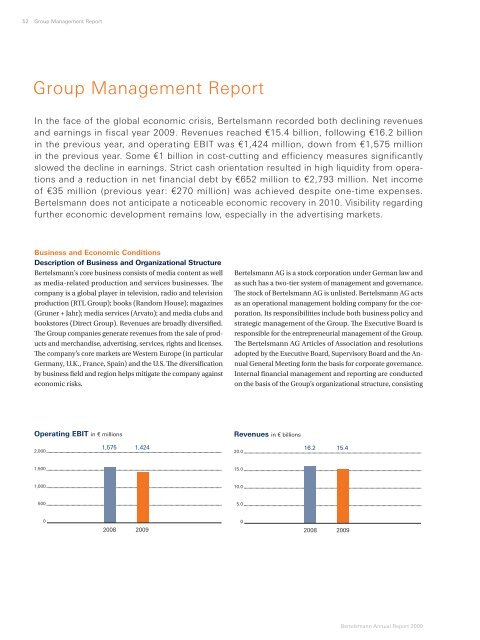

In the face of the global economic crisis, Bertelsmann recorded both declining revenues<br />

and earnings in fiscal year 2009. Revenues reached €15.4 billion, following €16.2 billion<br />

in the previous year, and operating EBIT was €1,424 million, down from €1,575 million<br />

in the previous year. Some €1 billion in cost-cutting and efficiency measures significantly<br />

slowed the decline in earnings. Strict cash orientation resulted in high liquidity from operations<br />

and a reduction in net financial debt by €652 million to €2,793 million. Net income<br />

of €35 million (previous year: €270 million) was achieved despite one-time expenses.<br />

Bertelsmann does not anticipate a noticeable economic recovery in 2010. Visibility regarding<br />

further economic development remains low, especially in the advertising markets.<br />

Business and Economic Conditions<br />

Description of Business and Organizational Structure<br />

Bertelsmann’s core business consists of media content as well<br />

as media-related production and services businesses. Th e<br />

company is a global player in television, radio and television<br />

production (RTL Group); books (Random House); magazines<br />

(Gruner + Jahr); media services (Arvato); and media clubs and<br />

bookstores (Direct Group). Revenues are broadly diversifi ed.<br />

Th e Group companies generate revenues from the sale of products<br />

and merchandise, advertising, services, rights and licenses.<br />

Th e company’s core markets are Western Europe (in particular<br />

Germany, U.K., France, Spain) and the U.S. Th e diversifi cation<br />

by business fi eld and region helps mitigate the company against<br />

economic risks.<br />

Operating EBIT in € millions Revenues in € billions<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

1,575<br />

1,424<br />

2008 2009<br />

Bertelsmann AG is a stock corporation under German law and<br />

as such has a two-tier system of management and governance.<br />

Th e stock of Bertelsmann AG is unlisted. Bertelsmann AG acts<br />

as an operational management holding company for the corporation.<br />

Its responsibilities include both business policy and<br />

strategic management of the Group. Th e Executive Board is<br />

responsible for the entrepreneurial management of the Group.<br />

Th e Bertelsmann AG Articles of Association and resolutions<br />

adopted by the Executive Board, Supervisory Board and the Annual<br />

General Meeting form the basis for corporate governance.<br />

Internal fi nancial management and reporting are conducted<br />

on the basis of the Group’s organizational structure, consisting<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0<br />

16.2<br />

15.4<br />

2008 2009<br />

Bertelsmann Annual Report 2009