Insight Magazine Issue 3 2017

Sierra Leone's most authoritative business and investment magazine. Interviews with Henry Macauley, Joule Africa, Abu Kamara, Joseph Fitzgerald Kamara and more.

Sierra Leone's most authoritative business and investment magazine.

Interviews with Henry Macauley, Joule Africa, Abu Kamara, Joseph Fitzgerald Kamara and more.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

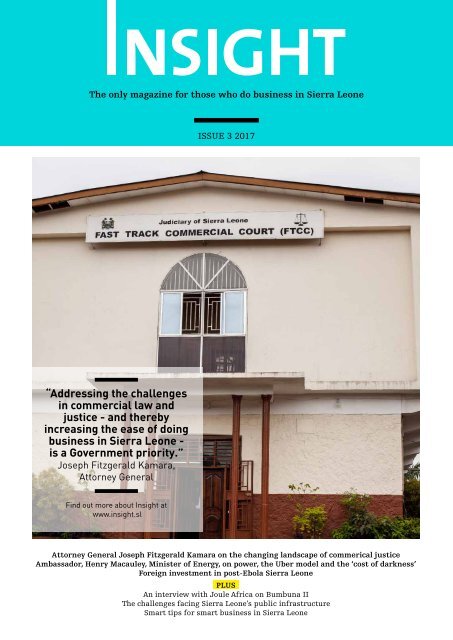

The only magazine for those who do business in Sierra Leone<br />

ISSUE 3 <strong>2017</strong><br />

“Addressing the challenges<br />

in commercial law and<br />

justice - and thereby<br />

increasing the ease of doing<br />

business in Sierra Leone -<br />

is a Government priority.”<br />

Joseph Fitzgerald Kamara,<br />

Attorney General<br />

Find out more about <strong>Insight</strong> at<br />

www.insight.sl<br />

Attorney General Joseph Fitzgerald Kamara on the changing landscape of commerical justice<br />

Ambassador, Henry Macauley, Minister of Energy, on power, the Uber model and the ‘cost of darkness’<br />

Foreign investment in post-Ebola Sierra Leone<br />

PLUS<br />

An interview with Joule Africa on Bumbuna II<br />

The challenges facing Sierra Leone’s public infrastructure<br />

Smart tips for smart business in Sierra Leone

EDITOR’S INSIGHT<br />

Ours is an age of disruption. It’s been said so often, that it’s now become a cliché. Truth be told, our shifting political,<br />

economic, social, and geopolitical landscapes are not unique. Our predecessors and their predecessors also lived in times<br />

of change. Disruption comes in many guises, and mankind’s history is one of discovery, revolution, evolution, invention, and<br />

innovation. How or if societies harness these forces, is what separates the leaders from the also-rans.<br />

Like other nations, Sierra Leone experiences positive and negative change. On the plus side, we can point to peaceful<br />

elections, improved infrastructure, regulatory reform, a growing economy and significantly increased influence on the<br />

international stage. On the down side, we’ve experienced disease, an economic recession and natural disaster in quick<br />

succession. In the process, It has become the thing to big up our society for its resiliance. No matter what fate throws our<br />

way, we keep on going.<br />

But admirable though all resilience is; it’s a truth universally acknowledged that some forms of resilience are more<br />

productive than others. In Sierra Leone, the indomitable instinct to survive, which allows communities to absorb their<br />

setbacks, recover and rebuild, also means that we often miss opportunities to innovate and improve in the process.<br />

Fortitude is no substitute for transformation and we need to learn from our experiences, and adapt our processes, systems<br />

and infrastructure in response to difficulty and disaster. When we rebuild or regroup, it should be bigger and better, more<br />

efficient and more effective than before.<br />

The very first subject of our change maker series was Dr Samura Kamara, Sierra Leone’s Foreign Minister, and now the<br />

flagbearer for the ruling APC party. We interviewed him about Sierra Leone’s economic recovery post Ebola and post the<br />

commodities slump. According to Dr Kamara, learning to accept and harness change has to be at the heart of development<br />

in Sierra Leone: “We need to introduce a culture of accepting change in Sierra Leone. We need to build patriotism and<br />

national pride and create attitudinal change throughout society,” he said.<br />

This issue of <strong>Insight</strong> is all about change, and its challenges. The massive Bumbuna II project will make a significant<br />

difference to our standards of living and to our economic prospects. Investors in developing economies need to have<br />

confidence in the justice system and the Attorney General’s programme of regulatory reform is intended to provide that<br />

reassurance. In an interview with Abu Kamara, Head of the PPP unit, we look at how PPP can support infrastructural<br />

development. The role of foreign investment in our emerging economy is the subject of opinion pieces by the CDC’s Murray<br />

Grant and consultant, Susanne Schroeder. And we are pleased to announce the launch of our ‘Smart Tools for Smart<br />

Business’ supplement. This new <strong>Insight</strong> regular, is designed to provide practical information and business support for those<br />

on the ground.<br />

3<br />

As always we look forward to your feedback. Thank you for continuing to support <strong>Insight</strong>.<br />

<strong>Insight</strong><br />

+44 771 7221023 / +232 78799999<br />

info@ftinsight.net<br />

Editor:<br />

Memuna Forna<br />

Art Director:<br />

Erika Perez-Leon<br />

Director of development:<br />

Mohamed Wurie- mohamedlwurie@gmail.com<br />

Director of corporate affairs:<br />

Habiba Wurie - wurie.habiba@yahoo.com<br />

Advertising Enquiries:<br />

+232 78984202<br />

Front cover image by Sullay Stephens<br />

www.ftinsight.net

CHANGE MAKER<br />

Joseph Fitzgerald<br />

Kamara – changing<br />

the landscape of<br />

commercial justice<br />

As well as access to water, energy, roads, ICT and a<br />

suitable workforce, investors in developing economies<br />

need to have confidence in the justice system. Some of the<br />

certainties they look for are protection for their property,<br />

access to justice and protection for their employees.<br />

They want assurance on contract enforcement and if any<br />

dispute arises, they want a judicial system that will bring rapid and<br />

efficient dispute solutions.<br />

To encourage foreign investment, many governments are increasingly focusing their attention on specific investment<br />

laws to provide this legal certainty. During the Invest Sierra Leone 2016 forum, whether Sierra Leone had or was<br />

developing the necessary regulatory infrastructure to protect investors became a major talking point.<br />

5<br />

Sierra Leone’s Attorney General and Minister of Justice - Joseph Fitzgerald Kamara, is all too aware that investors have<br />

certain expectations of commercial justice.<br />

When he delivered the keynote speech at Sierra Leone’s inaugural Commercial Law conference earlier this year, he<br />

emphasised the Government’s commitment in this area: “Addressing the challenges in commercial law and justice - and<br />

thereby increasing the ease of doing business in Sierra Leone - is a Government priority.”<br />

He explains that guaranteeing security and redress makes investors more prepared to take other risks and that one<br />

of the most important things for companies to hear is that there is a regulatory framework from which they can derive<br />

protection for their investment. “A reliable regulatory and legal system is essential for investors, as it reduces the risks<br />

they face when entering into commercial agreements. Potential investors arriving in Sierra Leone, will generally have<br />

calculated their expected return on investment, but often seek further clarity around their security of investment. They<br />

have a range of questions. Is my money secure? If I have a problem in my business, can I expect justice will be done?<br />

Will I have fair and equal access to the court system? These questions are paramount to any investor who wants to<br />

invest large amounts of money in Sierra Leone. Our job is to create a legal regulatory framework which protects both the<br />

interests of the investor and those of Sierra Leone.”<br />

A “massive improvement”, is how the Attorney General describes the relatively recent establishment of two fast track<br />

commercial courts that have reduced the length of time to hear commercial cases from three to four years in some of<br />

the worst cases, to “90 days on the outside”.<br />

He is particularly keen to highlight the advances made on Sierra Leone’s accession to the New York Convention. The<br />

Convention on the Recognition and Enforcement of Foreign Arbitral Awards, also known as the “New York Arbitration<br />

Convention” or the “New York Convention”, is one of the key instruments in international arbitration. It applies to<br />

the recognition and enforcement of foreign arbitral awards and the referral by a court to arbitration. More than half of<br />

the states in Africa are party to it including Nigeria, Ghana, Cote d’Ivoire, Kenya, Tanzania, South Africa and crucially our<br />

neighbours and fellow Mano River Union members – Guinea and Liberia.<br />

We may be behind our neighbours, but there is no question that acceding to the New York Convention is a key national<br />

priority – both in the Justice Sector Reform Strategy and Investment Plan III for Sierra Leone, and in the Judiciary’s<br />

Strategic Plan 2016-2021, which stresses ADR as a pro-conflict resolution and court decongestion strategy. The Attorney<br />

General confirms that the bill has now received cabinet approval and it is with the Government Printers, from where it<br />

will go to Parliament for the final legislative stages.<br />

Also on the Attorney General’s list is the land tenure system, which currently does not allow non-indigenous Sierra<br />

Leoneans to own land in the provinces. The belief in the need for land reform, for reasons of economic development,<br />

employment and ultimately peace and stability, is widespread.<br />

The “underdevelopment of rural areas” was identified in the postwar truth commission process as one of the underlying<br />

causes of the conflicts that devastated Sierra Leone. The problem remains – and the rural youth are still less likely to<br />

remain in rural areas and provide much-needed agricultural labour while the land tenure system limits their economic<br />

opportunities and status in rural communities. It also limits the industrialisation of agriculture. In 2011, the International<br />

Growth Centre published a paper by Omotunde E. G. Johnson, Reforming the Customary Land Tenure System in Sierra<br />

Leone: A Proposal. In it Johnson argued that reform of the customary land tenure system was “a major institutional<br />

change that would help to unleash the vast economic growth potential of Sierra Leone in tourism, agriculture and<br />

industry.”<br />

Joseph Fitzgerald Kamara concurs: “Our land tenure system mitigates against industrialisation, and large scale farming<br />

in the provinces. Reforming it would open up the market. Investors would find it easier to access the necessary finance –<br />

what a company would be able to attract under a lease agreement is different from the finance they could be able attract<br />

with the freehold.” He confirms that a new land policy has received cabinet endorsement and is expected to be enacted<br />

into law in the near future.<br />

www.insight.sl

CHANGE MAKER<br />

Inside the fast track<br />

commercial courts<br />

image by: Sullay Stephens<br />

Ambassador,<br />

Henry Macauley,<br />

Minister of Energy,<br />

on power, the Uber<br />

model and the<br />

‘cost of darkness’<br />

Interview by<br />

Habiba Wurie<br />

Power is one of the key drivers of economic growth. At the World<br />

Economic Forum in January this year, it was calculated that Africa’s<br />

economy could grow 30% by 2040 if the energy gap were to be closed.<br />

A “massive improvement”, is how the<br />

Attorney General describes the relatively<br />

recent establishment of two fast track<br />

commercial courts that have reduced the<br />

length of time to hear commercial cases<br />

from three to four years in some of the worst<br />

cases, to “90 days on the outside”.<br />

It is a critical situation and Ambassador Henry Macauley, the Minister of Energy is only too aware of the weight of his<br />

responsibilities. As he says: “The cost of darkness is much higher than the cost of power”. With a targeted 1000 mw<br />

capacity increase, he has embarked on an innovative strategic approach which is intended to supply cheaper tariffs<br />

and address some of the repercussions of climate change. The dry season gap- during which electricity generation from<br />

the hydro dams, falls from 50mw to 5 mw - is at the top of this list.<br />

What challenges is your Ministry facing regarding increasing access to energy and what strategies are you taking in<br />

order to overcome these?<br />

Electricity is a business, and as with all businesses, time is money, yet our biggest challenge remains delays in<br />

implementing projects that generate revenue due to public sector red tape and fiscal challenges on Government’s<br />

balance sheet. To solve this, I propose the ‘Uber model’ as the way forward for the energy sector in Sierra Leone. This<br />

would allow for a direct relationship between the customer and the generator/service provider thereby removing any red<br />

tape plus red tape costs. It allows for a deserved focus on the customer with the overall benefit to economic growth and<br />

development.<br />

We are also looking at re-inventing energy agreements such that our contract to say install 30 MW would see the<br />

government only guaranteeing a fraction of say 20MW or less. This reduces costs and manages our evacuation flexibility.<br />

We also now insist on part payment in local currency to help reduce our foreign exchange obligations.<br />

7<br />

Checks and balances which focus on local employment, skills development and ensuring that FDI does not crowd out<br />

or take away market opportunities from domestic enterprises, are an important part of the process of creating a stable<br />

environment for investors.<br />

The Attorney General highlights the value of Sierra Leone’s local content regulations, as a strategy for the forging of<br />

local economic links which support vertical business development. “Local content supports a peaceful coexistence with<br />

investors, by ensuring that the local population also benefits from incoming investment, through jobs, skills development<br />

and by boosting local economies.”<br />

The infrastructure of investment is multi-faceted. In transition economies such as Sierra Leone’s - commercial law is<br />

one of the main deficit areas. Reform facilitates economic integration, enables us to secure better terms in international<br />

or bilateral trade agreements, and encourages investment by improving the overall business climate. It is quite simply<br />

vital. Joseph Fitzgerald Kamara sums it up by saying: “Companies will not invest significantly in Sierra Leone if they lack<br />

confidence in our regulatory environment. Giving them confidence while protecting the interests of Sierra Leone and<br />

Sierra Leoneans is our job.”<br />

What opportunities would you say there are for prospective investors in this region?<br />

In 2016, the President, HE Ernest Bai Koroma launched the Energy Revolution and witnessed the signing of the Energy<br />

Africa Compact, an agreement with the UK government that saw the Government of Sierra Leone committing to the<br />

following steps to improve energy access in both the rural and urban areas of Sierra Leone:<br />

• Supply basic power to all of Sierra Leone’s population within nine years (by 2025)<br />

• Deliver “modern power” to one million people by 2020<br />

• Introduce household solar to all 149 chiefdoms in the country within the next 18 months<br />

• Eliminate import duties and VAT on qualified, internationally certified solar products<br />

To achieve these commitments, we have taken some bold steps to accelerate the participation of private investment in<br />

this sector. These steps will ensure that a thriving investment climate exists in the country, starting with the Renewable<br />

Energy and Energy Efficiency Policies which make Sierra Leone a leader in renewable energy in the region. Practical<br />

steps are also being pursued such as the installation of 54 solar mini grids around the country.<br />

www.insight.sl

Henry Macauley,<br />

Minister of Energy<br />

The sector has come a long way since 2007<br />

when our administration took over. To start<br />

with we saw a leap in power production by<br />

532% between 2007 and 2016. Household<br />

connections also increased by 23% during<br />

last year alone.<br />

Top image: MOE in partnership UK AID is powering community health centres throughout the country<br />

Bottom image: Household solar products. Image by Sullay Stephens<br />

3<br />

What would you say have been your biggest achievements so far?<br />

The sector has come a long way since 2007 when our administration took over. To start with we saw a leap in power<br />

production by 532% between 2007 and 2016. Household connections also increased by 23% during last year alone.<br />

We were also successful in establishing power generation in Magburaka, Lunsar and the district of Kono, areas that have<br />

not had any on-grid electricity. Lumley Beach will soon enjoy Government electricity, which they have not done for over<br />

30 years. We are working on deploying additional thermal plants all over the Country, in addition to hydro power with<br />

Moyamba, Betmai, Bekongor and Bumbuna 2 hydro power plants. When added together, these will provide over 300MW<br />

of hydro electricity, in addition to the current 50MW from Bumbuna 1.<br />

What developments should we all look forward to in the energy sector?<br />

I see great things for our country’s energy sector. With the right investment Sierra Leone could be the renewable energy<br />

hub for West Africa and I anticipate that by 2019, 50% of energy generated in Sierra Leone will come from various<br />

renewable energy sources such as hydro and solar along with the development of wind, thermal and bio mass energy.<br />

The recent energy sector reform road map developed with the Millennium Challenge Corporation will ensure that more<br />

will be done to make the policies and laws governing the sector more enabling. It will take a look at decentralising power<br />

supply for better customer focus and service, to deliver improved delivery and encourage the manufacturing and mining<br />

industries, creating jobs and growing our GDP<br />

And finally, what do you consider to be your biggest legacy as the longest serving Energy Minister of Sierra Leone?<br />

Without a doubt, the Energy Sector Reform Roadmap which is a transformational tool to put the Energy Sector on an<br />

irreversible path of sustainable growth and delivery. This reform will in turn bring us one step closer to introducing the<br />

‘uber model’ as a way of conducting the business of providing energy in Sierra Leone.<br />

www.insight.sl

ENERGY<br />

Bumbuna II -<br />

it’s a power thing<br />

Plans for the first phase of the Bumbuna hydropower project were<br />

unveiled in 1975. Eighty-five percent of construction was complete by<br />

May 1997, when it was halted because of civil war.<br />

The project was restarted in 2005 and was completed in November 2009. Almost eight years later, in August <strong>2017</strong>, Joule<br />

Africa signed a 25-year Power Purchase Agreement (PPA) with the Government, for electricity from a 143-MW expansion<br />

of the 50-MW Bumbuna station. It was an important milestone in the development of the project. <strong>Insight</strong> <strong>Magazine</strong> talked<br />

to Joule Africa to find out more about Bumbuna II.<br />

Tell us about Joule Africa, its experience in the energy sector and its objectives as a company.<br />

Joule Africa was established in 2011 and is a developer, owner and operator of sustainable power projects in Africa.<br />

Through the development and operation of sustainable energy assets, Joule Africa is committed to significantly<br />

increasing access to energy for the African nations in which it is needed most, a fundamental factor in any country’s<br />

ability to develop.<br />

years later. Seli Hydropower will provide electricity to the Electricity Distribution and Supply Authority (EDSA) for the next<br />

25 years at an agreed tariff.<br />

This project has been a long time in the making, the structure of the company has changed (for example the buy-out of<br />

Endeavour). What challenges have you encountered so far in this project and how have you managed them.<br />

Hydropower projects require extensive detailed planning, due diligence, assessment, modelling and consultation and as<br />

a result, tend to take a certain amount of time to get to the stage we are at today. We are proud that we are developing<br />

Bumbuna II in line with international best practice.<br />

It is unfortunate that during the last six years, Sierra Leone has also been confronted with the tragic Ebola crisis which<br />

paralysed the country for a considerable amount of time.<br />

Having been involved in the country since 2011, Joule Africa has a good understanding of how to do business in Sierra<br />

Leone. We have a close working relationship with our local partner, ESCO, and have built up some important connections<br />

with local businesses, government and the local communities over the past five years.<br />

We have a first-class, international team who have spent considerable time assessing the social and environmental<br />

considerations and are now in the process of finalising the respective action plans. We continue to be in dialogue with the<br />

Paramount chiefs and their respective communities.<br />

As regards the construction of Bumbuna II, we have been collaborating with the European Investment Bank to ensure<br />

that the project will be constructed in line with international best practice. We are close to appointing an internationallyrecognised<br />

contractor.<br />

The senior team of Joule Africa has a wealth of experience in developing and operating power projects across emerging<br />

markets, including overseeing the development of 10 GWh of power assets across Africa.<br />

Bumbuna II is Joule’s most advanced project; its second project - Kpep, is a 485MW hydropower project in Cameroon,<br />

which is currently embarking on the full feasibility stage.<br />

Explain the roles of Seli Hydropower and Energy Services Company (ESCO).<br />

Seli Hydropower is the registered project company in Sierra Leone, responsible for overseeing the successful<br />

development and operation of Bumbuna II. Seli Hydropower has overall responsibility for ensuring that Bumbuna<br />

II is developed safely and to a high standard, that the affected communities are well looked after and that affected<br />

environments are preserved and maintained. Seli Hydropower will also be responsible for the continued operation of<br />

Bumbuna I.<br />

Energy Services Company (ESCO) is Joule Africa’s local partner in Sierra Leone. ESCO provides various important local<br />

services, including supporting Seli Hydropower on its responsibilities towards the Government of Sierra Leone, the local<br />

communities and the local environment, as well as additional advisory and logistics services.<br />

How will Bumbuna II benefit Sierra Leone?<br />

Bumbuna II is a renewable power project, which will be harnessing Sierra Leone’s natural resource, in the form of heavy.<br />

seasonal rainfall. When operational, forecast to be in 2022, Bumbuna II will provide affordable, reliable, clean electricity<br />

throughout the year. At its peak it will be able to produce 143MW of additional capacity with a guarantee of 80MW of<br />

firm/guaranteed base power throughout the year.<br />

Experience shows us that this much-needed additional capacity will provide the opportunity for businesses and industry<br />

to grow, stimulating economic growth, while allowing households to become less dependent on existing dirtier, less<br />

healthy fuel alternatives and enjoy a better standard of living.<br />

As well as the provision of much-needed guaranteed electricity throughout the year, Bumbuna II also means significant<br />

local employment<br />

Joule Africa has signed a 25-year Power Purchase Agreement (PPA) with the Government. How does that work?<br />

Under the conditions of the Power Purchase Agreement (PPA), Seli Hydropower will build an extension to the existing<br />

50 MW hydro station, Bumbuna I, situated in the north east of the country, adding a further 143 MW of power capacity.<br />

Construction on the extension, Bumbuna II, is anticipated to start by mid-2018 with operations forecast to start four<br />

How is Bumbuna II financed and what factors were taken into account when financing this project?<br />

In terms of financing Bumbuna II, we have made good progress in securing the funding which will mainly come from<br />

organisations who are familiar and comfortable with investing in Africa and power projects.<br />

It is being financed by a combination of debt and equity and is being secured in such a way that we are able to generate<br />

electricity at an affordable tariff. The investors in Bumbuna II also share our long-term commitment to the project.<br />

Sierra Leone is experiencing the effects of climate change. How will this affect Bumbuna and will Bumbuna have any<br />

positive or negative impact on the effects of climate change in Sierra Leone (i.e. access to safe water)?<br />

With Bumbuna II, the availability of water is not predicted to be a significant issue. Data from the Bumbuna II Climate<br />

Change Resilience Assessment suggests that there is likely to be a general increase in precipitation across all seasons<br />

with an increase in flooding and heavy rain in some seasons. However, the data also suggests that there may be a<br />

decrease in the number of days with at least 1mm of rainfall, suggesting also that periods without rain may lengthen.<br />

The Bumbuna II project includes the creation of the Yiben reservoir which will have 4 times the usable storage capacity<br />

of the existing reservoir. This will make it more resilient to any decrease in days with at least 1mm of rainfall than the<br />

current Bumbuna I Hydro Electric Project configuration. This will enable both the existing and new power plants to be<br />

supplied with a more stable supply of water for power generation all year round. This will also result in a large increase<br />

in the power that can be generated all year round.<br />

What does the Bumbuna project contribute to Sierra Leone in terms of capacity building/skills transfer etc?<br />

Aside from the direct skills transfer during the construction of Bumbuna II, there will be further capacity building<br />

and training opportunities and initiatives, to be outlined in the Resettlement Action Plan (RAP) and the Community<br />

Development Action Plan, which will benefit local communities. These are being devised in consultation with the local<br />

communities.<br />

Our aspiration is that a significant proportion of the operating staff for the new scheme will be Sierra Leonean citizens.<br />

Where practical we will be recruiting local labour and sourcing local materials. As part of our agreement with the<br />

contractor, appropriate training will be provided.<br />

Explain the choice of construction and engineering firms.<br />

In partnership with our engineering advisers, Lahmeyer, we have conducted a comprehensive and rigorous tender<br />

process, resulting in a short-list of three internationally recognised bidders. The three bidders have extensive experience<br />

in working on similar projects and in Africa and two have already worked in Sierra Leone.<br />

11<br />

www.insight.sl

FINANCING<br />

FINANCING<br />

The three P’s<br />

of African<br />

infrastructure<br />

Driven by the need for long-term investment in public infrastructure<br />

allied to tight government budgets and Margaret Thatcher’s free market<br />

economics, the UK government began to explore avenues of co-production<br />

of public services with the private sector in the early 1990s. PFI, as it<br />

was called in the UK (Private Financing Initiative) spread quickly across<br />

sectors and took various forms, depending on the exact role that each<br />

project assigned to the private and public sectors.<br />

Almost 30 years on, the concept of PPPs has become influential globally, as countries face tight budgets while still<br />

needing long-term investment in public infrastructure.<br />

In Africa, the lack of adequate and well maintained infrastructure remains a major constraint to economic growth.<br />

According to the World Bank, the annual financial requirement for infrastructure in Sub-Saharan Africa (SSA) is about<br />

US$93 billion a year for both capital expenditures and maintenance. To finance this, only US$45 billion is being<br />

mobilised, two-thirds paid for by African governments and citizens, 8% by multilateral and bilateral donors and the rest<br />

by the private sector in emerging economies. There is therefore an estimated funding gap of US$50 billion a year.<br />

Unsurprisingly, increasing private investment is seen as a key strategy. As Clive Harris, Practice Manager in the Public<br />

Private Partnerships Group of the World Bank says: “Strengthening private investment in infrastructure in the world’s<br />

poorest countries is a priority for the World Bank Group. We are committed to working with development partners to<br />

address and de-risk challenging environments, in order to attract more private sector investment in a broader range<br />

of countries.”<br />

The figures show that the strategy is yielding dividends. According to the annual report of the Private Participation in<br />

Infrastructure Database, investments amounting to US$2.9 billion reached financial closure for 14 projects across seven<br />

International Development Association (IDA) countries in 2016. These are mainly in economic (physical) infrastructure,<br />

such as power, transport, telecommunications, and water and sanitation.<br />

The figures show that the strategy is yielding<br />

dividends. According to the annual report of the Private<br />

Participation in Infrastructure Database, investments<br />

amounting to US$2.9 billion reached financial closure<br />

for 14 projects across seven International Development<br />

Association (IDA) countries in 2016.<br />

“There’s a fourth<br />

‘P’ and it stands for<br />

people”, says Abu<br />

Kamara, Director of<br />

the PPP Unit<br />

The challenges facing Sierra Leone’s public infrastructure<br />

are well documented. By some assessments, addressing<br />

them will require a sustained expenditure of $258–<br />

478 million per year (Sierra Leone’s Infrastructure: A<br />

Continental Perspective, Nataliya Pushak and Vivien<br />

Foster, 2011).<br />

Based on that figure, we have an estimated annual funding gap of $58 to $278 million per year, most of it associated with<br />

water, power transport and agriculture. To address this the Government has been actively pursuing greater partnership<br />

with the private sector by strengthening the enabling environment for PPPs.<br />

In 2010 the Government passed the PPP Act. The country’s PPP unit was initially set up in 2011 to collaborate and<br />

provide technical support to Ministries, Departments, Agencies (MDAs) and local councils in engaging the private sector<br />

to deliver public sector services.<br />

Abu Kamara, took over the running of Sierra Leone’s PPP Unit in 2013 and shepherded the PPP Act through parliament<br />

in September of 2014. This sets out the responsibilities of the contracting authority and provides for the resolution of<br />

disputes, as well as covering the facilitation, conclusion and implementation of PPPs.<br />

With the recent signing of the Bumbuna II HEP PPP deal, <strong>Insight</strong> <strong>Magazine</strong> felt it was time to catch up with Abu Kamara<br />

to find out how PPPs are delivering infrastructural development in Sierra Leone, and what other projects are in the<br />

pipeline.<br />

He says that budgetary constraints, and an acknowledgement of private sector efficiencies and know-how are two of<br />

the principal reasons for the PPP approach to funding infrastructural projects. “At their core PPPs bring a business-like<br />

rigour and private sector efficiencies to big infrastructural projects. Around 70-80 percent of PPP financing comes from<br />

debt finance – this means that an additional layer of scrutiny comes from the banks.<br />

“Sierra Leone, like governments around the world, faces budgetary constraints. These impact on our ability to deliver<br />

new infrastructural projects. PPPs help to reduce the burden on direct government debt liabilities, which in turn frees<br />

up public capital to spend on other government services. They create access to other forms of finance, and because the<br />

private partner takes on the risk of financing, designing, constructing and maintaining the project, the Government’s<br />

exposure to risk is also reduced.<br />

“The downside is that PPP arrangements inevitably take longer to put in place than standard procurement procedures.<br />

A mega project can run from 300 million to a billion dollars and for that amount of capex, the private partner will want to<br />

ensure the rigour of their analysis and feasibility studies. This can cause tension in an environment like ours with urgent<br />

infrastructural needs, which is impatient for results.”<br />

13<br />

www.insight.sl

INVESTMENT<br />

Abu Kamara highlights the local content requirements<br />

of every PPP deal, which are structured to encourage<br />

the maximum use of local content and technology<br />

transfer. “As much as possible, we encourage linkages<br />

with local industries and the private sector and<br />

promote Sierra Leonean participation in private sector<br />

consortia,” he says. “After all, the end goal of all this<br />

is to grow our economy and develop the skills and<br />

capacity of Sierra Leoneans.”<br />

Making the PPP process in Sierra Leone more responsive to these needs is a priority of Abu Kamara’s. A team which<br />

includes the development arm of the Ministry of Finance and Economic Development and the Public Investment Unit as<br />

well as the PPP Unit, evaluates projects from the various Government ministries, departments and agencies (MDAs),<br />

with the aim of developing a long term infrastructural development plan and identifying projects with PPP potential. “The<br />

intention is that we can take the initiative, package PPP deals, and go out to market with them on a competitive basis”.<br />

Social as well as economic benefits are an important indicator of success says Kamara. He quotes a colleague who<br />

says that PPPs should come with a fourth ‘P’ - which stands for people. “Look for example at a project for a deep sea<br />

transhipment container port that we are currently working on. It will be able to berth 150 cargo vessels and will create<br />

over 20,000-30,000 jobs. The Bumbuna II hydro project will create 2,500 jobs in the construction phase. These big<br />

projects are transformational– they stimulate manufacturing, create jobs and improve livelihoods,” he explains.<br />

The Unit also encourages community PPPs. Kamara points to a DFID funded waste and recycling service in Bo and<br />

Makeni, which is providing jobs, keeping the cities clean and promoting recycling. “We hope to replicate the scheme in<br />

Kono and Kenema,” he says.<br />

Where the risks of a project are higher than returns, development partners can step in, if the project is delivering vital<br />

services. Kamara points to work that the Unit is currently doing on setting up diagnostic centres. “The capital required to<br />

set up well-equipped diagnostic centres and run them as commercial enterprises, would put their services beyond<br />

the reach of average Sierra Leoneans. Under these circumstances, bringing a development partner in with a grant for<br />

the initial capex, and then charging fees for opex makes their services more affordable,” he explains.<br />

Foreign investment<br />

in post-Ebola<br />

Sierra Leone<br />

Murray Grant,<br />

CDC Group Plc<br />

The Ebola crisis had a major impact on businesses in Sierra Leone. The<br />

World Bank estimates that Gross Domestic Output fell by as much as 22<br />

per cent during 2014-2015 - as a result of the crisis, and the dramatic dip<br />

in the price of iron ore. This economic contraction could have been worse<br />

had it not been for the necessary mobilisation of international aid and<br />

non-governmental organisations boosting demand for goods/services and<br />

injecting much needed foreign currency into the economy.<br />

While GDP growth has picked up since then – to just over 4 per cent in 2016 – the long term economic outlook<br />

remains a key question in a post-Ebola environment, where the private sector is significantly weaker and inflows from<br />

aforementioned international workers all but gone. Working alongside local teams, foreign investment can play a crucial<br />

role in reducing some of the constraints businesses face in order to drive economic performance.<br />

One of the main constraints is the lack of capital available to small and medium-sized businesses. During the crisis,<br />

many of the few remaining capital providers, mostly banks, had a temporary financing moratorium leaving businesses<br />

even more susceptible to the economic downturn at the time. In order to help, CDC partnered with Standard Chartered to<br />

develop a $50 million loan facility for local firms.<br />

The loans enabled borrowers to continue operating and to keep providing jobs. The CEO of Benco Trading, one of the<br />

beneficiaries of the loans, said: “It allowed us to actually maintain our workforce. Because we were at a time where<br />

we were going to have to lose half of our staff.” Last year, CDC provided a second loan facility and many of the same<br />

companies, including Benco Trading, borrowed again to drive growth now the economy had started to recover. The<br />

company has since created 50 new jobs and is still hiring. What Benco Trading shows is that successful businesses<br />

create jobs. This is particularly important in post-Ebola Sierra Leone, where youth unemployment is around 70 per<br />

cent. If local businesses can access capital, they can grow and provide employment to the many young Sierra Leoneans<br />

looking for work.<br />

15<br />

There is a full pipeline of PPP projects, dominated by the energy sector. “Energy is a powerful driver of economic<br />

growth,” he says, “and it has taken close to 55-60 percent of my working time.”. As well as Bumbuna II, he has the TCQ<br />

Freetown Heavy Fuel Oil project almost at completion stage. Together these two will bring in an additional 200+ MW.<br />

Smaller solar projects, which should be completed mid next-year are intended to add another 50 MW to the grid.<br />

Transport is another key area with the aforementioned transhipment port on the horizon, and phase two of the Bolloré<br />

concession already underway. The unit is also working closely with agriculture “to see how best we can develop largescale<br />

commercial farms that can take care of our domestic consumption,” he says. Under this sector, the Unit is in the<br />

final stages of concluding a PPP deal for an extensive oil palm plantation in Mattru.<br />

Abu Kamara highlights the local content requirements of every PPP deal, which are structured to encourage the<br />

maximum use of local content and technology transfer. “As much as possible, we encourage linkages with local<br />

industries and the private sector and promote Sierra Leonean participation in private sector consortia,” he says. “After<br />

all, the end goal of all this is to grow our economy and develop the skills and capacity of Sierra Leoneans.”<br />

www.insight.sl

In a country like Sierra Leone, with many vibrant smaller businesses but where larger firms are scarce, having a partner<br />

with an on-the-ground presence like Standard Chartered is invaluable. Without them, the loan facility simply wouldn’t<br />

have reached the same amount of companies. But businesses need more than just money if they are to succeed in Sierra<br />

Leone – they need support in developing the right strategy. Like every country in Africa, Sierra Leone comes with its own<br />

unique set of circumstances and as such investors must tailor their approach to the nuances of the investment climate.<br />

This is the approach CDC took in our most recent investment in the country – $20m into Solon Capital Partners, an<br />

investment holding company based in Freetown, to grow its existing businesses and invest in new opportunities in Sierra<br />

Leone. Solon’s structure and investment strategy takes a creative approach to solving market problems.<br />

By using a company structure, as opposed to the private equity (PE) fund model, Solon can offer greater flexibility to the<br />

businesses it invests in. Solon investee, Flash Vehicles, a vehicle hire and leasing firm, is an example where this model<br />

has allowed the Manager to start-up and invest in the business over a much longer period of time than it could have in a<br />

standard PE model. The business has scaled up significantly delivering international service standards in a space where<br />

supply had been informal and fragmented.<br />

SMART TOOLS<br />

FOR SMART<br />

BUSINESS<br />

Flash’s success and a commitment to reinvestment has enabled Solon to set up Rising Academies, a network of<br />

affordable schools in Sierra Leone and Liberia, aimed at improving access to education. Rising is already having an<br />

impact. In Liberia, a study was recently carried out to compare schools run by various providers. The study found that,<br />

pupils at Rising Academies schools made two to three times as much progress in reading and mathematics as children<br />

in some of the other groups.<br />

Investment in social infrastructure like education is essential for sustainable development in Sierra Leone. The Ebola<br />

crisis meant schools were shut for eight months and parents lost jobs (which paid for tuition fees) disrupting the<br />

education of thousands of school-aged children. Organisations which provide teaching at an affordable cost will be vital<br />

as the country continues to re-build in the long term. An educated and skilled management and labour workforce is<br />

essential to foreign investment as it requires local human resources at each stage of the investment cycle. From the<br />

availability of companies and projects in which to invest, to local input in an investor’s evaluation, to managing these<br />

businesses and projects.<br />

13<br />

Investing in affordable education is one example of how private sector investments can provide much needed affordable<br />

social and public infrastructure. This needs to be replicated in other sectors including affordable healthcare, housing and<br />

power. As foreign investors, we are now asking ourselves - and other similar organisations - how can we have a similarly<br />

high impact in these other sectors?<br />

Essential to the answer is partnering with teams who have a detailed understanding of doing business in Sierra Leone.<br />

More investors working closely with more local teams will help establish successful businesses which create quality<br />

jobs, build career paths so young people will be encouraged to stay in the country and contribute to government tax<br />

receipts, while helping Sierra Leone secure a stable future post-Ebola.<br />

Murray Grant is Managing Director, Intermediated Equity, at CDC Group Plc – the UK’s development finance institution.<br />

Here he writes about the themes in the Sierra Leonean economy that foreign investment can help overcome and what<br />

else is needed to help it flourish.<br />

www.insight.sl

RESEARCH<br />

<strong>Insight</strong>’s inaugural<br />

annual survey of<br />

working hours in<br />

Sierra Leone finds<br />

that respondents<br />

enjoy their work<br />

despite the long<br />

hours<br />

Survey results<br />

DO YOU OWN YOUR OWN BUSINESS OR ARE YOU AN EMPLOYEE?<br />

Employee<br />

Business owner<br />

Both<br />

Other<br />

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

HOW MANY HOURS A WEEK DO YOU WORK?<br />

0-10<br />

<strong>Insight</strong>’s newly launched annual survey of<br />

working hours in Sierra Leone aims to find<br />

out more about Sierra Leone’s work culture.<br />

“This is the first of an annual series of surveys which will measure<br />

working hours in Sierra Leone,” says the editor of <strong>Insight</strong> magazine.<br />

“Over time the results will build into a knowledge base that will help us<br />

track trends, and also look at the relationships between working hours<br />

and productivity, workplace stress, workplace satisfaction, health,<br />

income and professional success.”<br />

Measuring working hours is also an important economic indicator.<br />

Historically at the beginning of a recession, companies adjust working<br />

hours down, before making redundancies. As the economy picks up,<br />

employers increase hours before hiring more staff.<br />

This year’s survey is focused on the relationship between working hours and job satisfaction and compares the working<br />

hours of business owners with those of employees.<br />

Business owners made up the majority of respondents (31.6%), a further 26.3% of respondents were both business<br />

owners and employees. Twenty-six percent were employees and 16% categorised themselves as ‘other’.<br />

11-20<br />

21-30<br />

31-40<br />

41-50<br />

51-60<br />

60+<br />

No impact<br />

Little impact<br />

Heavy impact<br />

Don’t know/<br />

not sure<br />

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

WHAT IMPACT DO YOUR WORKING HOURS HAVE ON<br />

YOUR PERSONAL LIFE?<br />

19<br />

Over half (56%) say they work 51 hours or more a week. A third (33.3%) work between 41 and 50 hours a week. The<br />

majority (70%) of those who owned their own business worked over 51 hours a week. One particularly driven individual<br />

reported that he/she worked over 80 hours a week.<br />

10% 20% 30% 40% 50% 60% 70%<br />

DO YOU ENJOY YOUR WORK?<br />

80%<br />

90%<br />

100%<br />

The majority (53%) of respondents said that their working hours had little or no impact on their personal lives. Fortyseven<br />

percent however said that their working hours had a substantial impact on their personal lives.<br />

Yes<br />

No<br />

Despite this 95% of respondents said that they enjoyed their work.<br />

Future surveys will measure working hours across demographic groups, by sector, by gender and even by season. In<br />

time, they will also be able to look at the influence of technological innovation and policy changes.<br />

10%<br />

20%<br />

30%<br />

40%<br />

50%<br />

60%<br />

70%<br />

80%<br />

90%<br />

100%<br />

www.insight.sl

SMART BUSINESS<br />

Smart tips for<br />

smart business<br />

in Sierra Leone<br />

Location, location, location: A drive that takes 20 minutes without traffic, becomes a<br />

drive that takes an hour and a half in the mornings and evenings, particularly during<br />

the school term.<br />

Ensure reliable transport options: The AA and RAC have yet to reach this part of the world.<br />

Wardrobe malfunctions: Have<br />

a change of clothes on hand<br />

at all times. Sierra Leone is<br />

sometimes wet and muddy,<br />

sometimes hot and sweaty, and<br />

frequently both.<br />

Wardrobe malfunctions 2:<br />

Government offices operate a<br />

strict dress code, so don’t be<br />

tempted to dress down.<br />

Phone chargers, laptop chargers, in-car<br />

chargers, spare chargers, power packs,<br />

extensions and adaptors – you cannot<br />

have enough of these.<br />

These boots were made for walking:<br />

Familiarise yourself with all the walking<br />

routes (i.e. paved sidewalks) downtown.<br />

The city centre is small enough for you to<br />

be able to run all your errands or make<br />

all your meetings on foot, just make sure<br />

you’re wearing comfortable shoes.<br />

Always stay connected:<br />

Invest in a Mifi. For when the wifi<br />

bandwidth in your work space isn’t<br />

enough for the number of users. For<br />

when the power goes out. For those long<br />

hours stuck in traffic. For staying clear of<br />

high data rates.<br />

Having an office/home on the same road<br />

as high ranking state officials does not<br />

hurt.<br />

Enjoy the sunrise: prime uploading<br />

and downloading time is between the<br />

hours of 1am and 4am, when the rest of<br />

mankind has had enough of their social<br />

media accounts.<br />

Go to hot spots: Have several go-to spots<br />

with reliable internet access. One should<br />

be a busy restaurant so you can multitask<br />

by networking as well. The second<br />

should be a quiet corner for the times<br />

you have a deadline and don’t want to be<br />

distracted. Identify the various Limezone<br />

hotspots dotted around the city.<br />

Image by Freetown Street 366<br />

The rains: Have several umbrellas,<br />

wellington boots, and a spare outfit.<br />

Baby wipes and hand sanitiser.<br />

Need we say more<br />

Modes of communication are different. Expect to use your<br />

mobile phone to call, text and WhatsApp a lot. In a recent<br />

survey of <strong>Insight</strong> readers, 80% of respondents used WhatsApp<br />

for business purposes.<br />

Smart phoning. Have two mobile phones – one which uses the Airtel network, with the other<br />

on the Africell network. Calls across networks are expensive. When one network is down,<br />

you still have access to the other. Different networks are better in different parts of Sierra<br />

Leone.<br />

21<br />

Carry cash!! In an <strong>Insight</strong> survey – the top three forms of payment for retail transactions<br />

were cash, cheque and mobile payment – with cash coming out at a whopping 90%.<br />

A backpack containing all the above will be<br />

extremely heavy – learn to live with it.<br />

Top up, top up. Prepaid mobile services are more<br />

usual than post paid. Don’t be caught short.<br />

www.ftinsight.net

SURVEY RESULTS<br />

We surveyed<br />

more than 100<br />

businesses and<br />

these are the<br />

results…<br />

TYPES OF BUSINESS STORIES: Interesting business stories<br />

Editorial Calendar<br />

2018<br />

March <strong>Issue</strong><br />

Theme: Incorporating the corporate image<br />

In this issue we will be covering the top 10% industrial firms in the counry and learn from them on how<br />

their corporate structure enables a culture of effectiveness and efficiency. Firms with multiple base<br />

operations in Sierra Leone will be featured.<br />

Print Ad Deadline: 15th February 2018<br />

Publication Date: 1st March<br />

Investment opportunities 52.8%<br />

Business coverage on specific sectors<br />

Feature articles about succesful<br />

people or businesses<br />

Tips on doing business in SL<br />

Short news pieces<br />

Opinion pieces from business people<br />

and influencers<br />

27.4%<br />

24.5%<br />

20.8%<br />

20.8%<br />

19.8%<br />

June <strong>Issue</strong><br />

Theme: The case for diversification<br />

In this issue we will look at sectors with the most potential for diversification and identify both the<br />

barriers and opportunities in investment in these sectors.<br />

Print Ad Deadline: 15th May 2018<br />

Publicate Date: 1st June<br />

27<br />

Business trends and research<br />

Articles explaining a particular<br />

business process in SL<br />

17.9%<br />

13.2%<br />

September <strong>Issue</strong><br />

Theme: Infrastructure- what holds it all together<br />

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

BUSINESSES THAT ADVERTISE: Advertising in SL media<br />

9%<br />

49%<br />

In this issue which will be published a year after the first toll road in Sierra Leone was operationalised<br />

we will be looking at the direct and indirect impacts of infrastructural investment- from roads to fibre<br />

optic networks to air travel- to both the country and the investors.<br />

Print Ad Deadline: 15th August 2018<br />

Publication Date: 1st September<br />

42%<br />

REASONS FOR NOT ADVERTISING<br />

I don’t need to advertise<br />

25.9%<br />

Yes<br />

No<br />

I want to but I need guidance<br />

December <strong>Issue</strong><br />

Theme: Digging for ideas<br />

In this issue we will explore the institutions behind economic growth in the country and discuss<br />

their effects on the country’s growth. We will feature think tanks, tech innovation labs, business<br />

development firms, etc.<br />

Print Ad Deadline: 15th November 2018<br />

Publication Date: 1st December<br />

Advertising is too expensive<br />

I don’t think I will see results<br />

I don’t know where to advertise<br />

Other<br />

25.9%<br />

18.5%<br />

18.5%<br />

13%<br />

10%<br />

20%<br />

30%<br />

40%<br />

50%<br />

60%<br />

70%<br />

80%<br />

90%<br />

100%<br />

www.insight.sl

OPINION<br />

Together we can<br />

achieve more<br />

Susanne Schröder<br />

“Shaping an interconnected world”. That is the motto of Germany’s G20<br />

Presidency which runs from 1 December 2016 to 30 November <strong>2017</strong>.<br />

In her speech at the G20 summit in Hamburg in July <strong>2017</strong>, the German<br />

Chancellor reaffirmed this spirit of collaborative working saying: “What<br />

was true back then is still true today: we can achieve more if we act<br />

together than we could alone.”<br />

With these words she laid the foundation for a new cooperation between Europe, the G20 states and Africa during the<br />

coming years, giving Germany a leading role in intensifying the relationship between Europe and Africa.<br />

Reflecting Germany’s sense of urgency in this area, is the Federal Ministry of Economic Cooperation and Development’s<br />

new process: The Marshall plan with Africa.<br />

Launching the Marshall Plan, the German Development Minister Gerd Mueller said: “We need a paradigm shift; we have<br />

to realize that Africa is not the continent of cheap commodities but that the people of Africa need infrastructure and a<br />

future.”<br />

This analysis captured a new and ambitious aim - to support the development of infrastructure and therefore a future,<br />

especially for young people in Africa with a particular emphasis on encouraging private investment on the continent. It<br />

also signaled a new depth to African-German relations, and a commitment to closer collaboration.<br />

One of the programmes established by The Federal Ministry for Economic Cooperation and Development in cooperation<br />

with GIZ (Deutsche Gesellschaft für International Zusammenarbeit GMbH) is the Public Private Partnership (PPP) - Fund<br />

for Mano River Union countries. The aim is to strengthen the cooperation between these countries and the private sector<br />

globally, so as to create new jobs and provide sustainable access to income-generating activities and social services.<br />

Image by Freetown Street 366<br />

Challenges to this strengthened partnership with the private sector include the lack of infrastructure e.g. unreliable<br />

electricity and water supplies, an insufficient number of skilled workers, weaknesses in the rule of law and a lack of<br />

capacity in the public sector. Nevertheless, there is a huge potential for private partnerships to play an important role in<br />

developing the economy and future of the countries.<br />

The mutual advantages are clear: the private investor derives benefit from a growing market in the entire region (one<br />

office or production centre can supply not only Sierra Leone but also Guinea and Liberia) and the host countries have<br />

opportunities to improve their economic and social situation.<br />

Another programme to increase private investment in countries like Sierra Leone is the develoPPP.de programme . The<br />

objective of this programme is to overlap private enterprises and actors involved in development cooperation to provide<br />

training for local employees, promote the use of climate-friendly technologies or improve social standards at production<br />

facilities. It helps drive innovative projects forward in developing countries and emerging markets, while at the same<br />

time generating long-term benefits for the local population. Its website says: “develoPPP.de was set up by the German<br />

Federal Ministry for Economic Cooperation and Development (BMZ) to foster the involvement of the private sector at the<br />

point where business opportunities and development policy initiatives intersect.”<br />

As mentioned before there are challenges for companies looking to invest in countries like Sierra Leone. However,<br />

developing countries and emerging economies are the markets of tomorrow and through programmes like Public<br />

Private Partnership Fund for Mano River Union countries and develoPPP.de, financial risk can be reduced.<br />

Since Independence in 1961 Germany has stood with Sierra Leone side by side, assisting with the country’s socio<br />

economic development. Sierra Leone’s record of conflicts and crises mean that investment too often comes in the shape<br />

of humanitarian and development aid, but private investment can and should offer a more economically sustainable and<br />

mutually beneficial option.<br />

We can achieve more together than by acting alone. Although I would prefer to say: Only together can we achieve more<br />

than by acting alone!<br />

25<br />

Since Independence in 1961 Germany has stood with<br />

Sierra Leone side by side, assisting with the country’s<br />

socio economic development. Sierra Leone’s record<br />

of conflicts and crises mean that investment too often<br />

comes in the shape of humanitarian and development<br />

aid, but private investment can and should offer a more<br />

economically sustainable and mutually beneficial option.<br />

Susanne Schröder is a consultant for sustainable development cooperation Sierra Leone/Germany<br />

www.insight.sl

FINANCE<br />

Sierra Leone:<br />

Medium-term<br />

Economic<br />

Prospects<br />

(2018 – 2020)<br />

Contributed by the Ministry of Finance and Economic Development<br />

The key macroeconomic objectives over the medium term are to<br />

i) safeguard macroeconomic stability by reducing inflation, improving our foreign reserves position and<br />

maintaining debt sustainability<br />

ii) promote sustainable and inclusive growth by diversifying the economy through investments in<br />

agriculture, tourism and fisheries and scaling up investment infrastructure (roads, energy and water<br />

supply)<br />

iii) increase social spending including on social safety nets to promote human development<br />

iv) enhance domestic revenue mobilisation to provide the fiscal space for enhanced spending on<br />

infrastructure and social protection<br />

v) advance structural reforms to promote private sector participation in the economy<br />

Gross Domestic Product<br />

Growth in the medium term will continue on the path of strong recovery. Real GDP growth is projected to increase from<br />

6.1 percent in 2018 to an average of 6.8 percent during 2019 and 2020.<br />

Excluding iron ore, growth will increase from 5.1 percent to 6.6 percent during the same period.<br />

Economic growth will be driven by<br />

i) ramping up of iron ore production to pre-Ebola levels by Shandong Iron and Steel and the re-opening of<br />

the Marampa Iron Ore Mines under new ownership<br />

ii) investments in non-iron ore mining (rutile, bauxite and diamonds) to expand production capacities and<br />

the award of new mining licenses which is expected to increase production levels in this sector<br />

iii) the recent foreign investments in the agriculture and agribusiness sectors, in particular palm oil, will<br />

reach production stage<br />

iv) enhanced spending on infrastructure and the social sectors which will boost domestic demand to<br />

support the Ebola recovery as well as enhance supply response over the medium-term<br />

v) structural reforms to improve the business environment and reduce the cost of doing business in the<br />

country.<br />

On the basis of the assumptions made in the foregoing paragraphs, agricultural growth is projected to remain robust at<br />

an average of 5.1 percent during 2018-2020, of which, crop production will average 5.7 percent; livestock 4.3 percent;<br />

forestry 3.3 percent and fishery 3.7 percent.<br />

The resumption of iron ore production, is expected to drive an average growth of 15.5 percent in industry over the<br />

medium term. Mining and quarrying growth is projected to average 20.7 percent, of which iron ore will grow by an<br />

average of 26.1 percent and other minerals by 12.5 percent.<br />

Manufacturing growth is forecast to average 6.0 percent as electricity supply improves; electricity and water is expected<br />

to grow by 5.5 percent and construction, 5.3 percent. The strong recovery of the services sector is expected to continue,<br />

averaging 5.8 percent over the review period. Of this, trade and tourism is projected to grow by 5.3 percent, transport,<br />

storage and communications, 5.3 percent; finance, insurance and real estate, 5.3 percent; Government services, 7.8<br />

percent and other services, 5.3 percent.<br />

On the demand side, domestic demand including private and Government consumption as well as capital formation<br />

(private and public investments) will continue to account for the greater proportion of our Gross Domestic Product. Net<br />

exports (exports minus imports) are negative over the projection period as imports are projected to continue to exceed<br />

exports in the medium term.<br />

Inflation<br />

Inflationary pressures are projected to be moderate over the medium term. The year on year inflation is expected to fall<br />

to 9.5 percent by end 2018 and 8.5 percent by 2020. The stabilisation of the exchange rate will contribute to dampening<br />

inflationary pressures. The proactive stance of monetary policy complemented by fiscal consolidation is also expected<br />

to contain inflation. The projected increase in agricultural production, especially food crops will also lower consumer<br />

prices.<br />

Exchange rate<br />

The exchange rate will continue to be determined by market forces. Interventions by the Bank of Sierra Leone (BSL) in<br />

the foreign exchange market will be limited to contain temporary excessive volatility. BSL will aim to become a net buyer<br />

of foreign exchange in coming years, in order to increase reserve coverage.<br />

Exports<br />

The growth in exports is projected to average 14.3 percent over the medium term, moderating from 19.8 percent in 2018<br />

to 7.2 percent by 2020 as iron ore production reaches the maximum capacity. Exports are projected to continue to be<br />

dominated by minerals. Iron ore exports are conservatively projected to increase from 12 million metric tons in 2018 to<br />

15 million in 2020, relative to 6.1 million metric tons during 2016.<br />

The second iron mining company, (formerly) Timis Mining Corporation is also expected to commence operations<br />

during the period. Diamond production will average around 540,000 carats per annum over the medium term, of which<br />

Koidu Holdings will export an average of 300,000 carats, with alluvial diamonds responsible for the remaining 240,000<br />

carats per annum. Bauxite output will average 2.1 million metric tons; rutile, 183,000 metric tons; and ilmenite, 43,000<br />

metric tons. Exports will also be boosted by the production of palm oil and other export crops such as cocoa as recent<br />

investments in this sub-sector reach production stage.<br />

Imports<br />

Imports are projected to grow in an increasing trend by 7.0 percent in 2018, 8.1 percent in 2019 and 9.0 percent in 2020 in<br />

line with the expansion in economic activities.<br />

Current Account<br />

The current account deficit will narrow down slightly - initially to 18.6 percent of GDP in 2019 from 19.1 percent of GDP in<br />

2018, before increasing to 19.0 percent of GDP in 2020 in line with the movements in the trade balance.<br />

Balance of Payments<br />

The overall Balance of Payments position is projected to turn into a surplus of US$ 22 million (0.4 percent of GDP) in<br />

2018 and remain positive throughout the medium-term - from a negative position of US$59 million (1.6 percent of GDP)<br />

in <strong>2017</strong>.<br />

Gross foreign reserves are projected to increase from US$573 million (2.9 months of imports) in 2018 to US$695 million<br />

(3.0 months) of imports in 2020.<br />

27<br />

www.insight.sl

The Economy<br />

TEN YEARS OF TRANSFORMATION -<br />

2007-<strong>2017</strong><br />

Contributed by the Ministry of Finance and Economic Development<br />

• Economic growth was robust during the period rising from single digits in 2007 to 20.7 percent during<br />

2013. Despite the twin shocks of the Ebola and collapse of commodity prices, the Government was able to<br />

implement sound macroeconomic policies to revive the economy and put it on a high growth trajectory once<br />

again. Economic growth recovered by 6.1 percent in 2016 and projected to grow by 6.0 in <strong>2017</strong>. Growth was<br />

driven by increased investments in mining, agriculture, manufacturing, construction and services.<br />

• Domestic revenue collected increased from a low level of Le 536 billion (8.9 percent of GDP) in 2007 to 2.89<br />

trillion (12.2 percent of GDP) in 2016 and projected at Le 3.5 trillion (13.0 percent of GDP) in <strong>2017</strong>.<br />

• The growth in revenue has necessitated considerable investments in roads, energy, water supply, and other<br />

infrastructure projects. Total capital expenditures increased from Le 177 billion in 2007 to Le 2.04 trillion<br />

during <strong>2017</strong>, a clear indication of the Government’s commitment to transform the infrastructure landscape<br />

of the country.<br />

• Overall, Government expenditures increased from Le 835.5 billion (16.8 percent of GDP in 2007) in 2007 to<br />

Le 5.52 trillion (23.4 percent of GDP) in 2016 to fund largely priority spending including education, health,<br />

social safety, youth empowerment and economic diversification activities in agriculture, fisheries, and<br />

tourism. Government expenditures are projected at Le 6.5 trillion (22 percent of GDP) in <strong>2017</strong>.<br />

• Transfers to Local Councils to carry out devolved functions increased from Le 13.4 billion during 2007 to Le<br />

96.7 billion during 2016.<br />

• Exports amounted to US$300 million during 2007. Government has been proactive in ensuring an expanded<br />

export base during the past ten years. Exports increased fivefold to US$ 1.5 billion in 2013 prior to the<br />

external shock and US$ 1.3 billion in 2014 at the beginning of the external shock.<br />

• At the same time, imports, including essential inputs to increase productive capacity of the economy,<br />

increased from around US$ 400 million in 2007 to US$ 1.6 billion in 2015.<br />

• Gross foreign exchange reserves of the Bank of Sierra Leone were only US$ 215.5 million in 2007. Gross<br />

foreign exchange reserves increased to US$580 million in 2015 and declined slightly to US$500 million in<br />

2016 reflecting sound external sector policies.<br />

• To strengthen financial inclusion and broaden access to financial services, the Bank of Sierra Leone sought<br />

to improve the credit environment, notably by: i) preparing a development strategy for small-and medium<br />

sized enterprises; ii) launching the automated payments system to support deepening intermediation; iii)<br />

expanding the existing credit reference database to assess credit concentration; iv) establishing a collateral<br />

registry to support execution of collateral on bad loans and improve the credit culture; and v) establishing<br />

community banks in various parts of the country.<br />

• The Government inherited a difficult relationship with development partners including the IMF in 2007.<br />

Thanks to the prudent and professional management of the economy, Government overcame these<br />

difficulties and successfully completed the sixth and final review of the Poverty Reduction and Growth<br />

Facility in 2010.<br />

• Since then the Extended Credit Facility (ECF) programme approved in 2013 was successfully concluded,<br />

with all six reviews successfully completed by the Executive Board of the IMF. US$ 95.5 million was agreed<br />

under that ECF, but the IMF provided over $219 million in financial assistance during 2014–15 to alleviate<br />

the impact of the twin shocks by giving the budget greater resources at a time when social spending,<br />

especially for health and education, was critical.<br />

• Another ECF was approved in June <strong>2017</strong>, with US$ 224.2 million support to Government.<br />

• Government implemented various measures to promote responsible financial management including the<br />

following:<br />

• A new PFM Act was passed in 2016 aimed at increasing transparency and accountability in the<br />

management and reporting on the use of public resources;<br />

• Formation of a Cash Management Committee to take decisions on cash ceilings, short-term<br />

borrowing requirements, and placement of temporary cash. The Cash Management Unit provides<br />

monthly cash flow projections to serve as input for decisions of the cash management committee;<br />

• A Medium-Term Debt Management Strategy was completed by the Ministry of Finance and<br />

Economic Development. This was aimed at enhancing debt management capacity and borrowing<br />

policies;<br />

• Internal audit units have been established in key ministries, departments and agencies through<br />

the Ministry of Finance and Economic Development. These units are under the direct control of<br />

the chief internal auditor of the Ministry of Finance and Economic Development;<br />

• Government also promoted transparency by supporting the work of an independent external<br />

auditor, Audit Service Sierra Leone.<br />

3<br />

www.insight.sl

What our readers say<br />

“<br />

I have enjoyed reading your<br />

magazine, especially the recent<br />

blog on Olusegun Jaji. It’s been<br />

interesting reading up on the<br />

new investors, business and<br />

entrepreneurs in Sierra Leone.<br />

THE MAGAZINE FOR THOSE<br />

IN CHARGE OF CHANGE IN<br />

SIERRA LEONE<br />

3<br />

”<br />

Ernestine Blanco<br />

Senior Advisor at AARP<br />

Des Moines, Iowa area<br />

To advertise contact us on<br />

info@ftinsight.net