Fisa de Prezentare Obligatiuni Avicola Bucuresti - Kmarket.ro

Fisa de Prezentare Obligatiuni Avicola Bucuresti - Kmarket.ro

Fisa de Prezentare Obligatiuni Avicola Bucuresti - Kmarket.ro

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

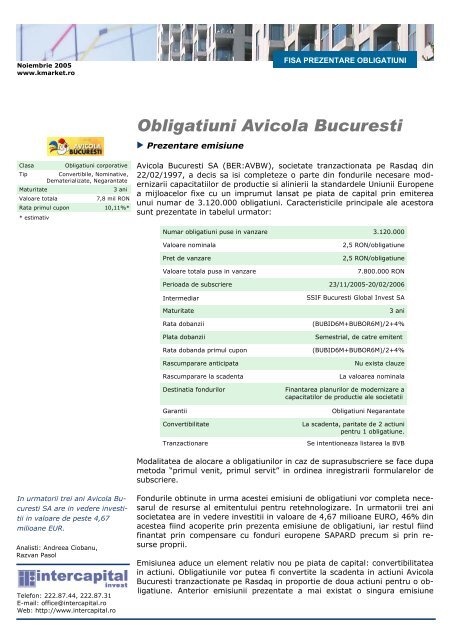

Noiembrie 2005www.kmarket.<strong>ro</strong>FISA PREZENTARE OBLIGATIUNI<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Prezentare</st<strong>ro</strong>ng> emisiuneClasa<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> corporativeTipConvertibile, Nominative,Dematerializate, NegarantateMaturitate3 aniValoare totala7,8 mil RONRata primul cupon 10,11%** estimativ<st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> SA (BER:AVBW), societate tranzactionata pe Rasdaq din22/02/1997, a <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>cis sa isi completeze o parte din fondurile necesare mo<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rnizariicapacitatiilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> p<strong>ro</strong>ductie si alinierii la standar<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>le Uniunii Eu<strong>ro</strong>penea mijloacelor fixe cu un imprumut lansat pe piata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> capital prin emitereaunui numar <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 3.120.000 obligatiuni. Caracteristicile principale ale acestorasunt prezentate in tabelul urmator:Numar obligatiuni puse in vanzare 3.120.000Valoare nominalaPret <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> vanzareValoare totala pusa in vanzare2,5 RON/obligatiune2,5 RON/obligatiune7.800.000 RONPerioada <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> subscriere 23/11/2005-20/02/2006IntermediarMaturitateRata dobanziiPlata dobanziiRata dobanda primul cuponRascumparare anticipataRascumparare la sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ntaDestinatia fondurilorGarantiiConvertibilitateTranzactionareSSIF <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> Global Invest SA3 ani(BUBID6M+BUBOR6M)/2+4%Semestrial, <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> catre emitent(BUBID6M+BUBOR6M)/2+4%Nu exista clauzeLa valoarea nominalaFinantarea planurilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> mo<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rnizare acapacitatilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> p<strong>ro</strong>ductie ale societatii<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> NegarantateLa sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nta, paritate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 2 actiunipentru 1 obligatiune.Se intentioneaza listarea la BVBModalitatea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> alocare a obligatiunilor in caz <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> suprasubscriere se face dupametoda “primul venit, primul servit” in ordinea inregistrarii formularelor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>subscriere.In urmatorii trei ani <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng>SA are in ve<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re investitiiin valoare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> peste 4,67milioane EUR.Analisti: Andreea Ciobanu,Razvan PasolTelefon: 222.87.44, 222.87.31E-mail: office@intercapital.<strong>ro</strong>Web: http://www.intercapital.<strong>ro</strong>Fondurile obtinute in urma acestei emisiuni <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni vor completa necesarul<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> resurse al emitentului pentru retehnologizare. In urmatorii trei anisocietatea are in ve<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re investitii in valoare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 4,67 milioane EURO, 46% dinacestea fiind acoperite prin prezenta emisiune <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni, iar restul fiindfinantat prin compensare cu fonduri eu<strong>ro</strong>pene SAPARD precum si prin resursep<strong>ro</strong>prii.Emisiunea aduce un element relativ nou pe piata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> capital: convertibilitateain actiuni. <st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng>le vor putea fi convertite la sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nta in actiuni <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng><st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> tranzactionate pe Rasdaq in p<strong>ro</strong>portie <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> doua actiuni pentru o obligatiune.Anterior emisiunii prezentate a mai existat o singura emisiune

www.kmarket.<strong>ro</strong>OBLIGATIUNI AVICOLA BUCURESTIpublica <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni convertibile in Romania, cea a International Leasingdin anul 2000.P<strong>ro</strong>spectul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> emisiune integral se gaseste pe site-ul www.kmarket.<strong>ro</strong>, sectiunea“Documentare si Analiza”. Cererile <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> informatii suplimentare vor fiadresate intermediarul ofertei, SSIF <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> Global Invest SA, telefon319.0251.DATE GENERALE EMITENTEmitent<st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> SASediuStr. Jandarmeriei Nr. 2,Sector 1, <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng>Telefon 230 0448FaxE-mail230 0632office@avicolabucuresti.<strong>ro</strong>Site Web www.avicolabucuresti.<strong>ro</strong>CUI 1551768ActivitateCont<strong>ro</strong>lDirectorGeneralCresterea pasarilorSIF MunteniaIon Costache <st<strong>ro</strong>ng>Prezentare</st<strong>ro</strong>ng> emitentObiectul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> activitate al societatii consta cresterea si valorificarea pasarilorsi a p<strong>ro</strong>duselor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rivate din acestea. Principalele activitati <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>sfarsurate includselectia, hibridarea si distributia pe piata interna si externa <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> materialbiologic pasari si animale mici, elaborarea tehnologiilor fiecarui hibrid,elaborarea p<strong>ro</strong>gramelor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> p<strong>ro</strong>filaxie sanitar-veterinara specifice fiecarui hibridprecum si analize <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> laborator, consultanta si expertiza sanitarveterinara.Cea mai mare pon<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re in venituri o inregistreaza ouale <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> consum (46,7%din veniturile pe 2004) si puii <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> carne vii (14,7%):P<strong>ro</strong>dus 2002 2003 2004Oua consum 28,4% 42,7% 46,7%Pui carne vii 3,9% 8,1% 14,7%Cea mai importanta pon<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re intotalul valoric a veniturile societatiio au vanzarile oualelor<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> consum.Puicute hibri<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> o zi 8,2% 8,1% 5,2%Pasari adulte vii 5,7% 5,7% 4,8%Alte 53,8% 35,4% 28,6%Piata pe care <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> activeaza este caracterizata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> o concurentaputernica din partea unor firme soli<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>. Astfel pe partea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> p<strong>ro</strong>ductie oua <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>consum principalii concurenti sunt: Tonelli Buftea, Jack Moris COM Gorneni,At Grup Draganesti Vlasca, Agrimond Braila. La p<strong>ro</strong>ductia <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> material biologic:Hyssec Carei, Zuras Grecia si ISA B<strong>ro</strong>wn. Pe partea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> p<strong>ro</strong>duse <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>carne: Tec Romania, Agrisol si <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> Calarasi, <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> Buzau, <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> Brasov,<st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> Bacau.Pe piata interna societatea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>tine momentan o cota <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> piata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 15% pepartea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> material biologic si doar <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 2% pe partea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> oua <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> consum si1% pe partea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> p<strong>ro</strong>duse din carne <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> pasare.Capitalul social al societatii are o valoare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 9.348.950 RON impartit in3.739.580 actiuni cu o valoare nominala <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 2,5 RON. Structura este puternicconcentrate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> catre SIF Muntenia:Actionar Nr. actiuni %capital socialSIF Muntenia 3.675.500 98,29%Free Float 64.080 1,71%Actiunile <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> se tranzactioneaza la Bursa Elect<strong>ro</strong>nica Rasdaqcu simbolul AVBW din anul 1997. Tinand cont <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> concentrarea actionariatului,lichiditatea in piata este extrem <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> redusa. Ultima tranzactie s-a inregistratpe data <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 14/04/2005, cand s-au transferat 80 <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> actiuni la pretul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>0,30 RON/actiune. De altfel, tot istoricul tranzactionarii actiunilor inclu<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> unvolum total <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> numai 7.311 actiuni (0,08% din capitalul social total) si ovaloare a tranzactiilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 1.820 RON. Evolutia tranzactiilor este prezentatamai jos:2

www.kmarket.<strong>ro</strong>OBLIGATIUNI AVICOLA BUCURESTI1.41.210.80.60.40.201997 1998 1999 2000 2001 2002 2003 2004 2005Pentru viitor sunt estimate p<strong>ro</strong>fituri cumulate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> circa 2,8 milioane RONpentru 2005, 7,8 milioane RON pentru 2006 si 10,6 milioane RON pentru2007. Un tabel comparativ cu principalii indicatori financiari inregistrati panaacum <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> si p<strong>ro</strong>gnozati pentru 2005-2007 este prezentat intabelul urmator:Mil RON 2003 2004 2005E 2006E 2007EVenituri totale 37,02 50,26 83,27 103,03 109,22Cheltuieli totale 38,56 49,86 80,41 95,26 95,64P<strong>ro</strong>fit net -1,54 0,39 2,86 7,76 10,57P<strong>ro</strong>fitabiliatate -4,16% 0,77% 3,36% 7,53% 9,67%Active totale 27,09 27,48 N/A N/A N/ACapital p<strong>ro</strong>priu 6,68 8,08 N/A N/A N/AAvand in ve<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re ap<strong>ro</strong>piata a<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rare a Romaniei la Uniunea Eu<strong>ro</strong>peana sipentru a face fata unui mediu concurential mult mai accentuat si diversificatsocietatea si-a p<strong>ro</strong>pus pentru urmatoarea perioada un plan <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>zvoltare siinvestitii masive concretizate in planuri <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> mo<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rnizare si retehnologizare aliniilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> p<strong>ro</strong>ductie.In acest sens este vizata specializarea fiecarei subunitati (Codlea, Mihailesti,Saliste, Butimanu) din cadrul societatii in functie <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> fluxurile tehnologice,cerintele <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> pe piata si zona <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> amplasare. Randament obligatiuniDobanda oferita este printer celemai mari din piataDobanda obligatiunilor <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> este calculata folosind o formulasimpla <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> calcul si anume media BUBID (rata anuala a dobanzii pasive latermen <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 6 luni atrase <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> la alte banci pe piata interbancara) si BUBOR(rata anuala medie a dobanzii active la termen <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 6 luni plasate la altebanci pe piata interbancara) la care se vor adauga 4 puncte p<strong>ro</strong>centuale:Rata dobanda = [(BUBID+BUBOR)/2]+4%/anRatele BUBID si BUBOR sunt actualizate zilnic pe pagina <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> web a BanciiNationale Romane, www.bn<strong>ro</strong>.<strong>ro</strong>. In functie <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> ultimele valori afisate o estimarea primului cupon oferit <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni indica o rata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 10,11%.P<strong>ro</strong>gramul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> plata a cupoanelor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> dobanda pe durata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> viata a emisiuniieste prezentat in tabelul urmator:3

www.kmarket.<strong>ro</strong>OBLIGATIUNI AVICOLA BUCURESTICuponRata dobandaData prece<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ntacuponData <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> referintaData curenta cupon1 10,11% - 15.04.2006 22.04.20062 Va fi anuntata 22.04.2006 15.10.2006 22.10.20063 Va fi anuntata 22.10.2006 15.04.2007 22.04.20074 Va fi anuntata 22.04.2007 15.10.2007 22.10.20075 Va fi anuntata 22.10.2007 15.04.2008 22.04.20086 Va fi anuntata 22.04.2008 A 1095-a zi <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> laconfimarea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> CNVMa primirii notificariiasupra rezultatuluiofertei fara sapte zilecalendaristiceA 1095 zi <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> la confirmarea<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> catre CNVM aprimirii notificarii asuprarezultatului oferteiDobanda se va plati semestrial. Agentul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> plata este chiar emitentul, iarcalculul dobanzii va avea drept reper valoarea celor doua dobanzi interbancareafisata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> BNR in ziua <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nta a dobanzilor la data cuponului indicatein tabelul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> mai sus. Plata efectiva se va efectua intr-un termen <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>10 zile lucratoare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> la momentul inceperii platilor. Rambursarea principaluluise va face intr-o singura transa, in termen <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 30 <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> zile calendaristice <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>la sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nta, adica in a 1095-a zi <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> la confirmarea <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> catre CNVM a primiriinotificarii cu rezultatele ofertei.La sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nta <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>tinatorii <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni isi pot exercita dreptul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> conversie aobligatiunilor in actiuni AVBW (listate pe piata elect<strong>ro</strong>nica Rasdaq) printr-unraport <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> convesie <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> 1:2.Facand o comparatie cu randamentul oferit <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> celelalte emisiuni <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiunifacute in Romania si listate acum la Bursa <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> Valori <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> se poateobserva ca obligatiunile <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> aduc cateva p<strong>ro</strong>cente peste dobanziledisponibile in piata. Totusi, avand la baza rezultatele financiare inregistratein ultimii ani <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> societate si obiectul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> activitate al emitentuluiam putea spune ca in acest caz si riscul asumat poate fi mai ridicat.Majoritatea emisiunilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nominate in RON implica in formula<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> calcul media BUBID si BUBOR oferind peste aceasta o marja <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> la 0,50%pana la 2,50%, p<strong>ro</strong>centele fiind cu atat mai mari cu cat investitia in respectiveleemisiuni este consi<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rate mai riscanta:IndicatorCuponcurentCupon estimativ*Formula <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> calcul<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng>(3 ani)<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> BRD(3 ani)<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> Finansbank(3 ani)<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> Hexol(2 ani)<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> Raiffeisen(3 ani)<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> Timisoara(5,5 ani)10,11%* 10,11% (BUBID6M+BUBOR6M)/2+4%7,94% 7,31% BUBOR6M9,22% 6,86% (BUBID6M+BUBOR6M)/2+0,75%7,50% 8,61% (BUBOR6M+BUBID6M)/2+2,5%8,91% 6,61% BUBID6M+BUBOR6M)/2+0.5%8,25% 8,25% Fixa4<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> Aiud(3.5 ani)*estimativ in functie <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> ultimele date furnizate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> BNR9,00% 8,38% (BUBID3M+BUBOR3M)/2+2%

www.kmarket.<strong>ro</strong>OBLIGATIUNI AVICOLA BUCURESTIIn mod evi<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nt randamentul obligatiunilor este cu mult mai mare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>cat alteplasamente cu venit fix disponibile pe piata:IndicatorRata anuala a dobanzii<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> SA (3 ani) 10,11%<st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> stat cu dobanda (2 ani) 7,50%Depozit la termen BCR 7,00%Depozit la termen BRD 4,75% RiscuriInvestitia in obligatiuni corporative prezinta riscuri, intre care riscul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> neplata,riscul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> fluctuatie a ratelor dobanzilor, riscuri economice, financiaresi <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> alta natura. In cazul emisiunii <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> trebuie analizate riscurilelegate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> activitatea economica a emitentului.Spre <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>osebire <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> majoritateaemisiunilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> pepiata, emisiunea <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> estenegarantata.Se pune p<strong>ro</strong>blema in viitor daca emitentul isi va putea onora platile <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> dobanzisi principal la sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nta. <st<strong>ro</strong>ng>Obligatiuni</st<strong>ro</strong>ng>le <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> nu sunt garantateprintr-o polita <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> risc financiar sau prin alte garantii, existand doar oclauza <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> prim rang, <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ci p<strong>ro</strong>misiunea ca imprumutul obligatar va fi onoratcu prioritate (daca vor exista fonduri disponibile). Spre <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>osebire <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> mareamajoritate a emisiunilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni corporative <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rulate pana acum siincheiate cu succes, precum cele ale BRD-G<strong>ro</strong>upe Societe Generale, BCR-Leasing, Finansbank, Raiffeisen sau TBI Leasing—companii cu o puternicaforta financiara, putem consi<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ra ca investitia in obligatiunile <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng>este mai riscanta. De altfel, acest lucru este luat in calcul si la stabilirearatei dobanzii.Avand in ve<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re rezultatele financiare inregistrate in ultimii ani se pune incontinuare p<strong>ro</strong>blema daca previziunile pentru urmatorii trei ani se vora<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>veri si conditiile pietei vor permite realizarea acestora. Momentan societateanu are o pozitie puternica pe piata, cumuland doar o mica parte dinsector mai ales pe partea vanzarilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> oua <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> consum zona cu pon<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>reacea mai insemnata in venituri. In plus concurenta pe piata este in cresteresi <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>terminata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> firme <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> renume, care au avut <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ja in ve<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re mo<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rnizareasi retehnologizarea p<strong>ro</strong>ductiei.Ca si valoare a imprumutului raportat la veniturile p<strong>ro</strong>gnozate pentru anul2005 emisiunea reprezinta doar 9,36% din totalul valoric al acestora, ceeace nu reprezinta prea mult—daca am avea in ve<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re celelalte emisiuni <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>obligatiuni corporative din tara noastra.Riscul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> rata a dobanzii este mai redus <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>cat in ultimii ani, datorita uneirelative stabilizari a dobanzilor si a unor flucutatii mai reduse. ConcluziiNumarul emisiunilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni corporative lansate in Romania nu estefoarte mare, astfel incat orice initiativa noua <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> acest gen merita analizata.Dobanda obligatiunilor <st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> este atragatoare, dar consi<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ram ca aceastanu compenseaza pe <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>plin riscurile asumate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> investitori.<st<strong>ro</strong>ng>Avicola</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng> este un emitent <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni nou; ca emitent <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> actiuni,societatea a fost foarte putin prezenta pe piata <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> capital, actiunile saletranzactionandu-se foarte putin datorita unei concentrari mai mult <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>catexcessive.5Rezultatele financiare ale emitentului nu sunt spectaculoase; ramane <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> va-

www.kmarket.<strong>ro</strong>OBLIGATIUNI AVICOLA BUCURESTIzut daca rezultatele estimate pentru anii urmatori pot fi atinse, in conditiilecresterii concurentei pe piata. Societatea este implicata si intr-un litigiu cuAPAPS in calitate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> parata, pentru pretentii semnificative in valoare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ap<strong>ro</strong>ximativ 9 mil RON—solutionarea acestui litigiu fiind incerta si putandafecta situatia viitoare a emitentului. Emisiunea este negarantata, ceea ceridica si mai mult riscurile investitiei.Posibilitatea conversiei actiunilor la sca<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nta, <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>si interesanta din punct <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ve<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re theoretic, nu poate fi luata in consi<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rare datorita conditiilor <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>zzavantajoase(raport <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> conversie, lichiditate redusa a actiunilor, performantefinanciare slabe ale emitentului).In cazul acestei investitii se pune si p<strong>ro</strong>blema participarii in oferta publica.Perioada <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rulare a ofertei este <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>stul <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> lunga, astfel incat investitoriitrebuie sa isi p<strong>ro</strong>grameze eventualele investitii cu atentie. Exista si risculneincheierii cu success a ofertei publice, insa acest risc p<strong>ro</strong>babil nu este excesiv<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> ridicat, iar actionarul majoritar al emitentului, SIF Muntenia, arputea participa la emisiune pentru acoperirea eventualelor obligatiuni nesubscrise.Intermediarul emisiunii nu a mai <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rulat pana acum nici o ofertapublica <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> vanzare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni.RECOMANDARE:NEUTRACu toate acestea riscurile nu sunt excesive. Dobanda, chiar daca o consi<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ramprea mica in raport cu riscurile emisiunii, nu este exagerat <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> reedusa.SIF Muntenia, actionarul majoritar al emisiunii, reprezinta un element<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> incre<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re. Alte elemente pozitive sunt dimensiunea relativ redusaa emisiunii, si statutul emitentului <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> societate consolidata, cu un istoricin<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>lungat pe piata.In acest context formulam o recomandare neutra pentru aceasta emisiune<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatiuni.Acest raport este realizat <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> Intercapital Invest SA (http://www.intercapital.<strong>ro</strong>), societate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>servicii <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> investitii financiare membra a Bursei <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> Valori <st<strong>ro</strong>ng>Bucuresti</st<strong>ro</strong>ng>. Preluarea informatiilor dinacest raport este permisa si gratuita cu conditia obligatorie a prezentarii Intercapital Investdrept sursa a informatiilor preluate. Pentru informatii suplimentare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>spre investitiile in valorimobiliare va invitam sa vizitati Pagina Pietei <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> Capital din Romania—http://www.kmarket.<strong>ro</strong>,sau sa ne scrieti la adresa info@kmarket.<strong>ro</strong>.Informatiile cuprinse in acest raport exprima anumite opinii legate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> o clasa <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> valori mobiliare.Decizia finala <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> cumparare sau vanzare a acestora trebuie luata in mod in<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>pen<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>nt <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>catre fiecare investitor in parte, pe baza unui numar cat mai mare <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> opinii si analize. IntercapitalInvest si angajatii sai pot <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>tine valori mobiliare prezentate in acest raport si/sau avearaporturi contractuale cu emitentii prezentati in raport. Este recomandabil ca o <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>cizie <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> investiresa fie luata dupa consultarea mai multor surse <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> informare diferite. Investitorii suntanuntati ca orice strategie, grafic, metodologie sau mo<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>l sunt mai <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>graba forme <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> estimaresi nu pot garanta un p<strong>ro</strong>fit cert. Investitia in valori mobiliare este caracterizata prin riscuri,inclusiv riscul unor pier<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ri pentru investitori. Faptele, informatiile, graficele si datele prezentateau fost obtinute din surse consi<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>rate <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> incre<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>re, dar corectitudinea si completitudinealor nu poate fi garantata. Intercapital Invest SA si realizatorii acestui raport nu isi asuma niciun fel <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> obligatie pentru eventuale pier<st<strong>ro</strong>ng>de</st<strong>ro</strong>ng>ri suferite in urma folosirii acestor informatii.6Prin acest raport Intercapital Invest si angajatii sai exprima opinii numai asupra valorilor mobiliareprezentate si a parametrilor acestora pentru investitori, si nu asupra eficientei activitatiiemitentilor valorilor mobiliare prezentate. Intercapital Invest si angajatii sai nu sunt raspunzatoripentru veridicitatea si calitatea informatiilor obtinute din surse publice sau direct <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> laemitenti, sau pentru efectele netransmiterii <st<strong>ro</strong>ng>de</st<strong>ro</strong>ng> catre emitenti a informatiilor solicitate acestora.