1S4F1A1_PAK-82

1S4F1A1_PAK-82

1S4F1A1_PAK-82

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

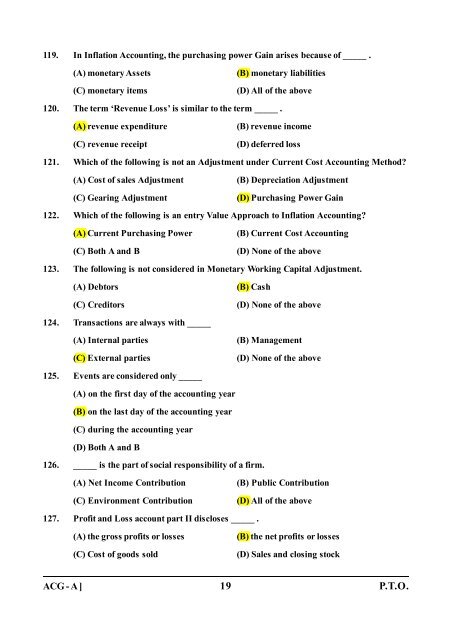

119. In Inflation Accounting, the purchasing power Gain arises because of _____ .<br />

(A) monetary Assets<br />

(C) monetary items<br />

(B) monetary liabilities<br />

(D) All of the above<br />

120. The term ‘Revenue Loss’ is similar to the term _____ .<br />

(A) revenue expenditure<br />

(C) revenue receipt<br />

(B) revenue income<br />

(D) deferred loss<br />

121. Which of the following is not an Adjustment under Current Cost Accounting Method?<br />

(A) Cost of sales Adjustment<br />

(C) Gearing Adjustment<br />

(B) Depreciation Adjustment<br />

(D) Purchasing Power Gain<br />

122. Which of the following is an entry Value Approach to Inflation Accounting?<br />

(A) Current Purchasing Power<br />

(C) Both A and B<br />

(B) Current Cost Accounting<br />

(D) None of the above<br />

123. The following is not considered in Monetary Working Capital Adjustment.<br />

(A) Debtors<br />

(C) Creditors<br />

(B) Cash<br />

(D) None of the above<br />

124. Transactions are always with _____<br />

(A) Internal parties<br />

(C) External parties<br />

(B) Management<br />

(D) None of the above<br />

125. Events are considered only _____<br />

(A) on the first day of the accounting year<br />

(B) on the last day of the accounting year<br />

(C) during the accounting year<br />

(D) Both A and B<br />

126. _____ is the part of social responsibility of a firm.<br />

(A) Net Income Contribution<br />

(C) Environment Contribution<br />

(B) Public Contribution<br />

(D) All of the above<br />

127. Profit and Loss account part II discloses _____ .<br />

(A) the gross profits or losses<br />

(C) Cost of goods sold<br />

(B) the net profits or losses<br />

(D) Sales and closing stock<br />

ACG - A ] 19 P.T.O.