- Page 1: Unterlagen zum Semimr FINANZMAPKTAN

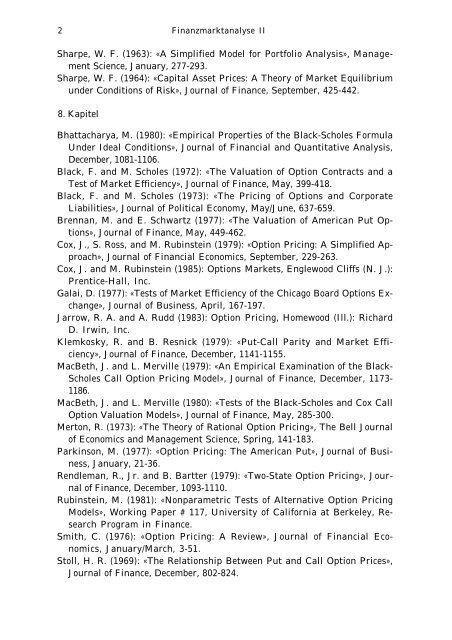

- Page 5 and 6: 4 Finanzmarktanalyse II Hong, H., R

- Page 7 and 8: _/_. 7. KATITALMARKTGLEICHGEMCHT

- Page 9 and 10: _..?_- ß. $fi&tä riß//u #%tf e$-

- Page 11 and 12: (wiïi d/e Ert/wrfefl -s- der rtifa

- Page 13 and 14: -/- Definiere Ifätor der iï>rffi/

- Page 15 and 16: -#- (M) W) a=o W CL*Ö E m- E&] &(&

- Page 17 and 18: -//- £. Eigmfaßen des KAPM • 3y

- Page 19 and 20: -13- Tab. 12 • AüsgwaMte firmen

- Page 21 and 22: -15- (?•$) iï ( 2u = 0/^/J , aot

- Page 23 and 24: -//- Ei/wtw M cw$,3/iiï. fyfr ffl/

- Page 25 and 26: -19- Ri'ciïfâr togktö atfawf w M

- Page 27 and 28: (l2Sti) -jy- m tar(/) - u 1 2 tu H

- Page 29 and 30: -23- ïï/yeiïe $M dttc/i ttottprt

- Page 31 and 32: -&- " Ufo/ml perte/lory • Mr %v&

- Page 33 and 34: !•'- -&- E&]-R fatdrfâj + wtâJj

- Page 35 and 36: -28- (2) te èïïm/tmte//w& cèr f

- Page 37 and 38: -3l- 4 • ÜtitfwIeßertnQ auf elf

- Page 39 and 40: -3B- ** (à) EK'post-MW Q>) £x-âr

- Page 41 and 42: -&- (4) far l/mre MM M g/M M faß*

- Page 43 and 44: -#- (/) &r 0të/$e gôltye r&t es i

- Page 45 and 46: -39- J. ms ArttiWde-Ttä-Maèll (A

- Page 47 and 48: -#- (?,46d) corfö?) - 0 [(wbtägß

- Page 49 and 50: Är -18- «SS? b\o\? 45 0/f€£) a

- Page 51 and 52: -45- (/) kei/) rmfyen Mfyt (2) k&ft

- Page 53 and 54:

-4 7 - $gé art ab) fofl&den MA ,h

- Page 55 and 56:

-43- Gtiteten w fax} art faff) to (

- Page 57 and 58:

-s/- Betty/et-- A/umfoM APM "•"

- Page 59 and 60:

$33) £&]-l'J*-s-ßX)+}&xHfeX)-S&X

- Page 61 and 62:

-d5~yefofâ me/d&>. AMiïff) M axbe

- Page 63 and 64:

-&- ke//ie tifffotot dnkye g/M ? 7.

- Page 65 and 66:

-S9- a) (tioM/en J/e a® ftufw® &

- Page 67 and 68:

-6tßr Sagen dye, ffterßKrfirlßf/

- Page 69 and 70:

-63- gfäten Mrföpiar-Martö'liNe

- Page 71 and 72:

8. OPT/OMEN A. EinlQfa -. /— 2/el

- Page 73 and 74:

-v3- Ml/ : ftrtetwy tfrß Mjjjr-'t

- Page 75 and 76:

—s~ £ -35, Ï-M9 ssj^m s-x, 0,

- Page 77 and 78:

-•7- ]3agé£ firm Me 2 Jiïmt/i

- Page 79 and 80:

-3- /> (?) •• O^&jff&iiger ît

- Page 81 and 82:

-II- Sgtöt_ [$03M?2> Aornè/iï/ë

- Page 83 and 84:

2u3jfe//ete _ S* •• ^s tär 3ig

- Page 85 and 86:

-tf- M. tâ-- ffruetiong v&iïtwfè

- Page 87 and 88:

-17- " fët/% TraMafätwkotätt, fa

- Page 89 and 90:

-0- >z^7, ctoß u/ngetä/fe tte/eho

- Page 91 and 92:

-21- (/.&) S*Û * C'O [j^fltë M

- Page 93 and 94:

M+ff-iïk Â"/2 } K //Z"// l y y &-

- Page 95 and 96:

Tab. 1/5 •• C=M Mtitien $t •

- Page 97 and 98:

-y- $mty/e (&) fi$ ax: B&etayat l o

- Page 99 and 100:

X KW -f i / 0 .////////////////////

- Page 101 and 102:

-#- (4b) ^ &&/w à&frmfen $&tfvn/d

- Page 103 and 104:

-,33- Getroffene Amhmfl: • ftitô

- Page 105 and 106:

-35- 3-C-100+40 = 0 ^ C=2Û 3. tot

- Page 107 and 108:

-37- (ü3a/>(mfy/tJ!e?ftä)-(k ÏÏ

- Page 109 and 110:

-3d- Kmtwj&en e/fi dggtotofa fatji

- Page 111 and 112:

-4lfänden fir wette Ttoa/e &(*/&)&

- Page 113 and 114:

'^a •• w[o t tftä-x]- v'df's-x

- Page 115 and 116:

-45- __'•• #-œ., /- # ffaüsJf

- Page 117 and 118:

-4fa* r •• fabxttefe (fwstok) M

- Page 119 and 120:

-48- Ôb&tm m AMjtôfa & titâiïyM

- Page 121 and 122:

-5l- R=è% : fä/fol!)& 2/wk pojrfr

- Page 123 and 124:

&xk/Ms-fim( tf fav0tMfaw&,$6 m oder

- Page 125 and 126:

ßat.$: Mti&W CDC-KO X=46 tobxhtet

- Page 127 and 128:

-4?- fe$«£. ÛT-/Z? /X^" (&&-M) 4

- Page 129 and 130:

-&- ftstfoltw G-? tet &ùvg / ft-fi

- Page 131 and 132:

-6l- > lato Mtenfo® iï &târ Tfo&

- Page 133 and 134:

-63- (Jtöttytiuy m k&My ytf &&& W-

- Page 135 and 136:

-#•- (2) abiï/Mfa-tôwti 0èt $&

- Page 137 and 138:

-6 7 - 16 Man %$; ctoâ ßr y@êitM

- Page 139 and 140:

-69- ? 4Mt faf) bsstefwï'a/s&/%rM

- Page 141 and 142:

-#- i 15 W/e $tâ & dr gy&twlrfye M

- Page 143 and 144:

-#- tiwMff) to-MK Jto/xr #& de A MK

- Page 145 and 146:

Anhöry -AB.I- Kml/etâ Miïctëfl/

- Page 147 and 148:

ffr d/e Ml a pu jmê & £#)•• O

- Page 149 and 150:

-M5- tymmfrë fo tomaMiUy /-tä)-Af

- Page 151 and 152:

y, FINANZMARKTANÂLKE Z Studen&rfnj

- Page 153 and 154:

-2- rrMn. (Pwffâtâft • ?/&$ gf

- Page 155 and 156:

-4- • mptf: Mifâ/vt® "ttriïwel

- Page 157 and 158:

-6- % ?[A/%]-Pl3j gswß (m) 2[Sj/A]

- Page 159 and 160:

£&/&]' -/- ?M-i&J _ o-i- OkJ ' Äf

- Page 161 and 162:

-10- nüto/oser Anltye m/t ft-6% ar

- Page 163 and 164:

£g] (%) -&• t% 1 v< i /o 20 BiÇ

- Page 165 and 166:

Û-- '//Ä7, 0, 0 0, //A/, 0 0, 0,

- Page 167 and 168:

~K>~ m. #3 •• (ft/male Ä? fr

- Page 169 and 170:

-//- M.&4>qûnakAtôœ far & [&&•

- Page 171 and 172:

-X- (m) jCik, ,4^-yft* 4*M A***J (f

- Page 173 and 174:

-22- &SÊU. ; tow&EL [fäytö?o.a.;

- Page 175 and 176:

-M- PRICE 700 YEt A R 1 B YE A 1R 2

- Page 177 and 178:

PRICE 950 85O 750 650 550 450 350 2

- Page 179 and 180:

-Jtflufmtöm besfa/ft imHsn, d?0. c

- Page 181 and 182:

üjfew&ff)' -30- />'tä+(W}(* ^> ä

- Page 183 and 184:

-&- -m - c &ô • (m) Eûtofa] \ -

- Page 185 and 186:

-&- mn CKofa$tân GmjfasyMiïstf. f

- Page 187 and 188:

-%- tâ fämfmfaft fö ßfffa atoff

- Page 189 and 190:

-x- dbungen- à/ ton Mmm ffi d/e fy

- Page 191 and 192:

-40- Kred/t M/zt m ôtffpiïfay&y/t

- Page 193 and 194:

war FINANZMARKTANALKE Z $ud/èP2%tn

- Page 195 and 196:

$LïMË£MldÊÇ: — 0— (B) 4-Â

- Page 197 and 198:

-4- /. (Wmhwy m J(M&'û&8,0si)'•

- Page 199 and 200:

-6- t 10 15N20J5^ Week re)ative to

- Page 201 and 202:

-/- Sä den /22 Grm,ct/ecfä /xtf/t

- Page 203 and 204:

-10- tôfe >^>^p!s^^^i^a2^^^^/a^ i

- Page 205 and 206:

-12- &fag ßrefoen &tâ Km Jwßrt c

- Page 207 and 208:

Performance index 1.05p l 04- „,

- Page 209 and 210:

120-I' 100- 80- E 60- 3 I 10/1/68-

- Page 211 and 212:

-//- / totosxtog tw %Mw (M) : _ fo)

- Page 213 and 214:

2. -$tm fâflfà/iM V/iïmh/g im Bn

- Page 215 and 216:

-22- &xtiß: —^^-———• luf

- Page 217 and 218:

-#- cfsr tösto. (töz M? & -

- Page 219 and 220:

-2èntf) al (/o. fi) iiml Mwhfc. *

- Page 221 and 222:

-$- /HP Qwm) Meut. C-- Ms (tos) ti^

- Page 223 and 224:

-30- fäoe $&&. ItijMe 'otept (atis

- Page 225 and 226:

FINANZMARKTANALYSE I M'enzentiw (x

- Page 227 and 228:

-#- X r*-> r. f r-^ 7 „\ (WtfiÄ)

- Page 229 and 230:

-#- 4' - (M)R +J$ j ]••&?Mtäß

- Page 231 and 232:

-/6- âefttôtM tiweMMxffî&rf coi?

- Page 233 and 234:

-a- EÜO- K *(£&]-*)•&£) ÔW-R*

- Page 235 and 236:

Been tâs WM ß@/ H ) = /$&> -uo-

- Page 237 and 238:

0rfâ,4) " q'ZQ [/ o] -£&- 'ô.Û

- Page 239 and 240:

-L/4- Qtit. /$>//£> ^ / / / tf$?/e

- Page 241 and 242:

-L/6- wfâ / J-# = fo;/Z'œ J -k (

- Page 243 and 244:

-Lßckr HMûifft dß /fr? ttiwfe) a

- Page 245 and 246:

-L20 Ēßh f. r>r *-

- Page 247 and 248:

-122- à) fâ /nié MrM èefà/mte

- Page 249 and 250:

-L24- rwlen M-W tâgt tufa ßrt&Arg

- Page 251 and 252:

fa) 2L Jûja w$ tef/n/ert m fc) ï-

- Page 253 and 254:

(#) |/r art fa Ke/irwföx -L2S- - $

- Page 255 and 256:

-L30- m Mff) Äf ivnt de Mr S*-C' ^

- Page 257 and 258:

-L32- & biïkn fëJérer) ibfa) wtt

- Page 259 and 260:

-IM- & Mfä mlffl x, Mst4 &goafc $i

- Page 261 and 262:

-136- in Aufgabt (a.), ivet'l w vot

- Page 263 and 264:

Losunqenzüffl Seminar v/ FINANZMÂ

- Page 265 and 266:

m M M fa #•• W der j £&J)~. A-

- Page 267 and 268:

-14- b) M^-titifdJ). ?&)-%)-fa-t)^?

- Page 269 and 270:

-16- c) 2&) > IM,)+fàW), ftè /,

- Page 271 and 272:

-L8- 8.3 tä w&tefitë fätöurg,

- Page 273 and 274:

W IMnj/è KO täofem Mao/è M. iaer

- Page 275 and 276:

ZEftlicfi iïfttr atise® (g. /tyjp

- Page 277 and 278:

-L/4- Urgle&ivflg yrisfato? Mfa$eg&

- Page 279 and 280:

-L/6- ?teß £, no» C, d® gy®ji&

- Page 281 and 282:

-LI8- mfl Mm j&fatât t wjam &dzr A

- Page 283 and 284:

-L2Û- (/$ er /mhalb der JiïMMw. I

- Page 285 and 286:

-122- M?a) & HtôpMatam v wd d (/+

- Page 287 and 288:

t.ß K faö) (ÛIÈ/J-- -/#- ßsyni

- Page 289 and 290:

-126- }

- Page 291 and 292:

-ügm[û,S-fe~*' r ],(f Kutten /f

- Page 293 and 294:

-L30~ ùr fonder MOMttëMXttotô(fr

- Page 295 and 296:

-L32- £ -AT - SM -4'/OÏ'$3 -&>'&?

- Page 297 and 298:

-l&- Q-î tJMtsiï ffr/mtâflfà Â

- Page 299 and 300:

-l£- (3) MIX-M,fiï. Bflgfân m (2

- Page 301 and 302:

-L&~ //M - I/M&) - i/ow - im_ Ja/wr

- Page 303 and 304:

Losungen zürn Seminar N/ FINANZMAR

- Page 305 and 306:

-12- iffff). Miï/b & afr %{ti/)8X

- Page 307 and 308:

M -L4- Mtßn 0, h s, ^K&k/e 0./Ï -

- Page 309 and 310:

-16- 3% M: wiïnet Mf; (M dt fët&f

- Page 311 and 312:

6 7 // ß 16 16 -L8- HatxÛM Wter Q