- Page 1 and 2:

Dansk ØkonomiEfterår 2006Konjunkt

- Page 3:

Dansk ØkonomiEfterår 2006Konjunkt

- Page 6:

INDHOLDFremsendelsesskrivelse til r

- Page 9 and 10:

Finansministeriets departementschef

- Page 11 and 12:

Formanden for Funktionærernes og T

- Page 13 and 14:

Nationalbankdirektøren var enig i,

- Page 15 and 16:

kante subsidiering af ejerboliger,

- Page 17 and 18:

nyankomne indvandrere. Der er intet

- Page 20 and 21:

forebygge fattigdom gennem en tidli

- Page 22 and 23:

Dansk Økonomi efterår 2006RESUMER

- Page 24 and 25:

Finanspolitikkenbidrager til risiko

- Page 26 and 27:

Fortsættelse afskattestop kanophæ

- Page 28 and 29:

ficere kommuner, der overskrider de

- Page 30 and 31:

elationer. Ud af knap 300.000 perso

- Page 32 and 33:

Børn afindvandrere børprioriteres

- Page 34 and 35:

Forhøjetbeskæftigelsesfradragtil

- Page 36:

tanthjælp i en afgrænset periode

- Page 39 and 40:

Betydelig risiko foroverophedningBe

- Page 41 and 42:

Tabel I.1 Hovedtal i konjunkturvurd

- Page 43 and 44:

Udsigt tilafdæmpet stigningi konta

- Page 45 and 46:

Høje oliepriserInflation pågodt 2

- Page 47 and 48:

Tabel I.2 Skøn for dansk økonomi,

- Page 49 and 50:

Opjustering afbetalingsbalancenFort

- Page 51 and 52:

Boks I.1Mængdeaggregater i faste p

- Page 53 and 54:

Boks I.2SMEC formuleret med kædein

- Page 55 and 56:

Figur I.4Pct.point54Vækst i Danmar

- Page 57 and 58:

Figur I.5Indeks11010510095908580Til

- Page 59 and 60:

Boks I.3Sveriges økonomiske politi

- Page 61 and 62:

Figur I.6a Inflation i Euroland Fig

- Page 63 and 64:

På sigt stigendelang rente iEurola

- Page 65 and 66:

kurs mangler, hvilket kan føre til

- Page 67 and 68:

Boks I.4Det amerikanske betalingsba

- Page 69 and 70:

verdensøkonomien, dvs. om boligmar

- Page 71 and 72:

… til trods forforventning om fal

- Page 73 and 74:

Boks I.5Kontantprisen - den ubekend

- Page 75 and 76:

Fortsat væksti boliginvesteringern

- Page 77 and 78:

Konstant bygningsinvesteringskvoteL

- Page 79 and 80:

Tabel I.4 Eksport og importÅrets M

- Page 81 and 82:

Boks I.6Udviklingen på de danske e

- Page 83 and 84:

Tabel I.5 Lønkonkurrenceevne2005 2

- Page 85 and 86:

Boks I.7Den økonomiske betydning a

- Page 87 and 88:

Lavere overskud påbetalingsbalance

- Page 89 and 90:

fremgang i beskæftigelsen i 2007.

- Page 91 and 92:

Figur I.201.000 pers.29402920Arbejd

- Page 93 and 94:

Figur I.21a Flaskehalse i byggeriet

- Page 95 and 96:

… men ledighedenvurderes ikke atk

- Page 97 and 98:

Tabel I.9 Udvikling i lønomkostnin

- Page 99 and 100:

Boks I.8ProduktivitetsudviklingenPr

- Page 101 and 102:

Oliepriser påvirkerforbrugerpriser

- Page 103 and 104:

Tabel I.12 Den offentlige sektors i

- Page 105 and 106:

Store personskatteogafgiftsindtægt

- Page 107 and 108:

Boks I.9Omsættelige kommunale udgi

- Page 109 and 110:

Udviklingen i offentligt forbrugOff

- Page 111 and 112:

Bestemmelse afBVT i offentligsektor

- Page 113 and 114:

Boks I.10Illustration af real og no

- Page 115 and 116:

Nominel vækst ioffentligt forbrugs

- Page 117 and 118:

Figur I.26a Offentlig beskæftigels

- Page 119 and 120:

Den offentligesektors størrelse er

- Page 121 and 122:

Ændringer ifinanspolitikkenhar alt

- Page 123 and 124:

Offentligeinvesteringerpåvirkereft

- Page 125 and 126:

Standardberegningerserbort fra effe

- Page 127 and 128:

lang sigt øges med 0,8 pct. 10 Det

- Page 129 and 130:

Boks I.11Beskatning og arbejdsudbud

- Page 131 and 132:

Boks I.12Effekt af lavere indkomsts

- Page 133 and 134:

Effekt af de enkelteelementer iskat

- Page 135 and 136:

Boks I.13VelfærdsforligetVelfærds

- Page 137 and 138:

Tabel I.17 Befolkningsudvikling fre

- Page 139 and 140:

½Tabel I.18 Forventede aldersgræn

- Page 141 and 142:

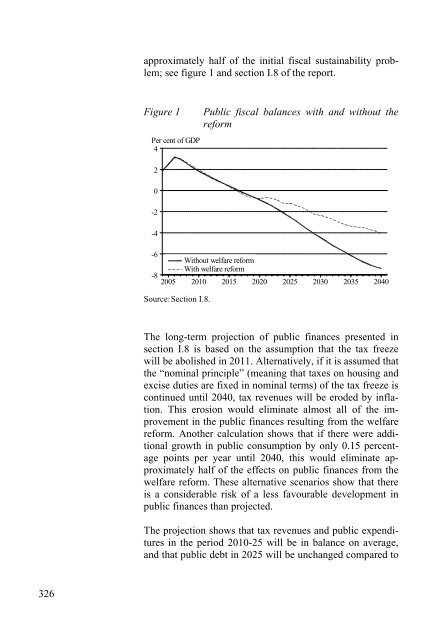

Figur I.30a Offentlig saldo Figur I

- Page 143 and 144:

Boks I.14Forudsætninger bag beregn

- Page 145 and 146:

Forudsætninger og usikkerhedsfakto

- Page 147 and 148:

Individueltoffentligt forbruger his

- Page 149 and 150:

af de sidstnævnte forbehold, er de

- Page 151 and 152:

lønsalderen. Denne overledighed ve

- Page 153 and 154:

Højere vækst ioffentligt forbruge

- Page 155 and 156:

I.9 Aktuel økonomisk politikTempoe

- Page 157 and 158:

verden, hvor kapital og arbejdskraf

- Page 159 and 160:

2010-plan et vigtigtredskab i styri

- Page 161 and 162:

Behov forstramninger pålængere si

- Page 163 and 164:

Omsætteligekommunaleudgiftsrettigh

- Page 165 and 166:

Frederiksen, A., E.K. Graversen and

- Page 167 and 168:

Bilagstabel I.2 Løn- og prisudvikl

- Page 169 and 170:

148Bilagstabel I.4 Hovedposter på

- Page 171 and 172:

150Bilagstabel I.6 Indkomster, forb

- Page 173 and 174:

152Bilagstabel I.8 Eksport og impor

- Page 175 and 176:

154Bilagstabel I.10 Den offentlige

- Page 177 and 178:

således betinget af, at personen i

- Page 179 and 180:

Socialt udsatte- et brederebegrebSo

- Page 181 and 182:

Unge har lavereindkomst endmidaldre

- Page 183 and 184:

vægte forskellige gruppers velfær

- Page 185 and 186:

II.2 Måling og fordeling af fattig

- Page 187 and 188:

Figur II.1Indeks120115Indeks for re

- Page 189 and 190:

Relativ måling ikomparativeanalyse

- Page 191 and 192:

indregnet værdien af at bo i ejerb

- Page 193 and 194:

Figur II.21000 kr.9080Fattigdomsgr

- Page 195 and 196:

Offentligeoverførsler følgersatsr

- Page 197 and 198:

Arbejde eralternativ tiloffentlige

- Page 199 and 200:

Figur II.4aFattige fordelt efter al

- Page 201 and 202:

Tabel II.2 Sandsynligheden for at v

- Page 203 and 204:

Figur II.5 Fattige som andel af bef

- Page 205 and 206:

vandrere kommer, fordi de har et jo

- Page 207 and 208:

pligt, kan indmelde sig i en a-kass

- Page 209 and 210:

Tabel II.3 Påvirkning af sandsynli

- Page 211 and 212:

Indvandrere harhøjere risiko for a

- Page 213 and 214:

Tabel II.4 Sandsynligheden for at f

- Page 215 and 216:

Indvandrereforbliver oftere ifattig

- Page 217 and 218:

Boks II.2Varighedsanalyse af period

- Page 219 and 220:

Tabel II.5Betydning af udvalgte soc

- Page 221 and 222:

Figur II.11Hazard1.000.80MændKvind

- Page 223 and 224:

øvrige del af landet. Det er ikke

- Page 225 and 226:

Figur II.13 Fattige opdelt efter ti

- Page 227 and 228:

Figur II.14 Beskæftigelsesomfang s

- Page 229 and 230:

Figur II.15Andel i pct.8050 pct. gr

- Page 231 and 232:

Figur II.17Andel i pct.6050 pct. gr

- Page 233 and 234:

Figur II.191000 personer12198820041

- Page 235 and 236:

Figur II.20Andel af diagnosticerede

- Page 237 and 238:

II.5 Indvandrere i fattigdomRelativ

- Page 239 and 240:

elativt mange fattige. Andelen af f

- Page 241 and 242:

fordi de bliver berettiget til offe

- Page 243 and 244:

Figur II.26Tilknytningen til arbejd

- Page 245 and 246:

Unge oftere fattigeKlare forskellem

- Page 247 and 248:

Social mobilitetmere præcistBørne

- Page 249 and 250:

kerhed om afkastet som følge af de

- Page 251 and 252:

Boks II.3Sociologiske forklaringer

- Page 253 and 254:

Afhængermobiliteten afplaceringen

- Page 255 and 256:

Tabel II.8Socioøkonomiske faktorer

- Page 257 and 258:

Tabel II.9Samvariation mellem sønn

- Page 259 and 260:

viser således, at døtrenes indkom

- Page 261 and 262:

nes markedsindkomster ret meget for

- Page 263 and 264:

danske døtre ligger på niveau med

- Page 265 and 266:

aggrund betyder mere for læsefærd

- Page 267 and 268:

pålægges også et loft over, hvor

- Page 269 and 270:

Forsørgere har enmeget begrænset

- Page 271 and 272:

sen er foretaget som en simpel samm

- Page 273 and 274:

ledighedsforløbet. 21 Graversen (2

- Page 275 and 276:

skuddet for f.eks. familier med to

- Page 277 and 278:

estemt fagområde, sådan at de i s

- Page 279 and 280:

ikke sikkert, at han ville opleve e

- Page 281 and 282:

Ej korrigeret foromfanget afarbejds

- Page 283 and 284:

indkomstmæssigt, hvor smedene har

- Page 285 and 286:

Uddannelse og jobkan være snævert

- Page 287 and 288:

Mænd tjener mereend kvinderLæger

- Page 289 and 290:

Færre selvstændigeend tidligereSe

- Page 291 and 292:

II.9 Sammenfatning og anbefalingerV

- Page 293 and 294:

stilles. Det gælder i særligt sto

- Page 295 and 296: gangsformer. Den indførte obligato

- Page 297 and 298: Forhøjetbeskæftigelsesfradragtil

- Page 299 and 300: Ansættelse medløntilskudBekæmpel

- Page 301 and 302: Poverty among Immigrants to Denmark

- Page 303 and 304: Generational Income Mobility in Nor

- Page 305 and 306: male immigrants. International Jour

- Page 307 and 308: Rawls (1971): A Theory of Justice.

- Page 309 and 310: 288

- Page 311 and 312: Økonomi- og ErhvervsministerietFor

- Page 313 and 314: på de offentlige finanser og betal

- Page 315 and 316: Det er fortsat en central udfordrin

- Page 317 and 318: miske incitamenter. Der fremlægges

- Page 319 and 320: Dansk ArbejdsgiverforeningDansk øk

- Page 321 and 322: De seneste tal for den økonomiske

- Page 323 and 324: I kapitel II ”Fattigdom i Danmark

- Page 325 and 326: DI deler Vismændenes tanker om, at

- Page 327 and 328: ningen nok først og fremmest finde

- Page 329 and 330: marginalskattens betydning for arbe

- Page 331 and 332: ejdsudbudseffekter. Vi konstaterer

- Page 333 and 334: vendigt at sikre en mere effektiv o

- Page 335 and 336: - men også de mere kortsigtede. Me

- Page 337 and 338: Funktionærernes og Tjenestemænden

- Page 339 and 340: overveje om man ikke også skulle s

- Page 341 and 342: er derfor, ligesom introduktionsyde

- Page 343 and 344: unemployment is expected to result

- Page 345: Policy recommendationsThe forecast

- Page 349 and 350: in public consumption, the system c

- Page 351 and 352: Figure 2Per cent1412108642Proportio

- Page 353 and 354: the dependent variables. The analys

- Page 355 and 356: alternative is to prescribe a lower