South Florida REALTOR® Leadership Issue - Miami Realtors

South Florida REALTOR® Leadership Issue - Miami Realtors

South Florida REALTOR® Leadership Issue - Miami Realtors

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Government Affairs<br />

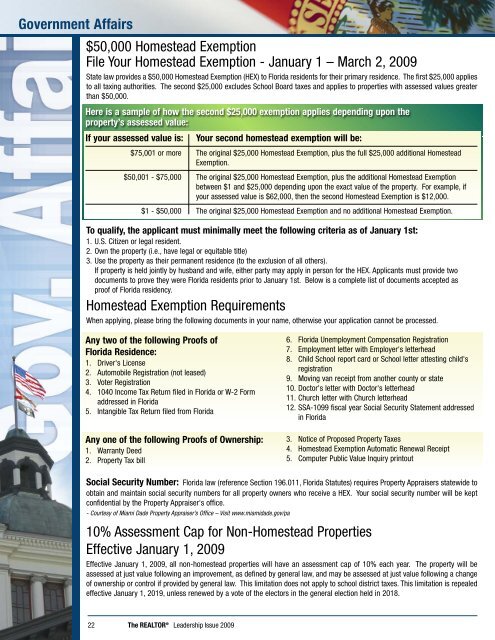

$50,000 Homestead Exemption<br />

File Your Homestead Exemption - January 1 – March 2, 2009<br />

State law provides a $50,000 Homestead Exemption (HEX) to <strong>Florida</strong> residents for their primary residence. The first $25,000 applies<br />

to all taxing authorities. The second $25,000 excludes School Board taxes and applies to properties with assessed values greater<br />

than $50,000.<br />

Here is a sample of how the second $25,000 exemption applies depending upon the<br />

property’s assessed value:<br />

If your assessed value is: Your second homestead exemption will be:<br />

$75,001 or more The original $25,000 Homestead Exemption, plus the full $25,000 additional Homestead<br />

Exemption.<br />

$50,001 - $75,000 The original $25,000 Homestead Exemption, plus the additional Homestead Exemption<br />

between $1 and $25,000 depending upon the exact value of the property. For example, if<br />

your assessed value is $62,000, then the second Homestead Exemption is $12,000.<br />

$1 - $50,000 The original $25,000 Homestead Exemption and no additional Homestead Exemption.<br />

To qualify, the applicant must minimally meet the following criteria as of January 1st:<br />

1. U.S. Citizen or legal resident.<br />

2. Own the property (i.e., have legal or equitable title)<br />

3. Use the property as their permanent residence (to the exclusion of all others).<br />

If property is held jointly by husband and wife, either party may apply in person for the HEX. Applicants must provide two<br />

documents to prove they were <strong>Florida</strong> residents prior to January 1st. Below is a complete list of documents accepted as<br />

proof of <strong>Florida</strong> residency.<br />

Homestead Exemption Requirements<br />

When applying, please bring the following documents in your name, otherwise your application cannot be processed.<br />

Any two of the following Proofs of<br />

<strong>Florida</strong> Residence:<br />

1. Driver's License<br />

2. Automobile Registration (not leased)<br />

3. Voter Registration<br />

4. 1040 Income Tax Return filed in <strong>Florida</strong> or W-2 Form<br />

addressed in <strong>Florida</strong><br />

5. Intangible Tax Return filed from <strong>Florida</strong><br />

Any one of the following Proofs of Ownership:<br />

1. Warranty Deed<br />

2. Property Tax bill<br />

Social Security Number: <strong>Florida</strong> law (reference Section 196.011, <strong>Florida</strong> Statutes) requires Property Appraisers statewide to<br />

obtain and maintain social security numbers for all property owners who receive a HEX. Your social security number will be kept<br />

confidential by the Property Appraiser's office.<br />

- Courtesy of <strong>Miami</strong> Dade Property Appraiser’s Office – Visit www.miamidade.gov/pa<br />

10% Assessment Cap for Non-Homestead Properties<br />

Effective January 1, 2009<br />

Effective January 1, 2009, all non-homestead properties will have an assessment cap of 10% each year. The property will be<br />

assessed at just value following an improvement, as defined by general law, and may be assessed at just value following a change<br />

of ownership or control if provided by general law. This limitation does not apply to school district taxes. This limitation is repealed<br />

effective January 1, 2019, unless renewed by a vote of the electors in the general election held in 2018.<br />

22 The REALTOR ® <strong>Leadership</strong> <strong>Issue</strong> 2009<br />

6. <strong>Florida</strong> Unemployment Compensation Registration<br />

7. Employment letter with Employer's letterhead<br />

8. Child School report card or School letter attesting child's<br />

registration<br />

9. Moving van receipt from another county or state<br />

10. Doctor's letter with Doctor's letterhead<br />

11. Church letter with Church letterhead<br />

12. SSA-1099 fiscal year Social Security Statement addressed<br />

in <strong>Florida</strong><br />

3. Notice of Proposed Property Taxes<br />

4. Homestead Exemption Automatic Renewal Receipt<br />

5. Computer Public Value Inquiry printout