Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16<br />

Directors’ <strong>Report</strong>: Business Review<br />

Operating review<br />

Exploration <strong>and</strong> Production<br />

Significant progress continued in Australia <strong>and</strong> Brazil, Pure Energy was<br />

acquired <strong>and</strong> an alliance to develop shale gas in the USA was formed.<br />

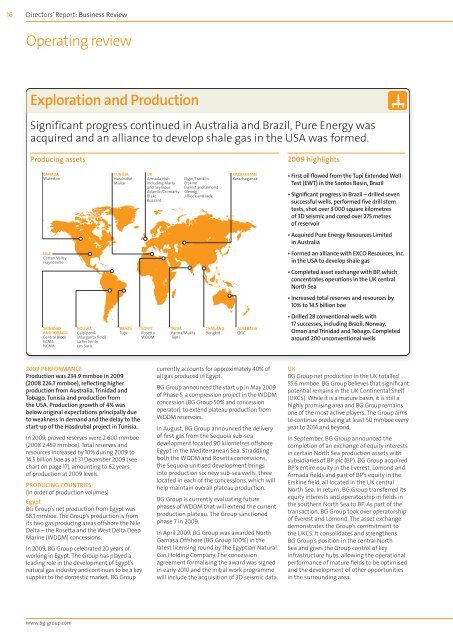

Producing assets<br />

CANADA<br />

Waterton<br />

USA<br />

Cotton Valley<br />

Haynesville<br />

TRINIDAD<br />

AND TOBAGO<br />

Central Block<br />

ECMA<br />

NCMA<br />

www.bg-group.com<br />

BOLIVIA<br />

Caipipendi<br />

(Margarita field)<br />

La Vertiente<br />

Los Suris<br />

TUNISIA<br />

Hasdrubal<br />

Miskar<br />

BRAZIL<br />

Tupi<br />

<strong>2009</strong> PERFORMANCE<br />

Production was 234.9 mmboe in <strong>2009</strong><br />

(2008 226.7 mmboe), reflecting higher<br />

production from Australia, Trinidad <strong>and</strong><br />

Tobago, Tunisia <strong>and</strong> production from<br />

the USA. Production growth of 4% was<br />

below original expectations principally due<br />

to weakness in dem<strong>and</strong> <strong>and</strong> the delay to the<br />

start-up of the Hasdrubal project in Tunisia.<br />

In <strong>2009</strong>, proved reserves were 2 600 mmboe<br />

(2008 2 459 mmboe). Total reserves <strong>and</strong><br />

resources increased by 10% during <strong>2009</strong> to<br />

14.5 billion boe as at 31 December <strong>2009</strong> (see<br />

chart on page 17), amounting to 62 years<br />

of production at <strong>2009</strong> levels.<br />

PRODUCING COUNTRIES<br />

(In order of production volumes)<br />

Egypt<br />

<strong>BG</strong> <strong>Group</strong>’s net production from Egypt was<br />

58.1 mmboe. The <strong>Group</strong>’s production is from<br />

its two gas producing areas offshore the Nile<br />

Delta – the Rosetta <strong>and</strong> the West Delta Deep<br />

Marine (WDDM) concessions.<br />

In <strong>2009</strong>, <strong>BG</strong> <strong>Group</strong> celebrated 20 years of<br />

working in Egypt. The <strong>Group</strong> has played a<br />

leading role in the development of Egypt’s<br />

natural gas industry <strong>and</strong> continues to be a key<br />

supplier to the domestic market. <strong>BG</strong> <strong>Group</strong><br />

UK<br />

Armada Hub<br />

including Maria<br />

<strong>and</strong> Seymour<br />

Atlantic/Cromarty<br />

Blake<br />

Buzzard<br />

EGYPT<br />

Rosetta<br />

WDDM<br />

Elgin/Franklin<br />

Erskine<br />

Everest <strong>and</strong> Lomond<br />

Glenelg<br />

J-Block <strong>and</strong> Jade<br />

INDIA<br />

Panna/Mukta<br />

Tapti<br />

THAILAND<br />

Bongkot<br />

KAZAKHSTAN<br />

Karachaganak<br />

AUSTRALIA<br />

QGC<br />

currently accounts for approximately 40% of<br />

all gas produced in Egypt.<br />

<strong>BG</strong> <strong>Group</strong> announced the start up in May <strong>2009</strong><br />

of Phase 5, a compression project in the WDDM<br />

concession (<strong>BG</strong> <strong>Group</strong> 50% <strong>and</strong> concession<br />

operator), to extend plateau production from<br />

WDDM reservoirs.<br />

In August, <strong>BG</strong> <strong>Group</strong> announced the delivery<br />

of first gas from the Sequoia sub-sea<br />

development located 90 kilometres offshore<br />

Egypt in the Mediterranean Sea. Straddling<br />

both the WDDM <strong>and</strong> Rosetta concessions,<br />

the Sequoia unitised development brings<br />

into production six new sub-sea wells, three<br />

located in each of the concessions, which will<br />

help maintain overall plateau production.<br />

<strong>BG</strong> <strong>Group</strong> is currently evaluating future<br />

phases of WDDM that will extend the current<br />

production plateau. The <strong>Group</strong> sanctioned<br />

phase 7 in <strong>2009</strong>.<br />

In April <strong>2009</strong>, <strong>BG</strong> <strong>Group</strong> was awarded North<br />

Gamasa Offshore (<strong>BG</strong> <strong>Group</strong> 100%) in the<br />

latest licensing round by the Egyptian Natural<br />

Gas Holding Company. The concession<br />

agreement formalising the award was signed<br />

in early 2010 <strong>and</strong> the initial work programme<br />

will include the acquisition of 3D seismic data.<br />

<strong>2009</strong> highlights<br />

• First oil flowed from the Tupi Extended Well<br />

Test (EWT) in the Santos Basin, Brazil<br />

• Significant progress in Brazil – drilled seven<br />

successful wells, performed five drill stem<br />

tests, shot over 3 000 square kilometres<br />

of 3D seismic <strong>and</strong> cored over 275 metres<br />

of reservoir<br />

• Acquired Pure Energy Resources Limited<br />

in Australia<br />

• Formed an alliance with EXCO Resources, Inc.<br />

in the USA to develop shale gas<br />

• Completed asset exchange with BP, which<br />

concentrates operations in the UK central<br />

North Sea<br />

• Increased total reserves <strong>and</strong> resources by<br />

10% to 14.5 billion boe<br />

• Drilled 28 conventional wells with<br />

17 successes, including Brazil, Norway,<br />

Oman <strong>and</strong> Trinidad <strong>and</strong> Tobago. Completed<br />

around 200 unconventional wells<br />

UK<br />

<strong>BG</strong> <strong>Group</strong> net production in the UK totalled<br />

55.6 mmboe. <strong>BG</strong> <strong>Group</strong> believes that significant<br />

potential remains in the UK Continental Shelf<br />

(UKCS). While it is a mature basin, it is still a<br />

highly promising area <strong>and</strong> <strong>BG</strong> <strong>Group</strong> remains<br />

one of the most active players. The <strong>Group</strong> aims<br />

to continue producing at least 50 mmboe every<br />

year to 2014 <strong>and</strong> beyond.<br />

In September, <strong>BG</strong> <strong>Group</strong> announced the<br />

completion of an exchange of equity interests<br />

in certain North Sea production assets with<br />

subsidiaries of BP plc (BP). <strong>BG</strong> <strong>Group</strong> acquired<br />

BP’s entire equity in the Everest, Lomond <strong>and</strong><br />

Armada fields <strong>and</strong> part of BP’s equity in the<br />

Erskine field, all located in the UK central<br />

North Sea. In return, <strong>BG</strong> <strong>Group</strong> transferred its<br />

equity interests <strong>and</strong> operatorship in fields in<br />

the southern North Sea to BP. As part of the<br />

transaction, <strong>BG</strong> <strong>Group</strong> took over operatorship<br />

of Everest <strong>and</strong> Lomond. The asset exchange<br />

demonstrates the <strong>Group</strong>’s commitment to<br />

the UKCS. It consolidates <strong>and</strong> strengthens<br />

<strong>BG</strong> <strong>Group</strong>’s position in the central North<br />

Sea <strong>and</strong> gives the <strong>Group</strong> control of key<br />

infrastructure hubs, allowing the operational<br />

performance of mature fields to be optimised<br />

<strong>and</strong> the development of other opportunities<br />

in the surrounding area.