You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

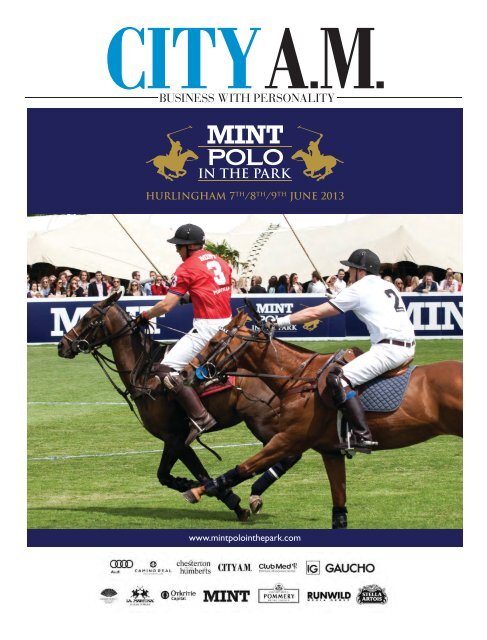

BUSINESS WITH PERSONALITY<br />

HURLINGHAM 7 TH /8 TH /9 TH JUNE 2013<br />

www.mintpolointhepark.com

WHERE LONDON COMES OUT TO PLAY<br />

HURLINGHAM 7TH /8TH /9TH TH TH TH<br />

HURLINGHA AM M 7 / /8 /9 JUNE<br />

2013<br />

Tickets on sale now through Ticketmaster ® Tickets<br />

on salee<br />

now<br />

through<br />

TTicke<br />

etmaster : 0844 00844<br />

248 5069<br />

www.mintpolointhepark.com<br />

www. .mintpolointhepark.com

London.<br />

Business.<br />

Masters.<br />

TRAVEL group Thomas Cook is<br />

this morning expected to unveil<br />

plans to raise around £400m<br />

through a share placing and<br />

rights issue as the company’s<br />

turnaround gathers pace.<br />

The business, which recorded an<br />

enormous £590m loss during the<br />

2010/11 financial year, has focused<br />

on cutting jobs and closing retail<br />

outlets to deal with a massive<br />

£1.56bn debt pile.<br />

The FTSE 250 company is also<br />

expected to announce new longterm<br />

banking facilities according<br />

Sir Mervyn King is<br />

upbeat on growth<br />

Thomas Cook in £400m fundraising plan<br />

BY JAMES WATERSON<br />

to Sky News, who first reported<br />

the story.<br />

Shareholders are unlikely to<br />

complain about today’s muchtrailed<br />

placing given the<br />

company – written off by the<br />

markets last year as on the brink of<br />

collapse – has seen an astonishing<br />

turnaround following last July’s<br />

appointment of chief executive<br />

Harriet Green.<br />

Green’s decisive action has seen<br />

her close around 200 high street<br />

stores, sack more than 2,000 staff<br />

and off-load non-core divisions<br />

such as the company’s North<br />

American business.<br />

BUSINESS WITH PERSONALITY<br />

KING HEADS TO NY<br />

MARK KLEINMAN ON THE BANK<br />

GOVERNOR’S NEXT MOVE Page 9<br />

www.cityam.com FREE<br />

TWO-SPEED EUROPE<br />

ISSUE 1,881 THURSDAY <strong>16</strong> MAY 2013<br />

BY TIM WALLACE<br />

BRITAIN’S economy is getting back on its feet<br />

and “a recovery is in sight”, Bank of England<br />

governor Sir Mervyn King said yesterday.<br />

Fears of a triple dip recession have been<br />

eradicated, employment increased by tens of<br />

thousands in March and the UK is rebalancing<br />

towards sustainable export growth.<br />

The spurt of growth stands in stark contrast<br />

to the gloom in Europe, where France has<br />

plunged back into recession and even<br />

Germany is barely keeping its head above<br />

water.<br />

“There is a welcome change in the economic<br />

outlook – growth is likely to strengthen<br />

over the course of the year,” King predicted.<br />

“That is the first time I have been able to say<br />

that since before the financial crisis.”<br />

He believes growth will pick up from 0.3 per<br />

cent in the first quarter to 0.5 per cent in the<br />

second quarter.<br />

And chancellor George Osborne last night<br />

argued the positive forecasts mean critics like<br />

the International Monetary Fund are wrong<br />

to call on him to spend and borrow even<br />

more money.<br />

“The most recent economic news has been<br />

more encouraging. The economy is growing.<br />

Surveys are better. Confidence is returning to<br />

financial markets,” he told the Confederation<br />

of British Industry last night.<br />

“Our plan is working. Now is not the time to<br />

lose our nerve. Let’s not listen to those who<br />

would take us back to square one. Let’s carry<br />

on doing what is right for Britain.”<br />

Osborne urged the Bank of England to continue<br />

pumping cheap money into the economy,<br />

in a sign that incoming governor Mark<br />

Carney will keep monetary policy very loose.<br />

And the chancellor also said he is pushing<br />

for more supply-side reforms –<br />

typically cutting red tape and<br />

taxes – in an effort to get businesses<br />

growing and exporting<br />

more.<br />

The CBI backed the chancellor,<br />

arguing the deficit reduction<br />

plan is the only option.<br />

“Whilst siren voices may suggest<br />

relaxation – in the words of<br />

Baroness Thatcher, ‘this is no time to<br />

wobble, George’,” said CBI<br />

president Sir Roger Carr.<br />

Interested in studying a<br />

world-class Masters part-time?<br />

MSc in Finance & Investment<br />

MSc in Wealth Management<br />

BY JULIAN HARRIS<br />

Investors have been delighted by<br />

her plan and over the last six<br />

months shares in the business have<br />

gained 587 per cent, rising from<br />

just 21p to yesterday’s closing price<br />

of 144.7p.<br />

Green has herself benefited<br />

financially from the share price<br />

rise, having bought 500,000 shares<br />

for 23p each last November in a<br />

show of confidence.<br />

The 172-year old group had been<br />

in the doldrums after failing to<br />

keep up with changing consumer<br />

habits. As part of its turnaround<br />

plan the company wants half of all<br />

sales made online.<br />

THE EUROZONE is mired in its longest ever<br />

recession, with figures from Brussels revealing<br />

yesterday that the single currency area began<br />

2013 by sinking to a sixth consecutive quarter<br />

of contraction.<br />

GDP was down 0.2 per cent in the first quarter<br />

of the year compared to the end of 2012,<br />

and economists expect the ailing currency<br />

bloc to experience yet another drop in the<br />

second quarter.<br />

The financial crisis prompted a more severe<br />

hit in 2008 and 2009, yet the slump was<br />

shorter-lived, lasting for five quarters.<br />

Unemployment in the area has<br />

climbed to 12.1 per cent, statistics<br />

revealed last month.<br />

Yesterday’s data also showed that the<br />

Eurozone’s second largest economy –<br />

France – has fallen into another official<br />

recession. French GDP sank 0.2 per<br />

cent in the three months to<br />

March, continuing<br />

a 0.2 per cent<br />

decline in the previous<br />

quarter.<br />

“The core is<br />

now as rotten as<br />

FTSE 100▲6,693.55 +7.49DOW▲15,275.69 +60.44 NASDAQ ▲3,471.62 +9.01 £/$ ▲1.523 +0.001 £/€ ▲1.182 +0.0<strong>05</strong> €/$ ▲ 1.288 +0.0<strong>05</strong><br />

the periphery,” commented Hector McNeil,<br />

chief exec of City firm Boost ETP. “The distinction<br />

between the two is now all but meaningless,<br />

as even German growth has slipped to<br />

negligible levels and France’s economy is wilting<br />

faster than President Francois Hollande’s<br />

re-election prospects.”<br />

Germany, often seen as the powerhouse<br />

economy of the euro area, saw its economy<br />

grow by just 0.1 per cent in quarter one, the<br />

estimates showed – having shrunk by 0.7 per<br />

cent the previous quarter.<br />

The bloc’s next two largest economies, Italy<br />

and Spain, were both down another 0.5 per<br />

cent. Economies also shrank in member states<br />

Finland, Cyprus, the Netherlands, Portugal, and<br />

Greece.<br />

There was a glimmer of light for Greece yesterday,<br />

however, as an upgrade of its sovereign<br />

credit rating caused Greek 10-year government<br />

bond yields to plummet to their lowest level<br />

since June 2010.<br />

Ratings giant Fitch lifted Greece to B-minus<br />

from CCC on Tuesday night.<br />

The yields, which were over 30 per cent as<br />

recently as last summer, reacted by sinking as<br />

low as 8.<strong>16</strong> per cent during yesterday’s trading,<br />

and were around 8.8 per cent last night.<br />

MORE ON UK / EUROZONE: Pages 2-3, 20<br />

Find out more at our lunchtime online information session<br />

Date: 4 June 2013<br />

Sign up: www.cass.city.ac.uk/masters/online-infosessions<br />

▲ ▲<br />

Bloomberg data row escalates<br />

as JP Morgan demands records<br />

BY KATIE HOPE<br />

THE Furore over how Bloomberg<br />

used client data intensified last<br />

night after JP Morgan said it had<br />

sent a formal legal request to the<br />

financial news agency to clarify<br />

what information reporters had<br />

access to.<br />

The US bank, one of Bloomberg’s<br />

largest customers, said it was<br />

seeking logs for five years detailing<br />

what information on their<br />

employees’ use of terminals<br />

reporters had accessed.<br />

JPMorgan said it was also seeking<br />

“confirmation” of controls that<br />

Bloomberg has put in place to stop<br />

future privacy breaches.<br />

Bloomberg came under fire last<br />

week after it emerged reporters may<br />

have had access to users’ login<br />

details, functions and help desk<br />

inquiries.<br />

Bloomberg’s editor-in-chief has<br />

apologised for the errors, saying<br />

reporters should never have had<br />

access to the information.<br />

Certified Distribution<br />

from 25/02/13 to 31/03/13 is 128,174

2 NEWS<br />

High Speed 2<br />

sums slammed<br />

by watchdog<br />

BY MARION DAKERS<br />

THE GOVERNMENT has so far<br />

failed to make the business case<br />

for building the High Speed 2 train<br />

link, the National Audit Office<br />

said in a report out today.<br />

The NAO warned of a £3.3bn<br />

funding gap in the £33bn scheme,<br />

and said the government has made<br />

poor arguments to support the<br />

claim that faster rail travel to the<br />

north of the country will help<br />

rebalance the economy.<br />

It also pointed out past errors<br />

and outdated information in the<br />

benefit-cost calculations on the<br />

scheme and concluded that the<br />

timetable is “overambitious”.<br />

“It’s too early in the High Speed<br />

2 programme to conclude on the<br />

likelihood of its achieving value<br />

for money,” said NAO head Amyas<br />

Morse. “Our concern at this point<br />

is the lack of clarity around the<br />

[Department for Transport’s]<br />

objectives. The strategic case for<br />

the network should be better<br />

developed at this stage.”<br />

Transport secretary Patrick<br />

McLoughlin brushed off much of<br />

the criticism. “I do not accept the<br />

NAO’s core conclusion,” he said in<br />

a statement. “We are not building<br />

HS2 simply because the computer<br />

says ‘yes’. We are building it<br />

because it is the right thing to do<br />

to make Britain a stronger and<br />

more prosperous place.”<br />

US freezes Bitcoin accounts<br />

US authorities have seized bank accounts<br />

belonging to the world’s biggest Bitcoin<br />

exchange, marking a signature moment in<br />

their dealings with the virtual currency.<br />

The Department of Homeland Security<br />

won court orders freezing two accounts<br />

used by Mt Gox, the Japanese exchange<br />

which accounts for more than half of all<br />

trades between Bitcoin and governmentbacked<br />

currencies. Lawmakers have<br />

expressed concern Bitcoin could be used<br />

to evade checks against money<br />

laundering and terrorist financing.<br />

Households crushed by<br />

huge drop in real wages<br />

BY MICHAEL BIRD<br />

AVERAGE earnings grew by a paltry<br />

0.4 per cent on the year this March,<br />

the smallest rise on record<br />

according to official figures<br />

published yesterday.<br />

At the same time prices jumped<br />

2.8 per cent on the consumer price<br />

measure and 3.3 per cent on the<br />

retail price, hitting households<br />

hard as pay packets no longer<br />

stretch as far.<br />

The picture is even bleaker for<br />

finance and business services<br />

workers – including bonuses, their<br />

weekly pay plunged 3.8 per cent on<br />

the year, even before inflation is<br />

taken into account.<br />

Earnings growth for government<br />

employees has been cut from two<br />

per cent in January to 1.2 per cent,<br />

but still remains considerably<br />

higher than private sector<br />

increases, fuelling fears that the<br />

coalition’s pay freeze remains<br />

ineffective.<br />

“The weakness of pay growth<br />

relative to inflation, currently<br />

running at 2.8 per cent, will be a<br />

concern to the Bank of England, as<br />

squeezed incomes will limit<br />

economic growth,” said Chris<br />

Williamson from Markit.<br />

After accounting for inflation,<br />

real wages have been falling<br />

constantly since 2009, as workers<br />

Banker to chair media group Mecom<br />

Mecom, the struggling European<br />

newspaper publisher, is to appoint a<br />

veteran banker as its chairman as<br />

investors ramp up pressure to sell assets.<br />

The London-listed firm is to appoint Rory<br />

Macnamara, a former M&A banker at<br />

Deutsche Morgan Grenfell.<br />

Tractor maker hit by poor weather<br />

John Deere shares fell more than four per<br />

cent yesterday as the agricultural<br />

equipment maker cut its full-year sales<br />

forecast because of global financial<br />

“pressures” and bad weather in the US.<br />

REAL WAGES SLIDE FOR FOUR YEARS<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

Change on the previous month<br />

Wage growth<br />

Inflation<br />

Mar ‘06 Mar ‘07 Mar ‘08 Mar ‘09 Mar ‘10 Mar ‘11 Mar ‘12 Mar ‘13<br />

MegaFon dividend boosts Usmanov<br />

Russia’s richest man stands to become<br />

more than £250m richer after a Russian<br />

mobile phone operator announced plans<br />

for a huge dividend payout yesterday.<br />

Alisher Usmanov, who is also a major<br />

shareholder in Arsenal Football Club, is<br />

already worth £11.6bn.<br />

Barclays accused of stealing deal<br />

Barclays will appear in court today<br />

accused of going behind a client’s back to<br />

steal a £100m deal for itself. Barclays<br />

denies all the allegations.<br />

Equitable Life victims’ details lost<br />

The Equitable Life scandal has taken a<br />

fresh turn as the Treasury admits to<br />

destroying disc containing 350,000<br />

victims’ names at an inquiry into the failed<br />

insurance company yesterday.<br />

Camilla joins credit union<br />

The Duchess of Cornwall is applying to join<br />

a credit union to support their bid to<br />

tackle payday lenders. Camilla yesterday<br />

met staff and members of the London<br />

Mutual Credit Union in Peckham.<br />

To contact the newsdesk email news@cityam.com<br />

Private sector workers’ pay frozen –but not public sector<br />

ZERO per cent. Yes, that’s right, a<br />

big fat zero: that was the rate by<br />

which total pay went up in the<br />

private sector in the first three<br />

months of the year, compared with<br />

the first quarter of 2012.<br />

The private sector is going through<br />

an actual, full-on pay freeze, with<br />

falling bonuses entirely cancelling<br />

out the meagre 0.8 per cent hike in<br />

regular pay. Some parts of the private<br />

sector are seeing substantial declines<br />

in pay. It’s a remarkable situation<br />

that, as far as I know, not a single<br />

economist predicted for this stage of<br />

the economic cycle.<br />

Given that inflation is currently at<br />

3.3 per cent on the retail price index<br />

measure, that means that the average<br />

private sector pay packet purchased<br />

substantially fewer goods and services<br />

in March than it did 12 months prior<br />

to that date. A 3.3 per cent real terms<br />

EDITOR’S<br />

LETTER ALLISTER HEATH<br />

WHAT THE OTHER PAPERS SAY THIS MORNING<br />

pay cut is hugely significant; there<br />

was a time when it would have been<br />

assumed impossible and unsustainable.<br />

In the past, such a collapse and gulf<br />

between cost of living increases and<br />

wages would have triggered irresistible<br />

demands for more pay – but<br />

the labour market has become so flexible,<br />

staff so aware of the difficult situation<br />

and the competition for jobs<br />

presumably so fierce that pay pressures<br />

are actually abating, rather<br />

THURSDAY <strong>16</strong> MAY 2013<br />

than increasing. Remarkably, we are<br />

nearing a non-Keynesian world where<br />

private sector wages might even<br />

sometimes fall in nominal terms.<br />

The good news is that workers are<br />

repricing themselves into the labour<br />

market at an accelerating rate. Total<br />

hours worked per week were 950.3m<br />

for January to March 2013, up 2.4m<br />

from October to December 2012 and<br />

up 20.2m on a year earlier. This 2.1<br />

per cent rise in the number of hours<br />

worked, during a time when the economy<br />

broadly stagnated, suggests a further<br />

drop in productivity on that<br />

measure – but the 3.3 per cent drop in<br />

real private sector wage costs means<br />

that the real cost of producing one<br />

unit of output actually went down.<br />

Long-term, that will be good for jobs.<br />

Given all of that, it is bizarre in the<br />

extreme that pay in the public sector<br />

is still outpacing that in the private<br />

readjust to a smaller economy.<br />

Meanwhile the number of<br />

unemployed people in the UK<br />

ticked up 0.6 per cent from the<br />

previous quarter, but was still down<br />

3.5 per cent on the previous year.<br />

There was also a decline of 7,300 in<br />

the claimant count, which<br />

measures the number of people<br />

who are in receipt of jobseeker’s<br />

allowance.<br />

Older workers and those in parttime<br />

jobs were the predominant<br />

driving forces behind the Spring<br />

rise in joblessness.<br />

sector, especially given the supposed<br />

pay freeze. This story has been regularly<br />

reported in this newspaper, and<br />

George Osborne finally noticed at the<br />

Budget, but still not enough has<br />

changed. Total pay and regular pay in<br />

the public sector both rose by 1.4 per<br />

cent. While that is still a much lower<br />

rate than inflation – and implies a<br />

real terms wage cut of 1.9 per cent, it<br />

is not fair that austerity is worse for<br />

private sector workers than it is for<br />

those in the public sector.<br />

There have of course been plenty of<br />

genuine instances of pay restraint in<br />

the public sector, but the reality is<br />

that average rates are still drifting up,<br />

presumably because large numbers of<br />

people keep being promoted. This has<br />

nothing to do with the nationalised<br />

banks, which actually drag down the<br />

average. The public sector workforce<br />

is no longer falling by as much either:<br />

The youth unemployment rate<br />

remains at 18.6 per cent, and fulltime<br />

employment was stable.<br />

Employment also declined on the<br />

quarter, bucking the trend of the<br />

last year, which had seen 700,000<br />

more people working.<br />

“These figures confirm the labour<br />

market is running out of steam,” said<br />

economist Nida Ali from the Ernst<br />

and Young Item Club.<br />

“This picture is more consistent with<br />

the fragile economic environment<br />

and will probably continue over the<br />

coming months.”<br />

it dropped 117,000 between December<br />

2011 and December 2012; the number<br />

of people employed by the private sector<br />

increased by 708,000.<br />

Overall, the economy is looking up a<br />

little, as a series of reports and surveys<br />

has demonstrated in recent days.<br />

Yesterday provided further confirmation<br />

– with the Bank of England hiking<br />

its growth forecast as part of Sir<br />

Mervyn King’s last Inflation Report –<br />

that we are seeing some sort of very<br />

modest turning point. Polls from<br />

YouGov and Ipsos Mori show that the<br />

public is becoming much more optimistic<br />

about its finances and the<br />

country’s economy.<br />

But the fact that this is coinciding<br />

with collapsing real take-home pay is<br />

truly extraordinary.<br />

allister.heath@cityam.com<br />

Follow me on Twitter: @allisterheath<br />

Gold slides<br />

below $1,400<br />

BY JAMES WATERSON<br />

GOLD fell below $1,400 an ounce<br />

yesterday as investors desert<br />

bullion in the face of record-high<br />

stock markets and growing<br />

economic confidence.<br />

The price of the metal closed<br />

down two per cent at $1,396.20, as<br />

US data suggested consumer prices<br />

are set to stay relatively flat<br />

undermining its safe-haven appeal.<br />

In October gold hit a peak of<br />

$1,794 an ounce before entering a<br />

period of decline. It eventually<br />

crashed in April.<br />

City vacancies<br />

stuck in slump<br />

BY MICHAEL BIRD<br />

OPPORTUNITIES for jobs in financial<br />

services slipped again in April, with<br />

22 per cent fewer vacancies than the<br />

previous year, according to Morgan<br />

McKinley.<br />

Though the number of people<br />

seeking new jobs in finance last<br />

month also fell from the 2012 level,<br />

a smaller decline of five per cent<br />

left more candidates fighting for<br />

each new position.<br />

The research also found that 36<br />

per cent of City employees were not<br />

happy with their bonus payments<br />

for 2012-13.<br />

IRS head resigns amid scandal<br />

The head of the US Internal Revenue<br />

Service resigned yesterday as the fallout<br />

widened from the tax agency’s treatment<br />

of right-wing political groups continues.<br />

Abercrombie & Fitch sign deal<br />

Abercrombie & Fitch yesterday said it had<br />

agreed to sign on to the Accord on Fire<br />

and Building Safety in Bangladesh.<br />

Abercrombie’s oral agreement is<br />

significant as it is a high-profile US<br />

retailer joining a wave of mostly European<br />

companies that have signed on.<br />

Find your next step at CITYAMCAREERS.com

cityam.com<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

Growth is picking up at last<br />

Bank estimates of past growth<br />

ONS data<br />

Chancellor George Osborne wants more cheap money to boost markets and spur growth<br />

crisis at last<br />

BY TIM WALLACE<br />

sumer price inflation now expected<br />

to peak at 3.1 per cent this year.<br />

THE UK economy will pick up strong- However markets are more sceptily<br />

this year, the Bank of England precal, pricing in inflation of 3.1 per<br />

dicted yesterday, getting back to cent in the medium term and 3.5 per<br />

healthy growth into 2014 and 2015. cent in the long term, five to 10 years<br />

And inflation will not be quite as ahead according to the Bank.<br />

high as previously, falling back to or Meanwhile the US Federal Reserve<br />

even below its two per cent target in was given a green light to continue<br />

2015 or 20<strong>16</strong>, it forecast.<br />

its ultra-loose monetary stance, as<br />

GDP is set to rise by 0.5 per cent in new data pointed to weak growth<br />

the current quarter, accelerating and low inflationary pressures.<br />

from the 0.3 per cent expansion in Producer prices across the pond<br />

the first quarter and well away from recorded their sharpest fall in three<br />

recession territory.<br />

years in April, according to one set of<br />

Such growth is a big improvement figures, while two other surveys<br />

on last year’s zig-zagging numbers, pointed to a sluggish industrial and<br />

and appears to mark the start of a manufacturing sector. And in stark<br />

real recovery at last.<br />

contrast to the UK’s burgeoning<br />

But there is still some uncertainty recovery the New York Federal<br />

in the outlook.<br />

Reserve’s widely-watched Empire<br />

“The main downside risk to the sus- State manufacturing survey dropped<br />

tainability of the recovery continues to a reading of minus 1.43 this month<br />

to stem from events overseas, espe- from 3.<strong>05</strong> in April, disappointing<br />

cially in the Eurozone,” governor Sir economists who had expected a<br />

Mervyn King warned.<br />

The Bank’s inflation forecasts were<br />

healthy rise.<br />

revised down a touch, with con- FORUM: Page 20-21<br />

King says even finance tax’s<br />

backers secretly oppose charge<br />

BY TIM WALLACE<br />

Projection<br />

2009 2010 2011 2012 2013 2014 2015 20<strong>16</strong><br />

UK recovering<br />

from financial<br />

NO CENTRAL bankers believe<br />

Europe’s planned financial<br />

transaction tax (FTT) is a good idea,<br />

Bank of England boss Sir Mervyn<br />

King said yesterday, and even<br />

politicians who publicly support<br />

the charge realise it is damaging.<br />

In a bold attack on politicians’<br />

plans the outgoing governor said<br />

the charge “is not likely to help”<br />

stabilise markets as its fans claim.<br />

Eleven EU nations want to raise<br />

the levy on trades of securities<br />

involving parties in the countries<br />

▲ ▲<br />

or securities issued in them.<br />

But Sir Mervyn believes EU<br />

leaders have been backed into a<br />

corner by a popular hatred of<br />

bankers and are now struggling to<br />

avoid implementing the tax.<br />

“I can see why politicians are<br />

wary of expressing the true<br />

scepticism that exists even in<br />

quarters that appear to be behind<br />

it,” he said yesterday.<br />

It came as new data from TMF<br />

Group shows Hungary’s FTT will<br />

raise 150bn forints (£425m) from<br />

the tax this year, barely half of the<br />

amount it hoped to bring in.<br />

THURSDAY <strong>16</strong> MAY 2013<br />

Mark Carney faces<br />

challenges at Bank<br />

BY TIM WALLACE when the economy improves.<br />

THE GOVERNMENT’S Help to Buy<br />

mortgage guarantee scheme could<br />

leave the taxpayer with a big bill if<br />

it becomes permanent, Sir Mervyn<br />

King warned.<br />

Stopping it being extended is<br />

one of several challenges his<br />

successor Mark Carney will<br />

inherit, as a huge array of<br />

market stimulus packages<br />

will have to be withdrawn<br />

Mark Carney starts in July<br />

Sir Mervyn also warned it will be<br />

difficult to unwind quantitative<br />

easing as markets become reliant<br />

on ultra-low interest rates.<br />

And he said Carney will reveal in<br />

August whether or not the Bank<br />

will give an unemployment target<br />

to achieve before it starts<br />

tightening policy again.<br />

“There is a debate to have<br />

on that – Mark Carney has<br />

been speaking to monetary<br />

policy committee members on<br />

it,” he said.<br />

NEWS<br />

114 Tories rebel<br />

over EU vote<br />

BY JAMES WATERSON<br />

DAVID Cameron’s assurances over<br />

an EU referendum have failed to<br />

placate his party, with 114<br />

Conservative MPs last night voting<br />

to regret the absence of a bill in<br />

the current legislative programme.<br />

Although the Prime Minister<br />

had said he was relaxed over how<br />

his backbenchers chose to vote,<br />

aides had hoped his pledge to<br />

introduce legislation would cause<br />

Eurosceptics to tone down their<br />

campaign.<br />

The motion was defeated by 277<br />

to 130 thanks to Labour and Lib<br />

Dem opposition – although 13<br />

Labour MPs backed an EU vote.<br />

3

THURSDAY <strong>16</strong> MAY 2013<br />

4 NEWS cityam.com<br />

Co-op Bank’s<br />

woes spread to<br />

hit group rating<br />

BY TIM WALLACE<br />

THE CO-OPERATIVE Group risks being<br />

damaged by the capital hole at its<br />

banking arm, credit ratings agency<br />

Standard and Poor’s said yesterday.<br />

The agency slapped a negative outlook<br />

on the group’s double-B plus rating,<br />

warning of a potential future<br />

downgrade.<br />

It came as the Co-op Bank began<br />

talks with the regulator over who will<br />

take on the top job after its chief executive<br />

Barry Tootell quit on Friday.<br />

Its eventual choice for the position<br />

must be vetted and interviewed<br />

by the Bank of<br />

England’s prudential regulation<br />

authority before<br />

taking the role.<br />

The banking arm has a<br />

capital hole of around<br />

£800m, which it hopes to<br />

fill by selling its life and<br />

insurance arms, and running<br />

down bad<br />

loan portfolios.<br />

But if the sales<br />

do not raise<br />

enough money,<br />

THE<br />

LUXURY<br />

SEAT<br />

SALE<br />

Treat yourself<br />

to fi rst and<br />

business class<br />

fl ights and<br />

holidays.<br />

Book by 4 June<br />

at ba.com<br />

the bank will come up short.<br />

And analysts fear that, in a stressed<br />

situation, the capital hole may even<br />

increase to £1.8bn. The bank can<br />

shrink its balance sheet or issue bonds<br />

to raise the capital.<br />

But it may also end up calling on its<br />

parent group for the funds.<br />

“The outlook revision reflects our<br />

view that the Co-operative banking<br />

group’s focus on strengthening its capital<br />

position could impede the group’s<br />

execution of its overall financial objectives,”<br />

said the ratings agency.<br />

“We believe it could increase the execution<br />

risks surrounding the trading<br />

group’s deleveraging plans, the realisation<br />

of which are critical for the<br />

group to maintain its ratings.”<br />

Meanwhile the Office of Fair<br />

Trading decided against referring<br />

the banking industry to the<br />

Competition Commission, as new<br />

entrants have come into the current<br />

account market since its last<br />

review in 2008.<br />

Co-op Bank chief Barry<br />

Tootell quit on Friday<br />

Cameron raises prospect of<br />

selling RBS to public by 2015<br />

BY JAMES WATERSON<br />

DAVID Cameron yesterday hinted<br />

that the government could sell off<br />

Royal Bank of Scotland to members<br />

of the public before the 2015 general<br />

election.<br />

Speaking on a trip to the US,<br />

Cameron told reporters that he is<br />

interested in “involving people in<br />

owning this bank in a genuine way”,<br />

before insisting “I’m open to all ideas<br />

and proposals”.<br />

He also said he wanted the sell-off<br />

to begin “as soon as possible”, with<br />

the proviso that the bank should be<br />

BY CITY A.M. REPORTER<br />

FASHION media and analysts<br />

yesterday broadly welcomed Marks<br />

& Spencer’s new clothing strategy<br />

and a preview of autumn/winter<br />

fashion ranges, giving the firm’s<br />

boss some respite from pressure<br />

over falling sales.<br />

Britain’s biggest clothing retailer<br />

said on Tuesday it would focus on<br />

better quality and styles in<br />

womenswear, deliver more<br />

compelling and clearer sub-brands,<br />

and make shopping easier in<br />

stores, as it tries to reverse nearly<br />

two years of declining sales.<br />

Yesterday, shares in the 129-year-<br />

in good financial health. RBS itself<br />

has suggested it may need another<br />

18 months to achieve this target.<br />

The Treasury is thought to be<br />

considering ways of handing part of<br />

the government’s 81 per cent stake<br />

in the bank to millions of people in<br />

one of the biggest ever privatisations.<br />

RBS shares are valued at 407p on<br />

the Treasury’s accounts but<br />

yesterday closed at 307p. With little<br />

chance of the government making a<br />

profit in the short-term, handing<br />

shares to members of the public<br />

would avoid allegations of selling<br />

stock to institutions on the cheap.<br />

M&S soars to five-year high as<br />

City welcomes new collection<br />

old firm, up 20 per cent over the<br />

past year after periodic bouts of<br />

bid speculation, rose by four per<br />

cent, hitting a five-year high of<br />

438p.<br />

“The changes outlined contained<br />

a variety of enhancements based<br />

on detailed customer feedback that<br />

even the bears will find hard to<br />

completely ignore,” said analysts at<br />

N+1 Singer, arguing that investors<br />

should not underestimate the<br />

potential from the changes.<br />

M&S will present the ranges to<br />

the bulk of the fashion media<br />

today but some key fashion editors<br />

have already viewed the ranges and<br />

like them.<br />

HSBC to cut<br />

14,000 jobs<br />

across world<br />

BY TIM WALLACE<br />

HSBC plans to cut another 14,000<br />

jobs over the next two years as it<br />

battles to bring down costs and offer<br />

sustainable returns to shareholders,<br />

the bank’s bosses told investors<br />

yesterday.<br />

As the bank returns to steady<br />

profitability, it plans to return cash<br />

to shareholders through higher<br />

dividends and stock buybacks.<br />

Headcount has already fallen from<br />

300,000 when chief executive Stuart<br />

Gulliver took over two years ago to<br />

254,000 now, and is set to fall as low<br />

as 240,000 in two more years.<br />

It is part of a wider plan to cut<br />

costs – the bank has cut $4bn<br />

(£2.6bn) per year off its bills already,<br />

in large part by closing or selling<br />

more than 50 businesses.<br />

But it is fighting an uphill battle<br />

against the new tide of regulation,<br />

hiring another 900 risk<br />

and compliance staff<br />

in the first quarter,<br />

and potentially<br />

hiring thousands<br />

more in the<br />

coming years.<br />

HSBC’s shares<br />

rose 0.79 per cent.<br />

Stuart<br />

Gulliver is<br />

leading the<br />

reforms<br />

Fly First and you’ll have<br />

a private concierge<br />

at your beck and call.<br />

To Fly. To Serve.<br />

Limited availability, particularly during peak periods. Includes selected destinations from LHR, LGW and LCY. Bookings to all destinations must be made by midnight on 04/06/13. Bookings to Europe from LHR and LGW are for travel between 01/06/13 – 15/12/13. Bookings to the Caribbean, Las Vegas, Orlando<br />

and Tampa from LGW are for travel between 29/<strong>05</strong>/13 – 30/04/14. Bookings to Mauritius and Colombo (Sri Lanka) are for travel between 29/<strong>05</strong>/13 – 31/10/13. Bookings to all other destinations are for travel between 29/06/13 – 07/09/13, 26/10/13 – 03/11/13 and 21/12/13 – <strong>05</strong>/01/14. Some destinations<br />

require bookings to be made a minimum of 28 days before the date of outbound departure. Holidays are ATOL protected (number ATOL5985). Fully fl at beds are operated in our Club World and First cabins. For selected destinations, eligible travel dates and full terms and conditions visit ba.com/luxury-sale

cityam.com<br />

WATER REGULATOR BOSS TO STEP DOWN<br />

THE CHIEF executive of UK water regulator Ofwat has resigned after six years in the<br />

post. Regina Finn will step down in November. A search for her successor is underway.<br />

“Regina wishes to take her career forward in a different direction,” Ofwat chairman<br />

Jonson Cox said yesterday.<br />

Boris confident<br />

of taking over<br />

London’s taxes<br />

BY JAMES WATERSON<br />

AND JAMES TITCOMB<br />

BORIS Johnson yesterday insisted he<br />

could convince the Treasury to<br />

devolve control of key taxes to City<br />

Hall by 20<strong>16</strong>, as part of an ambitious<br />

bid to give Londoners more control<br />

over how their money is spent.<br />

The Mayor of London wants his<br />

office to be granted more power over<br />

infrastructure and education<br />

provision in the capital, with<br />

funding coming from the<br />

council tax, business rates<br />

and stamp duty paid by<br />

Londoners.<br />

The capital’s central government<br />

grant would<br />

be reduced by an<br />

equivalent<br />

amount but<br />

City Hall<br />

would gain<br />

control over<br />

rates.<br />

“We are<br />

engaged in<br />

endless hand-<br />

to-mouth negotiations with government<br />

about penny packets of finance.<br />

And we have no real certainty about<br />

the financing of very important projects<br />

beyond 2015,” Johnson said yesterday.<br />

He said London was “fiscally infantilised”<br />

compared to the funding available<br />

to other major world cities such<br />

as New York or Madrid.<br />

“There is a bunker mentality in<br />

London government in dealing with<br />

the Treasury and a nervousness about<br />

upsetting government and seeming<br />

too ambitious.”<br />

“But this will be revenue neutral...<br />

It will give us consistency in funding<br />

and it will give us democratic<br />

accountability.”<br />

Johnson insisted it was possible<br />

to reach agreement<br />

on the plans by the time<br />

his mayoral term ends in<br />

three years’ time.<br />

Britain pledges to clamp down<br />

on oil firms amid price fix claim<br />

SUZIE NEUWIRTH<br />

BRITAIN’S energy minister<br />

yesterday said that oil companies<br />

would face full retribution if they<br />

have manipulated prices, as the<br />

European Commission’s probe<br />

throws the industry’s practices into<br />

the spotlight.<br />

“If it turns out to be the case that<br />

hard-pressed motorists and<br />

consumers have been hit in the<br />

pocket by manipulation in the<br />

market, the full force of the law<br />

should be down upon them,” said<br />

Energy Secretary Ed Davey.<br />

▲ ▲<br />

THE DEBATE: Page 21<br />

Johnson wants the power<br />

to set council tax bands<br />

Oil giants BP, Shell, Statoil and<br />

ENI have all confirmed that they<br />

are under investigation by the EU<br />

antitrust regulator.<br />

The probe into oil prices has<br />

been likened to the Libor scandal,<br />

when banks were found to have<br />

manipulated interbank lending<br />

rates.<br />

Last year the Office of Fair<br />

Trading found no evidence of<br />

price fixing in the oil market, but<br />

yesterday campaigning Tory MP<br />

Robert Halfon said the OFT’s<br />

probe had been “limp-wristed and<br />

lettuce-like”.<br />

THURSDAY <strong>16</strong> MAY 2013<br />

Google beats Apple<br />

to music streaming<br />

BY CITY A.M. REPORTER pioneered online music purchases<br />

GOOGLE launched a music service<br />

yesterday that allows users to listen<br />

to unlimited songs for $9.99 (£6.50)<br />

a month, challenging smaller<br />

companies like Pandora and<br />

Spotify in the market for streaming<br />

music.<br />

With its new service,<br />

announced at its annual<br />

developers’ conference in San<br />

Francisco, Google has adopted the<br />

streaming music business model<br />

ahead of rival Apple, which<br />

IN ASSOCIATION WITH<br />

with iTunes.<br />

Google’s “All Access” service lets<br />

users customise song selections<br />

from 22 genres, ranging from jazz<br />

to indie music, stream individual<br />

playlists, or listen to a curated,<br />

radio-like stream that can be<br />

tweaked. It will be launched for US<br />

users first, before being rolled out<br />

to several other countries.<br />

Google shares leapt to a new alltime<br />

high topping $900 for the<br />

first time. They closed up 3.25 per<br />

cent at $915.89.<br />

NEWS<br />

RP Martin boss<br />

on Libor leave<br />

BY JAMES WATERSON<br />

TWO top executives at interdealer<br />

broker RP Martin are understood to<br />

have been suspended amid an<br />

investigation into the company’s<br />

alleged involvement in the Libor<br />

fixing scandal.<br />

The pair, thought to be chief<br />

executive David Caplin and fellow<br />

director Alan Farnan, have been<br />

placed on leave as the probe<br />

continues.<br />

At the end of last year two RP<br />

Martin employees were arrested as<br />

part of the police investigation into<br />

the manipulation of the key<br />

interbank lending rate.<br />

RP Martin declined to comment.<br />

FINE CHINA<br />

Thursday 30 th May 6.30pm – 9pm<br />

Ne Hao! Join us for an authentic Chinese cultural<br />

experience at our award winning store on Cheapside.<br />

Our experts know the country intimately and will be on<br />

hand to discuss the ins and outs of your next holiday.<br />

A Chinese musical duo will create a fantastic oriental<br />

atmosphere, traditional Chinese food and drink will<br />

be available throughout the night, and there will be the<br />

chance to win a free luxury holiday to China.<br />

We have 100 complimentary tickets<br />

up for grabs. To apply, please visit<br />

abercrombiekent.co.uk/events<br />

5

cityam.com<br />

ITV ad sales set<br />

for steep fall in<br />

second quarter<br />

BY JAMES TITCOMB<br />

ITV has revealed improving sales in<br />

the first three months of the year,<br />

but said that advertising revenues in<br />

the second will be significantly lower<br />

than in 2012.<br />

The broadcaster said yesterday that<br />

TV advertising sales in the first quarter<br />

had been impressively robust, up<br />

six per cent on the same period last<br />

year. However, it warned that the current<br />

trading period will be much<br />

leaner than last year, when sales<br />

were boosted by the Euro 2012 football<br />

tournament.<br />

ITV forecast that advertising revenues<br />

will be down 12 per cent yearon-year<br />

in April, down seven per cent<br />

in May and down by up to 15 per cent<br />

in June. However, it promised an<br />

improvement in the second half of<br />

the year, predicting growth in July.<br />

The broadcaster has been buffeted<br />

by a volatile advertising market in<br />

recent years, causing chief executive<br />

Adam Crozier to focus his efforts on<br />

other sources of revenue.<br />

Crozier has been buying up TV production<br />

companies to bolster the ITV<br />

Studios arm, with the latest acquisition<br />

being Monday’s £17m purchase<br />

of a majority stake in Cake Boss<br />

maker High Noon.<br />

ITV Studios saw revenues decline by<br />

five per cent, although Crozier said<br />

this was against a tough comparative<br />

period and that he is confident the<br />

division will see double digit growth<br />

in the year as a whole.<br />

“While we are cautious about the<br />

outlook for TV advertising for 2013,<br />

our objective remains to outperform<br />

the market over the full year,” Crozier<br />

said. Overall, ITV saw first-quarter revenues<br />

of £666m, up two per cent on a<br />

year previously.<br />

ITV PLC<br />

133 p<br />

132<br />

131<br />

130<br />

129<br />

128<br />

127<br />

126<br />

129.20<br />

15 May<br />

9 May 10 May 11 May 14 May 15 May<br />

THURSDAY <strong>16</strong> MAY 2013<br />

ITV’s success in recent years has been fuelled by hit shows such as Downton Abbey<br />

ANALYST VIEWS<br />

Interviews by James Titcomb<br />

PATRICK YAU PEEL HUNT<br />

“<br />

ALEX DEGROOTE PANMURE GORDON<br />

“<br />

The firm appears to be performing in line with its transformation plan,<br />

and we expect ITV’s full-year broadcasting revenues to be flat, outperforming<br />

the general market. However, we will review margin assumptions and<br />

see shares as fully valued. We have a 130p target and ‘Hold’ guidance.<br />

DID ITV’S ADVERTISING<br />

WARNINGS AFFECT YOUR<br />

VIEW OF THE STOCK?<br />

”<br />

The stock market should not be surprised by this top-line performance,<br />

which had been well trailed. Even after a strong share rally, we consider this<br />

undemanding particularly taking into account the significant M&A taking<br />

”<br />

place across global broadcasting. We are buyers with a 180p target.<br />

IAN WHITTAKER LIBERUM CAPITAL<br />

“<br />

First quarter advertising revenues were ahead of expectations but second<br />

quarter guidance looks weaker than expecting. However, we remain happy<br />

with our ‘Buy’ guidance and 155p target, and there is enough earnings<br />

”<br />

growth from other non-TV advertising sources to see upgrades.<br />

NEWS<br />

Centaur chief<br />

exec quits after<br />

profit warning<br />

BY JAMES TITCOMB<br />

BUSINESS publishing group Centaur<br />

Media lost more than a quarter of its<br />

market value, as well as its chief<br />

executive, yesterday after a shock<br />

profit warning.<br />

Geoff Wilmot said he would step<br />

down from the publisher of The<br />

Lawyer and Marketing Week after<br />

six and a half years, after Centaur<br />

revealed that profit growth in the<br />

year to July would be “modest”.<br />

Analysts had expected the<br />

company to improve significantly<br />

on the £8m it made in the previous<br />

12-month period, and the<br />

disappointment sent Centaur’s<br />

shares down by 27.7 per cent.<br />

Wilmot will be replaced on an<br />

interim basis by chief financial<br />

officer Mark Kerswell, who was<br />

formerly chief operating officer of<br />

FTSE 100 media group Informa.<br />

Geoff Wilmot joined in November 2006<br />

7

cityam.com<br />

Lonrho shares<br />

surge 90pc on<br />

takeover offer<br />

BY SUZIE NEUWIRTH FS Africa had net debt totalling<br />

AFRICAN conglomerate Lonrho’s<br />

share price soared 90 per cent yesterday<br />

after the 104-year-old firm’s board<br />

recommended a £175m takeover bid<br />

from a Swiss consortium.<br />

FS Africa, which is jointly owned by<br />

Swiss investor Rainer-Marc Frey and<br />

billionaire Thomas Schmidheiny,<br />

offered 10.25p per share for the struggling<br />

oil and gas logistics provider.<br />

“The company had laudable objectives<br />

to capitalise on the growth of<br />

Africa, but repeatedly over promised<br />

and under delivered,” Damian<br />

McNeela, analyst at Panmure Gordon,<br />

told City A.M.<br />

“In the context of the company’s<br />

overstretched balance sheet and<br />

under-delivering on promises, I think<br />

they have been offered a fair price.”<br />

EVERY little helps.” Tesco’s<br />

ubiquitous advertising<br />

slogan would serve as an<br />

equally useful mandate<br />

from banking regulators as they<br />

seek to augment the capital and<br />

liquidity bases of the UK’s big<br />

lenders.<br />

Negotiations between the<br />

industry and the Prudential<br />

Regulation Authority have taken<br />

weeks longer than expected, but<br />

it has already become clear from<br />

events at the Co-operative Bank<br />

that “too big to fail” lenders are<br />

only one part of the problem.<br />

A capital hole of potentially<br />

more than £1.5bn at the Co-op<br />

highlights the fact that the<br />

regulatory underlap which<br />

blighted British banking before<br />

the crisis has far from<br />

disappeared.<br />

Efforts by the Prudential<br />

Regulatory Authority to<br />

orchestrate the appointment of<br />

the Co-op arm’s new chief<br />

executive is evocative of stable<br />

doors and horses. Nor is the Coop<br />

the only one of the<br />

newcomer banks that regulators<br />

have had cause to monitor.<br />

I understand that for<br />

approximately three months<br />

last year, Tesco’s banking arm<br />

was on the official watchlist of<br />

the Financial Services<br />

Authority owing to<br />

concerns about the<br />

adequacy of its IT<br />

systems.<br />

The retailer’s<br />

operation now has a<br />

clean bill of health,<br />

but its seriallydelayed<br />

plans to dive<br />

into the current account<br />

market remain<br />

patchilyformed.<br />

This was<br />

not the vision<br />

hailed by<br />

£99m at the end of the first quarter.<br />

“We believe Lonrho has strong longterm<br />

prospects, but the significant<br />

capital required to grow the business<br />

over time is evident,” said<br />

Schmidheiny.<br />

Lonrho’s shares closed 4.7p, or 90.4<br />

per cent higher, at 9.9p yesterday.<br />

Lonrho PLC<br />

10 p<br />

9<br />

8<br />

7<br />

6<br />

5<br />

INSIDE<br />

TRACK<br />

MARK KLEINMAN<br />

9.90<br />

15 May<br />

9 May 10 May 11 May 14 May 15 May<br />

George Osborne as he set out<br />

plans for a wave of upstart<br />

challengers taking on the<br />

entrenched oligopoly of the<br />

existing players. After all,<br />

regulators were not supposed to<br />

be the ones facing the challenge<br />

from their emergence.<br />

SWANN SIZING UP BUYOUT JOB<br />

The most unlikely business story<br />

I’ve seen since my last column a<br />

fortnight ago? A Sunday<br />

newspaper’s breathless<br />

suggestion that Kate Swann, the<br />

soon-to-depart chief executive of<br />

WH Smith, had sounded out<br />

Roger Holmes about the<br />

idiosyncrasies of running Marks<br />

& Spencer (M&S).<br />

Swann is an unlikely, though<br />

not an impossible, candidate to<br />

run Britain’s biggest clothing<br />

retailer.<br />

But even if she was in the<br />

frame to succeed Marc Bolland, I<br />

doubt she’d be seeking advice<br />

from a predecessor who left<br />

the chain nine years ago,<br />

and who was in the lame<br />

duck bracket long<br />

before Sir Philip Green<br />

turned up waving his<br />

chequebook.<br />

More plausible is the<br />

idea that Swann might be<br />

invited to join Change<br />

Capital, the private<br />

Kate Swann is<br />

weighing up her post-<br />

WH Smith options<br />

THURSDAY <strong>16</strong> MAY 2013<br />

PROFILE: TINY ROWLAND<br />

ROLAND ‘Tiny’ Rowland, who died in 1998,<br />

was the man who transformed the firm<br />

from a tiny mining firm in Africa to what<br />

was at its peak a huge international<br />

conglomerate.<br />

Recruited as chief executive of what was<br />

then the London and Rhodesian Mining and<br />

Land Company in 1962, Rowland led an<br />

aggressive expansion of the firm outside its<br />

mining comfort zone and refashioned<br />

the declining firm as a conglomerate<br />

running more than 600 global<br />

businesses including newspapers,<br />

hotels and textiles. His autocratic<br />

management style saw directors<br />

challenge his position in<br />

1973, and though he<br />

survived the coup, then<br />

Prime Minister Edward<br />

Heath labelled him “an<br />

unpleasant and<br />

ADVISERS LONRHO<br />

DAVID ANDERSON<br />

INVESTEC BANK<br />

Investec Bank advised FS Africa on its lifeline<br />

bid for struggling African conglomerate<br />

Lonrho. The team was led by David<br />

Anderson and Garry Levin, who both previously<br />

worked at KBC Peel Hunt. Law firm<br />

Slaughter and May also advised FS Africa,<br />

Challenger bank proves to be<br />

a challenge for the regulators<br />

equity vehicle that was founded<br />

by Holmes and his erstwhile M&S<br />

chairman, Luc Vandevelde.<br />

Plausible, but untrue,<br />

apparently.<br />

What I do understand to be<br />

the case is that Swann has been<br />

approached by buyout firms<br />

including Advent International,<br />

owner of the DFS furniture<br />

chain, about becoming an<br />

operating partner.<br />

The discussions are tentative,<br />

and given Swann’s youth, the<br />

odds must be on her instead<br />

taking a full-time executive’s<br />

role. There’s unlikely to be a<br />

shortage of interest – although<br />

given the dearth of big-time<br />

vacancies in the retail sector, she<br />

may be called upon to deploy her<br />

cost-cutting discipline elsewhere.<br />

SIR MERV’S TRANSATLANTIC SWERVE<br />

With Wimbledon’s conclusion<br />

and two Ashes series to look<br />

forward to, sport-loving Sir<br />

Mervyn King could hardly have<br />

hand-picked a more propitious<br />

time than the last day of June to<br />

end his second term as governor<br />

of the Bank of England.<br />

Sir Mervyn won’t, though, be<br />

spending his entire post-<br />

Threadneedle Street summer in<br />

the posh seats in SW19 and at<br />

Lord’s.<br />

Friends say he intends to<br />

relocate to New York for some<br />

time as he deliberates over the<br />

options for the next phase of his<br />

career.<br />

He might bump into Bob<br />

Diamond, although going into<br />

business with the former<br />

Barclays chief executive – whose<br />

ousting he ordered last year – is<br />

not thought to be high on the<br />

governor’s agenda.<br />

Mark Kleinman is the City editor<br />

of Sky News @MarkKleinmanSky<br />

unacceptable face of capitalism”.<br />

In 1981 he was handed control of the<br />

Observer newspaper, but blocked from<br />

bidding for Harrods. The decision incensed<br />

him so much he used his publishing<br />

platform to pursue a lengthy vendetta<br />

against Harrods and its new owner,<br />

Mohammed Al-Fayed, eventually forcing<br />

the DTI into publishing an internal report<br />

that questioned the Egyptian tycoon’s<br />

source of wealth. Eventually ousted from<br />

Lonrho by a second boardroom coup in<br />

1993, Tiny died five years later aged 80.<br />

Even before Lonrho, Rowland led an<br />

adventurous life. Born in an Indian<br />

detention camp during WW1,<br />

Rowland’s early years saw him<br />

join the Hilter Youth, work as<br />

a shipping agent, and spend<br />

eight weeks in a Berlin jail<br />

for anti-Nazi sentiment.<br />

led by corporate and M&A partner Mark<br />

Zerdin who previously worked on deals<br />

such as Liverpool FC’s sale to New England<br />

Sports Ventures and General Electric’s offer<br />

to buy Wellstream Holdings. Meanwhile<br />

Jefferies advised Lonrho, led by MD Sara<br />

Hale, Senior VP Harry Nicholas, MD Andrew<br />

Bell, VP Vaneet Malhotra and MD Michael<br />

Collinson. Hale and Nicholas previously<br />

worked at RBS Hoare Govett, while Bell<br />

came from HSBC. Headland Consultancy<br />

and FTI Consulting were PR advisers to FS<br />

Africa and Lonrho respectively.<br />

<br />

<br />

<br />

NEWS<br />

Investors still<br />

expect Severn<br />

Trent deal<br />

BY SUZIE NEUWIRTH<br />

SEVERN Trent’s share price<br />

remained relatively unchanged<br />

yesterday, despite the water<br />

supplier’s refusal of a takeover bid<br />

from a consortium of investors on<br />

the grounds that it undervalues the<br />

company.<br />

“The market is still confident that<br />

the deal will happen,” Chris<br />

Beauchamp, analyst at IG Group,<br />

told City A.M. “Previous water<br />

company takeovers were successful<br />

and utilities continue to be very<br />

attractive assets.”<br />

The FTSE 100 company’s shares<br />

rose a modest 13p yesterday.<br />

Severn Trent PLC<br />

2,200 p<br />

2,150<br />

2,100<br />

2,<strong>05</strong>0<br />

2,000<br />

1,950<br />

1,900<br />

1,850<br />

9 May 10 May 11 May 14 May 15 May<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

2,090.00<br />

15 May<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

9

cityam.com<br />

LSE boss Xavier Rolet has helped the exchange dodge poor volumes and deliver a profit<br />

London Stock<br />

Exchange spies<br />

money in data<br />

BY JAMES WATERSON undertaken to become more efficient<br />

LONDON Stock Exchange Group now<br />

makes more money from data services<br />

than from its core capital markets<br />

business, according to year-end<br />

results released yesterday.<br />

Revenue from the group’s information<br />

business grew 40 per cent to<br />

£306.3m over the twelve months to<br />

the end of March, driven by the<br />

acquisition of the FTSE business<br />

which calculates indices for<br />

exchanges around the world.<br />

By contrast income from the capital<br />

markets division – which includes<br />

the iconic London Stock Exchange<br />

itself – fell by a tenth to £267.5m.<br />

The company’s decision to diversify<br />

away from equity markets, which<br />

have been hit by falling trade volumes<br />

following the financial crisis,<br />

appears to have paid off, with total<br />

revenues rising seven per cent to<br />

£726.4m.<br />

Profits fell three per cent but chief<br />

executive Xavier Rolet said he was<br />

pleased with the “initiatives we have<br />

and diversify our business”.<br />

Earlier this month the LSE acquired<br />

London clearing house LCH.Clearnet<br />

in an attempt to increase revenues<br />

from post-trade services.<br />

The company, which joined the<br />

FTSE 100 this year, saw its share price<br />

jump as analysts rushed to praise the<br />

turnaround plan<br />

“We believe the company is being<br />

exceptionally run especially given the<br />

challenging market backdrop,” said<br />

analyst Peter Lenardos of RBC Capital<br />

Markets.<br />

1,400<br />

1,380<br />

1,360<br />

1,340<br />

London Stock Exchange Group PLC<br />

1,440 p 1,406.00<br />

15 May<br />

1,420<br />

9 May 10 May 11 May 14 May 15 May<br />

Debt drought forces caution in<br />

private equity dealmaking<br />

BY MICHAEL BOW<br />

A LOAN drought has crushed the<br />

number of private equity deals<br />

signed this year, sending deal<br />

values in the sector to a three-year<br />

low, figures showed yesterday.<br />

Lower levels of debt financing<br />

mean private equity firms are<br />

unwilling, or unable, to stump up<br />

the money to back deals, leaving<br />

them trailing behind their private<br />

company counterparts.<br />

This has sent total values paid in<br />

private equity-related deals down<br />

36 per cent in the past year, to its<br />

lowest level since the winter of<br />

2009.<br />

The drought contrasts with<br />

private businesses, who are willing<br />

to pay about five per cent more for<br />

companies than they were a year<br />

ago, the data from accountant<br />

BDO show.<br />

Yesterday’s figures tie-in with<br />

further numbers from Preqin,<br />

which shows the average holding<br />

period for a private equity-backed<br />

company in Europe is 5.2 years,<br />

compared to 3.8 years in 2008.<br />

Economic conditions are to<br />

blame, the group said.<br />

THURSDAY <strong>16</strong> MAY 2013<br />

BOTTOM<br />

LINE ELIZABETH FOURNIER<br />

No matter mattter<br />

where<br />

we stand<br />

you stand sta<br />

and secur secured secured<br />

ed d<br />

NEWS<br />

Rolet’s eye for an opportunity is<br />

paying off in a difficult market<br />

BRAVO Xavier. It’s been a<br />

bumpy ride for the London<br />

Stock Exchange chief<br />

executive since he took up the<br />

post exactly four years ago, with<br />

largely moribund equity markets<br />

and a non-existent IPO pipeline<br />

piling pressure on the exchange, but<br />

his strategies seem to be paying off.<br />

Yesterday investors cheered the<br />

news that full-year revenues were up<br />

seven per cent to £726.4m, while net<br />

debt had fallen from £703m a year<br />

ago to £549.9m over the last 12<br />

months – sending shares up almost<br />

six per cent and adding to the 23 per<br />

cent rise they’ve already seen since<br />

the start of the year.<br />

In a sector rife with consolidation,<br />

LSE has remained on the sidelines<br />

since its failed merger with the<br />

Toronto Metals Exchange (TMX) at<br />

the start of 2011. Instead, Rolet has<br />

ActivTrades ActivT rades is proud to<br />

o offer the security and peace o of mind of insuring its clients clients’ f funds<br />

above the threshold pr provided ovided by the Financial Services Servicces<br />

Compensation Scheme (FSCS).<br />

ActivTrades<br />

is the<br />

first<br />

UK broker<br />

- authorised to hol hold d client funds - to offer<br />

this co cover. over.<br />

This policy<br />

is underwri underwritten tten by Lloyd’s of London and andd<br />

comes as standard,<br />

at no cost co ost to<br />

you. Clients of ActivT ActivTrades raades<br />

are individually covered up uup<br />

to<br />

£50 £500,000 0,000<br />

as<br />

Excess<br />

of FSCS<br />

Insurance<br />

Insurance. . Because you your ur funds security is our main goal, g we can increase the maximum maxi imum<br />

amount covered accord according ding to your needs (terms and d conditions apply).<br />

For<br />

more information pplease<br />

please visit<br />

activtrades.co.uk<br />

oor<br />

or call us at<br />

020 7680<br />

7300.<br />

Forex Fo orex<br />

| Spread Betting | CFDs CCFDs<br />

Leveraged<br />

products are high<br />

risk, losses can exceed your<br />

initia initial al deposit.<br />

The ActivTrades ActivTr rades Excess of FSCS FSSCS<br />

Insurance is subject to the TTerms<br />

Terms<br />

and Conditions of the policy polic cy wording.<br />

Protection under this policy is afforded to retail clients who<br />

are eligible to claim under FSCS FSCS. S. Fur Further ther<br />

information<br />

can be found on our o website www.activtr<br />

www.activtrades.com. ades.com. ActivT ActivTrades rades PL PLC C is authorised and<br />

d regulated<br />

by the Financial Services Authority, Auth hority, FSA registration number<br />

4434413.<br />

434413.<br />

11<br />

focused on seeking out assets that<br />

diversify income streams away from<br />

traditional equity markets – a<br />

majority stake in LCH.Clearnet, a<br />

fixed-income joint venture with<br />

TMX, and a very successful clearing<br />

business in Italy, CC&G.<br />

With competition concerns high<br />

among regulators, he’s right to think<br />

small and branch out further afield,<br />

focusing on key overseas markets<br />

and the growing over-the counter<br />

market. At the moment it’s early<br />

days, but when the synergies really<br />

start rolling in, investors should have<br />

even more reasons to be cheerful.

THURSDAY <strong>16</strong> MAY 2013<br />

12 NEWS cityam.com<br />

Sales dip fails to stop Alliance<br />

Boots posting healthy profits<br />

BY JULIAN HARRIS<br />

ALLIANCE Boots, owner of the<br />

high street Boots stores, yesterday<br />

boasted a second straight year of<br />

double-digit growth in underlying<br />

profits, despite falling sales.<br />

The firm, which has been 45<br />

per cent owned by US retail giant<br />

Walgreen since last August, said<br />

that revenue for the year to 31<br />

March was down 2.6 per cent at<br />

£22.4bn, citing “challenging<br />

market conditions prevalent<br />

across the world.”<br />

Yet underlying profit after tax<br />

climbed to £8<strong>05</strong>m, up 12.7 per<br />

cent on a year earlier. The Boots<br />

retail wing, known as the firm’s<br />

health and beauty division, saw<br />

trading profits rise 6.8 per cent to<br />

£865m, despite sales dropping 2.5<br />

per cent to £7.48bn.<br />

While austerity measures and<br />

global economic slowdown may<br />

hit the firm by squeezing<br />

consumer demand, belttightening<br />

could actually benefit<br />

Alliance Boots, its report said.<br />

“Demographic and social<br />

pressures [are] continuing to drive<br />

demand for healthcare and<br />

medicines while payers continue<br />

to attempt to constrain overall<br />

costs,” it said. “These trends<br />

continue to drive demand for<br />

generic medicines and for high<br />

quality services delivered to local<br />

communities, both of which we<br />

are ideally placed to meet.”<br />

However, the company admitted<br />

that the contraction in its market<br />

“reflects government measures<br />

across Europe to constrain growth<br />

in healthcare costs”.<br />

Alliance Boot’s pharmaceutical<br />

wholesale branch brought in<br />

£<strong>16</strong>.4bn during 2012-13.<br />

RSA SLASHES PAY TO HEAD OFF REBELLION<br />

INSURER RSA’s 28 per cent cut in directors’ pay yesterday secured backing from<br />

shareholders angered by a sharp reduction in the company’s dividend. RSA’s pay plans won<br />

91 per cent approval at its annual shareholder meeting. Chairman Martin Scicluna, pictured,<br />

said total director remuneration was lower in 2012 compared with the previous year.<br />

French Connection cheers steady<br />

trading at the start of the year<br />

BY SUZIE NEUWIRTH grow as the year progresses,” the<br />

BRITISH clothes retailer French<br />

Connection yesterday said like-forlike<br />

trading in the UK and Europe<br />

was broadly flat in the 15 weeks to<br />

11 May.<br />

Wholesale revenues declined in<br />

the UK and Europe, while in North<br />

America wholesale was down but<br />

retail revenues climbed five per<br />

cent, the firm said in an update<br />

ahead of its shareholder meeting.<br />

Joint ventures in Asia performed<br />

well despite the retail market slowdown<br />

in China and Hong Kong,<br />

resulting in a small profit increase.<br />

“We are seeing progress from the<br />

initiatives that were instigated<br />

following the retail review last year<br />

and expect the impact of these to<br />

EasyJet soars as<br />

its winter losses<br />

are sliced in half<br />

BY MARION DAKERS<br />

EASYJET has almost halved its losses over<br />

the six months to April, helped by dreary<br />

weather in Britain sending holidaymakers<br />

on winter breaks abroad.<br />

The firm’s pre-tax loss of £61m was<br />

slightly ahead of forecasts in a traditionally<br />

quiet period for airlines.<br />

Revenues rose 9.3 per cent to £1.6bn,<br />

while revenues per seat rose 5.8 per cent<br />

to £53.39.<br />

Chief executive Carolyn McCall told<br />

reporters the low-cost carrier has the<br />

chance to take more market share from<br />

more established airlines in the coming<br />

years.<br />

“What we have seen is the legacy carriers<br />

can’t make money in their current<br />

set up on short haul in Europe,” she said.<br />

“It’s a few years away, there’s a lot of<br />

restructuring and consolidation to come<br />

but the potential for a low cost carrier<br />

like EasyJet is significant.”<br />

The firm had around a 30 per cent<br />

share on the routes it operated in the<br />

half-year period, McCall said, up from 28<br />

per cent.<br />

EasyJet said it is in the final stages of<br />

sizing up a possible plane order after<br />

company said.<br />

Group cash rose to £15.7m, from<br />

£10.4m a year ago, which the firm<br />

hailed as a sign of tight capital<br />

control.<br />

Analysts said the update showed<br />

signs of a strong start to the year.<br />

“French Connection remains a<br />

strong global brand and, with a<br />

new focus on change and a series<br />

of sensible initiatives being<br />

implemented in the UK, we see<br />

scope for losses to narrow,” said<br />

Numis in a note.<br />

But stock-watchers at Cantor<br />

Fitzerald said they do not expect<br />

the firm to break even until 2015.<br />

Shares in the FTSE-listed retailer<br />

closed 3.1 per cent higher<br />

yesterday at 28.20p.<br />

2017, a move that major shareholder<br />

Stelios Haji-Ioannou has opposed.<br />

McCall said if the firm decides to<br />

upgrade its planes, it will take the<br />

economic case to shareholders and<br />

ensure a deal “will be in the best<br />

interests of all of them”.<br />

As part of EasyJet’s plan to appeal to<br />

business passengers, it announced<br />

yesterday that its flexible fares will<br />

include fast-track passes through airport<br />

security.<br />

For the rest of the year, EasyJet said<br />

it expects to improve returns and<br />

profitability. The upbeat outlook<br />

helped send the FTSE 100 firm’s<br />

shares up 8.32 per cent yesterday.<br />

easyJet PLC<br />

1,240 p 1,224.00<br />

15 May<br />

1,220<br />

1,200<br />

1,180<br />

1,<strong>16</strong>0<br />

1,140<br />

9 May 10 May 11 May 14 May 15 May

cityam.com<br />

Millions to switch to BT internet<br />

for free Premier League football<br />

BY JAMES TITCOMB offering for free to its own internet<br />

MILLIONS of broadband subscribers<br />

are set to drop their current<br />

provider to switch to BT, having<br />

been tempted by the carrot of free<br />

Premier League football on TV.<br />

Initial figures from Usurv, an<br />

internet pollster, said that eight per<br />

cent of Sky’s TV customers –<br />

around 832,00 households – plan to<br />

switch from their current provider<br />

to BT. The research also said that<br />

six per cent of TalkTalk and Virgin<br />

Media broadband customers –<br />

roughly 500,000 people – intend to<br />

switch in order to take advantage<br />

of the sports channels BT is<br />

Europeans shun<br />

PCs as sales see<br />

worst ever fall<br />

BY JAMES TITCOMB<br />

PERSONAL computer sales have<br />

plummeted in Western Europe, as<br />

Microsoft’s Windows 8 software has<br />