Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 Business<br />

42<br />

overview<br />

Downstream<br />

3.1.2.8. Hydrogen and electric mobility<br />

TOTAL is continuing its hydrogen fueling demonstrations as part of<br />

the Clean Energy Partnership in Germany. A new prototype station<br />

is being built in the center of Berlin and is scheduled to open in<br />

February 2012. TOTAL is also involved in the “H 2 Mobility” study<br />

underway in Germany, which aims to identify the business model<br />

3.2. Trading & Shipping<br />

The Trading & Shipping division:<br />

– sells and markets the Group’s crude oil production;<br />

– provides a supply of crude oil for the Group’s refineries;<br />

– imports and exports the appropriate petroleum products for the<br />

Group’s refineries to be able to adjust their production to the<br />

needs of local markets;<br />

– charters appropriate ships for these activities; and<br />

– undertakes trading on various derivatives markets.<br />

3.2.1. Trading<br />

TOTAL is one of the world’s largest traders of crude oil and refined products on the basis of volumes traded. The table below sets forth<br />

selected information with respect to the worldwide sales and sources of supply of crude oil and sales of refined products for the Group’s<br />

Trading division for each of the last three years.<br />

Trading of physical volumes of crude oil and refined products amounted to 4.4 Mb/d in <strong>2011</strong>.<br />

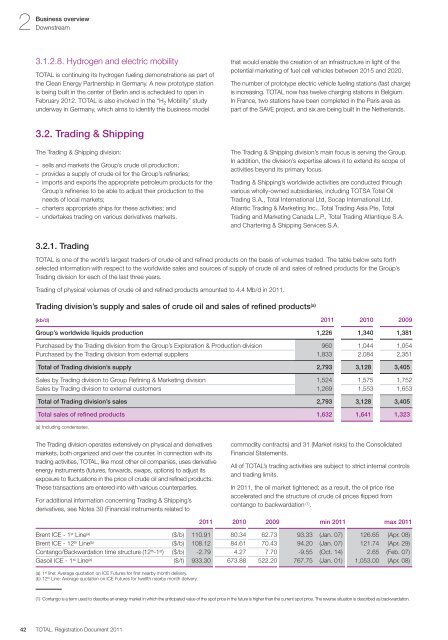

Trading division’s supply and sales of crude oil and sales of refined products (a)<br />

(kb/d) <strong>2011</strong> 2010 2009<br />

Group’s worldwide liquids production 1,226 1,340 1,381<br />

Purchased by the Trading division from the Group’s Exploration & Production division 960 1,044 1,054<br />

Purchased by the Trading division from external suppliers 1,833 2,084 2,351<br />

<strong>Total</strong> of Trading division’s supply 2,793 3,128 3,405<br />

Sales by Trading division to Group Refining & Marketing division 1,524 1,575 1,752<br />

Sales by Trading division to external customers 1,269 1,553 1,653<br />

<strong>Total</strong> of Trading division’s sales 2,793 3,128 3,405<br />

<strong>Total</strong> sales of refined products 1,632 1,641 1,323<br />

(a) Including condensates.<br />

The Trading division operates extensively on physical and derivatives<br />

markets, both organized and over the counter. In connection with its<br />

trading activities, TOTAL, like most other oil <strong>com</strong>panies, uses derivative<br />

energy instruments (futures, forwards, swaps, options) to adjust its<br />

exposure to fluctuations in the price of crude oil and refined products.<br />

These transactions are entered into with various counterparties.<br />

For additional information concerning Trading & Shipping’s<br />

derivatives, see Notes 30 (Financial instruments related to<br />

The Trading & Shipping division’s main focus is serving the Group.<br />

In addition, the division’s expertise allows it to extend its scope of<br />

activities beyond its primary focus.<br />

Trading & Shipping’s worldwide activities are conducted through<br />

various wholly-owned subsidiaries, including TOTSA <strong>Total</strong> Oil<br />

Trading S.A., <strong>Total</strong> International Ltd, Socap International Ltd,<br />

Atlantic Trading & Marketing Inc., <strong>Total</strong> Trading Asia Pte, <strong>Total</strong><br />

Trading and Marketing Canada L.P., <strong>Total</strong> Trading Atlantique S.A.<br />

and Chartering & Shipping Services S.A.<br />

<strong>com</strong>modity contracts) and 31 (Market risks) to the Consolidated<br />

Financial Statements.<br />

All of TOTAL’s trading activities are subject to strict internal controls<br />

and trading limits.<br />

In <strong>2011</strong>, the oil market tightened; as a result, the oil price rise<br />

accelerated and the structure of crude oil prices flipped from<br />

contango to backwardation (1) .<br />

<strong>2011</strong> 2010 2009 min <strong>2011</strong> max <strong>2011</strong><br />

Brent ICE - 1 st Line (a) ($/b) 110.91 80.34 62.73 93.33 (Jan. 07) 126.65 (Apr. 08)<br />

Brent ICE - 12 th Line (b) ($/b) 108.12 84.61 70.43 94.20 (Jan. 07) 121.74 (Apr. 29)<br />

Contango/Backwardation time structure (12 th -1 st ) ($/b) -2.79 4.27 7.70 -9.55 (Oct. 14) 2.65 (Feb. 07)<br />

Gasoil ICE - 1 st Line (a) ($/t) 933.30 673.88 522.20 767.75 (Jan. 01) 1,053.00 (Apr. 08)<br />

(a) 1 st line: Average quotation on ICE Futures for first nearby month delivery.<br />

(b) 12 th Line: Average quotation on ICE Futures for twelfth nearby month delivery.<br />

TOTAL. <strong>Registration</strong> Document <strong>2011</strong><br />

that would enable the creation of an infrastructure in light of the<br />

potential marketing of fuel cell vehicles between 2015 and 2020.<br />

The number of prototype electric vehicle fueling stations (fast charge)<br />

is increasing. TOTAL now has twelve charging stations in Belgium.<br />

In France, two stations have been <strong>com</strong>pleted in the Paris area as<br />

part of the SAVE project, and six are being built in the Netherlands.<br />

(1) Contango is a term used to describe an energy market in which the anticipated value of the spot price in the future is higher than the current spot price. The reverse situation is described as backwardation.