Financialization in Mexico - Dr. Gregorio Vidal

Financialization in Mexico - Dr. Gregorio Vidal

Financialization in Mexico - Dr. Gregorio Vidal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIALIzATION IN MEXICO: TRAJECTORY AND LIMITS 265<br />

Figure 1 Real m<strong>in</strong>imum wages (daily) <strong>in</strong> <strong>Mexico</strong><br />

Pesos<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20 2009<br />

2008<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2002<br />

2001<br />

2000<br />

1999<br />

1998<br />

1997<br />

1996<br />

1995<br />

1994<br />

1993<br />

1992<br />

1991<br />

1990<br />

1989<br />

1988<br />

1987<br />

1986<br />

1985<br />

1984<br />

1983<br />

1982<br />

1981<br />

1980<br />

Source: Authors’ calculations based on Banco de México’s (2010a) statistics on<br />

employment and consumer price <strong>in</strong>flation.<br />

risk. With the crisis, the cost of the process termed “pesification” was<br />

passed on to the public. The posterior dollarization and the existence of<br />

a double monetary circuit had significant repercussions over the generation<br />

of profits and salary levels dur<strong>in</strong>g the follow<strong>in</strong>g three decades<br />

(Parguez, 2010). In develop<strong>in</strong>g economies, this double monetary circuit<br />

represents part of the process of the f<strong>in</strong>ancialization of accumulation, as<br />

the denom<strong>in</strong>ation of profits <strong>in</strong> dollars is fundamental for their transfer<br />

and centralization.<br />

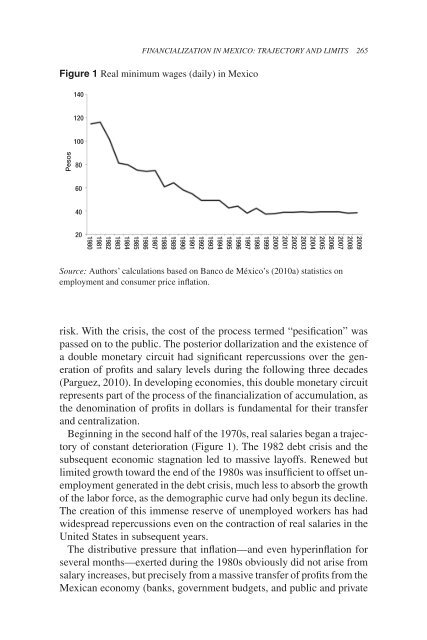

Beg<strong>in</strong>n<strong>in</strong>g <strong>in</strong> the second half of the 1970s, real salaries began a trajectory<br />

of constant deterioration (Figure 1). The 1982 debt crisis and the<br />

subsequent economic stagnation led to massive layoffs. Renewed but<br />

limited growth toward the end of the 1980s was <strong>in</strong>sufficient to offset unemployment<br />

generated <strong>in</strong> the debt crisis, much less to absorb the growth<br />

of the labor force, as the demographic curve had only begun its decl<strong>in</strong>e.<br />

The creation of this immense reserve of unemployed workers has had<br />

widespread repercussions even on the contraction of real salaries <strong>in</strong> the<br />

United States <strong>in</strong> subsequent years.<br />

The distributive pressure that <strong>in</strong>flation—and even hyper<strong>in</strong>flation for<br />

several months—exerted dur<strong>in</strong>g the 1980s obviously did not arise from<br />

salary <strong>in</strong>creases, but precisely from a massive transfer of profits from the<br />

Mexican economy (banks, government budgets, and public and private