TAX SALE - Worcester County

TAX SALE - Worcester County

TAX SALE - Worcester County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

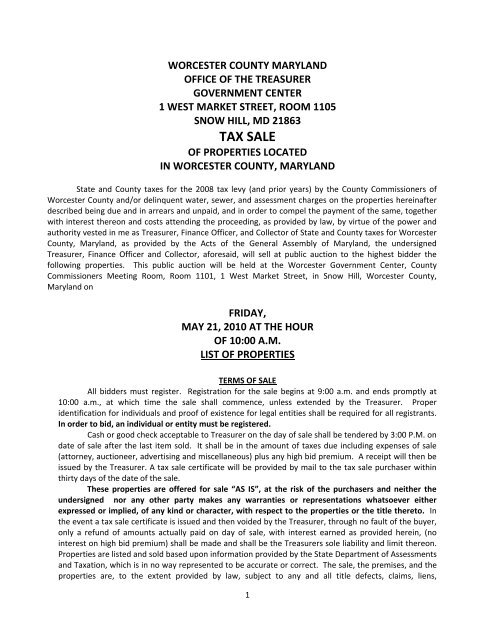

WORCESTER COUNTY MARYLAND<br />

OFFICE OF THE TREASURER<br />

GOVERNMENT CENTER<br />

1 WEST MARKET STREET, ROOM 1105<br />

SNOW HILL, MD 21863<br />

<strong>TAX</strong> <strong>SALE</strong><br />

OF PROPERTIES LOCATED<br />

IN WORCESTER COUNTY, MARYLAND<br />

State and <strong>County</strong> taxes for the 2008 tax levy (and prior years) by the <strong>County</strong> Commissioners of<br />

<strong>Worcester</strong> <strong>County</strong> and/or delinquent water, sewer, and assessment charges on the properties hereinafter<br />

described being due and in arrears and unpaid, and in order to compel the payment of the same, together<br />

with interest thereon and costs attending the proceeding, as provided by law, by virtue of the power and<br />

authority vested in me as Treasurer, Finance Officer, and Collector of State and <strong>County</strong> taxes for <strong>Worcester</strong><br />

<strong>County</strong>, Maryland, as provided by the Acts of the General Assembly of Maryland, the undersigned<br />

Treasurer, Finance Officer and Collector, aforesaid, will sell at public auction to the highest bidder the<br />

following properties. This public auction will be held at the <strong>Worcester</strong> Government Center, <strong>County</strong><br />

Commissioners Meeting Room, Room 1101, 1 West Market Street, in Snow Hill, <strong>Worcester</strong> <strong>County</strong>,<br />

Maryland on<br />

FRIDAY,<br />

MAY 21, 2010 AT THE HOUR<br />

OF 10:00 A.M.<br />

LIST OF PROPERTIES<br />

TERMS OF <strong>SALE</strong><br />

All bidders must register. Registration for the sale begins at 9:00 a.m. and ends promptly at<br />

10:00 a.m., at which time the sale shall commence, unless extended by the Treasurer. Proper<br />

identification for individuals and proof of existence for legal entities shall be required for all registrants.<br />

In order to bid, an individual or entity must be registered.<br />

Cash or good check acceptable to Treasurer on the day of sale shall be tendered by 3:00 P.M. on<br />

date of sale after the last item sold. It shall be in the amount of taxes due including expenses of sale<br />

(attorney, auctioneer, advertising and miscellaneous) plus any high bid premium. A receipt will then be<br />

issued by the Treasurer. A tax sale certificate will be provided by mail to the tax sale purchaser within<br />

thirty days of the date of the sale.<br />

These properties are offered for sale “AS IS”, at the risk of the purchasers and neither the<br />

undersigned nor any other party makes any warranties or representations whatsoever either<br />

expressed or implied, of any kind or character, with respect to the properties or the title thereto. In<br />

the event a tax sale certificate is issued and then voided by the Treasurer, through no fault of the buyer,<br />

only a refund of amounts actually paid on day of sale, with interest earned as provided herein, (no<br />

interest on high bid premium) shall be made and shall be the Treasurers sole liability and limit thereon.<br />

Properties are listed and sold based upon information provided by the State Department of Assessments<br />

and Taxation, which is in no way represented to be accurate or correct. The sale, the premises, and the<br />

properties are, to the extent provided by law, subject to any and all title defects, claims, liens,<br />

1

encumbrances, covenants, conditions, restrictions, easements, rights‐of‐way and matters of records. In<br />

the event of mistake, defective title, description or nonexistence of property, no refund shall be given.<br />

Bidders should be well versed in the law regarding tax sales and should investigate the<br />

properties and titles thereto prior to purchase or bid.<br />

Competent legal advice should be sought by prospective bidders prior to the sale. No legal advice shall<br />

be given by the <strong>County</strong> Attorney, Treasurer, or staff.<br />

Bidders representing legal entities are limited to one bidder per property sold. Bidding shall be<br />

conducted in accordance with procedures announced by the Treasurer or his agent at the sale.<br />

All costs in connection with the foreclosure of the right of redemption and all other title costs<br />

are at the expense of the purchaser or purchasers. All taxes and fees and other impositions, including,<br />

without limitation the following: transfer tax, agricultural transfer tax, recordation tax, and recording<br />

costs required will likewise be at the expense of the purchaser or purchasers. Terms of sale shall be<br />

complied with as determined by the Treasurer, who shall be the sole judge of such.<br />

These requirements are directory as to the Treasurer and not mandatory. They may be altered<br />

by the Treasurer at his sole discretion in the interests of justice, fairness, and efficiency or other good<br />

and valid reason.<br />

HIGH BID PREMIUM<br />

Notice is hereby given that the Treasurer has established a high‐bid premium, pursuant to Annotated<br />

Code of Maryland, Tax Property Article , Section 14‐817(b)(2). The high bid premium will be due in full<br />

and paid along with all taxes, interest, and costs of sale on the date of the sale. The high bid premium<br />

shall be equal to 20% of the amount by which the highest bid exceeds 40% of the property’s full cash<br />

value as assessed. In the case of an agricultural use assessment it shall be twenty percent (20%) of an<br />

appropriate value determined by the Treasurer. 100% of the property’s assessed value is shown in each<br />

item of this advertisement. The high bid premium shall be calculated and determined by the Treasurer<br />

whose decision shall be final. The high bid premium shall not earn interest and shall only be refunded in<br />

accordance with Annotated Code of Maryland, Tax Property Article Section 14‐817(b)(2).<br />

PROPERTIES LISTED HEREIN, ON WHICH <strong>TAX</strong>ES ARE PAID PRIOR TO DATE OF <strong>SALE</strong> WILL NOT BE SOLD.<br />

HAROLD L. HIGGINS<br />

TREASURER<br />

AND<br />

FINANCE OFFICER<br />

FOR WORCESTER COUNTY,<br />

MARYLAND AND<br />

COLLECTOR OF STATE<br />

AND COUNTY <strong>TAX</strong>ES<br />

FOR WORCESTER COUNTY,<br />

MARYLAND<br />

2

Item #1 Account #10755514<br />

Assessed To 14th Street LLC Described As Lot 18 6,743.67 Square Feet Harbor Master Boulevard West<br />

Harbor Village, Deed Reference 3951/0112, Assessed Value $43,550 Taxes Due $1,092.87<br />

Item #2 Account #10760739<br />

Assessed To 14th Street, LLC Described As Improvements Unit 17 Phase 1 Harbor Master Boulevard<br />

West Harbor Village Condominium, Deed Reference 3951/0112, Assessed Value $256,512 Taxes Due<br />

$4,912.32<br />

Item #3 Account #03033708<br />

Assessed To A Reggie Mariner Inc Described As 1.91 Acres 213' X 218' X 203' X 284' West Side Route<br />

113, Deed Reference 0395/0510, Assessed Value $139,820 Taxes Due $4,459.28<br />

Item #4 Account #01019880<br />

Assessed To Abbott, Roscole & Nancy Described As 65.5' X 163.3' X 103.3' X 140' Railroad Alley Near<br />

Dudley Avenue Pocomoke, Deed Reference 2948/0589, Assessed Value $23,182 Taxes Due $1,502.47<br />

Item #5 Account #10407125<br />

Assessed To All, Michael A & Laura A Hines Described As Improvements Boat Slip #27 Tern Drive Old<br />

Port Cove Condominium, Deed Reference 4505/0235, Assessed Value $15,000 Taxes Due $762.42<br />

Item #6 Account #08003416<br />

Assessed To Allen, Victoria Selena Described As Improvements 1.09 Acre St Pauls Road Surveyed Lands<br />

Of Victoria Allen, Deed Reference 1961/0495, Assessed Value $42,676 Taxes Due $518.57<br />

Item #7 Account #02022192<br />

Assessed To Analytic Process Realty Group, Inc. Described As 140' X 77' Near South Collins Street Snow<br />

Hill, Deed Reference 3059/0423, Assessed Value $14,942 Taxes Due $430.45<br />

Item #8 Account #05001064<br />

Assessed To Analytic Process Realty Group Inc Described As 100' X 438' Near Southeast Side Line Hotel<br />

Road South Of Selbyville, Deed Reference 3503/0360, Assessed Value $12,000 Taxes Due $222.17<br />

Item #9 Account #02021218<br />

Assessed To Analytic Process Realty Group Inc Described As 70' X 130' 212 South Collins Street Snow<br />

Hill, Deed Reference 4621/0313, Assessed Value $28,500 Taxes Due $1,211.30<br />

Item #10 Account #02029987<br />

Assessed To Analytic Process Realty Group Inc Described As Outlots A & C 6.39 Acres Village Trail<br />

Village Of Nassawango Phase 1, Deed Reference 3503/0356, Assessed Value $1,780 Taxes Due $32.81<br />

Item #11 Account #03000508<br />

Assessed To Armstrong, Isiah For Life Described As Improvements 6,837.86 Square Feet South Side<br />

Duncan Crossing Road Plat Of Bobbie L Armstrong Deed Reference 0340/0485, Assessed Value $84,670<br />

Taxes Due $1,559.67<br />

Item #12 Account #10026814<br />

Assessed To AWS 450 Limited Partnership Described As Improvements 40,497 Square Feet West Side<br />

Philadelphia Avenue Between Plat High Water Line Survey, Deed Reference 2242/0390, Assessed Value<br />

$6,129,200 Taxes Due $191,905.67<br />

Item #13 Account #03021300<br />

Assessed To Ayres, Clementine Harmon & Charlene R Harmon Described As 37 1/2 'Front X 588' North<br />

Side Trappe Road Southeast Of Berlin, Deed Reference 1297/0405, Assessed Value $46,220 Taxes Due<br />

$756.62<br />

Item #14 Account #10026660<br />

Assessed To Azzorac LLC Described As Improvements Part Lot 45 East Side Baltimore Avenue Ocean<br />

City, Deed Reference 2890/0199, Assessed Value $410,500 Taxes Due $11,455.23<br />

Item #15 Account #10026652<br />

3

Assessed To Azzorac LLC Described As Half Lot 45 East Side Baltimore Avenue Ocean City, Deed<br />

Reference 2890/0203, Assessed Value $300,000 Taxes Due $9,140.51<br />

Item #16 Account #10008298<br />

Assessed To Bailey, Gary W & Bawnmarie A Bailey Described As Improvements Lot 3 80 X 170 West<br />

Side Golf Course Road Plat Thoroughfare, Deed Reference 4838/0322, Assessed Value $220,960 Taxes<br />

Due $839.76<br />

Item #17 Account #10740622<br />

Assessed To Baily Properties LLC Described As Improvements Unit 403 Phase 1 East Side Route 611<br />

Decatur Business Center Condominium, Deed Reference 4994/0583, Assessed Value $145,000 Taxes<br />

Due $2,783.07<br />

Item #18 Account #10752817<br />

Assessed To Balcerzak, Anthony E Jr Described As Improvements Unit 104W 8th Street Jocelyn Manor<br />

Condominium, Deed Reference 4849/0683, Assessed Value $169,830 Taxes Due $5,631.85<br />

Item #19 Account #03010988<br />

Assessed To Balcerzak, A. Edwin Jr & G P Allen & C P Allen Described As 15.37 Acres South Side Route 90<br />

Minor Subdivision For M Fels Deed Reference 5127/0425, Assessed Value $26,890 Taxes Due $495.65<br />

Item #20 Account #02006936<br />

Assessed To Ballard, Artie H & Elizabeth W Described As Improvements Lot 18 Block 1 Section 1 West<br />

Side Market Street 35,184 Square Feet Plat Castle Hill Estates, Deed Reference 0465/0536, Assessed<br />

Value $102,160 Taxes Due $1,616.88<br />

Item #21 Account #10224632<br />

Assessed To Banashak, George J & Debra C Described As Improvements Unit 2 Wight Avenue 5/15<br />

Condominium, Deed Reference 2215/0377, Assessed Value $576,460 Taxes Due $12,083.68<br />

Item #22 Account #10320941<br />

Assessed To Banashak, George J. & Debra C. Described As Lot 54 North Heron Drive Heron Harbour<br />

Section 1, Deed Reference 3250/0356, Assessed Value $592,290 Taxes Due $13,718.09<br />

Item #23 Account #03095649<br />

Assessed To Bankers Development LLC Described As 30.47 Acres Remaining Phases Roadways Parking<br />

Club House Resubdivision Plat The Point, Deed Reference 3041/0368, Assessed Value $152,350 Taxes<br />

Due $12,897.85<br />

Item #24 Account #01001914<br />

Assessed To Barnes, Ellen Duncan & Isaac Hecht & Mercantile Safe Deposit & Trust Described As Lot<br />

West Side Clementine Street Southwest Of Pocomoke, Deed Reference 1617/0253, Assessed Value $946<br />

Taxes Due $39.71<br />

Item #25 Account #03026434<br />

Assessed To Beach Country LLC Described As Improvements 50' X 114.7' East Side 115 West Street<br />

Berlin, Deed Reference 3140/0237, Assessed Value $281,090 Taxes Due $9,142.11<br />

Item #26 Account #08001197<br />

Assessed To Beach Country, LLC Described As 47.7' X 110' X 48.8' X 106.6' E Side Route 12 Girdletree,<br />

Deed Reference 3895/0072, Assessed Value $25,786 Taxes Due $463.43<br />

Item #27 Account #08002878<br />

Assessed To Beach Country, LLC Described As Improvements 77' X 152' X 64' X 144' Taylor Landing<br />

Road Girdletree, Deed Reference 3895/0072, Assessed Value $33,200 Taxes Due $678.16<br />

Item #28 Account #01022989<br />

Assessed To Bernstein, Michael R & Carole A Described As Improvements 2 Lots West Side Sixth &<br />

Oxford Street Pocomoke, Deed Reference 0938/0399, Assessed Value $129,166 Taxes Due $4,998.81<br />

Item #29 Account #10225604<br />

4

Assessed To Beynon, Barry M Described As Improvements Unit 320 B A Phase 1 123rd Street Jockey<br />

Beach Club Condominium, Deed Reference 3919/0237, Assessed Value $146,580 Taxes Due $3,067.32<br />

Item #30 Account #02005786<br />

Assessed To Blake Betty Described As Lot 4 1 Acre South Side Timmons Road Plat Blake Subdivision<br />

Deed Reference 0684/0335, Assessed Value $18,000 Taxes Due $323.50<br />

Item #31 Account #01010689<br />

Assessed To Blake, Eunice Mae Described As Lot Northwide Side Boston School House Road South Of<br />

Pocomoke, Deed Reference 5027/0582, Assessed Value $6,100 Taxes Due $112.94<br />

Item #32 Account #01020773<br />

Assessed To Blount, Allen B Described As Improvements 57' X 61' North Side 511 & 511 Bonneville<br />

Avenue & Short Street Pocomoke, Deed Reference 4772/0461, Assessed Value $36,466 Taxes Due<br />

$2,276.51<br />

Item #33 Account #01016156<br />

Assessed To Blount, Allen B Jr Described As Improvements Parcel 2 35 X 162.51 East Side 813 2nd<br />

Street Plat W Ballard Miles Deed Reference 4968/0058, Assessed Value $59,960 Taxes Due $3,384.91<br />

Item #34 Account #01020536<br />

Assessed To Blount, Allen B Jr Described As Improvements 47.6' X 108.6' 523 Young Street Pocomoke,<br />

Deed Reference 4937/0535, Assessed Value $40,806 Taxes Due $1,733.71<br />

Item #35 Account #01020447<br />

Assessed To Blount, Allen B Jr Described As Improvements 57' X 108' 512 Young X Short Streets<br />

Pocomoke, Deed Reference 5011/0085, Assessed Value $90,702 Taxes Due $4,235.52<br />

Item #36 Account #01027816<br />

Assessed To Blount, Allen B Jr Described As Improvements 52' X 78' X 35' X 78.12' 500 Moore Street<br />

Pocomoke, Deed Reference 4977/0653, Assessed Value $37,092 Taxes Due $1,518.87<br />

Item #37 Account #01023284<br />

Assessed To Blount, Allen B Jr Described As Improvements 44' X 140' North Side 427 Oxford Street<br />

Pocomoke, Deed Reference 4836/0091, Assessed Value $40,716 Taxes Due $2,996.46<br />

Item #38 Account #01023276<br />

Assessed To Blount, Allen B Jr Described As Improvements 44' X 140' North Side 429 Oxford Street<br />

Pocomoke, Deed Reference 4868/0653, Assessed Value $41,220 Taxes Due $1,204.50<br />

Item #39 Account #01015001<br />

Assessed To Blount, Allen B Jr Described As Improvements 60' X 114' East Side 935 Clarke Avenue &<br />

Holly Street, Deed Reference 5006/0730, Assessed Value $36,732 Taxes Due $2,515.39<br />

Item #40 Account #01020609<br />

Assessed To Blount, Allen B Jr Described As 50' X 100' 510 Young Street Pocomoke, Deed Reference<br />

5075/0136, Assessed Value $9,382 Taxes Due $330.75<br />

Item #41 Account #01016369<br />

Assessed To Blount, Allen B Jr Described As Improvements 48.5 X 230 X 48.5 X 220 South Side 218<br />

Laurel Street Pocomoke, Deed Reference 4823/0377, Assessed Value $42,480 Taxes Due $1,107.77<br />

Item #42 Account #10725976<br />

Assessed To Blowe, Judy L Described As Improvements Boat Slip #4 Osprey Road Osprey Way<br />

Condominium, Deed Reference 4526/0441, Assessed Value $15,000 Taxes Due $637.38<br />

Item #43 Account #10047676<br />

Assessed To Boehm, Robin P Described As Improvements Unit 1 Sunset Drive Sunset Six Condominium,<br />

Deed Reference 3083/0319, Assessed Value $124,750 Taxes Due $4,639.16<br />

Item #44 Account #10018862<br />

Assessed To Boehm, Robin P Described As 35,179 Square Feet West Side Lewis Road Sinepuxent, Deed<br />

Reference 3626/0393, Assessed Value $59,830 Taxes Due $1,136.31<br />

5

Item #45 Account #10237807<br />

Assessed To Boehm, Robin P. Described As Improvements Unit C‐101 142nd Street Wedgewood<br />

Condominium, Deed Reference 2760/0223, Assessed Value $154,330 Taxes Due $4,048.50<br />

Item #46 Account #01011960<br />

Assessed To Boston, Louise Described As Approximately 1 Acre North Side Colona Road South Of<br />

Pocomoke, Deed Reference 0013/0589, Assessed Value $39,666 Taxes Due $648.29<br />

Item #47 Account #03023257<br />

Assessed To Bowen, Timothy P & Cathy Lee Smith Bowen Described As Improvements Part Lot 6 West<br />

Side Hayes Landing Road Plat Joseph Briddell Property, Deed Reference 4960/0422, Assessed Value<br />

$228,650 Taxes Due $2,839.14<br />

Item #48 Account #01026410<br />

Assessed To Boyd, Crawford & Jessica Boyd Described As Improvements Lot 6 Block E 60' X 150' 1403<br />

Princess Anne Lane Plat Small Bull & Dryden, Deed Reference 5021/0019, Assessed Value $98,820 Taxes<br />

Due $2,721.68<br />

Item #49 Account #03109534<br />

Assessed To Broseker, Kathryn A Described As Improvements Lot B‐14d‐054 14,725 Square Feet<br />

Goldeneye Court Plat Ocean Pines Section 14D Deed Reference 2464/0135, Assessed Value $342,610<br />

Taxes Due $4,402.35<br />

Item #50 Account #10003717<br />

Assessed To Brown, Ruth A Described As Improvements Lot 2 Block 26 Section C South Side Torquay<br />

Road Plat Cape Isle Of Wight, Deed Reference 4589/0389, Assessed Value $249,702 Taxes Due<br />

$3,586.30<br />

Item #51 Account #10384192<br />

Assessed To Burton, Kimberly & William Burton Described As Improvements Boat Slip #B 716 Bradley<br />

Road Tori B Condominium, Deed Reference 4498/0715, Assessed Value $15,000 Taxes Due $637.38<br />

Item #52 Account #02007061<br />

Assessed To Cannery Group Inc Described As Improvements 5.426 Acres Southwest Side Route 12 West<br />

Of Snow Hill, Deed Reference 2146/0517, Assessed Value $324,100 Taxes Due $5,424.58<br />

Item #53 Account #01017519<br />

Assessed To Captain Investments III, LLC Described As 28 1/2' X 78' South Side Market Street Booth<br />

Restaurant, Deed Reference 4653/0115, Assessed Value $17,832 Taxes Due $794.49<br />

Item #54 Account #10015308<br />

Assessed To Carmody, Michael F & Alison W Described As Improvements Lot 2 Block A 40' X 140' Lot 9<br />

Block A 40' X 150' Plat Ocean City, Deed Reference 2212/0218, Assessed Value $185,612 Taxes Due<br />

$4,156.83<br />

Item #55 Account #10015316<br />

Assessed To Carmody, Michael F & Alison W Described As Lot 1 Block A 60' X 140' Lot 8 Block A 60' X<br />

150' Plat Ocean City, Deed Reference 2212/0218, Assessed Value $133,332 Taxes Due $2,492.71<br />

Item #56 Account #10006368<br />

Assessed To Carmody, Michael F. & Alison W. Described As Improvements Lot 26 Block 19 Section A<br />

South Side Selsey Road Cape Isle Of Wight, Deed Reference 2564/0014, Assessed Value $539,270 Taxes<br />

Due $7,071.13<br />

Item #57 Account #03034372<br />

Assessed To Carpentry By Nolan Dove Inc Described As Improvements 53.46' X 140.25' South Side<br />

Branch Street Berlin, Deed Reference 4718/0001, Assessed Value $196,400 Taxes Due $6,461.97<br />

Item #58 Account #03137619<br />

6

Assessed To Carroll, Rodney S. & Linda H. Described As Lot 60 50,223 Square Feet Port Arthur Court<br />

Whitetail Sanctuary Section 15B Deed Reference 2806/0016, Assessed Value $240,370 Taxes Due<br />

$4,614.17<br />

Item #59 Account #10064961<br />

Assessed To Carroza, Joan M Described As Improvements Unit 69 Windjammer Lane Plat Runaway Bay<br />

Townhouses, Deed Reference 2140/0038, Assessed Value $214,540 Taxes Due $3,428.78<br />

Item #60 Account #01012029<br />

Assessed To Cherry, Eula Mae Described As Improvements 15,628 Square Feet South Side Colona Road<br />

Eula M Cherry Survey, Deed Reference 2647/0378, Assessed Value $69,080 Taxes Due $1,094.93<br />

Item #61 Account #10209870<br />

Assessed To Clarke, M Robert & Robert T Clarke Described As Lot 9 2.63 Acres Bay Landing Drive Plat<br />

Synepuxent Landing Subdivision, Deed Reference 3393/0089, Assessed Value $265,810 Taxes Due<br />

$4,921.10<br />

Item #62 Account #01022679<br />

Assessed To Colbourne, Ernest Described As 39.5' X 112.42' X 40' X 111' East Side 7 Fourth Street<br />

Pocomoke, Deed Reference 0158/0189, Assessed Value $18,686 Taxes Due $2,116.03<br />

Item #63 Account #10009022<br />

Assessed To Compass Resort Properties Llc Described As Improvements Lot 9 92.82' X 150' Shoal Lane<br />

Pl at 1 Section 2 Captains Hill, Deed Reference 4830/0398, Assessed Value $469,572 Taxes Due<br />

$8,224.51<br />

Item #64 Account #10083478<br />

Assessed To Compass Resort Properties, LLC Described As Improvements Lot 10 Block 40 50' X 102' East<br />

Side Coastal Highway Plat Oceanbay City, Deed Reference 2884/0249, Assessed Value $604,233 Taxes<br />

Due $16,589.63<br />

Item #65 Account #03164691<br />

Assessed To Conestabile, Anne Marie Described As Improvements Unit 201 Building 2 East Side William<br />

Street Jamestown Place Condominium, Deed Reference 4395/0652, Assessed Value $252,280 Taxes Due<br />

$8,499.01<br />

Item #66 Account #10037093<br />

Assessed To Council Of Unit Owners Of Decatur House Condominium Described As Improvements Unit<br />

101 Office 12th Street & Boardwalk Decatur House Condominium, Deed Reference 0808/0284, Assessed<br />

Value $132,700 Taxes Due $2,303.43<br />

Item #67 Account #10346649<br />

Assessed To Cropper, George B Described As Lot 11 Block 51 15th Street Plat C Edw Shute, Deed<br />

Reference 0011/0380, Assessed Value $330,490 Taxes Due $11,168.19<br />

Item #68 Account #10040809<br />

Assessed To Cropper, George B Described As Improvements Lot 12 Block 51 15th Street Plat C Edw<br />

Shute, Deed Reference 0011/0380, Assessed Value $257,030 Taxes Due $9,468.73<br />

Item #69 Account #10040817<br />

Assessed To Cropper, George B Described As Improvements 100' X 100' South Side 15th Street West<br />

Side Jacqueline Avenue, Deed Reference 1544/0324, Assessed Value $893,190 Taxes Due $15,838.26<br />

Item #70 Account #10029376<br />

Assessed To Cropper, George B Described As Improvements Lots 1 Thru 7, 11, 12, 13, 17 Thru 31 & A B<br />

C D East Plat J Bolgiano Land, Deed Reference 0021/0216, Assessed Value $15,799,900 Taxes Due<br />

$383,584.39<br />

Item #71 Account #10043557<br />

7

Assessed To Curran, James W Jr & Mary E Curran Trustees Described As Improvements Unit 3 Atlantic<br />

Avenue Six On The Boardwalk Center Condominium, Deed Reference 3551/0057, Assessed Value<br />

$417,230 Taxes Due $8,181.22<br />

Item #72 Account #02018780<br />

Assessed To Dale, Hazel M Described As Improvements 38'6'' X 221' 105 North Collins Street Snow Hill,<br />

Deed Reference 1211/0427, Assessed Value $72,016 Taxes Due $1,441.93<br />

Item #73 Account #02000512<br />

Assessed To Dale, Ollie Described As Improvements 3.66 Acres East Side Shockley Road North Of Snow<br />

Hill, Deed Reference 0149/0154, Assessed Value $115,786 Taxes Due $1,491.85<br />

Item #74 Account #01017446<br />

Assessed To Deal, Debra Jean Described As Improvements 45' X 102' North Side 213 Cedar Street<br />

Pocomoke, Deed Reference 1598/0084, Assessed Value $80,336 Taxes Due $2,482.55<br />

Item #75 Account #01015745<br />

Assessed To Delia, Victor J &Donna Joseph Delia Described As Improvements 60' X 200' West Side 810<br />

2nd Street Pocomoke, Deed Reference 4370/0156, Assessed Value $64,562 Taxes Due $3,101.87<br />

Item #76 Account #10069203<br />

Assessed To Dennis, Gregory P & Betty L Described As Improvements Unit 363 S B Beach Highway<br />

Wight Bay Condominium, Deed Reference 3103/0056, Assessed Value $241,080 Taxes Due $6,636.68<br />

Item #77 Account #01012207<br />

Assessed To Dennis, Philip & Josephine Described As Improvements 1 1/2 Acres South Side Colona Road<br />

South Of Pocomoke, Deed Reference 0674/0139, Assessed Value $57,740 Taxes Due $618.49<br />

Item #78 Account #01008447<br />

Assessed To Deshields, Margaret Jane Described As 56.6' X 94' X 74' X 64' North Side Newbridge Road<br />

South Of Pocomoke, Deed Reference 0149/0120, Assessed Value $29,252 Taxes Due $486.34<br />

Item #79 Account #10326451<br />

Assessed To Diaz, Raymonde B & Ray Described As Improvements Unit 205 Phase 3 142nd Street<br />

Hawaiian Village Condominium, Deed Reference 1861/0277, Assessed Value $350,440 Taxes Due<br />

$12,362.11<br />

Item #80 Account #01020471<br />

Assessed To Dickerson, May F & Allen Blount Described As Improvements Lot 21 40' X 80' East Side<br />

Short Street Plat Atkinsons Addition, Deed Reference 4167/0581, Assessed Value $51,132 Taxes Due<br />

$2,052.66<br />

Item #81 Account #03117286<br />

Assessed To Dize, Richard L Described As Improvements 1.42 Acres Pitts & Campbelltown Roads Minor<br />

Subdivision Of R L Gilliss, Deed Reference 4088/0214, Assessed Value $222,210 Taxes Due $2,298.21<br />

Item #82 Account #10734592<br />

Assessed To Dodds, David C Described As Improvements Boat Slip #F101 53rd Street Bayspot<br />

Condominium, Deed Reference 2260/0406, Assessed Value $15,000 Taxes Due $277.70<br />

Item #83 Account #10013038<br />

Assessed To Dogtel Hotel Ocean City LLC Described As Improvements 7.17 Acres Phase 130 & Plat 228<br />

South Side Route 50 West Of Ocean City, Deed Reference 2745/0172, Assessed Value $1,283,600 Taxes<br />

Due $22,175.98<br />

Item #84 Account #01016539<br />

Assessed To Drawbridge Villas LLC Described As Phase 1 & Future Phases 4.15 Acres Riverside Drive<br />

Drawbridge Villas Phase Plan, Deed Reference 4529/0017, Assessed Value $42,360 Taxes Due $1,731.87<br />

Item #85 Account #01016687<br />

Assessed To Drawbridge Villas LLC Described As Improvements 50' X 80' West Side 610 Clarke Avenue<br />

Pocomoke Deed Reference 4435/0213, Assessed Value $49,780 Taxes Due $1,543.41<br />

8

Item #86 Account #03004481<br />

Assessed To Dypsky, Philip C Jr & Carolyn M Described As Improvements 1 Acre East Side Campbelltown<br />

Road North Of St Martins, Deed Reference 0585/0253, Assessed Value $173,650 Taxes Due $1,733.71<br />

Item #87 Account #01035363<br />

Assessed To E F & T LLC Described As Improvements Lot 15 White Oaks Court White Oaks Subdivision,<br />

Deed Reference 4372/0631, Assessed Value $252,992 Taxes Due $6,789.87<br />

Item #88 Account #08001480<br />

Assessed To Eichhorn, Dudley M & Myrna L Described As Improvements 6.57 Acres South Side Taylor<br />

Landing Road East Of Girdletree, Deed Reference 0442/0447, Assessed Value $115,032 Taxes Due<br />

$1,217.38<br />

Item #89 Account #10766427<br />

Assessed To El Capitan Condominium Association Described As Improvements Restaurant Atlantic<br />

Avenue & 4th Street El Capitan Condominium, Deed Reference 0438/0431, Assessed Value $714,000<br />

Taxes Due $38,111.37<br />

Item #90 Account #10197945<br />

Assessed To Elko, Diane M & Nicholas A Elko Described As Improvements Lot 1495 Section 4A<br />

Constitutional Avenue Plat Montego Bay Mobile Home Park, Deed Reference 4524/0390, Assessed<br />

Value $232,050 Taxes Due $6,886.05<br />

Item #91 Account #08006636<br />

Assessed To Ellis, Edwin L Described As Improvements 134' X 307' George Island Landing Road<br />

Stockton, Deed Reference 0592/0695, Assessed Value $57,056 Taxes Due $1,076.54<br />

Item #92 Account #01009621<br />

Assessed To Evans, Roger F & Gail C Described As Improvements 2 Acres East Side Ocean Highway<br />

South Of Pocomoke, Deed Reference 1614/0360, Assessed Value $155,416 Taxes Due $2,498.17<br />

Item #93 Account #01009613<br />

Assessed To Evans, Roger F & Gail C Described As Improvements 100' X 100' X 1200' Northeast Side<br />

Route 13 South Of Pocomoke, Deed Reference 1614/0360, Assessed Value $194,666 Taxes Due<br />

$3,352.44<br />

Item #94 Account #10019079<br />

Assessed To Fassitt, George A Heirs Described As 7 Acres East Side Lewis Road Sinepuxent Deed<br />

Reference 0001/0135, Assessed Value $72,332 Taxes Due $1,379.89<br />

Item #95 Account #01020897<br />

Assessed To Finney, James Randolph Described As Improvements 40' X 80' West Side 724 Sixth Street &<br />

Fifth Avenue, Deed Reference 1739/0369, Assessed Value $30,082 Taxes Due $1,623.45<br />

Item #96 Account #10324106<br />

Assessed To Foley, Shannon J Described As Improvements Unit 84 B L Sunset Avenue Sunset Village<br />

Condominium, Deed Reference 3007/0289, Assessed Value $186,666 Taxes Due $1,306.78<br />

Item #97 Account #10019125<br />

Assessed To Fooks, Levin Described As Improvements 5.942 Acres West Side Stephen Decatur Road<br />

Southwest Of Ocean City, Deed Reference 0012/0565, Assessed Value $94,340 Taxes Due $1,064.29<br />

Item #98 Account #03021009<br />

Assessed To Foreman, Alice M Described As Improvements 1 Acre West Side Germantown Road<br />

Southeast Of Berlin, Deed Reference 0388/0211, Assessed Value $143,000 Taxes Due $1,456.16<br />

Item #99 Account #03018652<br />

Assessed To Fox Harbor Limited Partnership Described As 33 Acres Near North Side Sinepuxent Road<br />

East Of Berlin, Deed Reference 0501/0029, Assessed Value $10,930 Taxes Due $268.47<br />

Item #100 Account #10070651<br />

9

Assessed To Frederick, Donald L & Steven L Bulmer Described As Improvements Unit 335 N B Beach<br />

Highway Wight Bay Condominium, Deed Reference 4161/0241, Assessed Value $200,760 Taxes Due<br />

$5,425.55<br />

Item #101 Account #10301394<br />

Assessed To Frick, Gary & Robert Described As Improvements Unit 10c Sunset Avenue Plat Meyer's<br />

Siding Condo Phase 1, Deed Reference 1230/0581, Assessed Value $117,700 Taxes Due $2,007.86<br />

Item #102 Account #10301408<br />

Assessed To Frick, Gary & Robert Frick Described As Improvements Unit 11c Sunset Avenue Plat<br />

Meyer's Siding Condo Phase 1, Deed Reference 2087/0252, Assessed Value $117,700 Taxes Due<br />

$2,060.15<br />

Item #103 Account #03161005<br />

Assessed To Frick LLC Described As Lot 1 2.37 Acre Part Of Svh 188/30 Subdivision D Didomenico South<br />

Side Mason Road, Deed Reference 4523/0525, Assessed Value $122,740 Taxes Due $2,012.50<br />

Item #104 Account #03022919<br />

Assessed To Frick LLC Described As Improvements 1.0442 Acres North Side Mason Road South Of Berlin<br />

Plat 56518 State Highway Item 94203, Deed Reference 4841/0130, Assessed Value $122,080 Taxes Due<br />

$2,105.66<br />

Item #105 Account #03135047<br />

Assessed To Frick LLC Described As .50 Acres East Side Route 113 East Side Mason Road, Deed<br />

Reference 4703/0550, Assessed Value $17,232 Taxes Due $295.96<br />

Item #106 Account #03023052<br />

Assessed To Frick LLC Described As Improvements 2 Acres East Side Route 113 South Side Mason,<br />

Deed Reference 2172/0226, Assessed Value $182,900 Taxes Due $3,328.84<br />

Item #107 Account #10329884<br />

Assessed To Friesen, Peggy N. Described As Improvements Lot 196 3,000 Square Feet Bay Ridge Drive<br />

Assateague Point Resort Phase 1, Deed Reference 2749/0418, Assessed Value $152,012 Taxes Due<br />

$2,894.05<br />

Item #108 Account #03123901<br />

Assessed To G & F Ventures Inc Described As Parcel B 2 Acres Racetrack Road Timmons Subdivision,<br />

Deed Reference 1613/0030, Assessed Value $145,000 Taxes Due $2,431.13<br />

Item #109 Account #03005828<br />

Assessed To G & F Ventures Inc Described As Improvements Parcel A Racetrack Road Timmons<br />

Subdivision, Deed Reference 1613/0028, Assessed Value $154,430 Taxes Due $2,692.73<br />

Item #110 Account #03094030<br />

Assessed To Garzanit, Nancy Described As Improvements Lot B O2 O51 13,084 Square Feet Mayflower<br />

Court Plat Ocean Pines Section 2, Deed Reference 1952/0289, Assessed Value $266,730 Taxes Due<br />

$2,308.53<br />

Item #111 Account #10011914<br />

Assessed To Gillin, Mary Jeanette Massey & Shawn Gillin & Marie Gillin Described As Improvements 9<br />

Acres North Side Sinepuxent Road West Of Ocean City, Deed Reference 4533/0613, Assessed Value<br />

$122,672 Taxes Due $2,203.73<br />

Item #112 Account #10044804<br />

Assessed To Gjoni, Dhimiter & Krisanthi Gjoni Described As Improvements Lots 7 8 & Part Of 5 6 Block<br />

72n East Side Philadelphia Avenue Plat Sinepuxent Beach, Deed Reference 4028/0086, Assessed Value<br />

$2,460,000 Taxes Due $68,363.41<br />

Item #114 Account #03130460<br />

Assessed To Glenrichmond LLC Described As Lot 112 Leigh Drive Terns Landing, Deed Reference<br />

4759/0646, Assessed Value $390,030 Taxes Due $8,004.32<br />

10

Item #115 Account #10110270<br />

Assessed To Grabarck, R Doyle Described As Improvements Lot 23 West Side Point Lookout Road Plat<br />

Caine Keys II Extended, Deed Reference 1712/0025, Assessed Value $834,220 Taxes Due $27,510.19<br />

Item #116 Account #10020441<br />

Assessed To Graves Harold M III Described As Improvements 150' X 200' Northwest Side Stephen<br />

Decatur Road Southwest Of Ocean City, Deed Reference 4443/0011, Assessed Value $607,100 Taxes<br />

Due $10,023.42<br />

Item #117 Account #03130185<br />

Assessed To Gray Goose, LLC Described As Lot 87 Leigh Drive Terns Landing, Deed Reference<br />

2473/0068, Assessed Value $364,500 Taxes Due $6,612.22<br />

Item #118 Account #10308879<br />

Assessed To Gruber, Linda Described As Improvements Unit 7 Building E Phase Ii Sunset Avenue & Rt<br />

611 Plat Meyer's Siding Condominium, Deed Reference 4886/0569, Assessed Value $156,000 Taxes Due<br />

$3,159.11<br />

Item #119 Account #10140854<br />

Assessed To Hamill, Russell E Jr & Joann Described As Improvements Unit 4g Beach Highway High Point<br />

North Condominium, Deed Reference 2100/0204, Assessed Value $310,700 Taxes Due $7,496.18<br />

Item #120 Account #05004845<br />

Assessed To Handy, Cora Margaret Described As Improvements 12,190 Square Feet East Side Route<br />

113 North Of Bishop, Deed Reference 3051/0247, Assessed Value $100,460 Taxes Due $961.17<br />

Item #121 Account #01002082<br />

Assessed To Hargis, Johnhandy Described As Lot Pit Circle Road Franktown Southwest Of Pocomoke,<br />

Deed Reference 0021/0105, Assessed Value $5,500 Taxes Due $276.21<br />

Item #122 Account #08003394<br />

Assessed To Harmon, Ethel J Described As Improvements 8,863 Square Feet Near Stockton Road Survey<br />

Plat Row For Grant Road, Deed Reference 1537/0171, Assessed Value $30,686 Taxes Due $627.31<br />

Item #123 Account #01012312<br />

Assessed To Harmon, James E & Pearl E Described As Improvements 1.065 Acres South Side Colona<br />

Road South Of Pocomoke, Deed Reference 0220/0315, Assessed Value $96,932 Taxes Due $1,510.41<br />

Item #124 Account #10747686<br />

Assessed To Harmon, Michael J & Mary E Harmon Described As Improvements Lot 116 6,749 Square<br />

Feet Snug Harbor Road The Landings, Deed Reference 4841/0079, Assessed Value $461,616 Taxes Due<br />

$4,044.76<br />

Item #125 Account #01002112<br />

Assessed To Harmon, Willie R & Mary Ann S Described As Improvements Lot X South Side Unionville<br />

Road Southwest Of Pocomoke, Deed Reference 0240/0239, Assessed Value $50,350 Taxes Due $899.77<br />

Item #126 Account #01002104<br />

Assessed To Harmon, Willie R & Mary Ann S Described As 2 Acres South Side Unionville Road Southwest<br />

Of Pocomoke, Deed Reference 0240/0241, Assessed Value $14,232 Taxes Due $234.58<br />

Item #127 Account #03018660<br />

Assessed To Hastings, Richard Dean Described As 83.50 Acres Sinepuxent & Mary Road Intersection<br />

East Of Berlin, Deed Reference 5102/0510, Assessed Value $19,830 Taxes Due $1,769.32<br />

Item #128 Account #10246008<br />

Assessed To Hauf, John S III Described As Improvements Lot 31A‐2 South Surf Road Plat Sunset Villas<br />

Resubdivision Parcel 31A, Deed Reference 4184/0316, Assessed Value $588,720 Taxes Due $18,909.92<br />

Item #129 Account #01007319<br />

11

Assessed To Haun, Sheila Marie Bolander & Lisa Ann Bolander Wrinkle Described As Improvements 75'<br />

X 150' North Side Stockton Road East Of Pocomoke, Deed Reference 3629/0136, Assessed Value<br />

$43,760 Taxes Due $813.57<br />

Item #130 Account #10718945<br />

Assessed To Henneman, George T Jr & Lisa M Described As Improvements Boat Slip #6 13th Street<br />

Aronimink 1 Condominium, Deed Reference 2976/0063, Assessed Value $10,500 Taxes Due $241.54<br />

Item #131 Account #10039525<br />

Assessed To Henneman, George T. Jr. & Lisa M. Described As Improvements Unit 6 13th Street<br />

Aronimink 1 Condominium, Deed Reference 2976/0063, Assessed Value $226,960 Taxes Due $7,454.66<br />

Item #132 Account #10297303<br />

Assessed To Hensley, Thomas M & Debra D & Daniel E & Kimberly A Money Described As Improvements<br />

Unit 3 Trimper Avenue Yellow Bird Condominium, Deed Reference 4236/0726, Assessed Value $254,850<br />

Taxes Due $8,902.83<br />

Item #133 Account #10140498<br />

Assessed To Heper, Antonios & Denise Described As Improvements Unit 205 Beach Highway Sea Watch<br />

Condominium, Deed Reference 2817/0443, Assessed Value $417,990 Taxes Due $13,770.14<br />

Item #134 Account #10101697<br />

Assessed To Heper, Antonios & Denise Described As Improvements Unit 1101 Between 88th & 89th<br />

Streets Sea Terrace Condominium, Deed Reference 2690/0237, Assessed Value $405,470 Taxes Due<br />

$12,129.58<br />

Item #135 Account #10034418<br />

Assessed To Hickman, Jason Described As Improvements Part Lot 7 Block 22N Kubit Cottage Plat<br />

Sinepuxent Beach, Deed Reference 3947/0173, Assessed Value $268,050 Taxes Due $6,140.65<br />

Item #136 Account #10407117<br />

Assessed To Hines, Laura Described As Improvements Boat Slip #26 Tern Drive Old Port Cove<br />

Condominium, Deed Reference 4432/0709, Assessed Value $15,000 Taxes Due $762.42<br />

Item #137 Account #01002163<br />

Assessed To Holden, Amanda Described As Lot East Side Pit Circle Road Southwest Of Pocomoke, Deed<br />

Reference 0001/0353, Assessed Value $9,600 Taxes Due $609.25<br />

Item #138 Account #01021400<br />

Assessed To Holden, Gregory T & Vera L Described As Improvements 60' X 120.4' 509 Cedar Street<br />

Pocomoke, Deed Reference 0623/0536, Assessed Value $61,386 Taxes Due $2,063.52<br />

Item #139 Account #10426413<br />

Assessed To Holtz, Ann E Described As Improvements Lot 7 10,017 Square Feet South Side Inlet Isle<br />

Lane Estates At Inlet Isle, Deed Reference 4776/0484, Assessed Value $1,045,812 Taxes Due $18,888.70<br />

Item #140 Account #03015637<br />

Assessed To Hoover, Benjamin Edward Described As Lot X Flower Street Northeast Of Berlin, Deed<br />

Reference 4643/0427, Assessed Value $55,910 Taxes Due $1,045.03<br />

Item #141 Account #03114724<br />

Assessed To Hudson, Herbert Lee & Harriet Marie & Melvin Nathaniel Pitts & Others Described As Lot<br />

1b 3.01 Acres North Side Georgetown Road Resubdivision Of Lot 1 A G Pitts, Deed Reference 0803/0067,<br />

Assessed Value $150,050 Taxes Due $5,202.89<br />

Item #142 Account #03004775<br />

Assessed To Hudson, James Keith Described As Improvements 50 X 200' East Side Route 113 Showell<br />

Deed Reference 5043/0167, Assessed Value $135,180 Taxes Due $1,299.70<br />

Item #143 Account #02021250<br />

Assessed To Hudson, Thelma Described As Improvements 78.75' X 260' 108 East Martin Street Snow<br />

Hill, Deed Reference 2159/0102, Assessed Value $120,182 Taxes Due $4,158.13<br />

12

Item #144 Account #10354374<br />

Assessed To Hyatt, Mitchell & Bridgette Hyatt & Arnold Hyatt& Sheila Hyatt Described As Improvements<br />

Lot 63 6,500 Square Feet North Heron Gull Court Heron Harbour Section 2, Deed Reference 4716/0016,<br />

Assessed Value $1,103,580 Taxes Due $35,484.35<br />

Item #145 Account #02039028<br />

Assessed To Ijaz, Mohammad Described As Improvements Lot 2 7,538 Square Feet Stevens Street<br />

Subdivided Plat Delmarva Homes Mortage LLC Deed Reference 4875/0494, Assessed Value $216,252<br />

Taxes Due $8,191.35<br />

Item #146 Account #02007517<br />

Assessed To Ijaz, Mohammad Described As Improvements Lot 27 41,558 Square Feet Moat Road Snow<br />

Hill Estates, Deed Reference 4918/0736, Assessed Value $125,426 Taxes Due $2,296.04<br />

Item #147 Account #01040049<br />

Assessed To Island Developers Newtowne Square LLC Described As Improvements Lot 2 Phase 4 1.31<br />

Acres North Side Old Snow Hill Road Newtowne Square Subdivision, Deed Reference 3095/0516,<br />

Assessed Value $510,532 Taxes Due $45,266.16<br />

Item #148 Account #10018870<br />

Assessed To Island Enterprises, LLC Described As 2 Acres West Side Lewis Road Southwest Of Ocean<br />

City, Deed Reference 4071/0131, Assessed Value $67,332 Taxes Due $1,301.94<br />

Item #149 Account #10752787<br />

Assessed To J & V Co Of OC LLC Described As Improvements Unit 102W 8th Street Jocelyn Manor<br />

Condominium, Deed Reference 4850/0001, Assessed Value $135,880 Taxes Due $4,547.31<br />

Item #150 Account #10752809<br />

Assessed To J & V Co Of OC LLC Described As Improvements Unit 103w 8th Street Jocelyn Manor<br />

Condominium, Deed Reference 4850/0001, Assessed Value $135,190 Taxes Due $4,525.33<br />

Item #151 Account #10752914<br />

Assessed To J & V Co Of OC LLC Described As Improvements Unit 203W 8th Street Jocelyn Manor<br />

Condominium, Deed Reference 4850/0001, Assessed Value $135,190 Taxes Due $4,525.33<br />

Item #152 Account #10749476<br />

Assessed To J & V Co Of OC, LLC Described As Improvements Unit 33 Building L East Side St Louis<br />

Avenue Parrot Bay Condominium, Deed Reference 4656/0617, Assessed Value $172,536 Taxes Due<br />

$4,876.89<br />

Item #153 Account #10749468<br />

Assessed To J & V Co Of OC, LLC Described As Improvements Unit 32 Building L East Side St Louis<br />

Avenue Parrot Bay Condominium, Deed Reference 4656/0617, Assessed Value $172,536 Taxes Due<br />

$4,876.89<br />

Item #154 Account #02009455<br />

Assessed To Jackson Willie Jo Jr & Mary A & Vandella A Jackson Described As Improvements 5.926 Acres<br />

South Side Public Landing Road East Of Snow Hill, Deed Reference 1897/0472, Assessed Value $178,502<br />

Taxes Due $2,665.04<br />

Item #155 Account #02009897<br />

Assessed To Jackson, Willie Joe Jr & Mary A & Vandella A Jackson Described As 14.35 Acres Mount<br />

Wesley East Side Public Landing Road East Of Snow Hill, Deed Reference 3030/0112, Assessed Value<br />

$61,500 Taxes Due $1,087.92<br />

Item #156 Account #03079465<br />

Assessed To Jankowski, Paul J & Kelly E Described As Improvements Lot C‐14‐036 11,280 Square Feet<br />

North Pintail Drive Plat Ocean Pines Section 14, Deed Reference 1846/0360, Assessed Value $495,270<br />

Taxes Due $8,877.17<br />

Item #157 Account #03023214<br />

13

Assessed To Johnson, Francine Seryta Described As .14 Acre Camelia Lane Southeast Of Berlin, Deed<br />

Reference 4212/0750, Assessed Value $43,040 Taxes Due $697.74<br />

Item #158 Account #01027778<br />

Assessed To Johnson, Robert Michael Described As Part Lot 5 45' X 76.3' 508 Moore Street, Deed<br />

Reference 5001/0230, Assessed Value $16,606 Taxes Due $2,344.88<br />

Item #159 Account #10359805<br />

Assessed To Johnston, Earle C Described As Improvements Lots 1, 2 & 3 20,042 Square Feet South Side<br />

Sunset Avenue Brittingham Trust Survey, Deed Reference 2483/0410, Assessed Value $989,400 Taxes<br />

Due $12,796.15<br />

Item #160 Account #01033352<br />

Assessed To Jordan, Cynthia L. Described As 63' X 85' North Side Cedar Street Plat Christy Subdivision,<br />

Deed Reference 3239/0346, Assessed Value $23,050 Taxes Due $1,024.25<br />

Item #161 Account #01010263<br />

Assessed To Justice, Angela Martina Described As 22,059 Square Feet South Side Sheephouse Road<br />

Boundary Angela M Justice, Deed Reference 4308/0654, Assessed Value $33,906 Taxes Due $563.38<br />

Item #162 Account #01010271<br />

Assessed To Justice, Angela Martina Described As 31,053 Square Feet Northwest Boston School House<br />

Road Boundary Angela M Justice, Deed Reference 4308/0654, Assessed Value $35,556 Taxes Due<br />

$588.08<br />

Item #163 Account #01015605<br />

Assessed To Justice, Anglea & Licurtis G Whitney Described As Improvements 70' X 140' South Side 108<br />

Oak Street Pocomoke, Deed Reference 4889/0528, Assessed Value $42,910 Taxes Due $1,231.21<br />

Item #164 Account #10715962<br />

Assessed To K & M Properties And Improvement LLC Described As Improvements Unit G‐1 Phase 6<br />

North Side Route 611 Teal Marsh Comm Condominium, Deed Reference 4624/0622, Assessed Value<br />

$268,400 Taxes Due $4,707.24<br />

Item #165 Account #10408164<br />

Assessed To Kidwell, Joseph D Sr & Patricia J Described As Improvements Boat Slip #106 Mooring Road<br />

Barbados Sun Condominium, Deed Reference 0809/0181, Assessed Value $13,500 Taxes Due $742.54<br />

Item #166 Account #03028313<br />

Assessed To Koenig, Henry A & Julia W Described As Improvements Lot 2 17,427 Square Feet 414 South<br />

Main Street Mabel Davis Trusteed Subdivision, Deed Reference 2225/0199, Assessed Value $253,580<br />

Taxes Due $4,523.33<br />

Item #167 Account #10721318<br />

Assessed To Krug, George Edward Jr Described As Improvements Boat Slip #140 94th Street Casa Del<br />

Sol Condominium, Deed Reference 1797/0549, Assessed Value $15,000 Taxes Due $613.87<br />

Item #168 Account #10109558<br />

Assessed To Landsman, Allan M & Sandra E Described As Improvements Lot 93 Shifting Sands Drive Plat<br />

Caine Keys II Extended, Deed Reference 0539/0138, Assessed Value $434,820 Taxes Due $10,610.64<br />

Item #169 Account #10156432<br />

Assessed To Laprade, John C & Rona Foote Described As Improvements Unit 306 Between 128th &<br />

129th Streets Sea Harbor Condominium, Deed Reference 2136/0077, Assessed Value $106,620 Taxes<br />

Due $3,832.26<br />

Item #170 Account #10091233<br />

Assessed To Laprade, Rona F & John C Described As Improvements Unit 1d 84th Street Surfside 84<br />

Condominium, Deed Reference 3013/0496, Assessed Value $304,930 Taxes Due $10,230.64<br />

Item #171 Account #10734533<br />

14

Assessed To Laubach, Debra Described As Improvements Boat Slip #D201 53rd Street Bayspot<br />

Condominium, Deed Reference 4686/0467, Assessed Value $15,000 Taxes Due $646.84<br />

Item #172 Account #10734770<br />

Assessed To Laubach, Debra G Described As Improvements Boat Slip #K201 53rd Street Bayspot<br />

Condominium, Deed Reference 2796/0222, Assessed Value $15,000 Taxes Due $637.38<br />

Item #173 Account #03150402<br />

Assessed To Lewis, Steven Lee & Sandra L. Described As Improvements 32.13 Acres South Side Route<br />

346 West Of St Martins, Deed Reference 2753/0313, Assessed Value $227,990 Taxes Due $4,117.72<br />

Item #174 Account #10094941<br />

Assessed To Lewis, Henry A Jr. & Mariellen & Henry A. Sr.,& G.O. Lewis Described As Improvements Unit<br />

2 S 1 Rusty Anchor Road Bridge Point Condominium, Deed Reference 2912/0459, Assessed Value<br />

$251,390 Taxes Due $7,921.38<br />

Item #175 Account #03000125<br />

Assessed To Littleton, Horace W Jr & Carmetah L Murray & D W Wilkerson & Others Described As 0.4<br />

Acres West Side Sheppard Crossing Road North Of Whaleysville, Deed Reference 2236/0261, Assessed<br />

Value $45,740 Taxes Due $747.73<br />

Item #176 Account #05009243<br />

Assessed To Lloyd, Charles E & Dorothy A Described As Improvements Lot 41 240' X 125' North Side<br />

Goose Road Plat Frank Savage Subdivision, Deed Reference 0235/0616, Assessed Value $268,040 Taxes<br />

Due $4,429.63<br />

Item #177 Account #05009782<br />

Assessed To Lloyd, Charles E & Dorothy Described As Improvements Lot 40 Northwest Side Goose<br />

Road Plat Frank Savage Subdivision, Deed Reference 1172/0232, Assessed Value $350,280 Taxes Due<br />

$2,252.50<br />

Item #178 Account #10168236<br />

Assessed To Lucas, William H & Vicky Lynn Described As Improvements Unit 3‐W 138th Street<br />

Windward Condominium Deed Reference 2258/0576, Assessed Value $178,760 Taxes Due $4,745.76<br />

Item #179 Account #03124770<br />

Assessed To M T R LLC Described As Improvements 1 Acre Trailer Lot West Side Stephen Decatur High<br />

School Road, Deed Reference 4237/0378, Assessed Value $137,290 Taxes Due $2,381.85<br />

Item #180 Account #03018318<br />

Assessed To M T R, LLC Described As Improvements 5.88 Acres West Side Stephen Decatur High School<br />

Road, Deed Reference 4237/0378, Assessed Value $147,920 Taxes Due $2,624.34<br />

Item #181 Account #10065879<br />

Assessed To Maginniss, Linwood W & Berta W Described As Improvements Unit 105 42nd Street Mystic<br />

Point Condominium, Deed Reference 0400/0491, Assessed Value $293,300 Taxes Due $6,746.90<br />

Item #182 Account #10270758<br />

Assessed To Mann, Walter C Described As Improvements Unit 209 Z Wicomico & <strong>Worcester</strong> Streets<br />

Assateague House Condominium, Deed Reference 2068/0303, Assessed Value $359,640 Taxes Due<br />

$6,111.04<br />

Item #183 Account #03018709<br />

Assessed To Mariner, A Reginald II Described As Improvements 20 Acres Near Chadwick Lot Sinepuxent<br />

Road Berlin To Lewis Store, Deed Reference 0537/0494, Assessed Value $392,432 Taxes Due $7,093.75<br />

Item #184 Account #02027798<br />

Assessed To Mariner, A Reginald II Described As Improvements 11.25 Acres North Side Route 12 West<br />

Of Snow Hill, Deed Reference 2202/0481, Assessed Value $140,026 Taxes Due $2,458.46<br />

Item #185 Account #02005336<br />

15

Assessed To Mariner, A Reginald II Described As 98.69 Acres Townsend Farm Both Sides Route 12,<br />

Deed Reference 1332/0235, Assessed Value $39,470 Taxes Due $730.74<br />

Item #186 Account #02005727<br />

Assessed To Mariner A Reginald II Described As Improvements 52.38 Acres North Side Route 12 West<br />

Of Snow Hill, Deed Reference 2202/0481, Assessed Value $121,086 Taxes Due $2,175.65<br />

Item #187 Account #03033929<br />

Assessed To Mariner, Algia Reginald II Described As 77.7' X 88.9' X 131.41' 3,327.66 Square Feet South<br />

Side Branch Street Berlin, Deed Reference 0464/0108, Assessed Value $105,000 Taxes Due $3,426.31<br />

Item #188 Account #03068722<br />

Assessed To Marion, Claud C & Evelyn Described As Lot B O2 O46 13,645 Square Feet White Horse<br />

Drive Plat Ocean Pines Section 2 Deed Reference 0252/0277, Assessed Value $137,680 Taxes Due<br />

$2,981.89<br />

Item #189 Account #10316057<br />

Assessed To Marlin Cove Limited Partnership Described As Improvements Unit 109 Phase 3 Edward L<br />

Taylor Road Marlin Cove Condominium Deed Reference 0869/0408, Assessed Value $393,190 Taxes Due<br />

$7,958.13<br />

Item #190 Account #03128318<br />

Assessed To Marshall, William Thomas Described As Parcel A 1 Acre Ironshire Station Road Minor<br />

Subdivision Raymond & Axsie Marshall, Deed Reference 1598/0564, Assessed Value $120,000 Taxes Due<br />

$2,012.14<br />

Item #191 Account #08004110<br />

Assessed To Masciana, Perry K & Maria A Masciana Described As Improvements Lot Corner Route 12 &<br />

Pocomoke Road Stockton, Deed Reference 3750/0256, Assessed Value $49,766 Taxes Due $955.33<br />

Item #192 Account #08004226<br />

Assessed To Masciana, Perry K & Maria A Masciana Described As Improvements Lot Trader Building<br />

Corner George Island Landing Road & Route 12 Stockton, Deed Reference 3793/0549, Assessed Value<br />

$54,932 Taxes Due $1,043.81<br />

Item #193 Account #08007020<br />

Assessed To Mason, Elroy & Winnie Mae Described As Improvements 10,890 Square Feet Manuel<br />

Property Near South Side George Island Landing Road S Stockton, Deed Reference 1870/0221, Assessed<br />

Value $34,110 Taxes Due $677.01<br />

Item #194 Account #10019656<br />

Assessed To Massadin, Clementine S C/O Charlene H Hannah Described As Improvements 1.0123 Acres<br />

East Side Lewis Road Southwest Of Ocean City, Deed Reference 0301/0061, Assessed Value $120,850<br />

Taxes Due $2,335.69<br />

Item #195 Account #10082617<br />

Assessed To Mcconnaughy, Cheryl L For Life Described As Improvements Unit 302 72nd Street Atlantic<br />

Court Condominium, Deed Reference 4437/0750, Assessed Value $150,280 Taxes Due $6,318.26<br />

Item #196 Account #10060117<br />

Assessed To Mccray, Jujuan & Mary Described As Improvements Unit B‐203 Lark Lane And Eagle Drive<br />

Summer Winds Condominium, Deed Reference 3089/0594, Assessed Value $147,310 Taxes Due<br />

$3,059.01<br />

Item #197 Account #10000793<br />

Assessed To Mclean, William A Described As Lot 7 8 Block 9 Escaped Property Plat Atlantic Ocean<br />

Estates, Deed Reference 0712/0539, Assessed Value $800 Taxes Due $80.03<br />

Item #198 Account #03165817<br />

Assessed To Meinhardt, David T Described As Improvements Unit 2308 Phase 3 East Of Ocean Parkway<br />

Points Reach Condominium, Deed Reference 4596/0741, Assessed Value $499,590 Taxes Due $1,028.94<br />

16

Item #200 Account #10721571<br />

Assessed To Michaud, Cynthia J Described As Improvements Boat Slip #2 Osprey Road Crab Cove<br />

Condominium, Deed Reference 4933/0236, Assessed Value $15,000 Taxes Due $637.38<br />

Item #201 Account #10725283<br />

Assessed To Mikulka, Boniface Described As Improvements Boat Slip #A15 Chesapeake Drive Nassau<br />

Village Townhouse Condominium, Deed Reference 4798/0394, Assessed Value $15,000 Taxes Due<br />

$431.17<br />

Item #202 Account #10134978<br />

Assessed To Miller, Patrick F. Described As Improvements Unit 1702 Coastal Highway Irene<br />

Condominium, Deed Reference 2829/0424, Assessed Value $405,160 Taxes Due $9,633.21<br />

Item #203 Account #03018202<br />

Assessed To Miller, Paul E Jr & Michelle S Described As Improvements 1.3 Acres South Side Evans Road<br />

West Of Berlin, Deed Reference 4695/0026, Assessed Value $222,840 Taxes Due $3,874.17<br />

Item #204 Account #03007146<br />

Assessed To Miller, Rosemarie Coons & Nancy Ann Carey & Annette Miller Described As Improvements<br />

1 Acre North Side Route 346 St Martins, Deed Reference 2423/0025, Assessed Value $132,850 Taxes<br />

Due $828.02<br />

Item #205 Account #10748461<br />

Assessed To Modlin, Sharon L Described As Improvements Unit 102 North East Side 17th Street Pier 17<br />

Condominium, Deed Reference 4747/0306, Assessed Value $420,440 Taxes Due $14,028.93<br />

Item #206 Account #01015982<br />

Assessed To Molock Group Inc The Described As Improvements 92' X 168' West Side 710 2nd Street<br />

Pocomoke, Deed Reference 4433/0316, Assessed Value $67,326 Taxes Due $1,920.86<br />

Item #207 Account #10005752<br />

Assessed To Mooney, Thomas H & Irene S Described As Lot 3 Block 24 Section C West Side Walthan<br />

Road Plat Cape Isle Of Wight, Deed Reference 0631/0401, Assessed Value $110,786 Taxes Due<br />

$3,678.90<br />

Item #208 Account #10005736<br />

Assessed To Mooney, Thomas H & Irene S Described As Lot 1 Block 24 Section C Walthan Road Plat<br />

Cape Isle Of Wight, Deed Reference 0631/0401, Assessed Value $110,772 Taxes Due $3,678.69<br />

Item #209 Account #10005744<br />

Assessed To Mooney, Thomas H & Irene S Described As Lot 2 Block 24 Section C West Side Walthan<br />

Road Plat Cape Isle Of Wight Deed Reference 0631/0401, Assessed Value $110,786 Taxes Due $3,679.65<br />

Item #210 Account #10189160<br />

Assessed To Moore, Denver Calvin Jr Described As Improvements Lot 1556 Section 2 Melson Avenue<br />

Plat Montego Bay Mobile Home Park, Deed Reference 0340/0375, Assessed Value $167,900 Taxes Due<br />

$5,387.01<br />

Item #211 Account #05000971<br />

Assessed To Mumford, Octa Described As 1 Acre South Side Line Hotel Road South Of Selbyville, Deed<br />

Reference 0021/0140, Assessed Value $35,000 Taxes Due $713.56<br />

Item #212 Account #05005671<br />

Assessed To Mumford, Robert L Jr & Juanita & Robt L III Described As Improvements 36,134 Square Feet<br />

East Side Route 113 North Of Bishop, Deed Reference 0601/0465, Assessed Value $156,760 Taxes Due<br />

$1,657.32<br />

Item #213 Account #10119588<br />

Assessed To Murphy, Edward & Pamela Described As Improvements Unit 703 Coastal Highway Atlantis<br />

Condominium, Deed Reference 2897/0589, Assessed Value $332,990 Taxes Due $11,145.69<br />

Item #214 Account #03033139<br />

17

Assessed To N Main Street, LLC Described As Improvements 32' X 65' East Side 103 & 105 Main Street<br />

Berlin Deed Reference 3868/0193, Assessed Value $230,100 Taxes Due $7,874.79<br />

Item #215 Account #10007305<br />

Assessed To Nagy, Tammie A Described As Improvements Lot 14 Block 3 Section A East Side Bristol<br />

Road Plat Cape Isle Of Wight, Deed Reference 4624/0192, Assessed Value $223,832 Taxes Due<br />

$3,384.64<br />

Item #216 Account #10097630<br />

Assessed To Nelson, Francesca B For Life Described As Improvements Unit 210 Mooring Road Barbados<br />

Sun Condominium, Deed Reference 3348/0264, Assessed Value $275,070 Taxes Due $7,444.86<br />

Item #217 Account #03166945<br />

Assessed To New England Developers Inc Described As Lot 22 30,792 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,370 Taxes Due<br />

$1,571.25<br />

Item #218 Account #03166813<br />

Assessed To New England Developers Inc Described As Lot 10 36,016 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,900 Taxes Due<br />

$1,580.23<br />

Item #219 Account #03166953<br />

Assessed To New England Developers Inc Described As Lot 23 30,662 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,360 Taxes Due<br />

$1,571.11<br />

Item #220 Account #03166910<br />

Assessed To New England Developers Inc Described As Lot 19 34,475 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,740 Taxes Due<br />

$1,577.52<br />

Item #221 Account #03166880<br />

Assessed To New England Developers Inc Described As Lot 16 30,010 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,300 Taxes Due<br />

$1,570.11<br />

Item #222 Account #03166872<br />

Assessed To New England Developers Inc Described As Lot 15 30,009 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,300 Taxes Due<br />

$1,570.11<br />

Item #223 Account #03166864<br />

Assessed To New England Developers Inc Described As Lot 14 30,292 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,320 Taxes Due<br />

$1,570.44<br />

Item #224 Account #03166856<br />

Assessed To New England Developers Inc Described As Lot 13 30,345 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,330 Taxes Due<br />

$1,570.61<br />

Item #225 Account #03166821<br />

Assessed To New England Developers Inc Described As Lot 11 30,508 Square Feet Pennington Place<br />

Pennington Commons Rec Plat, Deed Reference 5127/0728, Assessed Value $95,350 Taxes Due<br />

$,1570.93<br />

Item #226 Account #03166783<br />

18

Assessed To New England Developers Inc Described As Lot 7 20,000 Square Feet Pennington Place<br />

Pennington Commons Rec Plat Deed Reference 5127/0728, Assessed Value $94,300 Taxes Due<br />

$1,553.22<br />

Item #227 Account #03166775<br />

Assessed To New England Developers Inc Described As Lot 6 30,090 Square Feet Pennington Place<br />

Pennington Commons Rec Plat Deed Reference 5127/0728, Assessed Value $95,300 Taxes Due<br />

$3,061.46<br />

Item #228 Account #03166902<br />

Assessed To New England Developers Inc Described As Lot 18 36,374 Square Feet Pennington Place<br />

Pennington Commons Rec Plat Deed Reference 5127/0728, Assessed Value $95,930 Taxes Due<br />

$1,580.75<br />

Item #229 Account #02022990<br />

Assessed To Newnam, Charles Edward Sr Described As Improvements 49 1/2' X 100' 111 Purnell Street<br />

Snow Hill Deed Reference 3013/0335, Assessed Value $38,152 Taxes Due $1,353.83<br />

Item #230 Account #03034399<br />

Assessed To Newton, Margaret & Marguerite Newton Described As Improvements 74.25' X 628' North<br />

Side Railroad Avenue Berlin, Deed Reference 0069/0364, Assessed Value $73,430 Taxes Due $2,477.06<br />

Item #231 Account #10439302<br />

Assessed To Nowalk Properties LLC Described As Improvements Unit 3 Rusty Anchor Road Nowalk To<br />

The Canal Condominium, Deed Reference 3606/0485, Assessed Value $309,960 Taxes Due $10,817.09<br />

Item #232 Account #10030218<br />

Assessed To Nowalk Properties, LLC Described As Improvements Unit B Philadelphia Avenue Nowalk To<br />

First Condominium, Deed Reference 3797/0073, Assessed Value $294,110 Taxes Due $6,169.30<br />

Item #233 Account #10430437<br />

Assessed To Nowalk Properties, LLC Described As Improvements Unit A Philadelphia Avenue Nowalk To<br />

First Condominium Deed Reference 3797/0073, Assessed Value $294,110 Taxes Due $6,169.30<br />

Item #234 Account #10176786<br />

Assessed To O.C. Boat Holding Co Inc Described As Improvements Lots 15 16 Block 45 North Side 145th<br />

Street Resubdivision Block 45 Fenwick, Deed Reference 2109/0527, Assessed Value $812,466 Taxes Due<br />

$2,2542.04<br />

Item #235 Account #10176883<br />

Assessed To OC 107 146 Street LLC Described As Lot 8 Block 45 State Line Road Resubdivision Block 45<br />

Fenwick, Deed Reference 4371/0220, Assessed Value $328,400 Taxes Due $9,462.24<br />

Item #236 Account #10176905<br />

Assessed To OC 107 146 Street LLC Described As Lots 3 & 5 Block 45 West Side Beach Highway Plat<br />

Fenwick, Deed Reference 4579/0190, Assessed Value $783,500 Taxes Due $28,975.39<br />

Item #237 Account #10176735<br />

Assessed To OC 107 146 Street LLC Described As Improvements Lot 14 Block 45 North Side 145th Street<br />

Plat Fenwick, Deed Reference 4535/0493, Assessed Value $407,800 Taxes Due $11,581.83<br />

Item #238 Account #10340489<br />

Assessed To OC 107 146 Street LLC Described As Lot 4 West Side Beach Highway Plat Fenwick, Deed<br />

Reference 4579/0190, Assessed Value $416,820 Taxes Due $9,236.81<br />

Item #239 Account #10176794<br />

Assessed To OC 107 146 Street, LLC Described As Improvements Lot 7 Block 45 State Line Road Plat<br />

Fenwick, Deed Reference 3918/0490, Assessed Value $479,566 Taxes Due $13,164.04<br />

Item #240 Account #10176891<br />

Assessed To OC 107 146 Street, LLC Described As Improvements Lot 6 Block 45 State Line Road Plat<br />

Fenwick, Deed Reference 4266/0633, Assessed Value $273,633 Taxes Due $7,051.72<br />

19

Item #241 Account #10176816<br />

Assessed To OC 107 146th Street LLC Described As Improvements Lots 12 13 Block 45 South Side 145th<br />

Street Resubdivision Block 45 Fenwick, Deed Reference 4819/0288, Assessed Value $783,600 Taxes Due<br />

$22,095.24<br />

Item #242 Account #01023713<br />

Assessed To Ocean Blue Properties Described As Improvements 64' X 74' X 60' X 74' East Side 701<br />

Seventh Street Pocomoke, Deed Reference 4484/0569, Assessed Value $44,042 Taxes Due $1,375.46<br />

Item #243 Account #01035355<br />

Assessed To Ocean Gateway Investments Inc Described As Lot 14 White Oaks Court White Oaks<br />

Subdivision, Deed Reference 4860/0645, Assessed Value $52,516 Taxes Due $1,306.53<br />

Item #244 Account #01035320<br />

Assessed To Ocean Gateway Investments Inc Described As Lot 11 Acorn Circle White Oaks Subdivision,<br />

Deed Reference 4856/0703, Assessed Value $51,196 Taxes Due $1,271.25<br />

Item #245 Account #01035312<br />

Assessed To Ocean Gateway Investments Inc Described As Lot 10 Acorn Circle White Oaks Subdivision,<br />

Deed Reference 4856/0703, Assessed Value $51,916 Taxes Due $1,446.58<br />

Item #246 Account #01035290<br />

Assessed To Oneill, Suzanne P Described As Lot 8 Acorn Circle White Oaks Subdivision, Deed Reference<br />

4170/0452, Assessed Value $51,086 Taxes Due $1,485.06<br />

Item #247 Account #03168115<br />

Assessed To Onlyland LLC Described As Improvements Phase 2 18,295 Square Feet Manklin Meadows<br />

Lane South Gate Crossing Condominium, Deed Reference 4927/0001, Assessed Value $1,757,866 Taxes<br />

Due $32,912.06<br />

Item #248 Account #03149013<br />

Assessed To Orange Tree Partnership Described As Lot 2 8,570.2 Square Feet Mumfords Landing Road<br />

Colonial Village Section 18C‐2, Deed Reference 3543/0565, Assessed Value $85,480 Taxes Due<br />

$2,048.60<br />

Item #249 Account #10409721<br />

Assessed To Overcash, Nancy D & Dirk A Overcash Described As Improvements Boat Slip #8 Edward L<br />

Taylor Road Club Ocean Villas II Condominium, Deed Reference 4125/0041, Assessed Value $15,000<br />

Taxes Due $837.83<br />

Item #251 Account #10133726<br />

Assessed To Oyster Bay Offices, LLC Described As Improvements Unit 116‐15 1/2 South Side Newport<br />

Bay Drive Plat Oyster Bay Condominium, Deed Reference 2525/0221, Assessed Value $321,066 Taxes<br />

Due $8,424.36<br />

Item #252 Account #10008670<br />

Assessed To Pairo, Joyce D Described As Improvements Lot 13 Indian Knoll Road Plat 1 Section 2<br />

Captains Hill, Deed Reference 3376/0261, Assessed Value $485,890 Taxes Due $1,281.53<br />

Item #253 Account #03027376<br />

Assessed To Parker, F Dennis Described As Improvements 80' X 330' South Side 214 Broad Street Berlin<br />

Deed Reference 4303/0345, Assessed Value $436,940 Taxes Due $14,297.22<br />

Item #254 Account #03036901<br />

Assessed To Parker, F Dennis Described As Improvements 90' X Approximately 142' East Side 104 Bryan<br />

Avenue Berlin, Deed Reference 4755/0249, Assessed Value $210,410 Taxes Due $7,006.44<br />

Item #255 Account #04005201<br />

Assessed To Parker, F. Dennis Described As 44.30 Acres East Side Basket Switch Road South Of Newark,<br />

Deed Reference 2826/0485, Assessed Value $3,740 Taxes Due $69.25<br />

Item #256 Account #08002053<br />

20

Assessed To Parker, Kathy Wimbrow Described As Improvements 4 Acres Southwest Side Taylors<br />

Landing Road, Deed Reference 4613/0538, Assessed Value $154,070 Taxes Due $2,501.56<br />

Item #257 Account #05006902<br />

Assessed To Patterson, Deborah A Described As Improvements 15 Acres South Side St Martins Neck<br />

Road East Of Bishopville, Deed Reference 4378/0214, Assessed Value $190,910 Taxes Due $3,380.19<br />

Item #258 Account #03131882<br />

Assessed To Patterson, Robert H & Deborah A Patterson Described As Improvements Lot 2 5.04 Acres<br />

East Side <strong>Worcester</strong> Highway Family Tree Garden, Deed Reference 3886/0075, Assessed Value $350,032<br />

Taxes Due $6,173.93<br />

Item #259 Account #02000024<br />

Assessed To Penn Central Corp The Described As .62 Acres Right Of Way, Deed Reference 0644/0192,<br />

Assessed Value $1,032 Taxes Due $72.92<br />

Item #260 Account #10400732<br />

Assessed To Perry, Sean M Described As Improvements Boat Slip 13 123rd Street Jockey Beach Club<br />

Condominium, Deed Reference 4740/0736, Assessed Value $15,000 Taxes Due $277.70<br />

Item #261 Account #01035274<br />

Assessed To Peterson, Thomas & Peggy Peterson Described As Lot 6 Acorn Circle White Oaks<br />

Subdivision, Deed Reference 4394/0740, Assessed Value $50,686 Taxes Due $2,491.01<br />

Item #262 Account #03091937<br />

Assessed To Pino, Charles A Described As Improvements Lot G‐06‐076 9,000 Square Feet Windjammer<br />

Road Plat Ocean Pines Section 6, Deed Reference 3360/0084, Assessed Value $223,030 Taxes Due<br />

$2,167.84<br />

Item #263 Account #03107256<br />

Assessed To Piotrowski, John H Described As Improvements Lot B‐10‐696 9,000 Square Feet Juniper<br />

Court Plat Ocean Pines Section 10, Deed Reference 2113/0317, Assessed Value $249,030 Taxes Due<br />

$4,558.21<br />

Item #264 Account #01020129<br />

Assessed To Planter, Bryant Described As Improvements 65' X 106' X 65' X 100' South Side 410 Laurel<br />

Street Pocomoke, Deed Reference 3665/0002, Assessed Value $51,772 Taxes Due $1,600.93<br />

Item #265 Account #01016458<br />

Assessed To Planter, Bryant E. Described As Improvements 134.5’ X 172.9’ X 95.5’ X 22.2’ X 44’ X<br />

149.10’ East Side 713 Second Street, Deed Reference 2899/0534, Assessed Value $56,822 Taxes Due<br />

$2,390.42<br />

Item #266 Account #01016067<br />

Assessed To Planter, Bryant L. Described As 60' X 200' North Side 103 Oak Street, Pocomoke Deed<br />

Reference 3238/0336, Assessed Value $24,146 Taxes Due $632.22<br />

Item #267 Account #01027832<br />

Assessed To Platinum Realty, LLC Described As Improvements 47' X 78' 502 Moore Street Pocomoke<br />

Deed Reference 4161/0355, Assessed Value $46,172 Taxes Due $1,301.85<br />

Item #268 Account #10028965<br />

Assessed To Powell W.B.S. Estate Described As Part Lot 11 Block 14 15' X 40' Wilmington Lane<br />

Seabright, Deed Reference 0002/0274, Assessed Value $12,000 Taxes Due $974.86<br />

Item #269 Account #10283035<br />

Assessed To Pruce, Michael G Sr & Martha C Described As Improvements Unit D Georgia Avenue<br />

Swathmore Townhouse Condominium, Deed Reference 1537/0250, Assessed Value $249,160 Taxes Due<br />

$8,690.29<br />

Item #270 Account #10012422<br />

21

Assessed To Purnell, Edward Lee Described As Improvements Lot East Side Holly Grove Road West Of<br />

Ocean City, Deed Reference 0162/0479, Assessed Value $111,376 Taxes Due $1,703.58<br />

Item #271 Account #01010697<br />

Assessed To Rebel, Willie Jr Described As 371' Triangular Shaped Lot South Side Sheephouse Road,<br />

Deed Reference 0183/0009, Assessed Value $33,852 Taxes Due $562.54<br />

Item #272 Account #08008957<br />

Assessed To Reeder, Earl C & Frances L Described As Improvements 8.03 Acres Near East Side Route 12<br />

North Of Stockton, Deed Reference 0735/0367, Assessed Value $128,746 Taxes Due $2,155.99<br />

Item #273 Account #03160793<br />

Assessed To Reeling, Russell Scott & Wendy Marie Reeling Described As Improvements Lot 34 Phase 2<br />

13,544 Square Feet Ruffian Lane Riddle Farm Subdivision, Deed Reference 4522/0102, Assessed Value<br />

$617,760 Taxes Due $3,074.94<br />

Item #274 Account #10028329<br />

Assessed To Reeves, Christopher N Described As Improvements Part Lots 132 & 149 Linwood Cottage<br />

Plat Ocean City, Deed Reference 2396/0331, Assessed Value $572,900 Taxes Due $16,841.99<br />

Item #275 Account #10723175<br />

Assessed To Reinhart, Harry J Jr Described As Improvements Boat Slip #2e Salt Spray Road Hideout<br />

Condominium, Deed Reference 2167/0361, Assessed Value $15,000 Taxes Due $891.13<br />

Item #276 Account #10397510<br />

Assessed To Repole, Mario & Patricia Repole Described As Improvements Unit 203 Phase 1 West Side<br />

Coastal Highway Sunset Bay Condominium, Deed Reference 3428/0378, Assessed Value $394,400 Taxes<br />

Due $13,184.89<br />

Item #277 Account #05005256<br />

Assessed To Robbins, Larry B & Eve C Described As Improvements 2.12 Acres Near East Side Collins<br />

Road South Of Bishopville, Deed Reference 1212/0214, Assessed Value $328,540 Taxes Due $5,746.05<br />

Item #278 Account #02037424<br />

Assessed To Robert L Culver Inc Described As Lot 18,515 Square Feet Southwest Side Route 12 West Of<br />

Snow Hill, Deed Reference 4439/0535, Assessed Value $71,566 Taxes Due $1,102.46<br />

Item #279 Account #10129923<br />

Assessed To Rogers, Brenda K. Described As Improvements Unit D B 1 Jamestown Road Balmoral Cove<br />

VII Condominium, Deed Reference 3269/0150, Assessed Value $196,560 Taxes Due $7,379.41<br />

Item #280 Account #08002177<br />

Assessed To Rosenbalm, Anne R & Peggy E Williams & Brenda J West & Others Described As<br />

Improvements Lot Back Of Baptist Church & Parsonage, Deed Reference 1444/0105, Assessed Value<br />

$44,570 Taxes Due $861.11<br />

Item #281 Account #10338549<br />

Assessed To Ruff, Joseph & Margaret Described As Improvements Lot 237 North Longboat Way<br />

Assateague Point Resort Phase 2, Deed Reference 1878/0234, Assessed Value $160,390 Taxes Due<br />

$2,971.23<br />

Item #282 Account #01021184<br />

Assessed To Scarborough, James & Germaine Goodman Described As Improvements 78.5' X 75' X 76.5'<br />

X 66.5' South Side 406 Cedar Street Pocomoke, Deed Reference 4509/0641, Assessed Value $56,080<br />

Taxes Due $2,618.29<br />

Item #283 Account #03045110<br />

Assessed To Scarborough, William G & Leslie Ann Described As Improvements Lot B‐13‐027 13,030<br />

Square Feet Juneway Lane Plat Ocean Pines Section 13, Deed Reference 2358/0408, Assessed Value<br />

$241,210 Taxes Due $1,993.45<br />

Item #284 Account #03137252<br />

22

Assessed To Scarlett, John T & Linda Stine Described As Lot 27 15,309 Square Feet Piedmont Court<br />

Whitetail Sanctuary Section 15B, Deed Reference 4735/0203, Assessed Value $188,530 Taxes Due<br />

$4,216.86<br />

Item #285 Account #10403537<br />

Assessed To Schmidt, Julie A Described As Improvements Boat Slip #D89 123rd Street Hidden Harbour<br />

III Condominium, Deed Reference 3416/0195, Assessed Value $5,000 Taxes Due $168.18<br />

Item #286 Account #01020935<br />

Assessed To Schoolfield, Kenneth L & Sheilah B Described As Improvements Lot 3 608 & 610 Laurel<br />

Street Plat Amwood Inc, Deed Reference 3000/0567, Assessed Value $54,760 Taxes Due $1,588.11<br />

Item #287 Account #01009249<br />

Assessed To Schoolfield, Stran & Others Jt Tenants Described As Improvements 1/2 Acre North Side<br />