market pricing - Lehrstuhl für Bankwirtschaft - Universität Hohenheim

market pricing - Lehrstuhl für Bankwirtschaft - Universität Hohenheim

market pricing - Lehrstuhl für Bankwirtschaft - Universität Hohenheim

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

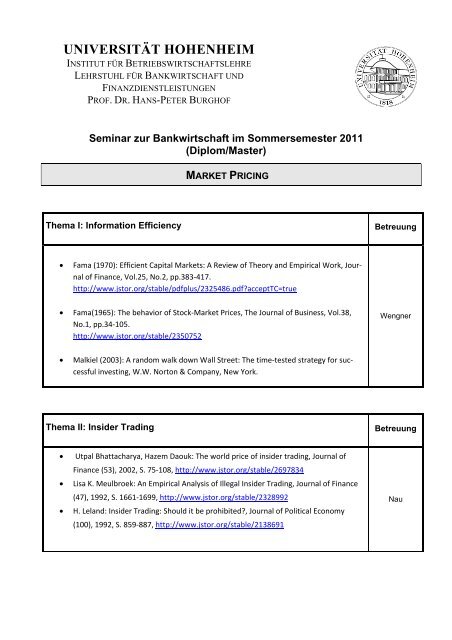

UNIVERSITÄT HOHENHEIM<br />

INSTITUT FÜR BETRIEBSWIRTSCHAFTSLEHRE<br />

LEHRSTUHL FÜR BANKWIRTSCHAFT UND<br />

FINANZDIENSTLEISTUNGEN<br />

PROF. DR. HANS-PETER BURGHOF<br />

Seminar zur <strong>Bankwirtschaft</strong> im Sommersemester 2011<br />

(Diplom/Master)<br />

Thema I: Information Efficiency<br />

MARKET PRICING<br />

• Fama (1970): Efficient Capital Markets: A Review of Theory and Empirical Work, Jour‐<br />

nal of Finance, Vol.25, No.2, pp.383‐417.<br />

http://www.jstor.org/stable/pdfplus/2325486.pdf?acceptTC=true<br />

• Fama(1965): The behavior of Stock‐Market Prices, The Journal of Business, Vol.38,<br />

No.1, pp.34‐105.<br />

http://www.jstor.org/stable/2350752<br />

• Malkiel (2003): A random walk down Wall Street: The time‐tested strategy for suc‐<br />

cessful investing, W.W. Norton & Company, New York.<br />

Thema II: Insider Trading<br />

• Utpal Bhattacharya, Hazem Daouk: The world price of insider trading, Journal of<br />

Finance (53), 2002, S. 75‐108, http://www.jstor.org/stable/2697834<br />

• Lisa K. Meulbroek: An Empirical Analysis of Illegal Insider Trading, Journal of Finance<br />

(47), 1992, S. 1661‐1699, http://www.jstor.org/stable/2328992<br />

• H. Leland: Insider Trading: Should it be prohibited?, Journal of Political Economy<br />

(100), 1992, S. 859‐887, http://www.jstor.org/stable/2138691<br />

Betreuung<br />

Wengner<br />

Betreuung<br />

Nau

Thema III: How to Measure Informed Trading<br />

• Easley, David et al. (1996): Liquidity, Information, and Infrequently Traded Stocks, in<br />

Journal of Finance, Vol.51, No.4, pp. 1405-1436.<br />

http://www.jstor.org/stable/pdfplus/2329399.pdf?acceptTC=true<br />

• Van Ness, Bonnie F.; Van Ness, Robert A.; Warr, Richard S. (2001): How Well Do<br />

Adverse Selection Components Measure Adverse Selection?, in: Financial Management,<br />

Vol.30, No.3, pp.77-98.<br />

http://www.jstor.org/stable/pdfplus/3666377.pdf<br />

Thema IV: Market Manipulation<br />

• Goldstein, Itay; Guembel, Alexander (2008): Manipulation and the Allocational Role of<br />

Prices, Review of Economic Studies, Vol.75, No.1, pp.133‐164.<br />

http://restud.oxfordjournals.org/content/75/1/133.full.pdf+html<br />

• Jiang, Guolin; Mahoney, Paul G.; Mei, Jianping (2005): Market Manipulation: A com‐<br />

prehensive study of stock pools. Journal of Financial Economics, Vol.77, No.1, pp.147‐<br />

170. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=663513<br />

• Comerton‐Forde, Carole; Putnins, Talis J. (2010): Measuring closing price manipula‐<br />

tion, Journal of Financial Intermediation, forthcoming.<br />

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1009001<br />

Betreuung<br />

Spankowski<br />

Betreuung<br />

Burghof

Thema V: Stabilization Activities after IPOs<br />

• Aggarwal, Reena (2000): Stabilization Activities by Underwriters after Initial Public Of‐<br />

ferings, in: Journal of Finance, Vol. LV, No.3, p.1075‐1103.<br />

http://faculty.msb.edu/aggarwal/jfstab.pdf<br />

• Lewellen, Katharina (2006): Risk, Reputation, and IPO Price Support, in: Journal of<br />

Finance, pp.613‐653<br />

http://onlinelibrary.wiley.com/doi/10.1111/j.1540‐6261.2006.00850.x/pdf<br />

Thema VI: Speculation and Bubbles<br />

• Tirole, Jean (1982): On the possibility of speculation under rational expectations,<br />

Econometrica, 50(5), pp. 1163‐1181.<br />

http://www.math.mcmaster.ca/~grasselli/Tirole82.pdf<br />

• Westerhoff, F.H. (2008) The use of agent‐based financial <strong>market</strong> models to test<br />

the effectiveness of regulatory policies, Jahrbücher f. Nationalökonomie u. Statis‐<br />

tik, Lucius&Lucius, Stuttgart.<br />

Thema VII: Behavioral Effects on Market Prices<br />

• Barberis, Nicholas and Richard Thaler (2003): A Survey of Behavioral Finance, in: G. M.<br />

Constantinides, M. Harris and R. Stulz (Ed.): Handbook of the Economics of Finance,<br />

pp. 1051‐1121.<br />

http://www.kmf.bwl.uni‐<br />

muenchen.de/aktuelles/aktuell_kmf/ws_10_11/bf_einstiegslit.pdf<br />

• Barberis, Nicholas, Andrei Shleifer and Robert Vishny (1998): A Model of Investor Sen‐<br />

timent, in: Journal of Financial Economics, 49, pp. 307‐343.<br />

http://www.lingnan.org/cferm/files/amodelofinvestorsentiment.pdf<br />

• De Long, Bradford J., Andrei Shleifer, Lawrence H. Summers und Robert J. Waldmann<br />

(1990): Positive Feedback Investment Strategies and Destabilizing Rational Specula‐<br />

tion, in: The Journal of Finance, 45(2), pp. 379‐295.<br />

http://www.jstor.org/stable/2328662<br />

Betreuung<br />

Flaig<br />

Betreuung<br />

Breuer<br />

Betreuung<br />

Kirsch

Betreuer:<br />

Prof. Dr. Hans-Peter Burghof Tel. 459-22900, burghof@uni-hohenheim.de<br />

Arne Breuer Tel. 459-22903, arne.breuer@uni-hohenheim.de<br />

Barbara Flaig Tel. 459-23283, barbara.flaig@uni-hohenheim.de<br />

Steffen Kirsch Tel. 459-22756, skirsch@uni-hohenheim.de<br />

Katharina Nau Tel. 459-23164, katharina.nau@uni-hohenheim.de<br />

Ulli Spankowski ulli.spankowski@uni-hohenheim.de<br />

Andreas Wengner Tel. 459-22983, andreas.wengner@uni-hohenheim.de<br />

Termine:<br />

Anmeldedatum: Vorbesprechung und Ausgabe der Anmelde- und Leistungsscheine am<br />

10.02.2011 um 08.00 Uhr in Hörsaal 7. Diese Veranstaltung ist <strong>für</strong> alle Interessenten<br />

verbindlich. Abgabe der Scheine bis spätestens 22.02.2011 bis<br />

12 Uhr im <strong>Lehrstuhl</strong>sekretariat.<br />

Themenzuteilung: 01.03.2011, Abgabe des Abstracts 01.04.2011<br />

Abgabedatum: 13.05.2011 bis 12 Uhr im Sekretariat<br />

Seminartermin: voraussichtlich Anfang Juli 2011<br />

______________________________________________________<br />

UNIVERSITÄT HOHENHEIM<br />

<strong>Lehrstuhl</strong> <strong>für</strong> <strong>Bankwirtschaft</strong> und Finanzdienstleistungen<br />

Andreas Wengner<br />

Tel. (0711) 459-22983<br />

Fax. (0711) 459-23448<br />

Email: andreas.wengner@uni-hohenheim.de<br />

Internet: www.bank.uni-hohenheim.de