HIRE and RENTAL

HIRE and RENTAL

HIRE and RENTAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEATURE<br />

Interest Rates — Fixed<br />

or Variable<br />

Given the option of selecting<br />

either a Fixed or Variable interest<br />

rate, which would you<br />

choose?<br />

Your attitude would probably depend<br />

upon your expectation of future movements<br />

in interest rates. And who knows<br />

just where they are heading? What appears<br />

to be emerging lately is a body of<br />

opinion supporting the likelihood of<br />

continuing relatively high interest rates<br />

for some considerable time to come.<br />

There are several quite sophisticated<br />

products involving interest rates in the<br />

marketplace at present. In this article we<br />

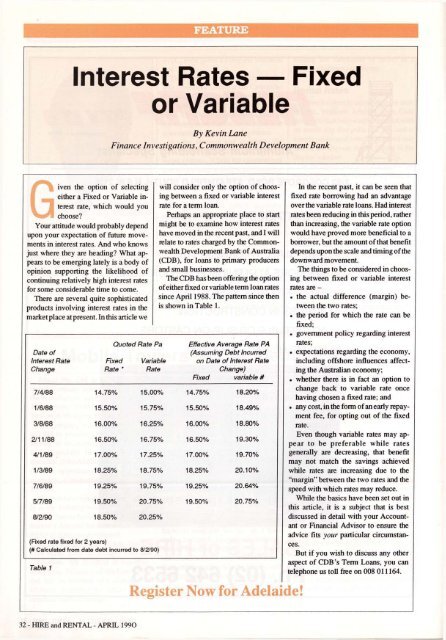

Date of<br />

Interest Rate<br />

Change<br />

By Kevin Lane<br />

Finance Investigations, Commonwealth Development Bank<br />

Quoted Rate Pa<br />

Fixed Variable<br />

Rate * Rate<br />

will consider only the option of choosing<br />

between a fixed or variable interest<br />

rate for a term loan.<br />

Perhaps an appropriate place to start<br />

might be to examine how interest rates<br />

have moved in the recent past, <strong>and</strong> I will<br />

relate to rates charged by the Commonwealth<br />

Development Bank of Australia<br />

(CDB), for loans to primary producers<br />

<strong>and</strong> small businesses.<br />

The CDB has been offering the option<br />

of either fixed or variable term loan rates<br />

since April 1988. The pattern since then<br />

is shown in Table 1.<br />

Effective Average Rate PA<br />

(Assuming Debt Incurred<br />

on Date of Interest Rate<br />

Change)<br />

Fixed variable #<br />

7/4/88 14.75% 15.00% 14.75% 18.20%<br />

1/6/88 15.50% 15.75% 15.50% 18.49%<br />

3/8/88 16.00% 16.25% 16.00% 18.80%<br />

2/11/88 16.50% 16.75% 16.50% 19.30%<br />

4/1/89 17.00% 17.25% 17.00% 19.70%<br />

1/3/89 18.25% 18.75% 18.25% 20.10%<br />

7/6/89 19.25% 19.75% 19.25% 20.64%<br />

5/7/89 19.50% 20.75% 19.50% 20.75%<br />

8/2/90 18.50% 20.25%<br />

(Fixed rate fixed for 2 years)<br />

(# Calculated from date debt incurred to 8/2/90)<br />

Table 1<br />

32 - <strong>HIRE</strong> <strong>and</strong> <strong>RENTAL</strong> - APRIL 1990<br />

Register Now for Adelaide!<br />

In the recent past, it can be seen that<br />

fixed rate borrowing had an advantage<br />

over the variable rate loans. Had interest<br />

rates been reducing in this period, rather<br />

than increasing, the variable rate option<br />

would have proved more beneficial to a<br />

borrower, but the amount of that benefit<br />

depends upon the scale <strong>and</strong> timing of the<br />

downward movement.<br />

The things to be considered in choosing<br />

between fixed or variable interest<br />

rates are -<br />

. the actual difference (margin) between<br />

the two rates;<br />

• the period for which the rate can be<br />

fixed;<br />

. government policy regarding interest<br />

rates;<br />

• expectations regarding the economy,<br />

including offshore influences affecting<br />

the Australian economy;<br />

. whether there is in fact an option to<br />

change back to variable rate once<br />

having chosen a fixed rate; <strong>and</strong><br />

. any cost, in the form of an early repayment<br />

fee, for opting out of the fixed<br />

rate.<br />

Even though variable rates may appear<br />

to be preferable while rates<br />

generally are decreasing, that benefit<br />

may not match the savings achieved<br />

while rates are increasing due to the<br />

"margin" between the two rates <strong>and</strong> the<br />

speed with which rates may reduce.<br />

While the basics have been set out in<br />

this article, it is a subject that is best<br />

discussed in detail with your Accountant<br />

or Financial Advisor to ensure the<br />

advice fits your particular circumstances.<br />

But if you wish to discuss any other<br />

aspect of CDB's Term Loans, you can<br />

telephone us toll free on 008 011164.