Download PDF - Federated Press

Download PDF - Federated Press

Download PDF - Federated Press

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

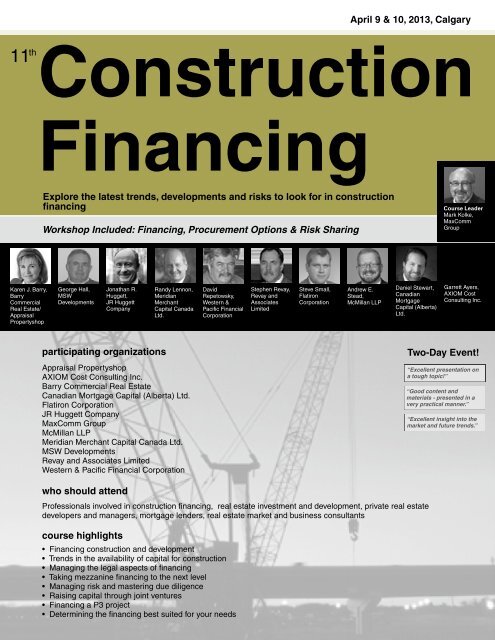

11 th<br />

Karen J. Barry,<br />

Barry<br />

Commercial<br />

Real Estate/<br />

Appraisal<br />

Propertyshop<br />

April 9 & 10, 2013, Calgary<br />

Construction<br />

Financing<br />

Explore the latest trends, developments and risks to look for in construction<br />

fi nancing<br />

Workshop Included: Financing, Procurement Options & Risk Sharing<br />

George Hall,<br />

MSW<br />

Developments<br />

Jonathan R.<br />

Huggett,<br />

JR Huggett<br />

Company<br />

participating organizations Two-Day Event!<br />

Appraisal Propertyshop<br />

AXIOM Cost Consulting Inc.<br />

Barry Commercial Real Estate<br />

Canadian Mortgage Capital (Alberta) Ltd.<br />

Flatiron Corporation<br />

JR Huggett Company<br />

MaxComm Group<br />

McMillan LLP<br />

Meridian Merchant Capital Canada Ltd.<br />

MSW Developments<br />

Revay and Associates Limited<br />

Western & Pacifi c Financial Corporation<br />

who should attend<br />

Professionals involved in construction fi nancing, real estate investment and development, private real estate<br />

developers and managers, mortgage lenders, real estate market and business consultants<br />

course highlights<br />

Randy Lennon,<br />

Meridian<br />

Merchant<br />

Capital Canada<br />

Ltd.<br />

David<br />

Repetowsky,<br />

Western &<br />

Pacifi c Financial<br />

Corporation<br />

• Financing construction and development<br />

• Trends in the availability of capital for construction<br />

• Managing the legal aspects of fi nancing<br />

• Taking mezzanine fi nancing to the next level<br />

• Managing risk and mastering due diligence<br />

• Raising capital through joint ventures<br />

• Financing a P3 project<br />

• Determining the fi nancing best suited for your needs<br />

Stephen Revay,<br />

Revay and<br />

Associates<br />

Limited<br />

Steve Small,<br />

Flatiron<br />

Corporation<br />

Andrew E.<br />

Stead,<br />

McMillan LLP<br />

Daniel Stewart,<br />

Canadian<br />

Mortgage<br />

Capital (Alberta)<br />

Ltd.<br />

Course Leader<br />

Mark Kolke,<br />

MaxComm<br />

Group<br />

Garrett Ayers,<br />

AXIOM Cost<br />

Consulting Inc.<br />

“Excellent presentation on<br />

a tough topic!”<br />

“Good content and<br />

materials - presented in a<br />

very practical manner.”<br />

“Excellent insight into the<br />

market and future trends.”

FACULTY<br />

COURSE LEADER<br />

MARK KOLKE<br />

Mark Kolke is President of MaxComm<br />

Realty Advisors, a commercial real estate<br />

consulting fi rm. He has experience in P3s as<br />

an owner’s representative, consortium organizer,<br />

bidder and consulting to proponents<br />

in pursuit of infrastructure projects and in<br />

proposal preparation.<br />

CO-LECTURERS<br />

GARRETT AYERS<br />

Garrett Ayers heads the loan monitoring<br />

division at AXIOM Cost Consulting. He has<br />

provided Project Cost Monitoring work on<br />

many of the country’s landmark projects in<br />

both the Toronto and Calgary markets.<br />

KAREN J. BARRY<br />

Karen Barry is President of Barry Commercial<br />

Real Estate and Appraisal Propertyshop.<br />

Together these companies provide<br />

clients with commercial valuations, appraisals,<br />

sales and leasing for Alberta properties.<br />

COURSE PROGRAM<br />

FINANCING CONSTRUCTION AND DEVELOPMENT<br />

Too often, borrowers do not give construction loan requests the<br />

proper time and effort required to maximize their chance of success.<br />

Timing is crucial, as the more time you have, the better chance to<br />

identify risks and successfully mitigate them. This session will outline<br />

the recent trends in the fi nancing of construction and development<br />

projects.<br />

• Sources of debt fi nancing and equity investment for construction<br />

• Features of loan packages that will satisfy concerns of lenders<br />

• Tools for creating a well documented construction budget<br />

• Construction underwriting process<br />

• Pricing the risk for construction and development<br />

SUPPLEMENTARY COURSE MATERIAL<br />

GEORGE HALL<br />

George Hall is Director, Finance at MSW<br />

Developments. He has thirty plus years of<br />

accomplishment as CFO and Controller with<br />

local, national and international construction<br />

corporations.<br />

JONATHAN R. HUGGETT<br />

Jonathan Huggett, Principal of J.R. Huggett<br />

Company, is an Engineer and infrastructure<br />

specialist with over 25 years experience in the<br />

delivery of public infrastructure.<br />

RANDY LENNON<br />

Randy Lennon is Managing Director & Co-<br />

Founder of Meridian Merchant Capital<br />

Canada Ltd. He is a 30 year entrepreneur who<br />

has founded and built successful enterprises<br />

in a number of fi elds.<br />

DAVID REPETOWSKY<br />

David Repetowsky is Managing Director at<br />

Western & Pacifi c Financial Corporation. He<br />

has had in excess of 30 years in commercial<br />

banking, real estate and mortgage banking<br />

and specializes in Commercial mortgage<br />

fi nancing.<br />

<strong>Federated</strong> <strong>Press</strong> is now providing delegates with access to an innovative new<br />

database containing at least 25 interactive multimedia presentations by leading<br />

experts including approximately 20 hours of lectures on the topics covered by<br />

this course, including all slides and speakers’ papers. See the list of presentations<br />

on page 4.<br />

STEPHEN REVAY<br />

Stephen O. Revay, Vice-President, Western<br />

Region, Revay and Associates Limited,<br />

has been active for the past 32 years in the<br />

analysis of progress, productivity and cost on<br />

numerous construction projects.<br />

STEVE SMALL<br />

Steve Small, Vice-President of Business<br />

Development, Canadian Region, Flatiron Corporation,<br />

is an internationally experienced and<br />

proven leader in the management and delivery<br />

of large infrastructure projects.<br />

ANDREW E. STEAD<br />

Andrew Stead is a Partner in the Litigation and<br />

Business Law practice groups of McMillan’s<br />

Calgary offi ce. His practice focuses on commercial<br />

dispute resolution and commercial and<br />

product liability defenses.<br />

DANIEL STEWART<br />

Daniel Stewart is Managing Partner at Canadian<br />

Mortgage Capital (Alberta) Ltd. He has<br />

over 35 years experience in real estate lending,<br />

feasibility analysis, project marketing and<br />

sales management in Western Canada and<br />

U.S. markets.<br />

APPRAISAL CONCERNS ON FINANCING CONSTRUCTION<br />

PROJECTS<br />

If a project is well formulated and thoroughly appraised, a good followthrough<br />

on the subsequent stages of the project cycle will see to its<br />

goals being achieved. This session will explore appraiser concerns on<br />

fi nancing construction projects.<br />

• Careful checking of the basic data, assumptions and methodology<br />

used in project preparation<br />

• In-depth review of the work plan, cost estimates and proposed<br />

fi nancing<br />

• Assessment of the project’s organizational and management aspects<br />

• Validity of the fi nancial, economic and social benefi ts expected from<br />

the project<br />

Audio/video segments clickable slide by slide<br />

Papers and overheads also included<br />

Print any of the material for your own use

COURSE PROGRAM<br />

SKATING THROUGH THE CONSTRUCTION FINANCING<br />

MAZE<br />

Finding the most appropriate sources of funding, structuring the<br />

deal, papering and above all closing the financing can be challenging.<br />

Whether debt or equity, or a combination, your financing source<br />

becomes a partner in the success of the project. This session will<br />

explore ways to determine what loan type and structure is most appropriate,<br />

as well as how to create winning strategies for finding the<br />

right capital source.<br />

• Determining the capital type best suited for your needs<br />

• Best practices for approaching lenders/investors/sources of<br />

capital<br />

• Choosing a source of capital<br />

• Choosing the right advisors/intermediaries and how to work<br />

effectively with them<br />

PUBLIC PRIVATE PARTNERSHIPS: ARE THEY AN<br />

EFFECTIVE FINANCING VEHICLE?<br />

The PPP marketplace in Canada has come into its own, drawing<br />

players from all over the world. Pursuit costs are high, success is<br />

rare, but rewards can be rich. For owners, particularly governments<br />

and NGOs, the refinement in analytical tools, life-cycle costing and<br />

political optics make for interesting drama. This session will help participants<br />

understand how each stakeholder views P3, how projects<br />

come about, morph, succeed and fail.<br />

• When is P3 the best approach?<br />

• Variations on the P3 concession: JVs, partnerships, design, build,<br />

own, operate, finance and transfer<br />

• What P3Canada is, or isn’t, doing to help<br />

• “Have” and “have-not” provinces<br />

CAUSES OF CONSTRUCTION PROJECT OVERRUNS:<br />

PROTECTING YOUR INVESTMENT<br />

Every construction project is susceptible to unidentified risks. Failure<br />

to mitigate and properly manage these risks will lead to cost overruns<br />

and expensive delays in project delivery. This session will explore the<br />

common causes of construction project overruns and present ways<br />

to avoid and address them to minimize their impact on success.<br />

• Major reasons for cost overruns in construction<br />

• Best practices for protecting projects against cost overruns<br />

• Importance of realistic project cost estimates from the outset<br />

• Common errors in budgeting/estimating a project<br />

• Improving risk tracking and monitoring for emerging risks<br />

DEALING WITH CONSTRUCTION LIENS<br />

This session will provide an overview of the lien provisions under<br />

the Construction Lien Act and how they affect projects and project<br />

financing. There will also be a discussion of how to deal with<br />

construction liens once asserted so as to lessen the impact of them<br />

upon project completion.<br />

• Overview of the Construction Lien Act: lien remedies, trust<br />

remedies<br />

• Holdbacks<br />

• Dealing with liens: vacating liens, lien actions, statutory limits on<br />

liability, practical tips<br />

• Priorities between mortgagees and lien claimants<br />

EFFECTIVELY MANAGING THE FINANCING<br />

Effective management of the financing can either make or break a<br />

construction project. Most risks and potential difficulties that arise in<br />

construction financing come from the actual project management and<br />

cash flow management of the project itself. This session will examine<br />

the steps you can take to ensure that the financing is managed effectively<br />

and efficiently.<br />

• Ensuring that you have the required capital in place on a timely basis<br />

• Taking proper steps to deploy the capital when required<br />

• Controls put in the proposed financing to address risks<br />

• Tools for creating a well thought out and documented construction<br />

budget<br />

• Staying on top of lender requirements throughout the project<br />

• Allowing for a reasonable contingency allowance<br />

KEY ISSUES IN MEZZANINE FINANCING<br />

Mezzanine financing is now an integral part of construction financing<br />

for developers & builders. This session will examine this non-traditional<br />

source of capital and the key role it can play in your next venture.<br />

• Latest mezzanine and high-ratio financing vehicles: who is actively<br />

providing this type of financing and how it is priced<br />

• Pros & cons: mezzanine vs. other financing options<br />

• Interim financing best practices: minimizing risk<br />

MANAGING RISK AND PERFORMING APPROPRIATE DUE<br />

DILIGENCE<br />

There is a need for all members of a large P3 consortium to clearly understand<br />

the risks each party retains through the contract. This session<br />

will cover the process that various members of large P3 consortium<br />

follow; typical risks; how these issues are resolved in the standard P3<br />

structure; how to ensure full due diligence; and a contingency approach<br />

to price the works.<br />

• Typical P3 organization structure<br />

• Various legal agreements that require appropriate due diligence<br />

reviews<br />

• Standard ‘go / no go’ provisions for contractors on P3 projects<br />

• Standard legal review checklists<br />

• Different approaches to dealing with owners on risk transfer<br />

• Typical contingency pricing method adopted by contractors<br />

WORKSHOP<br />

FINANCING, PROCUREMENT OPTIONS & RISK SHARING<br />

Value for money is maximized through choosing the optimal procurement<br />

method and risk allocation. This workshop will examine financing<br />

considerations associated with procurement options and risk sharing<br />

decisions.<br />

• Impact of choice of procurement options on financing<br />

• Allocating risk to the party best able to manage that risk<br />

• Reducing individual risk premiums and the overall cost of the project<br />

• Real life solutions to risk allocation<br />

• How different procurement options transfer similar risks

MULTIMEDIA<br />

Your registration includes an interactive multimedia CD-ROM comprising the following presentations from recent <strong>Federated</strong> <strong>Press</strong> courses and conferences.<br />

They are presented in their entirety with complete audio and accompanying slides.<br />

For an additional $175 to the registration fee, you can receive the multimedia proceedings of the course on CD-ROM, containing all presentations given at event.<br />

If not registered for the event, the cost of this CD-ROM, which also includes the presentations described below, is $599.<br />

Financing Construction & Development<br />

Brian Moir<br />

ATB Corporate Financial Services<br />

Surety Bonds & Risk Management<br />

Douglas R. Sanders, P Eng<br />

Borden Ladner Gervais LLP<br />

Taking Mezzanine Financing to the Next Level<br />

Ian E. MacRae<br />

MacLeod Dixon LLP<br />

Managing the Legal Aspects of Construction<br />

Financing<br />

Rebecca Braun<br />

Hopewell Residential Communities Inc<br />

Public Private Partnerships as an Expedient<br />

Vehicle<br />

Mark Kolke<br />

MaxComm Group<br />

Financing Challenges for PPPs in the Current<br />

Market<br />

Louis Belanger<br />

Stonebridge Financial Corporation<br />

Determining the Financing Best Suited for Your<br />

Needs<br />

Chris Bennett<br />

McMillan LLP<br />

Structuring a Cross-Border Construction<br />

Financing<br />

Bruce E. Darlington<br />

Davis LLP<br />

Overview of Financing and Industry Procurement<br />

Trends<br />

John Mollenhauer<br />

Toronto Construction Association<br />

Trends in the Availability of Capital for<br />

Construction<br />

Shamshad Madhok<br />

PricewaterhouseCoopers LLP<br />

Determining the Feasibility of a Construction<br />

Project<br />

Will Smith<br />

Smith to the Power of 100<br />

Managing the Legal Aspects of Construction<br />

Financing<br />

Ian E. MacRae<br />

Macleod Dixon LLP<br />

Dealing with Builders Liens<br />

John N. Craig<br />

Bennett Jones LLP<br />

Trends in the Availability of Capital for<br />

Construction/Raising Capital Through Joint<br />

Ventures<br />

Gary Morrison<br />

Ernst & Young Corporate Finance (Canada) Inc.<br />

Managing Risk & Mastering Due Diligence<br />

Steven D. Ness<br />

Surety Association of Canada<br />

Mitigating Risk in Construction Financing: The<br />

Lender’s Perspective<br />

Sabrina A. Gherbaz<br />

Torys LLP<br />

Registration: To reserve your place, call <strong>Federated</strong> <strong>Press</strong> toll-free at 1-800-363-0722.<br />

In Toronto, call (416) 665-6868 or fax to (416) 665-7733. Then mail your payment along with the<br />

registration form. Places are limited. Your reservation will be confirmed before the course.<br />

Location: SHERATON CAVALIER CALGARY HOTEL 2620 32nd Avenue NE, Calgary, AB T1Y 6B8<br />

Conditions: Registration covers attendance for one person, the supplementary course material<br />

as described in this document, lunch on both days, morning coffee on both days and<br />

refreshments during all breaks. The proceedings of the course will be captured on audio or<br />

video. Multimedia proceedings with all slides and handouts can be purchased separately on a<br />

CD-ROM which will also include the course material.<br />

Time: This course is a two-day event. Registration begins at 8:00 a.m. The morning sessions<br />

start promptly at 9:00. The second day ends at 4:00 p.m.<br />

TO REGISTER FOR CONSTRUCTION FINANCING<br />

Name<br />

Title Department<br />

Approving Manager Name<br />

Approving Manager Title<br />

Organization<br />

Address<br />

City Province Postal Code<br />

Telephone Fax e-mail<br />

Please bill my credit card: AMEX VISA Mastercard<br />

# Expiration date:<br />

Signature :<br />

Payment enclosed: Please invoice. PO Number:<br />

WHEN CALLING, PLEASE MENTION PRIORITY CODE:<br />

11CF1304/E<br />

MAIL COMPLETED FORM WITH PAYMENT TO:<br />

<strong>Federated</strong> <strong>Press</strong> P.O. Box 4005, Station “A”<br />

Toronto, Ontario M5W 2Z8<br />

Residential Construction Financing<br />

Bruno Iacovetta<br />

MCAP<br />

Risks Associated with Pre-Sale Contracts<br />

Brian D. MacKay<br />

Davis LLP<br />

Construction Project Risk Identification Checklist<br />

Ed Martingano<br />

Oxford Properties Group<br />

Change Orders, Delay & Impact Claims<br />

Harold Dorbin<br />

Marsh USA Inc.<br />

Structuring Finance<br />

Jeffrey W. Lem<br />

Davies Ward Phillips & Vineberg LLP<br />

Real Estate Joint Ventures<br />

Jeffrey Shore<br />

Goodmans LLP<br />

Negotiating Financing in an Unpredictable<br />

Environment<br />

Lou Iafrate, MRICS, AACI<br />

Altus Group<br />

Managing Construction Risk in Real Estate<br />

Development<br />

Steven D. Ness<br />

Surety Association of Canada<br />

Developing Multi Residential Buildings<br />

Derek A. Lobo<br />

Derek A. Lobo & Associates (DALA)<br />

Cancellation: Please note that non-attendance at the course does not entitle the registrant<br />

to a refund. In the event that a registrant becomes unable to attend following the deadline for<br />

cancellation, a substitute attendee may be delegated. Please notify <strong>Federated</strong> <strong>Press</strong> of any<br />

changes as soon as possible. <strong>Federated</strong> <strong>Press</strong> assumes no liability for changes in program content<br />

or speakers. A full refund of the attendance fee will be provided upon cancellation in writing<br />

received prior to March 26, 2013. No refunds will be issued after this date.<br />

Discounts: <strong>Federated</strong> <strong>Press</strong> has special team discounts. Groups of 3 or more from the same<br />

organization receive 15%. For larger groups please call.<br />

Payment must be received prior to April 2, 2013<br />

Phone: 1-800-363-0722 Toronto: (416) 665-6868 Fax: (416) 665-7733<br />

/<br />

REGISTRATION COSTS<br />

NUMBER OF PARTICIPANTS:<br />

COURSE: $1975<br />

COURSE + PROCEEDINGS CD-ROM:<br />

$1975 + $175 = $ 2150<br />

PROCEEDINGS CD-ROM: $599<br />

NOTE: Please add 13% HST to all prices.<br />

Proceedings CD-ROM will be available 30 days<br />

after the course takes place<br />

Enclose your cheque payable to<br />

<strong>Federated</strong> <strong>Press</strong> in the amount of:<br />

GST Reg. # R101755163<br />

PBN#101755163PG0001<br />

For additional delegates please duplicate this form<br />

and follow the normal registration process