US GAAP vs. IFRS The basics - Financial Executives International

US GAAP vs. IFRS The basics - Financial Executives International

US GAAP vs. IFRS The basics - Financial Executives International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

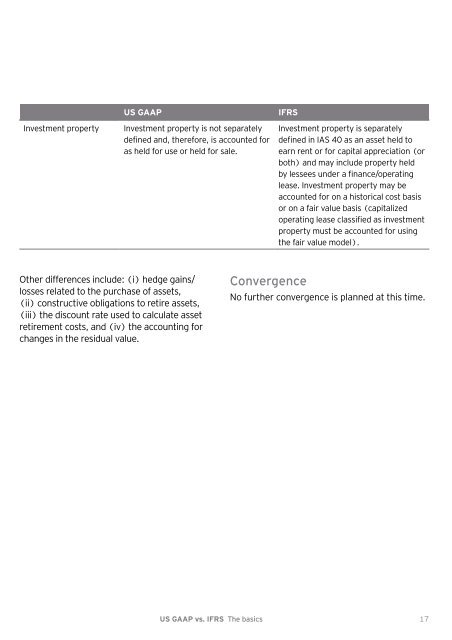

<strong>US</strong> <strong>GAAP</strong> <strong>IFRS</strong><br />

Investment property Investment property is not separately<br />

defined and, therefore, is accounted for<br />

as held for use or held for sale.<br />

Other differences include: (i) hedge gains/<br />

losses related to the purchase of assets,<br />

(ii) constructive obligations to retire assets,<br />

(iii) the discount rate used to calculate asset<br />

retirement costs, and (iv) the accounting for<br />

changes in the residual value.<br />

<strong>US</strong> <strong>GAAP</strong> <strong>vs</strong>. <strong>IFRS</strong> <strong>The</strong> <strong>basics</strong><br />

Convergence<br />

Investment property is separately<br />

defined in IAS 0 as an asset held to<br />

earn rent or for capital appreciation (or<br />

both) and may include property held<br />

by lessees under a finance/operating<br />

lease. Investment property may be<br />

accounted for on a historical cost basis<br />

or on a fair value basis (capitalized<br />

operating lease classified as investment<br />

property must be accounted for using<br />

the fair value model).<br />

No further convergence is planned at this time.<br />

17