THE FIAT GROUP IN

THE FIAT GROUP IN

THE FIAT GROUP IN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

36<br />

Net Financial Position of the Group<br />

At December 31, 2001, the consolidated net financial<br />

position of the Group showed net indebtedness of 6,035<br />

million euros, 432 million euros less than at the beginning<br />

of the fiscal year (net debt of 6,467 million euros).<br />

A breakdown of the changes affecting the net financial<br />

position in 2001 is provided below:<br />

(in millions of euros)<br />

Net financial position at December 31, 2000 (6,467)<br />

Decrease in working capital 3,022<br />

Investments in fixed and intangible assets (3,911)<br />

Cash flow 2,089<br />

Dividends (380)<br />

Acquisitions and capital contributions (1,524)<br />

Disposals (net of capital gains) 903<br />

Other changes 233<br />

Total change 432<br />

Net financial position at December 31, 2001 (6,035)<br />

Cash flow, which is equal to net income before minority<br />

interest plus depreciation and amortization, totaled 2,089<br />

million euros, down from the 3,630 million euros reported<br />

in 2000, mainly due to the net loss. Depreciation and<br />

amortization totaled 2,880 million euros, down slightly<br />

from the 3,052 million euros posted in 2000.<br />

In particular, depreciation and amortization is represented by<br />

fixed asset costs of 1,911 million euros (2,180 million euros<br />

in 2000), 376 million euros for leased assets (353 million euros<br />

in 2000), and 593 million euros for intangible fixed assets<br />

(519 million euros in 2000).<br />

Disposals does not include realized capital gains, as they<br />

are posted under cash flow.<br />

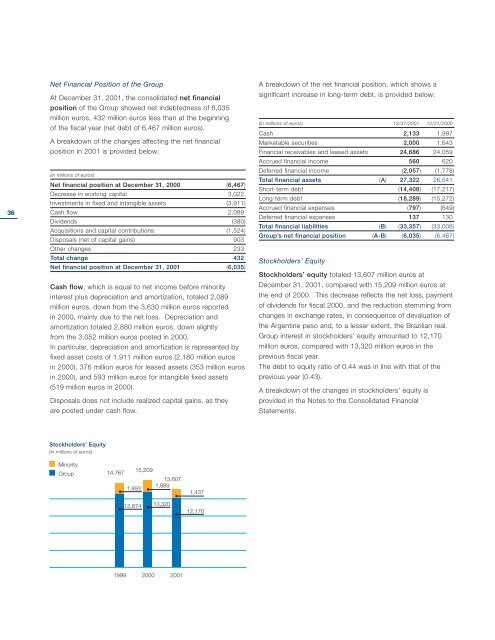

Stockholders’ Equity<br />

(in millions of euros)<br />

Minority<br />

Group<br />

14,767<br />

1999<br />

1,893<br />

12,874<br />

15,209<br />

2000<br />

13,607<br />

1,889<br />

13,320<br />

2001<br />

1,437<br />

12,170<br />

A breakdown of the net financial position, which shows a<br />

significant increase in long-term debt, is provided below:<br />

(in millions of euros) 12/31/2001 12/31/2000<br />

Cash 2,133 1,997<br />

Marketable securities 2,000 1,643<br />

Financial receivables and leased assets 24,686 24,059<br />

Accrued financial income 560 620<br />

Deferred financial income (2,057) (1,778)<br />

Total financial assets (A) 27,322 26,541<br />

Short-term debt (14,408) (17,217)<br />

Long-term debt (18,289) (15,272)<br />

Accrued financial expenses (797) (649)<br />

Deferred financial expenses 137 130<br />

Total financial liabilities (B) (33,357) (33,008)<br />

Group’s net financial position (A-B) (6,035) (6,467)<br />

Stockholders’ Equity<br />

Stockholders’ equity totaled 13,607 million euros at<br />

December 31, 2001, compared with 15,209 million euros at<br />

the end of 2000. This decrease reflects the net loss, payment<br />

of dividends for fiscal 2000, and the reduction stemming from<br />

changes in exchange rates, in consequence of devaluation of<br />

the Argentine peso and, to a lesser extent, the Brazilian real.<br />

Group interest in stockholders’ equity amounted to 12,170<br />

million euros, compared with 13,320 million euros in the<br />

previous fiscal year.<br />

The debt to equity ratio of 0.44 was in line with that of the<br />

previous year (0.43).<br />

A breakdown of the changes in stockholders’ equity is<br />

provided in the Notes to the Consolidated Financial<br />

Statements.