THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

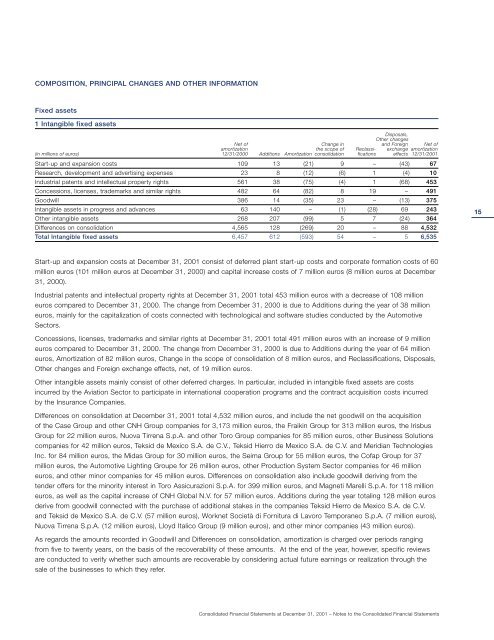

COMPOSITION, PR<strong>IN</strong>CIPAL CHANGES AND O<strong>THE</strong>R <strong>IN</strong>FORMATION<br />

Fixed assets<br />

1 Intangible fixed assets<br />

Disposals,<br />

Other changes<br />

Net of Change in and Foreign Net of<br />

amortization the scope of Reclassi- exchange amortization<br />

(in millions of euros) 12/31/2000 Additions Amortization consolidation fications effects 12/31/2001<br />

Start-up and expansion costs 109 13 (21) 9 – (43) 67<br />

Research, development and advertising expenses 23 8 (12) (6) 1 (4) 10<br />

Industrial patents and intellectual property rights 561 38 (75) (4) 1 (68) 453<br />

Concessions, licenses, trademarks and similar rights 482 64 (82) 8 19 – 491<br />

Goodwill 386 14 (35) 23 – (13) 375<br />

Intangible assets in progress and advances 63 140 – (1) (28) 69 243<br />

Other intangible assets 268 207 (99) 5 7 (24) 364<br />

Differences on consolidation 4,565 128 (269) 20 – 88 4,532<br />

Total Intangible fixed assets 6,457 612 (593) 54 – 5 6,535<br />

Start-up and expansion costs at December 31, 2001 consist of deferred plant start-up costs and corporate formation costs of 60<br />

million euros (101 million euros at December 31, 2000) and capital increase costs of 7 million euros (8 million euros at December<br />

31, 2000).<br />

Industrial patents and intellectual property rights at December 31, 2001 total 453 million euros with a decrease of 108 million<br />

euros compared to December 31, 2000. The change from December 31, 2000 is due to Additions during the year of 38 million<br />

euros, mainly for the capitalization of costs connected with technological and software studies conducted by the Automotive<br />

Sectors.<br />

Concessions, licenses, trademarks and similar rights at December 31, 2001 total 491 million euros with an increase of 9 million<br />

euros compared to December 31, 2000. The change from December 31, 2000 is due to Additions during the year of 64 million<br />

euros, Amortization of 82 million euros, Change in the scope of consolidation of 8 million euros, and Reclassifications, Disposals,<br />

Other changes and Foreign exchange effects, net, of 19 million euros.<br />

Other intangible assets mainly consist of other deferred charges. In particular, included in intangible fixed assets are costs<br />

incurred by the Aviation Sector to participate in international cooperation programs and the contract acquisition costs incurred<br />

by the Insurance Companies.<br />

Differences on consolidation at December 31, 2001 total 4,532 million euros, and include the net goodwill on the acquisition<br />

of the Case Group and other CNH Group companies for 3,173 million euros, the Fraikin Group for 313 million euros, the Irisbus<br />

Group for 22 million euros, Nuova Tirrena S.p.A. and other Toro Group companies for 85 million euros, other Business Solutions<br />

companies for 42 million euros, Teksid de Mexico S.A. de C.V., Teksid Hierro de Mexico S.A. de C.V. and Meridian Technologies<br />

Inc. for 84 million euros, the Midas Group for 30 million euros, the Seima Group for 55 million euros, the Cofap Group for 37<br />

million euros, the Automotive Lighting Groupe for 26 million euros, other Production System Sector companies for 46 million<br />

euros, and other minor companies for 45 million euros. Differences on consolidation also include goodwill deriving from the<br />

tender offers for the minority interest in Toro Assicurazioni S.p.A. for 399 million euros, and Magneti Marelli S.p.A. for 118 million<br />

euros, as well as the capital increase of CNH Global N.V. for 57 million euros. Additions during the year totaling 128 million euros<br />

derive from goodwill connected with the purchase of additional stakes in the companies Teksid Hierro de Mexico S.A. de C.V.<br />

and Teksid de Mexico S.A. de C.V. (57 million euros), Worknet Società di Fornitura di Lavoro Temporaneo S.p.A. (7 million euros),<br />

Nuova Tirrena S.p.A. (12 million euros), Lloyd Italico Group (9 million euros), and other minor companies (43 million euros).<br />

As regards the amounts recorded in Goodwill and Differences on consolidation, amortization is charged over periods ranging<br />

from five to twenty years, on the basis of the recoverability of these amounts. At the end of the year, however, specific reviews<br />

are conducted to verify whether such amounts are recoverable by considering actual future earnings or realization through the<br />

sale of the businesses to which they refer.<br />

Consolidated Financial Statements at December 31, 2001 – Notes to the Consolidated Financial Statements 15<br />

15