THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

THE FIAT GROUP IN - Fiat SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Reserve for pensions and similar obligations<br />

The reserve includes provisions for pensions and similar obligations determined on an actuarial basis, where applicable, and<br />

payable to employees and former employees according to contractual agreements or by law. The net decrease is due to the net<br />

reduction in the number of employees of the Group during the course of the year, also on account of the spin-off of the<br />

businesses to Global Value Services and the joint ventures with General Motors.<br />

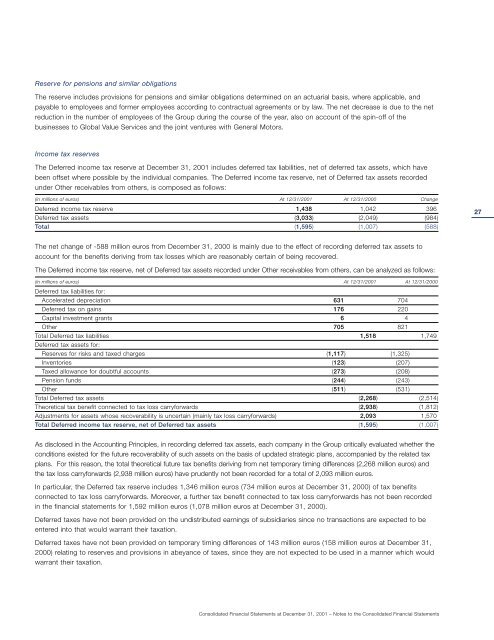

Income tax reserves<br />

The Deferred income tax reserve at December 31, 2001 includes deferred tax liabilities, net of deferred tax assets, which have<br />

been offset where possible by the individual companies. The Deferred income tax reserve, net of Deferred tax assets recorded<br />

under Other receivables from others, is composed as follows:<br />

(in millions of euros) At 12/31/2001 At 12/31/2000 Change<br />

Deferred income tax reserve 1,438 1,042 396<br />

Deferred tax assets (3,033) (2,049) (984)<br />

Total (1,595) (1,007) (588)<br />

The net change of -588 million euros from December 31, 2000 is mainly due to the effect of recording deferred tax assets to<br />

account for the benefits deriving from tax losses which are reasonably certain of being recovered.<br />

The Deferred income tax reserve, net of Deferred tax assets recorded under Other receivables from others, can be analyzed as follows:<br />

(in millions of euros) At 12/31/2001 At 12/31/2000<br />

Deferred tax liabilities for:<br />

Accelerated depreciation 631 704<br />

Deferred tax on gains 176 220<br />

Capital investment grants 6 4<br />

Other 705 821<br />

Total Deferred tax liabilities 1,518 1,749<br />

Deferred tax assets for:<br />

Reserves for risks and taxed charges (1,117) (1,325)<br />

Inventories (123) (207)<br />

Taxed allowance for doubtful accounts (273) (208)<br />

Pension funds (244) (243)<br />

Other (511) (531)<br />

Total Deferred tax assets (2,268) (2,514)<br />

Theoretical tax benefit connected to tax loss carryforwards (2,938) (1,812)<br />

Adjustments for assets whose recoverability is uncertain (mainly tax loss carryforwards) 2,093 1,570<br />

Total Deferred income tax reserve, net of Deferred tax assets (1,595) (1,007)<br />

As disclosed in the Accounting Principles, in recording deferred tax assets, each company in the Group critically evaluated whether the<br />

conditions existed for the future recoverability of such assets on the basis of updated strategic plans, accompanied by the related tax<br />

plans. For this reason, the total theoretical future tax benefits deriving from net temporary timing differences (2,268 million euros) and<br />

the tax loss carryforwards (2,938 million euros) have prudently not been recorded for a total of 2,093 million euros.<br />

In particular, the Deferred tax reserve includes 1,346 million euros (734 million euros at December 31, 2000) of tax benefits<br />

connected to tax loss carryforwards. Moreover, a further tax benefit connected to tax loss carryforwards has not been recorded<br />

in the financial statements for 1,592 million euros (1,078 million euros at December 31, 2000).<br />

Deferred taxes have not been provided on the undistributed earnings of subsidiaries since no transactions are expected to be<br />

entered into that would warrant their taxation.<br />

Deferred taxes have not been provided on temporary timing differences of 143 million euros (158 million euros at December 31,<br />

2000) relating to reserves and provisions in abeyance of taxes, since they are not expected to be used in a manner which would<br />

warrant their taxation.<br />

Consolidated Financial Statements at December 31, 2001 – Notes to the Consolidated Financial Statements 27<br />

27