FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

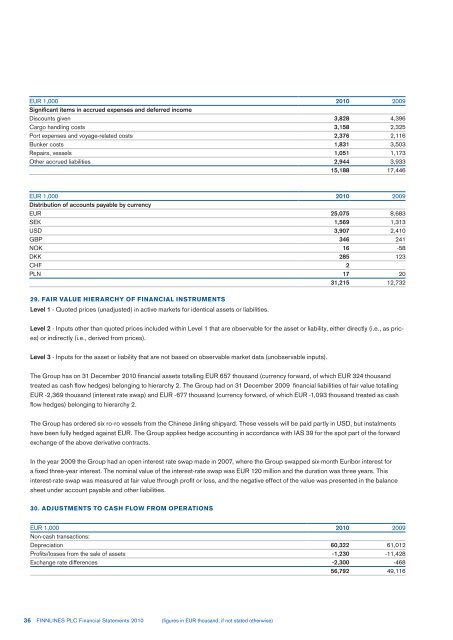

EUR 1,000 <strong>2010</strong> 2009<br />

Significant items in accrued expenses and deferred income<br />

Discounts given 3,828 4,396<br />

Cargo handling costs 3,158 2,325<br />

Port expenses and voyage-related costs 2,376 2,116<br />

Bunker costs 1,831 3,503<br />

Repairs, vessels 1,051 1,173<br />

Other accrued liabilities 2,944 3,933<br />

15,188 17,446<br />

EUR 1,000 <strong>2010</strong> 2009<br />

Distribution of accounts payable by currency<br />

EUR 25,075 8,683<br />

SEK 1,569 1,313<br />

USD 3,907 2,410<br />

GBP 346 241<br />

NOK 16 -58<br />

DKK 285 123<br />

CHF 2<br />

PLN 17 20<br />

31,215 12,732<br />

29. FAIR VALUE HIERARCHY OF <strong>FINANCIAL</strong> INSTRUMENTS<br />

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities.<br />

Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e., as pric-<br />

es) or indirectly (i.e., derived from prices).<br />

Level 3 - Inputs for the asset or liability that are not based on observable market data (unobservable inputs).<br />

The Group has on 31 December <strong>2010</strong> financial assets totalling EUR 657 thousand (currency forward, of which EUR 324 thousand<br />

treated as cash flow hedges) belonging to hierarchy 2. The Group had on 31 December 2009 financial liabilities of fair value totalling<br />

EUR -2,369 thousand (interest rate swap) and EUR -677 thousand (currency forward, of which EUR -1,093 thousand treated as cash<br />

flow hedges) belonging to hierarchy 2.<br />

The Group has ordered six ro-ro vessels from the Chinese Jinling shipyard. These vessels will be paid partly in USD, but instalments<br />

have been fully hedged against EUR. The Group applies hedge accounting in accordance with IAS 39 for the spot part of the forward<br />

exchange of the above derivative contracts.<br />

In the year 2009 the Group had an open interest rate swap made in 2007, where the Group swapped six-month Euribor interest for<br />

a fixed three-year interest. The nominal value of the interest-rate swap was EUR 120 million and the duration was three years. This<br />

interest-rate swap was measured at fair value through profit or loss, and the negative effect of the value was presented in the balance<br />

sheet under account payable and other liabilities.<br />

30. ADJUSTMENTS TO CASH FLOW FROM OPERATIONS<br />

EUR 1,000 <strong>2010</strong> 2009<br />

Non-cash transactions:<br />

Depreciation 60,322 61,012<br />

Profits/losses from the sale of assets -1,230 -11,428<br />

Exchange rate differences -2,300 -468<br />

56,792 49,116<br />

36 FINNLINES PLC Financial Statements <strong>2010</strong> (figures in EUR thousand, if not stated otherwise)