The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

The dawn of 5 Star flying The dawn of 5 Star flying - Kingfisher Airlines

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>dawn</strong> <strong>of</strong><br />

5 <strong>Star</strong> <strong>flying</strong>

C O N T E N T S<br />

Report <strong>of</strong> the Directors 2<br />

Corporate Governance Report 18<br />

Management Discussion & Analysis Report 31<br />

Auditors’ Report 36<br />

Balance Sheet 40<br />

Pr<strong>of</strong>it and Loss Account 41<br />

Schedules 42<br />

Cash Flow Statement 72<br />

Accounts <strong>of</strong> the Subsidiary 75

BOARD OF DIRECTORS Dr. Vijay Mallya, Chairman & CEO<br />

Capt. G. R. Gopinath, Vice Chairman<br />

Mr. S. R. Gupte<br />

Mr. A. K. Ravi Nedungadi<br />

Capt. K. J. Samuel<br />

Mr. Vijay Amritraj<br />

Mr. Anil Kumar Ganguly<br />

Mr. Piyush G. Mankad<br />

Dr. Naresh Trehan<br />

Diwan Arun Nanda<br />

Mr. Ghyanendra Nath Bajpai<br />

COMPANY SECRETARY Mr. N. Srivatsa<br />

CHIEF FINANCIAL OFFICER<br />

AUDITORS<br />

REGISTERED OFFICE<br />

Mr. A. Raghunathan<br />

M/s. B. K. Ramadhyani & Co.<br />

Chartered Accountants<br />

4B, 4 th Floor, 68, Chitrapur Bhavan,<br />

8 th Main, 15 th Cross, Malleswaram,<br />

Bangalore – 560 055<br />

UB Tower, Level 12, UB City,<br />

24, Vittal Mallya Road,<br />

Bangalore – 560 001<br />

1

2<br />

To <strong>The</strong> Members,<br />

Your Directors present the 14th Annual Report along with<br />

the Audited Accounts <strong>of</strong> your Company for the year ended<br />

March 31, 2009.<br />

As Members are aware, as already intimated in the Directors’<br />

Report for the previous financial period, the financial<br />

statements for the year ended March 31, 2009, pertains<br />

to the consolidated commercial airline entity consequent<br />

upon the demerger and transfer <strong>of</strong> the Commercial Airline<br />

Division Undertaking <strong>of</strong> the erstwhile <strong>Kingfisher</strong> <strong>Airlines</strong><br />

Limited into your Company with an Appointed Date <strong>of</strong><br />

April 1, 2008.<br />

Operations<br />

Your Company’s operations during the year ended March<br />

31, 2009 have resulted in:<br />

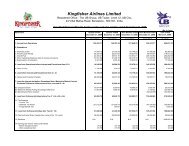

Year ended<br />

March 31,<br />

2009<br />

(Rs. in millions)<br />

Nine month<br />

period ended<br />

March 31, 2008<br />

Gross Income 55775 15454<br />

Earnings before financial<br />

charges, lease rentals,<br />

depreciation & amortization<br />

and taxes (EBITDAR)<br />

1352 (2379)<br />

Add/Less: Depreciation &<br />

Amortisation<br />

1716 366<br />

Lease Rentals 11851 3547<br />

Financial charges 6962 779<br />

Loss before taxes (19177) (7071)<br />

Provision for taxes<br />

(incl. FBT)<br />

5464 (4945)<br />

Net Pr<strong>of</strong>it/(Loss) from<br />

ordinary activities after tax<br />

(13173) (2126)<br />

Extraordinary items (2375) 245<br />

Net loss after tax (16088) (1881)<br />

Scheduled Airline Operations<br />

Your Company is the largest player in the Indian domestic<br />

aviation sector and during the year under review had the<br />

widest reach covering more destinations and carrying more<br />

passengers than any other domestic carrier.<br />

During the year under review, your Company carried<br />

approximately 10.9 million passengers, with a fleet <strong>of</strong> 77<br />

aircraft, a schedule <strong>of</strong> 412 domestic and 8 international<br />

Report <strong>of</strong> the Directors<br />

flights daily and a route network covering 70 domestic and<br />

2 international destinations.<br />

Further, since inception till March 31, 2009, your Company<br />

has carried approximately 28.4 million passengers.<br />

Your Company returned 8 Airbus A320 aircraft and 3 ATR-<br />

42 aircraft during the year under review consequent upon<br />

the route rationalization program initiated with a view to<br />

maximize operational synergies and cost savings pursuant to<br />

the Composite Scheme <strong>of</strong> Arrangement between erstwhile<br />

<strong>Kingfisher</strong> <strong>Airlines</strong> Limited, erstwhile Deccan Aviation<br />

Limited (your Company) and Deccan Charters Limited (“the<br />

Scheme”), approved by the Hon’ble High Court <strong>of</strong> Karnataka<br />

vide its Order dated June 16, 2008.<br />

During the year under review, the severe recession in<br />

global economies worldwide adversely impacted the<br />

global aviation industry. <strong>The</strong> domestic aviation industry<br />

witnessed significant capacity contraction by all major<br />

airline operators. However, rising operating costs, fall in<br />

passenger traffic and revenues as well as stiff competition<br />

among all operators is putting pressure on yields resulting<br />

in operating losses during the year under review. <strong>The</strong><br />

continued exorbitant rates <strong>of</strong> taxes on Aviation Turbine<br />

Fuel in India also adversely affected the domestic aviation<br />

industry. Avenues for funding continue to be blocked. <strong>The</strong><br />

unfortunate terrorist attacks on November 26, 2008 in<br />

Mumbai, further affected air traffic into and from India.<br />

Dialogue with the Government <strong>of</strong> India is underway for<br />

relief measures to revive the industry. Individual items <strong>of</strong><br />

the financial statements are more fully discussed in the<br />

section titled “Management Discussion and Analysis”.<br />

<strong>The</strong> Company continues to <strong>of</strong>fer the following classes <strong>of</strong><br />

service:<br />

<strong>Kingfisher</strong> First – Premium Business class <strong>of</strong> service<br />

<strong>Kingfisher</strong> Class – Premium Economy class <strong>of</strong> service<br />

<strong>Kingfisher</strong> Red – Low fare basic class <strong>of</strong> service<br />

Your Company commenced international operations with<br />

the launch <strong>of</strong> the non-stop service between Bangalore and<br />

London Heathrow Airport on September 3, 2008. However,<br />

for commercial reasons, your Company is discontinuing<br />

services on this route from September 15, 2009.<br />

<strong>The</strong> Company launched the non-stop daily service between<br />

Mumbai to London Heathrow Airport on January 5, 2009,

Report <strong>of</strong> the Directors (Contd.)<br />

on wide body Airbus A330-200 aircraft. Other leading<br />

international airlines already were in operation on this<br />

route. Despite that, your Company has been able to carve<br />

out a niche in this market due to the quality on-board<br />

service and in-flight experience it <strong>of</strong>fers.<br />

On January 19, 2009, your Company started flights from<br />

Chennai and Bangalore to Colombo, Sri Lanka. <strong>The</strong>se<br />

flights are operated on narrow - body Airbus A320 aircraft<br />

and have a single cabin configuration <strong>of</strong> 180 seats with<br />

<strong>Kingfisher</strong> Class <strong>of</strong> service. <strong>The</strong> Colombo flights have seen<br />

high seat load factors since inception, including guests from<br />

United Kingdom and other European markets to Colombo<br />

via Bangalore. However, for commercial reasons, your<br />

Company is discontinuing services on Bangalore – Colombo<br />

route from September 15, 2009.<br />

Subsequent to the year under review, your Company<br />

commenced flights from Kolkata to Dhaka, Bangladesh on<br />

May 15, 2009 and flights from Bangalore to Dubai on June<br />

25, 2009.<br />

In view <strong>of</strong> operating losses incurred during the year, your<br />

Directors do not recommend payment <strong>of</strong> any dividend.<br />

Subsidiaries<br />

During the year under review, Northway Aviation Limited<br />

ceased to be a subsidiary <strong>of</strong> the Company.<br />

<strong>The</strong> statement <strong>of</strong> your Company’s interest in its only<br />

subsidiary as at March 31, 2009, prepared in accordance<br />

with the provisions <strong>of</strong> Section 212(3) <strong>of</strong> the Companies Act,<br />

1956 is attached to the Balance Sheet.<br />

Outlook<br />

<strong>The</strong> integration <strong>of</strong> the commercial airline business into your<br />

Company pursuant to the Scheme has enabled the Company<br />

to sustain a market share <strong>of</strong> over 25%. <strong>The</strong> synergy benefits<br />

mapped out by Accenture are likely to be realized over a<br />

period <strong>of</strong> time and once the economy emerges from this<br />

recessionary phase your Directors are hopeful that this will<br />

reflect in the financial results <strong>of</strong> your Company. Oil prices<br />

continued to be volatile and coupled with the high rate<br />

<strong>of</strong> taxes on Aviation Turbine Fuel in India, the country’s<br />

Civil Aviation industry is operating under severe pressure.<br />

Continuing recessionary conditions in economies worldwide,<br />

the sluggish revival <strong>of</strong> the financial markets and the<br />

slump in the aviation industry worldwide have resulted in<br />

reduced funds allocation to industry and the Civil Aviation<br />

Sector. Given the recessionary conditions worldwide and<br />

the slow-down in the air travel market, pr<strong>of</strong>itability<br />

remains a concern for airlines in the short-term given<br />

the high cost <strong>of</strong> operations. However, your Company is<br />

hopeful that its ongoing dialogue with the Government <strong>of</strong><br />

India will result in measures that will revive the aviation<br />

industry.<br />

However, your Directors and the UB Group reiterate their<br />

confidence in the potential <strong>of</strong> the Indian aviation industry<br />

as Civil Aviation growth follows GDP growth. <strong>The</strong> Indian<br />

economy is a trillion dollar economy and is expected to grow<br />

at 5 to 6% per annum, despite the ongoing recessionary<br />

conditions worldwide. Civil Aviation is undoubtedly a key<br />

engine <strong>of</strong> this growth. Passenger traffic in India has grown<br />

from 14 million in 2005 to over 39 million in 2008-2009. Your<br />

Company is well-poised to meet the dynamic challenges<br />

faced by the industry in the short-term as well as to take<br />

advantage <strong>of</strong> the growth potential in the long-term.<br />

Moving ahead, your Company intends to intensify its<br />

presence in the Far East, Middle East and SAARC region. As<br />

the largest domestic Indian airline, with pan India coverage,<br />

your Company intends to use its international operations<br />

to further strengthen its domestic network. Your Company<br />

will commence operations on the following routes:<br />

South East Asia Region<br />

Kolkata – Bangkok, Thailand with effect from<br />

August 14, 2009<br />

Mumbai – Hong Kong with effect from<br />

September 15, 2009<br />

Mumbai – Singapore with effect from<br />

September 16, 2009<br />

Mumbai – Bangkok, Thailand<br />

New Delhi – Bangkok, Thailand<br />

SAARC Region<br />

Mumbai – Colombo, Sri Lanka<br />

Mumbai / Bangalore - Male, Maldives<br />

GCC Region<br />

Mumbai / New Delhi - Dubai, UAE<br />

3

Capital<br />

<strong>The</strong> Authorised Capital <strong>of</strong> your Company remained<br />

unchanged at Rs. 500,00,00,000 divided into 40,00,00,000<br />

<strong>of</strong> Rs. 10/- each and 1,00,00,000 Preference Shares <strong>of</strong><br />

Rs. 100/- each.<br />

<strong>The</strong> Issued, Subscribed and Paid-up Equity Share Capital <strong>of</strong><br />

your Company also remained unchanged at Rs. 3,629,088,830<br />

divided into 265,908,883 Equity Shares <strong>of</strong> Rs. 10/- each and<br />

9,700,000 6% Redeemable Non-Cumulative Preference<br />

Shares <strong>of</strong> Rs. 100/- each.<br />

Depository System<br />

<strong>The</strong> trading in the equity shares <strong>of</strong> your Company is under<br />

compulsory dematerialization mode. As <strong>of</strong> date, equity<br />

shares representing 96.28% <strong>of</strong> the equity share capital<br />

are in dematerialized form. As the depository system<br />

<strong>of</strong>fers numerous advantages, members are requested to<br />

take advantage <strong>of</strong> the same and avail <strong>of</strong> the facility <strong>of</strong><br />

dematerialization <strong>of</strong> your Company’s shares.<br />

Auditors’ Report<br />

As regards observations in para 4 <strong>of</strong> Auditors’ Report, as<br />

part <strong>of</strong> the rapid expansion plans, the Company in the past<br />

had incurred certain preoperative expenses and significant<br />

expenditure on in house training <strong>of</strong> pilots and technical<br />

engineers. All such deferred costs have been written <strong>of</strong>f to<br />

Pr<strong>of</strong>it and Loss Account by March 31, 2008 and no amount is<br />

pending for amortization after that date.<br />

In para 5 <strong>of</strong> the Auditors’ Report, the Statutory Auditors<br />

have qualified their report by remarking that the receipt <strong>of</strong><br />

subsidy from aircraft manufacturers should be recognized<br />

as income on an systematic basis over the period necessary<br />

to match them with related costs which they are intended<br />

to compensate though the accounting treatment does not<br />

appear to be covered by the Accounting Standard (AS)–19<br />

(Accounting for Leases) issued by the Institute <strong>of</strong> Chartered<br />

Accountants <strong>of</strong> India. In the opinion <strong>of</strong> the Directors:<br />

(1) <strong>The</strong> lessor <strong>of</strong> the Aircraft is a person other than the Aircraft<br />

manufacturer and the lease contract is independent <strong>of</strong><br />

the contract with Aircraft manufacturer.<br />

(2) <strong>The</strong> termination, if any, <strong>of</strong> the lease contract does not in<br />

any event breach the conditions for the grant <strong>of</strong> subsidy<br />

by the Aircraft manufacturer.<br />

(3) <strong>The</strong> subsidy value, referred to in Para 5 <strong>of</strong> the Audit<br />

Report have been received by the Company during<br />

4<br />

Report <strong>of</strong> the Directors (Contd.)<br />

the 15 months period ended June 30, 2006. As per<br />

Section 28 (iv) <strong>of</strong> the Income Tax Act, 1961, and<br />

precedents available under Income Tax laws, including<br />

pronouncements <strong>of</strong> the Apex Court, the revenue arising<br />

out <strong>of</strong> support packages will be treated as income<br />

for taxation purposes and therefore, it would not be<br />

prudent for the Company to treat the said revenues<br />

differently in the books <strong>of</strong> Accounts and for Taxation<br />

purposes.<br />

(4) In the event <strong>of</strong> non compliance <strong>of</strong> the contract with<br />

the Aircraft manufacturer, the resultant possibility <strong>of</strong><br />

recovery <strong>of</strong> subsidy granted by the Aircraft manufacturer<br />

has been disclosed as contingent liability and this<br />

accounting treatment adopted by the Company is also<br />

based on the well established principle <strong>of</strong> differentiation<br />

<strong>of</strong> revenue receipt and capital receipt.<br />

In view <strong>of</strong> the above, in the opinion <strong>of</strong> the Company, the<br />

accounting treatment <strong>of</strong> the support package, received from<br />

the Aircraft manufacturer, as Income in the year <strong>of</strong> accrual<br />

and receipt is in order.<br />

<strong>The</strong> fair market value <strong>of</strong> these Aircraft is not easily<br />

ascertainable due to the unique specifications <strong>of</strong> the Aircraft.<br />

<strong>The</strong>refore, the management has obtained the valuation<br />

report for Aircraft <strong>of</strong> similar type from a leasing company<br />

to ascertain the fair market value which is higher then the<br />

sale price <strong>of</strong> these Aircraft. This is also supported by the fact<br />

that the insurance value to be covered as per respective<br />

Lease Agreement is much more then the sale value <strong>of</strong> the<br />

Aircraft.<br />

As regards the observations in para 13(a) <strong>of</strong> the Auditors’<br />

Report, the Note number 19 to Notes to Accounts (Schedule<br />

19) is self explanatory.<br />

As regards the observations in the Annexure to the Auditors’<br />

Report, the Company has taken / is taking necessary steps<br />

to ensure improvement in certain procedures and also<br />

compliance with relevant laws.<br />

Directors<br />

Mr. A. K. Ravi Nedungadi, Capt. G. R. Gopinath and Capt. K.<br />

J. Samuel, Directors, retire by rotation and, being eligible,<br />

<strong>of</strong>fer themselves for reappointment.<br />

Mr. S. R. Gupte was appointed as an Additional Director with<br />

effect from January 28, 2009 and holds <strong>of</strong>fice up to the date<br />

<strong>of</strong> the ensuing Annual General Meeting <strong>of</strong> your Company.

Report <strong>of</strong> the Directors (Contd.)<br />

Notice in writing has been received from a Member<br />

signifying their intention to propose the appointment <strong>of</strong><br />

Mr. S. R. Gupte as a Director <strong>of</strong> your Company at the ensuing<br />

Annual General Meeting.<br />

Auditors<br />

M/s. B. K. Ramadhyani & Co, your Company’s Auditors<br />

have confirmed that they are eligible for re-appointment at<br />

the ensuing Annual General Meeting and it is proposed to<br />

re-appoint them and to fix their remuneration.<br />

Listing <strong>of</strong> Shares <strong>of</strong> Your Company<br />

<strong>The</strong> equity shares <strong>of</strong> your Company are listed on the Bombay<br />

Stock Exchange Limited and the National Stock Exchange <strong>of</strong><br />

India Limited. <strong>The</strong> listing fee for the year 2009-10 has been<br />

paid to these Stock Exchanges.<br />

Corporate Governance<br />

A report on Corporate Governance is annexed separately as<br />

part <strong>of</strong> this Report along with a certificate <strong>of</strong> compliance from<br />

a Company Secretary in practice. Necessary requirements <strong>of</strong><br />

obtaining certifications/ declarations in terms <strong>of</strong> Clause 49<br />

have been complied with.<br />

Management Discussion and Analysis<br />

Pursuant to Clause 49 <strong>of</strong> the Listing Agreement with the<br />

Stock Exchanges, the Management Discussion and Analysis<br />

Report is annexed and forms an integral part <strong>of</strong> the Annual<br />

Report.<br />

Human Resources<br />

Employee relations remained cordial. <strong>The</strong> information as are<br />

required to be provided in terms <strong>of</strong> Section 217(2A) <strong>of</strong> the<br />

Companies Act, 1956 read with the Companies (Particulars <strong>of</strong><br />

Employees) Rules, 1975, have been included as an annexure<br />

to this Report.<br />

Employee Stock Option Plan (ESOP)<br />

Disclosures as required by Clause 12 <strong>of</strong> the SEBI (Employee<br />

Stock Option Scheme and Employee Stock Purchase Scheme),<br />

Guidelines 1999 are annexed to this Report.<br />

Conservation <strong>of</strong> Energy, Research and Development,<br />

Technology Absorption, Foreign Exchange Earnings and<br />

Outgo<br />

<strong>The</strong> particulars as prescribed under section 217(1)(e) <strong>of</strong> the<br />

Companies Act, 1956 and the rules framed there under are<br />

not applicable to your Company.<br />

<strong>The</strong> relevant information relating to Foreign Exchange<br />

Earnings and Outgo appears in the Notes Nos. 9 to 11 <strong>of</strong><br />

Schedule 19 to the Financial Statements.<br />

Directors’ Responsibility Statement<br />

Pursuant to Section 217(2AA) <strong>of</strong> the Companies Act, 1956,<br />

in relation to the Financial Statements <strong>of</strong> your Company<br />

for the year ended March 31, 2009, the Board <strong>of</strong> Directors<br />

reports that:<br />

•<br />

•<br />

•<br />

•<br />

in the preparation <strong>of</strong> the Accounts for the year ended<br />

March 31, 2009, the applicable accounting standards<br />

have been followed along with proper explanation<br />

relating to material departures;<br />

accounting policies have been selected and applied<br />

consistently and that the judgments and estimates<br />

made are reasonable and prudent so as to give a true<br />

and fair view <strong>of</strong> the state <strong>of</strong> affairs <strong>of</strong> your Company as<br />

at March 31, 2009 and <strong>of</strong> the Loss <strong>of</strong> your Company for<br />

the year ended March 31, 2009;<br />

proper and sufficient care has been taken for the<br />

maintenance <strong>of</strong> adequate accounting records in<br />

accordance with the provisions <strong>of</strong> the Companies Act,<br />

1956, for safeguarding the assets <strong>of</strong> your Company<br />

and for preventing and detecting fraud and other<br />

irregularities;<br />

the accounts for the year ended March 31, 2009, have<br />

been prepared on a going concern basis.<br />

Thank You<br />

Your Directors place on record their sincere appreciation<br />

for the continued support from shareholders, customers,<br />

the Government <strong>of</strong> India especially the Ministry <strong>of</strong> Civil<br />

Aviation and the Directorate General <strong>of</strong> Civil Aviation,<br />

the various State Governments, Airports Authority <strong>of</strong><br />

India, banks and financial institutions, suppliers, other<br />

business associates and employees.<br />

For and on Behalf <strong>of</strong> the Board <strong>of</strong> Directors<br />

Bangalore Dr. Vijay Mallya<br />

July 28, 2009 Chairman & CEO<br />

5

<strong>The</strong> statement <strong>of</strong> Particulars <strong>of</strong> Employees as required under section 217 (2A) <strong>of</strong> the Companies<br />

Act, 1956 and Companies Rules, 1975 has been filed as part <strong>of</strong> Statutory Filings under the<br />

Companies Act.

Report <strong>of</strong> the Directors (Contd.)<br />

STOCK OPTIONS GRANTED UNDER THE ESOP 2005 & 2006<br />

Disclosures as required by Clause 12 <strong>of</strong> the SEBI (Employee Stock Option Scheme and Employee Stock Purchase Scheme)<br />

Guidelines, 1999<br />

Sl.No Particulars (ESOP 2006) (ESOP 2005)<br />

(a) Options granted Nil Nil<br />

(b) <strong>The</strong> Pricing formula Rs. 65/- Rs. 65/-<br />

(c ) Options vested 546,320 897,990<br />

(d) Options exercised 55,600 21,430<br />

(e) <strong>The</strong> total number <strong>of</strong> shares arising as a result <strong>of</strong> exercise <strong>of</strong> options 55,600 21,430<br />

(f) Options lapsed 1,142,600 472,855<br />

(g) Variation <strong>of</strong> terms <strong>of</strong> options Nil Nil<br />

(h) Money realized by exercise <strong>of</strong> options 3,614,000 1,392,950<br />

(i) Total no. <strong>of</strong> options in force 1,203,400 589,780<br />

(j) Employee wise details <strong>of</strong> options granted:<br />

(i) Senior managerial personnel Nil Nil<br />

(ii) Any other employee who received a grant in any one year <strong>of</strong> option amounting to 5% or<br />

more <strong>of</strong> option granted during the year.<br />

(iii) Identified employees who were granted options, during any one year, equal to or exceeding<br />

1% <strong>of</strong> the issued capital (excluding outstanding warrants and conversions) <strong>of</strong> the Company<br />

at the time <strong>of</strong> the grant<br />

(k) Diluted Earnings Per Share (EPS) pursuant to issue <strong>of</strong> shares on exercise <strong>of</strong> options calculated in<br />

accordance with Accounting Standard AS-20<br />

(l) Method <strong>of</strong> accounting followed for value <strong>of</strong> charge on stock options (as per the Guidance Note on<br />

Stock Based compensation by ICAI)<br />

(m) Difference <strong>of</strong> amount <strong>of</strong> ESOP charge calculated as per the Intrinsic Value Method and the fair<br />

value <strong>of</strong> the options (Black Scholes Method)<br />

(n) Pr<strong>of</strong>orma Earning Per Share if the Charge have been accounted in accordance with fair value<br />

method (Black Scholes Method)<br />

Nil Nil<br />

Nil Nil<br />

N.A.<br />

Intrinsic Value Intrinsic Value<br />

Rs. (5,103,738)<br />

Rs. (14.30)<br />

(o) (i) Weighted-averaged exercise prices Rs. 65.00 Rs. 65.00<br />

and<br />

(ii) weighted-average fair values <strong>of</strong> options Rs. 137.93 Rs. 78.54<br />

for options whose exercise price either equals or exceeds or is less than the market price <strong>of</strong><br />

the stock<br />

(p) A description <strong>of</strong> the method and significant assumptions used during the year to estimate the fair<br />

values <strong>of</strong> options :<br />

(i) risk-free interest rate (%) N.A. N.A.<br />

(ii) expected life (years) N.A. N.A.<br />

(iii) expected volatility (%) N.A. N.A.<br />

(iv) expected dividends (%) Nil Nil<br />

(v) the price underlying share in market at the time <strong>of</strong> option grant N.A. N.A.<br />

17

18<br />

1. Company’s Philosophy on Corporate Governance<br />

Your Company is committed to excellence in corporate<br />

governance practices and recognizes that good corporate<br />

governance is a continuous exercise. Your Company aims<br />

at achieving transparency, accountability, equity and<br />

ethics in all facets <strong>of</strong> its operations and in all interaction<br />

with its stakeholders. Your Company believes that all<br />

its operations and actions must result in enhancement<br />

<strong>of</strong> overall shareholder value over a sustained period <strong>of</strong><br />

time without compromising in any way compliance with<br />

laws and regulations.<br />

2. Board <strong>of</strong> Directors<br />

Sl.<br />

No.<br />

During the financial year under review, your Company’s<br />

Name <strong>of</strong> the Director Category <strong>of</strong> Directorship No. <strong>of</strong> Board<br />

Meetings<br />

attended<br />

1. Dr. Vijay Mallya Non-Executive<br />

Non-Independent<br />

Chairman (from April 22, 2008)<br />

Managing designated Chairman & CEO<br />

(from October 16, 2008)<br />

2. Capt. G. R. Gopinath Non-Independent<br />

Managing Director<br />

(till October 15, 2008)<br />

Vice Chairman and<br />

Non-Executive Director<br />

(from October 16, 2008)<br />

3. Capt. K. J. Samuel Non-Independent<br />

Executive Director<br />

(till October 15, 2008)<br />

Non-Executive Director<br />

(from October 16, 2008)<br />

4. Mr. A. K. Ravi Nedungadi Non-Executive<br />

Non-Independent Director<br />

5. Lt. Gen. (Retd.)<br />

N. S. Narahari<br />

Non-Executive<br />

Independent Chairman (till April 22, 2008)<br />

Non-Executive<br />

Independent Director (from April 22, 2008) 1<br />

6. Mr. S. N. Ladhani Non-Executive<br />

Non-Independent Director 2<br />

7. Mr. Vijay Amritraj Non-Executive<br />

Independent Director<br />

8. Col. Jayanth K. Poovaiah Executive<br />

Non-Independent Director 3<br />

9. Ms. Bala Deshpande Non-Executive<br />

Non-Independent Director 4<br />

Corporate Gover nance<br />

Board <strong>of</strong> Directors comprised 11 directors out <strong>of</strong> which<br />

1 is an Executive Director and 10 are Non-Executive<br />

Directors.<br />

During the year under review, Ten Board Meetings were<br />

held i.e. on April 17, 2008, April 22, 2008, May 19, 2008,<br />

July 25, 2008, September 29, 2008, October 15, 2008,<br />

October 31, 2008, December 10, 2008, December 26,<br />

2008 and January 31, 2009.<br />

Attendance <strong>of</strong> each Director at the Board Meetings and<br />

the last Annual General Meeting during the year under<br />

review and details <strong>of</strong> number <strong>of</strong> outside Directorships<br />

and Committee position(s) held by each <strong>of</strong> your Directors<br />

as on date are given below:<br />

Attendance at<br />

last AGM held<br />

on December,<br />

26, 2008<br />

# No. <strong>of</strong> Other<br />

Companies in<br />

which Director<br />

No. <strong>of</strong> Committees<br />

(other than your<br />

Company) in which<br />

Chairman/Member<br />

8 Yes 23 1<br />

(Chairman <strong>of</strong> 1)<br />

10 Yes 4 Nil<br />

7 Yes 2 Nil<br />

10 Yes 12 4<br />

(Chairman <strong>of</strong> 1)<br />

5 N.A. N.A. N.A.<br />

4 N.A. N.A. N.A<br />

4 Yes 3 6<br />

3 N.A. N.A. N.A.<br />

NIL N.A. N.A. N.A.

Corporate Governance (Contd.)<br />

Sl.<br />

No.<br />

Name <strong>of</strong> the<br />

Director<br />

Category <strong>of</strong><br />

Directorship<br />

10. Pr<strong>of</strong>. P. N. Thirunarayana Non-Executive<br />

Independent Director 5<br />

11. Mr. Anil Kumar Ganguly Non-Executive<br />

Independent Director<br />

12. Mr. Hitesh Harshad Patel Non-Executive<br />

Non-Independent Director 6<br />

13. Mr. Piyush Mankad Non-Executive<br />

Independent Director<br />

14. Dr. Naresh Trehan Non-Executive<br />

Independent Director<br />

15. Diwan Arun Nanda Non-Executive<br />

Independent Director<br />

16. Mr. Ghyanendra Nath<br />

Bajpai<br />

Non-Executive<br />

Independent Director<br />

17. Mr. S. R. Gupte Non-Executive<br />

Non-Independent Director*<br />

NOTE:<br />

# <strong>The</strong> above details are in respect <strong>of</strong> their Directorship<br />

only in Indian Companies.<br />

a. Out <strong>of</strong> 23 other companies in which Dr. Vijay Mallya<br />

is a Director, 9 are Private Limited companies and<br />

2 companies incorporated under Section 25 <strong>of</strong> the<br />

Companies Act, 1956.<br />

b. All the other companies in which Capt. G. R. Gopinath<br />

is a Director are Private Limited companies.<br />

c. Both the other companies in which Capt. K. J. Samuel is<br />

a Director are Private Limited companies.<br />

d. Out <strong>of</strong> 12 other companies in which Mr. A. K. Ravi<br />

Nedungadi is a Director, 4 are Private Limited companies<br />

and 1 is a company incorporated under Section 25 <strong>of</strong><br />

the Companies Act, 1956.<br />

e. Out <strong>of</strong> 3 other companies in which Mr. Vijay Amritraj is<br />

a Director, 2 are Private Limited companies.<br />

f. Out <strong>of</strong> 12 other companies in which Dr. Naresh Trehan<br />

is a Director, 8 are Private Limited companies.<br />

g. Out <strong>of</strong> 12 other companies in which Diwan Arun Nanda<br />

is a Director, 7 are Private Limited companies.<br />

h. Out <strong>of</strong> 17 other companies in which Mr. Ghyanendra<br />

Nath Bajpai is a Director, 6 are Private Limited companies<br />

and 1 is a company incorporated under Section 25 <strong>of</strong><br />

the Companies Act, 1956.<br />

No. <strong>of</strong> Board<br />

Meetings<br />

attended<br />

Attendance at<br />

last AGM held<br />

on December,<br />

26, 2008<br />

# No. <strong>of</strong> Other<br />

Companies in<br />

which Director<br />

No. <strong>of</strong> Committees<br />

(other than the<br />

Company) in which<br />

Chairman/ Member<br />

2 N.A. N.A. N.A.<br />

5 Yes 2 Nil<br />

2 N.A. N.A. N.A.<br />

3 No 12 9<br />

(Chairman <strong>of</strong> 1)<br />

1 No 12 2<br />

(Chairman <strong>of</strong> 1)<br />

5 Yes 12 3<br />

(Chairman <strong>of</strong> 2)<br />

2 No 17 9<br />

(Chairman <strong>of</strong> 5)<br />

1 N.A. 11 8<br />

(Chairman <strong>of</strong> 4)<br />

i. Out <strong>of</strong> 11 other companies in which Mr. S. R. Gupte<br />

is a Director, 2 are Private Limited companies and 1<br />

is a company incorporated under Section 25 <strong>of</strong> the<br />

Companies Act, 1956.<br />

1 Ceased to be Director w.e.f October 14, 2008.<br />

2 Ceased to be Director w.e.f October 1, 2008.<br />

3 Ceased to be Director w.e.f October 15, 2008.<br />

4 Ceased to be Director w.e.f September 10, 2008.<br />

5 Ceased to be Director w.e.f October 14, 2008.<br />

6 Ceased to be Director w.e.f. July 7, 2008.<br />

* Appointed Additional Director with effect from January<br />

28, 2009.<br />

Mr. Vishnu Singh Rawal, Alternate Director to Mr. S. N.<br />

Ladhani also ceased to be a director w.e.f. October 1, 2008<br />

upon the resignation <strong>of</strong> Mr. S. N. Ladhani as Director.<br />

<strong>The</strong> current constitution <strong>of</strong> the Board <strong>of</strong> Directors <strong>of</strong> your<br />

Company is as follows:<br />

• Dr. Vijay Mallya – Chairman & Managing Director<br />

designated Chairman & CEO<br />

• Capt. G. R. Gopinath – Vice Chairman–Non–Executive<br />

Director<br />

• Mr. S. R. Gupte – Non – Executive Director<br />

• Mr. A. K. Ravi Nedungadi – Non – Executive Director<br />

19

• Capt. K. J. Samuel – Non – Executive Director<br />

• Mr. Vijay Amritraj – Non – Executive Independent<br />

20<br />

Director<br />

• Mr. Anil Kumar Ganguly–Non–Executive Independent Director<br />

• Mr. Piyush Mankad–Non–Executive Independent Director<br />

• Dr. Naresh Trehan–Non–Executive Independent Director<br />

• Diwan Arun Nanda–Non–Executive Independent Director<br />

• Mr. Ghyanendra Nath Bajpai–Non – Executive Independent<br />

Director<br />

DISCLOSURE REGARDING APPOINTMENT AND<br />

REAPPOINTMENT OF DIRECTORS<br />

Directors retiring by rotation and seeking re-appointment<br />

Mr. A. K. Ravi Nedungadi, a Chartered and Cost Accountant<br />

joined the UB Group in 1990 as the Corporate Treasurer.<br />

Within two years, he became the Group Finance Director <strong>of</strong><br />

the Group’s international business managing the businesses<br />

<strong>of</strong> UB International, which included the paint giant Berger<br />

Jenson and Nicholson, spanning 27 countries. As the principal<br />

leadership resource <strong>of</strong> UB Group, he was instrumental in<br />

concluding the acquisition <strong>of</strong> Shaw Wallace & Co, Bouvet<br />

Ladubay, Whyte and Mackay, erstwhile Air Deccan etc. and<br />

has been deeply engaged with the creation <strong>of</strong> erstwhile<br />

<strong>Kingfisher</strong> <strong>Airlines</strong> Limited (now <strong>Kingfisher</strong> Training and<br />

Aviation Services Limited). He is a recipient <strong>of</strong> many awards<br />

<strong>of</strong> excellence including the Udyog Ratan Award, CNBC TV<br />

18’s – CFO <strong>of</strong> the Year - M & A, etc. and is on the Board <strong>of</strong><br />

several companies, both in India and overseas.<br />

<strong>The</strong> details <strong>of</strong> his Directorships in other Indian Companies<br />

and Committee Memberships are as under:-<br />

Other Directorships Position held<br />

Aventis Pharma Limited Director<br />

Bayer CropScience Limited Director<br />

United Breweries Limited Director<br />

Idea Streamz Consultants Private Limited Director<br />

Millenium Alcobev Private Limited Director<br />

Pie Education Limited Director<br />

Millenea Vision Advertising (P) Limited Director<br />

Shaw Wallace & Company Limited Director<br />

Shaw Wallace Breweries Limited Director<br />

SWEW Benefit Company (Section 25 Member<br />

Company)<br />

Deccan Charters Limited Director<br />

DCL Holdings Private Limited Director<br />

Corporate Governance (Contd.)<br />

Mr. A. K. Ravi Nedungadi holds the following other<br />

Committee positions:<br />

Name <strong>of</strong> the Committee Position held<br />

Audit Committee<br />

Aventis Pharma Limited Member<br />

Bayer CropScience Limited Member<br />

Shareholders/Investors Grievance Committee<br />

Aventis Pharma Limited Member<br />

Bayer CropScience Limited Chairman<br />

Mr. A. K. Ravi Nedungadi does not hold any shares in your<br />

Company.<br />

Capt. G. R. Gopinath, a Graduate <strong>of</strong> the National Defence<br />

Academy, is an ex Army <strong>of</strong>ficer who was in active service in<br />

1971 in the war against Pakistan and took early retirement in<br />

1979 to pursue his diverse interests. A pioneer in the areas <strong>of</strong><br />

organic farming and sericulture, he has several inventions to<br />

his credit. He was awarded the “Rolex Award for Enterprise”<br />

in 1996 for his contributions to organic farming. Your<br />

Company was incorporated and established as the first heli-<br />

charter company in India in 1995 under his direction.<br />

<strong>The</strong> details <strong>of</strong> his Directorships in other Indian Companies<br />

are as under:-<br />

Other Directorships Position held<br />

Pinewood Hospitality Private Limited Director and<br />

Member<br />

Deccan Emerging Business Ventures<br />

Private Limited<br />

Deccan Cargo & Express Logistics Private<br />

Limited<br />

Director and<br />

Member<br />

Director and<br />

Member<br />

DCL Holdings Private Limited Director and<br />

Member<br />

Deccan Charters Limited Director and<br />

Member<br />

Capt. G. R. Gopinath does not hold any Committee<br />

Membership in other Indian Companies.<br />

Capt. G. R. Gopinath holds 85,10,477 shares constituting<br />

3.20% <strong>of</strong> the paid up capital <strong>of</strong> your Company.<br />

Capt. K. J. Samuel, a recipient <strong>of</strong> the ‘Sena Medal’ for gallantry,<br />

is a graduate <strong>of</strong> the National Defence Academy. After being<br />

commissioned into the Indian Army in 1971, he fought in the<br />

1971 war against Pakistan and is an experienced helicopter

Corporate Governance (Contd.)<br />

pilot. He took voluntary retirement in 1992, as a Lieutenant<br />

Colonel. He is also a qualified <strong>flying</strong> instructor and a DGCA<br />

Examiner.<br />

<strong>The</strong> details <strong>of</strong> his Directorships in other Indian Companies<br />

are as under:<br />

Other Directorships Position held<br />

Deccan Cargo & Express Logistics Private<br />

Limited<br />

Director<br />

DCL Holdings Private Limited Director<br />

Capt. K. J. Samuel does not hold any Committee Membership<br />

in other Indian Companies.<br />

Capt. K. J. Samuel holds 77,56,807 shares constituting 2.92 %<br />

<strong>of</strong> the paid up capital <strong>of</strong> your Company.<br />

New Director<br />

Mr. S. R. Gupte is a Chartered Accountant with over<br />

four decades <strong>of</strong> corporate, financial, administration and<br />

personnel experience. He has over two decades experience<br />

in the Aviation Industry and served as the Acting Chairman<br />

and Managing Director <strong>of</strong> Air India prior to joining the UB<br />

Group. Mr. S. R. Gupte has been Vice-Chairman <strong>of</strong> the UB<br />

Group for the last 17 years.<br />

<strong>The</strong> details <strong>of</strong> his Directorships in other Indian Companies<br />

and Committee Memberships are as under:-<br />

Other Directorships Position held<br />

Associated Breweries & Distilleries<br />

Limited<br />

Director<br />

Aventis Pharma Limited Director<br />

Mangalore Chemicals & Fertilizers<br />

Limited<br />

Director<br />

Millennium Beer Industries Limited Director<br />

Shaw Wallace & Co. Limited Director<br />

Shaw Wallace Breweries Limited Director<br />

UB Electronic Instruments Limited Chairman<br />

United Spirits Limited Director<br />

United Helicharters Private Limited Chairman<br />

VJM Media Pvt. Limited Chairman<br />

Federation <strong>of</strong> Indian Chambers <strong>of</strong><br />

Commerce & Industry<br />

Executive<br />

Committee Member<br />

Mr. S. R. Gupte holds the following other Committee<br />

positions:<br />

Name <strong>of</strong> the Committee Position held<br />

Audit Committee<br />

Aventis Pharma Limited Chairman<br />

Millennium Beer Industries Limited Chairman<br />

Mangalore Chemicals & Fertilizers Limited Member<br />

Shaw Wallace & Company Limited Member<br />

United Spirits Limited Member<br />

Shareholders/Investors Grievance Committee<br />

Aventis Pharma Limited Chairman<br />

Millennium Beer Industries Limited Chairman<br />

Shaw Wallace & Company Limited Member<br />

Mr. S. R. Gupte does not hold any shares in your Company.<br />

3. AUDIT COMMITTEE<br />

<strong>The</strong> Audit Committee was constituted on December 21,<br />

2005 to meet the requirements under both the Listing<br />

Agreement and Section 292A <strong>of</strong> the Companies Act,<br />

1956.<br />

During the year under review, meetings <strong>of</strong> the<br />

Committee were held on April 22, 2008, October 15,<br />

2008 and October 31, 2008. <strong>The</strong> details <strong>of</strong> attendance<br />

by members <strong>of</strong> the Committee are as below:<br />

Members Category No. <strong>of</strong><br />

Meetings<br />

Attended<br />

Mr. Anil Kumar<br />

Ganguly<br />

Non-Executive/<br />

Independent<br />

Lt. Gen. N. S. Narahari Non-Executive/<br />

Independent<br />

Mr. P. N.<br />

Thirunarayana<br />

Non-Executive/<br />

Independent<br />

Mr. S. N. Ladhani Non-Executive/<br />

Non-<br />

Independent<br />

Mr. A. K. Ravi<br />

Nedungadi<br />

Non-Executive/<br />

Non-<br />

Independent<br />

Diwan Arun Nanda Non-Executive/<br />

Independent<br />

Dr. Naresh Trehan Non-Executive/<br />

Independent<br />

2<br />

1<br />

1<br />

1<br />

2<br />

2<br />

1<br />

21

22<br />

<strong>The</strong> terms <strong>of</strong> reference to the Audit Committee cover<br />

the areas mentioned under Clause 49 <strong>of</strong> the Listing<br />

Agreement and Section 292A <strong>of</strong> the Companies Act,<br />

1956, (besides some other functions as are referred to it<br />

by the Board <strong>of</strong> Directors) which are as follows:-<br />

• Regular review <strong>of</strong> accounts, accounting policies,<br />

disclosures, etc.<br />

• Review <strong>of</strong> the major accounting entries based on<br />

exercise <strong>of</strong> judgment by management and review<br />

<strong>of</strong> significant adjustments arising out <strong>of</strong> audit.<br />

• Qualifications in the draft audit report.<br />

• Establishing and reviewing the scope <strong>of</strong> the<br />

independent audit including the observations <strong>of</strong><br />

the auditors and review <strong>of</strong> the quarterly, half-yearly<br />

and annual financial statements before submission<br />

to the Board.<br />

• <strong>The</strong> Committee shall have post audit discussions<br />

with the independent auditors to ascertain any<br />

area <strong>of</strong> concern.<br />

• Establishing the scope and frequency <strong>of</strong> internal<br />

audit, reviewing the findings <strong>of</strong> the internal<br />

auditors and ensuring the adequacy <strong>of</strong> internal<br />

control systems.<br />

• To look into reasons for substantial defaults in<br />

the payment to depositors, debenture holders,<br />

shareholders and creditors.<br />

• To look into the matters pertaining to the<br />

Director’s Responsibility Statement with respect<br />

to compliance with Accounting Standards and<br />

Accounting Policies.<br />

• Compliance with Stock Exchange legal requirements<br />

concerning financial statements to the extent<br />

applicable.<br />

• <strong>The</strong> Committee shall look into any related party<br />

transactions i.e., transactions <strong>of</strong> the Company <strong>of</strong> a<br />

material nature, with promoters or management,<br />

their subsidiaries or relatives etc., that may have<br />

potential conflict with the interests <strong>of</strong> Company at<br />

large.<br />

• Appointment and remuneration <strong>of</strong> statutory and<br />

internal auditors.<br />

• Such other matters as may from time to time be<br />

required by any statutory, contractual or other<br />

Corporate Governance (Contd.)<br />

regulatory requirements to be attended to by the<br />

Audit Committee.<br />

Consequent upon the resignation <strong>of</strong> Directors and<br />

appointment <strong>of</strong> Additional Directors as mentioned<br />

hereinabove, the Audit Committee was reconstituted<br />

on October 15, 2008 and comprised <strong>of</strong> the following<br />

members:<br />

• Mr. Anil Kumar Ganguly- Chairman<br />

• Diwan Arun Nanda<br />

• Dr. Naresh Trehan<br />

• Mr. A. K. Ravi Nedungadi<br />

Subsequent to the year under review, Mr. S. R. Gupte<br />

was inducted into the Audit Committee on June 30,<br />

2009.<br />

<strong>The</strong> current composition <strong>of</strong> the Committee is as given<br />

below:<br />

• Mr. Anil Kumar Ganguly- Chairman<br />

• Diwan Arun Nanda<br />

• Dr. Naresh Trehan<br />

• Mr. A. K. Ravi Nedungadi<br />

• Mr. S. R. Gupte<br />

4. SHARE ALLOTMENT, TRANSFERS AND INVESTOR<br />

GRIEVANCE COMMITTEE<br />

<strong>The</strong> Share Allotment, Transfers and Investor Grievance<br />

Committee was constituted on December 21, 2005 to<br />

operate in terms <strong>of</strong> the provisions related thereto in the<br />

Listing Agreements with the Stock Exchanges and/or<br />

the provisions as prescribed or may be prescribed in this<br />

regard by the Companies Act, 1956.<br />

During the year under review, the said Committee<br />

comprised <strong>of</strong> the following Directors:<br />

• Mr. Anil Kumar Ganguly - Chairman<br />

• Lt. Gen. N. S. Narahari<br />

• Mr. S. N. Ladhani<br />

• Capt. K. J. Samuel<br />

• Col. Jayanth K. Poovaiah<br />

Mr. N. Srivatsa, Company Secretary, is the Compliance<br />

Officer.<br />

During the year under review, four meetings <strong>of</strong> the<br />

Committee were held on May 19, 2008, July 14, 2008,<br />

August 1, 2008 and October 1, 2008. <strong>The</strong> attendance

Corporate Governance (Contd.)<br />

<strong>of</strong> your Directors at these Committee meetings is as<br />

below:<br />

Members Category No. <strong>of</strong> Meetings<br />

Attended<br />

Mr. Anil Kumar<br />

Ganguly<br />

Non-Executive/<br />

Independent<br />

Lt. Gen. N. S. Narahari Non-Executive/<br />

Independent<br />

Mr. S. N. Ladhani Non-Executive/<br />

Non-Independent<br />

Capt. K. J. Samuel Executive / Non-<br />

Independent<br />

Col. Jayanth K.<br />

Poovaiah<br />

Executive/ Non-<br />

Independent<br />

Consequent upon the resignation <strong>of</strong> Directors and<br />

appointment <strong>of</strong> Additional Directors as mentioned<br />

hereinabove, the Committee has been reconstituted on<br />

October 15, 2008 and the current composition <strong>of</strong> the<br />

Committee is as given below:<br />

• Mr. Anil Kumar Ganguly - Chairman<br />

• Mr. A. K. Ravi Nedungadi<br />

• Capt. K. J. Samuel<br />

During the year under review, 31 complaints were<br />

received and replied/redressed to the satisfaction <strong>of</strong> the<br />

shareholders.<br />

5. REMUNERATION COMMITTEE<br />

<strong>The</strong> Remuneration Committee was constituted on<br />

March 16, 2005. <strong>The</strong> Committee is authorized, inter alia,<br />

to deal with matters relating to framing policies and<br />

compensation including salaries and salary adjustments,<br />

incentives, bonuses, promotion, benefits, stock options<br />

and performance targets <strong>of</strong> top executives, remuneration<br />

<strong>of</strong> Directors, strategies for attracting and retaining<br />

employees, employee development programmes and<br />

other key issues referred by the Board <strong>of</strong> Directors <strong>of</strong><br />

your Company.<br />

During the year under review, the Committee comprised<br />

<strong>of</strong> the following Directors:<br />

• Mr. S. N. Ladhani<br />

• Ms. Bala Deshpande<br />

• Lt. Gen. N. S. Narahari<br />

• Pr<strong>of</strong>. P. N. Thirunarayana<br />

• Mr. Anil Kumar Ganguly<br />

2<br />

4<br />

3<br />

3<br />

3<br />

Mr. N. Srivatsa, Company Secretary, is the Secretary <strong>of</strong><br />

the Committee.<br />

During the year under review, no meetings <strong>of</strong> the<br />

Committee were held.<br />

Consequent upon the resignation <strong>of</strong> Directors<br />

and appointment <strong>of</strong> Additional Directors as mentioned<br />

hereinabove, the Remuneration Committee and the<br />

ESOP Committee were merged into one committee<br />

namely “Remuneration and Compensation Committee”<br />

on October 15, 2008. <strong>The</strong> Committee is authorized,<br />

apart from the matters referred to above, to<br />

formulate and implement Employee Stock Option<br />

Scheme(s).<br />

<strong>The</strong> current composition <strong>of</strong> the Committee is as given<br />

below :<br />

• Diwan Arun Nanda - Chairman<br />

• Mr. Anil Kumar Ganguly<br />

• Mr. A. K. Ravi Nedungadi<br />

Remuneration <strong>of</strong> Directors<br />

<strong>The</strong> details <strong>of</strong> remuneration paid to the Directors during the<br />

year under review are given below:<br />

a) Remuneration <strong>of</strong> Executive Directors<br />

Name <strong>of</strong> the Director Salary payable<br />

per annum (Rs.)<br />

Capt. G. R. Gopinath<br />

Managing Director<br />

Capt. K. J. Samuel<br />

Executive Director<br />

Col. Jayanth K. Poovaiah<br />

Executive Director<br />

Actual Salary<br />

paid (Rs.)<br />

Rs. 30,00,000 Rs.16,20,968*<br />

Rs. 14,88,000 Rs.8,04,000*<br />

Rs. 24,00,000 NIL#<br />

* Ceased to be whole-time Directors from October 15,<br />

2008. Actual Salary paid is in respect <strong>of</strong> the period<br />

April 1, 2008 to October 15, 2008.<br />

# Ceased to be whole-time Director from October<br />

15, 2008. As the said Director was in charge <strong>of</strong> the<br />

Operations <strong>of</strong> the Charter Services, his Services and<br />

Remuneration were transferred to Deccan Charters<br />

Limited pursuant to the Composite Scheme <strong>of</strong><br />

Arrangement between your Company (formerly<br />

Deccan Aviation Limited), <strong>Kingfisher</strong> Training and<br />

Aviation Services Limited (formerly <strong>Kingfisher</strong> <strong>Airlines</strong><br />

Limited) and Deccan Charters Limited from the<br />

effective date <strong>of</strong> the Scheme as sanctioned by Hon’ble<br />

23

24<br />

High Court <strong>of</strong> Karnataka vide its Order dated June 16,<br />

2008.<br />

Mr. Vishnu Singh Rawal ceased to be Alternate Director<br />

w.e.f. October 1, 2008. His Services and Remuneration<br />

payable to him as an employee in the whole-time<br />

employment <strong>of</strong> the Charter Services Operations <strong>of</strong> your<br />

Company were transferred to Deccan Charters Limited<br />

pursuant to the Composite Scheme <strong>of</strong> Arrangement<br />

between your Company (formerly Deccan Aviation<br />

Limited), <strong>Kingfisher</strong> Training and Aviation Services<br />

Limited (formerly <strong>Kingfisher</strong> <strong>Airlines</strong> Limited) and<br />

Deccan Charters Limited from the effective date <strong>of</strong><br />

the Scheme as sanctioned by Hon’ble High Court <strong>of</strong><br />

Karnataka vide its Order dated June 16, 2008.<br />

b) Sitting fees <strong>of</strong> Non-Executive Directors:<br />

Name <strong>of</strong> the Director<br />

Fees paid for attending<br />

Board / Committee<br />

Meetings (Rs.)<br />

Dr. Vijay Mallya 1,00,000<br />

Lt. Gen. (Retd.) N. S. Narahari 1,50,000<br />

Mr. S. N. Ladhani` 1,20,000<br />

Mr. Vijay Amritraj 80,000<br />

Mr. A. K. Ravi Nedungadi 2,20,000<br />

Ms. Bala Deshpande Nil<br />

Mr. P. N. Thirunarayana 50,000<br />

Mr. Anil Kumar Ganguly 1,40,000<br />

Mr. Hitesh Patel 40,000<br />

Capt. G. R. Gopinath 80,000<br />

Capt. K. J. Samuel 60,000<br />

Mr. Piyush Mankad 60,000<br />

Dr. Naresh Trehan 30,000<br />

Diwan Arun Nanda 1,20,000<br />

Mr. Ghyanendra Nath Bajpai 40,000<br />

Mr. S. R. Gupte 20,000<br />

None <strong>of</strong> the Non-Executive Directors <strong>of</strong> your Company<br />

have any pecuniary relationship or transaction with your<br />

Company.<br />

c) Shareholding <strong>of</strong> Non-Executive Directors during the year<br />

under review<br />

Apart from Dr. Vijay Mallya, Capt. G. R. Gopinath<br />

and Capt. K. J. Samuel who held 1,51,17,321, 98,70,527<br />

and 79,56,807 Equity Shares <strong>of</strong> Rs. 10/- each respectively<br />

<strong>of</strong> your Company, no other Non-Executive Director held<br />

shares in your Company as on March 31, 2009.<br />

Corporate Governance (Contd.)<br />

None <strong>of</strong> the Non-Executive Directors owned any shares<br />

on beneficial basis during the year under review.<br />

6. GENERAL BODY MEETINGS<br />

<strong>The</strong> details in respect <strong>of</strong> the last three Annual General<br />

Meetings are furnished as under:<br />

Financial<br />

Year<br />

2005-2006 December 11,<br />

2006<br />

2006-2007 December 19,<br />

2007<br />

2007-2008 December 26,<br />

2008<br />

Date Time Venue<br />

10.30 a.m. Dr. Ambedkar<br />

Bhavan, Millers<br />

Road, Vasanthnagar,<br />

Bangalore - 560 052<br />

04.00 p.m. Senate Hall, Hotel<br />

Capitol, 3 Raj<br />

Bhavan Road,<br />

Bangalore - 560 001<br />

02.45 p.m. Dr. Ambedkar<br />

Bhavan, Millers<br />

Road, Vasanthnagar,<br />

Bangalore - 560 052<br />

All the resolutions set out in the Notices,<br />

including Special Resolutions were passed by the<br />

Shareholders.<br />

Postal Ballot<br />

Your Company has not passed any resolution at the<br />

above Annual General Meetings which was required to<br />

be passed through Postal Ballot as per the provisions <strong>of</strong><br />

the Companies Act, 1956 (“the Act”) and the rules framed<br />

thereunder.<br />

Pursuant to Section 192A <strong>of</strong> the Companies Act, 1956, your<br />

Company conducted Postal Ballot exercises following the<br />

provisions and rules framed under the Act for conducting<br />

Postal Ballot.<br />

<strong>The</strong> details / results <strong>of</strong> the Postal Ballot exercises so conducted<br />

are as under:<br />

Date <strong>of</strong><br />

Notice<br />

<strong>of</strong> Postal<br />

Ballot<br />

October<br />

31, 2008<br />

Date <strong>of</strong><br />

Scrutinizer’s<br />

Report<br />

December 16,<br />

2008<br />

Description Result<br />

Special Resolution<br />

under Section 17 <strong>of</strong><br />

the Companies Act,<br />

1956 for Alteration<br />

<strong>of</strong> Clause 3 viz. the<br />

Objects Clause <strong>of</strong><br />

the Memorandum<br />

<strong>of</strong> Association <strong>of</strong> the<br />

Company<br />

Carried with<br />

requisite<br />

majority.<br />

Number <strong>of</strong> votes<br />

cast in favour –<br />

16,33,29,885<br />

Number <strong>of</strong> votes<br />

cast against –<br />

10,475

Corporate Governance (Contd.)<br />

Date <strong>of</strong><br />

Notice<br />

<strong>of</strong> Postal<br />

Ballot<br />

May 28,<br />

2009<br />

Date <strong>of</strong><br />

Scrutinizer’s<br />

Report<br />

Description Result<br />

Ordinary Resolution<br />

under Section 293 (1)<br />

(d) <strong>of</strong> the Companies<br />

Act, 1956 authorising<br />

the Board <strong>of</strong> Directors<br />

to borrow moneys<br />

upto an aggregate<br />

amount <strong>of</strong> Rs. 7,500<br />

Crores (Rupees<br />

Seven Thousand Five<br />

Hundred Crores)<br />

Carried with<br />

requisite<br />

majority.<br />

Number <strong>of</strong> votes<br />

cast in favour –<br />

16,29,13,834<br />

Number <strong>of</strong> votes<br />

cast against –<br />

4,22,525<br />

Ordinary Resolution Carried with<br />

under Section 293 (1) requisite<br />

(a) <strong>of</strong> the Companies majority.<br />

Act, 1956 for creating Number <strong>of</strong> votes<br />

security on the Assets cast in favour –<br />

<strong>of</strong> the Company in 16,29,14,676<br />

connection with the Number <strong>of</strong> votes<br />

amounts borrowed/ to cast against –<br />

be borrowed by the<br />

Company<br />

4,21,647<br />

July 16, 2009 Ordinary Resolution<br />

under Section 293 (1)<br />

(d) <strong>of</strong> the Companies<br />

Act, 1956 authorising<br />

the Board <strong>of</strong> Directors<br />

to borrow moneys<br />

upto an aggregate<br />

amount <strong>of</strong> Rs. 12,500<br />

Crores (Rupees<br />

Twelve Thousand Five<br />

Hundred Crores)<br />

Ordinary Resolution<br />

under Section 293(1)<br />

(a) <strong>of</strong> the Companies<br />

Act, 1956 for creating<br />

security on the Assets<br />

<strong>of</strong> the Company in<br />

connection with the<br />

amounts borrowed/to<br />

be borrowed by the<br />

Company.<br />

Carried with<br />

requisite<br />

majority.<br />

Number <strong>of</strong> votes<br />

cast in favour –<br />

15,57,76,193<br />

Number <strong>of</strong> votes<br />

cast against –<br />

6,11,165<br />

Carried with<br />

requisite<br />

majority.<br />

Number <strong>of</strong> votes<br />

cast in favour –<br />

15,57,70,187<br />

Number <strong>of</strong> votes<br />

cast against –<br />

6,11,161<br />

<strong>The</strong> Postal Ballot exercise was conducted by Mr. G. Krishna,<br />

Company Secretary in Practice, Scrutinizer appointed for this<br />

purpose.<br />

7. DISCLOSURES<br />

During the year under review, there were no materially<br />

significant related party transactions with your<br />

Company’s promoters, the Directors or the management,<br />

their subsidiaries or relatives etc. that may have potential<br />

conflict with the interests <strong>of</strong> your Company at large.<br />

Details <strong>of</strong> related party transactions form part <strong>of</strong> Notes<br />

to Accounts.<br />

Your Company has complied with all the statutory<br />

requirements comprised in the Listing Agreements /<br />

Regulations / Guidelines / Rules <strong>of</strong> the Stock Exchanges /<br />

SEBI / other statutory authorities excepting when it could<br />

not hold an Audit Committee Meeting on January 31,<br />

2009 for lack <strong>of</strong> quorum. Also with respect to furnishing<br />

and publication <strong>of</strong> the Audited Financial Results relating<br />

to the Year ended March 31, 2009 in terms <strong>of</strong> Clause<br />

41 <strong>of</strong> the Listing Agreement, the Audit Committee<br />

Meeting to consider the Audited Financial Results for<br />

Year ended March 31, 2009 was convened to be held<br />

on June 29, 2009. However, due to the non availability<br />

<strong>of</strong> the Independent Directors as well as the Chairman<br />

<strong>of</strong> the Audit Committee (who met with an unfortunate<br />

accident) the requisite quorum for the Audit Committee<br />

Meeting was not present and the Audit Committee<br />

Meeting could not be held.<br />

<strong>The</strong> Board <strong>of</strong> Directors were <strong>of</strong> the opinion that it<br />

would be neither appropriate and proper in terms <strong>of</strong><br />

the compliance <strong>of</strong> the letter and spirit <strong>of</strong> Corporate<br />

Governance nor in the interest <strong>of</strong> the investors, to have<br />

the Annual Audited Accounts considered and<br />

recommended / approved by the meetings <strong>of</strong> the Audit<br />

Committee and the Board <strong>of</strong> Directors without adequate<br />

representation and participation <strong>of</strong> independent<br />

directors and without the presence <strong>of</strong> the Chairman <strong>of</strong><br />

the Audit Committee. <strong>The</strong> said Financial Results were<br />

however considered at the Audit Committee Meeting<br />

held on July 28, 2009 and approved by the Board <strong>of</strong><br />

Directors at the Board Meeting held the same day. SEBI<br />

and National Stock Exchange Limited have issued Show<br />

Cause Notices on the above which are being dealt with.<br />

In view <strong>of</strong> the de-merger Appointed Date being April 1,<br />

2008, and with a view to present to the shareholders a<br />

transparent financial statement <strong>of</strong> the airline business<br />

post-integration and to enable your Company to<br />

synchronize its accounting year as April 1 to March 31<br />

every year in line with the uniform financial year <strong>of</strong> the<br />

other companies in the UB Group <strong>of</strong> which your company<br />

is a constituent, the Board <strong>of</strong> Directors <strong>of</strong> your Company<br />

decided that your Company should present one single<br />

financial statement to the Members commencing April<br />

1, 2008 (the Appointed Date under the Scheme) and<br />

ending on March 31, 2009. As a consequence, the<br />

reporting period for the previous accounting year was<br />

for a period <strong>of</strong> nine months from July 1, 2007 to March<br />

31, 2008.<br />

25

26<br />

Considering that, the Company’s financial year 2007-08<br />

would be for the period July 1, 2007 to June 30, 2008,<br />

the Company availed the 3 months option available<br />

under the listing agreement for publication <strong>of</strong> the<br />

Audited Financial Results for the said financial year.<br />

However, in end September 2008, it was decided that,<br />

in view <strong>of</strong> reasons stated above, the financial year 2007-<br />

08 should be advanced to end on March 31, 2008 and<br />

accordingly, the Audited financial statements for the<br />

same was considered at the Audit Committee Meeting<br />

held in October 2008.<br />

In view <strong>of</strong> the above, there was a gap <strong>of</strong> 4 months<br />

between the two Audit Committee Meetings as observed<br />

in the certificate <strong>of</strong> the Practicing Company Secretary<br />

relating to compliance <strong>of</strong> Corporate Governance.<br />

<strong>The</strong>re were no other instances <strong>of</strong> non-compliance by<br />

your Company nor have any penalties, strictures been<br />

imposed by Stock Exchanges or SEBI or any statutory<br />

authority since incorporation <strong>of</strong> your Company on any<br />

matter related to capital markets.<br />

8. MEANS OF COMMUNICATION<br />

<strong>The</strong> unaudited quarterly and half-yearly results are sent<br />

to all the Stock Exchanges where the shares <strong>of</strong> your<br />

Company are listed. <strong>The</strong> results are normally published<br />

in Business Standard and Kannada Prabha.<br />

<strong>The</strong> results are displayed on your Company’s website<br />

www.flykingfisher.com.<br />

9. MANAGEMENT DISCUSSION AND ANALYSIS REPORT<br />

<strong>The</strong> Management Discussion & Analysis Report forms<br />

part <strong>of</strong> this Annual Report.<br />

10. GENERAL SHAREHOLDERS’ INFORMATION<br />

a) Annual General<br />

Meeting<br />

Date September 29, 2009<br />

Time 2.45 p.m.<br />

Venue Good Shepherd Auditorium,<br />

Opp. St. Joseph’s<br />

Pre-University College,<br />

Residency Road,<br />

Bangalore -560 025.<br />

b) Financial Year April 1, 2008 to March 31, 2009<br />

c) Dates <strong>of</strong> Book Closure Friday, September 25, 2009 to<br />

Tuesday, September 29, 2009<br />

(both days inclusive)<br />

d) Dividend Payment<br />

Date<br />

Corporate Governance (Contd.)<br />

Your Company has not<br />

declared any dividend for the<br />

period April 1, 2008 to March<br />

31, 2009.<br />

e) Listing Fees <strong>The</strong> listing fees for the year<br />

2009-10 have been paid to<br />

both the Stock Exchanges<br />

where your Company’s equity<br />

shares are listed.<br />

f) Registered Office UB Tower, Level 12, UB City, 24<br />

Vittal Mallya Road, Bangalore<br />

560 001 (w.e.f. June 2, 2008)<br />

g) Listing on Stock<br />

Exchanges in India<br />

Bombay Stock Exchange<br />

Limited, P. J. Towers, Dalal<br />

Street, Mumbai 400 001<br />

National Stock Exchange <strong>of</strong><br />

India Limited, Exchange Plaza,<br />

C/1, Block G, Bandra-Kurla<br />

Complex, Bandra (E),<br />

Mumbai 400 051<br />

h) Stock Code BSE- 532747<br />

NSE- SYMBOL- AIRDECCAN<br />

(upto October 5, 2008)<br />

NSE- SYMBOL- KFA<br />

(w.e.f. October 6, 2008)<br />

i) ISIN No. INE438H01019<br />

<strong>The</strong> listing fees for the year 2008-09 have been paid<br />

to both the Stock Exchanges<br />

j) Financial Calendar for the period April 1, 2009 to<br />

March 31, 2010 is as given below:<br />

First Quarterly<br />

Results<br />

Second Quarterly<br />

Results<br />

Third Quarterly<br />

Results<br />

Fourth Quarterly<br />

Results<br />

k) Market Price Data<br />

July 28, 2009<br />

By October 31, 2009<br />

By January 31, 2010<br />

By April 30, 2010<br />

<strong>The</strong> shares <strong>of</strong> the Company are listed on Bombay<br />

Stock Exchange Limited and National Stock<br />

Exchange <strong>of</strong> India Limited. <strong>The</strong> table below sets out<br />

the monthly high and low quotations <strong>of</strong> the shares<br />

traded during the year under review. Your Company’s<br />

Management cautions the readers that the share<br />

price performance shown in the table below should<br />

not be considered to be indicative <strong>of</strong> the share price<br />

in the future.

Corporate Governance (Contd.)<br />

l) Share Price <strong>of</strong> your Company<br />

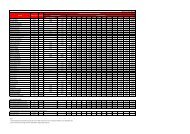

ON BSE ON NSE<br />

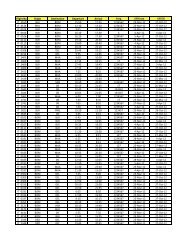

Month High (Rs.) Low (Rs.) Close (Rs.) Volume (Nos.) High (Rs.) Low (Rs.) Close (Rs.) Volume (Nos.)<br />

April 2008 151.30 113.40 143.30 6135083 151.90 113.15 143.45 16397134<br />

May 2008 158.50 115.00 115.85 4468142 158.45 115.00 115.60 13326597<br />

June 2008 117.50 59.00 59.85 4001746 117.00 59.00 59.90 11920653<br />

July 2008 84.75 54.00 79.20 12777869 84.25 52.00 79.15 33083760<br />

August 2008 96.20 75.00 79.35 6725383 96.30 75.00 79.60 16618888<br />

September 2008 93.70 52.25 60.10 5866677 94.70 52.55 60.25 17238723<br />

October 2008 64.30 24.90 32.25 4781921 64.50 24.15 32.25 10564998<br />

November 2008 36.80 22.00 27.50 9224859 38.00 22.10 27.65 18630910<br />

December 2008 43.85 25.85 40.70 21039281 44.00 25.50 40.80 41858406<br />

January 2009 44.70 30.10 35.05 15003212 44.85 30.00 35.05 33358011<br />

February 2009 37.85 30.55 32.30 14566838 37.60 30.50 32.30 35248818<br />

March 2009 37.00 24.40 33.40 10658739 35.60 24.40 33.45 28699032<br />

<strong>The</strong> Company’s performance for the period from April 1, 2008 to March 31, 2009 vis-à-vis BSE Sensex<br />

Your Company vis-à-vis BSE<br />

Your Company vis-à-vis NSE<br />

27

m) Registrar and Share Transfer Agents<br />

28<br />

Karvy Computershare Pvt. Ltd.<br />

Plot No. 17-24, Vittal Rao Nagar,<br />

Madhapur, Hyderabad - 500 081<br />

Tel No. : 91-040 - 23420816 - 824<br />

Fax No. : 91- 040 - 23420814<br />

Email ID : einward.ris@karvy.com<br />

n) Share Transfer System<br />

Corporate Governance (Contd.)<br />

<strong>The</strong> power to consider and approve share transfers/ transmission/ transposition/ consolidation/ subdivision etc. has been<br />

delegated to a Committee <strong>of</strong> Directors as indicated under the heading “Share Allotment, Transfers and Investor Grievance<br />

Committee”. <strong>The</strong> Committee meets generally once in a month. <strong>The</strong> requirements under the Listing Agreement/ Statutory<br />

regulations in this regard are being followed.<br />

o) Distribution <strong>of</strong> Shareholding as on March 31, 2009<br />

Equity Shares held Shareholders Shares held %<br />

1 - 5000 62144 7,077,012 2.66%<br />

5001 - 10000 2491 2,055,084 0.77%<br />

10001 - 20000 1068 1,661,745 0.63%<br />

20001 - 30000 384 996,991 0.38%<br />

30001 - 40000 156 566,232 0.21%<br />

40001 - 50000 153 733,056 0.28%<br />

50001 - 100000 230 1,712,144 0.64%<br />

100001 & Above 264 251,106,619 94.43%<br />

Total 66890 265,908,883 100.00<br />

p) Shareholding Pattern as on March 31, 2009<br />

Sl. No. Name <strong>of</strong> Shareholder No. <strong>of</strong> shares % <strong>of</strong> holding<br />

1. Promoters 176,217,925 66.27<br />

2. Mutual Funds / UTI 13,995,802 5.26<br />

3. Financial Institutions / Banks 11,200 0.00<br />

4. Venture Capital Funds 0 0.00<br />

5. Insurance Companies 1,254,420 0.47<br />

6. Bodies Corporate 20,664,305 7.77<br />

7. Individuals 37,127,444 13.96<br />

8. Trusts 515,959 0.19<br />

9. Clearing Members 1,158,099 0.44<br />

10. Foreign Institutional Investors 1,705,877 0.64<br />

11. Foreign Corporate Bodies 12,268,297 4.61<br />

12. Non Resident Indians 283,755 0.11<br />

13. Foreign Nationals 705,800 0.27<br />

Total 265,908,883 100.00

Corporate Governance (Contd.)<br />

q) Percentage <strong>of</strong> Shares held in Physical & Electronic Form as on March 31, 2009<br />

Sl. No. Category Holders Total Shares % To Equity<br />

1. Physical 40 32,832,809 12.35<br />

2. NSDL 47219 123,040,203 46.27<br />

3. CDSL 19631 110,035,871 41.38<br />

Total 66890 265,908,883 100.00<br />

Your Company has not issued GDRs/ADRs/Warrants or any convertible instruments.<br />

r) Dematerialisation <strong>of</strong> Shares<br />

87.65% <strong>of</strong> the paid-up capital is held in dematerialized form as on March 31, 2009 and 96.28% as on date.<br />

s) Insider Trading<br />

All the Directors and Senior Management Personnel have affirmed compliance <strong>of</strong> “<strong>The</strong> Code <strong>of</strong> Business Conduct and<br />

Ethics” as suggested under the SEBI (Prohibition <strong>of</strong> Insider Trading) Regulations, 1992 and have executed Indemnity<br />

Bonds there<strong>of</strong>, individually.<br />

t) Address for Correspondence<br />

Shareholder correspondence should be addressed to your Company’s Registrar and Share Transfer Agents:<br />

Karvy Computershare Pvt. Ltd.<br />

Plot No. 17-24, Vittal Rao Nagar, Madhapur,<br />

Hyderabad - 500 081<br />

Tel No.: 91-040- 23420816-824<br />

Fax No.: 91-040- 23420814<br />

Email ID: einward.ris@karvy.com<br />

Investors may also write to or contact Mr. N. Srivatsa, Company Secretary at:<br />

<strong>Kingfisher</strong> <strong>Airlines</strong> Limited<br />

35/2, Cunningham Road, Bangalore - 560 052<br />

Tel.: 91- 080-41148190-99<br />

Fax : 91-080-22352645/41148849<br />

Email: N.Srivatsa@flykingfisher.com<br />

In compliance with the provisions <strong>of</strong> Clause 47(f) <strong>of</strong> the Listing Agreement with the Stock Exchanges, an exclusive<br />