Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

Annual Report 2003 - Hannover Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The <strong>Hannover</strong> <strong>Re</strong> share<br />

The opinions of our analysts<br />

We see <strong>Hannover</strong> <strong>Re</strong> as the highest quality<br />

reinsurer in our universe. It is the only company<br />

that we feel espouses disciplined cycle management<br />

and has a track record to prove it. (...) <strong>Hannover</strong><br />

<strong>Re</strong> is the only reinsurer in our universe to<br />

have not destroyed value with its underwriting<br />

activities over the past ten years.<br />

Brian Shea<br />

Merrill Lynch, London<br />

March 2004<br />

Flexible cycle management has enabled<br />

<strong>Hannover</strong> <strong>Re</strong> to exploit the hard market in nonlife<br />

reinsurance more aggressively than its competitors<br />

(...). Long-tail business was expanded<br />

disproportionately strongly, and the company<br />

practises a conservative reserving policy. It is thus<br />

likely that the fruits of the business written during<br />

the present market phase will be harvested progressively<br />

for some years to come.<br />

Thorsten Wenzel<br />

DZ Bank, Frankfurt<br />

January 2004<br />

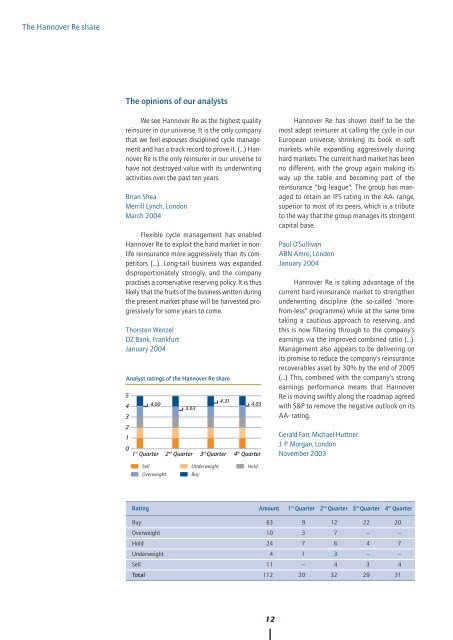

Analyst ratings of the <strong>Hannover</strong> <strong>Re</strong> share<br />

5<br />

4 4.00<br />

3<br />

2<br />

1<br />

3.63<br />

4.31<br />

4.03<br />

0<br />

1 st Quarter 2 nd Quarter 3 rd Quarter 4 th Quarter<br />

<strong>Hannover</strong> <strong>Re</strong> has shown itself to be the<br />

most adept reinsurer at calling the cycle in our<br />

European universe, shrinking its book in soft<br />

markets while expanding aggressively during<br />

hard markets. The current hard market has been<br />

no different, with the group again making its<br />

way up the table and becoming part of the<br />

reinsurance "big league". The group has managed<br />

to retain an IFS rating in the AA- range,<br />

superior to most of its peers, which is a tribute<br />

to the way that the group manages its stringent<br />

capital base.<br />

Paul O’Sullivan<br />

ABN Amro, London<br />

January 2004<br />

<strong>Hannover</strong> <strong>Re</strong> is taking advantage of the<br />

current hard reinsurance market to strengthen<br />

underwriting discipline (the so-called "morefrom-less"<br />

programme) while at the same time<br />

taking a cautious approach to reserving, and<br />

this is now filtering through to the company's<br />

earnings via the improved combined ratio (...).<br />

Management also appears to be delivering on<br />

its promise to reduce the company's reinsurance<br />

recoverables asset by 30% by the end of 2005<br />

(...) This, combined with the company's strong<br />

earnings performance means that <strong>Hannover</strong><br />

<strong>Re</strong> is moving swiftly along the roadmap agreed<br />

with S&P to remove the negative outlook on its<br />

AA- rating.<br />

Gerald Farr, Michael Huttner<br />

J. P. Morgan, London<br />

November <strong>2003</strong><br />

Sell Underweight Hold<br />

Overweight<br />

Buy<br />

Rating<br />

Amount<br />

1 st Quarter<br />

2 nd Quarter<br />

3 rd Quarter<br />

4 th Quarter<br />

Buy 63 9 12 22 20<br />

Overweight 10 3 7 – –<br />

Hold 24 7 6 4 7<br />

Underweight 4 1 3 – –<br />

Sell 11 – 4 3 4<br />

Total 112 20 32 29 31<br />

12