Chapter 13 Income Taxes

Chapter 13 Income Taxes

Chapter 13 Income Taxes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(P/A, i%, 5) = = 3.500 At i% P/A = 3.500<br />

At 15% P/A = 3.352<br />

By interpolation:<br />

ROR = <strong>13</strong>.25%<br />

b) ROR AFTER TAX<br />

PW B = PW C<br />

8,980(P/A, i%, n) = 35,000 At 8% P/A = 3.993<br />

(P/A, i%, 5) = = 3.898 At i% P/A = 3.898<br />

At 9% P/A = 3.890<br />

By interpolation:<br />

ROR = 8.92%<br />

<strong>Chapter</strong> <strong>13</strong> <strong>Income</strong> <strong>Taxes</strong> 187<br />

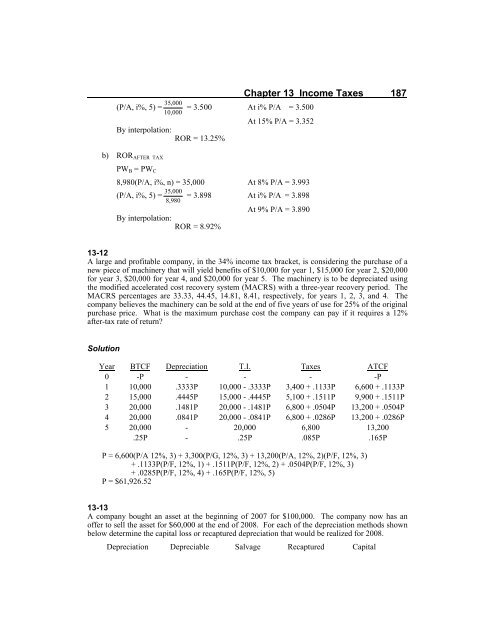

<strong>13</strong>-12<br />

A large and profitable company, in the 34% income tax bracket, is considering the purchase of a<br />

new piece of machinery that will yield benefits of $10,000 for year 1, $15,000 for year 2, $20,000<br />

for year 3, $20,000 for year 4, and $20,000 for year 5. The machinery is to be depreciated using<br />

the modified accelerated cost recovery system (MACRS) with a three-year recovery period. The<br />

MACRS percentages are 33.33, 44.45, 14.81, 8.41, respectively, for years 1, 2, 3, and 4. The<br />

company believes the machinery can be sold at the end of five years of use for 25% of the original<br />

purchase price. What is the maximum purchase cost the company can pay if it requires a 12%<br />

after-tax rate of return?<br />

Solution<br />

Year BTCF Depreciation T.I. <strong>Taxes</strong> ATCF<br />

0 -P - - - -P<br />

1 10,000 .3333P 10,000 - .3333P 3,400 + .1<strong>13</strong>3P 6,600 + .1<strong>13</strong>3P<br />

2 15,000 .4445P 15,000 - .4445P 5,100 + .1511P 9,900 + .1511P<br />

3 20,000 .1481P 20,000 - .1481P 6,800 + .0504P <strong>13</strong>,200 + .0504P<br />

4 20,000 .0841P 20,000 - .0841P 6,800 + .0286P <strong>13</strong>,200 + .0286P<br />

5 20,000 - 20,000 6,800 <strong>13</strong>,200<br />

.25P - .25P .085P .165P<br />

P = 6,600(P/A 12%, 3) + 3,300(P/G, 12%, 3) + <strong>13</strong>,200(P/A, 12%, 2)(P/F, 12%, 3)<br />

+ .1<strong>13</strong>3P(P/F, 12%, 1) + .1511P(P/F, 12%, 2) + .0504P(P/F, 12%, 3)<br />

+ .0285P(P/F, 12%, 4) + .165P(P/F, 12%, 5)<br />

P = $61,926.52<br />

<strong>13</strong>-<strong>13</strong><br />

A company bought an asset at the beginning of 2007 for $100,000. The company now has an<br />

offer to sell the asset for $60,000 at the end of 2008. For each of the depreciation methods shown<br />

below determine the capital loss or recaptured depreciation that would be realized for 2008.<br />

Depreciation Depreciable Salvage Recaptured Capital