Radnor Township Handbook 1972 - Delaware County PA History

Radnor Township Handbook 1972 - Delaware County PA History

Radnor Township Handbook 1972 - Delaware County PA History

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10<br />

TOWNSHIP<br />

FINANCES<br />

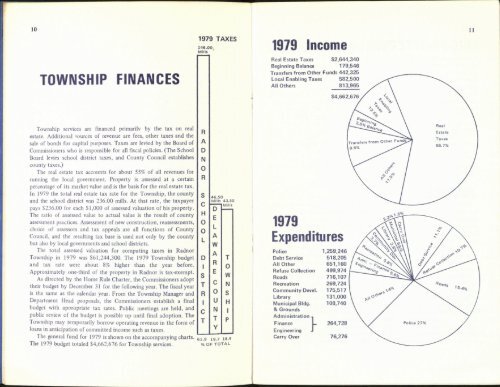

1979 TAXES<br />

r---<br />

I<br />

1979 Income<br />

Real Estate Taxes $2,644,340<br />

Beginning Balance 179,546<br />

Transfers from Other Funds 442,325<br />

Local Enabling Taxes 582,500<br />

All Others 813,965<br />

11<br />

I1<br />

<strong>Township</strong> services are financed primarily by the tax on real<br />

estate. Additional sources of revenue are fees, other taxes and the<br />

sale of bonds for capital purposes. Taxes are levied by the Board of<br />

Commissioners who is responsible for all fiscal policies. (The School<br />

Board levies school district taxes, and <strong>County</strong> Council establishes<br />

county taxes.)<br />

The real estate tax accounts for about 55% of all revenues for<br />

running the local government. Property is assessed at a certain<br />

percentage of its market value and is the basis for the real estate tax.<br />

In 1979 the total real estate tax rate for the <strong>Township</strong>, the county<br />

and the school district was 236.00 mills. At that rate, the taxpayer<br />

pays $236.00 for each $1,000 of assessed valuation of his property.<br />

The ratio of assessed value to actual value is the result of county<br />

assessment practices. Assessment of new construction, reassessments,<br />

choice of assessors and tax appeals are all functions of <strong>County</strong><br />

Council, and the resulting tax base is used not only by the county<br />

but also by local governments and school districts.<br />

The total assessed valuation for computing taxes in <strong>Radnor</strong><br />

<strong>Township</strong> in 1979 was $61,244,300. The 1979 <strong>Township</strong> budget<br />

and tax rate were about 8% higher than the year before.<br />

Approximately one-third of the property in <strong>Radnor</strong> is tax-exempt.<br />

As directed by the Home Rule Charter, the Commissioners adopt<br />

their budget by December 31 for the following year. The fiscal year<br />

is the same as the calendar year. From the <strong>Township</strong> Manager and<br />

Department Head proposals, the Commissioners establish a final<br />

budget with aporopriate tax rates. Public meetings are held, and<br />

public review of the budget is possible up until final adoption. The<br />

<strong>Township</strong> may temporarily borrow operating revenue in the form of<br />

loans in anticipation of committed income such as taxes.<br />

R<br />

A<br />

0<br />

N<br />

0<br />

R<br />

S 46.50<br />

Mills 43.50<br />

~MiIIS<br />

C<br />

H D -<br />

0 E<br />

0 L A<br />

L W<br />

0 A T<br />

R<br />

I 0<br />

E<br />

S W<br />

T C N<br />

R 0 S<br />

I U H<br />

C<br />

N I<br />

T<br />

T P<br />

V<br />

The general fund for 1979 is shown on the accompanying charts. 61.9 19.7 18.4<br />

The 1979 budget totaled $4,662,676 for <strong>Township</strong> services. % OF TOTAL<br />

I<br />

1979<br />

Expenditures<br />

Police<br />

Debt Service<br />

All Other<br />

Refuse Collection<br />

Roads<br />

Recreation<br />

Community Devel.<br />

Library<br />

Municipal Bldg.<br />

& Grounds<br />

AdministratiOn}<br />

Finance<br />

Engineering<br />

Carry Over<br />

1,259,246<br />

518,205<br />

651,160<br />

499,974<br />

716,107<br />

269,724<br />

175,517<br />

131,000<br />

108,740<br />

264,728<br />

76,276