Zimbabwe Platinum Mines - Imara

Zimbabwe Platinum Mines - Imara

Zimbabwe Platinum Mines - Imara

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OVERVIEW OF Q3 2012 FINANCIAL RESULTS<br />

Improved quarterly performance. Zimplats recently issued its Q3<br />

2012 financial results showing 32% q-o-q revenue growth to USD<br />

28.0m. However, y-o-y revenues were down 2.0%. We attribute the<br />

surge in quarterly earnings to improved metal prices.<br />

Mining production was adversely affected by illegal industrial<br />

actions. An industrial action at Zimplats led to a loss of two and<br />

half production shifts during Q3 2012. As a result, tonnes mined at<br />

1,125,000 were 1.0% below Q2 2012, though up 6.0% y-o-y. The<br />

head grade at 3.33g/t was satisfactory at 1.0% above Q2 2012.<br />

Tonnes of ore milled at 1,069,000 were 4.0% lower than Q2 2012 (up<br />

6.0% y-o-y) owing to scheduled major plant maintenance<br />

shutdowns. Overall, PGM production dropped by 2.0% to 90,557oz<br />

q-o-q (up 8.0% y-o-y) on the back of illegal strikes and power<br />

outages,which affected operations at the mine's platinum matte<br />

furnace.<br />

An increase in cash costs. Operating costs surged 18.0% y-o-y to<br />

USD 76.4m from USD 64.9m in Q3 2011. We note that cost<br />

performance for Q3 2012 was worse than same period last year due<br />

to significant increases in electricity and employment costs.<br />

Furthermore, the company’s local spend (including payments to<br />

government and related institutions) increased by 6.0% to 69% of<br />

total payments in Q3 2012. Consequently, the cash cost of<br />

production per 4E oz was 1.0% higher than Q2 2012 and 12.0% higher<br />

that Q3 2012, driven mainly by lower 4E production. Overall,<br />

operating profit for the quarter amounted to USD 51.9m.<br />

OPERATIONAL REVIEW<br />

Phase II at advanced stages. We note that Phase II project is<br />

progressing well, with a total spend of USD 89.0m by H1 2012.<br />

Generally, all three mines are now operating at full capacity and as<br />

a result ore mined totaled 2, 289,000 tonnes by H1 2012. We expect<br />

this trend to continue as the expansion projects gain momentum.<br />

Limited exploration drilling has resumed. We note that<br />

exploration drilling has resumed in the areas north of Portal 10. The<br />

overall FY12 exploration budget has been increased tenfold on FY<br />

2011 and also allows for further exploration of Portals 5.<br />

A number of legal issues still hanging. We recall that in December<br />

2010, the <strong>Zimbabwe</strong> Revenue Authority (ZIMRA) issued an amended<br />

Additional Profits Tax (APT) assessment in respect of the years 2001<br />

to 2007, whereby it disallowed the deduction of income tax<br />

assessed losses in the derivation of net cash receipts. The effect of<br />

this disallowance was to increase the previously assessed APT<br />

liability by USD 26.9m to USD 50.4m.<br />

The Zimplats board is of the view that the amendment of the APT<br />

assessment was based on incorrect interpretation of the provisions<br />

of the Income Tax Act. An objection to the amended assessment<br />

was lodged, but dismissed by ZIMRA. As a result, Zimplats has<br />

lodged an appeal through the Special Court of Income Tax Appeals,<br />

but the case is yet to be heard. On another note, ZIMRA has<br />

demanded royalties allegedly owed in the sum of USD 22.9m for the<br />

period January 2010 to September 2011. The royalties were<br />

computed at rates set in terms of the <strong>Mines</strong> and Minerals Act (as<br />

read with the Finance Act) rather than the Zimplats Mining<br />

Agreement.<br />

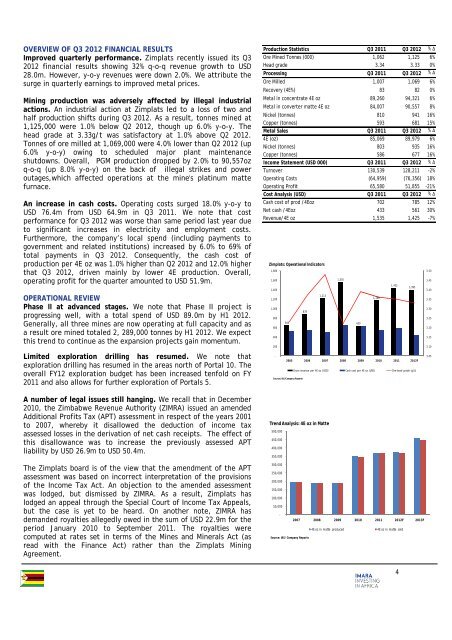

Production Statistics Q3 2011 Q3 2012 % Δ<br />

Ore Mined Tonnes (000) 1,062 1,125 6%<br />

Head grade 3.34 3.33 0%<br />

Processing Q3 2011 Q3 2012 % Δ<br />

Ore Milled 1,007 1,069 6%<br />

Recovery (4E%) 83 82 0%<br />

Metal in concentrate 4E oz 89,260 94,321 6%<br />

Metal in converter matte 4E oz 84,007 90,557 8%<br />

Nickel (tonnes) 810 941 16%<br />

Copper (tonnes) 593 681 15%<br />

Metal Sales Q3 2011 Q3 2012 % Δ<br />

4E (oz) 85,069 89,979 6%<br />

Nickel (tonnes) 803 935 16%<br />

Copper (tonnes) 586 677 16%<br />

Income Statement (USD 000) Q3 2011 Q3 2012 % Δ<br />

Turnover 130,539 128,211 -2%<br />

Operating Costs (64,959) (76,356) 18%<br />

Operating Profit 65,580 51,855 -21%<br />

Cost Analysis (USD) Q3 2011 Q3 2012 % Δ<br />

Cash cost of prod /4Eoz 702 785 12%<br />

Net cash /4Eoz 433 561 30%<br />

Revenue/4E oz 1,535 1,425 -7%<br />

Zimplats: Operational Indicators<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

-<br />

644<br />

878<br />

1,213<br />

1,555<br />

2005 2006 2007 2008 2009 2010 2011 2012F<br />

Source: IAS/Company Reports<br />

630<br />

1,169<br />

1,432<br />

1,395<br />

Gross revenue per 4E oz (USD) Cash cost per 4E oz (USD) Ore head grade (g/t)<br />

Trend Analysis: 4E oz in Matte<br />

500,000<br />

450,000<br />

400,000<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

-<br />

Source: IAS/ Company Reports<br />

2007 2008 2009 2010 2011 2012F 2013F<br />

4E oz in matte produced<br />

4E oz in matte sold<br />

3.50<br />

3.45<br />

3.40<br />

3.35<br />

3.30<br />

3.25<br />

3.20<br />

3.15<br />

3.10<br />

3.05<br />

4