May 2013 - Independent Insurance Agent

May 2013 - Independent Insurance Agent

May 2013 - Independent Insurance Agent

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A MONTHLY PUBLICATION FOR THE MEMBERS OF THE INDEPENDENT INSURANCE AGENTS OF INDIANA<br />

<strong>May</strong> <strong>2013</strong><br />

IIAI Hosts NAAIA Annual Meeting<br />

The <strong>Independent</strong> <strong>Insurance</strong> <strong>Agent</strong>s of Indiana hosted the annual meeting of the National<br />

African-American <strong>Insurance</strong> Association, Indianapolis Chapter, on Thursday, March 21<br />

at the Big I Headquarters in Indianapolis. The Indiana Big I and NAAIA have formed a<br />

strong partnership over the last several years under the guidance and leadership of Henry<br />

Pippins from Grain Dealers Mutual.<br />

Commercial Lines<br />

Feature<br />

ISO Commercial General<br />

Liability Filing - Part Three<br />

Page 7<br />

Property-casualty<br />

Feature<br />

Study Reveals Growth<br />

in Property-Casualty<br />

<strong>Insurance</strong> Market<br />

Page 12<br />

Legislative Feature<br />

Affordable Care Act<br />

Update<br />

Page 16<br />

NAAIA Indianapolis was extremely pleased to have the founder of NAAIA National, Jerald<br />

L. Tillman, LUTCF attend and participate in its meeting and install its officers for <strong>2013</strong>.<br />

Tillman had high praise for the Indianapolis chapter.<br />

“NAAIA National is so proud of our 13th newest chapter, NAAIA Indianapolis, which is<br />

our fastest growing chapter in the United States,” said Tillman. “Under the leadership of<br />

Henry Pippins and the current board members, they got off to a tremendous start that has<br />

impacted the local community with a partnership with the Indiana Big I, local colleges, and<br />

several community organizations.”<br />

“We measure success of our chapters based on membership growth, professional<br />

development, and community service. They have graded A+ in all three categories,”<br />

continued Tillman.<br />

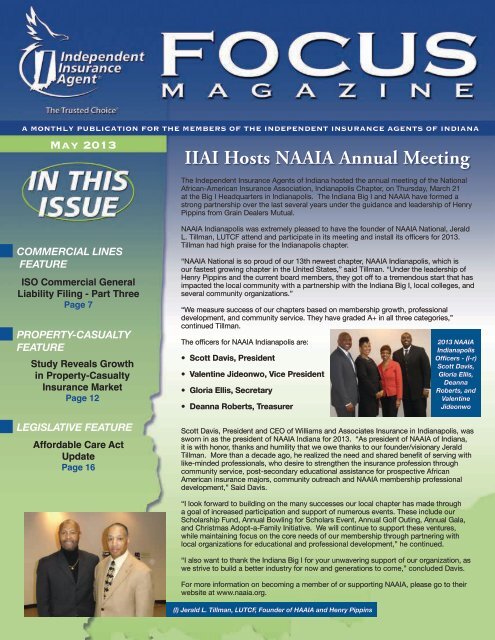

The officers for NAAIA Indianapolis are:<br />

• Scott Davis, President<br />

• Valentine Jideonwo, Vice President<br />

• Gloria Ellis, Secretary<br />

• Deanna Roberts, Treasurer<br />

<strong>2013</strong> NAAIA<br />

Indianapolis<br />

Officers - (l-r)<br />

Scott Davis,<br />

Gloria Ellis,<br />

Deanna<br />

Roberts, and<br />

Valentine<br />

Jideonwo<br />

Scott Davis, President and CEO of Williams and Associates <strong>Insurance</strong> in Indianapolis, was<br />

sworn in as the president of NAAIA Indiana for <strong>2013</strong>. “As president of NAAIA of Indiana,<br />

it is with honor, thanks and humility that we owe thanks to our founder/visionary Jerald<br />

Tillman. More than a decade ago, he realized the need and shared benefit of serving with<br />

like-minded professionals, who desire to strengthen the insurance profession through<br />

community service, post-secondary educational assistance for prospective African<br />

American insurance majors, community outreach and NAAIA membership professional<br />

development,” Said Davis.<br />

“I look forward to building on the many successes our local chapter has made through<br />

a goal of increased participation and support of numerous events. These include our<br />

Scholarship Fund, Annual Bowling for Scholars Event, Annual Golf Outing, Annual Gala,<br />

and Christmas Adopt-a-Family Initiative. We will continue to support these ventures,<br />

while maintaining focus on the core needs of our membership through partnering with<br />

local organizations for educational and professional development,” he continued.<br />

“I also want to thank the Indiana Big I for your unwavering support of our organization, as<br />

we strive to build a better industry for now and generations to come,” concluded Davis.<br />

For more information on becoming a member of or supporting NAAIA, please go to their<br />

website at www.naaia.org.<br />

(l) Jerald L. Tillman, LUTCF, Founder of HAAIA and Henry Pippins

MADE FROM<br />

THE HIGHEST<br />

CALIBER<br />

Our Partners Are A<br />

Cut Above The Rest.<br />

Anderson <strong>Insurance</strong><br />

Associated Agencies (New Castle)<br />

Beatty <strong>Insurance</strong><br />

Beauchamp & McSpadden<br />

Bennett & Bennett <strong>Insurance</strong><br />

Berkey <strong>Insurance</strong> Agency<br />

Brown <strong>Insurance</strong> Group<br />

Callistus Smith Agency<br />

Harrington-Hoch <strong>Insurance</strong><br />

Hayes, Murphy, Sharp & Brackney <strong>Insurance</strong><br />

Holland <strong>Insurance</strong> Group<br />

Hummel <strong>Insurance</strong> Group<br />

Jackson-McCormick <strong>Insurance</strong> & Risk Mgmt<br />

Knapp Miller Brown <strong>Insurance</strong> Services<br />

Matchett & Ward <strong>Insurance</strong><br />

PARTNERING WITH KEYSTONE INSURERS<br />

GROUP MEANS PUTTING THE FIFTH<br />

LARGEST PRIVATELY HELD PROPERTY<br />

AND CASUALTY AGENCY IN THE NATION<br />

TO WORK FOR YOU. THE POWER OF<br />

KEYSTONE IS NOT ONLY EVIDENT BY OUR<br />

STRONG OFFERING, BUT ALSO BY THOSE<br />

INDEPENDENT AGENCIES REPRESENTING<br />

KEYSTONE INSURERS GROUP IN INDIANA:<br />

Bringing the Best Together<br />

IN INDIANA<br />

McGowan <strong>Insurance</strong> Group<br />

Miller Norcen <strong>Insurance</strong> Agency<br />

Morgan <strong>Insurance</strong> Group<br />

Morrow <strong>Insurance</strong> Agency<br />

PCE <strong>Insurance</strong> Group<br />

Pinnacle <strong>Insurance</strong> Group of Indiana<br />

RME <strong>Insurance</strong><br />

Ritchie <strong>Insurance</strong><br />

Rosemeyer Agency<br />

Schultheis <strong>Insurance</strong> Group<br />

Synergy <strong>Insurance</strong> Group<br />

Tanner & Servies <strong>Insurance</strong><br />

The DeHayes Group<br />

Walker & Associates<br />

Call Neal Williams at 866.440.2203<br />

nwilliams@keystoneinsurancegrp.com | www.keystoneinsurancegrp.com | Northumberland, PA<br />

©<strong>2013</strong> Keystone Insurers Group ®. All rights reserved. This does not constitute an offer to sell a franchise in any state in which the Keystone Insurers Group franchise is not registered.

CONTENTS<br />

A Monthly Publication for the Members of the<br />

<strong>Independent</strong> <strong>Insurance</strong> <strong>Agent</strong>s of Indiana<br />

The IIAI staff has direct phone extensions,<br />

which are listed below, when you dial into<br />

either of the association’s numbers:<br />

(800)438-4424 or (317)824-3780.<br />

NAME<br />

EXTENSION<br />

Suzie Dodds 206<br />

dodds@bigi.org<br />

Steve Duff, CAE 208<br />

duff@bigi.org<br />

Carol Dulle 216<br />

dulle@bigi.org<br />

Linda Gray 213<br />

gray@bigi.org<br />

Kelly Lonberger 214<br />

lonberger@bigi.org<br />

Gwendolyn Mason 210<br />

mason@bigi.org<br />

Ted Mast 209<br />

mast@bigi.org<br />

Tracey Moore 201<br />

tmoore@bigi.org<br />

Nicole Murrell 205<br />

murrell@bigi.org<br />

Jen Rochester 211<br />

rochester@bigi.org<br />

Steve Urban 201<br />

urban@bigi.org<br />

Carol Watson 203<br />

watson@bigi.org<br />

FOCUS is a monthly publication of the<br />

<strong>Independent</strong> <strong>Agent</strong>s Services Corp., a<br />

subsidiary of the <strong>Independent</strong> <strong>Agent</strong>s<br />

of Indiana, Inc.<br />

Publisher Steve Duff<br />

Editor Carol Le<strong>May</strong> Watson<br />

Printing, Layout & Design<br />

Elite Printing • 317-257-2744<br />

For advertising information, questions<br />

or comments please call:<br />

(317)824-3780 or (800)438-4424<br />

Fax: (317)824-3786<br />

www.bigi.org<br />

Email: bigiinfo@bigi.org<br />

Cover Story<br />

1 IIAI Hosts NAAIA Annual Meeting<br />

IIAI feature<br />

5 Have You Contributed to IPAC Yet?<br />

COmmercial LInes feature<br />

7 ISO’s Commercial General Liability Filing –<br />

Part Three – New Endorsements<br />

8 ISO Commercial Property Changes –<br />

Part 4 – New Endorsements<br />

property-Casualty Feature<br />

12 Study Reveals Growth in Property-Casualty<br />

<strong>Insurance</strong> Market<br />

property Casualty trends Feature<br />

15 NOAA Predicts Greater Flood Risk This Spring<br />

legislative feature<br />

16 Affordable Care Act Update: Fees, and Taxes, and<br />

Higher Health <strong>Insurance</strong> Premiums: Oh My!<br />

business income feature<br />

21 Business Income Coverage for NonProfits<br />

cap feature<br />

22 Agency 2020 to Provide Vision for Agency of the Future<br />

Agency Management feature<br />

23 Phenom or Fraud?<br />

forms & substance feature<br />

24 Delivery Exclusions, Landscapers and Valet Parking<br />

business Auto/Garagekeepers feature<br />

25 Care, Custody or Control and Separation of Insureds<br />

COmmercial LInes/CGL feature<br />

27 Why the BAP and CGL Should Be Written by the Same Insurer<br />

personal LInes feature<br />

27 The REAL Value of a Renter’s Policy (and EXPERT Advice)<br />

Big “I” Info/IIAI News<br />

4 Employee Profile<br />

4 YAC Promo<br />

18 2012 IIAI Sponsors<br />

19 Education Calendar<br />

19 In Memory<br />

32 Amerisafe Inc.<br />

31 Burns & Wilcox<br />

11 & 20 EMC <strong>Insurance</strong><br />

22 Geneva <strong>Insurance</strong> Co.<br />

13 HCC Public Risk<br />

27 IASC Premium Finance<br />

14 Indiana Farmers Mutual<br />

ADVERTISERS<br />

25 Indiana Municipal Ins.<br />

14 J.M. Wilson Corp.<br />

2 Keystone Insurers Group<br />

20 Pekin <strong>Insurance</strong><br />

26 Secura <strong>Insurance</strong><br />

6 Society <strong>Insurance</strong><br />

10 West Bend Mutual

IIAI News<br />

Who is our newest employee?<br />

You might recognize her.<br />

IIAI is proud to introduce Jen Rochester as our new Marketing<br />

Manager. Jen began her insurance career over a decade ago in her<br />

home state of Wisconsin and has been actively involved with IIAI since<br />

moving to Indiana six years ago.<br />

You might recognize her as a fixture of the Young<br />

<strong>Agent</strong>s Committee, a part of the IIAI convention<br />

committee and a regular presence at industry events<br />

throughout the year. Please join us in welcoming Jen!<br />

Jen Rochester<br />

rochester@bigi.org<br />

317.228.3029<br />

4 www.bigi.org

Have You Contributed to IPAC Yet?<br />

IIAI Feature<br />

Beginning with the April <strong>2013</strong> issue of<br />

Focus, the IIAI began publishing regular<br />

updates of contributors to our state<br />

political action committee, IPAC. You<br />

will note in the accompanying list, an<br />

additional six corporate and individuals<br />

contributed to IPAC during the past<br />

month (the new contributors are listed<br />

at the end of each list). To date, IIAI<br />

members have contributed $4,870 in<br />

personal and corporate contributions to<br />

IPAC. This is much appreciated and a<br />

good start to the year, but frankly, not<br />

enough. If you have not contributed, we<br />

need you to do so today!<br />

IPAC supports state legislative<br />

candidates who share the same beliefs<br />

and philosophies as our members,<br />

regardless of party. If you have not<br />

contributed to IPAC, the IIAI urges you<br />

and members of your staff to go to<br />

our website, www.bigi.org, print out a<br />

form and send it in. IPAC can receive<br />

corporate and/or personal contributions<br />

-- and no amount is too small. In fact, if<br />

we could get just $50 from each of our<br />

member agencies per year, we would<br />

have well in excess of $50,000 per two<br />

year election cycle to contribute. And,<br />

this figure is exclusive of personal<br />

contributions.<br />

The IIAI and our industry need your help<br />

-- contribute to IPAC today! And, make<br />

sure your name and/or agency’s name is<br />

on this list next month.<br />

<strong>2013</strong> IPAC Contributors<br />

(through April 11, <strong>2013</strong>)<br />

Corporate Contributors<br />

Dale State Agency Inc.<br />

Edward Matthews <strong>Insurance</strong> Assoc., LLC<br />

Hammond National Company<br />

Hoosier Associates, Inc.<br />

Howard <strong>Insurance</strong>, Inc<br />

<strong>Insurance</strong> Center<br />

Jackson-McCormick Ins & Risk<br />

Management<br />

James Allen Ins Brokers, LTD<br />

McGowan <strong>Insurance</strong> Group, Inc.<br />

Mettler Agency Inc.<br />

Pinnacle <strong>Insurance</strong> Group of Indiana, Inc.<br />

Poe & Associates, Inc.<br />

RMD Patti Ins. & Financial Svcs.<br />

Tatem & Associates<br />

New Corporate Contributors --<br />

March 20 through April 11<br />

Alexander <strong>Insurance</strong> Agency<br />

Haywood and Fleming Associates<br />

ISU <strong>Insurance</strong> & Investment Group<br />

Kervan <strong>Insurance</strong> Agency<br />

Individual Contributors<br />

Anderson, William A.<br />

Anderson <strong>Insurance</strong> & Wealth Mgmt Inc<br />

Anton, Jr., Michael R.<br />

Anton <strong>Insurance</strong> Agency, Inc.<br />

Duff, Stephen<br />

IIAI<br />

Dulle, Carol<br />

IIAI<br />

Easley, Gregory A.<br />

RMD Patti Ins. & Financial Svcs.<br />

Eovaldi, Debra<br />

Old National <strong>Insurance</strong><br />

Gard, Roxanne<br />

Rothschild Agency<br />

George, David W.<br />

George <strong>Insurance</strong> Group<br />

Gescheidler, Daniel<br />

Hammond National Company<br />

Hamstra, Brooke D.<br />

Wetzel <strong>Insurance</strong> Agency<br />

Jackson, S. Todd<br />

Jackson-McCormick Ins & Risk Mgmt<br />

McGovern, Thomas J.<br />

Old National <strong>Insurance</strong> - Mishawaka<br />

Patton, Barbara L.<br />

Anton <strong>Insurance</strong> Agency, Inc.<br />

Schoen, James<br />

Hoosier Associates, Inc.<br />

Schultheis, Kenan L.<br />

Schultheis <strong>Insurance</strong> Agency Inc.<br />

Sroufek, Kerry M.<br />

Anton <strong>Insurance</strong> Agency, Inc.<br />

Uber, Bonnie<br />

MJ <strong>Insurance</strong>, Inc.<br />

New Individual Contributors --<br />

March 20 through April 11<br />

Munoz, William<br />

Silcox <strong>Insurance</strong> Services<br />

Wolcott, Vickie<br />

M.J. Schuetz <strong>Insurance</strong> Services<br />

Indiana <strong>Agent</strong><br />

and Company<br />

Marketplace<br />

Mark your calendars<br />

now for THE event for<br />

independent insurance<br />

agents in Indiana!<br />

November<br />

4-6, <strong>2013</strong><br />

The Westin Hotel<br />

Downtown Indianapolis<br />

<strong>2013</strong><br />

Annual<br />

Convention<br />

For more information<br />

contact IIAI at<br />

(317) 824-3780 or go to<br />

www.bigi.org<br />

www.bigi.org<br />

5

Commercial Lines Feature<br />

© <strong>2013</strong> Society <strong>Insurance</strong><br />

No waiting period.<br />

Small detail. Big difference.<br />

Some insurance companies say your customer’s power has to be out for at least 72 hours before they’ll<br />

be reimbursed for loss of business. But we both know a business starts losing money the second it loses<br />

power. That’s why our coverage kicks in immediately. If you agree that details like these can make a big<br />

difference, give us a call at 888-5-SOCIETY or visit societyinsurance.com.<br />

6 www.bigi.org

Commercial Lines Feature<br />

ISO’s Commercial General Liability Filing –<br />

Part Three – New Endorsements<br />

by Christopher J. Boggs, CPCU, ARM, ALCM<br />

<strong>Insurance</strong> Services Office’s (ISO’s) four<br />

major filings in commercial property,<br />

business auto, businessowners<br />

coverage, and commercial general<br />

liability (CGL) make <strong>2013</strong> a big year for<br />

insurance professionals. These articles<br />

focus on the changes that begin taking<br />

effect this year in the commercial general<br />

liability forms and endorsements. (View<br />

Part One and Part Two)<br />

Newly Introduced Endorsements<br />

Primary and Noncontributory – Other<br />

<strong>Insurance</strong> Condition (CG 20 01).<br />

This is a new optional endorsement<br />

introduced in response to contractual<br />

wording found in many construction<br />

contracts requiring coverage extended<br />

to the additional insured be provided<br />

on a “primary and noncontributory”<br />

basis. This endorsement alters<br />

the Other <strong>Insurance</strong> Condition to<br />

specifically state that coverage<br />

provided to an additional insured<br />

is, in fact, provided on a “primary<br />

and noncontributory” basis. This<br />

endorsement applies when:<br />

• The additional insured is a named<br />

insured on another policy; AND<br />

• A written contract or agreement<br />

requires the named insured’s policy<br />

to be primary and to not seek<br />

contribution from other insurance<br />

available to the additional insured.<br />

The endorsement applies to the CGL<br />

only, not any umbrella that may be<br />

attached. Whether and how much of an<br />

www.bigi.org<br />

additional premium applies is subject to<br />

the insurance carrier.<br />

Editorial comment: ISO states that this<br />

does not impact coverage. I disagree.<br />

There will be a later article exploring<br />

the primary and noncontributory<br />

requirement.<br />

Additional Insured – Owners, Lessees<br />

or Contractors – Automatic Status<br />

for Other Parties When Required<br />

in Written Construction Agreement<br />

(CG 20 38). For use with the CGL, this<br />

endorsement allows additional insured<br />

status to be extended to an upper tier<br />

party as required by a contract, but who<br />

may not be a direct party to the contract.<br />

For instance, the contract between<br />

the general contractor and a lower-tier<br />

subcontractor may require the sub to<br />

extend additional insured-level coverage<br />

to the property owner (who is not a party<br />

to the contract between the GC and the<br />

sub). This endorsement would allow the<br />

extension of additional insured status<br />

to the owner without the need for a<br />

specific listing. An additional premium<br />

applies to this endorsement and varies<br />

by company.<br />

Total Pollution Exclusion for<br />

Designated Products or Work – CG<br />

21 99. Used with either of the Products/<br />

Completed Operations Coverage Parts<br />

(CG 00 37 or CG 00 38), ISO classifies<br />

this endorsement as an “additional<br />

underwriting tool” for insurance carriers.<br />

The endorsement does not replace the<br />

optional Total Pollution Exclusion – CG<br />

21 98, it can<br />

be used in<br />

place of the<br />

CG 21 98. The<br />

key difference<br />

between the CG<br />

21 98 and the<br />

new CG 21 99 is<br />

that the CG 21<br />

99 applies to a<br />

pollution event<br />

(as defined in<br />

the form) from a<br />

specific product<br />

or work making<br />

this exclusion<br />

narrower than<br />

the CG 21 98<br />

which applies<br />

to any and all<br />

pollution event (in effect giving broader<br />

coverage).<br />

Liquor Liability – Bring Your Own<br />

Alcohol Establishments – CG 24 06.<br />

In the first section of this article the<br />

revised CG 21 50 and CG 21 51 were<br />

introduced and discussed. ISO intends<br />

this new endorsement, CG 24 06, to be<br />

used as an attachment to the either of<br />

the Liquor Liability Coverage Forms (CG<br />

00 33 or CG 00 34) to specifically extend<br />

coverage to Bring Your Own (BYO)<br />

establishments. Remember, coverage<br />

for these types of establishments is now<br />

included in the base CGL wording.<br />

Amendment of Personal and<br />

Advertising Injury Definition – CG 24<br />

13. This endorsement removes coverage<br />

for “oral or written publication, in any<br />

manner, of material that violates a<br />

person’s right of privacy,” from the list<br />

of covered offenses in Coverage B –<br />

Personal and Advertising Injury (it does<br />

not affect Coverage A). ISO couches<br />

this as an additional underwriting tool.<br />

Violation of a person’s right of privacy<br />

may include, for example, the use of a<br />

picture or likeness without permission.<br />

This is a reduction in coverage when<br />

used by the underwriter.<br />

Designated Location(s) Aggregate<br />

Limit – CG 25 14. This endorsement is<br />

intended for use with the Liquor Liability<br />

Coverage Part (CG 00 33 or CG 00 34).<br />

The current Designated Location(s)<br />

General Aggregate Limit endorsement<br />

(CG 25 04) is used for and applicable<br />

to the CGL only. The purpose of this<br />

endorsement (just like the CG 25 04)<br />

is to allow the aggregate limit to apply<br />

separately to each location where liquor<br />

is served. However, losses that cannot<br />

be attributed to a specific location are<br />

subject to the general aggregate.<br />

As stated, a later article will address the<br />

“primary and noncontributory” requirement<br />

commonly found in construction contracts.<br />

Following that, we return to highlighting the<br />

various form and endorsement changes<br />

ISO has made to the commercial auto<br />

coverage and the BOP.<br />

Christopher Boggs is the director of<br />

education for the <strong>Insurance</strong> Journal<br />

Academy,<br />

7

Commercial Lines Feature<br />

ISO Commercial Property Changes –<br />

Part 4 – New Endorsements<br />

by Christopher J. Boggs, CPCU, ARM, ALCM<br />

The commercial property changes<br />

presented in ISO’s filing begin taking<br />

effect on April 1, <strong>2013</strong> (effective dates<br />

differ by state). This presentation of the<br />

filing is split into four parts; parts one<br />

and two discuss changes to various<br />

policy forms. Part’s three and four of this<br />

article introduce and discuss changes<br />

being made to various endorsements.<br />

Thirty-two endorsements are altered<br />

by or introduced in ISO’s upcoming<br />

commercial property filing. Some<br />

changes are made to assure the specific<br />

endorsement dovetails with changes in<br />

a coverage form (see previous articles);<br />

other endorsements alter coverage<br />

grants; and some are new (and very<br />

important).<br />

New Endorsements<br />

Deductibles by Location – CP 03 29.<br />

A new option introduced by ISO in this<br />

filing is the ability to have separate<br />

deductibles by location. Insured’s now<br />

have the option to specify deductibles<br />

by:<br />

• Site (for insureds with multiple<br />

locations); or<br />

• Building (for insureds with multiple<br />

buildings at one location or multiple<br />

buildings at multiple locations).<br />

Deductibles apply separately per location<br />

even if the damage was caused by one<br />

occurrence. The deductible could be the<br />

same for each location or it could vary.<br />

The available options are somewhat<br />

flexible.<br />

Specified Business Personal Property<br />

Temporarily Away from Premises – CP<br />

04 04. This new optional endorsement<br />

extends coverage to business personal<br />

property (BPP) temporarily away from the<br />

described premises. Two requirements<br />

must be met for this coverage extension<br />

to apply: 1) the BPP must be away<br />

from the premises as part of the daily<br />

business activities; and 2) the BPP<br />

must be in the care, custody or control<br />

of the insured or an employee of the<br />

insured. Laptops and other like BPP<br />

are the main focus of this endorsement.<br />

Coverage under this endorsement is<br />

activated by: 1) describing the BPP in the<br />

schedule (either by item or by category);<br />

and 2) entering a limit of coverage in<br />

the schedule. Other provisions of this<br />

endorsement include:<br />

• The endorsement does not cover BPP<br />

possessed by salespersons (except at<br />

a fair, trade show or exhibition);<br />

• Coverage is not extended to stock or<br />

other business products (except at a<br />

fair, trade show or exhibition);<br />

• Coverage is not extended to BPP<br />

in the care, custody or control of a<br />

common or contract carrier or a bailee<br />

for hire;<br />

• Theft from a motor vehicle is covered if<br />

specified evidences of theft exist;<br />

• The coverage territory specified in<br />

the underlying form applies to BPP<br />

covered by this endorsement; and<br />

• When there is an overlap in coverage<br />

with another section of the underlying<br />

policy, the insured can elect payment<br />

under whichever provision provides<br />

the greatest amount of coverage.<br />

Higher Limits – CP 04 08. This new<br />

endorsement allows the insured to<br />

increase limits for certain property by<br />

attachment of the endorsement in lieu<br />

of using the declarations to increase<br />

limits. Several coverage grants limited<br />

in the policy can be increased by noting<br />

such increase in the declaration; this<br />

new endorsement allows the insured<br />

to increase these limits by use of the<br />

endorsement rather than depending on<br />

a note/change in the declaration. This<br />

endorsement does NOT replace and<br />

shall not be used in place of specific<br />

limit-increasing endorsements (i.e. debris<br />

removal, newly acquired property, and<br />

others).<br />

Increase in Rebuilding Expense<br />

Following Disaster (Additional Expense<br />

Coverage on Annual Aggregate<br />

Basis) – CP 04 09. Finally, a commercial<br />

property endorsement addressing the<br />

increase in all building costs (materials,<br />

labor, etc.) following a communal<br />

disaster. This endorsement is triggered<br />

when all the following apply:<br />

• The event causing the covered loss<br />

either: 1) results in the declaration<br />

of a state of disaster by federal or<br />

state authorities; or 2) occurs in close<br />

temporal proximity to the event that<br />

resulted in the declaration;<br />

• Labor and/or building material costs<br />

increase as a result of the disaster<br />

causing the cost to repair or replace<br />

the insured building or structure to<br />

exceed the limit of insurance;<br />

• The insured actually repairs or<br />

replaces the building; and<br />

• During the policy term, the insured<br />

notifies the insurance carrier within 30<br />

days of any improvements, alterations<br />

or additions to the building which<br />

increases the replacement cost by 5%<br />

or more (allowing the insurance carrier<br />

to adjust the limit).<br />

Key features of this new coverage<br />

include:<br />

• To be protected by this endorsement,<br />

the building must be scheduled on the<br />

endorsement;<br />

• The maximum amount of additional<br />

coverage is determined by applying<br />

a specific percentage to the limit of<br />

insurance for specific insurance or to<br />

the value of the building (adjusted for<br />

coinsurance) when insurance is written<br />

on a blanket basis. If the damage is<br />

caused by a peril with a sub-limit, the<br />

percentage is applied to the sub-limit;<br />

• The additional coverage is reduced<br />

proportionally if the property is<br />

underinsured;<br />

• A portion of the endorsement’s limit<br />

can be used to cover debris removal;<br />

• If ordinance or law coverage (CP 04<br />

05) is included in the underlying policy,<br />

a portion of this additional coverage<br />

can be applied towards the increased<br />

cost of compliance (Coverage Part C);<br />

• A separate amount of coverage applies<br />

to newly acquired or constructed<br />

buildings based on the highest<br />

percentage listed in the schedule;<br />

• The coverage limit is an annual<br />

aggregate limit; and<br />

• Any expenses payable under this<br />

endorsement are reduced by expenses<br />

covered under any business income<br />

8 www.bigi.org

ISO Commercial Property Changes – Part 4 – New Endorsements...continued from page 8<br />

Commercial Lines Feature<br />

or extra expense coverage form that is<br />

part of the policy.<br />

Exclusion of Loss Due to By-<br />

Products of Production or Processing<br />

Operations (Rental Properties) –<br />

CP 10 34. This new endorsement is<br />

to be attached to policies issued to<br />

owners and tenants of rental premises.<br />

Property damage caused by the tenant’s<br />

business operation is excluded by<br />

this endorsement; essentially, this is a<br />

business risk exclusion. ISO’s restaurant<br />

example follows: Damage caused<br />

by the long-term presence of grease<br />

released by the tenant restaurant’s<br />

cooking operations as the presence and<br />

“distribution” of grease is a part of the<br />

business operations and is not accidental<br />

and unexpected and is thus excluded<br />

from coverage. According to ISO, the<br />

endorsement’s genesis is a Washington<br />

State Court of Appeals finding: Graff v.<br />

Allstate <strong>Insurance</strong> Company. The case<br />

involved a methamphetamine lab and<br />

the damage the “cooking” caused the<br />

rental property over a period of time.<br />

The insurer denied the claim, the court<br />

disagreed. This new endorsement acts to<br />

exclude all such damage caused by the<br />

“by-products” of the tenant’s operations.<br />

Again, it is attached to both the tenant’s<br />

and the landlord’s policy so that neither<br />

can be called upon to pay for the<br />

“expected” damage.<br />

Limitations on Coverage for Roof<br />

Surfacing – CP 10 36. This new<br />

coverage option allows insurance<br />

carriers to limit the valuation on “roof<br />

surfacing” to actual cash value (ACV),<br />

even when the remainder of the building<br />

applies replacement cost as the valuation<br />

method. Additionally, the endorsement<br />

excludes “cosmetic” damage to the “roof<br />

surfacing” caused by wind and/or hail.<br />

• “Roof surfacing” means: shingles,<br />

tiles, cladding, metal or synthetic<br />

sheeting or similar materials covering<br />

the roof. The definition includes all<br />

materials used to secure the roof<br />

surface and all materials applied to<br />

or under the roof surface for moisture<br />

protection (this includes roof flashing).<br />

• “Cosmetic” means: marring, pitting<br />

or other superficial damage that alters<br />

the appearance of the roof surface<br />

but does not prevent the roof from<br />

functioning normally.<br />

Discharge from Sewer, Drain or Sump<br />

(Not Flood-Related) – CP 10 38. This<br />

newly available endorsement provides<br />

coverage for damage and business-shut<br />

down loss (business income loss) caused<br />

by the discharge of a sewer, drain or<br />

sump. Key features of this endorsement<br />

include:<br />

• Coverage is provided for physical<br />

damage to covered property<br />

caused by the discharge of water or<br />

waterborne material from a sewer,<br />

drain or sump ON the described<br />

premises.<br />

• If the insured carries any time element<br />

coverage (business income and/<br />

or extra expense), this endorsement<br />

adds the discharge from sewer, drain<br />

or sump on the described premises to<br />

the list of covered causes of loss.<br />

• The limits for this new cause of<br />

loss are sub-limits indicated in the<br />

endorsement. Separate sub-limits can<br />

be chosen for direct physical damage<br />

and time element coverage. The<br />

insured also has the option to use the<br />

total of the sub-limits as the annual<br />

aggregate limit.<br />

• The endorsement does not extend<br />

coverage to the discharge from a<br />

sewer, drain or sump caused by<br />

flood (these are included in the newly<br />

worded flood endorsement CP 10 65).<br />

• There is no coverage if the sump pump<br />

failure is caused by a power failure,<br />

unless the policy is endorsed to cover<br />

power failure.<br />

• No coverage is provided if the<br />

discharge results from the insured’s<br />

failure to properly maintain or repair<br />

the equipment.<br />

• The endorsement does not cover<br />

the cost to repair the sewer, drain<br />

or sump; only the cost to repair the<br />

damage caused by the release (or the<br />

income lost) up to the chosen sublimits.<br />

Theft of Building Materials and<br />

Supplies (Other than Builders Risk)<br />

– CP 10 44. This new cause-of-loss<br />

endorsement introduced by ISO allows<br />

the insured to extend theft coverage<br />

to building materials or supplies on<br />

or within 100 feet of the premises.<br />

The endorsement applies when these<br />

materials are intended to become a<br />

permanent part of the covered building<br />

or structure. It can be used only when<br />

the Cause of Loss – Special Form (CP 10<br />

30) is used without a theft exclusion. The<br />

endorsement is not intended to be used<br />

with the builders risk forms.<br />

Equipment Breakdown Cause of Loss<br />

– CP 10 46. ISO’s new coverage option/<br />

cause of loss – equipment breakdown<br />

is available only when the insured is<br />

protected by the special cause of loss<br />

form. Equipment breakdown becomes<br />

an additional covered peril when this<br />

endorsement is attached. Provisions<br />

found in this endorsement include:<br />

• “Breakdown” means: Failure of<br />

pressure or vacuum equipment;<br />

mechanical failure (which includes<br />

rupture or bursting caused by<br />

centrifugal force; or electrical failure<br />

including arcing; (the definition is<br />

subject to limitations));<br />

• “Covered equipment” means:<br />

Equipment built to operate under<br />

internal pressure or vacuum;<br />

electrical or mechanical equipment<br />

used to generate, transmit or use<br />

energy; communication equipment;<br />

and computer equipment (this is<br />

programmable electronic equipment<br />

used to store, retrieve and process<br />

data and associated equipment<br />

providing communication input and<br />

output functions). (There are limitations<br />

that apply.);<br />

• Coverage for direct damage is subject<br />

to the limit of insurance applicable to<br />

the equipment;<br />

• The covered equipment is considered<br />

part of “covered property;”<br />

• When business income or extra<br />

expense coverage is included,<br />

the loss is limited to time element<br />

limit of coverage in the form; this<br />

endorsement does not offer any<br />

additional coverage;<br />

• Coverage for ammonia contamination<br />

and hazardous substance is limited<br />

to the lesser of: 10% of the limit or<br />

$25,000; and<br />

• The insurer has the option to suspend<br />

coverage.<br />

When this endorsement is used, the<br />

equipment breakdown coverage is<br />

subject to the same coverage terms,<br />

conditions and limitations applicable to<br />

every other covered cause of loss.<br />

continued on page 11 ...<br />

www.bigi.org<br />

9

Commercial Feature<br />

Your customers deserve a<br />

Silver Lining. ®<br />

When something happens to your customer’s home, car, or business, it<br />

may not be a disaster. But no matter what it is, your customers always<br />

deserve fast and fair service from their insurance company.<br />

West Bend provides a Silver Lining, no matter what the claim may<br />

be. When the scoreboard at the Panther’s little league field was<br />

struck by lightning, it was important to get it fixed in time for the<br />

championship game. So that’s just what we did.<br />

Sometimes little things mean a lot. And every day, when something<br />

bad happens to someone, West Bend makes sure your customers<br />

experience the Silver Lining. Because the worst brings out our best.®<br />

10 www.bigi.org

ISO Commercial Property Changes – Part 4 – New Endorsements...continued from page 9<br />

Commercial Lines Feature<br />

Suspension or Reinstatement<br />

of Coverage for Loss Caused by<br />

Breakdown of Certain Equipment – CP<br />

10 47. In concert with the CP 10 46,<br />

ISO introduces the CP 10 47 to allow<br />

the insurance carrier to suspend and/or<br />

reinstate equipment breakdown coverage<br />

as per the conditions found in the CP 10<br />

46 endorsement.<br />

Food Contamination (Business<br />

Interruption and Extra Expense) –<br />

CP 15 05. Business income and extra<br />

expense losses resulting solely from food<br />

contamination have been excluded in<br />

the past; but ISO now gives insureds the<br />

option to purchase coverage to protect<br />

against business income and/or extra<br />

expense losses resulting from such food<br />

contamination. This is an important new<br />

coverage option. Key provisions of this<br />

endorsement include:<br />

• Coverage is triggered when: 1) the<br />

insured is ordered closed by the<br />

applicable governmental authority (i.e.<br />

the board of health); and 2) the closure<br />

is the result of the discovery of or<br />

suspicion of “food contamination.”<br />

• “Food contamination” means: An<br />

outbreak of food poisoning or foodrelated<br />

illness arising out of: 1) tainted<br />

food distributed or purchased by the<br />

insured; 2) food improperly processed,<br />

stored, handled or prepared by the<br />

insured; or 3) food contaminated by<br />

virus or bacteria transmitted by one or<br />

more employees of the insured.<br />

• The policy pays: 1) the insured’s<br />

expense to clean equipment (as<br />

required by the governmental<br />

authority); 2) the cost to replace<br />

food actually or suspected to<br />

be contaminated; 3) the costs<br />

of employee medical tests and<br />

vaccinations (this does not pay<br />

what would be paid by workers’<br />

compensation; 4) the loss of business<br />

income beginning 24 hours after the<br />

insured receives the notice of closure;<br />

and 5) additional advertising expenses<br />

incurred to restore the insured’s<br />

reputation.<br />

• A specific limit is chosen and entered<br />

into the endorsement. This limit is an<br />

annual aggregate limit. A separate limit<br />

is required for advertising expense if<br />

the coverage is desired.<br />

• The policy does not cover the costs<br />

of fines or penalties imposed by<br />

the regulatory authority (these are<br />

business risk expenses).<br />

Editorial Changes<br />

Four other endorsements receive<br />

updating or editorial changes in the<br />

upcoming filing, but none of these<br />

alterations result in any coverage<br />

change. These endorsements include:<br />

• Increased Cost of Loss and Related<br />

Expenses for Green Upgrades (CP 04<br />

02);<br />

• Windstorm or Hail Percentage<br />

Deductible – CP 03 21;<br />

• Vacancy Changes – CP 04 60; and<br />

• Loss Payable Provisions – CP 12 18.<br />

Christopher Boggs is the director of<br />

education for the <strong>Insurance</strong> Journal<br />

Academy<br />

Cross-Sell Strategy #21<br />

EPLI COVERAGE<br />

“ Addressing the growing<br />

concerns of clients can<br />

grow your business.”<br />

Paula Hutchinson, Kansas City Branch<br />

Senior Marketing Representative<br />

Employee lawsuits are more likely to occur than a<br />

fire. Include EMC’s Employment Practices Liability<br />

coverage to make certain your clients are protected<br />

from all the risks they may face. It’s just one of the<br />

many reasons policyholders Count on EMC ® .<br />

Cincinnati Branch: 800.732.5595 | Home Office: Des Moines, IA<br />

www.emcins.com<br />

© Copyright Employers Mutual Casualty Company <strong>2013</strong>. All rights reserved.<br />

www.bigi.org<br />

11

Property-Casualty Feature<br />

STUDY REVEALS GROWTH IN<br />

PROPERTY-CASUALTY INSURANCE MARKET<br />

<strong>Independent</strong> insurance agents outperformed captive agency carriers in several areas.<br />

The <strong>Independent</strong> <strong>Insurance</strong> <strong>Agent</strong>s & Brokers of America<br />

(IIABA or the Big “I”) has released the results of the <strong>2013</strong><br />

Market Share Study (based on 2011 data) which reveal<br />

that after years of market contraction, all property-casualty<br />

insurance premium lines grew. The study also showed that<br />

independent agents and brokers (collectively “IAs”) were well<br />

positioned to capture a substantial piece of the market going<br />

forward.<br />

This is the 17th year the Big “I” has contracted with A.M. Best<br />

Company to supply it with year-end industry market share and<br />

company expense data. The Big “I” analyzes this data annually<br />

to assess the state of the independent agency system.<br />

“The Big ‘I’ is pleased to announce that, despite the market<br />

fluctuations and challenges of recent years, the independent<br />

insurance agency system remains stable, strong and growing,”<br />

says Bob Rusbuldt, Big “I” president and CEO. “Many carriers<br />

that weathered the storm of market contractions for several<br />

years were able to successfully bounce back.”<br />

The market share study revealed that many regional and<br />

national IA carriers expanded their market shares by<br />

impressive double digits and that overall IA shares grew in<br />

several states. More good news also showed that regional IAs<br />

outpaced market growth in many business lines across the<br />

country.<br />

“This annual study provides the most accurate picture of what<br />

is occurring with property casualty insurance distribution<br />

because it separates out the direct response companies from<br />

the captive agency companies,” notes Madelyn Flannagan,<br />

Big ‘I” vice president of agent development, education and<br />

research. “Unique to the Big ‘I’ study, A.M. Best separates out<br />

the affiliates of groups which use different distribution systems<br />

and places these affiliates in the appropriate distribution<br />

category wherever the company group uses separate affiliates<br />

for this purpose.”<br />

Other findings from the Market Share Study include:<br />

• IAs outperformed captive agencies carriers in personal<br />

lines and grew premiums by nearly the same amount<br />

as direct response carriers largely due to impressive<br />

performance in homeowners, where IAs outperformed the<br />

captive agencies;<br />

• IA carriers also benefited greatly by a huge surge in<br />

commercial premiums, which climbed by 5% in 2011. IA<br />

carriers also captured $8.4 billion in additional premiums<br />

in 2011, which represents 74% of the entire $11.4 billion<br />

growth in that market.<br />

• IAs still control a majority of the entire p‐c market,<br />

writing 57% of all premiums, including a third of all<br />

personal premiums.<br />

• IAs still dominate commercial insurance sales, which<br />

resurged in 2011, growing $11 billion or 5% more than 2010.<br />

• IAs grew premiums and/or market share in several states<br />

and IA share remains strong in many states overall. In many<br />

states, IAs dominate both personal and commercial lines.<br />

• IAs are as efficient as other models. While IAs as a group<br />

may have higher efficiency ratios compared with captive<br />

and direct 2011 writers, Private-Passenger there are several Auto IA carriers with personal<br />

auto efficiency Direct Premium ratios that % Share rival % these Premium challengers. Growth As noted<br />

Written<br />

2010 to 2011<br />

in past reports, this proves that management, not the model<br />

National itself, is the key $11.3 driver. B 6.7% ‐2.7%<br />

Regional $44.4B 26.3% 1.2%<br />

• Exclusive Many Big “I” Best $81.8 Practices B 48.4% firms continued 0.3% to grow in<br />

Direct $29.3B 17.4% 7.5%<br />

the face of recent weak markets and are doing well now that<br />

TOTAL $169.0B 100% 1.6%<br />

the p‐c market appears to have turned around. Agencies<br />

that are easy to do business with, use improved access to<br />

technology and leverage the confidence and customization<br />

The overall p‐c market rebounded strongly in 2011, growing far faster than the o<br />

communicated through the Trusted Choice® brand have<br />

economy. Total p‐c premiums grew by $17.4 billion, or 3.7%, in 2011 over 2010<br />

the potential to enjoy robust growth in every state and every<br />

and independent agency companies and agents captured their fair share of this<br />

product line.<br />

maintaining control over nearly 57% of the total p‐c market in 2011. Independen<br />

It<br />

wrote<br />

is helpful<br />

$10.5 billion<br />

to look<br />

more<br />

at a<br />

in<br />

couple<br />

total premiums<br />

of specific<br />

in 2011<br />

lines/areas<br />

than they<br />

to<br />

did<br />

see<br />

in 2010.<br />

how the IA market is performing. The chart below shows the<br />

overall Regional share independent of property/casualty agency companies production grew premiums in 2011. the Total most, increasing<br />

property production and by $6.4 casualty billion premiums over 2010 grew levels, by and $17.4 national billion, IA companies or increased<br />

3.7 premiums percent by in $4.1 2011 billion. over (Note 2010 that levels. 2010 <strong>Independent</strong> data shown in this agency report reflects data<br />

companies has adjusted and relative agents to the maintained data shown control in last year's over nearly report and 57 may not match<br />

percent published of last the year.) total property and casualty market in 2011,<br />

writing $10.5 billion more in total premiums in 2011. While<br />

direct Direct response carriers grew were premiums able to by grow $2.4 their billion, premiums, which is an the impressive 7<br />

channel increase over still controls 2010, but only the channel slightly still more controls than only 7 percent slightly of more the than 7% of t<br />

total market. market. While exclusive agents wrote $3.0 billion more in 2011, it was not enou<br />

prevent their market share from slipping a fraction of a percentage point.<br />

Exclusive<br />

<strong>Agent</strong> Direct<br />

Writers<br />

34%<br />

Overall Share of P‐C Production<br />

2011<br />

Direct<br />

Response<br />

Writers<br />

7%<br />

Regional<br />

Agency<br />

Writers<br />

29%<br />

National<br />

Agency<br />

Writers<br />

28%<br />

Copyright © <strong>2013</strong> <strong>Independent</strong> <strong>Insurance</strong> <strong>Agent</strong>s & Brokers of America, Inc. All rights reserved.<br />

All data in this report is the property of A.M. Best and is reprinted with its permission.<br />

12 www.bigi.org

market they controlled in 1995.<br />

Exclusive $43.8B 18.3% 4.1%<br />

Direct $2.1B 0.9% 4.4%<br />

Regional IA carriers have increased 8.1 percentage points since 1995, increasing TOTAL $239.4B 100% 5.0%<br />

2 to3 percentage points every five years.<br />

Property-Casualty Feature<br />

Direct‐response writers are steadily increasing share, up 6.5 points since 1995 to National independent agency premiums grew by $4.1 billion, to close at $111.6 bill<br />

STUDY now account REVEALS for 13.6%. While GROWTH continuing to trail IN regional PROPERTY-CASUALTY IA carriers and captive Regional IA<br />

INSURANCE<br />

carriers wrote $ 4.3<br />

MARKET...continued<br />

billion more, despite their smaller<br />

from page<br />

market<br />

12<br />

size, clos<br />

carriers considerably, direct response leads over national IA carriers by 4.2 total of $76.1 billion in premiums in 2011. Exclusive agency writers booked $1.7 bil<br />

The percentage chart below points. illustrates a 17 year study of personal lines captured more than more in 2010, than for their a total previous of $43.8 billion. share Even of this direct growth, response, slightly which controls<br />

market share. Exclusive agency carriers/agents have seen improving than 1% of their market, market grew share. premiums, However, albeit no by a channel relatively gained small $88 or million.<br />

their National market IA carriers share have dip lost below almost 506 percent. percentage In points addition, of market regional share since lost more than one percentage ppoint of share, and IA carriers<br />

IA 1995, carriers now accounting have seen for their only 9.4% market of the share market. continuously This translates grow to almost to a still continue to control 78 percent of the market.<br />

26.3 40% decrease percent in of national the market IA share in during 2011. that period.<br />

59.4%<br />

18.2%<br />

15.3%<br />

17‐Year View of Personal Lines Share<br />

National IA Regional IA Exclusive Agency Direct Response<br />

7.1% 8.5%<br />

54.8% 53.0%<br />

50.0% 49.3%<br />

21.8% 23.3%<br />

26.1% 26.3%<br />

15.0% 12.7% 12.9%<br />

13.6%<br />

11.1% 9.6% 9.4%<br />

1995 2000 2005 2010 2011<br />

$250<br />

$200<br />

$150<br />

$100<br />

$50<br />

$0<br />

2.0<br />

42.1<br />

Commercial Lines in Billions<br />

2.1<br />

43.8<br />

107.5 111.6<br />

71.7 76.1<br />

2010 2011<br />

Direct Response Writers<br />

Exclusive <strong>Agent</strong> Direct<br />

Writers<br />

Regional Agency Writers<br />

National Agency Writers<br />

In the commercial lines arena, after three consecutive years<br />

Copyright of contraction, © <strong>2013</strong> <strong>Independent</strong> commercial <strong>Insurance</strong> <strong>Agent</strong>s lines & Brokers grew of by America, 5 percent Inc. All rights in 2011, reserved.<br />

increasing All data this by report $11.4 is the billion property of to A.M. a Best total and of is reprinted $239.4 with billion. its permission. All<br />

channels saw premium growth, but regional agency writers<br />

All of the data in the Big “I” report come from A.M. Best and<br />

is printed with its permission. More information on the study is<br />

available by request or online at: www.independentagent.com/<br />

Resources/Research/MarketShareReport.<br />

Copyright © <strong>2013</strong> <strong>Independent</strong> <strong>Insurance</strong> <strong>Agent</strong>s & Brokers of America, Inc. All rights reserved.<br />

All data in this report is the property of A.M. Best and is reprinted with its permission.<br />

The government agencies and organizations that protect the public<br />

take on enormous risks every day. HCC Public Risk has their backs.<br />

We have over 30 years of experience, the products and the financial<br />

stability you need to get the job done with confidence. What we know<br />

and how we work makes a critical difference. We call it mind over risk.<br />

For more information or to obtain a bid on property and liability coverage,<br />

contact us today at 800.748.0554 or info@bfgroup.com.<br />

HCC Public Risk<br />

hcc.com<br />

HCC Public Risk is a division of Professional Indemnity Agency, Inc., a subsidiary of HCC <strong>Insurance</strong> Holdings, Inc.<br />

HCC_PR_0128_230PM_clr.indd 1<br />

www.bigi.org<br />

2/10/11 12:04 PM<br />

13

Personal Lines Feature<br />

First State <strong>Insurance</strong> Agency<br />

Indiana Farmers Mutual’s <strong>2013</strong> Agency of the Year<br />

A class act with a proven track record of success.<br />

Your choice. Our commitment.<br />

COMMITMENT<br />

A PROMISE WE DON’T TAKE LIGHTLY<br />

“When it comes to my hockey team, I’m loyal to a fault. That same<br />

commitment and loyalty applies to serving our agents. My team takes<br />

pride in being a valuable niche for hard to place personal lines.<br />

Stacey Nelson, CISR<br />

Personal Lines & Garage Manager—and valuable team player<br />

Connect with Stacey on LinkedIn!<br />

Managing General Agency Since 1920<br />

Property/Casualty • Professional Liability • Surety<br />

Commercial Transportation • Personal Lines • Premium Finance<br />

800.666.5692 jmwilson.com<br />

14 www.bigi.org

Property Casualty Trends Feature<br />

NOAA Predicts Greater Flood Risk This Spring<br />

The next three months are expected to be a mix of flooding, drought and warm temperatures nationwide.<br />

River flooding is expected to be worse this<br />

spring compared to last year, the National<br />

Oceanic and Atmospheric Administration<br />

says in its three-month flood outlook<br />

released today.<br />

North Dakota has the greatest risk of<br />

flooding, says NOAA, whose outlook<br />

covers April to June and comes during its<br />

Flood Safety Awareness Week.<br />

North Dakota ranked as the eighthhighest<br />

state for National Flood <strong>Insurance</strong><br />

Program claims at 1,532 in 2011, the latest<br />

year for which data is available, according<br />

to the NFIP. That year, it also had the fifthgreatest<br />

number of NFIP claim payouts at<br />

$93.1 million.<br />

Homeowners insurance policies typically<br />

exclude flood protection. With a 30-day<br />

waiting period for flood policies to take<br />

effect, now is the time for individuals<br />

and businesses to review their insurance<br />

coverage, says Karen Marsh, deputy<br />

director of the individual and community<br />

preparedness division for the Federal<br />

Emergency Management Agency.<br />

Moderate-to-Major Flooding<br />

NOAA predicts moderate and major<br />

flooding for the Red River of the North<br />

between eastern North Dakota and<br />

northwest Minnesota, as well as the Souris<br />

River in North Dakota. In addition, 20,000<br />

acres of farms and roads are at risk for<br />

flooding in northeast North Dakota, where<br />

there is a 50% chance that the Devils and<br />

Stumps lakes will rise 2 feet.<br />

Minor-to-Moderate Flooding<br />

In addition, this year’s late-winter snowfall<br />

may cause minor to moderate flooding<br />

in the upper Mississippi River basin and<br />

upper Missouri River basin, depending<br />

on rainfall and the speed of snowmelt,<br />

NOAA says. The upper Mississippi River<br />

basin covers southern Wisconsin, northern<br />

Illinois and northern Missouri; and the<br />

upper Missouri River basin, includes the<br />

Milk River in eastern Montana, the Big<br />

Sioux River in South Dakota and the Little<br />

Sioux River in Iowa.<br />

Parts of several other states in the<br />

Southeast and along the lower Mississippi,<br />

middle Mississippi, lower Missouri and<br />

Ohio river basins may experience minor<br />

flooding this year, NOAA says. They are:<br />

• Arkansas<br />

• Alabama<br />

• Georgia<br />

• Illinois<br />

• Indiana<br />

• Eastern Iowa<br />

• Kansas<br />

• Kentucky<br />

• Louisiana<br />

• Mississippi<br />

• Missouri<br />

• Ohio<br />

• Tennessee<br />

Temperatures and Precipitation<br />

Most areas of the country are expected<br />

to have warmer temperatures than usual,<br />

while cooler temperatures are anticipated<br />

for the Pacific Northwest and extreme<br />

northern Great Plains, according to NOAA.<br />

In addition, rainier conditions are likely<br />

in the Great Lakes and Ohio Valley area,<br />

while drier-than-normal conditions are<br />

expected for parts of the West, Rockies,<br />

Southwest, Texas, Gulf Coast and Florida,<br />

NOAA says.<br />

Drought<br />

Despite flood risks for many U.S. areas,<br />

51% of the continental United States—<br />

comprised largely of central and western<br />

regions—is in a moderate-to-worse<br />

drought, according to NOAA.<br />

Ed O’Lenic, chief of the operations branch<br />

for NOAA’s Climate Prediction Center,<br />

notes that the continuation of last year’s<br />

drought in several areas is due, in part, to<br />

previous conditions.<br />

“The drought that we accumulated over the<br />

last five or six years in the middle part of the<br />

country and also the Southwest is going to<br />

take a long time to remove,” he says.<br />

In addition, NOAA says the Florida<br />

panhandle and areas of Texas, California,<br />

the southern Rockies and Southwest<br />

are at risk of developing new drought<br />

conditions.<br />

But NOAA also expects drought<br />

conditions to improve—though not be<br />

eliminated—in several areas, including<br />

parts of northern Alaska, the Carolinas,<br />

Georgia, the northern and central Great<br />

Plains, and the Midwest.<br />

Victoria Goff is IA online editor.<br />

www.bigi.org<br />

15

Legislative Feature<br />

Affordable Care Act Update<br />

Fees, and Taxes, and Higher Health <strong>Insurance</strong> Premiums: Oh My!<br />

By Jerry Rhinehart, CIC, CLU, ChFC, RHU, Panama City, FL<br />

January 1, 2014 is the first day for the<br />

major implementations of the Affordable<br />

Care Act (ACA). This law, dealing primarily<br />

with national health care reform, will affect<br />

millions of U.S. citizens, legal immigrants,<br />

and any business that has 50 or more<br />

full-time employees. Many look forward<br />

to this law’s full enactment; many do not.<br />

Whatever your views, it is important to<br />

understand how the law will impact you,<br />

your family, and virtually every business in<br />

this country. One key fact to understand:<br />

when a business is discussed in the context<br />

of the ACA, it means any and all employers.<br />

Some examples include the large privately<br />

owned manufacturing plant in your town,<br />

the small family-owned restaurant you visit<br />

periodically, the publicly-traded national<br />

technology company in which you own<br />

stock, the non-profit hospital in your town,<br />

your local school district, your church, your<br />

state government, etc.<br />

An important term to be aware of and how<br />

it works as it relates to the ACA is “Federal<br />

Poverty Level” (FPL). In 2014, the ACA<br />

definition and qualification rules concerning<br />

FPL will affect millions of individuals,<br />

families, and businesses. Here is how it<br />

works. If an individual’s (or family’s) income<br />

is below 400% of FPL in 2014, they will<br />

be eligible for a premium subsidy for the<br />

mandated Qualified Health Plan (QHP). In<br />

<strong>2013</strong>, the annual income threshold at 400%<br />

FPL is:<br />

• $94,200 for a family of four,<br />

• $62,040 for a family of two, and<br />

• $45,960 for a single individual.<br />

The income thresholds are indexed to increase<br />

each year. The more an individual’s (or family’s)<br />

income falls below 400% FPL, the larger the<br />

potential premium subsidy. If the income<br />

is above 400% FPL, there is no chance of<br />

a premium subsidy. Subsidies can only be<br />

received through the Exchange (now referred<br />

to as the Marketplace). The Congressional<br />

Budget Office estimated in <strong>May</strong> of 2010 that<br />

the average annual premium subsidy would be<br />

$3,970 in 2014. They have recently revised that<br />

number to be $5,510.<br />

Starting in 2014, the ACA states you must<br />

purchase a QHP. If an individual chooses not<br />

to purchase an approved plan, they will be<br />

subject to a penalty (minor exceptions exist).<br />

Here is how the penalty works. In 2014, the<br />

penalty (actually referred to as a “shared<br />

responsibility payment” in the ACA) for an<br />

individual would be the greater of $95 for<br />

the entire year or 1% of the gross income.<br />

As an example, for a person that has a gross<br />

annual income of $50,000, the penalty would<br />

the greater of $95 or $500. Remember this<br />

is an annual penalty. The premium for this<br />

individual’s QHP may be $500 per month for<br />

this same individual! The dollar amount of the<br />

penalty and the percentage is scheduled to<br />

increase in subsequent years. Complex rules<br />

concerning the penalty calculations for families<br />

with minor children dependents also apply.<br />

As an example, what about an individual (or<br />

family) whose income is below 133% FPL<br />

in 2014? For the family of four, that income<br />

level is $31,322. For the family of two it is<br />

$20,628, and it is $15,282 for an individual.<br />

They will qualify to be on Medicaid. This<br />

will be their QHP. There will be minor<br />

payments (premiums and out-of-pockets).<br />

One interesting item to keep in mind under<br />

this Medicaid/ACA rule: Income is the only<br />

determining qualification for Medicaid under<br />

this provision; assets are not counted. Both<br />

income and assets are examined when one<br />

tries to qualify for Medicaid as it relates to a<br />

stay in a Skilled Nursing Facility.<br />

How does the ACA impact an employer?<br />

There is no chance of a penalty to any<br />

employer that has less than 50 full-time<br />

employees (FTE) for the entire calendar year.<br />

A FTE is one that works 30 hours or more in<br />

a week. An employer with 50 or more FTEs<br />

(referred to as a large employer) probably<br />

needs to be concerned. First, what is the rule<br />

for a large employer that does not provide<br />

a QHP to its employees in 2014? If any<br />

FTE receives a federal subsidy through the<br />

Marketplace for their QHP (see the 400%<br />

FPL rule above), the employer will have<br />

an annual penalty of $2,000 for all FTEs.<br />

However, the employer gets to deduct 30<br />

FTEs from this calculation. The penalty is<br />

pro-rated monthly.<br />

Here is an example: ABC, Inc. has 65 FTEs<br />

for all of 2014 and does not provide a QHP.<br />

At least one FTE receives a subsidy for the<br />

entire 12 months. ABC will have an annual,<br />

non-deductible penalty of $70,000 (65 - 30 =<br />

35 x $2,000 =$70,000).<br />

How about an employer that has a<br />

substantial number of part-time employees?<br />

Well, the ACA has a complicated<br />

“measurement” formula that will require<br />

the employer to calculate the employment<br />

hours of all part-time employees. Consider<br />

this: at first glance an employer that has<br />

40 FTEs would not be thought of as a<br />

“large employer” under the ACA. However,<br />

assume the same employer has 20 (or so<br />

part-time) employees. After the required<br />

“measurement” the part-time employee’s<br />

hours may very well push this employer into<br />

“large employer” status. Any and all parttime<br />

employees that receive a subsidy will<br />

have NO penalty impact on their employer.<br />

Only FTEs receiving a subsidy cause penalty<br />

concerns to the employer. And, as stated<br />

earlier, any penalty to a large employer<br />

that does NOT provide coverage, is only<br />

calculated on the full time employee count<br />

exceeding 30.<br />

What if the large employer does provide a<br />

QHP for the entire 12 months in 2014? Well,<br />

the employer might still have a penalty. The<br />

rule is very complex, but basically provides<br />

that a FTE would be eligible for a subsidy if:<br />

1) They are under the 400% FPL rule, and;<br />

2) The employer’s provided coverage is<br />

not broad enough. For example, the<br />

insurance may not pay at least 60% of<br />

covered health care expenses for the<br />

typical population, or;<br />

3) The cost of employee’s required<br />

premium for the QHP is deemed to be<br />

“unaffordable”.<br />

What is “unaffordable”? If the employee’s<br />

portion of the “self-only” coverage exceeds<br />

9.5% of “household income”, then it is<br />

“unaffordable” as per the ACA. Should this<br />

happen (and using the example above), the<br />

employer’s penalty would be the lesser of<br />

$70,000 (65 - 30 = 35 x $2,000 =$70,000)<br />

or $3,000 for every FTE that received a<br />

subsidy. Let’s assume 15 FTEs received a<br />

subsidy. Then the calculation would be 15 x<br />

$3,000 = $45,000. So the employer penalty<br />

would be the lesser of $70,000 or $45,000.<br />

In this example, the employer may be paying<br />

$500,000 annually for the coverage on its<br />

65 FTEs. That premium would still be taxdeductible<br />

to the business, but any and all<br />

penalties are never deductible.<br />

So, is a penalty certain for the large employer<br />

that does not provide health coverage in<br />

2014? No, but unless their employees are<br />

high paid - over the 400% FPL rule - the<br />

chances are very high. And, the FPL rule in<br />

this situation states “family income”. Does<br />

an employer know what the employee’s<br />

spouse earns? Even thinking about asking<br />

that question will make the HR department<br />

cringe! What about the chance of a penalty<br />

concerning the large employer that does<br />

provide a QHP? A way to avoid any penalty<br />

would be to make certain the premiums are<br />

not “unaffordable”. This would mean the<br />

employer pays such a large portion of the<br />

FTEs “self-only premium” that the remaining<br />

portion it is not “unaffordable” to the<br />

employees. It will be essential for business<br />

owners to review the various options<br />

with their financial professionals: CPAs,<br />

attorneys, and health insurance agents.<br />

What will premiums and coverage look like<br />

in 2014? This will be of little surprise to<br />

virtually everyone: premiums will be higher<br />

than in <strong>2013</strong>. Many are speculating at least<br />

16 www.bigi.org

Legislative Feature<br />

Affordable Care Act Update...continued from page 16<br />

a 20% increase. Why that much? First,<br />

consider the generally broader coverage for<br />

all QHPs -- individual, small group and large<br />

group. They will look alike in their minimum<br />

coverage. The various states have the right<br />

to require additional mandated coverage, but<br />

they cannot strip down a plan from that set<br />

as minimum levels by the ACA. So, here is<br />

a basic list that health insurance carriers are<br />

using in their premium calculations:<br />

1) Broader coverage than now;<br />

2) No lifetime, nor annual dollar limits on<br />

coverage;<br />

3) No underwriting, no pre-existing<br />

questions;<br />

4) Guaranteed issue and guaranteed<br />

renewal;<br />

5) No out-of-pocket cost for preventive visits;<br />

6) Children staying on the parent’s plan until<br />

age 26 (some exceptions); and,<br />

7) Health insurance carriers are being<br />

charged several billion dollars in additional<br />

taxes.<br />

Are there other areas that might make the<br />

premiums higher? Yes, one is the recently<br />

announced Transitional Reinsurance Fee<br />

which will be imposed on all health insurance<br />

carriers. It will be passed along to the<br />

individual or group plans. The monthly fee is<br />

$5.25 “per-head” in 2014 (or $63 annually).<br />

Let’s assume you have a business that<br />

currently provides coverage for your 40<br />

employees. You pay 80% of the employee’s<br />

premium and none of the spouse and<br />

dependent cost. In addition to the coverage<br />

on your employees, you have 30 covered<br />

spouses, 60 covered dependents, 5 COBRA<br />

qualified beneficiaries, and 5 retirement<br />

employees. That is 140 covered “heads”<br />

x $63 = $8,820 for 2014. That amount<br />

would be added to the employer’s renewal<br />

premium. The three-year imposed fee drops<br />

to $42 in 2015 and then $26 in the last year.<br />

Most of this fee will go back to the health<br />

insurance carriers to financially assist them<br />

with the potential financial loss in the early<br />

years of the ACA due to guaranteed issue,<br />

adverse selections, etc. So the fee will<br />

increase the overall cost of the QHP.<br />

Another increase in premiums allowed by the<br />

ACA will cause concern to tobacco users.<br />

The carriers that file to write QHPs in 2014<br />

can only use certain rating criteria. First,<br />

what can they not use? No gender rating, no<br />

underwriting questions; thus no pre-existing<br />

condition exclusions. OK, what can they use<br />

to determine rates?<br />

• Age: Older individuals can be charged<br />

more than younger ones, but a maximum<br />

of 3 to 1 ratio;<br />

• Geographic area: Premiums can be<br />

higher in certain cities; e.g. higher for New<br />

York City residents than Rochester, NY<br />

residents;<br />

• Family composition: family of 3 or 4 can be<br />

charged more than an individual or family<br />

of 2; and<br />

www.bigi.org<br />

• Tobacco usage: maximum of 1.5 rating<br />

factor.<br />

Concerning the tobacco usage, note that it<br />

does not state “smoking”. It simply states<br />

“tobacco” which would encompass any and<br />

all forms of tobacco usage. How does this<br />

surcharge work? Assume the annual cost for<br />

your current health insurance plan in <strong>2013</strong> is<br />

$5,000. Next year it may very well be $6,000<br />

due to the reasons listed earlier in this article.<br />

However, should you use tobacco the carrier<br />

may surcharge your base premium as much<br />

as 50% ($3,000 in this example) and your<br />

new premium is now $9,000. Understand, a<br />

carrier may use a 1.5 factor; some will use<br />

the maximum, some may not.<br />

Another interesting bit of recently released<br />

information: those applying for an individual<br />

policy cannot receive any FPL subsidy on the<br />

tobacco surcharge portion. So, in the previous<br />

example, should the individual be eligible for<br />

a subsidy, it can only be calculated on the<br />

non-tobacco portion ($6,000), not the tobacco<br />

surcharge portion ($3,000). If the tobacco user<br />

is part of an employee group, the same nonsubsidy<br />

rule applies unless he/she enrolls in a<br />

“tobacco cessation” program. It is interesting<br />

that the surcharge applies to tobacco usage,<br />

but is silent on marijuana or illegal drug<br />

usage. Additionally, there have been no<br />

specific rules released on how the agent/<br />

company determines the tobacco usage and<br />

what would happen should the applicant<br />

make a “misrepresentation” concerning this<br />

rating factor. With life insurance, the carrier<br />

generally will require a urine exam and should<br />

there be a misrepresentation, the carrier can<br />

rescind the contract in the first two years.<br />