Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

109<br />

Financial <strong>statements</strong><br />

Notes to the consolidated <strong>financial</strong> <strong>statements</strong><br />

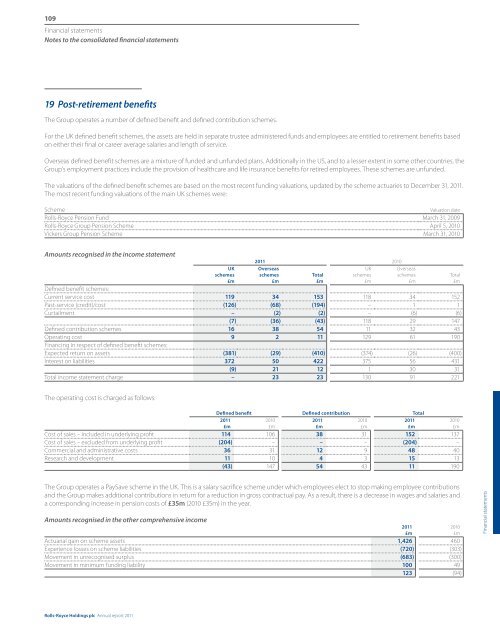

19 Post-retirement benefits<br />

The Group operates a number of defined benefit and defined contribution schemes.<br />

For the UK defined benefit schemes, the assets are held in separate trustee administered funds and employees are entitled to retirement benefits based<br />

on either their final or career average salaries and length of service.<br />

Overseas defined benefit schemes are a mixture of funded and unfunded plans. Additionally in the US, and to a lesser extent in some other countries, the<br />

Group’s employment practices include the provision of healthcare and life insurance benefits for retired employees. These schemes are unfunded.<br />

The valuations of the defined benefit schemes are based on the most recent funding valuations, updated by the scheme actuaries to December 31, 2011.<br />

The most recent funding valuations of the main UK schemes were:<br />

Scheme<br />

Valuation date<br />

<strong>Rolls</strong>-<strong>Royce</strong> Pension Fund March 31, 2009<br />

<strong>Rolls</strong>-<strong>Royce</strong> Group Pension Scheme April 5, 2010<br />

Vickers Group Pension Scheme March 31, 2010<br />

Amounts recognised in the income statement<br />

UK<br />

schemes<br />

£m<br />

2011 2010<br />

Overseas<br />

schemes<br />

£m<br />

Total<br />

£m<br />

UK<br />

schemes<br />

£m<br />

Overseas<br />

schemes<br />

£m<br />

Defined benefit schemes:<br />

Current service cost 119 34 153 118 34 152<br />

Past-service (credit)/cost (126) (68) (194) – 1 1<br />

Curtailment – (2) (2) – (6) (6)<br />

(7) (36) (43) 118 29 147<br />

Defined contribution schemes 16 38 54 11 32 43<br />

Operating cost 9 2 11 129 61 190<br />

Financing in respect of defined benefit schemes:<br />

Expected return on assets (381) (29) (410) (374) (26) (400)<br />

Interest on liabilities 372 50 422 375 56 431<br />

(9) 21 12 1 30 31<br />

Total income statement charge – 23 23 130 91 221<br />

Total<br />

£m<br />

The operating cost is charged as follows:<br />

Defined benefit Defined contribution Total<br />

2011<br />

£m<br />

Cost of sales – included in underlying profit 114 106 38 31 152 137<br />

Cost of sales – excluded from underlying profit (204) – – – (204) –<br />

Commercial and administrative costs 36 31 12 9 48 40<br />

Research and development 11 10 4 3 15 13<br />

(43) 147 54 43 11 190<br />

2010<br />

£m<br />

2011<br />

£m<br />

2010<br />

£m<br />

2011<br />

£m<br />

2010<br />

£m<br />

The Group operates a PaySave scheme in the UK. This is a salary sacrifice scheme under which employees elect to stop making employee contributions<br />

and the Group makes additional contributions in return for a reduction in gross contractual pay. As a result, there is a decrease in wages and salaries and<br />

a corresponding increase in pension costs of £35m (2010 £35m) in the year.<br />

Amounts recognised in the other comprehensive income<br />

Actuarial gain on scheme assets 1,426 460<br />

Experience losses on scheme liabilities (720) (303)<br />

Movement in unrecognised surplus (683) (300)<br />

Movement in minimum funding liability 100 49<br />

123 (94)<br />

2011<br />

£m<br />

2010<br />

£m<br />

Financial <strong>statements</strong><br />

<strong>Rolls</strong>-<strong>Royce</strong> Holdings plc Annual report 2011