Overview of Withholding Tax

Overview of Withholding Tax

Overview of Withholding Tax

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

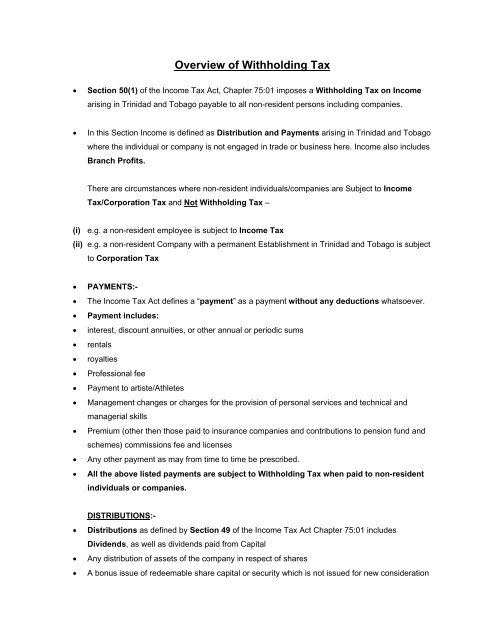

<strong>Overview</strong> <strong>of</strong> <strong>Withholding</strong> <strong>Tax</strong><br />

• Section 50(1) <strong>of</strong> the Income <strong>Tax</strong> Act, Chapter 75:01 imposes a <strong>Withholding</strong> <strong>Tax</strong> on Income<br />

arising in Trinidad and Tobago payable to all non-resident persons including companies.<br />

• In this Section Income is defined as Distribution and Payments arising in Trinidad and Tobago<br />

where the individual or company is not engaged in trade or business here. Income also includes<br />

Branch Pr<strong>of</strong>its.<br />

There are circumstances where non-resident individuals/companies are Subject to Income<br />

<strong>Tax</strong>/Corporation <strong>Tax</strong> and Not <strong>Withholding</strong> <strong>Tax</strong> –<br />

(i) e.g. a non-resident employee is subject to Income <strong>Tax</strong><br />

(ii) e.g. a non-resident Company with a permanent Establishment in Trinidad and Tobago is subject<br />

to Corporation <strong>Tax</strong><br />

• PAYMENTS:-<br />

• The Income <strong>Tax</strong> Act defines a “payment” as a payment without any deductions whatsoever.<br />

• Payment includes:<br />

• interest, discount annuities, or other annual or periodic sums<br />

• rentals<br />

• royalties<br />

• Pr<strong>of</strong>essional fee<br />

• Payment to artiste/Athletes<br />

• Management changes or charges for the provision <strong>of</strong> personal services and technical and<br />

managerial skills<br />

• Premium (other then those paid to insurance companies and contributions to pension fund and<br />

schemes) commissions fee and licenses<br />

• Any other payment as may from time to time be prescribed.<br />

• All the above listed payments are subject to <strong>Withholding</strong> <strong>Tax</strong> when paid to non-resident<br />

individuals or companies.<br />

DISTRIBUTIONS:-<br />

• Distributions as defined by Section 49 <strong>of</strong> the Income <strong>Tax</strong> Act Chapter 75:01 includes<br />

Dividends, as well as dividends paid from Capital<br />

• Any distribution <strong>of</strong> assets <strong>of</strong> the company in respect <strong>of</strong> shares<br />

• A bonus issue <strong>of</strong> redeemable share capital or security which is not issued for new consideration

• Any interest or distribution out <strong>of</strong> assets in respect <strong>of</strong> securities<br />

• Benefit derived by the difference between the market value and the “new consideration” given<br />

on a transfer <strong>of</strong> assets or liabilities from a company to its members<br />

• Branch Pr<strong>of</strong>it<br />

• 50 (6) “Where an <strong>of</strong>fice or a branch or agency <strong>of</strong> any non-resident company engaged in trade or<br />

business in Trinidad and Tobago, remits or is deemed to remit any part <strong>of</strong> the pr<strong>of</strong>its <strong>of</strong> such<br />

non-resident company accruing in or derived from Trinidad and Tobago, such <strong>of</strong>fice or branch or<br />

agency <strong>of</strong> the non-resident company shall be liable to account for and pay over <strong>Withholding</strong><br />

<strong>Tax</strong> in respect <strong>of</strong> such pr<strong>of</strong>its in accordance with the provisions <strong>of</strong> this Section as if the remitting<br />

<strong>of</strong> such pr<strong>of</strong>its was a distribution”<br />

• 50 (7) “For the purpose <strong>of</strong> subsection (6) an <strong>of</strong>fice or a branch or agency <strong>of</strong> a non-resident<br />

company shall be deemed to have remitted all the pr<strong>of</strong>its there<strong>of</strong>, except to the extent the<br />

<strong>of</strong>fice or the branch or agency has reinvested to the satisfaction <strong>of</strong> the Board such pr<strong>of</strong>its or any<br />

part there<strong>of</strong> in Trinidad and Tobago, (other than in the replacement <strong>of</strong> fixed assets)”.<br />

WITHHOLDING TAX AND RELATED SECTIONS IN THE INCOME TAX ACT<br />

Section 49 to 55 <strong>of</strong> the Income <strong>Tax</strong> Act Chapter 75:01 outlines the provisions governing the<br />

imposition <strong>of</strong> <strong>Withholding</strong> <strong>Tax</strong><br />

TAXATION<br />

The Gross Payments, without any deductions whatsoever, are subject to <strong>Withholding</strong> <strong>Tax</strong>. The<br />

obligation to deduct <strong>Withholding</strong> <strong>Tax</strong> and remit to the Board is on the person or company<br />

making the payment or distribution to the non-resident person or company<br />

The <strong>Tax</strong>payer who wishes to pay <strong>Withholding</strong> <strong>Tax</strong>es MUST SUBMIT to the International <strong>Tax</strong><br />

Unit, (except in special cases):-<br />

C5 – Payments other than Dividends and Distribution<br />

WT2 – Distribution including Dividends<br />

Invoices for payments<br />

Wire Transfer documents and other supporting information as requested<br />

For Branch Pr<strong>of</strong>it-<br />

‣ C5 and<br />

‣ The relevant schedules <strong>of</strong> the Corporation <strong>Tax</strong> Return/Petroleum Pr<strong>of</strong>it <strong>Tax</strong> Return in respect <strong>of</strong><br />

the Pr<strong>of</strong>its remitted or deemed remitted by the branch to the Head <strong>of</strong>fice.

The documents would be examined, approved and stamped by the International <strong>Tax</strong> Unit<br />

before the taxpayer proceeds to the Cashiering Unit to effect the payment<br />

<strong>Withholding</strong> <strong>Tax</strong> is calculated on each transaction<br />

• A General Rate <strong>of</strong> <strong>Withholding</strong> <strong>Tax</strong> is applied except where a DOUBLE TAXATION<br />

AGREEMENT exists:-<br />

The General Rate is as follows: (Part II Schedule 3)<br />

• Payments (2001 – 2007) - 20%<br />

• w.e.f (01/01/08) - 15%<br />

• Dividends (2001 – 2007) - 15%<br />

• w.e.f (01/01/08) - 10%<br />

• Branch Pr<strong>of</strong>its (2001 – 2007) - 10%<br />

• w.e.f (01/01/08) - 5%<br />

• Refer to Rate Schedule Appendix 1 for rates in accordance with Double <strong>Tax</strong> Treaties.<br />

• In addition to the principal amount <strong>of</strong> <strong>Withholding</strong> <strong>Tax</strong>-Interest and Penalty are also due.<br />

• The payer is responsible to account for and remit <strong>Withholding</strong> <strong>Tax</strong> to the Board within thirty<br />

(30) days <strong>of</strong> making each payment<br />

• Penalty with a due date prior to 31st December 2007 – 100%<br />

• Penalty with a due date with effect from 1st January 2008 – 25%<br />

• Interest 20% per annum on both the principal sum (withholding tax) and the penalty applicable.<br />

Bulk Transactions Of C5 / WT2<br />

• From April 21 st 2008 there would be a new system for the processing <strong>of</strong> C5/WT2 for the<br />

payment <strong>of</strong> <strong>Withholding</strong> <strong>Tax</strong>.<br />

Persons/Companies with Fifteen (15) or more Transactions on the same day should submit the<br />

information in our new Electronic format. A template is provided.<br />

Person/Company must use the template provided to facilitate the processing <strong>of</strong> the information.<br />

The Payer/Company is required to fill out:<br />

Name <strong>of</strong> payees<br />

Country <strong>of</strong> payee (Full address)

Type <strong>of</strong> transaction<br />

Gross amount<br />

Date paid/credited/deemed remitted and to submit a summary coversheet with:<br />

The total number <strong>of</strong> the transactions<br />

Total gross payments<br />

Total withholding tax remitted<br />

Date paid/credited/remitted or deemed remitted.