RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deals of the Year 2007 Handbook<br />

<strong>RAKIA</strong> <strong>Sukuk</strong> (<strong>continued</strong>...)<br />

or on the redemption of the <strong>Sukuk</strong>. Under the purchase<br />

undertaking, <strong>RAKIA</strong> agrees to purchase the issuer’s rights,<br />

interest and title over the assets at a specified price on<br />

a specified date following the issue of a notice from the<br />

issuer. The notice will be served by the issuer either upon the<br />

occurrence of an event of default or immediately before<br />

the maturity date of the <strong>Sukuk</strong>, and the assets will be sold to<br />

<strong>RAKIA</strong> under a separate sale agreement.<br />

(iv) Sale undertaking<br />

This undertaking was given by the issuer in favor of <strong>RAKIA</strong>.<br />

Under the sale undertaking, the issuer agrees to sell its rights,<br />

interest and title over the assets at a specifi ed price if there<br />

are changes in the taxation laws in the issuer’s and <strong>RAKIA</strong>’s<br />

jurisdiction.<br />

(v) Sales contract undertaking<br />

This undertaking was given by <strong>RAKIA</strong> in favor of the issuer,<br />

where <strong>RAKIA</strong> in its own independent capacity guarantees<br />

that the works will have a value of US$125 million following its<br />

completion. In addition, <strong>RAKIA</strong> also guarantees the payment<br />

performance of the third party developers for at least US$200<br />

million. This will ensure that the full amount of the <strong>Sukuk</strong> will be<br />

recoverable at maturity, given that <strong>RAKIA</strong> will only acquire<br />

the works pursuant to the purchase undertaking at maturity.<br />

The terms of this undertaking are designed to ensure that<br />

the investors will receive the outstanding principal amount<br />

in a manner that fi ts into the <strong>Sukuk</strong> structure.<br />

(vi) Guarantee deed<br />

The guarantee was issued by the government in favor<br />

of the issuer, where the government irrevocably and<br />

unconditionally guarantees <strong>RAKIA</strong>’s payment obligations<br />

under the transaction.<br />

DISTRIBUTION ANALYSIS<br />

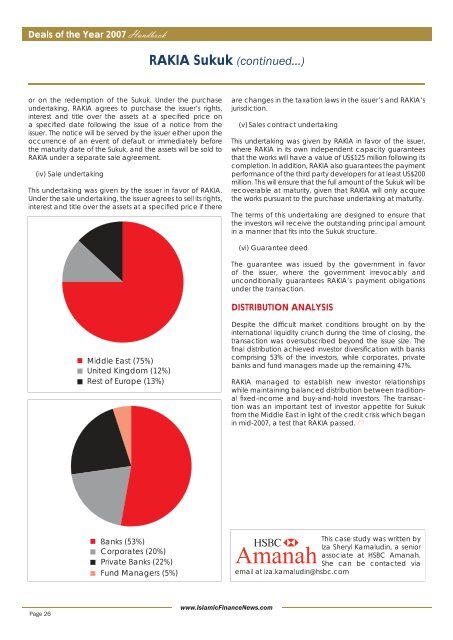

Middle East (75%)<br />

United Kingdom (12%)<br />

Rest of Europe (13%)<br />

Despite the difficult market conditions brought on by the<br />

international liquidity crunch during the time of closing, the<br />

transaction was oversubscribed beyond the issue size. The<br />

final distribution achieved investor diversification with banks<br />

comprising 53% of the investors, while corporates, private<br />

banks and fund managers made up the remaining 47%.<br />

<strong>RAKIA</strong> managed to establish new investor relationships<br />

while maintaining balanced distribution between traditional<br />

fi xed-income and buy-and-hold investors. The transaction<br />

was an important test of investor appetite for <strong>Sukuk</strong><br />

from the Middle East in light of the credit crisis which began<br />

in mid-2007, a test that <strong>RAKIA</strong> passed.<br />

Banks (53%)<br />

Corporates (20%)<br />

Private Banks (22%)<br />

Fund Managers (5%)<br />

This case study was written by<br />

Iza Sheryl Kamaludin, a senior<br />

associate at HSBC Amanah.<br />

She can be contacted via<br />

email at iza.kamaludin@hsbc.com<br />

Page 26<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com