ISRA VISION Buy EUR 26.00 - ISRA VISION AG

ISRA VISION Buy EUR 26.00 - ISRA VISION AG

ISRA VISION Buy EUR 26.00 - ISRA VISION AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ISRA</strong> <strong>VISION</strong><br />

(CDAX, Technology)<br />

<strong>Buy</strong><br />

<strong>EUR</strong> <strong>26.00</strong><br />

Price <strong>EUR</strong> 21.32<br />

Upside 22.0 %<br />

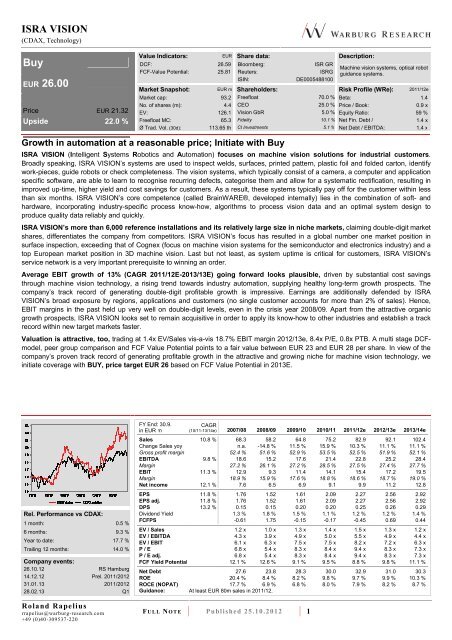

Value Indicators: <strong>EUR</strong> Share data: Description:<br />

DCF: 26.59<br />

FCF-Value Potential: 25.81<br />

Bloomberg:<br />

Reuters:<br />

ISIN:<br />

ISR GR<br />

ISRG<br />

DE0005488100<br />

Machine vision systems, optical robot<br />

guidance systems.<br />

Market Snapshot: <strong>EUR</strong> m Shareholders: Risk Profile (WRe): 2011/12e<br />

Market cap: 93.2 Freefloat 70.0 % Beta: 1.4<br />

No. of shares (m): 4.4 CEO 25.0 % Price / Book:<br />

0.9 x<br />

EV: 126.1 Vision GbR 5.0 % Equity Ratio: 59 %<br />

Freefloat MC: 65.3 Fidelity 10.1 % Net Fin. Debt /<br />

1.4 x<br />

Ø Trad. Vol. (30d):<br />

113.65 th CI Investments 5.1 % EBITDA: Net Debt / EBITDA:<br />

1.4 x<br />

Growth in automation at a reasonable price; Initiate with <strong>Buy</strong><br />

<strong>ISRA</strong> <strong>VISION</strong> (Intelligent Systems Robotics and Automation) focuses on machine vision solutions for industrial customers.<br />

Broadly speaking, <strong>ISRA</strong> <strong>VISION</strong>’s systems are used to inspect welds, surfaces, printed pattern, plastic foil and folded carton, identify<br />

work-pieces, guide robots or check completeness. The vision systems, which typically consist of a camera, a computer and application<br />

specific software, are able to learn to recognise recurring defects, categorise them and allow for a systematic rectification, resulting in<br />

improved up-time, higher yield and cost savings for customers. As a result, these systems typically pay off for the customer within less<br />

than six months. <strong>ISRA</strong> <strong>VISION</strong>’s core competence (called BrainWARE®, developed internally) lies in the combination of soft- and<br />

hardware, incorporating industry-specific process know-how, algorithms to process vision data and an optimal system design to<br />

produce quality data reliably and quickly.<br />

<strong>ISRA</strong> <strong>VISION</strong>’s more than 6,000 reference installations and its relatively large size in niche markets, claiming double-digit market<br />

shares, differentiates the company from competitors. <strong>ISRA</strong> <strong>VISION</strong>’s focus has resulted in a global number one market position in<br />

surface inspection, exceeding that of Cognex (focus on machine vision systems for the semiconductor and electronics industry) and a<br />

top European market position in 3D machine vision. Last but not least, as system uptime is critical for customers, <strong>ISRA</strong> <strong>VISION</strong>’s<br />

service network is a very important prerequisite to winning an order.<br />

Average EBIT growth of 13% (C<strong>AG</strong>R 2011/12E-2013/13E) going forward looks plausible, driven by substantial cost savings<br />

through machine vision technology, a rising trend towards industry automation, supplying healthy long-term growth prospects. The<br />

company’s track record of generating double-digit profitable growth is impressive. Earnings are additionally defended by <strong>ISRA</strong><br />

<strong>VISION</strong>’s broad exposure by regions, applications and customers (no single customer accounts for more than 2% of sales). Hence,<br />

EBIT margins in the past held up very well on double-digit levels, even in the crisis year 2008/09. Apart from the attractive organic<br />

growth prospects, <strong>ISRA</strong> <strong>VISION</strong> looks set to remain acquisitive in order to apply its know-how to other industries and establish a track<br />

record within new target markets faster.<br />

Valuation is attractive, too, trading at 1.4x EV/Sales vis-a-vis 18.7% EBIT margin 2012/13e, 8.4x P/E, 0.8x PTB. A multi stage DCFmodel,<br />

peer group comparison and FCF Value Potential points to a fair value between <strong>EUR</strong> 23 and <strong>EUR</strong> 28 per share. In view of the<br />

company’s proven track record of generating profitable growth in the attractive and growing niche for machine vision technology, we<br />

initiate coverage with BUY, price target <strong>EUR</strong> 26 based on FCF Value Potential in 2013E.<br />

Rel. Performance vs CDAX:<br />

1 month: 0.5 %<br />

6 months: 9.3 %<br />

Year to date: 17.7 %<br />

Trailing 12 months: 14.0 %<br />

Company events:<br />

26.10.12 RS Hamburg<br />

14.12.12 Prel. 2011/2012<br />

31.01.13 2011/2012<br />

28.02.13 Q1<br />

Roland Rapelius<br />

rrapelius@warburg-research.com<br />

+49 (0)40-309537-220<br />

FY End: 30.9.<br />

in <strong>EUR</strong> m<br />

C<strong>AG</strong>R<br />

(10/11-13/14e) 2007/08 2008/09 2009/10 2010/11 2011/12e 2012/13e 2013/14e<br />

Sales 10.8 % 68.3 58.2 64.8 75.2 82.9 92.1 102.4<br />

Change Sales yoy n.a. -14.8 % 11.5 % 15.9 % 10.3 % 11.1 % 11.1 %<br />

Gross profit margin 52.4 % 51.6 % 52.9 % 53.5 % 52.5 % 51.9 % 52.1 %<br />

EBITDA 9.8 % 18.6 15.2 17.6 21.4 22.8 25.2 28.4<br />

Margin 27.2 % 26.1 % 27.2 % 28.5 % 27.5 % 27.4 % 27.7 %<br />

EBIT 11.3 % 12.9 9.3 11.4 14.1 15.4 17.2 19.5<br />

Margin 18.9 % 15.9 % 17.6 % 18.8 % 18.6 % 18.7 % 19.0 %<br />

Net income 12.1 % 7.6 6.5 6.9 9.1 9.9 11.2 12.8<br />

EPS 11.8 % 1.76 1.52 1.61 2.09 2.27 2.56 2.92<br />

EPS adj. 11.8 % 1.76 1.52 1.61 2.09 2.27 2.56 2.92<br />

DPS 13.2 % 0.15 0.15 0.20 0.20 0.25 0.26 0.29<br />

Dividend Yield 1.3 % 1.8 % 1.5 % 1.1 % 1.2 % 1.2 % 1.4 %<br />

FCFPS -0.61 1.75 -0.15 -0.17 -0.45 0.69 0.44<br />

EV / Sales 1.2 x 1.0 x 1.3 x 1.4 x 1.5 x 1.3 x 1.2 x<br />

EV / EBITDA 4.3 x 3.9 x 4.9 x 5.0 x 5.5 x 4.9 x 4.4 x<br />

EV / EBIT 6.1 x 6.3 x 7.5 x 7.5 x 8.2 x 7.2 x 6.3 x<br />

P / E 6.8 x 5.4 x 8.3 x 8.4 x 9.4 x 8.3 x 7.3 x<br />

P / E adj. 6.8 x 5.4 x 8.3 x 8.4 x 9.4 x 8.3 x 7.3 x<br />

FCF Yield Potential 12.1 % 12.6 % 9.1 % 9.5 % 8.8 % 9.8 % 11.1 %<br />

Net Debt 27.6 23.8 28.3 30.0 32.9 31.0 30.3<br />

ROE 20.4 % 8.4 % 8.2 % 9.8 % 9.7 % 9.9 % 10.3 %<br />

ROCE (NOPAT) 17.7 % 6.9 % 6.8 % 8.0 % 7.9 % 8.2 % 8.7 %<br />

Guidance: At least <strong>EUR</strong> 80m sales in 2011/12.<br />

F U L L N O T E Published 25.10.2012 1

<strong>ISRA</strong> <strong>VISION</strong><br />

Sales development<br />

in <strong>EUR</strong> m<br />

Sales by regions<br />

2011; in %<br />

EBIT development<br />

in <strong>EUR</strong> m<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Company Background<br />

• Global leader in concentrated niche markets for optical surface inspection systems such as flat glass inspection, metals inspection or<br />

paper inspection. European leader in 3D machine vision.<br />

• These systems have very short amortisation periods of typically less than 6 months due to significant cost savings and yield<br />

improvements.<br />

• <strong>ISRA</strong> <strong>VISION</strong>'s track record of generating 2-digit sales growth and 2-digit EBIT margins is impressive driven by a largely untapped<br />

market (penetration only c. 15-20%) and a strong trend towards automation.<br />

• Management’s interest are aligned with shareholder’s interests as the CEO owns 25% of the company.<br />

Competitive Quality<br />

• Strong competitive position based on <strong>ISRA</strong> <strong>VISION</strong>'s relatively large size as well as over 6,000 reference installations, differentiating<br />

the company from competition.<br />

• Key customers are large, globally active blue chip industrial companies who value the one-stop-shop approach which few apart from<br />

the larger suppliers can deliver<br />

• Strong global sales and service network, which is constantly extended<br />

• Competitive defence due to high R&D expenditure<br />

• Diversification by technology, industry and region limits the dependency in weak economic periods, as evidenced by the company’s<br />

double-digit EBIT margin even in crisis year 2008/09.<br />

EBT development<br />

in <strong>EUR</strong> m<br />

Sales by segments<br />

2011; in %<br />

Net income development<br />

in <strong>EUR</strong> m<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

F U L L N O T E Published 25.10.2012 2

<strong>ISRA</strong> <strong>VISION</strong><br />

Investment Case 5<br />

Business Model 5<br />

Competitive Landscape 8<br />

Growth 11<br />

Valuation 16<br />

DCF Model 16<br />

Free Cash Flow Value Potential 18<br />

Peer-group comparison 19<br />

Newsflow 20<br />

Company & Products 21<br />

Product Range 21<br />

New product developments 24<br />

<strong>ISRA</strong> <strong>VISION</strong>’s History at a Glance 25<br />

Management background and shareholder structure 25<br />

Financials 27<br />

F U L L N O T E Published 25.10.2012 3

<strong>ISRA</strong> <strong>VISION</strong><br />

Company Profile<br />

Industrial Automation<br />

(19% of 2010/11 sales)<br />

Surface Vision<br />

(81% of 2010/11 sales)<br />

Products<br />

3D machine vision for robot guidance and<br />

Automation of optical surface inspection for<br />

positioning, assembly (e.g. car glass or tires),<br />

continuous industrial production processes at high<br />

handling or paint finishing. Service Incorporates accounts for ca. quality 10% of sales; avg. speeds selling (e.g. price metals, per system paper, € glass, 100,000 plastics).<br />

vision systems.<br />

Market positions<br />

End markets<br />

Customers<br />

Worldwide number one supplier of surface inspection systems for continuous production processes. European<br />

number one in 3D machine vision. Strong position in glass, metal, plastics/non-woven and automotive as well as a<br />

position among the top three in paper and solar glass<br />

Ranked from low to high market share: Print, Solar, Plastic, Paper, Automotive, Metal, Glass, Specialty Paper<br />

Blue-chip customer base with no single customer accounting for >2% of sales, including Daimler, VW, Ford, GM,<br />

Nissan, Hyundai, Renault, Pilkington, Schott, Q.Cells, First Solar, Nippon Steel, Bao Steel, posco, ThyssenKrupp,<br />

ArcelorMittal, ChinaSteel MAN, M-real, Kimberly-Clark, StoraEnso, International Paper, manroland, Du Pont, Bayer<br />

Competitors<br />

Raw Materials<br />

Fragmented market – mainly small competitors – Some overlap with Cognex, Perceptron, Advanced Vision<br />

Technology, Dr. Schenk, GP Solar, Vitronic, BST/Elexis, KLA Tencor, Orbotech, VAI/Voestalpine<br />

Mainly commodities including personal computers, digital cameras, components<br />

Source: <strong>ISRA</strong>, Warburg Research<br />

F U L L N O T E Published 25.10.2012 4

<strong>ISRA</strong> <strong>VISION</strong><br />

Investment Case<br />

Business Model<br />

A focus on niche markets in automation technology<br />

<strong>ISRA</strong> <strong>VISION</strong> is highly focused on the niche of machine vision solutions for automation in<br />

manufacturing and quality control.<br />

Generally speaking, machine vision technology is used to inspect welds, surfaces,<br />

printed pattern and folded carton, identify work-pieces, guide robots or check<br />

completeness. <strong>ISRA</strong> <strong>VISION</strong>’s systems are able to learn to recognise recurring defects,<br />

categorise them and allow for a systematic rectification, resulting in improved up-time<br />

and cost savings. Also, defective parts are prevented from proceeding to subsequent<br />

manufacturing stages, thus enabling a 100% quality target in a cost effective way. <strong>ISRA</strong><br />

<strong>VISION</strong>’s core competence (called BrainWARE®, developed internally) lies in the<br />

combination of soft- and hardware, incorporating industry-specific process know-how,<br />

algorithms to process vision data and an optimal system design to produce quality data<br />

reliably and quickly. Most hardware components are commodities such as personal<br />

computers and cameras, bought from the market and the final assembly is done inhouse<br />

on all relevant continents.<br />

As such, <strong>ISRA</strong> <strong>VISION</strong>’s products help customers to solve two important<br />

problems: to reduce costs through automation and yield management and to increase<br />

quality through fewer defects.<br />

The application specific machine vision systems are focusing on:<br />

• Automation of quality inspection<br />

• Automation of production<br />

• Yield enhancing production & management decision intelligence<br />

Company structure<br />

Industrial Automation<br />

Robot Vision<br />

Quality Vision<br />

Surface Vision<br />

automotive<br />

glass, print, paper/non-woven, plastics,<br />

metal, solar cells & modules<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

The business model is highly scalable. The combination of hard- and software knowhow<br />

incorporating intelligent detection algorithms in order to produce fast and reliable<br />

surface quality data can be applied to various end markets. Therefore, a high scalability<br />

of the business model – driving bottom-line growth – is achieved by transferring its<br />

technological expertise to new markets.<br />

Moreover, important success factors are industry-specific reference installations<br />

as well as a positive track record in a specific industry. These were important factors for<br />

<strong>ISRA</strong> <strong>VISION</strong>’s acquisitions of Parsytec in 2007 (metals and paper surface inspection<br />

systems) and Graphikon in 2010 (wafer based solar cells and modules surface<br />

inspection systems). Both companies are fully integrated and contribute important<br />

industry-specific know-how to <strong>ISRA</strong> <strong>VISION</strong>. Just recently <strong>ISRA</strong> <strong>VISION</strong> acquired 3D<br />

F U L L N O T E Published 25.10.2012 5

<strong>ISRA</strong> <strong>VISION</strong><br />

Shape, a small company active in 3D measurement of objects and surfaces.<br />

<strong>ISRA</strong> <strong>VISION</strong> – Diversification limits risk of dependencies<br />

Multi-Branch Strategy<br />

Robot Vision<br />

Surface Vision<br />

Quality Vision<br />

Metal<br />

Paper<br />

Print<br />

Plastics<br />

Glass<br />

Solar<br />

Automotive<br />

Europe<br />

Americas<br />

Asia<br />

Technologies Industries Regions<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

Within these target industries, the company has built up substantial expertise, customer<br />

relations and reference installations, differentiating the company from competitors. This<br />

focus and differentiation have resulted in strong global market positions with high doubledigit<br />

shares in its target markets.<br />

Reporting divisions<br />

<strong>ISRA</strong> <strong>VISION</strong> operates in two divisions:<br />

• Surface Vision (81% of 2010/11 sales): Optical surface inspection systems help<br />

locate, visualise, classify and evaluate defects. It is applied mainly to sheet and<br />

continuous web products such as flat glass, solar, paper, plastic, non-wovens and<br />

metal. These materials are checked for defects during the production process,<br />

preventing defective parts from proceeding to subsequent manufacturing steps. <strong>ISRA</strong><br />

<strong>VISION</strong> claims global market and technology leadership in surface inspection systems<br />

for continuous production processes. Originally established as a second-tier division,<br />

surface vision quickly emerged as the most important division for the company.<br />

Surface Vision: Foil inspection system<br />

Source: <strong>ISRA</strong> <strong>VISION</strong><br />

• Industrial Automation (19% of 2010/2011 sales): Robot vision/guidance systems are<br />

able to recognise and adjust the position of objects in pinpoint precision (2D or 3D).<br />

F U L L N O T E Published 25.10.2012 6

<strong>ISRA</strong> <strong>VISION</strong><br />

These systems are mainly supplied to the automobile industry, machine tool<br />

manufacturers, plant and system manufacturers and the original equipment<br />

manufacturers (OEM). The main contributors to this division are robot vision and quality<br />

vision systems. The latter can be considered as an add-on for existing customers in the<br />

automotive, glass, print and packaging industry. <strong>ISRA</strong> <strong>VISION</strong> claims a leading position<br />

for 3D machine vision and robot guidance solutions and market leadership in Europe.<br />

Technological requirements are demanding - for example a robot that inserts car<br />

windshields at a tolerance level of less than 1mm or mounts a wheel without scratching<br />

the car body. Just recently Industrial Automation revenues took a huge leap with order<br />

entries from a German premium car manufacturer.<br />

Industrial Automation: Car assembly<br />

Source: <strong>ISRA</strong> <strong>VISION</strong><br />

Customers & customer value<br />

Machine vision systems help to maximise yield. When pricing the finished products<br />

according to level of quality, machine vision systems are crucial. They generate quality<br />

data that customers use to maximise their revenues. That way, for example, a steel<br />

producer is able to identify different sheet steel qualities which can then be sold at<br />

different price levels to maximise the yield. For example, in automotive, steel quality is<br />

important because lower grades can be sold to mass producers while higher grades are<br />

sold to German premium manufacturers.<br />

A large service network matters as uptime is crucial. End customers - i.e. mainly<br />

large, globally active blue chip industrial companies - value a one-stop-shop approach<br />

and a broad product portfolio, setting <strong>ISRA</strong> <strong>VISION</strong> apart from smaller players. <strong>ISRA</strong><br />

<strong>VISION</strong>’s global sales and service network supplies significant competitive strength as<br />

system uptime is critical. A large sales and service network cannot be run economically<br />

by a smaller competitor. <strong>ISRA</strong> <strong>VISION</strong>’s maintenance service contributes ca. 10% to<br />

total sales.<br />

Short amortisation period of typically less than six months. Solutions offered by<br />

<strong>ISRA</strong> <strong>VISION</strong> provide customers with high added value relative to an average system<br />

price of <strong>EUR</strong> 100,000: cost reduction, quality improvement, better yield management and<br />

advanced production methods. For surface vision systems, apart from efficiency and<br />

quality gains, the customer benefits from process monitoring and upstream feedback for<br />

analysis and further process improvement. Typically, for surface vision systems<br />

amortisation is achieved in less than six months.<br />

In the robot vision segment the customer’s benefit lies in the automation which<br />

reduces or even eliminates manual work, increases flexibility and makes the assembly<br />

more accurate, resulting in higher quality and efficiency overall. Considering the total<br />

costs of a manufacturing cell or a complete production system, the costs of a machine<br />

vision system account for typically only a fraction of total costs while the value added to<br />

the process is significant.<br />

F U L L N O T E Published 25.10.2012 7

<strong>ISRA</strong> <strong>VISION</strong><br />

<strong>ISRA</strong> <strong>VISION</strong> boasts a total of over 6,000 reference installations. These installations<br />

are valued by customers in view of a system’s long lifetime and high total system costs<br />

of several million Euros compared to only <strong>EUR</strong> 100k for a machine vision system. These<br />

references are required to be specific with respect to a customer’s industry – such as<br />

metals, glass, plastic, solar, paper, print etc. and automotive – and with respect to a<br />

certain process step within this industry (e.g. pre-dryer, dryer, reeler etc. in a paper<br />

manufacturing process).<br />

Blue chip customer-list without overdependence. With the various and diverse<br />

application areas of the product portfolio, a broad variety of industries are supplied by<br />

<strong>ISRA</strong> <strong>VISION</strong>. The customer list includes mainly globally producing, blue-chip industrials<br />

including Daimler, Audi, VW, Ford, GM, Nissan, Hyundai, Renault, Porsche, Volvo,<br />

Saint-Gobain, NSG Group, Pilkington, Asahi Glass, Schott, Bosch, Q.Cells, Solarwatt,<br />

Epcos, aleo, First Solar, JFE, Nippon Steel, Bao Steel, posco, riva, Corus,<br />

ThyssenKrupp, ArcelorMittal, ChinaSteel, Constantia Packaging, MAN, UPM, M-real,<br />

Kimberly-Clark, StoraEnso, International Paper, manroland, Du Pont, Bayer. No single<br />

customer accounts for more than 2% of sales. <strong>ISRA</strong> <strong>VISION</strong> maintains long-term<br />

(contractual) relationships with several customers, providing a high revenue visibility.<br />

Regional split<br />

<strong>ISRA</strong> <strong>VISION</strong> is headquartered in Darmstadt, Germany and is represented by its<br />

international subsidiaries and offices worldwide. Marketing, finance, R&D, production<br />

and purchase are located in Darmstadt. The site in Herten/Germany is <strong>ISRA</strong> <strong>VISION</strong>’s<br />

main assembly site, also incorporating R&D activities. The company has an almost<br />

balanced global revenue breakdown because of early international expansion, such as<br />

<strong>ISRA</strong> <strong>VISION</strong>, Lansing, Michigan/USA or <strong>ISRA</strong> <strong>VISION</strong> France in Lyon.<br />

<strong>ISRA</strong> <strong>VISION</strong> - Regional sales breakdown<br />

Asia/ROW<br />

32.4%<br />

Germany<br />

26.7%<br />

Asia/ROW<br />

37.7%<br />

Germany<br />

23.2%<br />

2010/11 2009/10<br />

Americas<br />

21.7%<br />

Europe excl.<br />

Germany<br />

19.3%<br />

Americas<br />

15.5%<br />

Europe excl.<br />

Germany<br />

23.6%<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

The company is represented in 25 locations in 15 countries worldwide. Recently a<br />

site in Moscow, Russia was added while a site in Indonesia is being planned. About 75%<br />

of the workforce is located in Europe, about 15% in Asia and 10% in America.<br />

Competitive Landscape<br />

The highly fragmented machine vision market is characterised by a large number of<br />

smaller players. The average size of a European machine vision company is 29<br />

employees (<strong>ISRA</strong> <strong>VISION</strong> had 454 employees on average in 9M 2011/12). <strong>ISRA</strong><br />

<strong>VISION</strong>’s competitors vary depending on market segment, application niche and<br />

geographic market.<br />

Compared to smaller competitors, differentiation is based on size which enables<br />

<strong>ISRA</strong> <strong>VISION</strong> to offer important services, a complete range of solutions e.g. inspection<br />

systems at several relevant stages of a production process, and the respective industryrelated<br />

know-how. Larger, listed competitors include Cognex (US, 2x larger based on<br />

total revenues, however, in surface inspection which is <strong>ISRA</strong> <strong>VISION</strong>’s largest division,<br />

F U L L N O T E Published 25.10.2012 8

<strong>ISRA</strong> <strong>VISION</strong><br />

Cognex generated only 15% of total sales or <strong>EUR</strong> 31m in 2011).<br />

Compared to that, <strong>ISRA</strong> <strong>VISION</strong> is ca. 70% larger based on 2010/11 sales). Other listed<br />

peers include Perceptron (US), AVT (Israel) and Basler (Germany). Basler focuses<br />

mainly on digital cameras and as such is not fully comparable. Also in respect to the<br />

other companies, a direct comparison should not be over-interpreted as competitors are<br />

encountered in no more than one market.<br />

Peer group overview<br />

Country<br />

Cognex Perceptron AVT<br />

US<br />

Basler<br />

(focus on cameras)<br />

US Israel Germany<br />

Market cap<br />

Employees<br />

Avg. EBIT margin<br />

2006-2011<br />

C<strong>AG</strong>R sales<br />

2006-2011<br />

€1.2bn €37m €21.7m €38.8m<br />

955 229 202 294<br />

14.9% 0.7% -0.4% 3.76%<br />

6.19% 0.48% 10.06% 1.1%<br />

Business<br />

model<br />

• Offers complete<br />

machinevision systems<br />

as well as single<br />

omponents<br />

• Two divisions: Modular<br />

Vision Systems and<br />

Surface Inspection<br />

Systems<br />

• MVS are us ed for<br />

automation of the<br />

manufacturing process<br />

• SIS provide surface<br />

inspection for materials<br />

proc essed such as<br />

metals, paper, plastics<br />

• Competes with <strong>ISRA</strong> in<br />

almost every segment<br />

(see graphic below)<br />

• Claims a #1 position as<br />

a supplier of the<br />

semiconductor and<br />

electronics industries<br />

• Two business units:<br />

Industrial and<br />

Commercial Products<br />

• Industrial Business Unit<br />

provides highlyconfigurable<br />

measurement solutions<br />

to monitor quali ty<br />

• IBS supplies primarily to<br />

the automotive sector<br />

• Commercial Products<br />

Busines s Unit offers<br />

inspection products and<br />

various accessories to<br />

plumbers, electricians,<br />

mechanics etc as well<br />

as do-it-yourself<br />

homeowner<br />

• Offers value-added<br />

services in the field of<br />

training, maintenace,<br />

consulting and software<br />

• Provides products for<br />

automatic inspection of<br />

printed materials, press<br />

and color control and<br />

reporting software<br />

• Competes with <strong>ISRA</strong> in<br />

the print and paper<br />

market<br />

• Main product<br />

automatically detect<br />

defects and deviations<br />

• Offers installation<br />

trai ning and support<br />

services<br />

• Operates directly and<br />

through dis tributors in<br />

Europe and the US<br />

• Manufactures digital<br />

camers for industrial<br />

applications , medical<br />

devices, traffic systems<br />

and video surveillance<br />

• Claims to be the #2<br />

camera supplier<br />

worldwide<br />

• Two segments:<br />

Components (83.7% of<br />

total sales) and<br />

Solutions (16.3%)<br />

• Competes with <strong>ISRA</strong> in<br />

terms of optical<br />

inspection solutions for<br />

glass (incl. solar panels)<br />

Source: Company data, Bloomberg, Warburg Research<br />

Compared to its peer group of listed competitors, <strong>ISRA</strong> <strong>VISION</strong> generated the<br />

highest average sales growth (C<strong>AG</strong>R 2006-2011). Average EBIT margins over the<br />

past five fiscal years were also impressive and more resilient than its peers, even in the<br />

crisis year of 2009, supported by a broad diversification by regions, industries and<br />

customers.<br />

F U L L N O T E Published 25.10.2012 9

<strong>ISRA</strong> <strong>VISION</strong><br />

Peer group – EBIT margin development<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

2006 2007 2008 2009 2010 2011<br />

-20%<br />

Cognex Perceptron AVT Basler <strong>ISRA</strong><br />

Source: Bloomberg, Warburg Research<br />

Perceptron as <strong>ISRA</strong> <strong>VISION</strong>’s closest comparable peer in automotive, is expecting<br />

additional growth in the United States. Basler, which mainly focuses on its Components<br />

segment, reported a harsh decline of 67% of sales in the relevant Solutions segment,<br />

which was due to excess capacities in the LCD industry, resulting in a capex decrease.<br />

In terms of market share, <strong>ISRA</strong> <strong>VISION</strong> claims the strongest positioning in the<br />

following industries (ranked from low to high):<br />

- Print<br />

- Solar<br />

- Plastic<br />

- Paper<br />

- Automotive<br />

- Metal<br />

- Glass<br />

- Specialty Paper<br />

High R&D supplies competitive defence against smaller competitors. <strong>ISRA</strong><br />

<strong>VISION</strong>’s size allows the company to spend high amounts on R&D (12.9% of 2010/11<br />

sales, cost of sales accounting) to support its technological expertise. These sums are<br />

unlikely to be matched by smaller competitors. Among the listed competitors, only<br />

Cognex’s R&D budget is higher in absolute terms but the product mix and end market<br />

focus (mainly on semiconductor and electronics) differ from those of <strong>ISRA</strong> <strong>VISION</strong>.<br />

Therefore direct comparisons are limited. The development of technological innovations<br />

is one of <strong>ISRA</strong> <strong>VISION</strong>’s key strengths. The company focuses on creating additional<br />

value and achieving a quick return-on-investment for customers. This makes a high<br />

contribution to the mix of the company’s technology, market and cost leadership position.<br />

<strong>ISRA</strong> <strong>VISION</strong> profits from ongoing market consolidation. Customers, which are<br />

mainly global manufacturers, prefer to be served by global suppliers and value the onestop-shop<br />

approach offered by <strong>ISRA</strong> <strong>VISION</strong>. Within this environment, the company<br />

should profit from overall consolidation and should increase its market share. Through<br />

the acquisitions of Parsytec and Graphikon <strong>ISRA</strong> <strong>VISION</strong> gained market share<br />

inorganically, especially in the metal, print and solar industry.<br />

F U L L N O T E Published 25.10.2012 10

<strong>ISRA</strong> <strong>VISION</strong><br />

Growth<br />

A high-growth company with favourable market outlook<br />

<strong>ISRA</strong> <strong>VISION</strong> exhibits an impressive track record: Over the last decade the company<br />

grew profitably with double-digit sales growth rates and double-digit EBIT margins.<br />

Coupled with a sound balance sheet (57% equity ratio, 31% net gearing) <strong>ISRA</strong> <strong>VISION</strong><br />

signals financial health and stability which is important for its industrial customers. The<br />

C<strong>AG</strong>R from 2001 to 2011 was 15%, generating double-digit EBIT margins even in crisis<br />

years.<br />

<strong>ISRA</strong> <strong>VISION</strong> - Revenue and EBIT development (<strong>EUR</strong> m)<br />

100<br />

25%<br />

80<br />

20%<br />

60<br />

15%<br />

40<br />

10%<br />

20<br />

5%<br />

0<br />

0%<br />

00/01<br />

01/02<br />

02/03<br />

03/04<br />

04/05<br />

05/06<br />

06/07<br />

07/08<br />

08/09<br />

09/10<br />

10/11<br />

11/12E<br />

12/13E<br />

Sales EBIT EBIT margin<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

<strong>ISRA</strong> <strong>VISION</strong> - Segment revenue growth (<strong>EUR</strong> m)<br />

30<br />

30%<br />

20<br />

20%<br />

10<br />

10%<br />

0<br />

0%<br />

-10<br />

Q1/09<br />

Q2/09<br />

Q3/09<br />

Q4/09<br />

Q1/10<br />

Q2/10<br />

Q3/10<br />

Q4/10<br />

Q1/11<br />

Q2/11<br />

Q3/11<br />

Q4/11<br />

Q1/12<br />

Q2/12<br />

Q3/12<br />

-10%<br />

-20<br />

-20%<br />

-30<br />

-30%<br />

Surface Vision Industrial Automation Total change in % (y-o-y)<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

The Industrial Automation segment (18.5% of 2010/11 sales) benefits from several<br />

trends in the automotive industry. The industry is faced with a rising need for efficiency<br />

increases in the mature markets, the need for new, local production sites in emerging<br />

markets such as Brazil and China, and generally a high degree of competitiveness,<br />

which is driving the need for ever higher quality standards and cost advantages. This<br />

year’s impressive Q3 figures in Industrial Automation were driven by some big orders by<br />

German premium car manufacturers.<br />

Order backlog on record levels: The total order backlog rose gradually to <strong>EUR</strong> 55m<br />

per end of Q3 with a 50% increase in the Industrial Automation segment in the first nine<br />

F U L L N O T E Published 25.10.2012 11

<strong>ISRA</strong> <strong>VISION</strong><br />

months of 2011/12.<br />

<strong>ISRA</strong> <strong>VISION</strong> - Order backlog (<strong>EUR</strong> m)<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Q1/10<br />

Q2/10<br />

Q3/10<br />

Q4/10<br />

Q1/11<br />

Q2/11<br />

Q3/11<br />

Q4/11<br />

Q1/12<br />

Q2/12<br />

Q3/12<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

Management’s medium-term financial targets include a sales volume of more than <strong>EUR</strong><br />

100m (like-for-like) with at least stable margins. The gross margin should stay at 60%<br />

minimum, based on total cost accounting, and an EBT margin target of 20% which is a<br />

high level in comparison to peers. For 2011/12 <strong>ISRA</strong> <strong>VISION</strong> is aiming to reach sales of<br />

more than <strong>EUR</strong> 80m (WRe: <strong>EUR</strong> 83). Taking acquisitions into account, we see sales<br />

volume climbing beyond the <strong>EUR</strong> 100m threshold in the medium term.<br />

We expect average sales growth of 11% and EBIT growth of 13% (C<strong>AG</strong>R 2012e-<br />

2014e) as a result of…<br />

• …rising quality requirements and a rising need for manufacturing efficiency driving the<br />

need for automation and quality inspection systems in several customer industries.<br />

• …an extension of sales activities and geographical presence.<br />

• …a bigger product portfolio: Several products are nearing market launch and lowbudget<br />

products will be introduced soon. With “Plug & Automate” <strong>ISRA</strong> <strong>VISION</strong> enters<br />

the do-it-yourself terrain. The new generic product family is a ready-to-use automation<br />

technology for the factory floor.<br />

• …<strong>ISRA</strong> <strong>VISION</strong>’s cost leadership position, which will help to maintain and increase<br />

profitability levels.<br />

• …balance sheet improvements: Increasing equity ratio and unused credit lines<br />

translate into a solid capital endowment for further growth.<br />

<strong>ISRA</strong> <strong>VISION</strong>’s growth is diversified by regions and customer industries. During the<br />

economic crisis in 2008/09, <strong>ISRA</strong> <strong>VISION</strong>’s revenues declined 15% which is only one<br />

third compared to the German engineering sector decline of 45% (VDMA). This is the<br />

result of a broad sales exposure to uncorrelated end markets and regions:<br />

F U L L N O T E Published 25.10.2012 12

<strong>ISRA</strong> <strong>VISION</strong><br />

<strong>ISRA</strong> <strong>VISION</strong> - regional sales breakdown 2010/11<br />

Asia/ROW<br />

32,4%<br />

Germany<br />

26,7%<br />

Americas<br />

21,7%<br />

Europe excl.<br />

Germany<br />

19,3%<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

<strong>ISRA</strong> <strong>VISION</strong> - sales split by customer industries 2010/11<br />

Paper<br />

17%<br />

Print<br />

5%<br />

Automotive<br />

16%<br />

Metal<br />

19%<br />

Glass<br />

20%<br />

Plastics<br />

23%<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

<strong>ISRA</strong> Vision - Divisional split<br />

in <strong>EUR</strong> m 2008 2009 2010 2011 2012e 2013e 2014e<br />

Industrial Automation<br />

Sales Industrial Automation 15.8 10.9 11.5 14.6 19.4 21.6 24.1<br />

EBIT Industrial Automation 3.0 1.3 1.9 2.5 3.4 3.8 4.4<br />

margin 19.2% 12.3% 16.3% 17.5% 17.5% 17.7% 18.2%<br />

Surface Vision<br />

Sales Surface Vision 52.4 47.3 53.3 60.6 63.5 70.5 78.2<br />

EBIT Surface Vision 9.9 7.9 9.6 11.6 12.0 13.4 15.1<br />

margin 18.9% 16.8% 18.0% 19.1% 18.9% 19.0% 19.3%<br />

Group<br />

Sales 68.3 58.2 64.8 75.2 82.9 92.1 102.4<br />

EBIT 12.9 9.3 11.4 14.1 15.4 17.2 19.5<br />

margin 18.9% 15.9% 17.6% 18.8% 18.6% 18.7% 19.0%<br />

Sources: <strong>ISRA</strong> Vision (historical data), Warburg Research (estimates)<br />

Growth drivers and market dynamics<br />

10% average market growth expected by 2015: The total turnover for the global<br />

machine vision market was estimated at USD 11.2bn in 2010. Until 2015, the market is<br />

expected to grow to nearly USD 18bn (C<strong>AG</strong>R 10%, BCC Research).The potential size of<br />

the market for machine vision technology that <strong>ISRA</strong> <strong>VISION</strong> focuses on is estimated at<br />

<strong>EUR</strong> 3.2bn sales per year. In terms of application, surface vision technology accounts for<br />

more than 50% of the market, followed by robot vision and quality vision systems.<br />

F U L L N O T E Published 25.10.2012 13

<strong>ISRA</strong> <strong>VISION</strong><br />

Addressable market has niche character with size of less than <strong>EUR</strong> 1bn: The actual<br />

addressable market size is assumed to be between <strong>EUR</strong> 480m – <strong>EUR</strong> 640m sales per<br />

year, based on the assumption that currently not even 20% of the potentially<br />

addressable market is yet penetrated. However, other industry sources estimate that<br />

only 10% of the potentially addressable market for machine vision technology is yet<br />

penetrated, mainly because some sectors have easier tasks to perform than others and<br />

certain industries including automotive and electronics were able to adopt automation<br />

technologies earlier than others.<br />

VDMA in July 2012 said it expects 5% market growth this year after 20% yoy in<br />

2011 which varies by subsector. The VDMA, the German association for engineering<br />

and plant engineering, expects the market for industrial machine vision systems and<br />

components to grow by 5% yoy in 2012 in terms of revenues of suppliers located in<br />

Germany with customers located in Germany and abroad. In 2011, revenues reached<br />

<strong>EUR</strong> 1.5bn for the first time. After 2009 the worldwide automation trend continued even<br />

more dynamically. Rationalisation, productivity improvements, shorter and faster cycle<br />

times and quality demands all require automation and surface inspection.<br />

Machine Vision turnover of German suppliers (<strong>EUR</strong> m)<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

9% C<strong>AG</strong>R (00-12E)<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012E<br />

Source: VDMA, Warburg Research<br />

Growth is supported by a low degree of automation. <strong>ISRA</strong> <strong>VISION</strong> is expanding in<br />

both high growth areas such as Eastern Europe, Asia and South America and already<br />

established markets including Japan. Global car manufacturers are expanding their<br />

manufacturing capacities in China, underscored by the statements of Dürr, a supplier of<br />

capital goods to the automotive industry, (mainly paint shops and automation solutions)<br />

in its recent capital markets day in China.<br />

South Korea, Thailand, and Malaysia offer further potential to increase the degree of<br />

automation in its industrial applications, according to the VDMA. The US still has a<br />

relatively small degree of automation in production facilities and could offer some growth<br />

opportunities.<br />

In first nine months of FY 11/12, the US was the fastest growing region for <strong>ISRA</strong><br />

<strong>VISION</strong>. Europe, however, is expected to remain the most important market, with growth<br />

opportunities especially in Eastern countries. Even though Germany and Japan are the<br />

highest automated countries, they have always been lucrative for <strong>ISRA</strong> <strong>VISION</strong> and are<br />

likely to maintain their position as cash cow markets.<br />

New VDMA figures support our growth scenario. 2011 VDMA figures (published in<br />

2012) again illustrate that Asia is the fastest growing region for German machine vision<br />

suppliers. In absolute terms, Asia caught up with Europe and looks set to outperform the<br />

European market.<br />

Americas, especially North America, made a huge step forward, according to VDMA,<br />

with strong growth of 35% in 2011, which is also perceptible in <strong>ISRA</strong> <strong>VISION</strong>’s latest<br />

F U L L N O T E Published 25.10.2012 14

<strong>ISRA</strong> <strong>VISION</strong><br />

results. Germany disappointed in 2010 with a 5% decline compared to 2008 but bounced<br />

back in 2011 with an impressive 20% increase yoy. We compare 2010 to 2008 because<br />

of the low base in 2009. Again, these numbers refer to the regional sales split of<br />

suppliers located in Germany only.<br />

Market - Machine vision sales development by regions<br />

50%<br />

40%<br />

40%<br />

35%<br />

30%<br />

28%<br />

20%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

Germany<br />

-5%<br />

2%<br />

9%<br />

Europe (excl.<br />

Germany)<br />

8%<br />

Asia<br />

Americas<br />

2010 vs 2008 2011 vs 2010<br />

Source: VDMA, Warburg Research<br />

Industry-specific investment patterns play a key role for <strong>ISRA</strong> <strong>VISION</strong>. Especially<br />

customers who are engaged in highly competitive environments and low-margin<br />

businesses could spur growth for <strong>ISRA</strong> <strong>VISION</strong>. Also, new quality standards and the<br />

commitment to green technology could build momentum. Below we have briefly<br />

summarised recent macro- and micro-trends for <strong>ISRA</strong> <strong>VISION</strong>’s relevant industries.<br />

Industry-specific market dynamics<br />

Automotive<br />

Metal<br />

Glass<br />

• Large order increases from premium car manufacturers,<br />

especially in Germ any and China, driven by regional<br />

expansion, rising quality requirem ents and efficienc y gains.<br />

• Developm ent of new models goes hand in hand with<br />

pressur e on higher efficienc y and higher quality<br />

• com petition is on high levels which could trigger<br />

investm ents in m argin-im prov ing technology<br />

• Introduction of new surface vis ion sys tem s for the<br />

production/processing of steel and alum inium<br />

• Growth perceptible from USA<br />

• Risk: Low raw material prices (iron ore at alm ost three year<br />

low) do not apply enough pressure on m argins<br />

• Three new innovations about to be launched<br />

• Including a new generation of surface vision systems for<br />

inspection of automobile- and floatglass<br />

• P rosperous especially in China and Japan (new sales<br />

team )<br />

Print<br />

Plastics<br />

Solar<br />

Paper<br />

• S trong dynam ics<br />

• DRUPA 2012 triggered momentum : gain of new valuable<br />

contacts<br />

• Good results lately<br />

• New applications<br />

• Increased marketing activ ities in USA and ASIA could pay<br />

off<br />

• Recent downturn perceptible<br />

• W eak demand expected to continue in the short term<br />

• Chance: China‘s m anufacturers generate very low yields<br />

and are forced to im prove m argins; inc reas ing quality<br />

requirement could also play a role<br />

• Impressive growth in Q2 and Q3 11/12<br />

• S pecialty paper (bank notes) prosperous business unit<br />

• Introduction of low-budget products should further stimulate<br />

the market<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

F U L L N O T E Published 25.10.2012 15

<strong>ISRA</strong> <strong>VISION</strong><br />

Valuation<br />

Valuation based on a multi-stage DCF Model, FCF Value Potential and Peer Group<br />

Comparison yields the following range of a fair value per share.<br />

Valuation summary – fair value (<strong>EUR</strong> per share)<br />

DCF Model 25.0 - 28.3<br />

Free Cash Flow Value Potential 22.5 - 25.8<br />

Peer Group Comparison 23.4 - 24.3<br />

Sources: <strong>ISRA</strong> <strong>VISION</strong> (reported data), Warburg Research (estimates)<br />

DCF Model<br />

A DCF-model yields a fair value per share between <strong>EUR</strong> 25 and <strong>EUR</strong> 28<br />

Our key model assumptions are as follows:<br />

• Sales growth in the foreseeable future looks set to remain at low doubledigit<br />

levels on the back of an ongoing trend towards automation and the<br />

need to increase manufacturing efficiency and quality standards.<br />

• EBT margins at high levels near 20% look plausible driven by sales growth<br />

and operating leverage. Margins look set to erode gradually over time<br />

anticipating increasing competitiveness, partly defended by the company’s<br />

R&D and innovative products.<br />

• Working capital requirements are expected to remain at high levels owing<br />

to the customer structure.<br />

• Capex requirements are expected to remain at levels between 10% and<br />

12% of sales in the foreseeable future, mainly driven by capex for internally<br />

produced and capitalised assets while capex for PPE is expected to<br />

account for possibly between <strong>EUR</strong> 0.5m to <strong>EUR</strong> 1m going forward.<br />

Reason: the product portfolio determines most of <strong>ISRA</strong> <strong>VISION</strong>’s asset<br />

value whereas PPE requirements are limited.<br />

F U L L N O T E Published 25.10.2012 16

<strong>ISRA</strong> <strong>VISION</strong><br />

DCF Model<br />

Detailed forecast period Transitional period Term. Value<br />

Figures in <strong>EUR</strong> m 11/12e 12/13e 13/14e 14/15e 15/16e 16/17e 17/18e 18/19e 19/20e 20/21e 21/22e 22/23e 23/24e<br />

Sales 82.9 92.1 102.4 110.5 119.4 128.9 139.3 147.6 156.5 164.3 172.5 179.4 184.8<br />

Sales change 10.3 % 11.1 % 11.1 % 8.0 % 8.0 % 8.0 % 8.0 % 6.0 % 6.0 % 5.0 % 5.0 % 4.0 % 3.0 % 2.0 %<br />

EBIT 15.4 17.2 19.5 21.0 22.7 24.5 25.8 27.3 28.2 28.8 29.3 28.7 27.7<br />

EBIT-margin 18.6 % 18.7 % 19.0 % 19.0 % 19.0 % 19.0 % 18.5 % 18.5 % 18.0 % 17.5 % 17.0 % 16.0 % 15.0 %<br />

Tax rate (EBT) 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 % 31.0 %<br />

NOPAT 10.6 11.9 13.4 14.5 15.7 16.9 17.8 18.8 19.4 19.8 20.2 19.8 19.1<br />

Depreciation 7.4 8.0 8.9 9.6 10.3 11.2 12.1 12.8 13.6 14.2 14.9 15.5 16.0<br />

in % of Sales 8.9 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 % 8.7 %<br />

Changes in provisions 0.0 0.1 0.1 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.1 0.1<br />

Change in Liquidity from<br />

- Working Capital 9.0 5.9 8.4 6.8 7.3 7.9 8.5 6.9 7.3 6.5 6.8 5.7 4.4<br />

- Capex 10.3 10.4 11.4 12.4 13.3 12.9 13.9 14.0 14.7 15.4 16.2 16.9 16.1<br />

Capex in % of Sales 12.4 % 11.3 % 11.2 % 11.2 % 11.2 % 10.0 % 10.0 % 9.5 % 9.4 % 9.4 % 9.4 % 9.4 % 8.7 %<br />

Other 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0<br />

Free Cash Flow (WACC<br />

Model)<br />

-1.3 3.6 2.5 5.1 5.6 7.5 7.6 10.9 11.1 12.3 12.3 12.9 14.7 16<br />

PV of FCF -1.3 3.3 2.1 4.0 4.0 4.9 4.6 6.1 5.8 5.9 5.4 5.2 5.5 92<br />

share of PVs 2.79 % 34.90 % 62.32 %<br />

Model parameter<br />

Valuation (m)<br />

Derivation of WACC: Derivation of Beta: Present values 2023/24e 55<br />

Terminal Value 92<br />

Debt ratio 30.00 % Financial Strength 1.20 Financial liabilities 34<br />

Cost of debt 2.9 % Liquidity 1.60 Pension liabilities 2<br />

Market return 9.00 % Cyclicality 1.20 Hybrid capital 0<br />

Risk free rate 4.00 % Transparency 1.20 Minority interest 1<br />

Others 1.60 Market val. of investments 0<br />

Liquidity 6 No. of shares (m) 4.4<br />

WACC 8.44 % Beta 1.36 Equity Value 116 Value per share (<strong>EUR</strong>) 26.59<br />

Sensitivity Value per Share (<strong>EUR</strong>)<br />

Terminal Growth<br />

Delta EBIT-margin<br />

Beta (WACC) 1.25 % 1.50 % 1.75 % 2.00 % 2.25 % 2.50 % 2.75 % Beta (WACC) -1.5 pp -1.0 pp -0.5 pp 0.0 +0.5 pp +1.0 pp +1.5 pp<br />

1.65 (9.4 %) 19.53 19.99 20.49 21.01 21.58 22.18 22.83 1.65 (9.4 %) 16.65 18.10 19.56 21.01 22.47 23.93 25.38<br />

1.50 (8.9 %) 21.80 22.35 22.95 23.59 24.28 25.02 25.82 1.50 (8.9 %) 18.89 20.46 22.02 23.59 25.16 26.72 28.29<br />

1.43 (8.7 %) 23.05 23.67 24.32 25.03 25.79 26.62 27.51 1.43 (8.7 %) 20.15 21.77 23.40 25.03 26.66 28.29 29.92<br />

1.36 (8.4 %) 24.40 25.08 25.81 26.59 27.44 28.36 29.35 1.36 (8.4 %) 21.50 23.20 24.89 26.59 28.28 29.98 31.68<br />

1.29 (8.2 %) 25.85 26.60 27.41 28.28 29.22 30.25 31.37 1.29 (8.2 %) 22.98 24.75 26.51 28.28 30.05 31.81 33.58<br />

1.22 (7.9 %) 27.42 28.25 29.15 30.12 31.18 32.33 33.59 1.22 (7.9 %) 24.58 26.43 28.27 30.12 31.96 33.81 35.66<br />

1.07 (7.4 %) 30.96 31.99 33.10 34.32 35.66 37.14 38.77 1.07 (7.4 %) 28.25 30.28 32.30 34.32 36.35 38.37 40.40<br />

Sources: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

F U L L N O T E Published 25.10.2012 17

<strong>ISRA</strong> <strong>VISION</strong><br />

Free Cash Flow Value Potential<br />

Fair value between <strong>EUR</strong> 23 to <strong>EUR</strong> 26 per share looks reasonable<br />

Smaller companies rarely bear sufficient resemblance to peers in terms of geographical exposure,<br />

size or competitive strength and long-term returns often are flawed by the lack of sufficient visibility.<br />

Therefore, a Free Cash Flow based valuation has additionally been conducted.<br />

The “FCF Value Potential" reflects the ability of the company to generate sustainable free cash flows.<br />

It is based on the "FCF potential" - a FCF "ex growth" figure - which assumes unchanged working<br />

capital and pure maintenance capex. A value indication is derived by discounting the “FCF potential”<br />

of a given year with the weighted costs of capital.<br />

Free Cash Flow Value Potential – <strong>ISRA</strong> <strong>VISION</strong><br />

Figures in <strong>EUR</strong> m 2008 2009 2010 2011 2012e 2013e 2014e<br />

Net Income before minorities 8.0 6.4 7.0 9.1 10.0 11.3 12.8<br />

+ Depreciation + Amortisation 5.7 5.9 6.2 7.3 7.4 8.0 8.9<br />

- Net Interest Income -1.6 -1.0 -0.9 -1.0 -0.9 -0.9 -0.9<br />

- Maintenance Capex 5.7 5.9 6.2 7.3 7.2 8.0 8.9<br />

+ Others 0.0 0.0 0.0 0.0 0.0 0.0 0.0<br />

= Free Cash Flow Potential 9.6 7.4 7.8 10.1 11.1 12.1 13.7<br />

Free Cash Flow Yield Potential 7.6% 5.9% 6.2% 8.0% 8.6% 9.6% 10.9%<br />

WACC 8.4% 8.4% 8.4% 8.4% 8.4% 8.4% 8.4%<br />

= Enterprise Value 126.0 126.0 126.0 126.0 128.9 127.0 126.3<br />

= Fair Enterprise Value 113.7 87.9 92.9 119.9 131.3 143.9 162.4<br />

- Net Debt (Cash) 28.1 28.1 28.1 28.1 30.9 29.0 28.2<br />

- Pension Liabilities 2.0 2.0 2.0 2.0 2.0 2.0 2.1<br />

- Others 0.0 0.0 0.0 0.0 0.0 0.0 0.0<br />

- Market value of minorities 0.0 0.0 0.0 0.0 0.0 0.0 0.0<br />

+ Market value of investments 0.0 0.0 0.0 0.0 0.0 0.0 0.0<br />

= Fair Market Capitalisation 83.7 57.9 62.9 89.9 98.5 112.9 132.1<br />

No. of shares (m) 4.4 4.4 4.4 4.4 4.4 4.4 4.4<br />

= Fair value per share (<strong>EUR</strong>) 19.13 13.24 14.39 20.56 22.52 25.81 30.22<br />

premium (-) / discount (+) in % -12.8% -39.7% -34.4% -6.3% 2.6% 17.6% 37.7%<br />

Sensitivity Fair value per Share (<strong>EUR</strong>)<br />

WACC<br />

9.9% 15.21 10.21 11.19 16.42 17.98 20.85 24.61<br />

9.4% 16.38 11.11 12.14 17.66 19.34 22.33 26.28<br />

8.9% 17.68 12.12 13.20 19.03 20.84 23.97 28.14<br />

8.4% 19.13 13.24 14.39 20.56 22.52 25.81 30.22<br />

7.9% 20.77 14.51 15.73 22.29 24.41 27.89 32.56<br />

7.4% 22.63 15.95 17.25 24.25 26.56 30.24 35.21<br />

6.9% 24.76 17.59 18.99 26.49 29.01 32.93 38.25<br />

Sources: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

F U L L N O T E Published 25.10.2012 18

<strong>ISRA</strong> <strong>VISION</strong><br />

Peer-group comparison<br />

Fair value indication between <strong>EUR</strong> 23 and <strong>EUR</strong> 24 per share<br />

Based on EV/EBIT and EV/EBITDA 2012E, respectively, the peer group comparison<br />

yields a fair value between <strong>EUR</strong> 23 and <strong>EUR</strong> 24 per share.<br />

That said, a peer group comparison is not very relevant, in our view, as a peer with a<br />

comparable business model, similar end market exposure by industries, market position,<br />

and market capitalisation does not seem to be on offer.<br />

Peergroup overview<br />

Peergroup - Key Figures<br />

<strong>ISRA</strong> Vision LC Price MC EV<br />

EPS Sales EBITDA EBIT<br />

in LC in LC m in LC m 12e 13e 14e 12e 13e 14e 12e 13e 14e 12e 13e 14e<br />

Cognex USD 35.73 1,532.0 1,141.3 1.53 1.92 n.a. 327.0 364.3 393.0 98.1 119.0 112.0 81.5 101.4 98.1<br />

Perceptron USD 5.66 47.9 20.3 0.30 0.45 0.51 61.0 60.5 65.0 4.6 6.7 7.7 n.a. n.a. n.a.<br />

AVT <strong>EUR</strong> 4.10 21.8 14.0 0.66 0.71 0.66 41.0 42.5 45.5 4.3 n.a. n.a. 3.8 5.1 5.5<br />

Basler <strong>EUR</strong> 11.76 41.2 61.1 1.08 1.24 1.37 55.4 60.3 66.4 13.8 15.2 15.0 6.5 7.3 7.9<br />

<strong>ISRA</strong> Vision <strong>EUR</strong> 21.95 96.0 128.9 2.27 2.56 2.92 82.9 92.1 102.4 22.8 25.2 28.4 15.4 17.2 19.5<br />

Source: Bloomberg, Warburg Research<br />

Peergroup – Valuation Multiples<br />

Peergroup<br />

<strong>ISRA</strong> Vision LC Price MC EV<br />

P / E EV / EBITDA EV / EBIT<br />

in LC in LC m in LC m 12e 13e 14e 12e 13e 14e 12e 13e 14e<br />

Cognex USD 35.73 1,532.0 1,141.3 23.38 18.63 n.a. 11.63 9.59 10.19 14.00 11.26 11.63<br />

Perceptron USD 5.66 47.9 20.3 18.87 12.72 11.21 4.41 3.03 2.65 n.a. n.a. n.a.<br />

AVT <strong>EUR</strong> 4.10 21.8 14.0 6.17 5.76 6.21 3.25 n.a. n.a. 3.69 2.73 2.52<br />

Basler <strong>EUR</strong> 11.76 41.2 61.1 10.89 9.52 8.62 4.44 4.03 4.09 9.40 8.37 7.73<br />

Average 14.83 11.66 8.68 5.93 5.55 5.64 9.03 7.45 7.30<br />

Median 14.88 11.12 8.62 4.43 4.03 4.09 9.40 8.37 7.73<br />

<strong>ISRA</strong> Vision <strong>EUR</strong> 21.95 96.0 128.9 9.67 8.57 7.52 5.66 5.11 4.54 8.37 7.48 6.61<br />

Valuation difference to Average 53% 36% 15% 5% 9% 24% 8% 0% 10%<br />

Fair value per share based on Average 33.66 29.84 25.34 23.39 24.48 29.08 24.28 21.83 25.01<br />

Source: Bloomberg, Warburg Research<br />

F U L L N O T E Published 25.10.2012 19

<strong>ISRA</strong> <strong>VISION</strong><br />

Newsflow<br />

Solid Q3 results, outlook confirmed: Q3 results reported on August 31 were solid with<br />

9M sales growth of 11% yoy mainly driven by new orders in the industrial automation<br />

segment. EBIT margins increased slightly, owing to operating leverage. Cash flow from<br />

operations improved to <strong>EUR</strong> 10.5m in 9M (from <strong>EUR</strong> 4.1m in 9M 10/11) mainly driven by<br />

working capital management.<br />

Order backlog per end of Q3 increased to c. <strong>EUR</strong> 55m which is impressive (<strong>EUR</strong><br />

40m in 9M 10/11). The equity ratio of 58% (vs. 57% at the end of Q3 last year) is very<br />

solid. Against this backdrop, management reiterated its outlook for 2011/12 with a sales<br />

target of at least <strong>EUR</strong> 80m (WRe: <strong>EUR</strong> 83m).<br />

<strong>ISRA</strong> <strong>VISION</strong> – Q3 2011/12 results (FY ends 30.09.)<br />

in <strong>EUR</strong> m Q3/12 Q3/11 yoy 9M/12 9M/11 yoy<br />

Sales 20.3 19.0 6.9% 57.6 51.7 11.5%<br />

Gross profit 11.1 10.6 5.5% 31.4 28.3 10.9%<br />

margin 54.8% 55.5% 54.6% 54.8%<br />

EBIT 3.8 3.4 9.1% 10.7 9.6 12.1%<br />

margin 18.5% 18.1% 18.6% 18.5%<br />

EPS in <strong>EUR</strong> 0.56 0.51 9.8% 1.58 1.41 12.1%<br />

Sources: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

Smaller acquisition in September 2012: on September 5, the company announced the<br />

acquisition of 3D-Shape, a smaller 3D machine vision specialist (sales of c. <strong>EUR</strong> 1.5m)<br />

supplying in-depth knowledge of 3D shape measurement of objects and surfaces. The<br />

technology can be applied in the fields of quality control and precision measurement.<br />

Next datapoint: preliminary Q4 2011/2012 results due on December 14, 2012.<br />

<strong>ISRA</strong> Vision - Event activity chart<br />

0.50<br />

0.43<br />

Volume (Shrs. in Mil.) 15-Oct-2010 to 18-Oct-2012 High: 22.75 Low: 14.56 Last: 22.18 Price (<strong>EUR</strong>)<br />

1<br />

25.00<br />

23.14<br />

0.36<br />

0.29<br />

0.21<br />

0.14<br />

0.07<br />

3<br />

2<br />

21.29<br />

19.43<br />

17.57<br />

15.71<br />

13.86<br />

0.00<br />

1.11 4.11 7.11 10.11 1.12 4.12 7.12 10.12<br />

12.00<br />

Volume(Left) Price (Right) Event<br />

Date Event Type Event Description Source Impact(%)*<br />

1 05-Sep-12 Deal Activity <strong>ISRA</strong> <strong>VISION</strong> <strong>AG</strong> acquired 3D-Shape GmbH for an undisclosed amount. The... Mergerstat 4,09<br />

2 21-Mrz-12 Corporate Actions Ex-date for dividend payment of €0.25 Pricing -2,54<br />

3 30-Mrz-11 Corporate Actions Ex-date for dividend payment of €0.20 Pricing -4,00<br />

*As a default, the impact column displays the percentage price change of the stock based on three days prior and three days after the event took place.<br />

Sources: FactSet, Warburg Research<br />

F U L L N O T E Published 25.10.2012 20

<strong>ISRA</strong> <strong>VISION</strong><br />

Company & Products<br />

Product Range<br />

<strong>ISRA</strong> <strong>VISION</strong> reports in two divisions: Surface Vision (81.5% of sales in 2010/11) and<br />

Industrial Automation (18.5% of sales). To take a closer look at the technology, however,<br />

it is reasonable to further divide the Industrial Automation segment into Robot Vision and<br />

Quality Inspection.<br />

Surface Vision<br />

Today’s quality standards demand high quality levels with regard to complex surfaces.<br />

These can be homogenous, patterned, printed, coated and colored. <strong>ISRA</strong> <strong>VISION</strong> offers<br />

inspection solutions for glass, plastics/non-wovens, painted finished parts, paper and<br />

print products. Customers gain flexibility through <strong>ISRA</strong> <strong>VISION</strong>’s basic concept of<br />

standard modules and components developed in-house. This concept classifies,<br />

visualises and archives the detected defects. With the help of intelligent software,<br />

defects do not proceed to subsequent production steps thus helping to produce in a costeffective<br />

way.<br />

Surface Vision: Metal inspection<br />

Source: <strong>ISRA</strong> <strong>VISION</strong><br />

Characteristics:<br />

• Image database of defects<br />

• Real-time image processing<br />

• Teaching Process (see graphic below)<br />

• Statistical evaluation of the results<br />

• User-friendly configuration<br />

• Easy integration into existing process cycles<br />

• System can be controlled and monitored.<br />

F U L L N O T E Published 25.10.2012 21

<strong>ISRA</strong> <strong>VISION</strong><br />

Automatic generation of training data<br />

Type A<br />

High confidence<br />

ok<br />

Classifier<br />

Type B<br />

Evaluation of<br />

classification<br />

Low confidence<br />

Type ?<br />

Unknown<br />

Training<br />

unknown<br />

uncertain<br />

Teacher<br />

Ask teacher<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

EPROMI / Expert5i modules<br />

Quality data provided by surface inspection systems is crucial to manufacturers but<br />

alone not sufficient to improve processes. EPROMI – Enterprise PROduction<br />

Management Intelligence – is a software suite that enables customers to have access to<br />

all relevant information and its evaluation, thereby supporting management decisions.<br />

With EPROMI production management can exercise direct control over operations in the<br />

production hall. Data is provided in a clear and compact format and can be connected to<br />

business management data such as order and resource planning. The so-called Expert5i<br />

modules then analyse and weigh-up all of the information and generate knowledgebased<br />

suggestions for the decision makers. Combining the information in different ways<br />

reveals correlations and unleashes optimisation potential for processes. The tool also<br />

works in a preventative way: if problems are likely to occur, operators will receive early<br />

warnings and relevant intervention options.<br />

Robot Vision<br />

Robot guidance has been the core competence since <strong>ISRA</strong> <strong>VISION</strong> was founded in<br />

1985. Nowadays, robotic technology has become an important economic factor in<br />

industrial automation and provides a huge number of application opportunities. Ever<br />

since, the company has been regularly introducing technology to new markets. An<br />

example is Floatscan 5D for glass inspection which enables five inspection steps in a<br />

single product, thereby contributing to cost-effective production.<br />

Robot Vision gives industrial robots intelligent eyes. With these eyes, robots can<br />

recognise and adjust the position of objects with pinpoint precision. It provides the<br />

handling system with information on where the component to be moved is located. <strong>ISRA</strong><br />

<strong>VISION</strong> offers a broad range of robot vision products – from simple pick & place<br />

applications to complex 3D tasks.<br />

F U L L N O T E Published 25.10.2012 22

<strong>ISRA</strong> <strong>VISION</strong><br />

Robot Vision: Multiple eyes for the three dimensional world<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

Technologies:<br />

• Fast and precise position determination of components using robust algorithms<br />

• Coordination between the camera system, the robot, the object and the cell<br />

• Resistance to transmission errors between the image processor and the robot via<br />

several interfaces and protocols<br />

• Add-ons: quality measurement, inspection and documentation of the results<br />

• Simplification of the software and the interface to make it user-friendly<br />

Core components:<br />

• High-performance frame grabbers (developed in-house)<br />

• Sensors for robot-suited miniature cameras, stereo sensors and 3D form matching<br />

sensors<br />

• Supporting technology: easy-to-use software with components for measuring,<br />

inspecting, communication, data archiving and user support<br />

New product line: “Plug & Automate”<br />

With “Plug & Automate” <strong>ISRA</strong> <strong>VISION</strong> steps into the do-it-yourself terrain. The new<br />

generic product family is a ready-to-use automation technology for the factory floor.<br />

Customers can use the tools for various tasks (robot guidance, measurement technology<br />

and quality assurance). The sensors already incorporate all common communication and<br />

robot interfaces. Depending on the budget and the need, customers are able to buy<br />

sensors, the software suite or the entire package. The clear and simply designed<br />

software (based on Windows 8) has a tablet-like touch control. The easy<br />

parameterisation approach makes programming and thereby experts redundant.<br />

Revenue contribution is not expected before 2012/2013.<br />

F U L L N O T E Published 25.10.2012 23

<strong>ISRA</strong> <strong>VISION</strong><br />

Plug & Automate<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

Quality Inspection<br />

Quality inspection systems involve the inspection of presence, contours and<br />

measurements, the assurance of complete assembly and right positions and the<br />

verification of article or production codes. An example of a quality inspection solution<br />

offered by <strong>ISRA</strong> <strong>VISION</strong> is the inspection of placed rivets in the aerospace production.<br />

New product developments<br />

For <strong>ISRA</strong> <strong>VISION</strong>, the focus of new technology lies on the generation of higher ROI and<br />

added value for customers. In the last two years the company has launched more than<br />

20 new innovations, emphasising its technological leadership. In the first nine month of<br />

2011/12 <strong>ISRA</strong> <strong>VISION</strong> invested a total of <strong>EUR</strong> 9.4m in R&D, thereof <strong>EUR</strong> 6.4m for new<br />

products which are nearing market launch. Some technologies, which will most likely<br />

contribute to <strong>ISRA</strong> <strong>VISION</strong>’s growth story in the next quarters, are briefly described<br />

below.<br />

Floatscan 5D<br />

Floatscan 5D is a next generation inspection system with patented high-speed LED<br />

technology for float glass production. It includes five optical channels in one sensor. The<br />

multi-modal lighting system is able to carry out different lighting effects, making multiple<br />

angle arrangements redundant. It detects a far greater number defects than conventional<br />

systems due to higher light intensity. On top of this, it not only locates the defects but<br />

assess where and why the defects occurred. The upgraded software provides a greater<br />

differential defect classification. Floatscan 5D has a high potential as even smallest<br />

defects in the float glass production can cause serious problems in higher processing<br />

steps. It is estimated that with this technology customers can save up to <strong>EUR</strong> 1m per<br />

year.<br />

PrintSTAR (extended portfolio)<br />

PrintSTAR is the world-leading inspection system in the print industry that enables both<br />

quality and process control. Recently, <strong>ISRA</strong> <strong>VISION</strong> launched the third generation series.<br />

It offers new features in that it provides in-line PDF verification in colour using a single<br />

reference image. This image is compared with the “golden master” produced during the<br />

first print run. It is now possible to compare printed sheets with the proofed master sheet<br />

during the actual running production. In case of deviations between the PDF and the<br />

print image, the defect can be corrected before expensive machine time and paper is<br />

wasted. With the new series, gaps in the digital inspection chain are eliminated.<br />

F U L L N O T E Published 25.10.2012 24

<strong>ISRA</strong> <strong>VISION</strong><br />

PATTERNSCAN<br />

The PATTERNSCAN system offers a 100% optical in-line inspection of pattern glass for<br />

the solar industry. The system is equipped with <strong>ISRA</strong> <strong>VISION</strong>’s new multi-mode and<br />

multi-view lighting technologies. The extremely fast and switchable LEDs enable as yet<br />

unequalled inspection performances by detecting even smallest defects and scratches.<br />

The low operating cost and technical requirements make it an interesting tool to increase<br />

yields and save material, which is crucial in the competitive solar industry. Less than one<br />

year after market launch, PATTERNSCAN was already sold 50 times to solar panel<br />

manufacturers (primarily in Asia).<br />

Surface Master<br />

The Surface Master is a product line for the metal industry, providing surface inspection,<br />

quality assessment, process monitoring and statistical analysis for decision making. The<br />

defect recognition rate is >98% and system availability >99.8%. It contains an industryleading<br />

multi-stage classifier which, in case of detection, immediately takes action to<br />

correct and improve the production process. According to <strong>ISRA</strong> <strong>VISION</strong>, newest lighting<br />

and fastest camera technology, highest resolution and image quality coupled with the<br />

shortest pay-back period makes Surface Master systems a must-have for metal<br />

manufacturers. The first roll-outs took place in Q3 2011/12.<br />

Acquisition of 3D Shape<br />

Most recently, <strong>ISRA</strong> <strong>VISION</strong> has acquired a smaller 3D machine vision specialist called<br />

‘3D Shape’. While its size (sales of c. <strong>EUR</strong> 1.5m) is not meaningful, the in-depth knowhow<br />

in 3D technology strengthens <strong>ISRA</strong> <strong>VISION</strong>’s own product portfolio. 3D Shape was<br />

founded as a university spin-off and focuses on 3D shape measurement of objects and<br />

surfaces. The technology can be applied in the fields of quality control and precision<br />

measurement. According to <strong>ISRA</strong> <strong>VISION</strong>, 3D Shape boasts important customer<br />

relationships in the glass, semiconductor – opening up additional growth potential -,<br />

medical and automotive industry.<br />

<strong>ISRA</strong> <strong>VISION</strong>’s History at a Glance<br />

Company history<br />

Foundation of <strong>ISRA</strong><br />

Systemtechnik GmbH<br />

at the Technical<br />

University of<br />

Darmstadt, Germany<br />

by Enis Ersü and other<br />

experts<br />

<strong>ISRA</strong> supervised<br />

TEXAUGE, a commercial<br />

and scientific project for<br />

fast surface texture<br />

inspection<br />

After the creation of<br />

<strong>ISRA</strong> Vision <strong>AG</strong>, the<br />

company went<br />

public; Volkswagen<br />

achieved equipment<br />

for the Transparent<br />

Factory<br />

<strong>ISRA</strong> was<br />

awarded as<br />

one of the Top<br />

100 most<br />

innovative<br />

German SMEs.<br />

Integration of<br />

Parsytec<br />

Integration of<br />

Graphikon GmbH<br />

solar market<br />

penetration<br />

1985 1988<br />

1996 1997 2000<br />

2001-<br />

2006<br />

2007 2010<br />

First system for<br />

automotive<br />

development obtained<br />

the Hessian<br />

Innovation Award<br />

Enis Ersü, CEO,<br />

carried out a spin-off<br />

and founded the <strong>ISRA</strong><br />

Vision GmbH; first 3D<br />

robot vision system<br />

followed<br />

Several acquisitions<br />

and co-operations were<br />

placed. Long-term<br />

contractual agreements<br />

were signed<br />

Expansion to<br />

Shanghai. Today<br />

<strong>ISRA</strong> is represented<br />

in 15 countries<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

Management background and shareholder structure<br />

The major shareholder, Mr. Enis Ersü, is the founder and CEO of <strong>ISRA</strong> <strong>VISION</strong>. The free<br />

float of ca. 70% is calculated excluding the stake of the CEO and Vision GbR is an<br />

investment vehicle of <strong>ISRA</strong> <strong>VISION</strong> employees. Other shareholdings are included in the<br />

F U L L N O T E Published 25.10.2012 25

<strong>ISRA</strong> <strong>VISION</strong><br />

free float. The company is publicly listed in the Prime Standard of the Frankfurt Stock<br />

Exchange. At the moment, the company has 4.4m shares outstanding.<br />

Shareholder structure<br />

Fidelity; 10.1%<br />

Enis Ers ü; 25.2%<br />

CI Inves tments; 5.1%<br />

Vision GbR; 5.0%<br />

Argos; 3.3%<br />

Panamera Found.; 3.2%<br />

DW S Inv.; 3.1%<br />

Other; 42.2%<br />

Source: Bloomberg, Warburg Research<br />

<strong>ISRA</strong> <strong>VISION</strong> – Management team<br />

Enis Ersü<br />

• CEO since 1998 founded <strong>ISRA</strong> Vision GmbH (transformed from a<br />

university spin-off)<br />

• Studied engineering at the Technical University of Darmstadt<br />

• Former VDMA chairman (machine vision division)<br />

Hans-Jürgen Christ<br />

• Co-CEO and CEO of Parsytec<br />

• Head of sales<br />

• Studied engineering at the Technical University of Darmstadt<br />

Werner Rothermel<br />

• Member of the exec. board<br />

• Head of production and<br />

engineering<br />

• Graduated engineer<br />

Dr. Johannes Giet<br />

• Member of the exec. board<br />

• Head of research<br />