Notes to the Financial Statements - Kenford.com.hk

Notes to the Financial Statements - Kenford.com.hk

Notes to the Financial Statements - Kenford.com.hk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

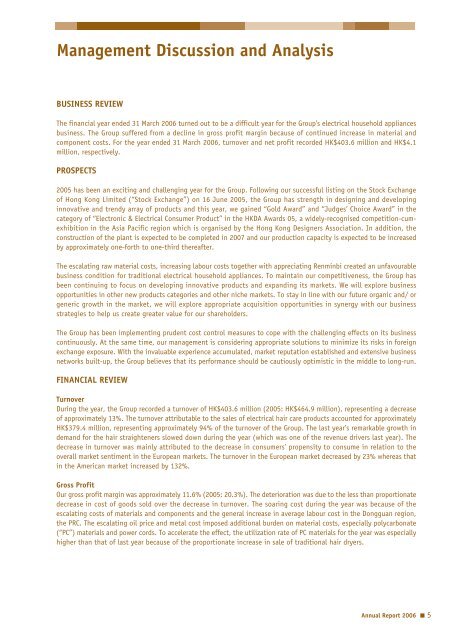

Management Discussion and Analysis<br />

BUSINESS REVIEW<br />

The financial year ended 31 March 2006 turned out <strong>to</strong> be a difficult year for <strong>the</strong> Group’s electrical household appliances<br />

business. The Group suffered from a decline in gross profit margin because of continued increase in material and<br />

<strong>com</strong>ponent costs. For <strong>the</strong> year ended 31 March 2006, turnover and net profit recorded HK$403.6 million and HK$4.1<br />

million, respectively.<br />

PROSPECTS<br />

2005 has been an exciting and challenging year for <strong>the</strong> Group. Following our successful listing on <strong>the</strong> S<strong>to</strong>ck Exchange<br />

of Hong Kong Limited (“S<strong>to</strong>ck Exchange”) on 16 June 2005, <strong>the</strong> Group has strength in designing and developing<br />

innovative and trendy array of products and this year, we gained “Gold Award” and “Judges’ Choice Award” in <strong>the</strong><br />

category of “Electronic & Electrical Consumer Product” in <strong>the</strong> HKDA Awards 05, a widely-recognised <strong>com</strong>petition-cumexhibition<br />

in <strong>the</strong> Asia Pacific region which is organised by <strong>the</strong> Hong Kong Designers Association. In addition, <strong>the</strong><br />

construction of <strong>the</strong> plant is expected <strong>to</strong> be <strong>com</strong>pleted in 2007 and our production capacity is expected <strong>to</strong> be increased<br />

by approximately one-forth <strong>to</strong> one-third <strong>the</strong>reafter.<br />

The escalating raw material costs, increasing labour costs <strong>to</strong>ge<strong>the</strong>r with appreciating Renminbi created an unfavourable<br />

business condition for traditional electrical household appliances. To maintain our <strong>com</strong>petitiveness, <strong>the</strong> Group has<br />

been continuing <strong>to</strong> focus on developing innovative products and expanding its markets. We will explore business<br />

opportunities in o<strong>the</strong>r new products categories and o<strong>the</strong>r niche markets. To stay in line with our future organic and/ or<br />

generic growth in <strong>the</strong> market, we will explore appropriate acquisition opportunities in synergy with our business<br />

strategies <strong>to</strong> help us create greater value for our shareholders.<br />

The Group has been implementing prudent cost control measures <strong>to</strong> cope with <strong>the</strong> challenging effects on its business<br />

continuously. At <strong>the</strong> same time, our management is considering appropriate solutions <strong>to</strong> minimize its risks in foreign<br />

exchange exposure. With <strong>the</strong> invaluable experience accumulated, market reputation established and extensive business<br />

networks built-up, <strong>the</strong> Group believes that its performance should be cautiously optimistic in <strong>the</strong> middle <strong>to</strong> long-run.<br />

FINANCIAL REVIEW<br />

Turnover<br />

During <strong>the</strong> year, <strong>the</strong> Group recorded a turnover of HK$403.6 million (2005: HK$464.9 million), representing a decrease<br />

of approximately 13%. The turnover attributable <strong>to</strong> <strong>the</strong> sales of electrical hair care products accounted for approximately<br />

HK$379.4 million, representing approximately 94% of <strong>the</strong> turnover of <strong>the</strong> Group. The last year’s remarkable growth in<br />

demand for <strong>the</strong> hair straighteners slowed down during <strong>the</strong> year (which was one of <strong>the</strong> revenue drivers last year). The<br />

decrease in turnover was mainly attributed <strong>to</strong> <strong>the</strong> decrease in consumers’ propensity <strong>to</strong> consume in relation <strong>to</strong> <strong>the</strong><br />

overall market sentiment in <strong>the</strong> European markets. The turnover in <strong>the</strong> European market decreased by 23% whereas that<br />

in <strong>the</strong> American market increased by 132%.<br />

Gross Profit<br />

Our gross profit margin was approximately 11.6% (2005: 20.3%). The deterioration was due <strong>to</strong> <strong>the</strong> less than proportionate<br />

decrease in cost of goods sold over <strong>the</strong> decrease in turnover. The soaring cost during <strong>the</strong> year was because of <strong>the</strong><br />

escalating costs of materials and <strong>com</strong>ponents and <strong>the</strong> general increase in average labour cost in <strong>the</strong> Dongguan region,<br />

<strong>the</strong> PRC. The escalating oil price and metal cost imposed additional burden on material costs, especially polycarbonate<br />

(“PC”) materials and power cords. To accelerate <strong>the</strong> effect, <strong>the</strong> utilization rate of PC materials for <strong>the</strong> year was especially<br />

higher than that of last year because of <strong>the</strong> proportionate increase in sale of traditional hair dryers.<br />

Annual Report 2006<br />

5