FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

FINANCIAL STATEMENTS - KPN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

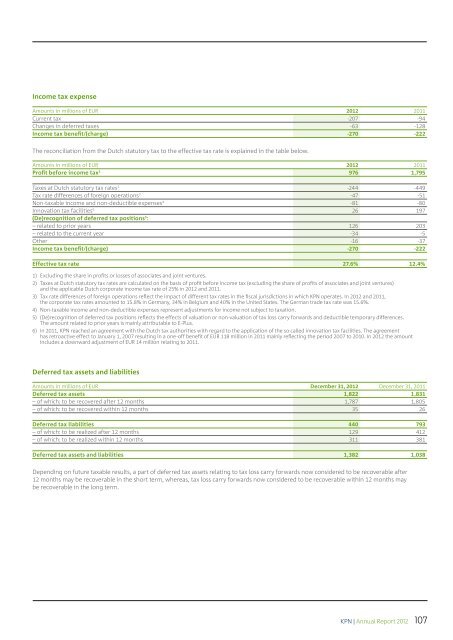

Income tax expense<br />

Amounts in millions of EUR 2012 2011<br />

Current tax -207 -94<br />

Changes in deferred taxes -63 -128<br />

Income tax benefit/(charge) -270 -222<br />

The reconciliation from the Dutch statutory tax to the effective tax rate is explained in the table below.<br />

Amounts in millions of EUR 2012 2011<br />

Profit before income tax 1 976 1,795<br />

Taxes at Dutch statutory tax rates 2 -244 -449<br />

Tax rate differences of foreign operations 3 -47 -51<br />

Non-taxable income and non-deductible expenses 4 -81 -80<br />

Innovation tax facilities 6 26 197<br />

(De)recognition of deferred tax positions 5 :<br />

– related to prior years 126 203<br />

– related to the current year -34 -5<br />

Other -16 -37<br />

Income tax benefit/(charge) -270 -222<br />

Effective tax rate 27.6% 12.4%<br />

1) Excluding the share in profits or losses of associates and joint ventures.<br />

2) Taxes at Dutch statutory tax rates are calculated on the basis of profit before income tax (excluding the share of profits of associates and joint ventures)<br />

and the applicable Dutch corporate income tax rate of 25% in 2012 and 2011.<br />

3) Tax rate differences of foreign operations reflect the impact of different tax rates in the fiscal jurisdictions in which <strong>KPN</strong> operates. In 2012 and 2011,<br />

the corporate tax rates amounted to 15.8% in Germany, 34% in Belgium and 40% in the United States. The German trade tax rate was 15.6%.<br />

4) Non-taxable income and non-deductible expenses represent adjustments for income not subject to taxation.<br />

5) (De)recognition of deferred tax positions reflects the effects of valuation or non-valuation of tax loss carry forwards and deductible temporary differences.<br />

The amount related to prior years is mainly attributable to E-Plus.<br />

6) In 2011, <strong>KPN</strong> reached an agreement with the Dutch tax authorities with regard to the application of the so called innovation tax facilities. The agreement<br />

has retroactive effect to January 1, 2007 resulting in a one-off benefit of EUR 118 million in 2011 mainly reflecting the period 2007 to 2010. In 2012 the amount<br />

includes a downward adjustment of EUR 14 million relating to 2011.<br />

Deferred tax assets and liabilities<br />

Amounts in millions of EUR December 31, 2012 December 31, 2011<br />

Deferred tax assets 1,822 1,831<br />

– of which: to be recovered after 12 months 1,787 1,805<br />

– of which: to be recovered within 12 months 35 26<br />

Deferred tax liabilities 440 793<br />

– of which: to be realized after 12 months 129 412<br />

– of which: to be realized within 12 months 311 381<br />

Deferred tax assets and liabilities 1,382 1,038<br />

Depending on future taxable results, a part of deferred tax assets relating to tax loss carry forwards now considered to be recoverable after<br />

12 months may be recoverable in the short term, whereas, tax loss carry forwards now considered to be recoverable within 12 months may<br />

be recoverable in the long term.<br />

<strong>KPN</strong> | Annual Report 2012 107