Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

67<br />

Chairman’s introduction<br />

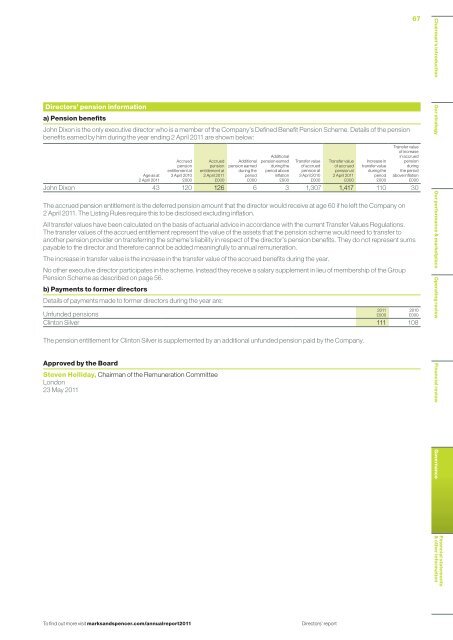

Directors’ pension information<br />

a) Pension benefits<br />

John Dixon is the o<strong>nl</strong>y executive director who is a member of the Company’s Defined Benefit Pension Scheme. Details of the pension<br />

benefits earned by him during the year ending 2 April <strong>2011</strong> are shown below:<br />

Age as at<br />

2 April <strong>2011</strong><br />

Accrued<br />

pension<br />

entitlement at<br />

3 April 2010<br />

£000<br />

Accrued<br />

pension<br />

entitlement at<br />

2 April <strong>2011</strong><br />

£000<br />

Additional<br />

pension earned<br />

during the<br />

period<br />

£000<br />

Additional<br />

pension earned<br />

during the<br />

period above<br />

inflation<br />

£000<br />

Transfer value<br />

of accrued<br />

pension at<br />

3 April 2010<br />

£000<br />

Transfer value<br />

of accrued<br />

pension at<br />

2 April <strong>2011</strong><br />

£000<br />

Increase in<br />

transfer value<br />

during the<br />

period<br />

£000<br />

Transfer value<br />

of increase<br />

in accrued<br />

pension<br />

during<br />

the period<br />

above inflation<br />

£000<br />

John Dixon 43 120 126 6 3 1,307 1,417 110 30<br />

The accrued pension entitlement is the deferred pension amount that the director would receive at age 60 if he left the Company on<br />

2 April <strong>2011</strong>. The Listing Rules require this to be disclosed excluding inflation.<br />

All transfer values have been calculated on the basis of actuarial advice in accordance with the current Transfer Values Regulations.<br />

The transfer values of the accrued entitlement represent the value of the assets that the pension scheme would need to transfer to<br />

another pension provider on transferring the scheme’s liability in respect of the director’s pension benefits. They do not represent sums<br />

payable to the director <strong>and</strong> therefore cannot be added meaningfully to annual remuneration.<br />

The increase in transfer value is the increase in the transfer value of the accrued benefits during the year.<br />

No other executive director participates in the scheme. Instead they receive a salary supplement in lieu of membership of the Group<br />

Pension Scheme as described on page 56.<br />

b) Payments to former directors<br />

Details of payments made to former directors during the year are:<br />

Unfunded pensions<br />

Clinton Silver 111 108<br />

The pension entitlement for Clinton Silver is supplemented by an additional unfunded pension paid by the Company.<br />

Approved by the Board<br />

Steven Holliday, Chairman of the Remuneration Committee<br />

London<br />

23 May <strong>2011</strong><br />

<strong>2011</strong><br />

£000<br />

2010<br />

£000<br />

Our strategy Our performance & marketplace Operating review Financial review<br />

Governance<br />

Financial <strong>statements</strong><br />

& other information<br />

To find out more visit marks<strong>and</strong>spencer.com/annual<strong>report</strong><strong>2011</strong><br />

Directors’ <strong>report</strong>