Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

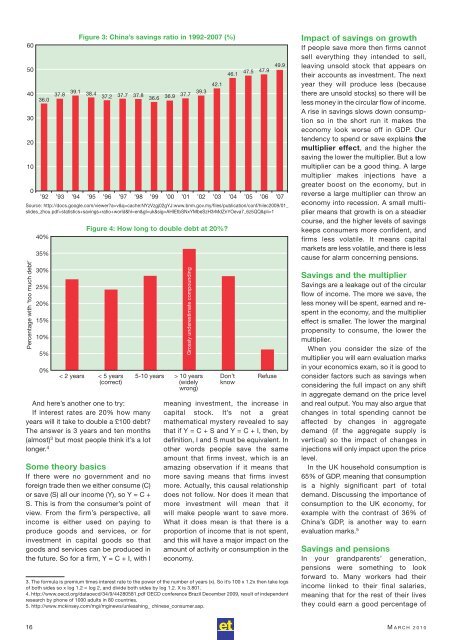

36.0<br />

’92<br />

37.8<br />

’93<br />

39.1<br />

’94<br />

Figure 3: China’s savings ratio in 1992-<strong>2007</strong> (%)<br />

38.4<br />

’95<br />

37.2<br />

’96<br />

37.7<br />

37.8<br />

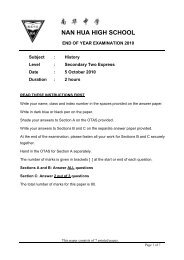

And here’s another one to try:<br />

If interest rates are 20% how many<br />

years will it take to double a £100 debt?<br />

The answer is 3 years and ten months<br />

(almost) 3 but most people think it’s a lot<br />

longer. 4<br />

Some theory basics<br />

If there were no government and no<br />

foreign trade then we either consume (C)<br />

or save (S) all our income (Y), so Y = C +<br />

S. This is from the consumer’s point of<br />

view. From the firm’s perspective, all<br />

income is either used on paying to<br />

produce goods and services, or for<br />

investment in capital goods so that<br />

goods and services can be produced in<br />

the future. So for a firm, Y = C + I, with I<br />

36.6<br />

36.9<br />

37.7<br />

39.3<br />

42.1<br />

46.1<br />

47.5<br />

47.9<br />

49.9<br />

’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07<br />

Source: http://docs.google.com/viewer?a=v&q=cache:NYzVzgj02gYJ:www.bnm.gov.my/files/publication/conf/hilec2009/01_<br />

slides_zhou.pdf+statistics+savings+ratio+world&hl=en&gl=uk&sig=AHIEtbSNxYMbeSzH3rMdZnYOeva7_6z5QQ&pli=1<br />

Percentage with ‘too much debt’<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

< 2 years<br />

Figure 4: How long to double debt at 20%?<br />

< 5 years<br />

(correct)<br />

5-10 years > 10 years<br />

(widely<br />

wrong)<br />

Don’t<br />

know<br />

Refuse<br />

meaning investment, the increase in<br />

capital stock. It’s not a great<br />

mathematical mystery revealed to say<br />

that if Y = C + S and Y = C + I, then, by<br />

definition, I and S must be equivalent. In<br />

other words people save the same<br />

amount that firms invest, which is an<br />

amazing observation if it means that<br />

more saving means that firms invest<br />

more. Actually, this causal relationship<br />

does not follow. Nor does it mean that<br />

more investment will mean that it<br />

will make people want to save more.<br />

What it does mean is that there is a<br />

proportion of income that is not spent,<br />

and this will have a major impact on the<br />

amount of activity or consumption in the<br />

economy.<br />

3. The formula is premium times interest rate to the power of the number of years (x). So it’s 100 x 1.2x then take logs<br />

of both sides so x log 1.2 = log 2, and divide both sides by log 1.2. X is 3.801.<br />

4. http://www.oecd.org/dataoecd/34/9/44280581.pdf OECD conference Brazil December 2009, result of independent<br />

research by phone of 1000 adults in 80 countries.<br />

5. http://www.mckinsey.com/mgi/mginews/unleashing_ chinese_consumer.asp.<br />

Grossly underestimate compounding<br />

Impact of savings on growth<br />

If people save more then firms cannot<br />

sell everything they intended to sell,<br />

leaving unsold stock that appears on<br />

their accounts as investment. The next<br />

year they will produce less (because<br />

there are unsold stocks) so there will be<br />

less money in the circular flow of income.<br />

A rise in savings slows down consump -<br />

tion so in the short run it makes the<br />

economy look worse off in GDP. Our<br />

tendency to spend or save explains the<br />

multiplier effect, and the higher the<br />

saving the lower the multiplier. But a low<br />

multiplier can be a good thing. A large<br />

multi plier makes injections have a<br />

greater boost on the economy, but in<br />

reverse a large multiplier can throw an<br />

economy into recession. A small multi -<br />

plier means that growth is on a steadier<br />

course, and the higher levels of savings<br />

keeps consumers more confident, and<br />

firms less volatile. It means capital<br />

markets are less volatile, and there is less<br />

cause for alarm concerning pensions.<br />

Savings and the multiplier<br />

Savings are a leakage out of the circular<br />

flow of income. The more we save, the<br />

less money will be spent, earned and respent<br />

in the economy, and the multiplier<br />

effect is smaller. The lower the marginal<br />

propensity to consume, the lower the<br />

multiplier.<br />

When you consider the size of the<br />

multiplier you will earn evaluation marks<br />

in your economics exam, so it is good to<br />

consider factors such as savings when<br />

considering the full impact on any shift<br />

in aggregate demand on the price level<br />

and real output. You may also argue that<br />

changes in total spending cannot be<br />

affected by changes in aggregate<br />

demand (if the aggregate supply is<br />

vertical) so the impact of changes in<br />

injections will only impact upon the price<br />

level.<br />

In the UK household consumption is<br />

65% of GDP, meaning that consumption<br />

is a highly significant part of total<br />

demand. Discussing the importance of<br />

consumption to the UK economy, for<br />

example with the contrast of 36% of<br />

China’s GDP, is another way to earn<br />

evaluation marks. 5<br />

Savings and pensions<br />

In your grandparents’ generation,<br />

pensions were something to look<br />

forward to. Many workers had their<br />

income linked to their final salaries,<br />

meaning that for the rest of their lives<br />

they could earn a good percentage of<br />

16 M ARCH 2010