Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

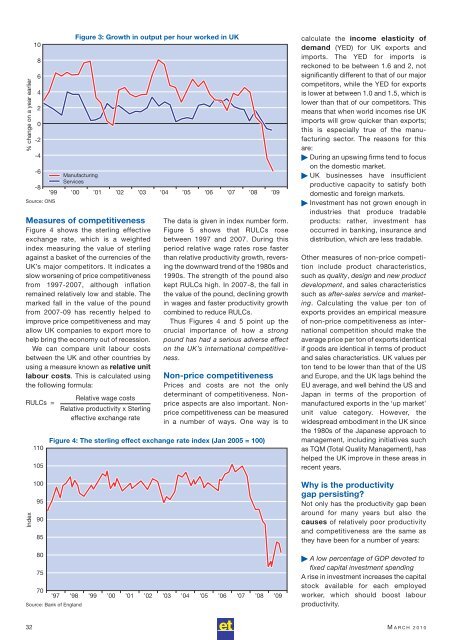

% change on a year earlier<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

Manufacturing<br />

Services<br />

-8<br />

’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09<br />

Source: ONS<br />

Measures of competitiveness<br />

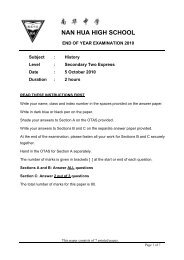

Figure 4 shows the sterling effective<br />

exchange rate, which is a weighted<br />

index measuring the value of sterling<br />

against a basket of the currencies of the<br />

UK’s major competitors. It indicates a<br />

slow worsening of price competitiveness<br />

from 1997-<strong>2007</strong>, although inflation<br />

remained relatively low and stable. The<br />

marked fall in the value of the pound<br />

from <strong>2007</strong>-09 has recently helped to<br />

improve price competitiveness and may<br />

allow UK companies to export more to<br />

help bring the economy out of recession.<br />

We can compare unit labour costs<br />

between the UK and other countries by<br />

using a measure known as relative unit<br />

labour costs. This is calculated using<br />

the following formula:<br />

RULCs =<br />

Index<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

70<br />

Figure 3: Growth in output per hour worked in UK<br />

Relative wage costs<br />

Relative productivity x Sterling<br />

effective exchange rate<br />

The data is given in index number form.<br />

Figure 5 shows that RULCs rose<br />

between 1997 and <strong>2007</strong>. During this<br />

period relative wage rates rose faster<br />

than relative productivity growth, revers -<br />

ing the downward trend of the 1980s and<br />

1990s. The strength of the pound also<br />

kept RULCs high. In <strong>2007</strong>-8, the fall in<br />

the value of the pound, declining growth<br />

in wages and faster productivity growth<br />

combined to reduce RULCs.<br />

Thus Figures 4 and 5 point up the<br />

crucial importance of how a strong<br />

pound has had a serious adverse effect<br />

on the UK’s international competitive -<br />

ness.<br />

Non-price competitiveness<br />

Prices and costs are not the only<br />

determinant of competitiveness. Nonprice<br />

aspects are also important. Nonprice<br />

competitiveness can be measured<br />

in a number of ways. One way is to<br />

Figure 4: The sterling effect exchange rate index (Jan 2005 = 100)<br />

’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09<br />

Source: Bank of England<br />

calculate the income elasticity of<br />

demand (YED) for UK exports and<br />

imports. The YED for imports is<br />

reckoned to be between 1.6 and 2, not<br />

significantly different to that of our major<br />

competitors, while the YED for exports<br />

is lower at between 1.0 and 1.5, which is<br />

lower than that of our competitors. This<br />

means that when world incomes rise UK<br />

imports will grow quicker than exports;<br />

this is especially true of the manu -<br />

facturing sector. The reasons for this<br />

are:<br />

During an upswing firms tend to focus<br />

on the domestic market.<br />

UK businesses have insufficient<br />

productive capacity to satisfy both<br />

domestic and foreign markets.<br />

Investment has not grown enough in<br />

industries that produce tradable<br />

products: rather, investment has<br />

occurred in banking, insurance and<br />

distribution, which are less tradable.<br />

Other measures of non-price competi -<br />

tion include product charac teristics,<br />

such as quality, design and new product<br />

development, and sales characteristics<br />

such as after-sales service and market -<br />

ing. Calculating the value per ton of<br />

exports provides an empirical measure<br />

of non-price competi tiveness as inter -<br />

national competition should make the<br />

average price per ton of exports identical<br />

if goods are identical in terms of product<br />

and sales charac teristics. UK values per<br />

ton tend to be lower than that of the US<br />

and Europe, and the UK lags behind the<br />

EU average, and well behind the US and<br />

Japan in terms of the proportion of<br />

manufactured exports in the ‘up market’<br />

unit value category. However, the<br />

widespread embodiment in the UK since<br />

the 1980s of the Japanese approach to<br />

manage ment, including initiatives such<br />

as TQM (Total Quality Management), has<br />

helped the UK improve in these areas in<br />

recent years.<br />

Why is the productivity<br />

gap persisting?<br />

Not only has the productivity gap been<br />

around for many years but also the<br />

causes of relatively poor productivity<br />

and competitiveness are the same as<br />

they have been for a number of years:<br />

A low percentage of GDP devoted to<br />

fixed capital investment spending<br />

A rise in investment increases the capital<br />

stock available for each employed<br />

worker, which should boost labour<br />

productivity.<br />

32 M ARCH 2010