MASTERCARD SIX NATIONS RUGBY REPORT

MASTERCARD SIX NATIONS RUGBY REPORT

MASTERCARD SIX NATIONS RUGBY REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>MASTERCARD</strong> <strong>SIX</strong> <strong>NATIONS</strong> CHAMPIONSHIP <strong>RUGBY</strong> <strong>REPORT</strong><br />

Report prepared by the Centre for the International Business of Sport (CIBS)<br />

<strong>REPORT</strong> HEADLINES<br />

Positive economic impact:<br />

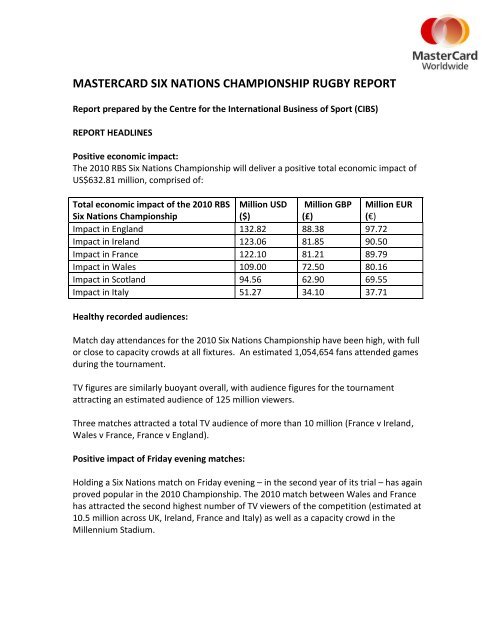

The 2010 RBS Six Nations Championship will deliver a positive total economic impact of<br />

US$632.81 million, comprised of:<br />

Total economic impact of the 2010 RBS<br />

Six Nations Championship<br />

Million USD<br />

($)<br />

Million GBP<br />

(£)<br />

Million EUR<br />

(€)<br />

Impact in England 132.82 88.38 97.72<br />

Impact in Ireland 123.06 81.85 90.50<br />

Impact in France 122.10 81.21 89.79<br />

Impact in Wales 109.00 72.50 80.16<br />

Impact in Scotland 94.56 62.90 69.55<br />

Impact in Italy 51.27 34.10 37.71<br />

Healthy recorded audiences:<br />

Match day attendances for the 2010 Six Nations Championship have been high, with full<br />

or close to capacity crowds at all fixtures. An estimated 1,054,654 fans attended games<br />

during the tournament.<br />

TV figures are similarly buoyant overall, with audience figures for the tournament<br />

attracting an estimated audience of 125 million viewers.<br />

Three matches attracted a total TV audience of more than 10 million (France v Ireland,<br />

Wales v France, France v England).<br />

Positive impact of Friday evening matches:<br />

Holding a Six Nations match on Friday evening – in the second year of its trial – has again<br />

proved popular in the 2010 Championship. The 2010 match between Wales and France<br />

has attracted the second highest number of TV viewers of the competition (estimated at<br />

10.5 million across UK, Ireland, France and Italy) as well as a capacity crowd in the<br />

Millennium Stadium.

MasterCard Worldwide – Page 2<br />

MasterCard Six Nations Championship Rugby Report<br />

Increasing participation:<br />

The overall growth in rugby worldwide is estimated at 15% per year, while participation<br />

has been growing across the Six Nations, with substantial increases recorded since 2007:<br />

Nation<br />

% Growth<br />

Italy 36<br />

Ireland 33<br />

Scotland 32<br />

France 22<br />

Wales 10<br />

England 5<br />

OVERVIEW OF THE <strong>REPORT</strong><br />

Ahead of the 2010 RBS Six Nations Championship, MasterCard – a Worldwide Partner<br />

and official payment system of the Rugby World Cup 2011 – commissioned leading<br />

international sport business experts at the Centre for the International Business of Sport<br />

(CIBS) to conduct a study into the economic impact of the 2010 RBS Six Nations<br />

Championship and associated demographic trends.<br />

The report consists of the following sections:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Section 1: Report Aims<br />

Section 2: History of the Competition<br />

Section 3: Sport Events and Impacts Research<br />

Section 4: Sports Events and Demographic Profile<br />

Section 5: Broadcasting<br />

Section 6: Participation<br />

Section 7: Conclusions<br />

Section 8: Methodology<br />

- more -

MasterCard Worldwide – Page 3<br />

MasterCard Six Nations Championship Rugby Report<br />

SECTION 1: <strong>REPORT</strong> AIMS<br />

The aims of this report are:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

To identify the economic impact of the 2010 Six Nations Championship on the host<br />

countries<br />

To indicate how these impacts might be felt across product categories/ industrial<br />

sectors<br />

To assess the likely impact that emerging from the recession has had<br />

To consider the socio-demographic profile of rugby fans in relation to the above<br />

To analyse the popularity of the Championship on TV<br />

To examine the implications of the Friday night fixture<br />

To compare to other televised sports events<br />

To outline participation figures in rugby union across the nations involved in the<br />

tournament<br />

To highlight areas of growth by demographics<br />

- more -

MasterCard Worldwide – Page 4<br />

MasterCard Six Nations Championship Rugby Report<br />

SECTION 2: HISTORY OF THE <strong>SIX</strong> <strong>NATIONS</strong> CHAMPIONSHIP<br />

The Six Nations Championship is the oldest and most high profile rugby union<br />

tournament in the Northern hemisphere. Contested annually by six of Europe’s rugby<br />

playing nations (England, France, Ireland, Italy, Scotland and Wales), the tournament<br />

consists of 15 matches, with each nation playing the others once. Home advantage<br />

alternates year by year. In the 2010 edition, England, Scotland and Italy played two ties<br />

at home, while Ireland, France and Wales played three 1 .<br />

England and Scotland contested the first official rugby union international in 1871 and<br />

following occasional friendly matches between the two over the next 12 years, the<br />

Home International Championship was introduced in 1883. This was a tournament held<br />

between the four home nations of England, Ireland, Scotland and Wales. Though France<br />

played in the tournament four times previously, it was not until 1910 that they officially<br />

joined and it became known as the Five Nations Championship.<br />

The tournament reverted back to the Home Nations in 1932 after French teams were<br />

found to have been illegally paying their amateur players 2 and this remained the case<br />

until 1939. The competition had breaks for the two world wars, then the Five Nations<br />

resumed in 1947. The competition grew in popularity, and by the 1970s matches were<br />

all ticket events and coverage on television was becoming increasingly popular. The<br />

tournament was again renamed in 2000 when the addition of Italy made it the Six<br />

Nations Championship.<br />

In its first decade of existence, France has been the Six Nations winner most frequently,<br />

with Scotland and Italy never having been Champions.<br />

Table 1: Past Six Nations Winners<br />

Year<br />

Winning nation<br />

2000 England<br />

2001 England<br />

2002 France<br />

2003 England<br />

2004 France<br />

2005 Wales<br />

2006 France<br />

2007 France<br />

2008 Wales<br />

2009 Ireland<br />

2010 France<br />

1 This scenario will be reversed in the 2011 edition.<br />

2 Rugby Union turned professional on 27 th August 1995.<br />

- more -

MasterCard Worldwide – Page 5<br />

MasterCard Six Nations Championship Rugby Report<br />

The Six Nations Tournament receives consistently high attendance figures and compares<br />

very favourably with other tournaments of its type, in many cases beating the<br />

attendance of other high profile major events.<br />

Table 2: Attendance at Selected Competitions between National Representative Sides<br />

(sorted by average match attendance)<br />

Tournament Sport Host nation Games Total<br />

attendance<br />

Average match<br />

attendance<br />

1994 FIFA World Soccer USA 52 3,587,538 68,991<br />

Cup Finals<br />

2009 Six Nations Rugby England, 15 981,963 65,464<br />

Championship Union Ireland,<br />

Scotland,<br />

Wales, Italy,<br />

France<br />

2006 FIFA World Soccer Germany 52 3,353,655 52,401<br />

Cup Finals<br />

2007 Rugby Rugby France 48 2,274,037 47,376<br />

World Cup<br />

2009 Rugby<br />

Union Tri-<br />

Nations<br />

2007 FIFA<br />

Women’s World<br />

Cup Finals<br />

Union<br />

Rugby<br />

Union<br />

Australia,<br />

New Zealand,<br />

South Africa<br />

9 399,907 44,434<br />

Soccer China 32 1,190,971 37,218<br />

Euro 2008 Soccer Austria, 31 1,140,902 36,308<br />

Switzerland<br />

2004 AFC Asian Soccer China 32 1,000,025 31,258<br />

Cup<br />

2006 Rugby<br />

League Tri-<br />

Nations<br />

Rugby<br />

League<br />

Australia,<br />

New Zealand,<br />

Great Britain<br />

7 163,769 23,395<br />

2009 Baseball<br />

Classic<br />

2004 World Cup<br />

Of Hockey<br />

2007 Cricket<br />

World Cup<br />

Baseball<br />

Various, USA<br />

final<br />

39 801,408 20,549<br />

Ice<br />

19 303,630 15,981<br />

hockey<br />

Cricket West Indies 51 672,000 13,176<br />

Attendances reported for the 2010 competition suggest that overall attendance is<br />

similar but higher than the 2009 event. An estimated 1,054,654 fans attended games<br />

during the 2010 tournament, compared to 981,963 for the 2009 Championship.<br />

- more -

MasterCard Worldwide – Page 6<br />

MasterCard Six Nations Championship Rugby Report<br />

SECTION 3: SPORT EVENTS AND IMPACT RESEARCH<br />

A large number of studies analysing the economic impact of sporting events have been<br />

produced in the past. Amongst these studies is a view that sporting events can be<br />

categorised in the following way:<br />

<br />

<br />

<br />

<br />

Global sporting event – irregular, one-off, major sporting events that generate<br />

significant economic activity and media interest e.g. FIFA World Cup, Rugby World<br />

Cup<br />

Domestic sporting event – major spectator events, generating significant economic<br />

activity and media interest which are part of an annual domestic cycle of sporting<br />

events e.g. FA Cup Final<br />

Irregular sporting event – one-off, major spectator/competitor events generating<br />

considerable economic activity albeit less than global sporting events e.g. UEFA Euro<br />

2008<br />

Major competitor event – generates limited economic activity and are part of an<br />

annual domestic cycle of sport events e.g. national championships<br />

However, the Six Nations Championship does not readily fit into any of the categories<br />

identified. Instead, a new category of event is proposed:<br />

<br />

Continental/Hemispheric sporting event – part of a regular cycle, major sporting<br />

event that generates significant economic activity and is of interest to media outlets<br />

across the world<br />

In addition to the Six Nations Championship, this definition also accounts for events like<br />

the Tri-Nations rugby union tournament in the Southern Hemisphere.<br />

- more -

MasterCard Worldwide – Page 7<br />

MasterCard Six Nations Championship Rugby Report<br />

Various studies have examined the economic impact of sporting events, the majority of<br />

which are multi-sport in nature or are held over an extended time period. Although the<br />

methodologies used in each are likely to have been different, one report reveals the<br />

following as the ten sporting events that generate the largest economic impact:<br />

Table 3: Top 10 Sporting Events by Economic Impact<br />

Rank Event<br />

$<br />

(billion)<br />

£<br />

(billion)<br />

€<br />

(billion)<br />

1 Olympic Games 11.34 7.53 8.32<br />

2 FIFA World Cup 9.16 6.08 6.72<br />

3 America's Cup 6.98 4.63 5.12<br />

4 FIA F1 World Championship 3.05 2.03 2.24<br />

UEFA European<br />

5 Championships 2.18 1.45 1.60<br />

6 Baseball World Series 1.09 0.72 0.80<br />

7 NFL Superbowl 1.09 0.72 0.80<br />

8 Rugby World Cup 0.34 0.23 0.25<br />

Athletics World<br />

9 Championship 0.34 0.23 0.25<br />

10 Cricket World Cup 0.16 0.11 0.12<br />

NB All impacts are global<br />

To enable comparisons to be made between events of various sizes, the economic<br />

impact of a selection of other sporting events is presented below:<br />

Table 4: Economic Impact of Selected Events<br />

Event<br />

$<br />

(million)<br />

£<br />

(million)<br />

€<br />

(million)<br />

1997 World Badminton<br />

3.29 2.18 2.41<br />

Championships, UK<br />

1999 MLB All-Star Game, US 65.43 43.42 48.00<br />

1999 NFL Superbowl, US 226.82 150.51 166.40<br />

2000 MLB World Series, US 218.09 144.72 160.00<br />

2000 NFL Superbowl, US 254.73 169.03 186.88<br />

2001 Cooper River Bridge Run, US 5.32 3.53 3.90<br />

2001 Girls Fastpitch World Series, US 3.49 2.32 2.56<br />

2001 NCCA Basketball Last Four, US 95.96 63.68 70.40<br />

2001 St Giles Youth Soccer Classic, US 1.47 0.98 1.08<br />

- more -

MasterCard Worldwide – Page 8<br />

MasterCard Six Nations Championship Rugby Report<br />

2002 Breeders Cup, US 49.73 33.00 36.48<br />

2003 UEFA Champions League Final, 12.98 8.61 9.52<br />

UK<br />

2003 NFL Superbowl, US 327.14 217.08 240.00<br />

2003 World Gymnastics<br />

26.17 17.37 19.20<br />

Championship, US<br />

2005 European Eventing, UK 2.77 1.84 2.03<br />

2005 Open Golf Championship, UK 39.82 26.42 29.21<br />

2005 British F1 Grand Prix 36.35 24.12 26.67<br />

2006 NFL Superbowl, US 348.95 231.55 256.00<br />

2006 World Rowing Championships, 4.84 3.21 3.55<br />

UK<br />

2007 FIFA U-20 World Cup, Canada 110.97 73.63 81.41<br />

2007 UEFA Cup Final, UK 28.22 18.72 20.70<br />

N.B. All impacts are local<br />

Specifically in the context of rugby, various studies have provided estimates of economic<br />

impacts. Table 5 lists some of the main findings:<br />

Table 5: Economic Impacts of Rugby Events<br />

Event<br />

$<br />

(million)<br />

£<br />

(million)<br />

€<br />

(million)<br />

2002 Scotland v South Africa Autumn Test Match,<br />

18.08 12.00 13.27<br />

Scotland<br />

2002 Scotland v Fiji Autumn Test Match, Scotland 6.03 4.00 4.42<br />

2002 Scotland v Romania Autumn Test Match, Scotland 6.03 4.00 4.42<br />

2003 IRB Rugby World Cup, Australia (national impact) 183.85 £122 134.88<br />

2007 Scotland v Ireland Six Nations Match, Scotland 39.18 26.00 28.74<br />

2008 RBS 6 Nations Championship, Overall 592.84 393.40 434.92<br />

2008 RBS 6 Nations Championship, England 124.47 82.60 91.32<br />

2008 RBS 6 Nations Championship, Ireland 115.28 76.50 84.57<br />

2008 RBS 6 Nations Championship, Scotland 88.61 58.80 65.01<br />

2008 RBS 6 Nations Championship, Wales 102.17 67.80 74.96<br />

2008 RBS 6 Nations Championship, France 114.38 75.90 83.91<br />

2008 RBS 6 Nations Championship, Italy 48.07 31.90 35.27<br />

2009 Heineken Cup Final, Scotland 33.15 £22 24.32<br />

2009 Super League Magic Weekend, Scotland 16.58 11.00 12.16<br />

2009 Emirates Airline Edinburgh 7s Festival, Scotland 4.52 3.00 3.32<br />

2009 Heineken Cup Quarter Final Match, Limerick,<br />

Ireland<br />

110.94 73.62 81.39<br />

- more -

MasterCard Worldwide – Page 9<br />

MasterCard Six Nations Championship Rugby Report<br />

The positive economic impact of sporting events is likely to be evident at four levels:<br />

<br />

<br />

<br />

<br />

Local level – within the host cities, where the 2010 Six Nations Championship is held<br />

Regional level – this will include the political and geographic area within which the<br />

tournament is staged<br />

National level – more broadly and generally across each of the six nations<br />

International level – there will be a multiplicity of impacts across Europe and the<br />

world that can be attributed to the Six Nations Championship. Interest in the<br />

Championship will have an economic impact.<br />

The impacts attributable to the 2010 Six Nations Championship will take one of a<br />

number of forms including:<br />

<br />

<br />

<br />

Direct effects – includes the market revenues directly attributable to the individual<br />

matches either at the time of the event or in the future once the event has finished<br />

Indirect and Induced effects – normally generated following an investment in<br />

infrastructure (e.g. stadium developments), also wider impacts from increased sales<br />

etc which has a multiplier effect on economic activity amongst those with direct and<br />

indirect links to the initial investment<br />

External effects – includes non-market factors that benefit communities linked to<br />

the host venue such as improving the image of a locality and raising local economic<br />

growth<br />

In the context of the above commentary the range of positive impacts for the host cities,<br />

local area and for countries participating in the Six Nations in general, that one would<br />

normally expect from such an event are:<br />

<br />

<br />

<br />

<br />

<br />

Ticket sales<br />

Food and beverage sales<br />

Merchandise and related sales<br />

Visitor use of accommodation<br />

Visitor numbers at host venue attractions<br />

Research undertaken at previous sporting events (shown in Table 6 below) indicates<br />

which forms of expenditure are most likely to be influenced by people attending either.<br />

- more -

MasterCard Worldwide – Page 10<br />

MasterCard Six Nations Championship Rugby Report<br />

Table 6: Profile of Expenditure at Sporting Events<br />

Rank Gratton et al.<br />

(2000)<br />

Bernthal<br />

& Regan<br />

(2004)<br />

Haug et<br />

al. (2004)<br />

1 Accommodation Tickets Tickets &<br />

event<br />

spending<br />

Lee & Taylor<br />

(2005)<br />

Culture &<br />

recreation<br />

Saayman (2005)<br />

Entrance<br />

Daniels &<br />

Norman<br />

(2006)<br />

Hotels &<br />

lodging<br />

UK Sport (2006) Wilson (2006)<br />

Accommodation Food & drink<br />

2 Food & drink Food Food Shopping Food Meals Food & drink Accommodation<br />

3 Shopping &<br />

souvenirs<br />

Shopping Hotels Accommodation Alcoholic drinks Sport Shopping and<br />

souvenirs<br />

Shopping &<br />

souvenirs<br />

4 Travel Travel Transport Tours &<br />

transport<br />

Accommodation Retail Programmes &<br />

merchandise<br />

Programmes &<br />

merchandise<br />

5 Entertainment Event<br />

Food &<br />

Transport Automobiles Travel Travel<br />

spending<br />

beverages<br />

6 Programmes &<br />

merchandise<br />

Recreation Souvenirs Entertainment Entertainment Entertainment<br />

- more -

MasterCard Worldwide – Page 11<br />

MasterCard Six Nations Championship Rugby Report<br />

One might also expect there to be a direct or indirect economic impact in the host cities,<br />

in the wider six participating nations and/or across Europe on the following:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Increased amount of electronic and print media advertising<br />

Increased use of telecommunications and new media services<br />

Activities and sales based around event officials<br />

Activities and sales based around officials from commercial partners and sponsors<br />

Place marketing benefits and image improvement<br />

Magazine, newspaper sales and other related sales<br />

Sales of sport apparel, equipment and related items<br />

Sales of official merchandise and memorabilia<br />

Increases in betting and gambling services<br />

There is also evidence to indicate that sporting success can have a positive economic<br />

impact on the national economy of the winners, previous studies highlighting positive<br />

share price movements linked to winning.<br />

ECONOMIC IMPACT OF THE 2010 RBS <strong>SIX</strong> <strong>NATIONS</strong>:<br />

Considering the above, and on the basis of all available data, it is projected that the<br />

2010 RBS Six Nations Championship has delivered the following positive impact:<br />

Table 7: Projected Economic Impact of the 2010 Six Nations<br />

Total economic impact of the 2010 RBS<br />

Six Nations Championship<br />

Million USD<br />

($)<br />

Million GBP<br />

(£)<br />

Million EUR<br />

(€)<br />

Impact in England 132.82 88.38 97.72<br />

Impact in Ireland 123.06 81.85 90.50<br />

Impact in France 122.10 81.21 89.79<br />

Impact in Wales 109.00 72.50 80.16<br />

Impact in Scotland 94.56 62.90 69.55<br />

Impact in Italy 51.27 34.10 37.71<br />

In total, it is estimated that the cumulative economic impact of the 2010 RBS Six<br />

Nations Championship has amounted to upwards of $632.81m (£420.94m).<br />

This economic boost results from a short term positive commerce flow through fan<br />

spending in bars, clubs, shops, hotels, city attractions, transport, bookmakers and inside<br />

the stadia, along with sponsors and organisations spending on marketing in the cities.<br />

-more-

MasterCard Worldwide – Page 12<br />

MasterCard Six Nations Championship Rugby Report<br />

Research suggests that major rugby events such as the Six Nations, tend to be<br />

characterised by significant numbers of travelling supporters. As international visitors<br />

bring significant new consumer spending into the economy, they tend to provide the<br />

primary source of additional income to a host. The differences in the boost for each city<br />

relates heavily to the attendance of non-local visitors to games, which is in turn<br />

influenced by stadium capacity.<br />

The projected boost to the English economy of $132.82 million compares very<br />

favourably to the Italian boost which is estimated to be closer to $50 million. There are a<br />

number of reasons for this difference. Firstly, capacity utilisation for the tournament is<br />

invariably high, thus the grounds with the highest capacity clearly have a greater<br />

potential to accommodate the demand for tickets to games.<br />

A major reason for the greatest impacts being felt in England, Ireland and France,<br />

therefore, is because of these nations’ bigger stadiums, which means they are more<br />

capable of meeting the demand for tickets.<br />

Table 8: Average Attendance and Capacity Utilisation for the 2009 Six Nations<br />

Nation Ground Capacity Average<br />

Attendance<br />

(2009<br />

Championship)<br />

England Twickenham 82,000 82,000 100<br />

Ireland Croke Park 82,300 80,500 98<br />

Scotland Murrayfield 67, 130 61,000 91<br />

Wales Millennium 74,500 73,813 99<br />

Stadium<br />

France Stade de France 81,338 79,800 98<br />

Italy Stadio Flaminio 30,000 28,683 96<br />

Source: Six Nations Match Reports, statbunker.com<br />

Capacity<br />

Utilisation (%)<br />

Given the ease of access to all of the host cities from the other competing nations, and<br />

also the crowds for the 2009 tournament which fell at the height of the credit crunch, it<br />

was reasonable to expect a significant number of additional fans to travel to the host<br />

cities for the 2010 competition.<br />

-more-

MasterCard Worldwide – Page 13<br />

MasterCard Six Nations Championship Rugby Report<br />

Attendance demographics<br />

Research suggests that on average more than 85% of fans attending matches are drawn<br />

from the host nation, with 10% from opposing teams and the remaining 5% from other<br />

fans of rugby in general. Of course this changes according to which teams are playing.<br />

For example in 2006, the Wales v Scotland match in the Six Nations Championship<br />

resulted in 85,499 visitors to Cardiff, generating a total of £16.4 million ($24.73, €18.14)<br />

for the Cardiff economy. Of this total estimated 85,499 visitors, 87% were ticket holders;<br />

92.6% were Wales supporters; 7.5% were Scotland supporters and 0.01% were neutral<br />

supporters.<br />

In 1997, estimates indicated that visitors attending Six Nations games spent on average<br />

€469 ($638, £423), with other out of state visitors (non-attendees at games) spending<br />

on average €379 ($516, £342). Further research based on fans attending an Ospreys<br />

match, who have a similar demographic profile to those watching the Six Nations rugby<br />

suggests that on average €527 ($715, £474) was spent per visiting supporter, with 27%<br />

being spent on accommodation and 68% on food and beverages in the team’s home<br />

city.<br />

To add to those travelling to the match venues, a large number of people watch the<br />

games in pubs, clubs, bars or cafes, as well as at home. The projected economic impacts<br />

also incorporate a potentially longer-term economic legacy for the hosts, through<br />

increased tourism, civic sponsorship and a greater likelihood of repeat visits. Some<br />

visitors also incorporate watching a match into a longer visit and travel with additional<br />

friends and family, thus also increasing the economic impact.<br />

In addition, success at such a tournament can encourage increased participation, which<br />

in the long term can deliver significant health benefits and have a positive impact on<br />

community cohesion (Discussed in section 6 below) and contribute to employment (full,<br />

part time and temporary) and entrepreneurship as well as generating increased revenue<br />

from sales of equipment and sporting goods.<br />

-more-

MasterCard Worldwide – Page 14<br />

MasterCard Six Nations Championship Rugby Report<br />

SECTION 4: SPORTS EVENTS AND DEMOGRAPHIC PROFILE<br />

Given the diverse population of the geographic area of the Six Nations, it is difficult to<br />

generalise about the nature and characteristics of people involved in consumption in<br />

and around the tournament. Nevertheless, there are inevitably a large number of<br />

people who are engaged in consuming the Six Nations product.<br />

Interest in rugby across all of the six nations is strong and growing. The IRB World Cup<br />

2007 generated an unprecedented interest in rugby in France, with the France-England<br />

Semi-Final watched by 18.3 million people and the Quarter-Final against the New<br />

Zealand All Blacks by 16.6 million, while two of the three pool matches had audiences of<br />

more than 14 million.<br />

Additionally, the total attendance for the French championship reached 3.2 million<br />

spectators in the 2007-2008 season, which was accompanied by an increase from<br />

400,000 to 500,000 for the French national team's matches, and from 400,000 to<br />

500,000 for the European Cup matches. Evidence indicates that 29% of French people<br />

follow rugby, as opposed to 30% who follow football; while the French national rugby<br />

team's progress is followed by 41% of French people, as opposed to 40% who follow<br />

football. 62% of the public gives rugby a favourable rating of between 8 and 10, as<br />

opposed to only 36% who give a similar rating to football.<br />

In Italy too, the sport is developing rapidly. Despite the North of the country still being<br />

classed as rugby’s heartland, a sell-out crowd of 80,000 attended the recent Italy-New<br />

Zealand match at the San Siro in Milan. Such is the demand for rugby that two Italian<br />

sides are set to join the Magner’s League next season. This is likely to create ‘superclubs’<br />

similar to those in Wales and Ireland.<br />

The addition of the Italian sides would benefit not only the development of Italian rugby<br />

but have a positive effect on the other sides and their surrounding economy too with a<br />

rise in the number of games likely to induce a corresponding increase in the number of<br />

spectators, thus generating additional revenue for the clubs and regions. Related to this<br />

additional exposure, and with an additional market for brands to sell in, the value of<br />

sponsorship would be expected to increase, as would the brand of the competing sides<br />

and locations. This also impacts the broadcast market which is discussed further in<br />

section 5.<br />

There is evidence from the UK that approximately 2.8% of the population paid to watch<br />

rugby union in 2008, compared to 2.5% in 2004 (2.7% cricket, 9.4% football). This<br />

increases to 22% regarding people who watched rugby union on television, and 38%<br />

follow the sport media reports. (Mintel, 2009).<br />

-more-

MasterCard Worldwide – Page 15<br />

MasterCard Six Nations Championship Rugby Report<br />

Additional information on socio-economic characteristics of rugby supporters in the UK<br />

suggest that rugby supporters are traditionally from higher economic groups compared<br />

to the average of the population. While 24% of the adult population are from group AB,<br />

54% of those that play rugby or watch and attend rugby are from the top social<br />

grouping. In Ireland, as with the other Six Nations participants, the socio-demographic<br />

profile of rugby union supporters is predominately male, although approximately 30% of<br />

attendees at international fixtures are female. In Scotland too, the majority of people<br />

who express an interest in rugby are drawn from classes A, B and C1, with over 65%<br />

being male (Mintel).<br />

This interest from relatively wealthy social groups is associated with greater spending<br />

capacity than fans of some other sports. This higher propensity to spend translates<br />

favourably in terms of economic impacts and the ability for rugby to recover strongly<br />

from the credit crunch. This is likely to be reflected in the number of overnight stays, the<br />

overall spend (research suggests that rugby fans spend more than football fans overall<br />

on attending sports events). Additionally they are more likely to travel in groups with<br />

family members and stay for longer than just the match visit.<br />

Location impacts<br />

The Six Nations Championship hosts benefit from being in popular capital city locations<br />

so trips which are planned around the rugby but perhaps include an extended stay are<br />

more likely. Large numbers of travelling fans from high-income groups tend to bring<br />

significant additional expenditure. Research suggests that fans travelling further<br />

distances tend to spend more during their stay in the host nation.<br />

For example evidence from two 2002 Six Nations matches suggests that French fans<br />

visiting the UK tend to have a higher spend than the home nations fans and also tend to<br />

travel outside of the host city. High end events recover quickly because the market they<br />

attract is still wealthy, but value for money is also important.<br />

Emerging from the global economic downturn<br />

While the previous two years competitions have taken place in the grips of the global<br />

downturn, the competing nations are now all technically out of recession. In previous<br />

reports it has been argued that major sporting events would be largely resistant to the<br />

negative impact of the economic downturn, and that new supporter groupings would<br />

emerge to consume the sporting product in different ways (Chadwick, 2009) – in<br />

particular the stay at home audience and the way in which they engage.<br />

Indeed, despite the slow economic recovery, reports suggest that the demand for<br />

corporate hospitality in the UK, for example, will exceed £1.25b (€1.38b, $1.89) by 2013<br />

(MBD Commercial Due Diligence UK Corporate Hospitality Market Development Report,<br />

2009).<br />

-more-

MasterCard Worldwide – Page 16<br />

MasterCard Six Nations Championship Rugby Report<br />

At Twickenham, following a 35% decrease in sales revenue from corporate packages for<br />

the 2009 Championship (causing the RFU to lose £2m, (€2.21m, $3.02m)) 2010 has seen a<br />

great recovery with a 60% rise in hospitality sales. Demand has outstripped supply of<br />

boxes and hospitality seats for the Ireland game and the situation is similar against<br />

Wales. Reports indicate that RFU could have filled 82,000-capacity Twickenham twice<br />

for both of England's home matches this season, despite a 2.5% increase in ticket prices<br />

following recent VAT rise.<br />

Similarly hotels in close proximity to the grounds have experienced strong demand. The<br />

Marriot Hotel, located in Twickenham’s redeveloped South Stand, sold out for both<br />

weekends of England’s home 2010 Six Nations matches. This is particularly good news<br />

for the service sector who have been hit hard in the recession, especially at a time of<br />

year when traditionally hotels are facing low occupancy rates.<br />

While corporate entertainment suffered heavily in the downturn, events offering value<br />

for money have been among the first to recover. As public criticism has been strong for<br />

corporates wasting money over indulging at events, the recovery has seen a shift with<br />

companies keen to keep their activities more low key. However rugby union appears to<br />

have bounced back strongly, with Twickenham having sold out its hospitality area for<br />

the Ireland game, and achieved sales of 4,000 tickets for the game against Wales<br />

(compared to sales last season of 2,800 and 3,000 against Scotland and France<br />

respectively) in advance of the start of the tournament.<br />

Brands are being careful with how they are seen to be spending but have rejoined the<br />

market in force. Experiential and bespoke events have proved popular, particularly<br />

those involving meeting players, and the Unions have reacted to this. Scottish rugby<br />

have launched a series of innovative partnerships with local hotels to offer bespoke<br />

packages for the Six Nations matches to ensure any additional revenues from corporate<br />

hospitality can be reinvested into the game by boosting the union’s revenues instead of<br />

fans buying unofficial packages.<br />

However, growth in corporate sales has not been repeated across all nations. In Ireland<br />

companies continue to curtail their hospitality spend. While hospitality packages are still<br />

selling, this tends to be on a smaller scale. Despite sport sponsorship in Ireland growing<br />

by 2% to €133m (£120.26m, $181.39m) in 2009, it is expected to fall by up to 6% in<br />

2010, compared to a predicted 5% rise in Europe overall (Onside Sponsorship Report).<br />

While technically, based on growth in GDP, Ireland exited recession in December 2009,<br />

this was mainly due to higher profits of multinationals which use Ireland for tax<br />

purposes. Without this effect, GNP would have decreased by 1.4%, suggesting that most<br />

of the Irish population are still in the grip of recession. Ireland’s recession has been one<br />

of the deepest, with its economy shrinking by 10% in 2009. Clearly this has filtered<br />

through to corporate sales.<br />

-more-

MasterCard Worldwide – Page 17<br />

MasterCard Six Nations Championship Rugby Report<br />

However, Ireland’s Central Bank has predicted that the country will exit recession in the<br />

second half of this year, and recovery is expected for the 2011 edition of the<br />

Championship.<br />

The 2010 Championship is expected to be the final time in the modern era that Ireland<br />

will play their home games at Croke Park. The Aviva Stadium, built on the site of the old<br />

Landsdown Road ground is due to open later this year. Though the reduction in seating<br />

capacity from 82,000 at Croke Park to 50,000 at the Aviva Stadium will inevitably mean a<br />

reduction in attendances, the new stadium is designed to accommodate premium and<br />

hospitality guests. There are 10,000 seats at premium level and a further 1,300 at box<br />

level.<br />

While the Six Nations tournament draws its attending audience primarily from existing<br />

rugby fans in the participating countries, it is popular throughout the rest of Europe and<br />

the rest of the world.<br />

Categorising the Six Nations audience<br />

Drawing from observations made in previous CIBS reports for MasterCard, and also from<br />

observations made above, one should expect the composition of people expressing an<br />

interest in the Six Nations Championship to include:<br />

<br />

<br />

The Mobiles: people predominantly from the participating nations, but also rugby<br />

fans across Europe, who travel to one or more of the host cities to watch a match<br />

(this group in turn will consist of a series of further consumer segments, each of<br />

which display distinctive characteristics – see below); the Mobiles are more likely to<br />

be male, middle class, earning an above average income and be aged 20-44 years<br />

old.<br />

The Engagers: people who engage with the Final at some level but stay in their<br />

home nation to watch it; the most engaged are likely to be existing rugby fans, and<br />

potentially fans of the teams from which players are drawn and spend money<br />

around the matches on e.g. food and drink, replica shirts and other merchandise<br />

etc.; the least engaged are likely to be aware of the tournament, may watch it given<br />

that it is the most prestigious northern hemisphere tournament and may spend on<br />

e.g. drinks and snacks, newspapers etc.; given the breadth and depth of people with<br />

an interest in rugby, it is difficult to characterise the demographic characteristics of<br />

the Engagers, although we can predict that large numbers of people talk about the<br />

tournament, read about it, watch it, spend around at and have at least some interest<br />

in it. However, those most engaged are likely to be from a high social grouping,<br />

reflecting the general socio-economic profile of those with an interest in rugby.<br />

-more-

MasterCard Worldwide – Page 18<br />

MasterCard Six Nations Championship Rugby Report<br />

<br />

The Recession-Resisters: people and organisations who deliberately seek to engage<br />

with the Six Nations in some way in order to displace the pessimism associated with<br />

harsh economic conditions. Amongst these, people will engage with the tournament<br />

because it will help them to forget other problems they have which have been<br />

caused by economic hardship; people will engage because it excites them at a time<br />

of pessimism and concern. Amongst some organisations such as advertisers etc.,<br />

there will be a feeling that the tournament constitutes a safe-haven and good value<br />

for money given the exposure and profile it provides.<br />

Across the Northern hemisphere and the rest of the world, there is also considerable<br />

interest in the tournament. Although a categorisation of whom these interested parties<br />

are and what their interest in the tournament might be proves difficult, the following<br />

provides an indication:<br />

<br />

<br />

<br />

<br />

<br />

<br />

They may be fans of a player competing in the tournament<br />

They may be fans of the Six Nations<br />

They may be fans of a particular nation/ patriotic<br />

They may be fans of rugby generally<br />

They may be fans of sporting spectacle<br />

They may be fans of good entertainment<br />

As was identified above, there are likely to be a sizeable number of ‘Mobiles’ who travel<br />

to the host cities to watch matches, some of whom have (or secure upon arrival) match<br />

tickets.<br />

Others, who are more likely to be domestic fans, travel to watch the game in bars and<br />

cafes, or to experience the feeling of being associated with a major sporting event.<br />

Kurtzman (2005) identified that visitors to cities hosting major sporting events, can be<br />

classified in the following way:<br />

<br />

<br />

<br />

<br />

<br />

Preluders: visitors who travel to a host city ahead of a sporting event<br />

Attenders: visitors who travel to a host city specifically for a sporting event<br />

Retainers: visitors who remain in a host city after a sporting event has finished<br />

Residuals: visitors who return to a host city up to 24 months after a sporting event<br />

Continuers: visitors who return to a host city during a period 2-5 years after a<br />

sporting event<br />

-more-

MasterCard Worldwide – Page 19<br />

MasterCard Six Nations Championship Rugby Report<br />

The work of Preuss et al. (2007) helped to further clarify these categories by identifying<br />

the following groups of visitor who travel to sporting events:<br />

<br />

<br />

<br />

<br />

Event visitors: those who travel to a host city specifically because of a sporting event<br />

Extensioners: those who travel to a host city anyway but stay longer because of a<br />

sporting event<br />

Home stayers: local residents who opt to stay in a host city and spend their money<br />

on attending a sporting event rather than on a vacation out of the region at some<br />

other time in the year<br />

Time switchers: those who wanted to travel to the host city at another time but<br />

bring their journey forwards to coincide with a sporting event<br />

On the basis of evidence presented elsewhere, this report proposes that the following<br />

groups of people associate themselves with the Six Nations:<br />

<br />

<br />

<br />

<br />

The Buzzers: people who arrive before the day of the match in order to get the buzz<br />

of being in the city, soak up the atmosphere and enjoy the experience; stay in local<br />

accommodation, as well as eating and drinking in the capitals; buy souvenirs and<br />

merchandise; may or may not have tickets upon arrival and may not necessarily<br />

make it to the stadium, instead watching the game in a bar or café.<br />

The Acclimatisors: people who arrive before the day of the match in order to<br />

establish themselves in the city before the match takes place and the majority of<br />

fans arrive; stay in local accommodation, as well as eating and drinking in the host<br />

city; visit local tourist attractions and buy souvenirs and merchandise; may or may<br />

not have tickets when they arrive but are intent on attending the match rather than<br />

watching from outside the stadium e.g. in a bar or café.<br />

The Instant Hitters: people who arrive in, and leave, the host city within a short<br />

space of time (possibly less than 24 hours); want to get the buzz of being in the city<br />

for the match, particularly if it’s their team against high profile opposition, soak up<br />

the atmosphere and enjoy the experience i.e. they either want, or only have time<br />

for, a short, sharp hit; likely to spend their money mainly on food and drink; may not<br />

have tickets upon arrival and may not necessarily make it to the stadium; likely to<br />

have other professional or domestic commitments that dictate their short stay in the<br />

city.<br />

The Late Landers: people who arrive in, and leave, the host city within a short space<br />

of time (possibly less than 24 hours) i.e. they land at the airport, eat, drink, watch<br />

the game and leave; spending focused on food and drink; may or may not have<br />

tickets when they arrive but are intent on attending the match rather than watching<br />

from outside the stadium e.g. in a bar or café; likely to have other professional or<br />

domestic commitments that dictate their short stay in the city.<br />

-more-

MasterCard Worldwide – Page 20<br />

MasterCard Six Nations Championship Rugby Report<br />

<br />

<br />

<br />

<br />

The Indulgers: people who choose to stay in the city once the match is over; keen to<br />

immerse themselves in either the ecstasy of victory or the pain of defeat, and<br />

recognition by locals of either state; stay likely to be less than a week and<br />

expenditure will be focused on food, drink and merchandise; may not have a<br />

permanent base in the city and may or may not have attended the game; are keen<br />

to assert their credentials as true fans for staying once the main event is over.<br />

The Tourers: people who choose to stay in the city once the match is over; likely to<br />

enjoy the post-match atmosphere, and the recognition amongst locals that this<br />

brings; mainly stay in the city to sight-see and take in tourist attractions, possibly<br />

having brought forward a similar such trip or substituted the trip for another they<br />

were going to take elsewhere at a later date; focus of expenditure likely to be on<br />

accommodation, food, drink, tourist attractions and souvenirs.<br />

The Returners: people who return to the host city at least once in the period up to<br />

two years after the match; in the event of their team’s victory, return will be<br />

motivated by desire to relive the memory of winning; may also return to visit<br />

attractions they were unable to see or spent little time visiting around the time of<br />

the match; focus of expenditure likely to be on accommodation, entertainment,<br />

visitor attractions etc.<br />

The Long-Termers: people who return to the host city on more than one occasion in<br />

the period up to five years after the match; in the event of their teams victory,<br />

return will be motivated by desire to relive the memory of winning; may also return<br />

to visit attractions they were unable to see or spent little time visiting around the<br />

time of the match; may have a particular bond with the local area such as friends, a<br />

partner or a deep liking for the host city/country; focus of expenditure likely to be on<br />

accommodation, entertainment, visitor attractions etc.<br />

In addition to people visiting the host cities to watch or be associated with the Six<br />

Nations Championship, it is also likely that residents of the city, and from elsewhere in<br />

the host countries, contribute to the economic impact of the Championship. The group<br />

consists of people who are most likely to generate economic activity in the following<br />

areas:<br />

<br />

<br />

<br />

<br />

Ticket sales<br />

Transport<br />

Food and drink<br />

Merchandising<br />

For those people who travel from outside of the host cities, additional economic activity<br />

may be associated with accommodation and visits to tourist attractions.<br />

-more-

MasterCard Worldwide – Page 21<br />

MasterCard Six Nations Championship Rugby Report<br />

SECTION 5: BROADCASTING<br />

The TV market has shown a keen interest in rugby in recent rights cycles with both the<br />

IRB Rugby World Cup and Six Nations Championship rights attracting higher sums. In<br />

France for example, the Six Nations’ broadcaster recently renewed its contract for €100<br />

million ($136.40 million, £90 million) over four seasons, an increase of 28%. The average<br />

audience for Six Nations matches is just over 3 million, while French Championship<br />

games attract approximately 500,000 viewers.<br />

Table 9: Current Contracts for Six Nations Broadcasting<br />

Value per year (million)<br />

Country Broadcaster € £ $ Terms<br />

UK BBC 44.00 39.79 60.01 2010-2013<br />

France<br />

France<br />

Televisions 25.00 22.61 34.09 2010-2013<br />

Ireland RTE 5.00 4.50 6.82 2010-2013<br />

Italy Sky Italia 10.00 9.00 13.64 2010-2014<br />

Source: SportCal, SportBusiness, National press<br />

In 2002 total viewing figures averaged just under 5 million per game, with no game<br />

exceeding 10 million viewers (RBS, 2008). By 2004, BBC reported average viewing figures<br />

of 4.1 million and by 2009 BBC coverage alone attracted record peak audience viewing<br />

figures averaging 6.2 million, and average viewing figures of 4.3 million per match,<br />

representing an increase of over a third since 2002.<br />

As table 10 shows, in 2009 Ireland v France, Wales v England, France v Wales and<br />

England v France all attracted an average audience of over 10 million across the six<br />

territories. In 2009, four of Ireland’s most watched sporting events on television were<br />

Six Nations games. According to the BBC, the 2009 Six Nations tournament reached – or<br />

at least was watched at some point – 65% of the population of Wales and 41% of the UK<br />

as a whole.<br />

The third weekend of the 2009 competition was the most viewed overall, attracting a<br />

total audience of 26,649,968.<br />

In the 2010 competition, the tournament is estimated to have been watched by 125<br />

million people across the UK, Ireland, France and Italy, with the France v Ireland, Wales<br />

v France and France v England matches attracting over 10 million viewers in total from<br />

the six participating nations. The final match of the tournament (France v England) is<br />

thought to have attracted almost 15 million viewers.<br />

-more-

MasterCard Worldwide – Page 22<br />

MasterCard Six Nations Championship Rugby Report<br />

Table 10: Six Nations 2009 Average Audience Viewing Figures<br />

Match UK (BBC) France Italy (LA7) Ireland Total<br />

(France 2/3)<br />

(RTE)<br />

England v 4,600,000 2,175,310 994,479 262,000 8,031,789<br />

Italy<br />

Ireland v 4,800,000 5,323,785 411,007 702,,000 10,534,792<br />

France<br />

Scotland v 4,100,000 1,889,085 427,936 256000 6,673,021<br />

Wales<br />

France v 3,700,000 4,178,885 397,028 240,000 8,515,913<br />

Scotland<br />

Wales v 7,200,000 2,690,515 467,000 348,000 10,705,515<br />

England<br />

Italy v Ireland 2,900,000 2,003,575 749,720 558,000 6,211,295<br />

France v 4,400,000 5,896,235 327,586 384,000 11,007,821<br />

Wales<br />

Scotland v 3,100,000 1,717,350 633,311 230,000 5,680,661<br />

Italy<br />

Ireland v 6,100,000 2,690,515 282,971 888,000 9,961,486<br />

England<br />

Italy v Wales 2,900,000 1,889,085 709,238 230,000 5,728,323<br />

Scotland v 4,100,000 2,232,555 306,577 670,000 7,309,132<br />

Ireland<br />

England v 4,900,000 4,808,580 312,330 249,000 10,269,910<br />

France<br />

Italy v France 2,000,000 3,377,455 626,829 143,000 6,147,284<br />

England v 4,400,000 2,175,310 309,047 293,000 7,177,357<br />

Scotland<br />

Wales v 6,000,000 2,347,045 468,389 955,000 9,770,434<br />

Ireland<br />

TOTAL 65,200,000 45,395,285 7,423,491 6,408,000 124,426,776<br />

Average per 4,346,667 3,026,352 494,899 427,200 8,295,118<br />

game<br />

Source: Ofcom<br />

-more-

MasterCard Worldwide – Page 23<br />

MasterCard Six Nations Championship Rugby Report<br />

Benefits of the Friday evening match<br />

A Friday night match (France v Wales) was introduced as part of a two year trial,<br />

following the success of Friday night matches in the IRB Rugby World Cup. 2009 viewing<br />

figures show that this was a popular decision, attracting the second highest total<br />

audience of the Championship.<br />

The Friday evening game was repeated for the reverse fixture (Wales v France) in the<br />

2010 event and has also proved extremely popular, with a live audience of around 10.5<br />

million viewers, including almost a quarter of the television audience share in France<br />

and approximately 65% in Wales (NB as the match was shown on BBC across the UK, not<br />

just Wales, the available figure cited is 17% of the UK total). Viewing figures suggest that<br />

this was the second most viewed match of the 2010 tournament.<br />

Comparing viewership<br />

In 2007, the year of the IRB Rugby World Cup in France, rugby replaced football at the<br />

top of the sports viewing charts in the majority of television markets across Europe.<br />

Matches from the IRB Rugby World Cup were the most watched events in France and<br />

the UK, according to the annual survey by TV Sports Markets. The biggest audience was<br />

attracted by France’s semi-final match against England which attracted 18.3 million<br />

viewers, the biggest sports audience in any of the 17 countries surveyed.<br />

ITV’s live coverage of Brazil v Ireland international football (Tuesday 2 March 2010)<br />

averaged just 3.3 million viewers, while the UEFA Cup match between Sporting Lisbon<br />

and Everton drew in an average of 1.6 million viewers on Channel 5 (25 February 2010).<br />

ITV1’s coverage of the UEFA Champions League match between Arsenal and Porto<br />

(Wednesday 17 February 2010) was watched by considerably more people, attracting<br />

average viewing figures of 4.8 million and a peak of 6 million viewers.<br />

In contrast, over 7 million viewers watched the BBC show the climax of the England v<br />

Wales Six Nations rugby match on the first weekend of the Six Nations Championship<br />

(Saturday 6 February). Live coverage of the rugby averaged 6.4 million viewers, and<br />

peaked at 7.3 million in the final 15 minutes of the game.<br />

It is estimated that revenue generated by the Six Nations Championship amounts to<br />

approximately 30% of total commercial revenues (including broadcast, marketing,<br />

ticketing and hospitality) earned by the domestic governing bodies from the premier<br />

rugby union competitions in the Northern hemisphere. The rest of the revenue is<br />

generated from the Autumn internationals and main club competitions (including<br />

Heineken Cup, Challenge Cup and domestic / cross-nation leagues).<br />

-more-

MasterCard Worldwide – Page 24<br />

MasterCard Six Nations Championship Rugby Report<br />

As table 11 shows, Italy is the only country where the live broadcaster of the<br />

Championship is not a terrestrial channel. As rugby continues to grow in popularity and<br />

participation throughout Italy, pay per view channel Sky Italia has taken over the live<br />

broadcasting of the Six Nations from La7 from 2010. The channel also holds the rights to<br />

the IRB Rugby World Cup 2011, Tri Nations and the Heineken Cup. Early estimates show<br />

that while figures for live viewing of the matches in Italy are significantly lower than<br />

those of in 2009 3 , the delayed coverage on La7 combined with the live Sky Italia footage<br />

is likely to amount to figures very similar to those of last year. As would be expected, the<br />

matches involving Italy have proved to be Sky Italia’s most popular.<br />

Table 11: Exclusive television broadcasting rights to the championship<br />

Country 2002 – 05 2006 – 09 2010 – 13<br />

UK BBC BBC BBC<br />

Ireland RTE RTE RTE<br />

France France Televisions France Televisions France Televisions<br />

Italy La7 La7 Sky Italia<br />

Healthy sponsorship agreements<br />

Related to this increasing popularity, many major firms appear in rugby clubs' customer<br />

portfolios. For example, in France: Renault (Stade Français, Clermont), Axa (SF &<br />

Perpignan), Afflelou (Bayonne), Peugeot (Toulouse), Capgemini (Biarritz), Seat (Brive),<br />

Mercure (Castres), and Sony (Dax) among others.<br />

The French rugby union league has a number of loyal major partners: in 2008, all of its<br />

big contracts (Orange, EDF, PMU, GMF, and Société Générale) were renewed for an<br />

additional four years: a total of €12 million (£10.85, $16.36) per season. The French<br />

National team attracts major sponsorship revenue, with leading deals worth between<br />

€6m (£5.43m, $8.81m) and €9m (£8.14m, $12.27m) over 5 years. The Scottish national<br />

team also has several large sponsorships including with Murray International, which is<br />

worth £2.7 million (€3m, $4.07m) over 3 years. Welsh Rugby Union also recently signed<br />

a one-year extension to one of its leading sponsorship deals, amounting to a value of<br />

almost £500,000 (€553,000, $753,000)<br />

3 A similar situation was true in the 2001-2 season when England v Wales at Twickenham attracted a Sky<br />

Sports audience of under half a million. A year later the same teams in Cardiff attracted a BBC audience of<br />

6 million (Review of Free to Air Listed Events, 2009).<br />

-more-

MasterCard Worldwide – Page 25<br />

MasterCard Six Nations Championship Rugby Report<br />

SECTION 6: PARTICIPATION<br />

While the game at the professional level is clearly healthy, with record attendances,<br />

sponsorship deals and television viewing figures, grass roots sport is a key part of the<br />

game, without which, the elite level could not exist. Following stagnation and decreases<br />

in participation and interest in rugby through the 1990s and early 2000, the governors of<br />

the game now see participation as the key to expansion.<br />

The Six Nations sides are well represented in terms of participation worldwide. England<br />

the world’s largest rugby playing nation (35% of the participants in the top ten rugby<br />

playing countries) and France is in third place with 272,000 (16%) players. Overall it is<br />

estimated that the game has grown by over 16% worldwide since the last rugby world<br />

cup; with England, the largest country, growing by over 4%. Table 12 sets out the<br />

number of participants in each major country divided into Adult, Youth and Mini/Junior<br />

categories as recorded by the IRB.<br />

Table 12: Estimated Rugby Participation in Top 10 Countries in 2008<br />

2004 2007 2008<br />

Adult Youth Mini/Jun Total<br />

Share<br />

(%)<br />

Share<br />

(%)<br />

Share<br />

(%)<br />

England 177 89 420 686 32.70% 37.60% 34.60%<br />

South<br />

Africa 69 144 274 487 30.30% 25.50% 24.60%<br />

France 91 106 75 272 11.50% 11.80% 13.70%<br />

New<br />

Zealand 29 38 62 129 6.70% 7.50% 6.50%<br />

Ireland 25 38 39 102 2.70% 5.00% 5.10%<br />

Australia 36 18 26 80 7.30% 3.70% 4.00%<br />

Argentina* 21 24 46 91 2.60% 2.90% 4.60%<br />

Italy 14 22 22 58 1.90% 2.40% 2.90%<br />

Wales 47 0 0 47 2.90% 2.30% 2.40%<br />

Scotland 11 13 8 32 1.40% 1.40% 1.60%<br />

Totals 520 492 972 1984 100.00% 100.00% 100.00%<br />

Source: IRB, RFU<br />

All Six Nations countries feature in the top ten for participation worldwide and there is<br />

estimated to have been overall growth in European participation of around 8% between<br />

2007 and 2010. England is the biggest market boasting over 2 million registered players,<br />

with 678,000 thought to be active, while the other six nations countries have<br />

experienced recent growth. Of the top ten, Argentina appears to be growing at the<br />

fastest rate, demonstrating similar development to that of Italy in the 1990s. Their<br />

addition to the Tri-Nations in 2012 will be timely.<br />

-more-

MasterCard Worldwide – Page 26<br />

MasterCard Six Nations Championship Rugby Report<br />

The growth or decline in the number of clubs, shown in table 12, is interesting in that<br />

clear differences are seen between the nations which are still developing and those that<br />

are established. While the number of clubs in England and Ireland have stayed relatively<br />

constant, those in Italy have continued to increase, suggesting that the sport is gaining<br />

in popularity in new areas.<br />

However, the sizes of clubs are very different with those in Ireland servicing<br />

approximately 490 players each, while the average number of players at clubs in Italy is<br />

80. In terms of increases in participation, Italy has the strongest growth of the six unions<br />

with a 36% rise since 2007. This is to be expected as it started from the smallest base.<br />

Future growth would also be predicted following Italian sides joining the Magners<br />

League. The sport is enjoying greater popularity than ever before in terms of fans,<br />

players and media coverage, with rugby union especially popular in Rome, L’Aquila,<br />

Treviso, Milans, Genoa, Parma and Bologna. This surge in popularity has seen a large<br />

improvement in the domestic player quality in Italy which has in turn led to a flow of<br />

Italian players being bought by other European clubs.<br />

Table 13: Number of Registered Clubs and Players in the Six Nations<br />

Nation Clubs (2010) Clubs (2008) Registered players<br />

France 1,734 1,683 273,084<br />

England 1,900 1,900 2,146,140<br />

Italy 744 718 61,487<br />

Ireland 207 208 152,830<br />

Scotland 241 234 32,817<br />

Wales 325 239 46,324<br />

TOTAL 2,712,682<br />

Source: IRB<br />

Table 14: Estimated Participation Growth from 2007 – 2010<br />

Nation<br />

% Growth<br />

Italy 36<br />

Ireland 33<br />

Scotland 32<br />

France 22<br />

Wales 10<br />

England 5<br />

Source: BARB, Media Guardian, Sportcal<br />

-more-

MasterCard Worldwide – Page 27<br />

MasterCard Six Nations Championship Rugby Report<br />

The growth in participation figures for the other Six Nations countries can be explained<br />

in a number of ways:<br />

As the largest rugby playing nation it is difficult for participation figures to grow<br />

substantially. Success in the IRB Rugby World Cup 2003 provided the catalyst for further<br />

development of the game in England and was built upon by reaching the Final in 2007.<br />

Participation rates have been steadily increasing in the years following. With this has<br />

been increased investment in facilities and infrastructure to ensure that clubs can be<br />

well run.<br />

For France, the IRB Rugby World Cup 2007 generated an unprecedented interest in<br />

rugby in France and participation since has grown. Rugby in France has a highly<br />

geographically specific constituency, with most clubs located in south-western and<br />

southern France, or in Paris.<br />

Scotland too has a rugby heartland traditionally based in the border regions. However,<br />

the two Magners League sides are based in Glasgow and Edinburgh and there has been<br />

a year-on-year growth in rugby participation, at both adult and youth levels. The SRU<br />

restructured in 2006 introducing new initiatives to encourage engagement, and<br />

following this, participation has been growing strongly at both the junior and adult<br />

levels.<br />

Though the headline figures are healthy, they mask to a certain extent some of the<br />

challenges the governing bodies are facing. In England for example, while 72% of the<br />

active participants are involved in the mini/junior game, there is a sharp decline at the<br />

youth level (13%, the lowest of all of the top ten), suggesting that in the past the game<br />

has found it difficult to retain their players as they enter their teens, but have a good<br />

recovery in participants returning to the game as adults shown in table 15.<br />

Table 15: Participation by Age<br />

Adult Youth Mini/Jun<br />

England 25.80% 13.00% 61.20%<br />

South<br />

Africa 14.20% 29.60% 56.30%<br />

New<br />

Zealand 33.50% 39.00% 27.60%<br />

France 22.50% 29.50% 48.10%<br />

Australia 24.50% 37.30% 38.20%<br />

Ireland 45.00% 22.50% 32.50%<br />

Wales 23.10% 26.40% 50.60%<br />

Scotland 24.10% 37.90% 37.90%<br />

Italy 34.40% 40.60% 25.00%<br />

Totals 26.20% 24.80% 49.00%<br />

-more-

MasterCard Worldwide – Page 28<br />

MasterCard Six Nations Championship Rugby Report<br />

Table 16: Participation by Gender (%)<br />

Country Mini/Jr<br />

Male<br />

Mini/Jr<br />

Female<br />

Youth<br />

Male<br />

Youth<br />

Female<br />

Adult<br />

Male<br />

Adult<br />

Female<br />

Overall<br />

Male<br />

Overall<br />

Female<br />

France 97 3 97 3 95 5 96 4<br />

England 91 9 100 0 99 1 99 1<br />

Italy 90 10 97 3 94 6 94 6<br />

Ireland 90 10 95 5 90 10 92 8<br />

Scotland 99 1 97 3 93 7 96 4<br />

Wales 99 1 97 3 96 4 97 3<br />

While proportionately rugby is very male dominated, there is evidence of an increasing<br />

numbers of girls being involved at young ages. New formats and versions of the game<br />

have made rugby more accessible for females, with many young girls playing tag and<br />

touch rugby up to the age of 13 within a mixed gender environment in clubs and<br />

schools.<br />

Rugby appears to be most popular for girls in Ireland. However the proportions do not<br />

translate directly to attendance at rugby matches where the percentage of female fans<br />

is much higher. Overall, there are more participating rugby players in the Leinster region<br />

(57,001) than anywhere else in Ireland (the next is Ulster with 44,216);<br />

Growth in participation is a key aim for all of the national federations with each putting<br />

strategies in place to achieve this. This is also likely to have an impact on the<br />

demographics of those playing and watching rugby as targeting different groups will<br />

lead to a broader base of fans across all social groups.<br />

The inclusion of Rugby Sevens in the Olympic programme is also likely to have a positive<br />

effect. The socio-economic benefits of sports participation have been particularly<br />

prominent in recent years as the benefits of health and social cohesion are increasingly<br />

identified as important. Estimates suggest that an increase in participation in sport for at<br />

least 1 hour per week of 10% overall for the UK would lead to a reduction in health<br />

spending of in the region of £100m (€110.57m, $150.79m).<br />

The World Health Organisation has provided evidence of the link between people's<br />

physical activity and their health. However, trends show that young people in particular<br />

are not doing enough physical exercise and that a growing number of young people are<br />

affected by obesity. A recent Eurobarometer survey suggests that only 15% of youths<br />

are active in sports and that the average EU citizen spends more than six hours per day<br />

seated.<br />

-more-

MasterCard Worldwide – Page 29<br />

MasterCard Six Nations Championship Rugby Report<br />

Overall, the number of children not participating in any sporting activity is constantly<br />

rising across the Northern hemisphere. In response to the perceived benefits and the<br />

debate on how to boost sports participation, governing bodies, with the support of<br />

national governments, are making a concerted effort to engage with communities and<br />

their potential fans and future players.<br />

Clearly the economic impact of rugby in the Six Nations countries must not be ignored<br />

both in terms of economic impact from rugby events and also utilisation of stadia for<br />

other activities which generate large sums for the local economy as well as the<br />

additional benefits accruing from increased participation and the knock on effect on<br />

health and public services.<br />

-more-

MasterCard Worldwide – Page 30<br />

MasterCard Six Nations Championship Rugby Report<br />

SECTION 7: CONCLUSIONS<br />

The Six Nations Championship is one of the world’s most important sporting events and<br />

one of the most popular events of its sort in the world.<br />

Not only does the tournament routinely attract around 1 million visitors (an estimated<br />

1,054,654 in 2010) to its host cities each year, television viewing figures show that the<br />

tournament may be watched by as many people as 125 million people worldwide.<br />

Added to this there are large numbers of people who buy related merchandise,<br />

consume food and drink in and around the venues, read about it in newspapers and<br />

magazines and place bets on the outcome of matches, as well as large numbers of<br />

officials and commercial partners travelling to the matches.<br />

This means that the tournament represents a bonanza for a range of organisations from<br />

the nations taking part through to sportsware manufacturers and venue managers at<br />

the stadiums in which matches take place.<br />

The economic impact of the tournament is therefore profound; it is financially<br />

significant, reverberates across time and spans international boundaries.<br />

The profile and significance of the Northern hemisphere’s premier rugby competition<br />

retains a value that places it alongside the most valuable other sport events properties<br />

in the world. The fact that this is an annual event makes the impact even more<br />

significant.<br />

For many industries, and indeed for sports, the economic downturn has had a profound<br />

effect, resulting in unprecedented levels of pessimism. However, as major events such<br />

as football’s UEFA Champions League Final and the NFL Superbowl have shown, major<br />

sporting events are of such a nature that they can be recession busting in their impact.<br />

Indeed, further evidence suggests fans, broadcasters and commercial partners seek safe<br />

havens during times of economic hardship. That is to say they consume or invest in<br />

products that provide them with the best value for money.<br />

One can therefore argue that rugby properties provide this value, with signs that<br />

corporates are again engaging with the sport and the Six Nations Championship.<br />

While the tough economic climate has of course had an impact on demand with 2009<br />

estimates suggesting it was harder to sell tickets and hospitality, there are signs that the<br />

tournament is emerging from those hard times stronger, adapting by necessity to create<br />

more bespoke offerings for fans which can attract a premium fee.<br />

-more-

MasterCard Worldwide – Page 31<br />

MasterCard Six Nations Championship Rugby Report<br />

It is also likely that the prestige and profile of the tournament has caused more people<br />

to buy into the event as it provides an escape from the tough economic conditions.<br />

Rugby fans tend to be young, males with a relatively high disposable income and travel<br />

in large numbers. Additionally, the fact that the majority of rugby consumers belong to<br />

the highest socio-economic groups means that events such as the Six Nations are<br />

rebounding from the recession more quickly.<br />

Even when people chose not to travel to the host cities to be at the event in person<br />

during the worst of the downturn, the TV audience figures showed that the spectacle<br />

has remained popular, with record numbers of fans tuning in.<br />

This also results in the generation of economic and commercial activity, based around<br />

for example, expenditure on food, beverages and merchandise. It is also essential to<br />

note that the vast majority of the reduction in fans travelling will be those without<br />

tickets – as the attendance figures show demand is still high with the stadiums filled<br />

close to capacity and in some cases could have been sold out more than once.<br />

The TV market for rugby is stronger than ever, with assessments suggesting record<br />

numbers of viewers are tuning in to matches across the host nations. This is in line with<br />

the increases in rights fees received for the competition.<br />

While live viewing figures for Italy are significantly lower following the move away from<br />

terrestrial TV, there is a commitment from the broadcaster (Sky Italia) to a range of<br />

rugby events which will doubtless engage the Italian viewers. The slightly delayed<br />

terrestrial coverage has proved very popular.<br />

The addition of a Friday night fixture has proved popular overall. While there are<br />

inevitable difficulties for fans to travel on a work day, and for transport networks to<br />

cope with the demand, the fixture still proved very popular with a sell-out crowd,<br />

including a strong away contingent.<br />

The timing is certainly not thought to have had an adverse effect on attendance or<br />

spend, particularly given that French fans may have been inclined to stay longer in the<br />

Welsh capital and surrounding area for the weekend after the match. The Friday night<br />

timing, while new for the tournament, is a proven popular slot in both the Magners<br />

League and LNF and it is expected that this will be kept for future editions of the<br />

tournament.<br />

Similarly, the Friday night fixture has been popular with the TV audience, with estimates<br />

suggesting that it was the second most watched game of the tournament with 10.5<br />

million viewers across the six participating nations, behind only the France v England<br />

finale to see if France could secure the Grand Slam.<br />

-more-

MasterCard Worldwide – Page 32<br />

MasterCard Six Nations Championship Rugby Report<br />

Compared to some recent televised football games in the same territories, the Six<br />

Nations has been extremely popular. In fact, this continues the general trend shown in<br />

2007 when the IRB Rugby World Cup replaced football at the top of the sports viewing<br />

charts in the majority of television markets across Europe for that year.<br />

The six competing nations have very different relationships with rugby. While in Wales it<br />

is the national sport and televised matches can attract two thirds of the audience share,<br />

in other nations though popular overall, there tend to be pockets of regions that are<br />

rugby fans in terms of both participation and viewing.<br />

Participation overall is growing strongly with the Six Nations unions all recording<br />

significant growth over the past decade. As the strategic plans are implemented by the<br />

governing bodies of rugby it is expected that more and more people from ethnic<br />

minorities, lower social groups and females will become engaged.<br />

While rugby is experiencing great popularity on all fronts, with passionate fans travelling<br />