oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

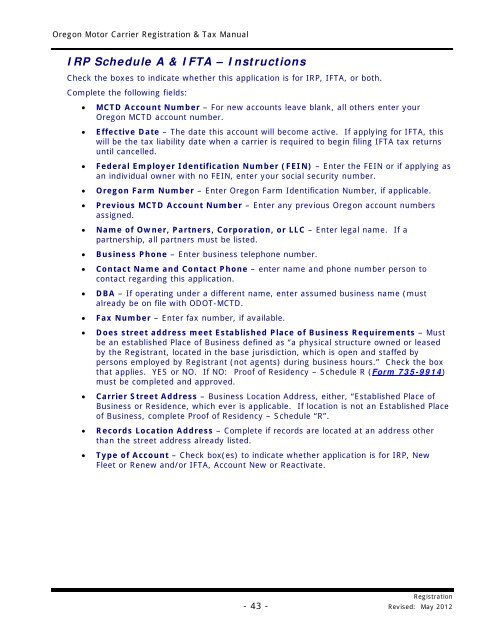

<strong>Oregon</strong> Motor Carrier Registration & Tax Manual<br />

IRP Schedule A & IFTA – Instructions<br />

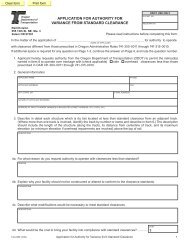

Check the boxes to indicate whether this application is for IRP, IFTA, or both.<br />

Complete the following fields:<br />

MCTD Account Number – For new accounts leave blank, all others enter your<br />

<strong>Oregon</strong> MCTD account number.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Effective Date – The date this account will become active. If applying for IFTA, this<br />

will be the <strong>tax</strong> liability date when a <strong>carrier</strong> is required to begin filing IFTA <strong>tax</strong> returns<br />

until cancelled.<br />

Federal Employer Identification Number (FEIN) – Enter the FEIN or if applying as<br />

an individual owner with no FEIN, enter your social security number.<br />

<strong>Oregon</strong> Farm Number – Enter <strong>Oregon</strong> Farm Identification Number, if applicable.<br />

Previous MCTD Account Number – Enter any previous <strong>Oregon</strong> account numbers<br />

assigned.<br />

Name of Owner, Partners, Corporation, or LLC – Enter legal name. If a<br />

partnership, all partners must be listed.<br />

Business Phone – Enter business telephone number.<br />

Contact Name and Contact Phone – enter name and phone number person to<br />

contact regarding this application.<br />

DBA – If operating under a different name, enter assumed business name (must<br />

already be on file with ODOT-MCTD.<br />

Fax Number – Enter fax number, if available.<br />

Does street address meet Established Place of Business Requirements – Must<br />

be an established Place of Business defined as “a physical structure owned or leased<br />

by the Registrant, located in the base jurisdiction, which is open and staffed by<br />

persons employed by Registrant (not agents) during business hours.” Check the box<br />

that applies. YES or NO. If NO: Proof of Residency – Schedule R (Form 735-9914)<br />

must be completed and approved.<br />

Carrier Street Address – Business Location Address, either, “Established Place of<br />

Business or Residence, which ever is applicable. If location is not an Established Place<br />

of Business, complete Proof of Residency – Schedule “R”.<br />

Records Location Address – Complete if records are located at an address other<br />

than the street address already listed.<br />

Type of Account – Check box(es) to indicate whether application is for IRP, New<br />

Fleet or Renew and/or IFTA, Account New or Reactivate.<br />

Registration<br />

- 43 - Revised: May 2012