Employee Benefit Guide 2012 - City of Oklahoma City

Employee Benefit Guide 2012 - City of Oklahoma City

Employee Benefit Guide 2012 - City of Oklahoma City

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

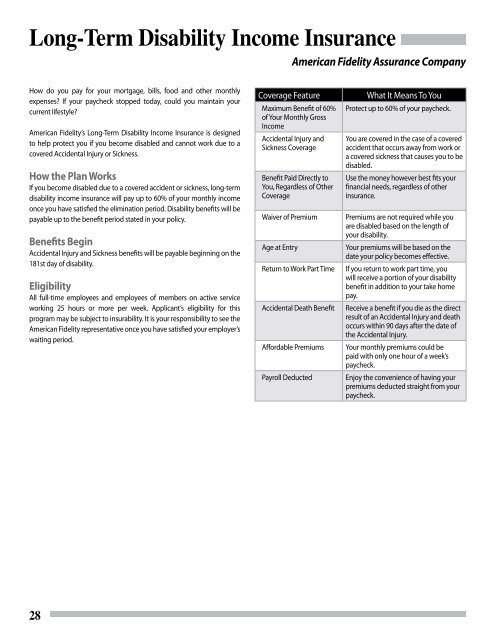

Long-Term Disability Income Insurance<br />

American Fidelity Assurance Company<br />

How do you pay for your mortgage, bills, food and other monthly<br />

expenses? If your paycheck stopped today, could you maintain your<br />

current lifestyle?<br />

American Fidelity’s Long-Term Disability Income Insurance is designed<br />

to help protect you if you become disabled and cannot work due to a<br />

covered Accidental Injury or Sickness.<br />

How the Plan Works<br />

If you become disabled due to a covered accident or sickness, long-term<br />

disability income insurance will pay up to 60% <strong>of</strong> your monthly income<br />

once you have satisfied the elimination period. Disability benefits will be<br />

payable up to the benefit period stated in your policy.<br />

<strong>Benefit</strong>s Begin<br />

Accidental Injury and Sickness benefits will be payable beginning on the<br />

181st day <strong>of</strong> disability.<br />

Eligibility<br />

All full-time employees and employees <strong>of</strong> members on active service<br />

working 25 hours or more per week. Applicant’s eligibility for this<br />

program may be subject to insurability. It is your responsibility to see the<br />

American Fidelity representative once you have satisfied your employer’s<br />

waiting period.<br />

Coverage Feature<br />

Maximum <strong>Benefit</strong> <strong>of</strong> 60%<br />

<strong>of</strong> Your Monthly Gross<br />

Income<br />

Accidental Injury and<br />

Sickness Coverage<br />

<strong>Benefit</strong> Paid Directly to<br />

You, Regardless <strong>of</strong> Other<br />

Coverage<br />

Waiver <strong>of</strong> Premium<br />

Age at Entry<br />

Return to Work Part Time<br />

Accidental Death <strong>Benefit</strong><br />

Affordable Premiums<br />

Payroll Deducted<br />

What It Means To You<br />

Protect up to 60% <strong>of</strong> your paycheck.<br />

You are covered in the case <strong>of</strong> a covered<br />

accident that occurs away from work or<br />

a covered sickness that causes you to be<br />

disabled.<br />

Use the money however best fits your<br />

financial needs, regardless <strong>of</strong> other<br />

insurance.<br />

Premiums are not required while you<br />

are disabled based on the length <strong>of</strong><br />

your disability.<br />

Your premiums will be based on the<br />

date your policy becomes effective.<br />

If you return to work part time, you<br />

will receive a portion <strong>of</strong> your disability<br />

benefit in addition to your take home<br />

pay.<br />

Receive a benefit if you die as the direct<br />

result <strong>of</strong> an Accidental Injury and death<br />

occurs within 90 days after the date <strong>of</strong><br />

the Accidental Injury.<br />

Your monthly premiums could be<br />

paid with only one hour <strong>of</strong> a week’s<br />

paycheck.<br />

Enjoy the convenience <strong>of</strong> having your<br />

premiums deducted straight from your<br />

paycheck.<br />

28