The Federal Reserve System A. The History and Structure of the Fed ...

The Federal Reserve System A. The History and Structure of the Fed ...

The Federal Reserve System A. The History and Structure of the Fed ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

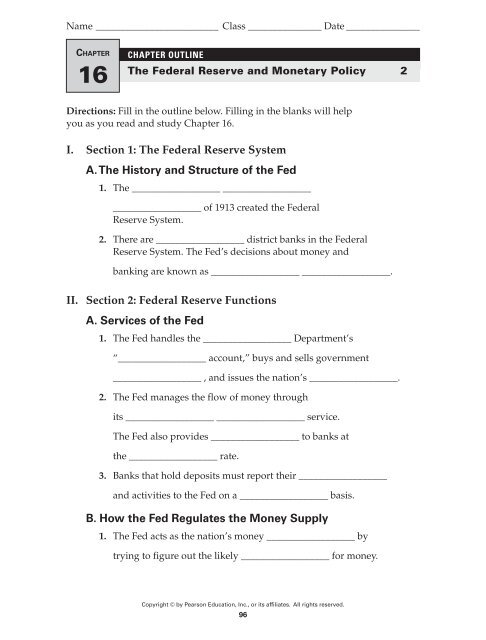

Name _________________________ Class _______________ Date _______________<br />

CHAPTER<br />

16<br />

CHAPTER OUTLINE<br />

<strong>The</strong> <strong><strong>Fed</strong>eral</strong> <strong>Reserve</strong> <strong>and</strong> Monetary Policy 2<br />

Directions: Fill in <strong>the</strong> outline below. Filling in <strong>the</strong> blanks will help<br />

you as you read <strong>and</strong> study Chapter 16.<br />

I. Section 1: <strong>The</strong> <strong><strong>Fed</strong>eral</strong> <strong>Reserve</strong> <strong>System</strong><br />

A. <strong>The</strong> <strong>History</strong> <strong>and</strong> <strong>Structure</strong> <strong>of</strong> <strong>the</strong> <strong>Fed</strong><br />

1. <strong>The</strong> __________________ __________________<br />

__________________ <strong>of</strong> 1913 created <strong>the</strong> <strong><strong>Fed</strong>eral</strong><br />

<strong>Reserve</strong> <strong>System</strong>.<br />

2. <strong>The</strong>re are __________________ district banks in <strong>the</strong> <strong><strong>Fed</strong>eral</strong><br />

<strong>Reserve</strong> <strong>System</strong>. <strong>The</strong> <strong>Fed</strong>’s decisions about money <strong>and</strong><br />

banking are known as __________________ __________________.<br />

II. Section 2: <strong><strong>Fed</strong>eral</strong> <strong>Reserve</strong> Functions<br />

A. Services <strong>of</strong> <strong>the</strong> <strong>Fed</strong><br />

1. <strong>The</strong> <strong>Fed</strong> h<strong>and</strong>les <strong>the</strong> __________________ Department’s<br />

“__________________ account,” buys <strong>and</strong> sells government<br />

__________________ , <strong>and</strong> issues <strong>the</strong> nation’s __________________.<br />

2. <strong>The</strong> <strong>Fed</strong> manages <strong>the</strong> flow <strong>of</strong> money through<br />

its __________________ __________________ service.<br />

<strong>The</strong> <strong>Fed</strong> also provides __________________ to banks at<br />

<strong>the</strong> __________________ rate.<br />

3. Banks that hold deposits must report <strong>the</strong>ir __________________<br />

<strong>and</strong> activities to <strong>the</strong> <strong>Fed</strong> on a __________________ basis.<br />

B. How <strong>the</strong> <strong>Fed</strong> Regulates <strong>the</strong> Money Supply<br />

1. <strong>The</strong> <strong>Fed</strong> acts as <strong>the</strong> nation’s money __________________ by<br />

trying to figure out <strong>the</strong> likely __________________ for money.<br />

Copyright © by Pearson Education, Inc., or its affiliates. All rights reserved.<br />

96

Name _________________________ Class _______________ Date _______________<br />

CHAPTER OUTLINE (continued)<br />

<strong>The</strong> <strong><strong>Fed</strong>eral</strong> <strong>Reserve</strong> <strong>and</strong> Monetary Policy 2<br />

III. Section 3: Monetary Policy Tools<br />

A. Money Creation<br />

1. <strong>The</strong> __________________ __________________ formula<br />

shows how much new money can be created from a<br />

bank deposit.<br />

B. Tools <strong>of</strong> Monetary Policy<br />

1. <strong>The</strong> <strong>Fed</strong> might __________________ reserve requirements<br />

if <strong>the</strong>re was inflation <strong>and</strong> __________________ <strong>the</strong>m if<br />

unemployment is high.<br />

2. __________________ <strong>the</strong> discount rate encourages banks<br />

to borrow more money <strong>and</strong> <strong>the</strong>n __________________ it<br />

to <strong>the</strong>ir own customers.<br />

3. When <strong>the</strong> <strong><strong>Fed</strong>eral</strong> Open Market Committee buys government<br />

__________________ , it __________________ <strong>the</strong> money supply.<br />

IV. Section 4: Monetary Policy <strong>and</strong> Macroeconomic Stabilization<br />

A. How Monetary Policy Works<br />

1. When interest rates are low, investment spending __________________.<br />

2. <strong>The</strong> <strong>Fed</strong> follows an __________________ money policy to<br />

speed up <strong>the</strong> economy <strong>and</strong> a __________________ money<br />

policy to slow it down.<br />

3. <strong>The</strong>re is a longer __________________ lag for monetary<br />

policy <strong>and</strong> a longer __________________ lag for fiscal policy.<br />

B. Two Approaches to Monetary Policy<br />

1. An __________________ policy encourages action.<br />

2. __________________ __________________ economists believe<br />

<strong>the</strong> economy will self-correct.<br />

Copyright © by Pearson Education, Inc., or its affiliates. All rights reserved.<br />

97