AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

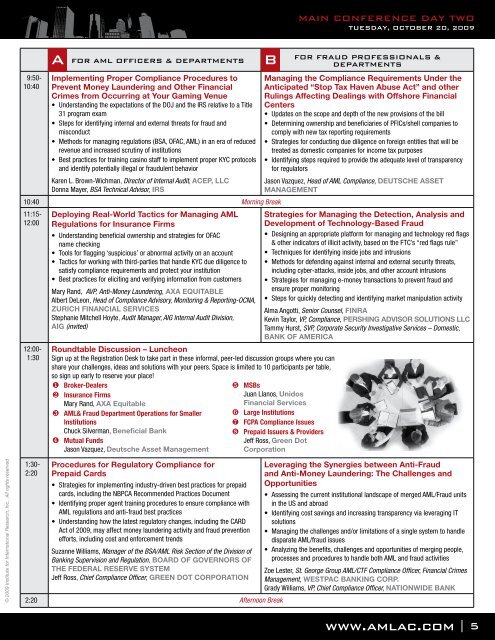

9:50-<br />

10:40<br />

For AML Officers & Departments<br />

Implementing Proper Compliance Procedures to<br />

Prevent Money Laundering and Other Financial<br />

Crimes from Occurring at Your Gaming Venue<br />

• Understanding the expectations of the DOJ and the IRS relative to a Title<br />

31 program exam<br />

• Steps for identifying internal and external threats for fraud and<br />

misconduct<br />

• Methods for managing regulations (BSA, OFAC, AML) in an era of reduced<br />

revenue and increased scrutiny of institutions<br />

• Best practices for training casino staff to implement proper KYC protocols<br />

and identify potentially illegal or fraudulent behavior<br />

Karen L. Brown-Wichman, Director of Internal Audit, ACEP, LLC<br />

Donna Mayer, BSA Technical Advisor, IRS<br />

10:40 Morning Break<br />

11:15-<br />

12:00<br />

12:00-<br />

1:30<br />

A<br />

Deploying Real-World Tactics for Managing AML<br />

Regulations for Insurance Firms<br />

• Understanding beneficial ownership and strategies for OFAC<br />

name checking<br />

• Tools for flagging ‘suspicious’ or abnormal activity on an account<br />

• Tactics for working with third-parties that handle KYC due diligence to<br />

satisfy compliance requirements and protect your institution<br />

• Best practices for eliciting and verifying information from customers<br />

Mary Rand, AVP, Anti-Money Laundering, AXA EQUITABLE<br />

Albert DeLeon, Head of Compliance Advisory, Monitoring & Reporting-OCNA,<br />

ZURICH FINANCIAL SERVICES<br />

Stephanie Mitchell Hoyte, Audit Manager, AIG Internal Audit Division,<br />

AIG (invited)<br />

Roundtable Discussion – Luncheon<br />

Sign up at the Registration Desk to take part in these informal, peer-led discussion groups where you can<br />

share your challenges, ideas and solutions with your peers. Space is limited to 10 participants per table,<br />

so sign up early to reserve your place!<br />

❶ Broker-Dealers<br />

❷ Insurance Firms<br />

Mary Rand, AXA Equitable<br />

❸ AML& <strong>Fraud</strong> Department Operations for Smaller<br />

Institutions<br />

Chuck Silverman, Beneficial Bank<br />

❹ Mutual Funds<br />

Jason Vazquez, Deutsche Asset Management<br />

B<br />

For <strong>Fraud</strong> Professionals &<br />

Departments<br />

Managing the Compliance Requirements Under the<br />

Anticipated “Stop Tax Haven Abuse Act” and other<br />

Rulings Affecting Dealings with Offshore Financial<br />

Centers<br />

• Updates on the scope and depth of the new provisions of the bill<br />

• Determining ownership and beneficiaries of PFICs/shell companies to<br />

comply with new tax reporting requirements<br />

• Strategies for conducting due diligence on foreign entities that will be<br />

treated as domestic companies for income tax purposes<br />

• Identifying steps required to provide the adequate level of transparency<br />

for regulators<br />

Jason Vazquez, Head of AML Compliance, DEUTSCHE ASSET<br />

MANAGEMENT<br />

Strategies for Managing the Detection, Analysis and<br />

Development of Technology-Based <strong>Fraud</strong><br />

• Designing an appropriate platform for managing and technology red flags<br />

& other indicators of illicit activity, based on the FTC’s “red flags rule”<br />

• Techniques for identifying inside jobs and intrusions<br />

• Methods for defending against internal and external security threats,<br />

including cyber-attacks, inside jobs, and other account intrusions<br />

• Strategies for managing e-money transactions to prevent fraud and<br />

ensure proper monitoring<br />

• Steps for quickly detecting and identifying market manipulation activity<br />

Alma Angotti, Senior Counsel, FINRA<br />

Kevin Taylor, VP, Compliance, PERSHING ADVISOR SOLUTIONS LLC<br />

Tammy Hurst, SVP, Corporate Security Investigative Services – Domestic,<br />

BANK OF AMERICA<br />

❺ MSBs<br />

Juan Llanos, Unidos<br />

Financial Services<br />

❻ Large Institutions<br />

❼ FCPA Compliance Issues<br />

❽ Prepaid Issuers & Providers<br />

Jeff Ross, Green Dot<br />

Corporation<br />

MAIN CONFERENCE DAY Two<br />

TuesDAY, OCTOBER 20, 2009<br />

© 2009 Institute for International Research, Inc. All rights reserved<br />

1:30-<br />

2:20<br />

Procedures for Regulatory Compliance for<br />

Prepaid Cards<br />

• Strategies for implementing industry-driven best practices for prepaid<br />

cards, including the NBPCA Recommended Practices Document<br />

• Identifying proper agent training procedures to ensure compliance with<br />

AML regulations and anti-fraud best practices<br />

• Understanding how the latest regulatory changes, including the CARD<br />

Act of 2009, may affect money laundering activity and fraud prevention<br />

efforts, including cost and enforcement trends<br />

Suzanne Williams, Manager of the BSA/AML Risk Section of the Division of<br />

Banking Supervision and Regulation, BOARD OF GOVERNORS OF<br />

THE FEDERAL RESERVE SYSTEM<br />

Jeff Ross, Chief Compliance Officer, GREEN DOT CORPORATION<br />

2:20 Afternoon Break<br />

Leveraging the Synergies between Anti-<strong>Fraud</strong><br />

and Anti-Money Laundering: The Challenges and<br />

Opportunities<br />

• Assessing the current institutional landscape of merged AML/<strong>Fraud</strong> units<br />

in the US and abroad<br />

• Identifying cost savings and increasing transparency via leveraging IT<br />

solutions<br />

• Managing the challenges and/or limitations of a single system to handle<br />

disparate AML/fraud issues<br />

• Analyzing the benefits, challenges and opportunities of merging people,<br />

processes and procedures to handle both AML and fraud activities<br />

Zoe Lester, St. George Group AML/CTF Compliance Officer, Financial Crimes<br />

Management, WESTPAC BANKING CORP.<br />

Grady Williams, VP, Chief Compliance Officer, NATIONWIDE BANK<br />

www.amlac.com<br />

| 5