Valuing Intangible Assets - Seattle University

Valuing Intangible Assets - Seattle University

Valuing Intangible Assets - Seattle University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

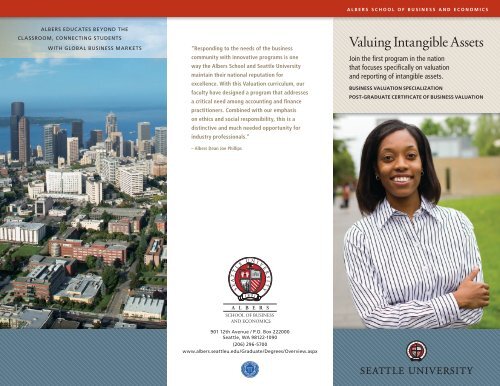

A L B E R S S C H O O L O F B U S I N E S S A N D E C O N O M I C S<br />

ALBERS EDUCATES BEYOND THE<br />

CL ASSROOM, CONNECTING STUDENTS<br />

WITH GLOBAL BUSINESS MARKETS<br />

“Responding to the needs of the business<br />

community with innovative programs is one<br />

way the Albers School and <strong>Seattle</strong> <strong>University</strong><br />

maintain their national reputation for<br />

excellence. With this Valuation curriculum, our<br />

faculty have designed a program that addresses<br />

a critical need among accounting and finance<br />

practitioners. Combined with our emphasis<br />

on ethics and social responsibility, this is a<br />

distinctive and much needed opportunity for<br />

industry professionals.”<br />

– Albers Dean Joe Phillips<br />

<strong>Valuing</strong> <strong>Intangible</strong> <strong>Assets</strong><br />

Join the first program in the nation<br />

that focuses specifically on valuation<br />

and reporting of intangible assets.<br />

BUSINESS VALUATION SPECIALIZATION<br />

POST-GRADUATE CERTIFICATE OF BUSINESS VALUATION<br />

901 12th Avenue / P.O. Box 222000<br />

<strong>Seattle</strong>, WA 98122-1090<br />

(206) 296-5700<br />

www.albers.seattleu.edu/Graduate/Degrees/Overview.aspx

Meeting a<br />

Growing Need<br />

In response to the changing economic environment<br />

and developments in the accounting and<br />

finance industries, there will be increasing<br />

demand for practitioners who have in-depth<br />

knowledge of both finance and accounting.<br />

Driving this need is the increasing use of fair value<br />

estimates on balance sheets in corporate annual<br />

reports and SEC filings. This trend will only<br />

increase in the future as accounting standards<br />

migrate from U.S. rules to International rules.<br />

With few professionals possessing these skills,<br />

Albers has introduced a new Business Valuation<br />

Specialization for Master of Professional Accounting<br />

(MPAC) and Master of Science in Finance (MSF)<br />

students and a new Post-Graduate Certificate of<br />

Business Valuation for professionals with a master’s<br />

degree from an AACSB accredited school.<br />

“Valuation of intangible assets requires specialized<br />

knowledge in finance and accounting. Typically,<br />

most finance and accounting professionals do not<br />

have this breadth of knowledge needed to value<br />

intangible assets. The new graduate specialization<br />

and post-graduate certificate are designed to<br />

bridge this huge gap,” said Chair of the<br />

Department of Accounting, Dr. Bruce Koch.<br />

Get More “Value” Out of Your Graduate Degree<br />

SPECIALIZATION COURSES<br />

MBA 501<br />

MBA 515<br />

FINC 542<br />

FINC 550<br />

FINC 554<br />

FINC 560<br />

ACCT 531<br />

ACCT 532<br />

ACCT 533<br />

FINC/ACCT 565<br />

Statistical Applications and<br />

Quantitative Methods<br />

Corporate Financial<br />

Management<br />

Valuation of Derivatives<br />

Financial Risk Management<br />

<strong>Valuing</strong> <strong>Intangible</strong> <strong>Assets</strong><br />

Business Valuation<br />

Intermediate Financial<br />

Accounting I<br />

Intermediate Financial<br />

Accounting II<br />

Advanced Financial<br />

Accounting<br />

Valuation for Financial<br />

Reporting<br />

PROGRAM REQUIREMENTS<br />

To earn a Business Valuation Specialization,<br />

students in the MPAC and MSF programs<br />

must take one or two extra classes in addition<br />

to their master’s course requirements. New<br />

courses developed for this specialization include<br />

FINC 560, Business Valuation, FINC 554 (revised<br />

course), <strong>Valuing</strong> <strong>Intangible</strong> <strong>Assets</strong>, and FINC/<br />

ACCT 565, Valuation for Financial Reporting.<br />

The Post-Graduate Certificate in Business<br />

Valuation program is designed for accounting<br />

and finance professionals to gain expertise<br />

in valuing intangible assets. The chairs of the<br />

accounting and finance departments will tailor<br />

a program for a certificate candidate of six<br />

or more courses that include FINC 560 and<br />

FINC/ACCT 565.<br />

“In the past few years, we have all seen a significant rise in the use and importance of valuation concepts<br />

and methods in financial reports. I am very excited about <strong>Seattle</strong> <strong>University</strong>’s focus on this important<br />

area. I believe the Albers School is at the ‘leading edge’ in its efforts to prepare future leaders of the<br />

accounting profession for the valuation-related issues they will face.”<br />

David C. Dufendach, CPA/ABV, ASAPartner, Advisory Services at Grant Thornton LLP