Prepayable NHA MBS - Securitization.Net

Prepayable NHA MBS - Securitization.Net

Prepayable NHA MBS - Securitization.Net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Canadian ABS/<strong>MBS</strong><br />

Research<br />

www.cibcwm.com/research<br />

<strong>Securitization</strong> Files October 24, 2000<br />

Profiting from Prepayments:<br />

<strong>Prepayable</strong> <strong>NHA</strong> <strong>MBS</strong><br />

Peter Weldon<br />

416-956-3211<br />

Joanna Zapior, CFA<br />

416-594-8498<br />

Tina Lai, CFA<br />

416-956-6273<br />

Trevor Bateman, CA<br />

416-594-7992<br />

Geoff Watson, CFA<br />

416-594-8146<br />

<strong>MBS</strong><br />

prepayments<br />

can be<br />

beneficial to<br />

investors in a<br />

rising interest<br />

rate<br />

environment<br />

<strong>Prepayable</strong> or open <strong>NHA</strong> Mortgage Backed Securities offer investors a way to increase<br />

yield over Government of Canada bonds while maintaining the security of a government<br />

backed credit. The spread over Canadas can be attributed to many factors including: less<br />

liquidity relative to benchmarks, the amortizing feature of the bonds and the fact that payments<br />

are monthly. While investors can always expect to receive a yield premium when<br />

purchasing open <strong>NHA</strong> <strong>MBS</strong>, the potential for yield enhancement can increase in rising<br />

interest rate environments.<br />

Traditional semi-annual pay bullet bonds offer little opportunity or flexibility to investors as<br />

rates rise. In this interest rate climate, investors are faced with the problem of selling bonds at a<br />

loss as prices decrease or the problem of holding bonds in their portfolio which are currently<br />

yielding less than comparable credits. The possibility of greater than expected prepayments<br />

from prepayable <strong>MBS</strong> can prove to be beneficial in an environment where semi-annual<br />

pay bullets are decreasing in value.<br />

In bear markets, trading opportunities exist due to the tendency of standardized<br />

prepayment models to underestimate the actual level of prepayments, due to the<br />

seasoning effect on Canadian residential mortgages. The seasoning effect refers to the<br />

propensity of mortgages in an open pool to prepay at progressively higher rates, up to a point,<br />

throughout the term of the <strong>MBS</strong>, even when an economic incentive to refinance does not exist.<br />

In these instances, investors can be rewarded for examining open pools and identifying those<br />

prepaying at higher than expected levels and trading at a discount. Canada Trust pool<br />

97000269 is one of the pools currently meeting these criteria and is an example of an <strong>MBS</strong><br />

we recommend based on the process of analysis outlined in this report.<br />

<strong>Prepayable</strong><br />

<strong>MBS</strong> pools<br />

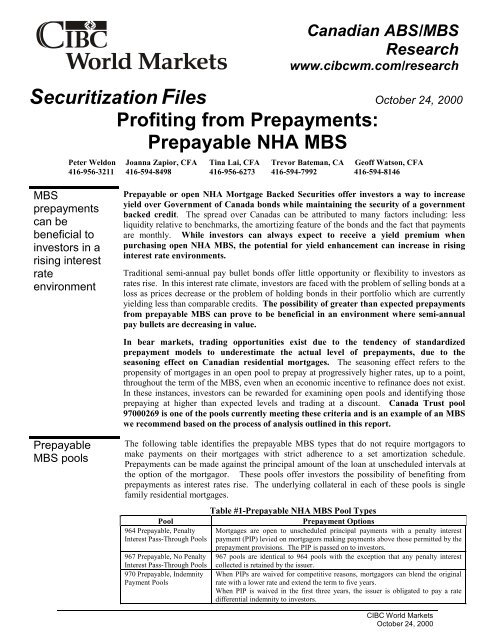

The following table identifies the prepayable <strong>MBS</strong> types that do not require mortgagors to<br />

make payments on their mortgages with strict adherence to a set amortization schedule.<br />

Prepayments can be made against the principal amount of the loan at unscheduled intervals at<br />

the option of the mortgagor. These pools offer investors the possibility of benefiting from<br />

prepayments as interest rates rise. The underlying collateral in each of these pools is single<br />

family residential mortgages.<br />

Pool<br />

964 <strong>Prepayable</strong>, Penalty<br />

Interest Pass-Through Pools<br />

967 <strong>Prepayable</strong>, No Penalty<br />

Interest Pass-Through Pools<br />

970 <strong>Prepayable</strong>, Indemnity<br />

Payment Pools<br />

Table #1-<strong>Prepayable</strong> <strong>NHA</strong> <strong>MBS</strong> Pool Types<br />

Prepayment Options<br />

Mortgages are open to unscheduled principal payments with a penalty interest<br />

payment (PIP) levied on mortgagors making payments above those permitted by the<br />

prepayment provisions. The PIP is passed on to investors.<br />

967 pools are identical to 964 pools with the exception that any penalty interest<br />

collected is retained by the issuer.<br />

When PIPs are waived for competitive reasons, mortgagors can blend the original<br />

rate with a lower rate and extend the term to five years.<br />

When PIP is waived in the first three years, the issuer is obligated to pay a rate<br />

differential indemnity to investors.<br />

CIBC World Markets<br />

October 24, 2000

10<br />

13<br />

16<br />

19<br />

22<br />

25<br />

28<br />

31<br />

34<br />

37<br />

40<br />

43<br />

46<br />

49<br />

52<br />

55<br />

For this study,<br />

we have<br />

eliminated<br />

pools with<br />

economically<br />

motivated<br />

refinancings in<br />

order to<br />

examine core<br />

prepayment<br />

patterns<br />

For this study, in order to analyze the level of prepayments due exclusively to seasoning,<br />

those open pools have been identified that offer no incentive for mortgagors to refinance.<br />

Put another way, the pools examined in this study are out of the money. The prepayable<br />

<strong>MBS</strong> included in this study have been selected on the basis of having a weighted average<br />

mortgage rate (WAM) minus the prevailing five-year mortgage rate of less than 50 basis points.<br />

Using these parameters we can be certain there are few economically motivated refinancings<br />

because it is not financially beneficial to refinance mortgages under these conditions.<br />

Mortgagors in these pools are deterred by the penalties and inconveniences associated with<br />

refinancing. By eliminating refinancings that may be motivated by economic considerations,<br />

the pattern of core prepayments over time can be examined. Core prepayments are comprised<br />

of liquidations due to defaults, substitutions and relocation, and are generally insensitive to<br />

interest rate changes.<br />

Figure #1 graphs the monthly annualized liquidation rate (LQR) of out of the money, fiveyear,<br />

open pool <strong>MBS</strong> as the pools season from the interest adjustment date (IAD), which is the<br />

date that a mortgage in a pool is originated or renewed. The liquidation rate refers to the<br />

percentage of mortgages on which the entire principal balance is repaid.<br />

Figure #1 illustrates that as securitized pools of mortgages season, liquidations tend to increase<br />

regardless of whether or not economic incentives to refinance exist. Over time, up to a point,<br />

liquidations increase, returning unscheduled amounts of principal to <strong>MBS</strong> investors at<br />

increasing rates. Increasing prepayments translate into quicker principal repayment for<br />

investors, which can be desirable, particularly in a rising interest rate environment.<br />

21%<br />

Figure #1<br />

Monthly Annualized Liquidation Rate (LQR)<br />

(includes all out of the money <strong>NHA</strong> <strong>MBS</strong> pools)<br />

18%<br />

Liquidations (%)<br />

15%<br />

12%<br />

9%<br />

6%<br />

3%<br />

0%<br />

1<br />

4<br />

7<br />

Months after IAD<br />

<strong>MBS</strong> prices are<br />

standardized<br />

across dealers<br />

using the<br />

Canadian<br />

Liquidation<br />

Vector model<br />

Prepayments are expected in prepayable pools and are factored into <strong>MBS</strong> pricing by analyzing<br />

the propensity to refinance at prevailing mortgage rates. To ensure accurate and comparable<br />

pricing across dealers and to use prepayment assumptions which reflected historical data, the<br />

Canadian Liquidation Vector (CLV) model was developed in June of 1998 for the <strong>NHA</strong> <strong>MBS</strong><br />

market and subsequently adopted by the IDA. It is important to note that the model is designed<br />

to estimate prepayments and is more effective than constant prepayment assumptions, but is not<br />

intended as a completely predictive model.<br />

Figure #2 (following page) shows the Standard Canadian Curve (SCC). It is a key component<br />

of the CLV and its shape is based on a composite of 10 years of prepayment history.<br />

2<br />

CIBC World Markets<br />

October 24, 2000

10<br />

13<br />

16<br />

19<br />

22<br />

25<br />

28<br />

31<br />

34<br />

37<br />

40<br />

43<br />

46<br />

49<br />

52<br />

55<br />

Figure #2<br />

Canadian Standard Liquidation Vector (CLV)<br />

produces the<br />

Standard Canadian Curve (SCC)<br />

15%<br />

Liquidations (%)<br />

12%<br />

9%<br />

6%<br />

3%<br />

0%<br />

1<br />

4<br />

7<br />

Month<br />

The SCC curve<br />

is made pool<br />

specific by<br />

applying the<br />

standard<br />

multiplier to the<br />

Standard<br />

Canadian<br />

Curve<br />

Prepayments<br />

return principal<br />

to investors,<br />

which is then<br />

invested at<br />

current interest<br />

rates<br />

Opportunity<br />

exists when the<br />

CLV differs<br />

from the actual<br />

data<br />

The SCC is the core of the CLV and it is used to price <strong>MBS</strong>, in conjunction with a standard<br />

multiplier formula which takes into account the average mortgage rate in the pool and the<br />

current refinancing rate. The multiplier formula is as follows:<br />

(40*(average rate in pool-refinancing rate))<br />

Multiplier=.85*e<br />

The multiplier standardizes prepayment expectations, which is necessary for comparable<br />

pricing across dealers. The formula computes the level of prepayments expected at any given<br />

difference between the average mortgage rate in the pool and the current refinancing rate. As<br />

the refinancing rate decreases, expected prepayments increase and vice versa. It is worthwhile<br />

to note that in the event that the rate differential is zero, prepayments are expected to occur at a<br />

lower rate than the SCC. Expected prepayments track the SCC curve at an interest rate<br />

differential of about 40.5 basis points.<br />

The prepayment option, in a decreasing interest rate environment, is beneficial to borrowers as<br />

they can refinance their mortgages at lower prevailing rates, but a detriment to investors. As<br />

interest rates decrease, investors receive unscheduled principal payments and are forced to reinvest<br />

these proceeds at lower interest rates. Conversely, in an increasing interest rate<br />

environment, it is the mortgagors who have no incentive to refinance as new mortgages would<br />

be written at higher rates than those currently contracted. Prepayments occurring in<br />

conjunction with rising rates, particularly if they are greater than expected using the<br />

CLV, can increase returns to investors.<br />

The opportunity for investors, as demonstrated by our data, lies in the fact that core<br />

prepayments increase as pools of mortgages become more seasoned, regardless of<br />

economic incentives. In an increasing interest rate environment, liquidations in pools<br />

trading at a discount can become a significant advantage for investors in open pool <strong>MBS</strong>.<br />

In a bear bond market, rising interest rates decrease the value of the multiplier and produce a<br />

liquidation vector that is below the SCC, indicating lower expected prepayments. Seasoning<br />

has the effect of increasing core prepayments over time because they are insensitive to the<br />

prevailing interest rate environment. Comparing specific seasoned pool data against the CLV<br />

may indicate that prepayments have been underestimated during certain months, which could<br />

result in underpriced securities.<br />

3<br />

CIBC World Markets<br />

October 24, 2000

Differences<br />

between the<br />

LQR and the<br />

SCC translate<br />

into pricing<br />

anomalies<br />

In an increasing interest rate environment, these pricing anomalies can provide investors<br />

with a method of receiving principal more quickly and re-investing it at higher prevailing<br />

rates. Prepayments tend to peak between three years of seasoning and prepayment burnout,<br />

which refers to decreasing prepayments during the final months of a pools life due to a growing<br />

insensitivity to refinancing opportunities. Pricing anomalies should be highest during this time<br />

frame, even where no economic incentive to refinance exists and the CLV vector is on or below<br />

the SCC.<br />

Figure #3 demonstrates a practical example of greater than expected prepayments using<br />

Canada Trust Pool 97000269, which has a coupon of 5.40%. The solid line charts the<br />

actual annualized monthly LQR and the broken line shows the expected prepayments,<br />

using the SCC and the applicable multiplier for the pool. Prepayments have consistently<br />

outpaced expectations in the third year of seasoning and the pool has been trading at a discount<br />

since July of 1999. The quicker repayment of principal in a bear market environment has a<br />

positive effect on returns through the early return of principal at par, the ability to reinvest<br />

principal at higher rates and the reduction of duration. Prepayments appear to be peaking, as is<br />

consistent with historical data, between the third and fourth year. The CLV, however, is<br />

projecting prepayments lower than the SCC which provides investors with an opportunity to<br />

take advantage of higher than expected prepayments which may not be priced into an offer.<br />

14%<br />

Figure #3<br />

Canada Trust <strong>MBS</strong> Pool 97000269<br />

Actual LQR vs. Expected Prepayments using CLV<br />

LQR<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

Annualized Monthly LQR<br />

2%<br />

0%<br />

(SCC)*(pool 97000269 multiplier)<br />

Sep-97<br />

Dec-97<br />

Mar-98<br />

Jun-98<br />

Sep-98<br />

Dec-98<br />

Mar-99<br />

Jun-99<br />

Sep-99<br />

Dec-99<br />

Mar-00<br />

Jun-00<br />

Sep-00<br />

Months<br />

Opportunities<br />

continue to<br />

exist<br />

Pool 97000269 is an example of an <strong>MBS</strong> that has recently offered investors an opportunity<br />

to exploit actual versus expected prepayment patterns. Investors purchasing pool<br />

97000269 on June 30, 1999 would have realized an extra 3 basis points over the stated<br />

spread as of October 16, 2000.<br />

Table #2 (following page) provides examples of pools that may offer opportunities to take<br />

advantage of greater than expected prepayments in the future. Each of the pools has been<br />

identified based on the criteria outlined in this report. Each pool is currently trading at a<br />

discount and is entering the seasoning period where actual prepayments may begin to outpace<br />

those expected using the CLV.<br />

4<br />

CIBC World Markets<br />

October 24, 2000

Table #2-Pools Meeting Analysis Criteria<br />

Pool # Issuer Coupon Matures Issued<br />

Seasoning<br />

(months) Price Yield<br />

Remaining<br />

Principal<br />

97001564 BMO 5.00% 7/1/03 2/1/99 20 97.49 6.09% $ 177,997,541<br />

97001465 NBC 5.00% 8/1/03 12/1/98 22 97.46 6.08% $ 346,265,028<br />

97001408 CT 5.00% 10/1/03 10/1/98 24 97.34 6.08% $ 501,893,564<br />

97001341 CT 5.00% 7/1/03 7/1/98 27 97.47 6.08% $ 144,383,613<br />

97001267 CT 5.00% 6/1/03 6/1/98 28 97.60 6.09% $ 189,864,807<br />

97001259 NBC 5.38% 2/1/03 6/1/98 28 98.55 6.09% $ 143,847,205<br />

97001234 NBC 5.38% 8/1/02 6/1/98 28 98.83 6.06% $ 180,063,465<br />

97001192 CT 5.00% 3/1/03 5/1/98 29 97.83 6.09% $ 86,040,955<br />

97001184 CT 5.00% 9/1/02 5/1/98 29 98.27 6.07% $ 53,405,006<br />

97001127 CT 5.00% 3/1/03 5/1/98 29 97.95 6.09% $ 64,671,689<br />

97001119 CT 5.00% 9/1/02 5/1/98 29 98.39 6.06% $ 51,083,063<br />

97001101 CT 5.00% 3/1/02 5/1/98 29 98.70 6.07% $ 65,320,039<br />

97001093 CT 5.00% 9/1/03 9/1/98 25 97.57 6.09% $ 96,203,330<br />

97001028 CIBC 5.35% 4/1/03 4/1/98 30 98.33 6.09% $ 79,862,142<br />

<strong>MBS</strong><br />

prepayment<br />

analysis offers<br />

actual trading<br />

opportunities<br />

While investors generally prefer semi-annual pay bullets, due primarily to convenience and<br />

standardization, discounted monthly-pay open pool <strong>MBS</strong> can reduce interest rate risk in a bear<br />

bond market.<br />

The data demonstrates that receiving greater than expected monthly prepayments in a rising<br />

interest rate environment can offer a number of benefits to investors. Investing in open pool<br />

<strong>MBS</strong> as a result of careful analysis of prepayment data can be a labour intensive process but the<br />

potential benefits are significant.<br />

This report is issued by (i) in Canada, CIBC World Markets Inc., a member of the IDA and CIPF, (ii) in the US, CIBC World Markets Corp., a<br />

member of the NYSE and SIPC, and (iii) in the UK, CIBC World Markets International Ltd. or CIBC World Markets plc, each of which is<br />

regulated by the SFA. Any questions should be directed to your sales representative. Every province in Canada, state in the US, and most<br />

countries throughout the world have their own laws regulating the types of securities and other investment products which may be offered to their<br />

residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested<br />

investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any<br />

securities discussed herein in any jurisdiction where such would be prohibited. No part of any report may be reproduced in any manner without<br />

the prior written permission of CIBC World Markets. The information and any statistical data contained herein have been obtained from sources<br />

which we believe to be reliable, but we do not represent that they are accurate or complete, and should not be relied upon as such. All opinions<br />

expressed and data provided herein are subject to change without notice. A CIBC World Markets company or its shareholders, directors, officers<br />

and/or employees may have a long or short position or deal as principal in the securities discussed herein, related securities or in options, futures<br />

or other derivative instruments based thereon. A CIBC World Markets company may have acted as initial purchaser or placement agent for a<br />

private placement of any of the securities of any company mentioned in this report, may from time to time solicit from or perform financial<br />

advisory, investment banking or other services for such company, or have lending or other credit relationships with the same. The securities<br />

mentioned in this report may not be suitable for all types of investors; their prices, value and/or the income they produce may fluctuate and/or be<br />

adversely affected by exchange rates. Since the levels and bases of taxation can change, any reference in this report to the impact of taxation<br />

should not be construed as offering tax advice; as with any transaction having potential tax implications, clients should consult with their own tax<br />

advisors. Past performance is no guarantee of future results. For private clients in the UK: Investors should seek the advice of an investment<br />

advisor if they have any doubts about the suitability of an investment. Although each company issuing this report is a wholly-owned subsidiary<br />

of Canadian Imperial Bank of Commerce (“CIBC”), each is solely responsible for its contractual obligations and commitments, and any securities<br />

products offered or recommended to or purchased or sold in any client accounts (i) will not be insured by the Federal Deposit Insurance<br />

Corporation, the Canada Deposit Insurance Corporation or other similar deposit insurance, (ii) will not be deposits or other obligations of CIBC,<br />

(iii) will not be endorsed or guaranteed by CIBC, and (iv) will be subject to investment risks, including possible loss of the principal invested.<br />

The CIBC trademark is used under license. ©1999 CIBC World Markets Corp. and CIBC World Markets Inc. All rights reserved.<br />

5<br />

CIBC World Markets<br />

October 24, 2000

6<br />

CIBC World Markets<br />

October 24, 2000