Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT <strong>2010</strong>-<strong>11</strong> ________________________________________________________<br />

The matter of shortage of coal stock is under investigation by the Vigilance Department.<br />

6.4 A provision of 210.00 lakh was made in the year 2006-07 pending investigation of shortage/<br />

difference in the closing stock of raw coal as on 31.03.07 in between the Kathara colliery and<br />

Kathara washery. The said provision has been retained as on 31.03.20<strong>11</strong> which is considered<br />

necessary.<br />

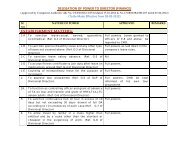

7. SUNDRY DEBTORS<br />

7.1 A provision of 6628.05 lakh (previous year 12348.83 lakh) has been made during the year<br />

against disputed dues on the basis of fair estimate. The total provision of 52030.00 lakh (after<br />

utilizing against Bad Debt written off 3802.41 lakh and withdrawal of excess provision made<br />

earlier periods for 368.64 lakh) as on 31.03.20<strong>11</strong> is considered adequate.<br />

7.2 Sundry debtors balances are subject to confirmation by the parties.<br />

8. LOANS & ADVANCES AND OTHER CURRENT ASSETS<br />

8.1 Sundry Debtors, Advances, Stores in Transit and Claims Receivable include some old items<br />

pending reconciliation/ review and adjustments to appropriate accounts.<br />

8.2 Provision of <strong>11</strong>4.44 lakh has been withdrawn during the year as claim for refund of professional<br />

tax has been lodged with Hazaribagh Mines Board for refund of the same. Total provision of<br />

5368.15 lakh (after write back of the excess provision of <strong>11</strong>4.44 lakh which had been made<br />

in earlier years) up to 31.03.<strong>11</strong> is considered adequate (Refer Sch-K, L & M).<br />

9. CURRENT LIABILITIES & PROVISIONS<br />

9.1 By virtue of enactment of Cess and Other Taxes on Minerals (Validation) Act, 1992, the Company,<br />

in 1992-93, raised supplementary bills on customers up to 4th April, 1991 for 10033.04 lakh on<br />

account of cess and sales tax thereon. The said amount has been included in statutory dues<br />

payable for cess and sales tax under the head "Current liabilities and Provisions" (Sch-N) with<br />

corresponding Debit in "Claims Receivable-Cess" (Sch-M).<br />

9.2 There are no Micro, Small and Medium Enterprises, to whom the Company owes dues, which<br />

are outstanding for more than 45 days as at 31.03.20<strong>11</strong>. This information as required to be<br />

disclosed under the MS & MED Act, 2006 has been determined to the extent such parties have<br />

been identified on the basis of information available with the Company.<br />

9.3 Sundry creditors, other current liabilities includes some old items pending reconciliation and<br />

review and adjustments to appropriate accounts.<br />

10. PROFIT AND LOSS ACCOUNT<br />

10.1 The liability towards Incremental Gratuity for the year amounting to 5456.96 lakh (previous<br />

year <strong>11</strong>731.64 lakh) has been provided on actuarial basis.<br />

10.2 An amount of 3756.81 lakh has been provided in the accounts during the year towards leave<br />

encashment & HPL (Previous year 739.22 lakh) making a total provision of 24217.92 lakh.<br />

(Previous year 20461.<strong>11</strong> lakh) on the basis of actuarial valuation.<br />

10.3 Apex charges amounting to 2620.67 Lakh (previous year 2601.15 lakh) levied by the<br />

Holding Company @ 5 per tonne of coal produced towards rendering various services like<br />

procurement, marketing, Corporate Service etc. based on agreement entered into, have been<br />

accounted for.<br />

104