Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2010</strong>-<strong>11</strong> ________________________________________________________<br />

ascertained liabilities in the current year an amount of 22591.94 lakh out of the past obligation<br />

and s5360.43 lakh for the current year making a total amount of 27487.96 lakh to the <strong>CCL</strong><br />

Employees Group Gratuity Fund Trust (the Trust). Trustees administered contribution made to<br />

the Trust and contribution are invested with Employees Group Gratuity Cash Accumulation<br />

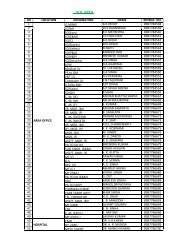

Scheme with Life Insurance Corporation of India. The following table sets out the gratuity plan<br />

and the amounts recognized in the Company’s financial statements as at 31st March, 20<strong>11</strong>.<br />

Disclosure Item 120 (c) As at 31.03.20<strong>11</strong><br />

(Figs. in Lakh)<br />

1. Change in benefit obligations :<br />

Projected benefit obligation, beginning of the year April, <strong>2010</strong> 12469135893<br />

Interest Cost 928785533<br />

Current Service Cost 503765821<br />

Benefits paid 1841877628<br />

Actuarial gain/loss on obligations (–)955022298<br />

Present value of obligation at the end of the year 13014831917<br />

____________<br />

2. Fair value of the plan assets : Dissclosure item 120 (e) :<br />

Fair value of the plan assets beginning of the year April, 20<strong>11</strong> 32<strong>11</strong>871909<br />

Contribution by Employer 2748796333<br />

Benefits paid 813073347<br />

Actuarial gain/loss on plan assets 157294108<br />

Fair value of the plan assets at the end of the year (net of Claims Receivables) 4102359145<br />

____________<br />

3. Amount recognized in the Balance Sheet :<br />

Disclosure item 120 (f) funded status :<br />

Present value of obligation as on 31.03.20<strong>11</strong> 13014831917<br />

Fair value of plan assets as on 31.03.20<strong>11</strong> 4102359145<br />

Net liability recognized in Balance Sheet 8912472772<br />

____________<br />

4. Amount recognized in the Profit & Loss Account :<br />

Disclosure item 120 (g) :<br />

Current service cost 503765821<br />

Interest cost 928785533<br />

Actual gain/loss of plan assets 256949753<br />

Net actuarial gain/loss recognised in this year 797728190<br />

Total included in gratuity cost (refer Sch.-6) 1973329791<br />

____________<br />

5. Principal actuarial assumption :<br />

Mortality table LICI 1994-96<br />

Superannuation age<br />

60 years<br />

Salary Escalation<br />

6.00 % p.a.<br />

Inflation Rate<br />

6.00 % p.a.<br />

Discount Rate<br />

8.50 % p.a.<br />

Return on Asset<br />

9.50 % p.a.<br />

Formula used<br />

Projected unit credit method<br />

____________<br />

In the case of Leave Encashment Benefit (EL/HPL) Disclosure items 12(c):<br />

As at 31.03.20<strong>11</strong><br />

Present value of obligation at the beginning of the year 2046<strong>11</strong>1543<br />

Interest Cost 154526474<br />

Current Service Cost 448074992<br />

Curtailment Cost 0.00<br />

Settlement Cost 0.00<br />

106