Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

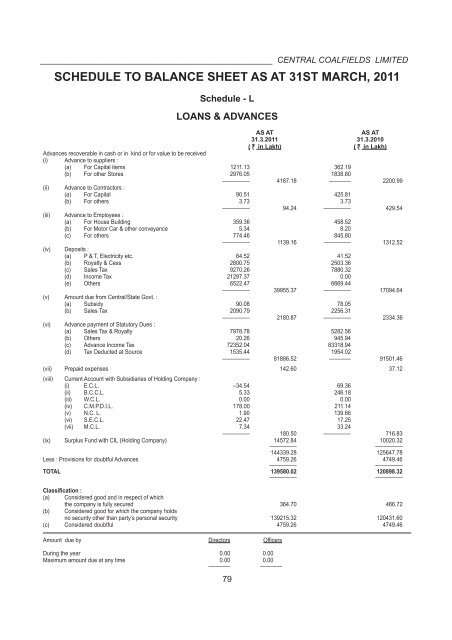

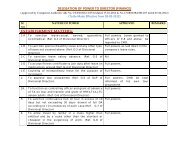

__________________________________________________ CENTRAL COALFIELDS LIMITED<br />

SCHEDULE TO BALANCE SHEET AS AT 31ST MARCH, 20<strong>11</strong><br />

Schedule - L<br />

LOANS & ADVANCES<br />

AS AT<br />

AS AT<br />

31.3.20<strong>11</strong> 31.3.<strong>2010</strong><br />

( in Lakh) ( in Lakh)<br />

Advances recoverable in cash or in kind or for value to be received<br />

(i) Advance to suppliers :<br />

(a) For Capital items 12<strong>11</strong>.13 362.19<br />

(b) For other Stores 2976.05 1838.80<br />

————— 4187.18 ———— 2200.99<br />

(ii) Advance to Contractors :<br />

(a) For Capital 90.51 425.81<br />

(b) For others 3.73 3.73<br />

————— 94.24 ————— 429.54<br />

(iii) Advance to Employees :<br />

(a) For House Building 359.36 458.52<br />

(b) For Motor Car & other conveyance 5.34 8.20<br />

(c) For others 774.46 845.80<br />

————— <strong>11</strong>39.16 ————— 1312.52<br />

(iv) Deposits :<br />

(a) P & T, Electricity etc. 64.52 41.52<br />

(b) Royalty & Cess 2800.75 2503.36<br />

(c) Sales Tax 9270.26 7880.32<br />

(d) Income Tax 21297.37 0.00<br />

(e) Others 6522.47 6669.44<br />

————— 39955.37 ————— 17094.64<br />

(v) Amount due from Central/State Govt. :<br />

(a) Subsidy 90.08 78.05<br />

(b) Sales Tax 2090.79 2256.31<br />

————— 2180.87 ————— 2334.36<br />

(vi) Advance payment of Statutory Dues :<br />

(a) Sales Tax & Royalty 7978.78 5282.56<br />

(b) Others 20.26 945.94<br />

(c) Advance Income Tax 72352.04 83318.94<br />

(d) Tax Deducted at Source 1535.44 1954.02<br />

————— 81886.52 ———— 91501.46<br />

(vii) Prepaid expenses 142.60 37.12<br />

(viii) Current Account with Subsidiaries of Holding Company :<br />

(i) E.C.L. –34.54 69.36<br />

(ii) B.C.C.L. 5.33 246.18<br />

(iii) W.C.L. 0.00 0.00<br />

(iv) C.M.P.D.I.L. 178.00 2<strong>11</strong>.14<br />

(v) N.C. L. 1.90 139.66<br />

(vi) S.E.C.L. 22.47 17.25<br />

(vii) M.C.L. 7.34 33.24<br />

————— 180.50 ————— 716.83<br />

(ix) Surplus Fund with CIL (Holding Company) 14572.84<br />

—————<br />

10020.32<br />

—————<br />

144339.28 125647.78<br />

Less : Provisions for doubtful Advances 4759.26 4749.46<br />

————— —————<br />

TOTAL 139580.02 120898.32<br />

————— —————<br />

Classification :<br />

(a) Considered good and in respect of which<br />

the company is fully secured 364.70 466.72<br />

(b) Considered good for which the company holds<br />

no security other than party’s personal security 139215.32 120431.60<br />

(c) Considered doubtful 4759.26 4749.46<br />

Amount due by Directors Officers<br />

During the year 0.00 0.00<br />

Maximum amount due at any time 0.00 0.00<br />

———— ————<br />

79