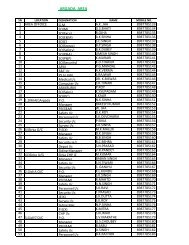

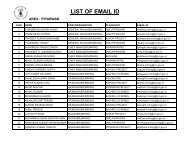

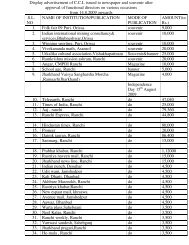

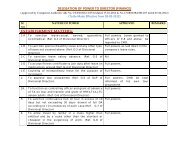

Year : 2010-11 - CCL

Year : 2010-11 - CCL

Year : 2010-11 - CCL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

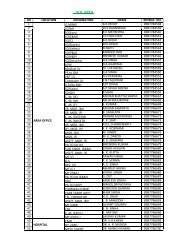

__________________________________________________ CENTRAL COALFIELDS LIMITED<br />

SCHEDULE TO BALANCE SHEET AS AT 31ST MARCH, 20<strong>11</strong><br />

Schedule - N<br />

CURRENT LIABILITIES AND PROVISIONS<br />

AS AT<br />

AS AT<br />

31.3.20<strong>11</strong> 31.3.<strong>2010</strong><br />

( in Lakh) ( in Lakh)<br />

(A) Current Liabilities :<br />

(i) Sundry Creditors for goods (Small Scale Industry) :<br />

(a) For Capital 0.00 0.00<br />

(b) For Revenue 25.41 71.96<br />

———— 25.41 ———— 71.96<br />

(ii) Sundry Creditors for goods (Others) :<br />

(a) For Capital 3070.65 2513.82<br />

(b) For Revenue 5962.39 6056.19<br />

———— 9033.04 ———— 8570.01<br />

(iii) Expenses :<br />

Employees remuneration 23163.16 78886.38<br />

Gratuity 89124.72 92572.64<br />

Attendance Bonus 2042.58 2191.19<br />

PPLB/PPLR 28003.43 <strong>11</strong>885.51<br />

Unpaid Wages 306.37 1001.58<br />

Leave Pay 24217.92 20461.<strong>11</strong><br />

Power & Fuel 5161.62 4339.56<br />

Repairs 3386.41 2614.55<br />

Mine Closure 9265.57 4526.27<br />

Contractual Expenses :<br />

Capital 3069.51 3476.10<br />

Revenue 21223.01 19757.09<br />

———— 24292.52 ———— 23233.19<br />

————— 208964.30 ———— 2417<strong>11</strong>.98<br />

(iv) Statutory Dues :<br />

Sales Tax - Central 879.94 486.76<br />

State 6<strong>11</strong>.05 497.61<br />

Royalty <strong>11</strong>47.22 1889.62<br />

Cess on Coal <strong>11</strong>714.87 <strong>11</strong>714.87<br />

Stowing Excise Duty 10<strong>11</strong>.28 859.71<br />

Clean Energy Cess 1676.44 0.00<br />

Central Excise Duty 9214.73 0.00<br />

Tax deducted at source (I. Tax) :<br />

Employees 5180.13 894.90<br />

Contractors 214.<strong>11</strong> 84.19<br />

Govt. Grants (Environmental) 12.65 12.65<br />

Life Cover Scheme 813.53 991.60<br />

Provident Fund 5176.57 5400.42<br />

————— 37652.52 ————— 22832.33<br />

(v) Current Account with CIL –886.36 –1930.56<br />

(vi) Interest Accrued but not Due 0.00 0.00<br />

(vii) Advances and Deposits from :<br />

Customers 33641.13 31224.77<br />

Contractors & Others 41077.77 39929.36<br />

————— 74718.90 —————— 7<strong>11</strong>54.13<br />

(viii) Employees’ Pension Contribution 7727.43 5885.22<br />

(ix) Accumulated Reserve for future OBR 106482.04 86090.38<br />

Less : Advance Stripping 18816.30 8487.30<br />

————— 87665.74 —————— 77603.08<br />

(x) Other Liabilities<br />

Capital (for Loss of Assets) 1098.18 1087.08<br />

Revenue 10052.18 8837.88<br />

———— <strong>11</strong>150.36 ———— 9924.96<br />

————— —————<br />

TOTAL (A) 436051.34 435823.<strong>11</strong><br />

(B) Provisions :<br />

Provisions for Income Tax 60149.39 50659.06<br />

Proposed Dividend (incl. Dividend Tax) 86946.05 45197.51<br />

————— —————<br />

TOTAL (B) 147095.44 95856.57<br />

————— —————<br />

TOTAL (A+B) 583146.78 531679.68<br />

————— —————<br />

81