You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>Standard</strong> August 3 to 9 2014 5<br />

National<br />

Pension Scheme<br />

1994 - 2014<br />

For 20 Years<br />

Your Social Security Our Priority<br />

October this year marks the 20th anniversary<br />

of the birth of the National Social Security<br />

Authority’s Pension and Other Benefits Scheme, also<br />

known as the National Pension Scheme (NPS). It was<br />

October 1994 that employees first contributed to the national<br />

pension scheme.<br />

Since a new social security pension scheme is normally<br />

considered as having reached maturity after 40 years,<br />

when the youngest founding generation retires, the 20<br />

year mark is a significant milestone. <strong>The</strong> scheme is<br />

half-way towards maturity.<br />

Those who started contributing to the scheme in 1994<br />

at 18 will be 38 now. <strong>The</strong>y will be 22 years away from the<br />

normal pensionable age of 60 and 27 years away from the<br />

latest pensionable age of 65.<br />

<strong>The</strong> size of one’s pension depends on one’s contribution<br />

period and insurable earnings at retirement.<br />

<strong>The</strong> expected retirement pension after 40 years of<br />

contributions is 63,3% of insurable earnings at retirement.<br />

After 45 years the insurable earnings replacement rate<br />

is 75%. After 47 years it is 79,7%. After 20 years of<br />

contributions, the insurable earnings replacement rate is<br />

26,7%.<br />

Many current pensioners are receiving pensions that<br />

are more than the percentage of the insurable earnings<br />

they would ordinarily have been entitled to, because<br />

NSSA has set a minimum retirement pension level, which<br />

is currently $60. <strong>The</strong> minimum survivor’s pension is $30.<br />

<strong>The</strong> minimum contribution period for a national pension<br />

scheme retirement pension is 10 years. A lump sum<br />

grant, instead of a pension, is payable to those who have<br />

contributed for less than that but not less than 12 months.<br />

First Pensioners<br />

However, to enable some of those who, due to their age,<br />

would have been unable to contribute to the scheme for<br />

10 years prior to retirement, provision was made for up to<br />

seven credit years for contributors who were already aged<br />

49 and above as at October 1, 1994. This meant the first<br />

pensions were payable three years after the scheme began.<br />

<strong>The</strong> credit years were calculated by subtracting 49 from<br />

the age of the person on 1 October 1994.<br />

At the end of 1998 there were already 3 907 retirement<br />

pensioners. Today there are 41 405.<br />

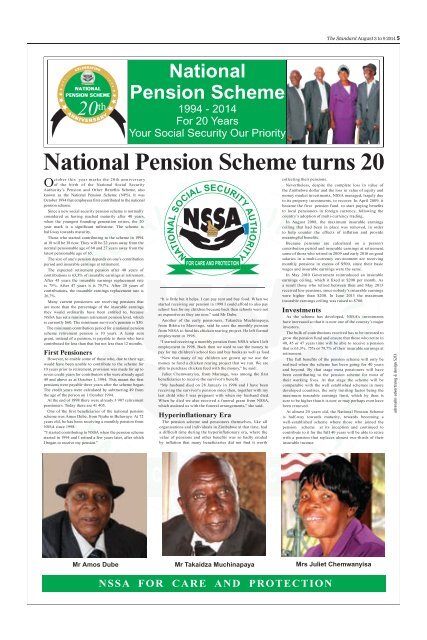

One of the first beneficiaries of the national pension<br />

scheme was Amos Dube, from Njube in Bulawayo. At 72<br />

years old, he has been receiving a monthly pension from<br />

NSSA since 1998.<br />

“I started contributing to NSSA when the pension scheme<br />

started in 1994 and I retired a few years later, after which<br />

I began to receive my pension.”<br />

National Pension Scheme turns 20<br />

“It is little but it helps. I can pay rent and buy food. When we<br />

started receiving our pension in 1998 I could afford to also pay<br />

school fees for my children because back then schools were not<br />

as expensive as they are now,” said Mr Dube.<br />

Another of the early pensioners, Takaidza Muchinapaya,<br />

from Bikita in Masvingo, said he uses the monthly pension<br />

from NSSA to fund his chicken rearing project. He left formal<br />

employment in 1998.<br />

“I started receiving a monthly pension from NSSA when I left<br />

employment in 1998. Back then we used to use the money to<br />

pay for my children’s school fees and buy books as well as food.<br />

“Now that many of my children are grown up we use the<br />

money to fund a chicken rearing project that we run. We are<br />

able to purchase chicken feed with the money,” he said.<br />

Juliet Chemwanyisa, from Marange, was among the first<br />

beneficiaries to receive the survivor’s benefit.<br />

“My husband died on 28 January in 1996 and I have been<br />

receiving the survivor’s pension since then, together with my<br />

last child who I was pregnant with when my husband died.<br />

When he died we also received a funeral grant from NSSA,<br />

which assisted us with the funeral arrangements,” she said.<br />

Hyperinflationary Era<br />

<strong>The</strong> pension scheme and pensioners themselves, like all<br />

organisations and individuals in Zimbabwe at that time, had<br />

a difficult time during the hyperinflationary era, where the<br />

value of pensions and other benefits was so badly eroded<br />

by inflation that many beneficiaries did not find it worth<br />

collecting their pensions.<br />

Nevertheless, despite the complete loss in value of<br />

the Zimbabwe dollar and the loss in value of equity and<br />

money market investments, NSSA managed, largely due<br />

to its property investments, to recover. In April 2009, it<br />

became the first pension fund to start paying benefits<br />

to local pensioners in foreign currency, following the<br />

country’s adoption of multi-currency trading.<br />

In August 2008, the maximum insurable earnings<br />

ceiling that had been in place was removed, in order<br />

to help counter the effects of inflation and provide<br />

meaningful benefits.<br />

Because pensions are calculated on a person’s<br />

contribution period and insurable earnings at retirement,<br />

some of those who retired in 2009 and early 2010 on good<br />

salaries in a multi-currency environment are receiving<br />

monthly pensions in excess of $500, since their basic<br />

wages and insurable earnings were the same.<br />

In May 2010 Government reintroduced an insurable<br />

earnings ceiling, which it fixed at $200 per month. As<br />

a result those who retired between then and May 2013<br />

received low pensions, since nobody’s insurable earnings<br />

were higher than $200. In June 2013 the maximum<br />

insurable earnings ceiling was raised to $700.<br />

Investments<br />

As the scheme has developed, NSSA’s investments<br />

have increased so that it is now one of the country’s major<br />

investors.<br />

<strong>The</strong> bulk of contributions received has to be invested to<br />

grow the pension fund and ensure that those who retire in<br />

40, 45 or 47 years time will be able to receive a pension<br />

that is 63,3%, 75% or 79,7% of their insurable earnings at<br />

retirement.<br />

<strong>The</strong> full benefits of the pension scheme will only be<br />

realised when the scheme has been going for 40 years<br />

and beyond. By that stage most pensioners will have<br />

been contributing to the pension scheme for most of<br />

their working lives. At that stage the scheme will be<br />

comparable with the well established schemes in more<br />

developed countries, the only limiting factor being the<br />

maximum insurable earnings limit, which by then is<br />

sure to be higher than it is now or may perhaps even have<br />

been removed.<br />

At almost 20 years old, the National Pension Scheme<br />

is half-way towards maturity, towards becoming a<br />

well-established scheme where those who joined the<br />

pension scheme at its inception and continued to<br />

contribute to it for the full 40 years will be able to retire<br />

with a pension that replaces almost two-thirds of their<br />

insurable income.<br />

adrenalin advertising & design 5213<br />

Mr Amos Dube Mr Takaidza Muchinapaya Mrs Juliet Chemwanyisa<br />

NSSA FOR CARE AND PROTECTION