Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Business streams<br />

estimated completion cost for ongoing projects, multiplied<br />

by the economic vacancy rate for each respective<br />

project. Capital at risk is limited to a maximum amount<br />

approved by the Board <strong>of</strong> Directors.<br />

A leader in Green Premises<br />

Interest in green and energy-efficient commercial premises<br />

is continuously increasing. <strong>Skanska</strong> is a leader in<br />

developing energy-efficient, environmentally certified<br />

properties. Energy-efficient solutions add value for both<br />

investors and users.<br />

<strong>Skanska</strong> is the first construction and development<br />

company to require LEED certification <strong>of</strong> all new commercial<br />

properties developed for its own account in the<br />

Nordic countries, Central Europe and the U.S. In recent<br />

years, a number <strong>of</strong> projects have also received EU Green-<br />

Building certification, which requires a building to show<br />

25 percent lower energy use and climate impact than the<br />

national construction norm for new properties.<br />

When completed, the Gårda <strong>of</strong>fice building project<br />

will be the first in Gothenburg to achieve the highest<br />

level, LEED Platinum. The aim <strong>of</strong> <strong>Skanska</strong>’s new projects<br />

in Warsaw, Wrocław, Prague and Budapest is to achieve<br />

LEED Platinum certification.<br />

By means <strong>of</strong> new, improved technical solutions,<br />

consumption <strong>of</strong> both energy and water is substantially<br />

reduced in both renovated and newly constructed<br />

projects, compared to standard projects.<br />

Markets<br />

<strong>Skanska</strong> carries out commercial property development,<br />

mainly <strong>of</strong> <strong>of</strong>fice buildings, in selected major Nordic,<br />

Central European and U.S. growth centers.<br />

It also develops logistics and high-volume retail<br />

properties at strategic locations in Sweden, Denmark<br />

and Finland.<br />

Increasing investment appetite<br />

The capital market is increasingly interested in commercial<br />

property investments. Return requirements<br />

are falling. Transaction market volume rose in <strong>2010</strong>.<br />

<strong>Skanska</strong> sold <strong>USD</strong> 0.5 billion worth <strong>of</strong> properties during<br />

the year, <strong>of</strong> which <strong>USD</strong> 416 M in the Nordic countries. Its<br />

gain on these divestments totaled <strong>USD</strong> 110 M.<br />

<strong>Skanska</strong>’s financial strength enables it to start new<br />

property projects early in the business cycle. During <strong>2010</strong><br />

it invested a total <strong>of</strong> <strong>USD</strong> 430 M in 14 new <strong>of</strong>fice building<br />

projects and in land for future projects in the U.S., Central<br />

Europe and the Nordic countries.<br />

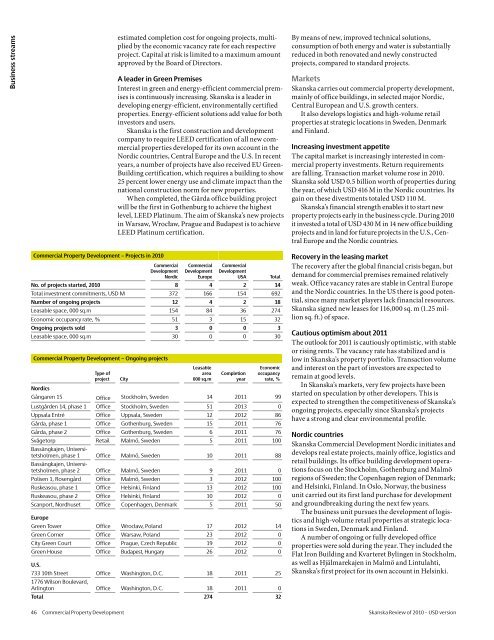

Commercial Property Development – Projects in <strong>2010</strong><br />

Commercial<br />

Development<br />

Nordic<br />

Commercial<br />

Development<br />

Europe<br />

Commercial<br />

Development<br />

USA<br />

No. <strong>of</strong> projects started, <strong>2010</strong> 8 4 2 14<br />

Total investment commitments, <strong>USD</strong> M 372 166 154 692<br />

Number <strong>of</strong> ongoing projects 12 4 2 18<br />

Leasable space, 000 sq.m 154 84 36 274<br />

Economic occupancy rate, % 51 3 15 32<br />

Ongoing projects sold 3 0 0 3<br />

Leasable space, 000 sq.m 30 0 0 30<br />

Commercial Property Development – Ongoing projects<br />

Type <strong>of</strong><br />

project<br />

City<br />

Leasable<br />

area<br />

000 sq.m<br />

Completion<br />

year<br />

Total<br />

Economic<br />

occupancy<br />

rate, %<br />

Nordics<br />

Gångaren 15 Office Stockholm, Sweden 14 2011 99<br />

Lustgården 14, phase 1 Office Stockholm, Sweden 51 2013 0<br />

Uppsala Entré Office Uppsala, Sweden 12 2012 86<br />

Gårda, phase 1 Office Gothenburg, Sweden 15 2011 76<br />

Gårda, phase 2 Office Gothenburg, Sweden 6 2011 76<br />

Svågetorp Retail Malmö, Sweden 5 2011 100<br />

Bassängkajen, Universitetsholmen,<br />

phase 1 Office Malmö, Sweden 10 2011 88<br />

Bassängkajen, Universitetsholmen,<br />

phase 2 Office Malmö, Sweden 9 2011 0<br />

Polisen 1, Rosengård Office Malmö, Sweden 3 2012 100<br />

Ruskeasou, phase 1 Office Helsinki, Finland 13 2012 100<br />

Ruskeasou, phase 2 Office Helsinki, Finland 10 2012 0<br />

Scanport, Nordhuset Office Copenhagen, Denmark 5 2011 50<br />

Europe<br />

Green Tower Office Wrocław, Poland 17 2012 14<br />

Green Corner Office Warsaw, Poland 23 2012 0<br />

City Green Court Office Prague, Czech Republic 19 2012 0<br />

Green House Office Budapest, Hungary 26 2012 0<br />

U.S.<br />

733 10th Street Office Washington, D.C. 18 2011 25<br />

1776 Wilson Boulevard,<br />

Arlington Office Washington, D.C. 18 2011 0<br />

Total 274 32<br />

Recovery in the leasing market<br />

The recovery after the global financial crisis began, but<br />

demand for commercial premises remained relatively<br />

weak. Office vacancy rates are stable in Central Europe<br />

and the Nordic countries. In the US there is good potential,<br />

since many market players lack financial resources.<br />

<strong>Skanska</strong> signed new leases for 116,000 sq. m (1.25 million<br />

sq. ft.) <strong>of</strong> space.<br />

Cautious optimism about 2011<br />

The outlook for 2011 is cautiously optimistic, with stable<br />

or rising rents. The vacancy rate has stabilized and is<br />

low in <strong>Skanska</strong>’s property portfolio. Transaction volume<br />

and interest on the part <strong>of</strong> investors are expected to<br />

remain at good levels.<br />

In <strong>Skanska</strong>’s markets, very few projects have been<br />

started on speculation by other developers. This is<br />

expected to strengthen the competitiveness <strong>of</strong> <strong>Skanska</strong>’s<br />

ongoing projects, especially since <strong>Skanska</strong>’s projects<br />

have a strong and clear environmental pr<strong>of</strong>ile.<br />

Nordic countries<br />

<strong>Skanska</strong> Commercial Development Nordic initiates and<br />

develops real estate projects, mainly <strong>of</strong>fice, logistics and<br />

retail buildings. Its <strong>of</strong>fice building development operations<br />

focus on the Stockholm, Gothenburg and Malmö<br />

regions <strong>of</strong> Sweden; the Copenhagen region <strong>of</strong> Denmark;<br />

and Helsinki, Finland. In Oslo, Norway, the business<br />

unit carried out its first land purchase for development<br />

and groundbreaking during the next few years.<br />

The business unit pursues the development <strong>of</strong> logistics<br />

and high-volume retail properties at strategic locations<br />

in Sweden, Denmark and Finland.<br />

A number <strong>of</strong> ongoing or fully developed <strong>of</strong>fice<br />

properties were sold during the year. They included the<br />

Flat Iron Building and Kvarteret Bylingen in Stockholm,<br />

as well as Hjälmarekajen in Malmö and Lintulahti,<br />

<strong>Skanska</strong>’s first project for its own account in Helsinki.<br />

46 Commercial Property Development <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>